Monday, April 28, 2014 11:49:25 AM

STWA -- >>> TransCanada Tries A New Clean-Tech Pipeline Solution

Apr. 10, 2014

http://seekingalpha.com/article/2135793-transcanada-tries-a-new-clean-tech-pipeline-solution

Summary

•TransCanada is trialing a new, clean technology for improving pipeline efficiencies and volume throughput for pumping crude oil.

•The new tech uses electric fields to temporarily alter the alignment of particulates in crude oil, lowering viscosity without changing the chemical composition.

•TransCanada has entered into a contract with a little-known oil tech start-up, STWA Inc., for a pilot program with the new technology, on its flagship Keystone pipeline.

•STWA Inc., who holds an exclusive worldwide licensing agreement for the patents, appears to be moving fast to establish itself.

The Need for Speed

TransCanada (TRP), one of the largest energy transportation companies in North America, is in the news a lot these days, mostly because of its proposed Keystone XL pipeline and the difficulties the project is encountering. At the same time, the company is moving to ensure that it gets the most out of its existing infrastructure, most recently by beginning a pilot program of a promising new technology for crude oil viscosity reduction.

On July 17 last year, TransCanada signed a contract to install on its flagship Keystone pipeline a technology that reduces the viscosity of crude oil in a manner that has never been widely applied before: electrorheology.

The term refers to the use of electric fields to change the internal composition of crude oil, in order to make it less viscous and therefore easier to flow. A lower viscosity level means that the crude can be pumped at a lower pressure, or at a higher speed and lower cost - ultimately allowing more of it to be transported.

The most surprising thing about this development is the company that is on the other end of the deal: a little-known oil tech start-up called STWA Inc. (OTCQB:ZERO), which trades over the counter. TransCanada is STWA's first client, and the company appears to be under a strict non-disclosure agreement, since none of its press releases mention TransCanada by name.

But because the contract with TransCanada is a material event for STWA, the deal shows up in SEC filings.

The 8K from August 2013 announcing the contract, for example, says:

“

"TransCanada has agreed to lease, install, maintain, operate and test the effectiveness of the Company's AOT ["Applied Oil Technology"] technology and equipment on one of TransCanada's operating pipelines."

Under the terms of the deal, STWA is paid $60,000 per month, and works with TransCanada engineers while they evaluate the device. The initial term began on March 1, 2014, and runs through September. If TransCanada decides to purchase the device, its price is $4.3 million (or fair market value, whichever is greater) per unit.

There's an energy boom in North America right now, and there are not nearly enough pipelines to service demand for crude oil transport. Building new long-distance pipelines is a fraught process for companies like TransCanada, as we see with the Keystone XL project. (The AOT new technology is being installed on the existing, working Keystone pipeline, not the embattled Keystone XL portion, which is an extension on the Keystone). Clearly, it is a desirable for a company like TransCanada to move more product, and STWA's technology seems to hold a lot of promise.

New Technology for Conventional Energy

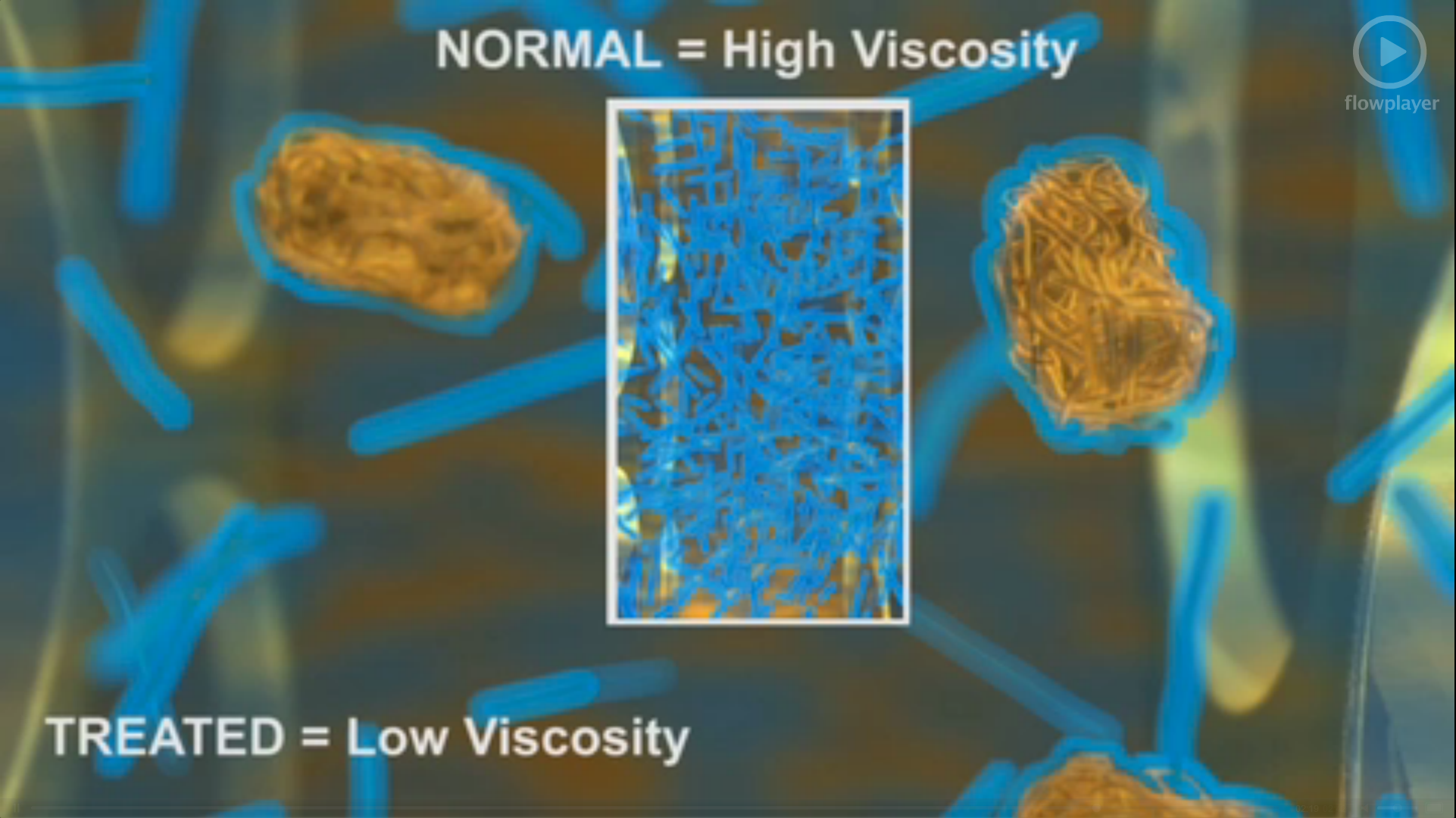

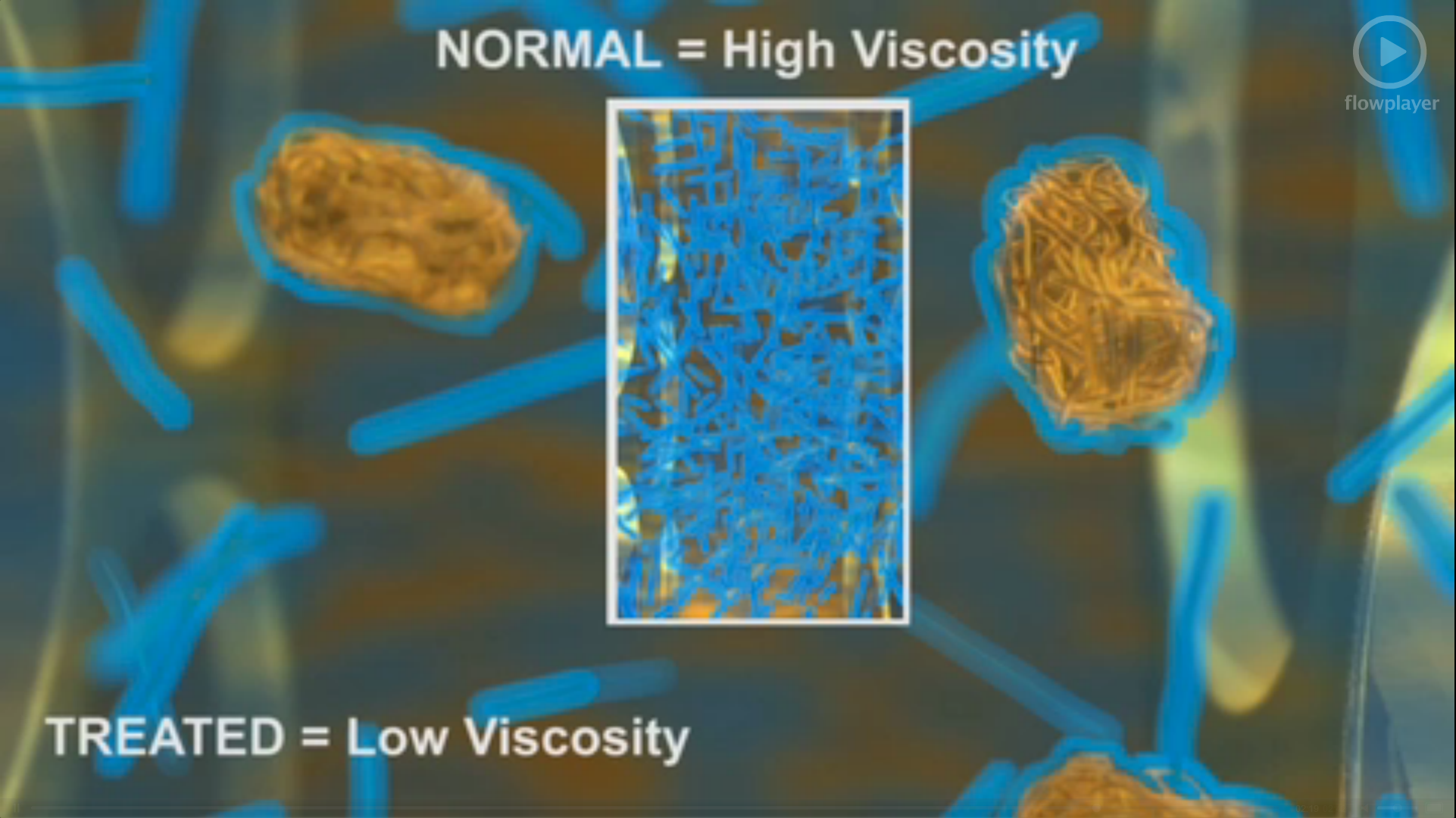

Crude oil is full of many tiny minerals and molecules, like paraffin, asphaltene, and more, which create friction and drag as it flows. Those substances are what make it thick, or viscous. The application of an electric field to crude oil causes them to aggregate together, reducing their surface area in the crude, and reducing interparticulate drag (i.e. making it less viscous), and able to flow more readily.

The oil is first pictured in its natural state:

Then, after the AOT treatment, where the paraffin is clumped together:

The company explains it further in a tech brief:

“

"In the AOT system, the nano-scale clusters reduce the total surface area for their volume-fraction of the fluid, thereby reducing the viscosity of the fluid, making it easier to flow…. The newly aggregated particles make the same fluid act as though it has been thinned out with a super light end fluid product such as naptha, natural gasoline, ethane, etc., yet while retaining its original chemical formula. This simple premise leads to multiple flow assurance benefits without the traditional penalties associated with the normal chemical treatment alternatives..."

The technology was developed by Dr. Rongjia Tao, the chair of the physics department at Temple University, in 2006. Because the company funded the research, STWA Inc. gained exclusive rights to its commercial deployment worldwide.

The process is shown in the following diagram -

In 2006, Science Daily wrote of Dr. Tao's research:

“

"Offshore oil producers long have dreamed of the technological equivalent of a magic wand: Wave it over pipelines carrying the thick crude oil produced in much of the world, and the oil thins out for just a few hours… Rongjia Tao and Xiaojun Xu now report development of one such method."

In field tests, the technology was successful. Engineers with the Department of Energy at the Rocky Mountain Oilfield Testing Center (RMOTC) conducted three field tests: in October 2011, April 2012, and May 2012. The Pipeline Research Council International, a global research collaboration organization chaired by major oil companies, partly funded the tests.

In the May 2012 test, the result showed that the AOT would, depending on different variables, achieve a viscosity reduction as high as 56%. The effect lasted nearly a full 12 hours.

Following the tests, the company struck a deal with TransCanada. The pilot program with TransCanada is the first time that a company has undertaken the commercial application of this technology, which uses these new principles of viscosity reduction.

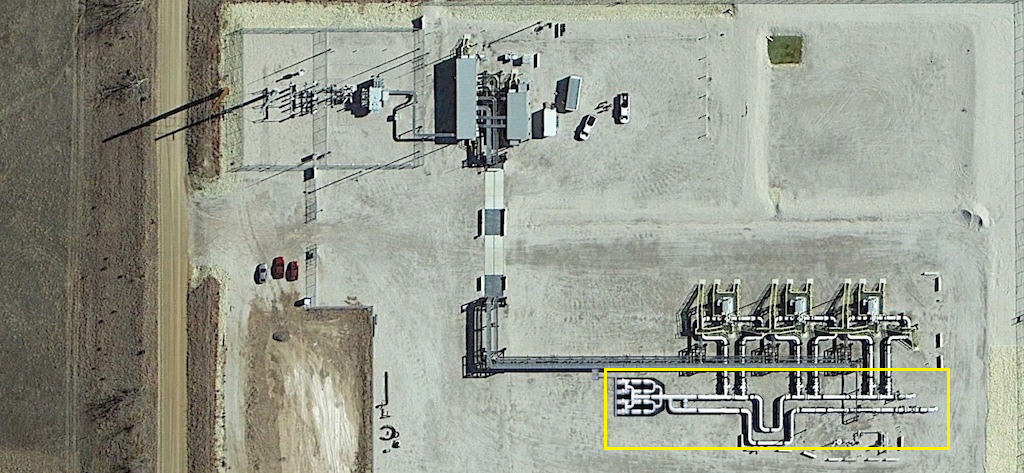

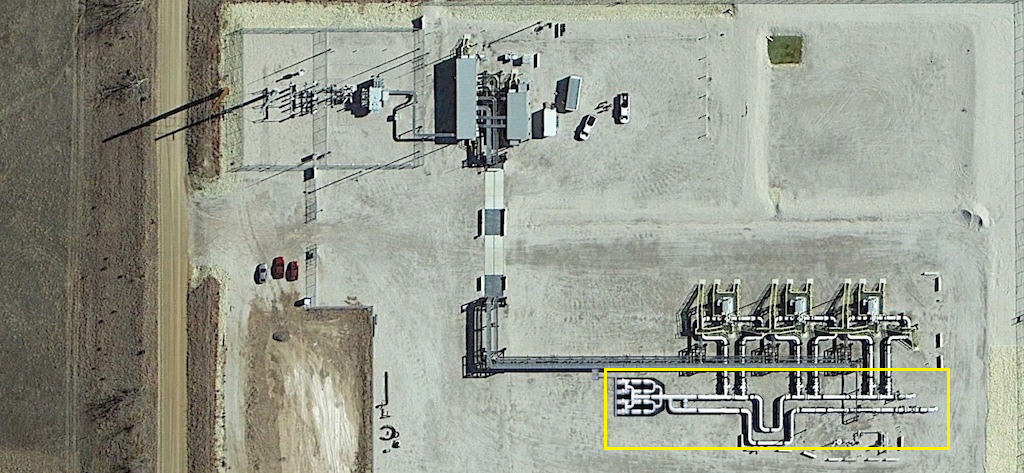

It is also crucial to note where the AOT is being placed. According to the 8K, that is "currently described as PS 30 (ROCK) and PS 31 (PONCA CITY)" in Kansas. This places the AOT on what is known as the "Cushing Link" of the Keystone Pipeline, and is just north of the newly-built Gulf Coast Project in Oklahoma, and one or two pumping stations before the oil hub of Cushing. The choice is key: Cushing is one of the largest oil storage facilities in the United States.

TransCanada did not put the first commercial midstream application of this technology in the middle of nowhere in Canada: it put it on its flagship pipeline, the Keystone, pumping hundreds of thousands of barrels of crude per day through the heartland of the United States.

As installed, the AOT is pictured (in a rendering) on the bottom right at the ROCK pump station in Kansas.

(At the site of TransCanada's Keystone II in February 2014. Source: STWA)

Industry Context

The need for technology like the AOT should be clear.

Warren Buffett recently announced plans to buy Phillips Specialty Products Inc., part of Phillips 66 Corp., for $1.4 billion some time this year. TransCanada told the Omaha World-Herald that it could be used on the Keystone and other pipelines.

The enormous bottlenecks in the U.S. domestic oil transportation sector are widely known: infrastructure set up decades ago is still coping with the influx of new volumes from oil sources, such as the Bakken, Barnett, Eagle Ford, and others, coming on line. The need to pump more oil through existing pipeline (or newly constructed ones) is thus acute.

There are currently three widely-used methodologies to make crude oil flow more readily: heating, the addition of high molecular-weight polymers, called Drag Reducing Agents (which Buffett is buying), and the addition of diluents (chemical agents like naptha, natural gas, and other light products). Heating is costly and can be inefficient; diluents are expensive; and DRAs can pose logistical challenges, do not work for all oil types, and may be ineffective with higher viscosity oils.

The tests show that the effect of the AOT is potentially just as, if not more, effective than existing methodologies, without the penalties associated with them, because it does not change the composition of the oil or add substances that need to be filtered out.

This, along with the fact that it moves oil at lower pump cost makes it a clean technology for oil companies who may want to brandish their "green" credentials.

The other methodologies are not necessarily competitors with STWA's technology. With the likelihood of continued bottlenecks for crude oil transport in the United States, it is possible that they will be used in conjunction with one another.

The Company

With less than a dozen full-time employees, the company has battled for years to get where it is today: a decade ago, it booted bad management; it has reoriented itself multiple times; it survived by raising money through private placements; and finally, it has developed the AOT, field-tested it, and had it installed on the flagship pipeline of a $34 billion oil transportation player.

There is other evidence that STWA is moving to secure a foothold in the crude oil transportation sector. It says it is under nondisclosure agreements with seven companies, and is making progress on AOT units customized for the upstream exploration market, where technology adoption is faster and the profits available greater.

The most recent sign of industry acceptance of STWA's technology offerings is Kinder Morgan's (KMP) invitation for the company to present at the 2014 Pipeline Energy Group Conference next month (in May). There, Bjorn Simundson, STWA technical and operations director, will give a presentation about "Pipeline Flow Improver Using Dielectrophoresis" to introduce the development of the AOT and its technical capabilities. The conference is an insider, premier industry event organized by a different company each year. Kinder Morgan is hosting the conference in 2014. Kinder Morgan is the largest pipeline operator in the United States.

Fortunately for STWA, the agreement it signed with TransCanada was non-exclusive.

<<<

Apr. 10, 2014

http://seekingalpha.com/article/2135793-transcanada-tries-a-new-clean-tech-pipeline-solution

Summary

•TransCanada is trialing a new, clean technology for improving pipeline efficiencies and volume throughput for pumping crude oil.

•The new tech uses electric fields to temporarily alter the alignment of particulates in crude oil, lowering viscosity without changing the chemical composition.

•TransCanada has entered into a contract with a little-known oil tech start-up, STWA Inc., for a pilot program with the new technology, on its flagship Keystone pipeline.

•STWA Inc., who holds an exclusive worldwide licensing agreement for the patents, appears to be moving fast to establish itself.

The Need for Speed

TransCanada (TRP), one of the largest energy transportation companies in North America, is in the news a lot these days, mostly because of its proposed Keystone XL pipeline and the difficulties the project is encountering. At the same time, the company is moving to ensure that it gets the most out of its existing infrastructure, most recently by beginning a pilot program of a promising new technology for crude oil viscosity reduction.

On July 17 last year, TransCanada signed a contract to install on its flagship Keystone pipeline a technology that reduces the viscosity of crude oil in a manner that has never been widely applied before: electrorheology.

The term refers to the use of electric fields to change the internal composition of crude oil, in order to make it less viscous and therefore easier to flow. A lower viscosity level means that the crude can be pumped at a lower pressure, or at a higher speed and lower cost - ultimately allowing more of it to be transported.

The most surprising thing about this development is the company that is on the other end of the deal: a little-known oil tech start-up called STWA Inc. (OTCQB:ZERO), which trades over the counter. TransCanada is STWA's first client, and the company appears to be under a strict non-disclosure agreement, since none of its press releases mention TransCanada by name.

But because the contract with TransCanada is a material event for STWA, the deal shows up in SEC filings.

The 8K from August 2013 announcing the contract, for example, says:

“

"TransCanada has agreed to lease, install, maintain, operate and test the effectiveness of the Company's AOT ["Applied Oil Technology"] technology and equipment on one of TransCanada's operating pipelines."

Under the terms of the deal, STWA is paid $60,000 per month, and works with TransCanada engineers while they evaluate the device. The initial term began on March 1, 2014, and runs through September. If TransCanada decides to purchase the device, its price is $4.3 million (or fair market value, whichever is greater) per unit.

There's an energy boom in North America right now, and there are not nearly enough pipelines to service demand for crude oil transport. Building new long-distance pipelines is a fraught process for companies like TransCanada, as we see with the Keystone XL project. (The AOT new technology is being installed on the existing, working Keystone pipeline, not the embattled Keystone XL portion, which is an extension on the Keystone). Clearly, it is a desirable for a company like TransCanada to move more product, and STWA's technology seems to hold a lot of promise.

New Technology for Conventional Energy

Crude oil is full of many tiny minerals and molecules, like paraffin, asphaltene, and more, which create friction and drag as it flows. Those substances are what make it thick, or viscous. The application of an electric field to crude oil causes them to aggregate together, reducing their surface area in the crude, and reducing interparticulate drag (i.e. making it less viscous), and able to flow more readily.

The oil is first pictured in its natural state:

Then, after the AOT treatment, where the paraffin is clumped together:

The company explains it further in a tech brief:

“

"In the AOT system, the nano-scale clusters reduce the total surface area for their volume-fraction of the fluid, thereby reducing the viscosity of the fluid, making it easier to flow…. The newly aggregated particles make the same fluid act as though it has been thinned out with a super light end fluid product such as naptha, natural gasoline, ethane, etc., yet while retaining its original chemical formula. This simple premise leads to multiple flow assurance benefits without the traditional penalties associated with the normal chemical treatment alternatives..."

The technology was developed by Dr. Rongjia Tao, the chair of the physics department at Temple University, in 2006. Because the company funded the research, STWA Inc. gained exclusive rights to its commercial deployment worldwide.

The process is shown in the following diagram -

In 2006, Science Daily wrote of Dr. Tao's research:

“

"Offshore oil producers long have dreamed of the technological equivalent of a magic wand: Wave it over pipelines carrying the thick crude oil produced in much of the world, and the oil thins out for just a few hours… Rongjia Tao and Xiaojun Xu now report development of one such method."

In field tests, the technology was successful. Engineers with the Department of Energy at the Rocky Mountain Oilfield Testing Center (RMOTC) conducted three field tests: in October 2011, April 2012, and May 2012. The Pipeline Research Council International, a global research collaboration organization chaired by major oil companies, partly funded the tests.

In the May 2012 test, the result showed that the AOT would, depending on different variables, achieve a viscosity reduction as high as 56%. The effect lasted nearly a full 12 hours.

Following the tests, the company struck a deal with TransCanada. The pilot program with TransCanada is the first time that a company has undertaken the commercial application of this technology, which uses these new principles of viscosity reduction.

It is also crucial to note where the AOT is being placed. According to the 8K, that is "currently described as PS 30 (ROCK) and PS 31 (PONCA CITY)" in Kansas. This places the AOT on what is known as the "Cushing Link" of the Keystone Pipeline, and is just north of the newly-built Gulf Coast Project in Oklahoma, and one or two pumping stations before the oil hub of Cushing. The choice is key: Cushing is one of the largest oil storage facilities in the United States.

TransCanada did not put the first commercial midstream application of this technology in the middle of nowhere in Canada: it put it on its flagship pipeline, the Keystone, pumping hundreds of thousands of barrels of crude per day through the heartland of the United States.

As installed, the AOT is pictured (in a rendering) on the bottom right at the ROCK pump station in Kansas.

(At the site of TransCanada's Keystone II in February 2014. Source: STWA)

Industry Context

The need for technology like the AOT should be clear.

Warren Buffett recently announced plans to buy Phillips Specialty Products Inc., part of Phillips 66 Corp., for $1.4 billion some time this year. TransCanada told the Omaha World-Herald that it could be used on the Keystone and other pipelines.

The enormous bottlenecks in the U.S. domestic oil transportation sector are widely known: infrastructure set up decades ago is still coping with the influx of new volumes from oil sources, such as the Bakken, Barnett, Eagle Ford, and others, coming on line. The need to pump more oil through existing pipeline (or newly constructed ones) is thus acute.

There are currently three widely-used methodologies to make crude oil flow more readily: heating, the addition of high molecular-weight polymers, called Drag Reducing Agents (which Buffett is buying), and the addition of diluents (chemical agents like naptha, natural gas, and other light products). Heating is costly and can be inefficient; diluents are expensive; and DRAs can pose logistical challenges, do not work for all oil types, and may be ineffective with higher viscosity oils.

The tests show that the effect of the AOT is potentially just as, if not more, effective than existing methodologies, without the penalties associated with them, because it does not change the composition of the oil or add substances that need to be filtered out.

This, along with the fact that it moves oil at lower pump cost makes it a clean technology for oil companies who may want to brandish their "green" credentials.

The other methodologies are not necessarily competitors with STWA's technology. With the likelihood of continued bottlenecks for crude oil transport in the United States, it is possible that they will be used in conjunction with one another.

The Company

With less than a dozen full-time employees, the company has battled for years to get where it is today: a decade ago, it booted bad management; it has reoriented itself multiple times; it survived by raising money through private placements; and finally, it has developed the AOT, field-tested it, and had it installed on the flagship pipeline of a $34 billion oil transportation player.

There is other evidence that STWA is moving to secure a foothold in the crude oil transportation sector. It says it is under nondisclosure agreements with seven companies, and is making progress on AOT units customized for the upstream exploration market, where technology adoption is faster and the profits available greater.

The most recent sign of industry acceptance of STWA's technology offerings is Kinder Morgan's (KMP) invitation for the company to present at the 2014 Pipeline Energy Group Conference next month (in May). There, Bjorn Simundson, STWA technical and operations director, will give a presentation about "Pipeline Flow Improver Using Dielectrophoresis" to introduce the development of the AOT and its technical capabilities. The conference is an insider, premier industry event organized by a different company each year. Kinder Morgan is hosting the conference in 2014. Kinder Morgan is the largest pipeline operator in the United States.

Fortunately for STWA, the agreement it signed with TransCanada was non-exclusive.

<<<

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.