Wednesday, December 24, 2014 12:33:41 AM

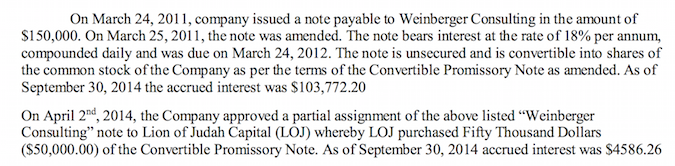

According to the most recent OTC filing Michael Zoyes (Lion of Judah Capital) was assigned partial ownership of an old debt $150,000 Note from March of 2011 that originally belonged to Weinberger Consulting

http://www.otcmarkets.com/financialReportViewer?symbol=GRCV&id=129574

http://search.sunbiz.org/Inquiry/CorporationSearch/SearchResultDetail/EntityName/forp-f14000001664-715eda9c-2000-4494-987e-f7b71c2efc40/Lion%20of%20Judah%20Capital/Page1

If that Note really was issued in March of 2011 it should be in one of the old filings for GRCV right?

It's not in the Quarterly report for the period ending 6/30/11

http://www.otcmarkets.com/financialReportViewer?symbol=GRCV&id=57829

It's not in the Quarterly report for the period ending 9/30/11

http://www.otcmarkets.com/financialReportViewer?symbol=GRCV&id=68584

It's not in the Annual report for the period ending 12/31/11

http://www.otcmarkets.com/financialReportViewer?symbol=GRCV&id=94681

It's not in the next Quarterly report for the period ending 9/30/12

http://www.otcmarkets.com/financialReportViewer?symbol=GRCV&id=94680

It's not in the Annual report for the period ending 12/31/12

http://www.otcmarkets.com/financialReportViewer?symbol=GRCV&id=101929

It's not in the Quarterly report for the period ending 3/31/13

http://www.otcmarkets.com/financialReportViewer?symbol=GRCV&id=104549

It's not in the Quarterly report for the period ending 6/30/13

http://www.otcmarkets.com/financialReportViewer?symbol=GRCV&id=109181

The Note didn't show up until the end of 2013 after GRCV "acquired" an LED lighting company controlled by Michael Zoyes called Corporate Excellence Consulting Inc and Michael Zoyes took over control of this shell.

http://www.otcmarkets.com/financialReportViewer?symbol=GRCV&id=128399

So this debt Note that was used to kill the share price today came with the acquisition of Corporate Excellence Consulting Inc and its subsidiaries DMD Lighting & Energy Control Systems Inc in October of 2013

Corporate Excellence Consulting Inc is a Florida entity whose officers include Courtney Talley (daughter of Michael Zoyes), Peter Ruggeri, Dominick Falso, and hidden in the background - Michael Zoyes

http://search.sunbiz.org/Inquiry/CorporationSearch/SearchResultDetail/EntityName/domp-p09000078034-32f1b5b7-fd16-489d-8c22-db5d69f15cc6/Corporate%20Excellence%20Consulting%20Inc/Page1

All these same people were involved in the HSCO dilution scam and the ASKE dilution scam. HSCO did 3 reverse splits and got suspended by the SEC. ASKE did 1 reverse split is and now stuck on no bid.

HSCO was also an LED lighting company. The links don't end there. This group out of Florida tie into other fake LED lightening companies that became penny stock dilution scams:

HSCO, ONTC, SAVW, OTFT, MIRA, IACH

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=60381647

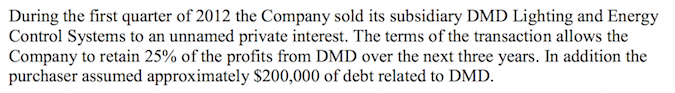

DMD Lighting & Energy Control Systems Inc were once owned by HSCO until March of 2012 when HSCO sold them to an unnamed private investor - in reality they were just removing the entities out of the HSCO shell so that Michael Zoyes could recycle them again in another public shell later (which turned out to be GRCV) since by this point HSCO had already done its 3rd reverse split in 3 years and had no more value left that could be sucked out.

http://www.otcmarkets.com/financialReportViewer?symbol=HSCO&id=82158

Rinse, wash, repeat.

But that isn't the only thing Michael Zoyes rinsed and repeated which takes us back to that Weinberger Consulting debt Note.

That Note actually originated in HSCO:

http://www.marketwired.com/press-release/hi-score-enters-agreement-with-weinberger-consulting-1412313.htm

March 16, 2011 - HSCO enters a consulting agreement with Weinberger Consulting

That Consulting agreement would lead to Eric Weinberger being over 170,000,000 free trading shares in HSCO between March of 2011 and January of 2012 yet some how Weinberger Consulting was still owed $150,000?

How did consulting money owed to Weinberger Consulting by HSCO from March of 2011 end up being transferred from HSCO to Corporate Excellence Consulting Inc (Michael Zoyes) then to GRCV then back to Michael Zoyes so that he could dump some 500 million free trading shares into the market?

Sounds very illegal.

But that is how these scammers operate

FEATURED Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • Apr 25, 2024 8:52 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM