Friday, July 18, 2014 5:03:32 PM

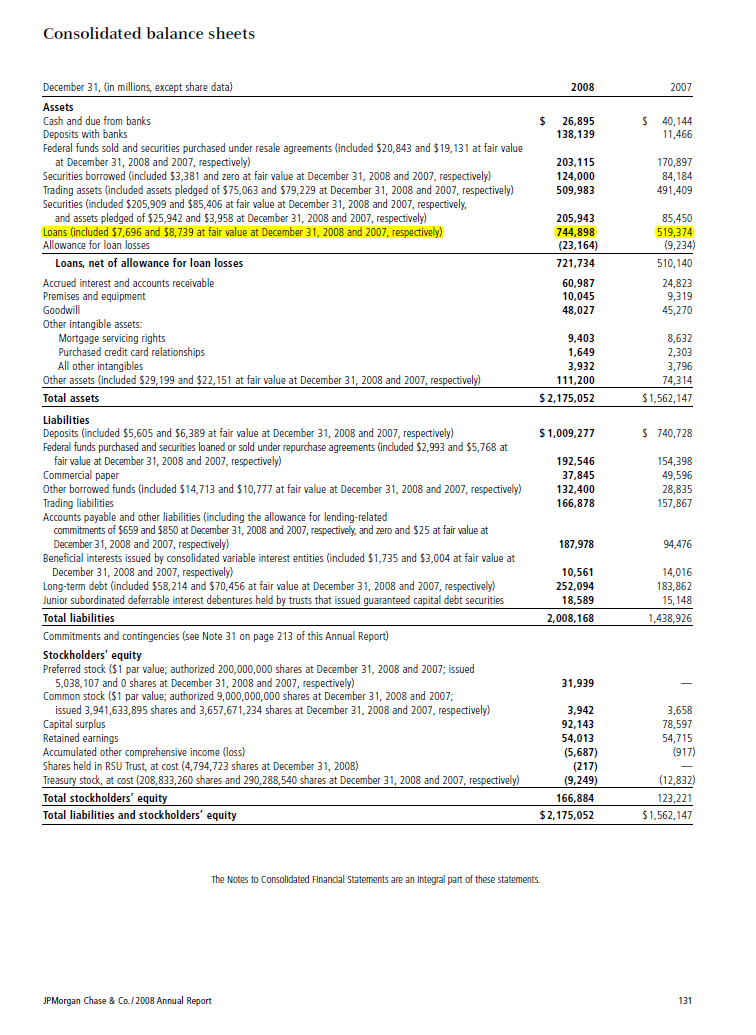

It is being asserted that JPM's 2008 SEC and Audited financial statements disclosing the Washington Mutual transaction, are ERRONEOUS BY $244 BILLION DOLLARS. Such disclosures are UNCHANGED in 2009, 2010, 2011, 2012, 2013 and 2014 Annual 10K and a 10Q and Annually Audited Financial Statements. I find this, well, totally unreliable. Considering that such would mean that all of the shareholder's equity of JPM would be WIPED OUT by this theory, and considering the investment quality of JPM stockholders, I find it unlikely that "they are all wrong."

NOW TO ACTUAL REALITY

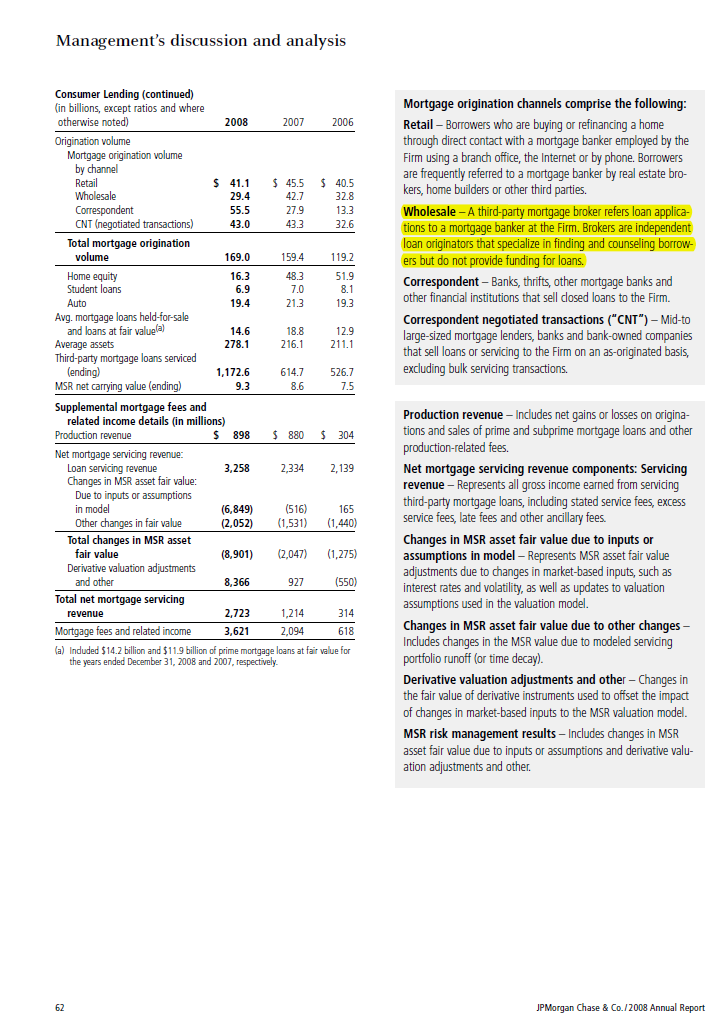

JPM Loans - Below

The increase you come up with is INCLUDING WHOLESALE LOANS. As we all know those are NOT considered PORTFOLIO LOANS!

There are two perspectives on Wholesale Loans (first, the "Wholesale Channel" than brings such to a Mortgage Lender i.e., the IN BOX, and second, the "decision" to retain the loan/mortgages in "Portfolio" or to "hold for securitization, after origination at the Mortgage Lender, with services rights identified, and sold on the secondary market (MBS) i.e., the OUT BOX.

The decision to portfolio is based on the bank liabilities and bank regulated matrix. Such a bank in this case is a portfolio lender, also can be called a direct lender if the bank did not use a wholesale channel source. Those loans that the Mortgage Lender (a) cannot by regulation or (b) chooses not by scoring the mortgage, KEEP IN PORTFOLIO, are classified as wholesale intended but they are not expedited overnight. It usually takes 2-3 months even for a process wholesaler with no intention or ability to portfolio; requires steps to securitize (MBS) and sell.

So, whether or not a wholesale channel put the mortgage in the IN BOX, if the mortgage hasn't been packaged and sold yet and is in the OUT BOX, it could be classified in SEC filings as a wholesale mortgage. In either case, at that time, they are owned by the bank.

Does JPM Chase Identify that is uses a Wholesale Mortgage Channel?

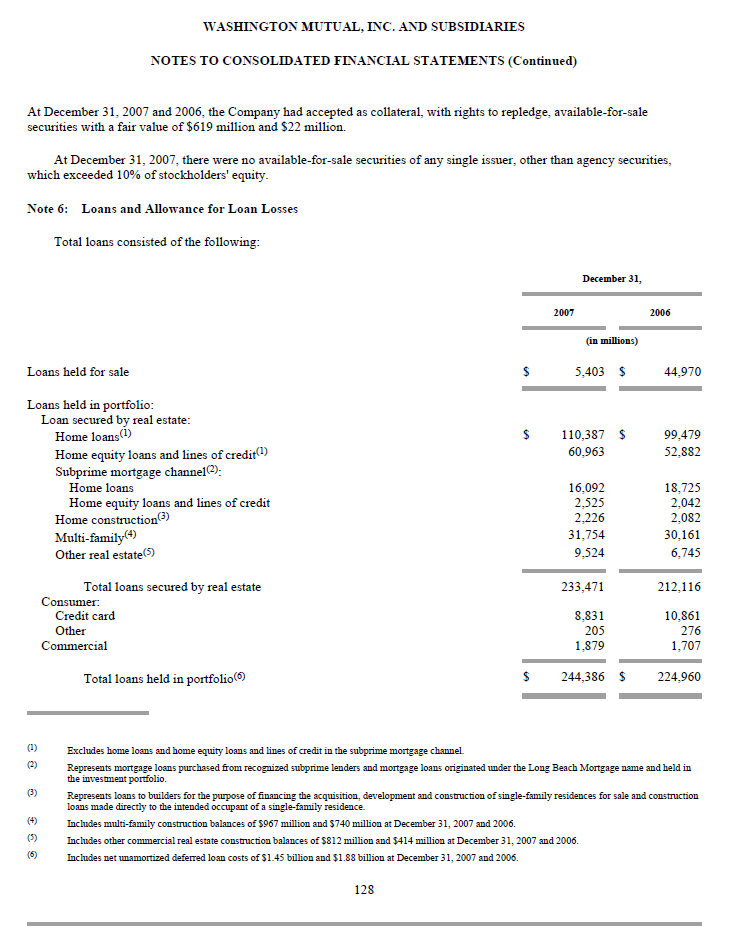

What were WMB’s 2007 Loans

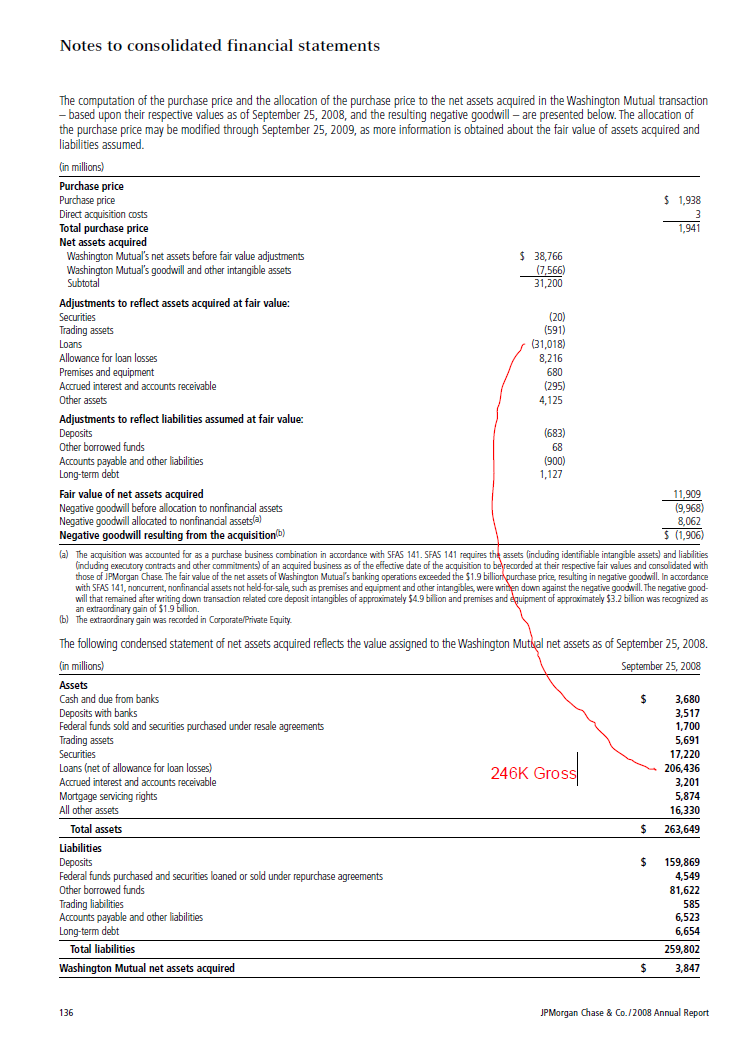

What did JPM disclose it bought in WMB loans in 2008?

What were JPM’s total loans 2008-2007?

Yep, the WMB $244B at 2007, less $31B in write-downs, is what JPM bought and recorded.

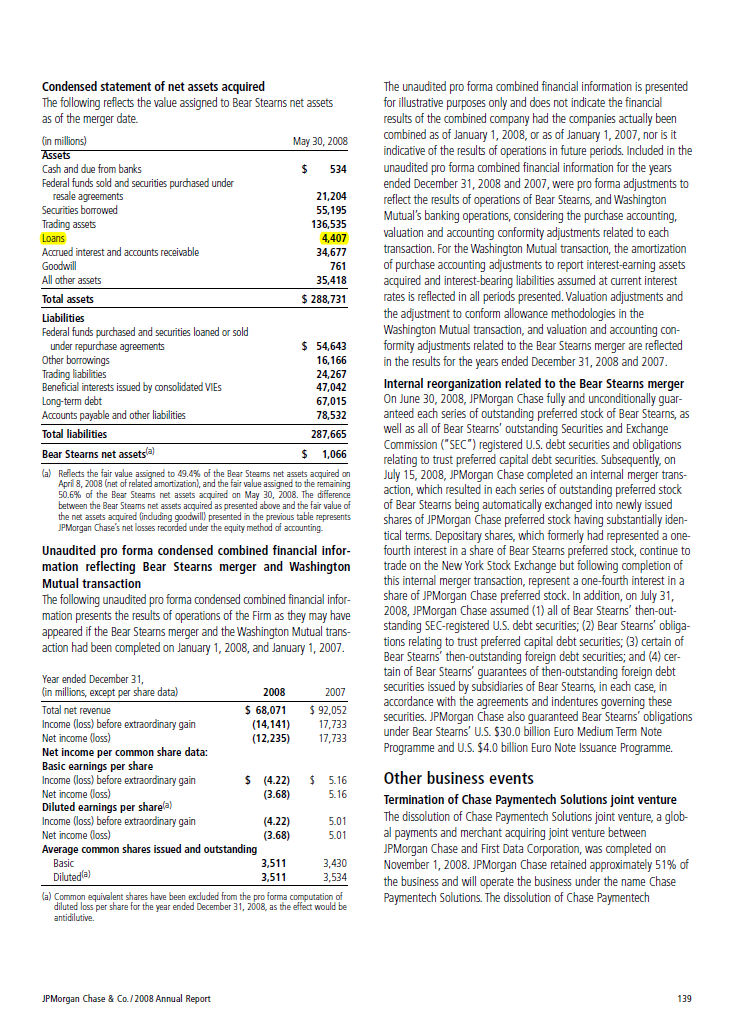

Also, the CLAIM that it was BEAR STEARNS?

Recent COOP News

- Mr. Cooper Group Reports First Quarter 2024 Results • Business Wire • 04/24/2024 11:00:00 AM

- Mr. Cooper Group Announces Two New Senior Leaders • Business Wire • 04/23/2024 01:00:00 PM

- Mr. Cooper Group Inc. to Discuss First Quarter 2024 Financial Results on April 24, 2024 • Business Wire • 04/05/2024 03:37:00 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/11/2024 09:34:36 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 11:05:39 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 11:04:15 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 11:03:04 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 11:01:41 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/04/2024 10:59:25 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/26/2024 09:28:25 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/14/2024 09:15:59 PM

- Form 3 - Initial statement of beneficial ownership of securities • Edgar (US Regulatory) • 02/09/2024 09:13:50 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/09/2024 12:00:29 PM

- Mr. Cooper Group Reports Fourth Quarter 2023 Results • Business Wire • 02/09/2024 12:00:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/01/2024 09:30:02 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/30/2024 09:26:40 PM

- Mr. Cooper Group Inc. Announces Pricing of Offering of $1 Billion of Senior Notes • Business Wire • 01/29/2024 11:02:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/29/2024 12:55:56 PM

- Mr. Cooper Group Inc. to Discuss Fourth Quarter 2023 Financial Results on February 9, 2024 • Business Wire • 01/11/2024 09:55:00 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 01/09/2024 09:00:53 PM

- Mr. Cooper Group Appoints Mike Weinbach as President • Business Wire • 01/09/2024 09:00:00 PM

- Meta CEO Sells $428 Million in Shares Since November, AMC Hits New Record Low, and More • IH Market News • 01/04/2024 09:51:01 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/02/2024 09:19:20 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 12/29/2023 08:45:45 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 09:08:37 PM

Bantec Engaged in a Letter of Intent to Acquire a Small New Jersey Based Manufacturing Company • BANT • May 1, 2024 10:00 AM

Cannabix Technologies to Deliver Breath Logix Alcohol Screening Device to Australia • BLO • Apr 30, 2024 8:53 AM

Hydromer, Inc. Reports Preliminary Unaudited Financial Results for First Quarter 2024 • HYDI • Apr 29, 2024 9:10 AM

Avant Technologies to Implement AI-Empowered, Zero Trust Architecture in Its Data Centers • AVAI • Apr 29, 2024 8:00 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • BLO • Apr 25, 2024 8:52 AM