| Followers | 130 |

| Posts | 18112 |

| Boards Moderated | 0 |

| Alias Born | 01/16/2007 |

Saturday, April 19, 2014 12:51:11 AM

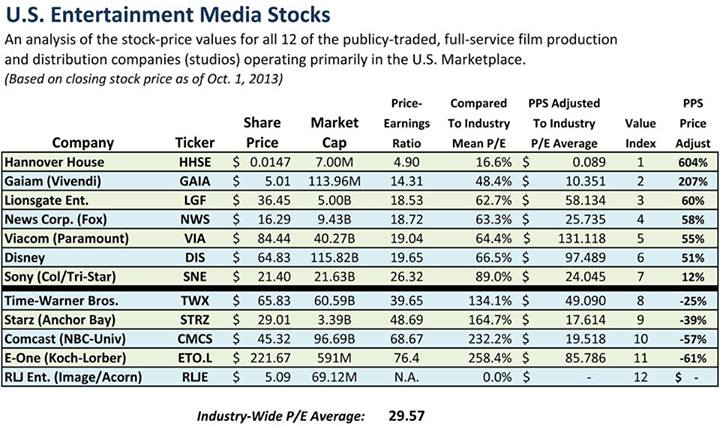

HHSE Stock Valuation

Hannover House (HHSE) Key Financial Ratios - Q4 2013

Market CAPitalization April 4, 2014 = $9,240,518

Earnings Per Share = $0.002

Price-Earnings Ratio (P/E) = 8

Pre-Tax Profit Margin = 28.4 %

Current Ratio = 5.44

Net Working Capital = $7,983,798

Debt-Equity Ratio = 0.22

Book Value Per Share = $.043

Price-to-Book Value = 0.37

The Valuations below were performed before, and do not include 2 new ventures that each in their own right have multiple million dollars potential:

* VODwiz - Independent Films Online Portal

* Medallion International Pictures

HHSE 2013 SALES & MARGINS SNAPSHOT

Period .. Gross Sales ....... HH Margin

Q1 ...... $ 539,336.71 ..... $ 432,783.04 ..... Actual

Q2 ...... $ 223,801.78 ..... $ 200,830.22 ..... Actual

Q3 ..... $ 1,205,392.68 .... $ 428,669.51 .... Actual

Q4 ..... $ 1,134,425.54 .... $ 313,343.50 ..... ProForma

$ 3,102,956.71 .... $ 1,375,626.27

Earnings Per Share = 0.00238824

Industy P/E Ratio: 22

PPS Value = $ 0.0525

http://hannoverhousemovies.blogspot.com/2014/01/snapshot-summary-of-2013-setting-stage.html

HHSE

Recent HHSE News

- Form 8-K - Current report • Edgar (US Regulatory) • 01/05/2024 07:17:02 PM

North Bay Resources Commences Operations at Bishop Gold Mill, Inyo County, California; Engages Sabean Group Management Consulting • NBRI • Sep 25, 2024 9:15 AM

CEO David B. Dorwart Anticipates a Bright Future at Good Gaming Inc. Through His Most Recent Shareholder Update • GMER • Sep 25, 2024 8:30 AM

Cannabix Technologies and Omega Laboratories Inc. Advance Marijuana Breathalyzer Technology - Dr. Bruce Goldberger to Present at Society of Forensic Toxicologists Conference • BLOZF • Sep 24, 2024 8:50 AM

Integrated Ventures, Inc Announces Strategic Partnership For GLP-1 (Semaglutide) Procurement Through MedWell USA, LLC. • INTV • Sep 24, 2024 8:45 AM

Avant Technologies Accelerates Creation of AI-Powered Platform to Revolutionize Patient Care • AVAI • Sep 24, 2024 8:00 AM

VHAI - Vocodia Partners with Leading Political Super PACs to Revolutionize Fundraising Efforts • VHAI • Sep 19, 2024 11:48 AM