Wednesday, December 03, 2014 9:11:15 AM

Buy Silver Bull Today, Get $2 Billion Of Free Zinc

By Lazarus Investment Partners

Dec. 1, 2014 7:15 AM ET

Summary

* Silver Bull is an exceedingly rare asset: a huge resource in a mining-friendly area with great infrastructure.

*As zinc prices climb higher and the forecast calls for a supply deficit, Silver Bull is complementing its silver story by advancing the company’s 2.2 billion pounds of zinc.

*M&A in the mining sector has been perking up, and we think Silver Bull is an extremely attractive company for an acquirer to own.

* Silver Bull offers incredible optionality on higher silver prices, although the reversal in silver this year is a significant challenge to the company.

* We provide an interview with the company’s CEO.

Introduction. We believe that Silver Bull (NYSEMKT:SVBL; TSX SVB) has one of the single largest and most attractive silver and zinc resources on the planet. The company's Sierra Mojada project is estimated to contain 164 million ounces of silver, 2.2 billion pounds of zinc, and hundreds of millions of pounds of lead and copper, with further upside potential in surrounding parcels. It is in a mining friendly jurisdiction in Mexico with a skilled local workforce and great infrastructure, including grid power, water, paved roads, and a railway to site. Silver Bull has a strong balance sheet with no near-term financing needs. Management is advancing the project as far as it can with the intention of selling it to or partnering with a larger company who can fund the mine into production.

The company's presentation highlights an after-tax IRR for the project of 23.1% and an after-tax NPV of $464 million. These numbers need to be adjusted significantly for the latest movements in metals prices, but even so, the project's NPV is still dramatically higher than the company's market cap of just $28 million. Weak silver prices have made our investment in Silver Bull frustrating, but we still love the optionality it offers on a rebound in silver, as well as its exposure to a massive zinc resource.

For additional background on the company, please see our article from last December and our update in July. We will use the balance of this article to summarize developments at the company and share an update conversation with Tim Barry, Silver Bull's CEO.

Pivot to Zinc. The elephant in the room for Silver Bull has been declining silver prices. When we wrote about the company this past summer, silver was up modestly for the year. It has since given up those gains and is now down for the year. Silver hit a high of $22 an ounce at the beginning of the year, and now trades at around $16.50. True to its name, Silver Bull's flagship project, at least as previously conceived, was heavily focused on silver production (72% silver, 28% zinc). Yes, even at $16 silver the project has a double digit IRR, but the drop in silver prices dampens both the economics of the project as well as the acquisition urgency of larger miners.

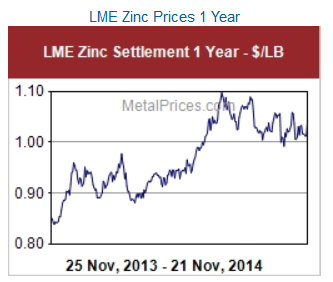

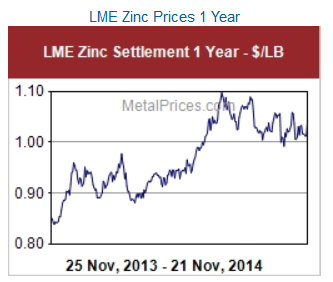

In September Silver Bull announced that following a 28% rise in zinc prices, it would be re-examining the zinc potential of its resource. In the interview below with Silver Bull's CEO, he explains what the company will be doing differently as it pivots to zinc. In our opinion, this is a smart, if not obvious move. The company has long been undervalued, getting no credit for its zinc assets. Interestingly, before Sierra Mojada was presented as a silver mine, engineers thought to develop it as a zinc mine. With zinc prices climbing and analysts predicting a worsening zinc deficit ahead, it makes sense to highlight the zinc aspects of the Silver Bull story. There seems to be little downside to doing so, since most of the mine prep is the same whether it's a zinc mine or a silver mine.

Silver Bull is Still for Silver Bulls. We are disappointed that the long-awaited bull market in silver is yet to return. The silver lining, if there ever was an apt time to use that phrase, is that the company's silver is not going anywhere. We see huge optionality in Silver Bull on higher silver prices. In the past 5 years silver traded close to $50, reaching a high of $48.55. At $20 silver, the Sierra Mojada project's NPV is over 10x Silver Bull's market cap. At $30 silver - not even double today's spot price - the NPV is about 27x the market cap.

Source: Google Finance. SVBL, SLV, and GDXJ year-to-date

Even with the backdrop of a depressed silver market this year, we think Silver Bull shares have dropped more than they should have. The silver ETF (NYSEARCA:SLV) is down about 16% and the Junior Gold Miners ETF (NYSEARCA:GDXJ), which, despite its name has exposure to both silver and gold resources, is down about 7%. In contrast, Silver Bull has been sliced in half year-to-date. We don't think there's a fundamental reason for the stock to be down so sharply. We simply think it's due to Silver Bull being a microcap that investors have abandoned and now the share price is at an irrational level - driven by investor impatience and not the company's asset values.

M&A. In the interview portion, Tim discusses some of the recent M&A transactions in the mining space, which has been surprisingly active lately, following relative quiet. Tim's thesis is that miners are forced to replace the assets they mine, especially now that they haven't been doing so for some time. He thinks we are likely to see continued transactions in the industry.

We don't know if tomorrow we'll find out that a forward-looking acquirer recognizes the opportunity to own Silver Bull's assets when they are down and out, or if we'll need to see a recovery in silver before someone steps in with a bid. The additional analysis that management will be presenting on the project's zinc could also inject new life into the story, either through a new pool of acquirers or through investors who are seeking zinc exposure.

As we wait, Tim and his team have been making great progress in slashing costs, lowering option prices on land, and advancing through the permitting process. We confess that the Silver Bull story we wrote about in our prior articles, with silver in the 20's and rising, was an even better pitch, but we think the investment still works - at least for patient investors. We like owning shares in a company that is undervalued today with a strong balance sheet. If an acquirer bids on the assets we could get a handsome premium, but what really excites us is the prospect of making many multiples on our money should zinc and silver prices move favorably.

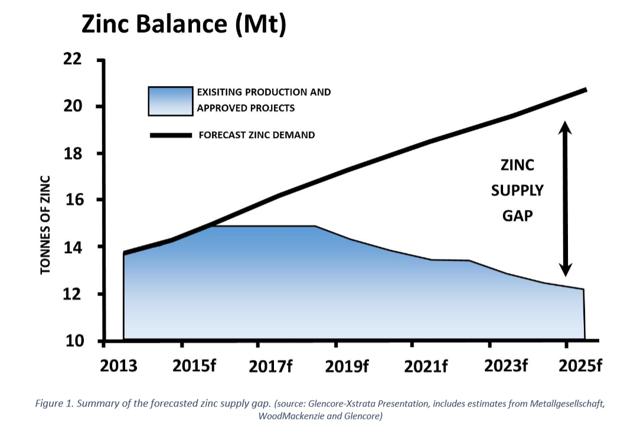

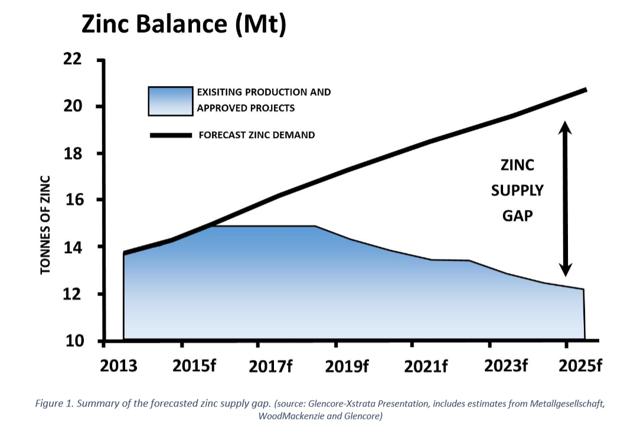

The coming zinc deficit. Source: Silver Bull

CEO Interview. We had a recent conversation with Tim Barry, Silver Bull's CEO, to get updated on progress at the company and hear his latest thinking. We are pleased to share this conversation with our readers, and express our sincerest thanks to Tim for participating in the interview.

Let's start by talking about Silver Bull's key accomplishments so far in 2014.

Tim: 2014 has been a year where we've focused on the permitting and the de-risking of the project. Following our release of our preliminary economic assessment at the end of 2013, we very much moved into getting other aspects of a potential mine in line. That's included permitting water rights, getting surface rights sorted, access to gas lines, railway lines, etc. So, a lot of the minutia that needs to go into getting a mine in production. We've had a lot of success on all of those fronts so far in 2014.

We've long noticed that the company has 2.2 billion pounds of zinc that we felt the market never gave it credit for. In September you announced a shift to focus on the zinc potential at Sierra Mojada. Will you tell us about the reasoning behind the shift?

Tim: It was really two-fold. First, as you point out, is the fact that we do have a very large zinc resource, which had been overshadowed by the silver, and the company didn't receive much or any credit for its zinc. The other thing is that zinc is on the upswing due to solid fundamentals, a lot of big zinc deposits shutting down, and not a lot of new zinc supply coming online. It just made sense that we focus on the commodity that is getting the limelight.

When you talk about a shift in the focus, what, in practical terms, does it mean that we'll be doing differently?

Tim: Let me highlight that the silver is still there - over 160 million ounces of it. What we're doing is examining the potential of the zinc under various economic scenarios and really bringing that to the fore of the company as well. So, we'll present this as two deposits: a silver deposit with robust fundamentals, and then the zinc story, which we expect to be talking more about ahead. As we delve deeper into our analysis of the zinc, we'll be able to talk more fully to investors and potential acquirers about the economics of it.

What this does is open up a new potential group of investors or buyers into the company who have a base metal focus. With the fundamentals of zinc looking as strong as they do since it's going into a supply deficit, this actually melds nicely with the investment philosophies of some funds.

How does the shift in focus to zinc impact the development of our silver resource?

Tim: It doesn't in any major way. The permitting and most everything else that goes along with that needs to happen for both the zinc and the silver. So, ultimately, any mine that goes ahead, whether it's a silver mine or a zinc mine, has no detrimental effect on the other.

Do you have an outlook, your personal outlook, for silver and zinc pricing?

Tim: I do. Silver, in my opinion, is going to have its day again. Lately it's been under pressure because of strength in the dollar. But I think the loose monetary policy, the anemic growth we're seeing in a lot of other economies, and black swan events around the world are going to make precious metals a haven. If a threat of inflation creeps back into the equation, then we're really going to see precious metals go north. When that will happen exactly is anyone's guess, but my sense on silver in particular is that we have bottomed out. There is a natural floor for the production of silver and that's really based on the cost of production. You're just not going to see silver go back to where it was in the pre-2000's, in my opinion.

Regarding the outlook for zinc, analysts forecast that by 2015-2016 we are going to be looking at a price of $1.20-$1.25 per pound. That's just based on the known demand for zinc. Its main use is in galvanizing steel, and building is continuing around the world. When you look at that, combined with the number of mines that have already gone offline or are about to, the sums just don't add up. We are going into a zinc deficit on the supply side. So, I think that the outlook for zinc in the short to medium term is very positive.

How has M&A activity been in the industry lately?

Tim: It has been relatively quiet with the caveat that we are now starting to see a number of deals moving forward. I think companies have been very careful about catching the falling knife and so they're looking to see the market settle down a bit before M&A activity fully kicks in.

Recently, we had Lundin Mining taking the Candelaria copper mine down in Chile off the hands of Freeport for nearly $2 billion. We've also had some smaller deals: New Gold acquiring Bayfield just days ago. AuRico and Carlisle have merged. US Silver and Scorpio Mining have merged. And this has all happened just in the last few days. So, we are starting to see this space consolidate and are seeing companies acquiring assets that they think have value. I think we're going to see this continue into 2015.

It's no secret that Silver Bull's plans are to eventually sell to or partner with a larger company who can fund development of the assets. What can you share with us regarding the various confidentiality agreements that we have with potential acquirers and partners?

Tim: We've had a number of confidentiality agreements signed. All of those companies have come to site. We're still in conversations with a lot of them. There are varying degrees of interest. No doubt, some are still trying put their own house in order and others are better positioned to act. I can't comment on the timing. Most of the companies have extended their confidentiality agreements with us, which is a good sign. It shows that they want to stay up-to-date on the project and remain knowledgeable on the developments.

Every potential acquirer has its own situation, but, speaking broadly, what I do think is that once people feel comfortable that we have seen the worst of this market, companies like ours are increasingly going to be at the forefront of M&A-type activity because we're already known to groups and I think a project like Sierra Mojada fits into their plans. This is a great development project. It's a big resource in a viable jurisdiction. Investors are going to ask the larger companies: where's the next mine? What's your inventory like? And that's where I think a project like Sierra Mojada fits in well.

As you look to rest of this year and into next year, what milestones should investors expect to see out of the company?

Tim: I think we're going to continue to see the permitting process come through. Some of the permitting process will be released to the market. Some of it won't be because we're simply just going to be on a continuum, pushing this to a mine stage. I also think we're going to see a clearer vision of what the zinc potential is on the project, based on the size of the resource, the grade, and, ultimately, the economics.

At this stage, we're pushing forward on an internal assessment of the economics of the zinc ore body and based on the results of this work and market conditions we would potentially look to do a preliminary economic assessment in the first half of 2015. What will also come along with that will be continued metallurgical test work focused on the zinc in particular. So, permitting, re-modeling the zinc resource with a view to mining it underground, and then continued metallurgical work, which will ultimately be pushing it toward a feasibility or will be needed for a feasibility study.

Is there anything else worth pointing out to investors?

Tim: The thing I will highlight about Sierra Mojada is that assets of this size are very rare. Although we're in a difficult market right now, the fundamentals for metals going forward are very strong, I believe. Demand is always going to be there, especially in emerging economies. We're witnessing many jurisdictions becoming more difficult to get mines going. A lot of the big, easy deposits have already been found around the world. There are very few places left that haven't already been looked at.

To bring that back to Silver Bull, when you've got a project of this size with a major silver resource and a major zinc resource in a viable jurisdiction with great infrastructure it's a compelling story that I think makes a very good investment for the future as a takeout or a joint venture. In the entire world there just aren't that many mining assets as attractive as ours.

Tim, thank you very much. It was great catching up with you.

Tim: My pleasure.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Additional disclosures: I will not sell shares of SVBL for the 3 trading days following publication of this article. Please see our full legal disclaimer which applies to this article.

http://seekingalpha.com/article/2719565-buy-silver-bull-today-get-2-billion-of-free-zinc

By Lazarus Investment Partners

Dec. 1, 2014 7:15 AM ET

Summary

* Silver Bull is an exceedingly rare asset: a huge resource in a mining-friendly area with great infrastructure.

*As zinc prices climb higher and the forecast calls for a supply deficit, Silver Bull is complementing its silver story by advancing the company’s 2.2 billion pounds of zinc.

*M&A in the mining sector has been perking up, and we think Silver Bull is an extremely attractive company for an acquirer to own.

* Silver Bull offers incredible optionality on higher silver prices, although the reversal in silver this year is a significant challenge to the company.

* We provide an interview with the company’s CEO.

Introduction. We believe that Silver Bull (NYSEMKT:SVBL; TSX SVB) has one of the single largest and most attractive silver and zinc resources on the planet. The company's Sierra Mojada project is estimated to contain 164 million ounces of silver, 2.2 billion pounds of zinc, and hundreds of millions of pounds of lead and copper, with further upside potential in surrounding parcels. It is in a mining friendly jurisdiction in Mexico with a skilled local workforce and great infrastructure, including grid power, water, paved roads, and a railway to site. Silver Bull has a strong balance sheet with no near-term financing needs. Management is advancing the project as far as it can with the intention of selling it to or partnering with a larger company who can fund the mine into production.

The company's presentation highlights an after-tax IRR for the project of 23.1% and an after-tax NPV of $464 million. These numbers need to be adjusted significantly for the latest movements in metals prices, but even so, the project's NPV is still dramatically higher than the company's market cap of just $28 million. Weak silver prices have made our investment in Silver Bull frustrating, but we still love the optionality it offers on a rebound in silver, as well as its exposure to a massive zinc resource.

For additional background on the company, please see our article from last December and our update in July. We will use the balance of this article to summarize developments at the company and share an update conversation with Tim Barry, Silver Bull's CEO.

Pivot to Zinc. The elephant in the room for Silver Bull has been declining silver prices. When we wrote about the company this past summer, silver was up modestly for the year. It has since given up those gains and is now down for the year. Silver hit a high of $22 an ounce at the beginning of the year, and now trades at around $16.50. True to its name, Silver Bull's flagship project, at least as previously conceived, was heavily focused on silver production (72% silver, 28% zinc). Yes, even at $16 silver the project has a double digit IRR, but the drop in silver prices dampens both the economics of the project as well as the acquisition urgency of larger miners.

In September Silver Bull announced that following a 28% rise in zinc prices, it would be re-examining the zinc potential of its resource. In the interview below with Silver Bull's CEO, he explains what the company will be doing differently as it pivots to zinc. In our opinion, this is a smart, if not obvious move. The company has long been undervalued, getting no credit for its zinc assets. Interestingly, before Sierra Mojada was presented as a silver mine, engineers thought to develop it as a zinc mine. With zinc prices climbing and analysts predicting a worsening zinc deficit ahead, it makes sense to highlight the zinc aspects of the Silver Bull story. There seems to be little downside to doing so, since most of the mine prep is the same whether it's a zinc mine or a silver mine.

Silver Bull is Still for Silver Bulls. We are disappointed that the long-awaited bull market in silver is yet to return. The silver lining, if there ever was an apt time to use that phrase, is that the company's silver is not going anywhere. We see huge optionality in Silver Bull on higher silver prices. In the past 5 years silver traded close to $50, reaching a high of $48.55. At $20 silver, the Sierra Mojada project's NPV is over 10x Silver Bull's market cap. At $30 silver - not even double today's spot price - the NPV is about 27x the market cap.

Source: Google Finance. SVBL, SLV, and GDXJ year-to-date

Even with the backdrop of a depressed silver market this year, we think Silver Bull shares have dropped more than they should have. The silver ETF (NYSEARCA:SLV) is down about 16% and the Junior Gold Miners ETF (NYSEARCA:GDXJ), which, despite its name has exposure to both silver and gold resources, is down about 7%. In contrast, Silver Bull has been sliced in half year-to-date. We don't think there's a fundamental reason for the stock to be down so sharply. We simply think it's due to Silver Bull being a microcap that investors have abandoned and now the share price is at an irrational level - driven by investor impatience and not the company's asset values.

M&A. In the interview portion, Tim discusses some of the recent M&A transactions in the mining space, which has been surprisingly active lately, following relative quiet. Tim's thesis is that miners are forced to replace the assets they mine, especially now that they haven't been doing so for some time. He thinks we are likely to see continued transactions in the industry.

We don't know if tomorrow we'll find out that a forward-looking acquirer recognizes the opportunity to own Silver Bull's assets when they are down and out, or if we'll need to see a recovery in silver before someone steps in with a bid. The additional analysis that management will be presenting on the project's zinc could also inject new life into the story, either through a new pool of acquirers or through investors who are seeking zinc exposure.

As we wait, Tim and his team have been making great progress in slashing costs, lowering option prices on land, and advancing through the permitting process. We confess that the Silver Bull story we wrote about in our prior articles, with silver in the 20's and rising, was an even better pitch, but we think the investment still works - at least for patient investors. We like owning shares in a company that is undervalued today with a strong balance sheet. If an acquirer bids on the assets we could get a handsome premium, but what really excites us is the prospect of making many multiples on our money should zinc and silver prices move favorably.

The coming zinc deficit. Source: Silver Bull

CEO Interview. We had a recent conversation with Tim Barry, Silver Bull's CEO, to get updated on progress at the company and hear his latest thinking. We are pleased to share this conversation with our readers, and express our sincerest thanks to Tim for participating in the interview.

Let's start by talking about Silver Bull's key accomplishments so far in 2014.

Tim: 2014 has been a year where we've focused on the permitting and the de-risking of the project. Following our release of our preliminary economic assessment at the end of 2013, we very much moved into getting other aspects of a potential mine in line. That's included permitting water rights, getting surface rights sorted, access to gas lines, railway lines, etc. So, a lot of the minutia that needs to go into getting a mine in production. We've had a lot of success on all of those fronts so far in 2014.

We've long noticed that the company has 2.2 billion pounds of zinc that we felt the market never gave it credit for. In September you announced a shift to focus on the zinc potential at Sierra Mojada. Will you tell us about the reasoning behind the shift?

Tim: It was really two-fold. First, as you point out, is the fact that we do have a very large zinc resource, which had been overshadowed by the silver, and the company didn't receive much or any credit for its zinc. The other thing is that zinc is on the upswing due to solid fundamentals, a lot of big zinc deposits shutting down, and not a lot of new zinc supply coming online. It just made sense that we focus on the commodity that is getting the limelight.

When you talk about a shift in the focus, what, in practical terms, does it mean that we'll be doing differently?

Tim: Let me highlight that the silver is still there - over 160 million ounces of it. What we're doing is examining the potential of the zinc under various economic scenarios and really bringing that to the fore of the company as well. So, we'll present this as two deposits: a silver deposit with robust fundamentals, and then the zinc story, which we expect to be talking more about ahead. As we delve deeper into our analysis of the zinc, we'll be able to talk more fully to investors and potential acquirers about the economics of it.

What this does is open up a new potential group of investors or buyers into the company who have a base metal focus. With the fundamentals of zinc looking as strong as they do since it's going into a supply deficit, this actually melds nicely with the investment philosophies of some funds.

How does the shift in focus to zinc impact the development of our silver resource?

Tim: It doesn't in any major way. The permitting and most everything else that goes along with that needs to happen for both the zinc and the silver. So, ultimately, any mine that goes ahead, whether it's a silver mine or a zinc mine, has no detrimental effect on the other.

Do you have an outlook, your personal outlook, for silver and zinc pricing?

Tim: I do. Silver, in my opinion, is going to have its day again. Lately it's been under pressure because of strength in the dollar. But I think the loose monetary policy, the anemic growth we're seeing in a lot of other economies, and black swan events around the world are going to make precious metals a haven. If a threat of inflation creeps back into the equation, then we're really going to see precious metals go north. When that will happen exactly is anyone's guess, but my sense on silver in particular is that we have bottomed out. There is a natural floor for the production of silver and that's really based on the cost of production. You're just not going to see silver go back to where it was in the pre-2000's, in my opinion.

Regarding the outlook for zinc, analysts forecast that by 2015-2016 we are going to be looking at a price of $1.20-$1.25 per pound. That's just based on the known demand for zinc. Its main use is in galvanizing steel, and building is continuing around the world. When you look at that, combined with the number of mines that have already gone offline or are about to, the sums just don't add up. We are going into a zinc deficit on the supply side. So, I think that the outlook for zinc in the short to medium term is very positive.

How has M&A activity been in the industry lately?

Tim: It has been relatively quiet with the caveat that we are now starting to see a number of deals moving forward. I think companies have been very careful about catching the falling knife and so they're looking to see the market settle down a bit before M&A activity fully kicks in.

Recently, we had Lundin Mining taking the Candelaria copper mine down in Chile off the hands of Freeport for nearly $2 billion. We've also had some smaller deals: New Gold acquiring Bayfield just days ago. AuRico and Carlisle have merged. US Silver and Scorpio Mining have merged. And this has all happened just in the last few days. So, we are starting to see this space consolidate and are seeing companies acquiring assets that they think have value. I think we're going to see this continue into 2015.

It's no secret that Silver Bull's plans are to eventually sell to or partner with a larger company who can fund development of the assets. What can you share with us regarding the various confidentiality agreements that we have with potential acquirers and partners?

Tim: We've had a number of confidentiality agreements signed. All of those companies have come to site. We're still in conversations with a lot of them. There are varying degrees of interest. No doubt, some are still trying put their own house in order and others are better positioned to act. I can't comment on the timing. Most of the companies have extended their confidentiality agreements with us, which is a good sign. It shows that they want to stay up-to-date on the project and remain knowledgeable on the developments.

Every potential acquirer has its own situation, but, speaking broadly, what I do think is that once people feel comfortable that we have seen the worst of this market, companies like ours are increasingly going to be at the forefront of M&A-type activity because we're already known to groups and I think a project like Sierra Mojada fits into their plans. This is a great development project. It's a big resource in a viable jurisdiction. Investors are going to ask the larger companies: where's the next mine? What's your inventory like? And that's where I think a project like Sierra Mojada fits in well.

As you look to rest of this year and into next year, what milestones should investors expect to see out of the company?

Tim: I think we're going to continue to see the permitting process come through. Some of the permitting process will be released to the market. Some of it won't be because we're simply just going to be on a continuum, pushing this to a mine stage. I also think we're going to see a clearer vision of what the zinc potential is on the project, based on the size of the resource, the grade, and, ultimately, the economics.

At this stage, we're pushing forward on an internal assessment of the economics of the zinc ore body and based on the results of this work and market conditions we would potentially look to do a preliminary economic assessment in the first half of 2015. What will also come along with that will be continued metallurgical test work focused on the zinc in particular. So, permitting, re-modeling the zinc resource with a view to mining it underground, and then continued metallurgical work, which will ultimately be pushing it toward a feasibility or will be needed for a feasibility study.

Is there anything else worth pointing out to investors?

Tim: The thing I will highlight about Sierra Mojada is that assets of this size are very rare. Although we're in a difficult market right now, the fundamentals for metals going forward are very strong, I believe. Demand is always going to be there, especially in emerging economies. We're witnessing many jurisdictions becoming more difficult to get mines going. A lot of the big, easy deposits have already been found around the world. There are very few places left that haven't already been looked at.

To bring that back to Silver Bull, when you've got a project of this size with a major silver resource and a major zinc resource in a viable jurisdiction with great infrastructure it's a compelling story that I think makes a very good investment for the future as a takeout or a joint venture. In the entire world there just aren't that many mining assets as attractive as ours.

Tim, thank you very much. It was great catching up with you.

Tim: My pleasure.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Additional disclosures: I will not sell shares of SVBL for the 3 trading days following publication of this article. Please see our full legal disclaimer which applies to this article.

http://seekingalpha.com/article/2719565-buy-silver-bull-today-get-2-billion-of-free-zinc

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.