| Followers | 130 |

| Posts | 18112 |

| Boards Moderated | 0 |

| Alias Born | 01/16/2007 |

Monday, August 25, 2014 9:18:03 PM

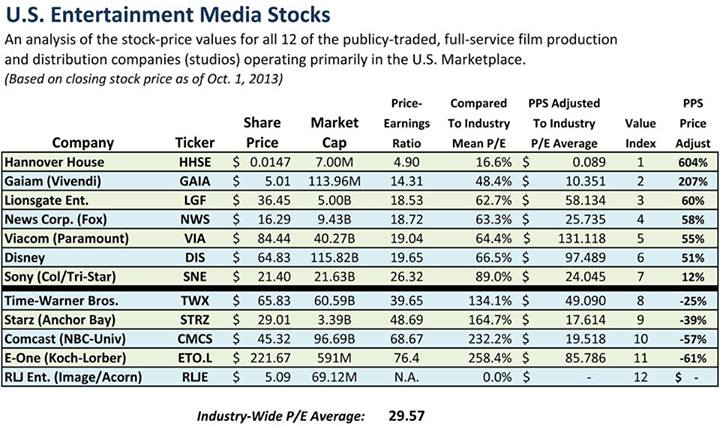

Hannover House (HHSE) Key Financial Ratios - 2nd Quarter 2014

Market CAPitalization (August 22, 2014) = $6,692,391

Pre-Tax Profit Margin = 27%

Earnings Per Share = $0.0021

Price-Earnings Ratio = 5.24

Current Ratio = 4.16

Net Working Capital = $8,628,778

Debt-Equity Ratio = 0.23

Book Value Per Share = $0.042

Price-to-Book Value = 0.26

The Actual HHSE Metrics Calculations

HHSE Market CAPitalization (Total Dollar Market Value):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=105612153

HHSE Pre-Tax Profit Margin (Profitability Percentage):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=105610002

HHSE Earnings Per Share (Profitability):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=105609576

HHSE Price-Earnings - P/E Ratio (Valuation):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=105609790

HHSE Current Ratio (Liquidity):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=105604184

HHSE Net Working Capital (Operating Liquidity):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=105605075

HHSE Debt-Equity Ratio (Debt Measurement):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=105607730

HHSE Book Value Per Share (Liquidation Value):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=105608021

HHSE Price-to-Book Value (Stock Price Evaluation):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=105609029

HHSE 10-Q Financials Period Ended June 30, 2014 Filed with SEC EDGAR:

http://www.sec.gov/Archives/edgar/data/1069680/000147124214000317/hhse10q06302014.htm

All HHSE SEC EDGAR Filings:

http://www.sec.gov/cgi-bin/browse-edgar?company=hannover+house&owner=exclude&action=getcompany

http://www.nasdaq.com/symbol/hhse/sec-filings

All HHSE Financials & Filings at OTC Markets:

http://www.otcmarkets.com/stock/HHSE/filings

The Valuations below were performed before, and do not include three (3) new ventures that each in their own right have multiple million dollars potential:

* VODwiz - Independent Films Online Portal

* Medallion International Pictures

* Medallion Releasing Inc.

HHSE 2013 SALES & MARGINS SNAPSHOT

Period .. Gross Sales ....... HH Margin

Q1 ...... $ 539,336.71 ..... $ 432,783.04 ..... Actual

Q2 ...... $ 223,801.78 ..... $ 200,830.22 ..... Actual

Q3 ..... $ 1,205,392.68 .... $ 428,669.51 .... Actual

Q4 ..... $ 1,134,425.54 .... $ 313,343.50 ..... ProForma

$ 3,102,956.71 .... $ 1,375,626.27

Earnings Per Share = 0.00238824

Industy P/E Ratio: 22

PPS Value = $ 0.0525

http://hannoverhousemovies.blogspot.com/2014/01/snapshot-summary-of-2013-setting-stage.html

HHSE

Recent HHSE News

- Form 8-K - Current report • Edgar (US Regulatory) • 01/05/2024 07:17:02 PM

North Bay Resources Announces Assays up to 5 oz/ton Gold, 1.5 oz/ton Platinum, 0.5 oz/ton Palladium, and 0.5 oz/ton Rhodium at Mt. Vernon Gold Mine, Sierra County, California • NBRI • Oct 4, 2024 9:15 AM

Basanite, Inc. Appoints Ali Manav as Interim Chief Executive Officer • BASA • Oct 3, 2024 9:15 AM

Integrated Ventures Announces Launch of MedWell Facilities, LLC and Lease Agreement with Giant Fitness Clubs • INTV • Oct 3, 2024 8:45 AM

Beyond the Horizon: Innovative Drug Combinations Offer New Hope for Alzheimer's and More • NVS • Oct 3, 2024 8:45 AM

SMX and FinGo Enter Into Collaboration Mandate to Develop a Joint 'Physical to Digital' Platform Service To Enhance Natural Rubber Industry's Ability to Report on Sustainable and Ethical Supply Chains • SMX • Oct 3, 2024 7:00 AM

Transforming Alzheimer's Treatment: Innovative Combinations to Boost Cognition • PFE • Oct 2, 2024 9:00 AM