Tuesday, October 07, 2014 7:56:46 AM

*** Technical Updates

THE CHARADE - FOUNDATIONAL BASES - *** Updated

1. The FDIC has not been released for other than WMB “creditor” claims, despite the facts and reality in the terms of the Confirmed Plan, POR7 and the GSA.

***UPDATED***

Such “creditor” claims “were” (they “were” settled on the Effective Date in accordance with the Confirmed Plan, POR7 and the GSA, so they no longer “are”) were NEVER WMI’s claims against the FDIC (WMI, was the debtor, the Parent company of WMB, the bank, along with WMBfsb that were seized by the OTS, placed into Receivership with the FDIC and sold per a WHOLE BANK Purchase and Assumption Agreement with the standard 6 year term for finalization of the Terms of the Agreement; not the “P&AA state SELLING PRICE,) were really the “creditor” claims were WMI’s “creditor” claims against WMB. Again, those technically existed ‘only at the time of the Abandonment of WMB, by the debtor WMI, which generated the net $6 billion NOL that unrestricted by the Annual Limitations of IRC 382, and then such claims against WMB (then and still held in Receivership by the FDIC) were settled at the Effective Date (which was after Abandonment motion of such reference).

Of note, and generally ignored, is the clear statement in the same paragraph in the abandonment motion.

[bold]and (ii) established that, upon such abandonment, WMI and its chapter 11 estate shall automatically be deemed to have permanently surrendered and relinquished all of their right, title and interest to the WMB Stock, including any recovery rights and/or litigation claims with respect thereto[/bold]

Further, the origination of such claims, the DC Court Action, was yielded to the bankruptcy court, then mooted by the GSA on the "Effective Date," which would be after the Abandonment (which is represented by the Original Abandonment Motion and subsequent Court Orders "affirming such," through 2012's Abandonment).

This time line on Abandonment is currently discussed.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=106949613

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=106955736

2. The FDIC has $110-$130 BILLION of WMB assets that were not sold to JPM, despite the facts and reality that such was not being disclosed in the P&AA, nor being challenged by the debtor, creditors or equity during the bankruptcy and thereafter.

***UPDATED***

At the time of the seizure of WMB, and all of its subsidiaries (numerous subsidiaries, including financial entities purchased by WMB that have names of title chain on the following) that were used to “securitize” mortgage pools and issue Mortgage Backed Securities, sold in series and tranches based on the ratings of the mortgages therein, to market buyers such as Trusts managed by Deutsche Bank (now litigating the FDIC and JPMorgan over $13 billion of mortgage losses on impaired mortgage loans that underperformed based upon alleged underwriting procedures of WMB and its subsidiaries), the GSE’s Fannie and Freddie, and, directly to Pension funds like the Boilermakers (who sought to recover in the WMI bankruptcy), was in the normal process of securitizing pools of mortgages. They regularly and routinely sold these Residential MBS. Those SOLD are owned by those that bought them.

Those “in-process securitized mortgages” at the time of the seizure, representing transactions under contracts of the buyers of the Residential MBS, met the requirements under General Accepted Accounting Principles (GAAP) at the time to be “off-balance sheet;” thereby allowing the mortgage assets to be recorded as sold, a sale recorded and the proceeds receivable. All in-process securitizations that were off-balance sheet at the time of seizure were completed by JPMorgan after purchasing WMB assets as identified in the P&AA.

Per WMI’s consolidated financial statements:

The Company transforms loans into securities through a process known as securitization. When the Company securitizes loans, the loans are usually sold to a qualifying special-purpose entity ("QSPE"), typically a trust. The QSPE, in turn, issues securities, commonly referred to as asset-backed securities, which are secured by future cash flows on the sold loans. The QSPE sells the securities to investors, which entitle the investors to receive specified cash flows during the term of the security. The QSPE uses the proceeds from the sale of these securities to pay the Company for the loans sold to the QSPE. These QSPEs are not consolidated within the financial statements since they satisfy the criteria established by Statement No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities. In general, these criteria require the QSPE to be legally isolated from the transferor (the Company), be limited to permitted activities, and have defined limits on the types of assets it can hold and the permitted sales, exchanges or distributions of its assets.

Also at the time of the seizure of WMB, residual “retained interests” in such securitized mortgage pools, although severely impaired in later years, which represent estimated valuations of potentially over-collateralized estimates of the mortgage pool returns; such was accounted for as “trading assets” by WMB, and reported in the consolidated financial statements and SEC filings as such, were also sold via the P&AA.

Per WMI’s consolidated financial statements:

When the Company sells or securitizes loans that it originated, it generally retains the right to service the loans and may retain senior, subordinated, residual, and other interests, all of which are considered retained interests in the sold or securitized assets. Retained interests in mortgage loan securitizations, excluding the rights to service such loans, were $1.23 billion at June 30, 2008, of which $1.13 billion are of investment-grade quality. Retained interests in credit card securitizations were $1.56 billion at June 30, 2008, of which $421 million are of investment-grade quality. Additional information concerning the pretax gains, cash flows, servicing fees, principal and interest received on and valuation of retained interests and loan repurchases, in each case, arising from the Company's securitization activities is included in Note 7 to the Consolidated Financial Statements – "Securitizations" in the Company's 2007 Annual Report on Form 10-K/A. Additional information concerning the revenue and expenses from the sales and servicing of home mortgage loans, including the effects of derivative risk management instruments is included in Note 8 to the Consolidated Financial Statements – "Mortgage Banking Activities" in the Company's 2007 Annual Report on Form 10-K/A.

3. The FDIC has been holding these assets, purported to be Mortgage Backed Securities, in administrative court registry accounts, despite the facts and reality that such was not being disclosed in the P&AA, not challenged by those that actually bought the MBS (Deutsche Bank trusts, Fannie and Freddie, and pension funds like the Boilermakers, for example), nor being challenged by the debtor, creditors or equity during the bankruptcy and thereafter.

***UPDATED***

Since the seizure, there have been settlements on these MBS originated at WMB pre-seizure (originated by WMB, purchased by WMB by producers and other financial institutions, and packaged via WMB subsidiaries). The settlements have included some under the inducement of the Department of Justice which sought to protect the FDIC from the “indemnification clause” that JPM had with regard to such (and unrelated to JPM indemnification claims against the receivership for state tax and over 30 other issues disclosed on the FDIC receivership site under Status of Receivership).

In December of 2013, JPM filed litigation against the FDIC for various matters under the P&AA indemnification clause, seeking to (1) establish a claim for reimbursement of billions of amounts it has settled representing WMB pre-seizure claims and (2) establish the basis for a claim for potential reimbursement if it loses the $13 billion Deutsche Bank (on behalf of, “trusts”) litigation against the FDIC and JPM for underperforming mortgages in the MBS pools, return losses and related costs as a result of underwriting practices at WMB (and subsidiaries) pre-seizure.

In establishing the above claims under the P&AA, and prior to the 6th year anniversary to make such claims against the assets of the receivership ($2.7 billion; the $1.9 billion purchase price of WMB and the balance in NOL carryback tax refunds negotiated to the FDIC in the GSA in the confirmed Plan), in order to establish an “administrative claim priority” of the highest level at the receivership “above” WMB Senior and Junior bondholders (such as Paulson and Company, which almost immediately SOLD its positions in WMB Senior bonds).

FDIC “Status of Receivership”

On February 24, 2012, the Bankruptcy Court entered an order confirming the seventh amended plan proposed by WMI and its co-debtor WMI Investment Corp (the "Plan"). The Settlement, as amended from time to time, remains integral to and incorporated in the Plan. The Plan and Settlement became effective on March 19, 2012. The Receiver received $843.9 million pursuant to the terms of the Settlement. When added to the approximately $1.87 billion currently held by the Receiver (WAMU Quarterly Receivership Balance Sheet Summary ) , the Receiver will have a total of approximately $2.71 billion to distribute to holders of claims allowed by the receivership, according to the priority established in 12 U.S.C. § 1821(d)(11)(A). Before the Receiver can distribute these funds, however, it must pay administrative expenses and resolve a number of lawsuits that have been filed against it, the largest of which was filed by Deutsche Bank National Trust Co. claiming $6 to $10 billion in damages arising out of WAMU's alleged breach of representations and warranties made in connection with mortgages sold to securitized trusts. (Amended Complaint)

Also, the Receiver must resolve a number of indemnity claims made by JPMC. JPMC has submitted over 35 notices of potential indemnity claims. (Notices can be found at JPMorgan Chase Notices relating to Washington Mutual Whole Bank P&A in the Freedom of Information Act (FOIA) Service Center Reading Room). Some of these claims for indemnification will be resolved through the implementation of the settlement, but many will not. In addition, JPMC has until September 2014 to provide the Receiver with notice of additional potential indemnity claims. Should the Receiver be found liable on any of JPMC's indemnity claims, under the P&A, those claims will be satisfied as administrative expenses and thus before the claims of general unsecured creditors. Current information indicates that the Receiver is unlikely to have sufficient funds to distribute to holders of receivership certificates issued to junior note holders or equity holders of WAMU.

(A) In general

Subject to section 1815 (e)(2)(C) of this title, amounts realized from the liquidation or other resolution of any insured depository institution by any receiver appointed for such institution shall be distributed to pay claims (other than secured claims to the extent of any such security) in the following order of priority:

(i) Administrative expenses of the receiver.

(ii) Any deposit liability of the institution.

(iii) Any other general or senior liability of the institution (which is not a liability described in clause (iv) or (v)).

(iv) Any obligation subordinated to depositors or general creditors (which is not an obligation described in clause (v)).

(v) Any obligation to shareholders or members arising as a result of their status as shareholders or members (including any depository institution holding company or any shareholder or creditor of such company).

4. The FDIC has $280 BILLION of WMB loans that were not sold to JPM, despite the facts and reality that JPM has recorded them on their financial statements (or the “loss” would wipe out the entire stockholder’s equity of JPM), and despite the facts and reality that such was not disclosed in the P&AA, nor being challenged by the debtor, creditors or equity during the bankruptcy and thereafter.

***UPDATED***

The theory component is based upon the erroneous posit that JPM “only bought the servicing rights” to WMB loans. The support for this appears to be that, in a couple of instances (and some with state-wide implications), some borrowers (who don’t want to pay their mortgages to “anyone”) have stopped FORECLOSURES due to the lack of state regulatory compliance with documenting assignments and perfecting security interests in notes and mortgage recordings. In these limited cases, the courts have held that such FORECLOSURES could be voided; i.e., “voidable,” (for the time being, to allow the “correct recording and notifications per state by state laws and regulations) BUT NOT voided forever; i.e., “void ab initio.” In essence, when the chain of title and regulatory compliance is corrected, the borrowers would be foreclosed on they would be held responsible for the loan balances.

Several of the cases, mostly from 2012 when they were “headlines,” have continued in courts to no success of the borrower avoiding ultimately the foreclosure. One famous “support case” depicts that borrow plaintiffs as “debtors” (i.e., I think we can ascertain what that means) and are docketed in “contempt of court.”

5. The FDIC has been selling BILLIONS of WMB assets, despite the facts and reality that such are not recorded on the Receivership accounts online.

***UPDATED***

There is no visible update, generally as there was no visible support for such in the first place.

6. The FDIC is going to receive the largest portion of an estimated $35 BILLION LIBOR settlement in regard to a lawsuit filed on behalf of the Receivership's of the failed banks, and is going to GIFT such recoveries to the WMILT (out of the goodness of its' dark heart) despite the facts and reality that there are certificated FDIC claims outstanding of over $12 BILLION in the Receivership.

***UPDATED***

There is no update, nor any recorded information to change the erroneous theory posit.

7. JPM did not actually buy the WMB loan assets, the facts and reality that they recorded them on their 2008-current SEC filed audited financial statements.

***UPDATED***

The WMB loans, after write-down of almost $30 billion, were purchased by JPM and are disclosed in the 2008-2009 annual audited financial statements and 10K annual report filed with the SEC. The WMB assets sold by the FDIC receivership are established in the P&AA.

The WMB loans, the off-balance sheet “in process of securitization MBS,” retained interests and prior MBS sold and currently “serviced” by JPM is also under a NEW THEORY ASSERTION that is ~

WMI actually owned all such, there (1) the hundreds of billions of loans and MBS “already sold” are simply “Hidden Assets” (there actually is a sticky for this) from the debtors reporting or (2) “not reported” by the FDIC Receivership.

Again, the ‘core is WMI performed these banking activities.

The facts and reality is that WMI never engaged in such business activities.

Per the WMI Liquidating Trust, in a docketed court response to a borrower (mortgage), indicated that such was the case.

OBJECTION OF WMI LIQUIDATING TRUST TO THE LATE-FILED, WRONG-PARTY PROOF OF CLAIM OF JAMES T. ROBERTS AND VINNIE ROBERTS

https://www.kccllc.net/wamu/document/0812229140911000000000001

11. Finally, the Claim, which appears to relate to WMB’s mortgage business, contains no allegations that would impose any liability upon the Debtors or WMILT. WMI never issued or served commercial loans or mortgage loans and was never directly engaged in any of these activities. As the Claim fails to assert any actionable conduct on the part of either the Debtors or WMILT, the Claim should be disallowed in its entirety.

6. In addition, upon information and belief, the Claim arises from a mortgage executed and delivered by Roberts and held by WMB. The Claim seeks a recovery on account of conduct that is not attributable to WMI or WMI Investment. Specifically, WMI itself does not currently, and never has, engaged in any of the following business activities:

i. operated as a bank;

ii. originated or serviced mortgage loans anywhere in the United States or elsewhere;

iii. contracted with depositors of WMB in a bank capacity;

iv. originated or serviced non-mortgage commercial loans anywhere in the United States or elsewhere;

v. issued or serviced any consumer or commercial line of credit, including home equity and letters of credit (other than on an intercompany basis);

vi. engaged in any form of banking function, such as investments on behalf of banking customers, the issuance or servicing of any passbook savings accounts, credit cards, checking accounts or the maintenance of a safe deposit function; or

vii. initiated foreclosure proceedings.

ORDER GRANTING THE OBJECTION OF WMI LIQUIDATING TRUST TO THE LATE-FILED, WRONG-PARTY PROOF OF CLAIM OF JAMES T. ROBERTS AND VINNIE ROBERTS

https://www.kccllc.net/wamu/document/0812229141002000000000001

ORDERED that the Objection is GRANTED as set forth herein; and it is further

ORDERED that the Claim of James T. Roberts and Vinnie Roberts, a copy of which is attached hereto as Exhibit 1, is hereby disallowed in its entirety; and it is further

ORDERED that this Court shall retain jurisdiction to hear and determine all matters arising from or related to the implementation, interpretation, or enforcement of this Order.

Dated: October 2, 2014

Wilmington, Delaware

THE HONORABLE MARY F. WALRATH

UNITED STATES BANKRUPTCY JUDGE

8. JPM, in addition to the above-referenced fraudulent SEC annual and quarterly filings in 2008, 2009, 2010, 2011, 2012, 2013 and to date 2014 (which include pertinent reference to the WMB loans it has and the increased earnings as a result of), which has been audited each and every year, and each related 10K has been accepted without such question in each and every year; nonetheless and out of THE EXTREME HEARTFELT APPRECIATION toward WMI shareholders and YEARS OF PROFIT GUILT, will be authorized by its Board to go into the time machine and ultimately agree to pay the $8 per common share it once offered, and also pay at FACE value all of the preferred stock; somehow with a stock exchange that it has already agreed to (under the thumb of Susman himself) but has simply not disclosed any such think in any SEC filing to date.

***UPDATED***

Nothing apparent to a reasonably prudent person to update as the JPM Board has not (at least in public) disclosed that such a stock exchange has been approved (and are unconcerned with the SEC violations of such and the duty to its shareholders for disclosure).

SPECIFIC

9. The above has all been “timed” by Susman Godfrey, in a “filing” (of which there is no record, also the basis for the lack of 3rd party suits), after he personally used the “sealed documents” (that allowed for the Equity Committee to “win” the appointment of an Examiner with a “narrow scope” and “no under oath consequences") that the debtor, the court, the creditors committee and all of the “professionals that have been paid HUNDREDS OF MILLIONS” are SECRETLY WITHHOLDING; the facts and reality that Susman Godfrey, the debtor, the WMILT, or any other party have never indicated any such in any manner at any time, as well as at al.

***UPDATED***

Nothing apparent to a reasonably prudent person to update as the none of the above-mentioned officials or professionals have uttered any such thing (despite the continued billing to the WMILT).

10. In review, creditors got nothing in the bankruptcy, despite the facts and reality that they got 100% paid (almost including the hybrid PIERS, who are being punished for being debt even though the valuation of the PIERS follows the NVP of the instruments agreed to by the Indentured Trustee and the impact of the FJR up-subordination).

***UPDATED***

In another purported siting, as part of the above “blackout or cover-up,” also the court records that showed the debtors “paid TRICADIA (holders of CCB’s, a creditor class, that had argued the value of the NOLs of WMB* (*not WMI, the parent company, the debtor)) FIFTY MILLIONS DOLLARS TO BE SILENT about what the true amount of the NOLs are (theorized as high as $30 billion) so that ‘the world would never know.

Actual, the fact and reality is, TRICADIA was reimbursed $300,000 in legal fees.

ORDER APPROVING STIPULATION AND AGREEMENT BETWEEN THE DEBTORS AND TRICADIA CAPITAL MANAGEMENT, LLC WITH RESPECT TO THE DEBTORS' SEVENTH AMENDED PLAN

https://www.kccllc.net/wamu/document/0812229120215000000000006

NOW, THEREFORE, IT IS HEREBY STIPULATED AND AGREED by and between the Debtors and Tricadia:

AGREEMENT

1. This Stipulation shall become effective and binding upon entry of an order by the Bankruptcy Court approving the Stipulation (the "Effective Date"). The Debtors shall use their reasonable best efforts to obtain prompt approval hereof.

2. Notwithstanding the Effective Date, from and after the date hereof, Tricadia shall (a) not oppose and otherwise support, and take any and all actions reasonably requested by the Debtors (provided the same are at no material cost to Tricadia) to support confirmation of the Seventh Amended Plan in accordance with section 1129 of the Bankruptcy Code (or, subject to the provisions of section 1127 of the Bankruptcy Code and Bankruptcy Rule 3019, any modification thereof provided that such modification does not materially adversely affect the economic treatment or expected recovery to holders of CCB-2 Guarantees Claims pursuant to the terms and provisions of the Seventh Amended Plan and as set forth in the Disclosure Statement), (b) not vote for or support any chapter 11 plan not proposed or supported by the Debtors and (c) otherwise take no action to impede or preclude the administration of the Debtors' Chapter 11 Cases, the entry of a confirmation order, or the consummation, implementation and administration of, the Seventh Amended Plan.

3. Upon the effectiveness of the Seventh Amended Plan, and notwithstanding anything to the contrary provided therein, but only to the extent they are determined to be reasonable pursuant to an order of the Bankruptcy Court in accordance with Section 41.18 of the Seventh Amended Plan, upon notice and hearing, Tricadia shall be paid the legal fees and expenses it has incurred in connection with the Seventh Amended Plan and the Debtors' Chapter 11 Cases; provided, however, that, to the extent such fees and expenses are equal to or Jess than Three Hundred Thousand Dollars ($300,000.00), the Debtors shall not oppose any such application.

11. The PIERS creditors, originally after the HUNDREDS OF BILLIONS “hidden” in 1-8 above, were never simply after WMIH (the reorganized debtor) for “a handful of worthless tax attributes and a $75M shell,” despite the facts and reality that WMIH is what it is.

***UPDATED***

The theorist’s continue that such BILLIONS will “flow to WMIH” and “capitalize it instead of KKR,” as a result of the settlement with the AAOC for what is purported to be 2.5% of HUNDREDS OF BILLIONS that will flow to the WMI Liquidating Trust under the above theory CHAIN (which is based on positons dealing with WMB mortgages, WMB Residential Mortgage Backed Securities sold to buyers (owners), off—balance sheet “in-process” securitizations recorded in accordance with GAAP and completed by JPM and “servicing rights only assertions”).

The facts and realities are that WMIH has the AAOC’s “interest in certain litigation proceeds” (defined by the settlement agreement and docketed in the confirmed Plan) which the WMI Liquidation Trust (with regard to Goldman Sachs and another identified party) has disclosed that it would not pursue.

12. The AAOC settlement included a provision, regarding their $10M stock pledge to WMIH, that yields 50% of their “interests” in WMILT “certain litigation proceeds,” and such “interests” will result in BILLIONS to WMIH, the facts and reality there are no such certain litigation proceeds (especially of that magnitude) to date and the holdings of the AAOC in the WMILT cannot even be speculated.

***UPDATED***

See 11.

13. WMI was a $350 BILLION enterprise and the “value” just does not disappear, the facts and reality that all such assets are almost 90% offset by liabilities, as evidenced by the bankruptcy court financial filings and matched with JPM’s financial SEC filings and audited financial statements.

***UPDATED***

There is no visible update, generally as there was no visible support for such in the first place.

14. The AAOC 2.5% (*) that generated BILLIONS (in 12 above) to WMIH is what is holding up WMIH acquisitions as such BILLIONS will be used to increase the MKT CAP of WMIH to BILLIONS more so that “only then” WMIH can do an acquisition meeting the size-to-size requirements of IRC 382 in order to preserve the $6B in NOLs.

***UPDATED***

See 11.

SUMMATION

15. All of the above was negotiated in mediation, and it is a secret (the mediation results filed and recorded with the Court, disclosed in POR 7, disclosed in the voting ballots and all related communications were planned, allowable and fraudulent) because the entire world is watching and the secret can never get out (even to those who are to received FACE +50% on their preferreds and $8-$24 on their commons).

***UPDATED***

Still “out there” and supported by “now, in 2014” going back and looking at the P&AA (2008), court documents (2—8-2012), FDIC web publications of general procedures, and determining (counter to the professionals, including those representing Equity, who have been paid hundreds of millions in fees 2008-2014)) that ~

the ABOVE IS WHAT IS TRUE because “there is no record of it,” and,

everything THAT DID HAPPEN IS NOT TRUE because “it is recorded and documented.”

FURTHER, a new and equally factually incorrect, is the studied reference to the FDIC RECEIVERSHIP PROCEDURES and BANKRUPTCY PROCEDURES are “SEPARATE” highlight, is the underlying assertion that “since all of the creditors have now been paid (or about to be when the PIERS are finished), then the FDIC now will have to move to the lower classes and tranches.”

Such an assertion is BLENDING FDIC PROCEDURES and BANKRUPTCY PROCEDURES, and FDIC RECEIVERSHIP “liabilities and certificates” and BANKRUPTCY “claims matrix” as recorded in the WMI Liquidating Trust.

This is a woeful cross-error; the WMI Liquidating Trust outstanding claims are related to BANKRUPTCY PROCEDURES and they are SEPARATE from FDIC RECEIVERSHIP PROCEDURES.

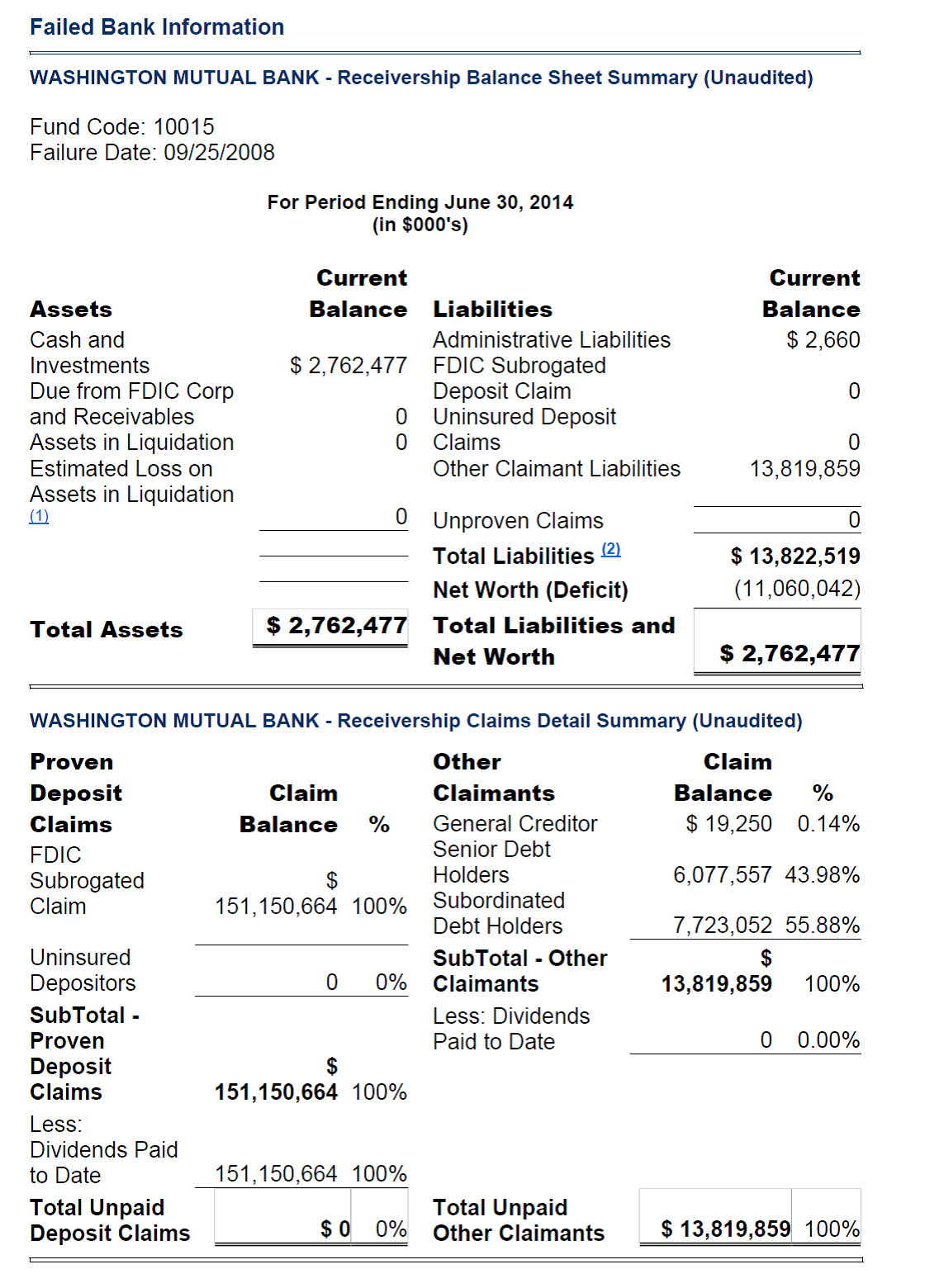

Per the FDIC Receivership Balance Sheet, the “liabilities and certificates” have not been paid, and they are very LARGE.

CONSEQUENCES AND BLAME

If 1-15 above do not happen, it will because Mike Willingham (and the Equity Committee) and Susman Godfrey, despite every statement, document and filing of the mediated settlement to the contradiction of “everything above” and never anything other than “it is what it is,” lied to some retail shareholders by “not perpetrating the above lies and fraudulent withholding of the real terms of the settlement in mediation.”

The facts and reality? NOT.

***UPDATED***

Not “if,” just simply “when.” Already, a NEW TERM HAS ARRIVED since the P&AA close-out did not produce the TENS TO HUNDREDS OF BILLIONS posited;

It is now in the PROCESS OF RECONCILIATION.

We’ve now entered the neutral zone “created” when nothing that was to erupt from the P&AA closure (if such took place, and such was between the FDIC and JPM; not WMI or WMB) is not being disclosed because (a continuing theory) it is a SECRET and the parties are in the PROCESS OF RECONCILIATION (of how to gather all of the TENS TO HUNDREDS OF BILLIONS OF ASSETS and distribute them to beloved ESCROW ACCOUNTS).

And, OH YEAH, IT IS GONNA BE A LOUD ONE FOR SURE.

Already it is being injected with the defense separation serum “unless we were SOLD OUT.” That is HEDGE that won’t fly.

Recent COOP News

- Mr. Cooper Group Inc. to Present at the Barclays Global Financial Services Conference • Business Wire • 09/03/2024 09:00:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 08/30/2024 08:17:46 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 08/01/2024 08:31:53 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 07/30/2024 08:09:25 PM

- Mr. Cooper Group Inc. Announces Pricing of Offering of $750 Million of Senior Notes • Business Wire • 07/29/2024 08:30:00 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 07/29/2024 08:24:31 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 07/26/2024 08:20:36 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 07/25/2024 11:00:12 AM

- FLAGSTAR BANK, N.A. ANNOUNCES SALE OF ITS MORTGAGE SERVICING BUSINESS • PR Newswire (US) • 07/25/2024 11:00:00 AM

- Mr. Cooper Group Reports Second Quarter 2024 Results and Announces Acquisition of Mortgage Operations From Flagstar • Business Wire • 07/25/2024 11:00:00 AM

- Mr. Cooper Group Inc. to Discuss Second Quarter 2024 Financial Results on July 25, 2024 • Business Wire • 07/11/2024 08:00:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/30/2024 08:07:34 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 05/24/2024 08:36:48 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:33:25 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:28:46 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:26:19 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:24:11 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:22:07 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:19:44 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/24/2024 08:17:44 PM

- Xome Democratizes Real Estate with Launch of DIY Sales Platform, No Agent Required • Business Wire • 05/22/2024 01:00:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/15/2024 10:47:32 PM

- Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material • Edgar (US Regulatory) • 05/15/2024 12:11:30 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 05/10/2024 12:12:48 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 05/07/2024 08:22:09 PM

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM