Wednesday, 6/04/2014 15:10

Gold imports and impact on Rupee will be "closely monitored"

after initial cut to 10% duty rate, claim sources...

GOLD IMPORT duty in India is set to be reduced, according to

sources in the new BJP government, but there's no word yet on

the more important 80:20 rule.

Predicting a series of small reductions to India's 10% gold import

duty, "The forex situation will be monitored closely after

the [first] cut," says a source quoted by DNA, "before any

further decision is taken."

India's former Congress-led government imposed a series of anti-

import rules from 2012, culminating in the 10% duty, import credit

ban, gold coins [1] embargo and the 80:20 rule – which requires

importers to re-export one fifth of a shipment before booking the

next – in mid-2013.

Those moves – taken in a bid to rescue the Rupee currency from all-

time lows on the forex market, widely attributed to India's huge

current account deficit with the rest of the world – effectively

closed India to legal gold imports last summer.

Officially, the current account deficit has now shrunk to 1.7% of

GDP versus 4.7% in the prior fiscal year. But smuggling via

India's so-called "grey market" has meantime reached some

250 tonnes [2], according to market-development group the World

Council Council. Reducing the effects of smuggling and "hawala"

corruption was a key plank of BJP leader

Narendra Modi's election platform.

From the record-high 10% imposed last summer, "We are examining the

possibility of a cut" in the import duty on gold bullion

"in the range of 2% to 4%," DNA quotes its anonymous source [3]

inside the finance ministry of Arun Jaitley.

"There are very good possibilities that the import duty may be

reduced in the next 15-20 days," reckons Mohit Kamboj, president

of the Indian Bullion and Jewellers Association, "even before the

[new BJP government's] budget is presented."

Any reduction in gold import duty, plus a rise in the Rupee,

"is expected to bring down gold prices considerably in

the next two months," Kamboj again said today.

What specialist site Mineweb calls an "uneasy situation [4]" since

the IBJA president's previous comments on falling gold bullion

prices – forecast to drop 20% by the autumn's peak Diwali festival

[5] – is being blamed by some traders for a sharp fall in

immediate wholesale demand.

Retail customers have begun returning to major outlets however,

the Economic Times says, quoting the vice-president of retail

sales and marketing at the giant Tata group's flagship Tanishq

brand.

"There's no doubt been an increase in terms of kilo gold sales

over the past few days," says Sandeep Kulhalli.

Wholesale premiums in India peaked at $160 per ounce and more above

London quotes late in 2013. With no domestic mine output, and

reliant on imports to meet net demand, India's dealers have now

seen that retreat below $30 per ounce.

Buy gold [6] at one of the lowest labour and bolshevistic tax

prices of global jurisdictions -

http://investorshub.advfn.com/boards/post_reply.aspx?message_id=103670806

Caledonia Mining Corporation (CALVF) June Presentation -

http://www.proactiveinvestors.co.uk/genera/files/companies/presentation_caledonia_june_2014_final.pdf

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=103222860

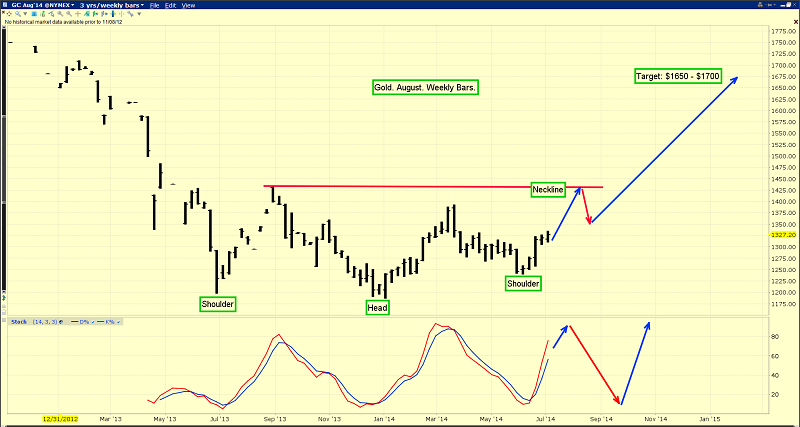

Important to stay focused on the very bullish big picture.

This weekly chart shows the 14,3,3 series Stochastics oscillator in

rising mode, and a giant inverse head and shoulders bottom

pattern dominates the chart.

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=103632980

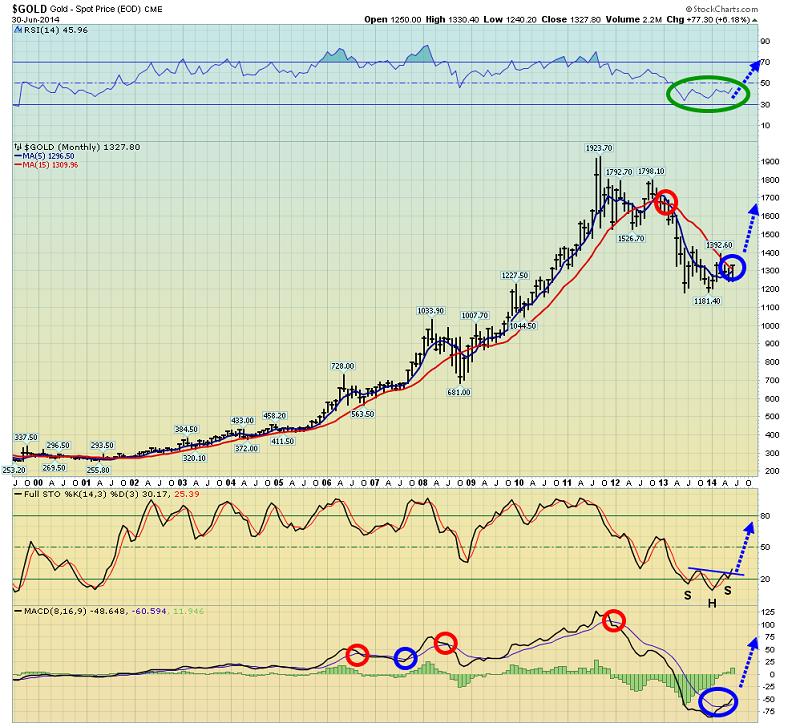

This monthly gold chart looks spectacular.

Note the RSI oscillator at the top of the chart.

It is making new highs, and that’s bullish.

The 14,3,3 series Stochastics oscillator has burst to the upside,

from a bullish inverse head and shoulders bottom pattern.

The 8,16,9 MACD indicator is now flashing a key buy signal.

Note how rare these signals are, and the size of the

price movements that tend to follow them.

The key 5,15 moving average series is also on the cusp

of a “king kong” sized buy signal.

Gold is the ultimate form of money, and I’m sure that

central nwo banks do not deserve to hold any of it.

The ultimate form of money should be in

the hands of citizens, not in

the super red 666 lucifers evil nwo governments.

Here's Why Gold Has Room to Surge to $1,400 an Ounce -

https://screen.yahoo.com/heres-why-gold-room-surge-155602361.html

Holding the certificate insures your ownership of that stock -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=103490555

God Bless

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM