| Followers | 374 |

| Posts | 16841 |

| Boards Moderated | 4 |

| Alias Born | 03/07/2014 |

Monday, February 23, 2015 9:47:17 AM

BUT, past quarters are history and there is a new business plan in town. Caustic borrowing was what "painfully" was required to keep BHRT alive to a point where revenue could be generated to offset the expense of moving forward. They even have a reserve (Manga) available if they would still need more.

NOW, revenue is being generated to a point in which BHRT can pay off expensive debt and pay staff reasonably for their hard, dedicated, and effective work. It will be more obvious in the coming quarterly report - facts. They will also be able to buy back diluting shares, and most important to me (an investor) give me tremendous value considering the risk I took with my money in a science and people who I am convinced will earn me returns of serious proportion."

End quote.

1) ""Everybody is entitled to their own opinions, but not their own facts"?? WHAT does that even mean? "past quarters are history"?? Wow, like things that happened prior are the PAST? There's been a "new plan" of some sort like about every 6 months IMO and per my experience- I could list all the "teams of experts brought on-board" PR links and "$20 million financing to be raised" PR that never happened and "term sheets inked" PR or "we have an agreement" or a "partnership" never heard about again- all liked in PR etc. It's nothing "new" in my opinion. Been reading the same sounding "stuff" for yrs - all as the share price continued to decline, no "big financing" ever materialized and "no major trial" ever advanced again and dilution occurred unabated at a furious rate- unending for all intents and purposes. "new plan"?? OK, sure IMO. Great. As the shares are hitting 52 week and near all time lows. OK.

2) BS to the rest- as it's does not contain "facts"

a) BHRT is not done using toxic debt? They just inked a Magna note only a few months ago- at horrible terms (face value of like $307K but BHRT only received $205K, a 33% discount- something to that effect. See latest 10-Q) I'll speculate that by this next 10-K filing, there's a very good possibility they've taken on at least one more, if not more, toxic note financing deals- for survival cash, IMO. It'll be one of the first things I check for. They also inked another series of toxic notes as recent as Oct 2014, all coming due this summer, despite "revenues"- those notes were for pittance amounts of cash like $25K and $38K etc. If this imaginary "revenues makes them cash positive now" blah, blah then WHY would they be doing toxic, floorless convertible debt notes for micro increments of cash like $25K at a time? Notes that are going to cause millions if not 10's of MILLIONS of shares of dilution at share prices like the present? Why?

b) There is a whole slew of toxic debt, aka convertible debt "notes" all coming due in the coming months- which will mean massive, massive dilution shares being issued as those notes are converted. The Magna credit line is 100% dilutive and has a share discount involved- and at these prices, mega dilutive. Again, it's not a "reserve" - BHRT said they plan to tap and use it all. What "reserve"? They don't have enough cash presently to conduct month to month operations- and that's with R&D wiped to near zero. What happens the instant they fund even the start of a phase 3 trial? Where's that cash going to come from?

c) The Magna credit line is not some "back up" line? BHRT made it 100% clear in the prospectus that they plan to tap, draw-down on all of it. BHRT has no cash or cash reserves? NONE. Where on the balance sheet are they, what page in what SEC filing? BHRT has cut R&D spending to essentially nothing (less than $3K a month per last 10-Q filing) yet they just "claimed" they're supposedly going to re-start and conduct a phase 3 level trial. They have no cash for that? They'd need every dime of that Magna credit line and then some IMO to even put a down payment on a decent, FDA quality phase 3 trial. (REMEMBER MIRROR, being "fully funded by Bioheart"??) How'd that work out? They HAD NO CASH to fund it- never did.

d) BHRT has no cash to run a share buyback program? That's comical IMO. Read the supposed "share buyback" PR. It's so loaded with "might" "if" "maybe" "possibly" "if the time is right" blah, blah, blah SAFE HARBOR same old story. It of course gives no dollar amount(s) allocated over what time period for the “possible/might/maybe/perhaps ole “share buy back ( a company share buy back will typically announce what portion/maximum amount of cash reserves may be used for the buy back and over what time frame – as in “a maximum of $1 billion over the next 12 month period” of similar wording.). The way the BRHT PR is written- if then buy no shares back or buy one shar back then the PR is true- makes no difference SEE SAFE HARBOR and every word of disclaimer that it may/might/maybe won’t happen and can be cancelled at any time no notice needed and none will be given blah, blah, blah what a surprise. (Remember ONE PATIENT ENROLLED in MIRROR PR? How much farther did MIRROR ever go after that- 1.5 yrs later? Yep.) What cash do they have to buy back shares- let alone in a quantity to even remotely make a dent in the massive on-going, continual dilution? Read the last filed 10-Q, BHRT was still, despite the big "revenue" claim- still paying common bills by issuing common stock shares- for a whole slew of things, as they HAVE NO CASH. They finished the last qtr with $46K total cash on-hand despite "revenues". Top line revenues made NO DIFFERENCE to their cash desperation situation as their expenses out grew "revenue" results- especially after the high cost of sales. Look at the gross margin last qtr- it was dismal. They banked about 10% on the top line revenue- nowhere even remotely close to enough cash to fund even their base salaries and bonuses- let alone actually run and conduct business and all the other expenses plus debt they face.

e) They're not producing any positive cash flows that could be used to pay down debts? What page of their SEC filings shows that to be true? Again, they finished last qtr with a grand total of $46K cash on-hand, and they didn't pay down any major debts using cash? They had one debt discharged as the creditor was willing to take a write-off on it. The other debt reduction was primarily via debt to equity swaps done by some insiders. They weren't paying off any major debts using any internally generated cash? It simply isn't true per their own financials? What page of a SEC filing shows that happening?

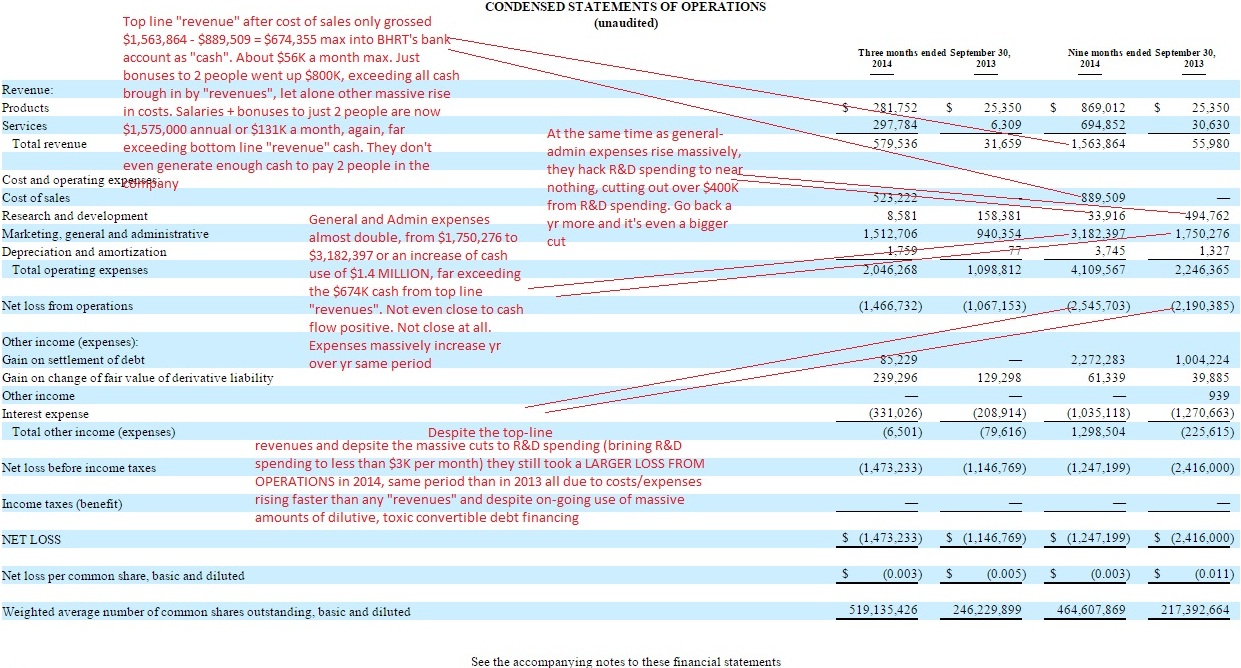

f) Again, "revenues" aren't even close to producing enough internal cash to pay even the base salaries and bonuses to just 2 people in the company. "Revenues" first have to have COST OF SALES subtracted before any cash is banked- look at the statement of operations and see what they banked versus what they spend. Also, their loss from operations is actually LARGER yr over yr for the same period of the latest 10-Q filing for 2014 versus 2013. And that's after cutting R&D by over $400K in just this yr alone, and far more over the past 2 yrs- diverting cash from R&D to pay who knows what? WHAT cash is going to fund this supposed Phase 3 "re-start" of an FDA level trial? The INSTANT that spending is added back in to their cash flow statement and statement of operations (if it ever actually is, as in they ever actually re-start and fund a phase 3 trial again, as in remember MIRROR?)- the INSTANT those expenses would hit, they'd be even more cash poor, more cash flow negative, need to tap Magna for major dilution etc. As they do not have one dime of cash reserves and even while spending a pittance of $3K a month on R&D (which does not fund any trials- LOL) they still aren't self generating even close to enough cash to pay their own bills and not using toxic borrowing to survive. Just read the last 10-Q "statement of operations" or "statement of cash flows" and then the "going concern warning", it's all their in the FACT BASED SEC filings. You know, the "facts" part.

g) "future SEC filings are going to show or prove this"? One knows already what's coming in a public traded company's future SEC filings-like they've been told insider trading information? How would anyone but a corporate Sr. Officer be able to say "what's coming" in the next 10-K filing for example? How is that possible to know?

h) LOL, "NOW, revenue is being generated to a point in which BHRT can pay off expensive debt and pay staff reasonably for their hard, dedicated, and effective work."

Revenue is NOT being generated to a point to "pay off expensive debt"?? Again, where on their accounting entries is that fantasy happening? They discharged a key debt- they didn't use cash to pay back one dime on it? There filing is loaded with inter-party "related notes" and borrowing from Peter to pay Paul, only later to pay the "new" note back with interest, etc. Northstar is still owed money and earning and being paid w/ interest- while other debts total over $10 million. Just accounts receivable last qtr exceeded $2 million w/ $46K cash on hand (essentially insolvent IMO, and their own Sr. mgt SEC filed "going concern warning" I believe backs that up). Pay staff reasonably? What "staff"?? The entire company is a few "employees" and the only ones getting richly paid are TWO, who now per the SEC filing "exec compensation table" are receiving over $1,575,000 between the two of them as the common shares have hit and are hitting, all, all, all time lows while at the same time being diluted out at an incredible pace- over 300 MILLION shares in the approx past 1 yrs and about 50 MILLION more share just from around Nov 2nd 2014 to about early Feb 2015 via looking at the 10-Q filing versus the "proxy vote" SEC filing O/S share counts and doing the math. Over a $million a yr in compensation as your common shares have lost over 98% of their value "on your watch"?? In what alternate universe is that "normal" in any company, let alone a public traded stock firm? "performance" like that isn't usually "rewarded" - it typically ends up in some people being sent packing from my experience watching what BOD's do when their common shares are nearly wiped out or experience extreme loss of value as this company has? Bonuses and large base pay increases- as the common shares have been devastated? Makes ZERO sense IMO. None. Especially when they're paying common bills by issuing dilutive shares of stock (see any 10-Q or 10-K filing "subsenquent issuances" of shares, usually at the bottom area of the filing)

So yeah, lets stick to FACTS versus made up non-facts. Totally agree.

My .009 cents worth.

Everything just explained, is IMO right there in plain accounting form- on their own SEC filing, latest 10-Q, "statement of operations" - the rising costs, the increase in loss from operations (not positive cash flow, blah, blah), the enormous rise in expenses on the general/admin expense line, the low margin on the latest qtr's top line "revenues" which means they banked hardly anything on them (cost of sales ate it all up), etc

Avant Technologies Equipping AI-Managed Data Center with High Performance Computing Systems • AVAI • May 10, 2024 8:00 AM

VAYK Discloses Strategic Conversation on Potential Acquisition of $4 Million Home Service Business • VAYK • May 9, 2024 9:00 AM

Bantec's Howco Awarded $4.19 Million Dollar U.S. Department of Defense Contract • BANT • May 8, 2024 10:00 AM

Element79 Gold Corp Successfully Closes Maverick Springs Option Agreement • ELEM • May 8, 2024 9:05 AM

Kona Gold Beverages, Inc. Achieves April Revenues Exceeding $586,000 • KGKG • May 8, 2024 8:30 AM

Epazz plans to spin off Galaxy Batteries Inc. • EPAZ • May 8, 2024 7:05 AM