Friday, April 11, 2014 5:04:03 PM

Mark Mayr’s Economic Report ~ When Market Manipulation Reaches its’ Apex & Its’ Turnstile Opens the Gate to Tumble-time

Report by Mark Mayr

BS ~ Utah State University

Certified Investor Relations Representative ~ University of California, Irvine

Graduate Work in Industrial and Organizational Psychology (FL, CO)

April 11, 2014

Introduction:

Collapse Will Be Sudden

“That’s the thing about the collapse of civilization. It never happens according to plan – there’s no slavering horde of zombies. No actinic flash of thermonuclear war. No Earth-shuddering asteroid. The end comes in unforeseen ways; the stock market collapses, and then the banks, and then there is no food in the supermarkets, or the communications system goes down completely and inevitably, and previously amiable co-workers find themselves wrestling over the last remaining cookie that someone brought in before all the madness began.” (1) ? Mark A. Rayner – The Fridgularity

Once upon a time there was a nation. This nation was called, “The United States of America”. It was founded on the basis that each individual who had the will to succeed and prosper during the most challenging of times would be rewarded with a lucrative career and position in society worthy of their efforts for betterment of the human experience. The efforts with those who had the “will” were deemed valuable to society and required no associations with clandestine groups or secrets of a higher order to connect and manifest an individual’s success. Times have changed.

In the United States was a nation built on the fundamentals of the right to pursue happiness under the virtues of freedom, honesty, integrity and a high degree of morality. We had a Constitution and a Bill of Rights which stabilized the directives of our nation’s and each individual’s progression. To understand these principles, one need only review an overview of the concepts that our nation’s founding fathers put into place with the intentions that future generations would keep them in place (2).

It Couldn’t Be Done

By Edgar Albert Guest[/I]

“Somebody said that it couldn’t be done

But he with a chuckle replied

That ‘maybe it couldn’t,’ but he would be one

Who wouldn’t say so till he’d tried.

So he buckled right in with the trace of a grin

On his face, If he worried he hid it.

He started to sing as he tackled the thing

That couldn’t be done, and he did it!”

The True Condition of the US Economy:

Recent studies show that once a person is out of the job market greater than six months their chances of finding stable work are greatly reduced. According to a research paper by Alan Krueger and other economists from Princeton University, only 11% of long-term unemployed find permanent, full-time work a full twelve month after losing what they perceived as being a stable position. Those seeking stable employment will most likely find unsteady work, with 14% finding part-time work and 11% accepting temporary work until acceptable conditions can be found. (Study: Are the Long-Term Unemployed on the Margins of the Labor Market?)

At present there are some seven million people working part time positions and would prefer full-time work. This number is actually lower than last year which was estimated at 8 million according to data from the Bureau of Labor Statistics but the present realization is it is still stubbornly high for the current unemployment rate. This week in Chicago, Federal Reserve Chairwoman Janet Yellen called that figure “a sign that labor conditions are worse than indicated by the unemployment rate.” That is an odd statement considering the present occupant of the White House that listens to the directions from the Federal Reserve (Barry whoever he is) is presently boasting that the economy is steadily improving as he touts more and more people are gaining employment. The type of employment people are getting is covered later in this brief research expose’ of the true state of the US economy.

What Are People Spending Their “Hard Earned” Money On? (Inclusive of Student Loan Expenditures I’m Sure):

Consumer credit in January increased by $13.8 billion, of which $14.0 billion went into student loans and car loans which means consumers continued deleveraging on their credit card statements (in effect applying one loan towards another), then February’s numbers were even worse but the headlines were great: Increase in consumer credit was $16.5 billion, well above the $14.0 billion expected. Here is where the problem comes in. . . more than 100%, or $18.9 billion was applied towards car purchases and paying down "student bills" (American students are notorious for spending their student loans as a means to pay for everything else but tuition).

Even if the madness of the student loan explosion continues or sub-prime auto lending keeps surging this is not leading to an improvement in the overall condition of the US economy. What this is doing is strapping consumers further down in the debt bucket which reduces their ability to spend money on other items (diminished disposable income). And when considering the $10 trillion mortgage mountain the student loan debacle and sub-prime auto loans are baby biology by comparison. This time around, a renewed household borrowing binge will not happen due to the baby-boom retirement crush, which liquidates household debt, and the “Dodd-Franking” of the banking system which inhibits lending—risky and otherwise. There is therefore a mechanism in place which reduces Federal money from flowing to the consumer. Pretty tricky stuff, when you think about it. As this all comes into focus, the Fed is printing money for the banks.

Complicating Matters Further: Tuition Expense Increases

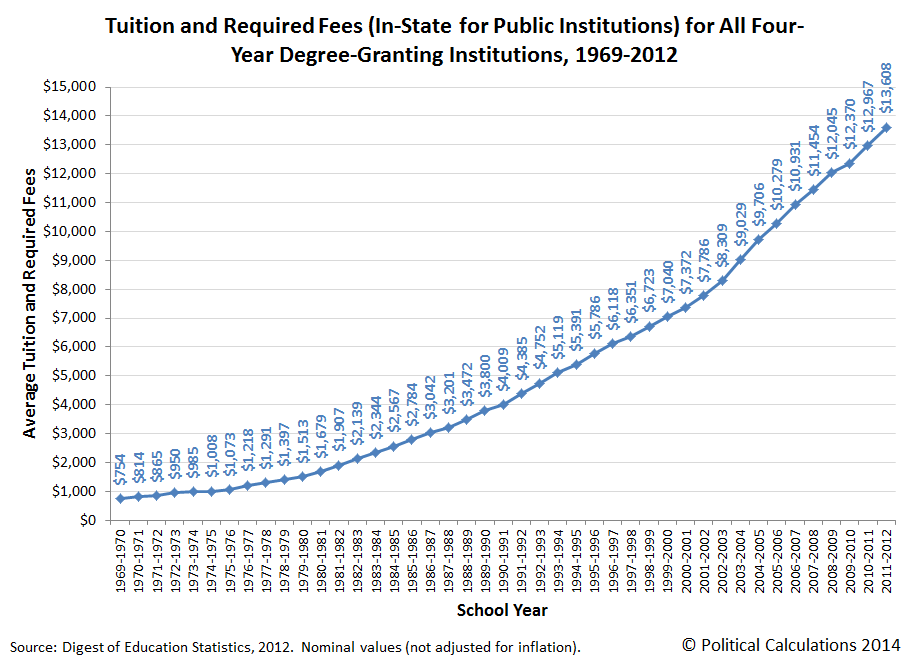

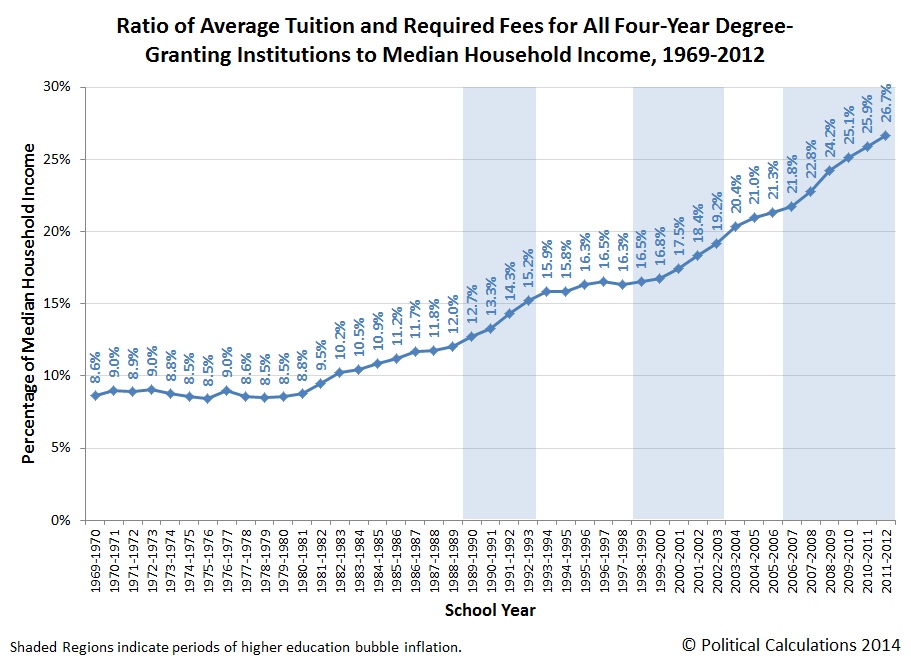

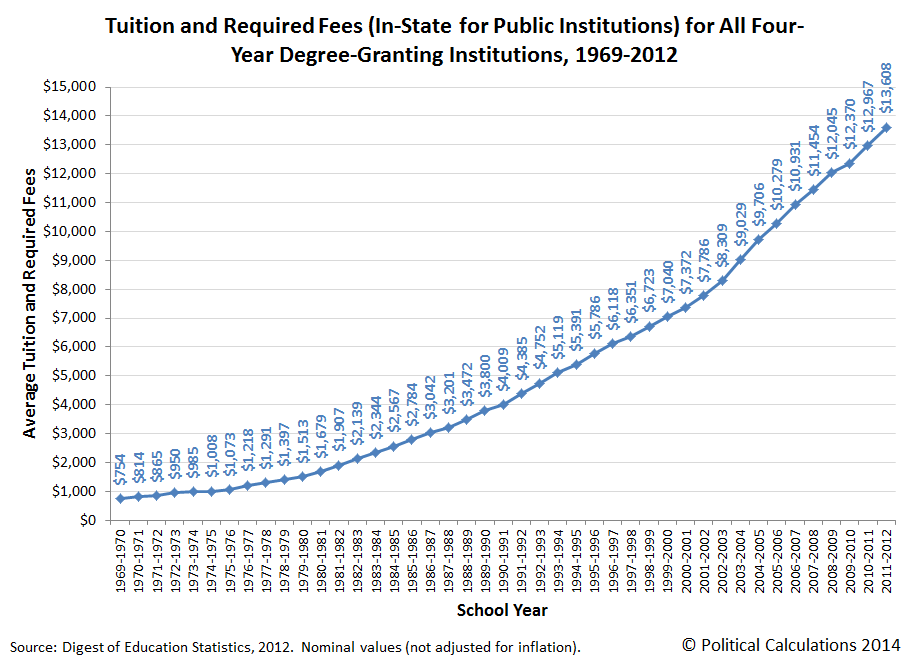

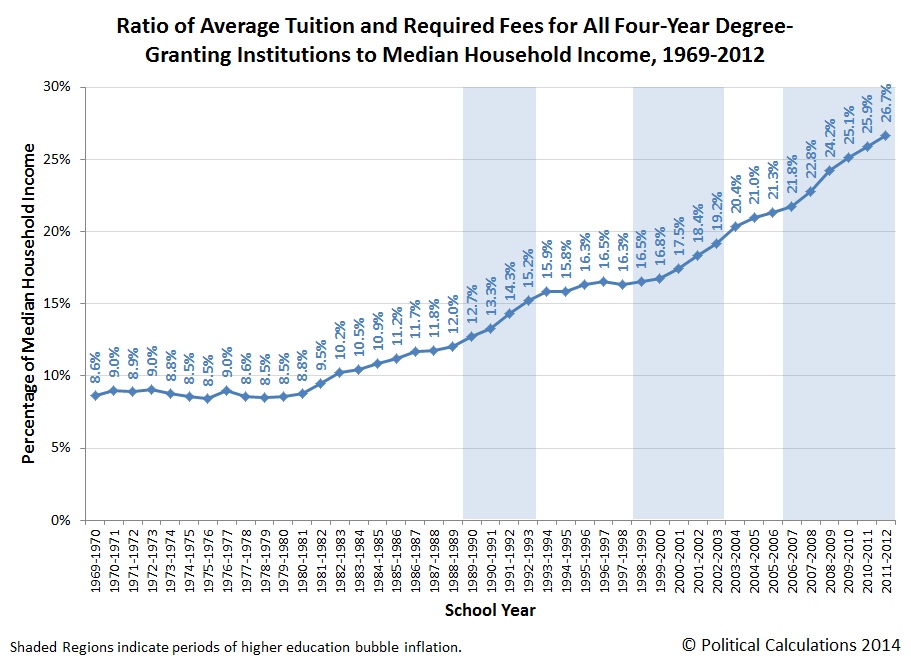

Let’s take a look at the cost of college tuition fees (per annum) which continue to flow upward through the year 2012 and parabolic from 2012-2014:

With such expensive “degrees” in hand, perhaps college graduates can look forward to getting a position with one of these quality jobs (where the real job expansion in the US is coming from that the occupant of the White House [Barry, whoever he is] boasts so loudly about):

With that being said and seen, take a look at the labor market participation rate in the United States (Civilian):

Does anybody see a recovery taking place when college students are asses in over their elbows in student loan debt and can only get minimum wage jobs with their college degrees? At least they can purchase an automobile, huh? Where has the growth (if any) been? Has it been with automakers dumping their inventory from their pipeline while the next sucker comes in to look for a “free ride”? For those of you that have been reading you can see that the present situation is well documented. Consumers are basically being enticed to increase their education level (which leads to nowhere in many cases) while “buying a new car” on a “minimum wage earning schedule” and eliminating their disposable income by pushing any extra cash they might be able to accumulate towards rent, associated bills and with rental properties along with gasoline for transportation to and from work along with food which is guaranteed to take every last dime that they make. I can just hear the background noise, “Hey dad can I borrow some more money?!” Welcome to the “New World” economy.

“Somebody scoffed: ‘Oh, you’ll never do that;

At least no one ever has done it;’

But he took off his coat and he took off his hat

And the first thing we knew he’d begun it.

With a lift of his chin and a bit of a grin,

Without any doubting or quiddit,

He started to sing as he tackled the thing

That couldn’t be done, and he did it.”

The Demise of the Petro-Dollar ~ The Final Act of Poisoning The US Economy:

Dr. Jim Willie (known as “The Golden Jackass”) CB is a statistical analyst in marketing research and retail forecasting and holds a PhD in Statistics. In the financial world, his career has stretched over 25 years. During a recent interview with Greg Hunter of USA Watchdog, Dr. Willie recently stated, “We’re going to end this year with no resemblance to the beginning.” Dr. Willie agrees with this writer’s perspective in that the whole system broke in 2007 and 2008 with the subprime mortgages. Actually, the system was crumbling prior to 2007 and 2008. During the dot.com era, the system was under a high degree of abuse. It was during that time when the Glass-SteagulI Act was repealed under the guidance of then President William Clinton. This was a major part that played a role in the creation of the now infamous dot.com stock market bubble which handed a great deal of financial power over to the globalists and the ruling elite (the bankers). Meanwhile, those that were fortunate enough to get in on the ride were out drinking Kool-aid and had reached the conclusion the party would go on forever. Well, it didn’t. Those who fell asleep at the wheel went over the cliff. The system was never fixed. Instead, wound covers were put in place along with spit and fears to cover up the catastrophe that was developing and experienced by those who “trusted the system in existence”.

As internal conditions worsened through the year 2007, The Federal Reserve Bank pursued “0 Percent Interest Rates” to keep the dysfunctional system alive. What else happened? Then the Federal Reserve monetized bonds with zero percent interest rates to create liquidity in the financial systems. This was monetary or “fiat money” inflation and the event ran in comparison to what happened during the period of the Weimer Republic (1921-1924) in Germany. Dr. Willie made another statement in Greg Hunter’s interview that, “Now all the QE and bond purchases are causing some major problems, breaking major economic structures. . . It’s all breaking, it’s all breaking, and they are having a tremendous problem holding it together. Now, the whole Eastern World is rebelling against the dollar.”

Global Evidence of Financial Collapse at Precision Points are Revealing Themselves in The Financial Markets of the World

Back in 1971, NASDAQ stood for National Association of Securities Dealers Automated Quotations. It was founded in 1971 by the National Association of Securities Dealers (NASD). This past week, the readers of the “All Star Economics Thread” on Investorshub.com were notified of the following parameters for a “market correction” that had taken place. For those that closely monitored this situation and were previously forewarned

~ they had the benefits of utilizing the free tools that were available to them. At this point, who really cares? Take a look at the trigger signals that sent chills down the spine of “the informed”:

And expectations for the future in the Nasdaq market are:

During this same period of time, the “Quantitative Easing” also known as “QE,” (or printing money out of thin air) that the Federal Reserve has been pumping into the market led to the revelation of the following trend in the Dow Jones Industrial Average charts. From Wikipedia, “The Dow Jones Industrial Average /?da? 'd?o?nz/, also called the Industrial Average, the Dow Jones, the Dow Jones Industrial, the Dow 30, or simply the Dow, is a stock market index, and one of several indices created by Wall Street Journal editor and Dow Jones & Company co-founder Charles Dow.”:

Now take a look at the Nikkei Stock Exchange and understand what this exchange is along with why it is relevant to this article. Here is the definition based in simple terms from Wikipedia: “The Nikkei 225 (?????? Nikkei heikin kabuka?, ??225), more commonly called the Nikkei, the Nikkei index, or the Nikkei Stock Average[1][2] (/'n?ke?/, /'ni?ke?/, or /n?'ke?/), is a stock market index for the Tokyo Stock Exchange (TSE). It has been calculated daily by the Nihon Keizai Shimbun (Nikkei) newspaper since 1950. It is a price-weighted index (the unit is yen), and the components are reviewed once a year. Currently, the Nikkei is the most widely quoted average of Japanese equities, similar to the Dow Jones Industrial Average. In fact, it was known as the "Nikkei Dow Jones Stock Average" from 1975 to 1985.[3]”

Japan’s economy is based on the same delusional belief that Ben Bernanke of the Federal Reserve Bank (privately owned bank) put into full swing. “Printing money” or otherwise, “throwing money from helicopters” is how Ben stated it when he initiated the program for his own purposes in order to divert another “Great Depression”. Obviously, he either didn’t know what he was doing or had another agenda in mind. Guess what, it didn’t work for Japan and it most certainly isn’t working for the United States. We won’t jump the gun just yet. First take a look at where we can expect Ben’s policy to take the Dow and the Nasdaq stock exchanges by seeing how well a similar program has been working for Japan:

So the QE program in Japan has led Japanese stocks down 15% from their highs and they are presently trading at six-month lows which get lower every day while the USDJPY is tumbling further. The following chart is a comparison of the Dow Jones stock market in America and the Nikkei from Japan:

The next chart shows where the money printing from Ben Bernanke started and the effect it has had on the amount of debt created by the privately owned Federal Reserve Bank:

(Image can be seen on the sister thread to this blog as denoted in the Intro)

At the moment, David Stockman who served as Budget Director under President Ronald Reagan ~ has an assessment that looks something like this, “. . .the Fed’s balance sheet was $500 billion then and $4.5 trillion today–a 9X gain. Needless to say, this comparison does not comprehend a brief interval; it encompasses the greatest monetary policy experiment ever undertaken and suggests that there is no link whatsoever between the Fed’s policy of radical balance sheet expansion and job market developments.” See the following chart for further understanding:

Is this time really going to be different? Let us now venture to look at the Russell 2000 index. Here’s another quick definition from Wikipedia so that you can all see how this fits into the present state of the economy: “The Russell 2000 is by far the most common benchmark for mutual funds that identify themselves as "small-cap", while the S&P 500 index is used primarily for large capitalization stocks. It is the most widely quoted measure of the overall performance of the small-cap to mid-cap company shares.” With that being defined, we can see how the companies represented by the Russell 2000 index are performing and how they are expected to perform at present and in the near future:

Legendary Swiss investor and jovial doom-and-gloom forecaster Marc Faber says a market crash “worse than 1987” is coming in 2014. You can see the full content of Faber’s article in the reference section of this market expose’. For now, take a look at the comparison with the S&P 500 index over the years of dismal activity from 1982-1987 and now compare to 2009 – 2014 (totally based on fake money being pumped into the market by the Federal Reserve Bank). The S&P 500 is the cardinal comparison stock exchange for how well the economy is performing. At least, it was at a point prior to the artificial Federal Reserve money printing. So in fact, most experts consider the S&P 500 one of the best benchmarks available to judge overall U.S. market performance. At least during the years of 82’ through 87’ it was a real economy. Now, this economy is a total fake as created by the Federal Reserve. Does anybody smell a fish, here? It appears to be three days old (three QE’s) and it has been sitting in the sun a bit too long:

Before leaving the charts of this wonderful economy, let us not veer from revealing what is going on with the European markets. The exuberance in European stocks is fading fast:

Off The Charts:

Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy under Ronald Reagan and associate editor of the Wall Street Journal. Dr. Paul Craig Roberts has his own ideas and perceptions of how all of this is going to turn out which he expresses in his latest article in the reference section of this text named, “Is the US or the World Coming to an End?” His projections and assumptions are pretty much in alignment with those of this writer. Unless people are totally blind they can see events overseas where instability is taking place in Iran, Iraq, Afghanistan, Libya, Syria, Ukraine, Egypt, the EU, Turkey and in South America as well. All of these events were perpetrated by the West. Do a little history research to discover who that involves. During this period of economic collapse, there is one thing to consider, “Are you prepared?”

Ponder that last thought as well as the following: “What is the secret to life?” The answer comes naturally for those with direction. . . “To live for something, and live in opposition to something else.” Or in the “Warrior’s Code,” be ready to “Fight for that which is right and be willing to die fighting against that which is wrong.” And in general terms. . .”One will either stand for something, or they will fall for anything.” How can you fail on that pretext? Think about it.

“There are thousands to tell you it cannot be done,

There are thousands to prophesy failure,

There are thousands to point out to you one by one,

The dangers that wait to assail you.

But just buckle in with a bit of a grin,

Just take off your coat and go to it;

Just start to sing as you tackle the thing

That ‘cannot be done,’ and you’ll do it.”

PS: Never you fear folks, we can trust our government to take care of us (view the following posts to be assured things will be getting better with the Bozos directing procedures from the Beltway):

1: http://www.shtfplan.com/headline-news/video-militias-are-on-route-is-the-2nd-american-revolution-starting-in-bunkerville-nevada_04102014

2: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100359083

3: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100349767

4: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100262819

5: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100205344

References:

1: John Burch Society, Overview of America ~ (Video): http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100120692

2: The Burning Platform: http://www.theburningplatform.com/

Marketwatch.com ~ Why long-time unemployed can’t get back on track: http://www.marketwatch.com/story/for-long-time-unemployed-full-time-work-is-elusive-2014-04-04?link=MW_story_popular

The Economic Collapse ~ This Is What Employment In America Really Looks Like: http://theeconomiccollapseblog.com/archives/this-is-what-employment-in-america-really-looks-like

USA Watchdog ~ Whole Eastern World Rebelling Against the Dollar-Jim Willie interview with Greg Hunt: http://usawatchdog.com/whole-eastern-world-rebelling-against-the-dollar-jim-willie/

Investopedia ~ What Was The Glass-Steagall Act?: http://www.investopedia.com/articles/03/071603.asp

Zero Hedge; The Day That BTFD Failed: http://www.zerohedge.com/news/2014-04-06/day-btfd-failed

Political Calculations ~ The Ongoing Inflation of the Higher Education Bubble: http://politicalcalculations.blogspot.ca/2014/04/the-ongoing-inflation-of-higher.html#.U0OvsMIo_IX

Investor’s Hub ~ Consumer Credit Expenses: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100188302

Investor’s Hub ~ Another Banker Mysteriously Loses Life: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100188089

Enenews ~ The Latest on Fukushima: http://enenews.com/canadian-experts-predict-fukushima-radioactivity-in-fish-shellfish-to-exceed-govt-food-limit-to-be-well-above-1000-bqkg-maximum-according-to-scientific-model-a-high-priority-looming

Of Two Minds, Charles Hugh Smith: http://www.oftwominds.com/blog.html

Mark Faber Comment @ http://www.zerohedge.com/news/2014-04-10/marc-faber-warns-market-waking-how-clueless-fed

Contra Corner, David Stockman’s Assessment: http://davidstockmanscontracorner.com/2014/04/10/the-born-again-jobs-scam-part-2-the-feds-labor-market-delusion/

Dr. Paul Craig Roberts; Is the US or the World Coming to an End?”: http://www.paulcraigroberts.org/2014/04/09/us-world-coming-end-paul-craig-roberts/

National Center for Education Statistics. 2012 Digest of Education Statistics. Table 381. Average undergraduate tuition and fees and room and board rates charged for full-time students in degree-granting institutions, by level and control of institution: 1969-1970- through 2011-12. [Excel Spreadsheet]. NCES 2014-015, December 2013.

U.S. Census Bureau. 2013 Current Population Survey. Annual Social and Economic Supplement. Table H-5. Race and Hispanic Origin of Householder--Households by Median and Mean Income: 1967 to 2012. [Excel Spreadsheet]. P60-245, September 2013.

Bureau of Labor Statistics. Consumer Price Index - All Urban Consumers. U.S. City Average, All Items, Not Seasonally Adjusted. Online Application]. Accessed 8 March 2014.

Recommended Sites on the Internet for Attaining Accurate Geopolitical and Financial Information:

1: Zerohedge.com: http://www.zerohedge.com/

2: The Keiser Report: http://www.maxkeiser.com/

3: Breaking The Set with Abby Martin: https://www.youtube.com/channel/UC2Xd902w9u5_2oa7SHFSvZw?sub_confirmation=1

4: The Common Sense Show with Dave Hodges: http://thecommonsenseshow.com/

5: The X22 Report: http://x22report.com/

6: Ben Swann’s “Truth in Media”: http://benswann.com/

7: The Hagmann & Hagmann Report: http://www.homelandsecurityus.com/

8: Paul Craig Roberts Official Homepage: http://www.paulcraigroberts.org/

9: Canada Free Press: http://canadafreepress.com/

10: Caravan to Midnight with John B. Wells: http://caravantomidnight.com/

11: Peter Schiff’s Europacific Capital: http://www.europac.net/

12: Testosterone Pit: http://www.testosteronepit.com/

Report by Mark Mayr

BS ~ Utah State University

Certified Investor Relations Representative ~ University of California, Irvine

Graduate Work in Industrial and Organizational Psychology (FL, CO)

April 11, 2014

Introduction:

Collapse Will Be Sudden

“That’s the thing about the collapse of civilization. It never happens according to plan – there’s no slavering horde of zombies. No actinic flash of thermonuclear war. No Earth-shuddering asteroid. The end comes in unforeseen ways; the stock market collapses, and then the banks, and then there is no food in the supermarkets, or the communications system goes down completely and inevitably, and previously amiable co-workers find themselves wrestling over the last remaining cookie that someone brought in before all the madness began.” (1) ? Mark A. Rayner – The Fridgularity

Once upon a time there was a nation. This nation was called, “The United States of America”. It was founded on the basis that each individual who had the will to succeed and prosper during the most challenging of times would be rewarded with a lucrative career and position in society worthy of their efforts for betterment of the human experience. The efforts with those who had the “will” were deemed valuable to society and required no associations with clandestine groups or secrets of a higher order to connect and manifest an individual’s success. Times have changed.

In the United States was a nation built on the fundamentals of the right to pursue happiness under the virtues of freedom, honesty, integrity and a high degree of morality. We had a Constitution and a Bill of Rights which stabilized the directives of our nation’s and each individual’s progression. To understand these principles, one need only review an overview of the concepts that our nation’s founding fathers put into place with the intentions that future generations would keep them in place (2).

It Couldn’t Be Done

By Edgar Albert Guest[/I]

“Somebody said that it couldn’t be done

But he with a chuckle replied

That ‘maybe it couldn’t,’ but he would be one

Who wouldn’t say so till he’d tried.

So he buckled right in with the trace of a grin

On his face, If he worried he hid it.

He started to sing as he tackled the thing

That couldn’t be done, and he did it!”

The True Condition of the US Economy:

Recent studies show that once a person is out of the job market greater than six months their chances of finding stable work are greatly reduced. According to a research paper by Alan Krueger and other economists from Princeton University, only 11% of long-term unemployed find permanent, full-time work a full twelve month after losing what they perceived as being a stable position. Those seeking stable employment will most likely find unsteady work, with 14% finding part-time work and 11% accepting temporary work until acceptable conditions can be found. (Study: Are the Long-Term Unemployed on the Margins of the Labor Market?)

At present there are some seven million people working part time positions and would prefer full-time work. This number is actually lower than last year which was estimated at 8 million according to data from the Bureau of Labor Statistics but the present realization is it is still stubbornly high for the current unemployment rate. This week in Chicago, Federal Reserve Chairwoman Janet Yellen called that figure “a sign that labor conditions are worse than indicated by the unemployment rate.” That is an odd statement considering the present occupant of the White House that listens to the directions from the Federal Reserve (Barry whoever he is) is presently boasting that the economy is steadily improving as he touts more and more people are gaining employment. The type of employment people are getting is covered later in this brief research expose’ of the true state of the US economy.

What Are People Spending Their “Hard Earned” Money On? (Inclusive of Student Loan Expenditures I’m Sure):

Consumer credit in January increased by $13.8 billion, of which $14.0 billion went into student loans and car loans which means consumers continued deleveraging on their credit card statements (in effect applying one loan towards another), then February’s numbers were even worse but the headlines were great: Increase in consumer credit was $16.5 billion, well above the $14.0 billion expected. Here is where the problem comes in. . . more than 100%, or $18.9 billion was applied towards car purchases and paying down "student bills" (American students are notorious for spending their student loans as a means to pay for everything else but tuition).

Even if the madness of the student loan explosion continues or sub-prime auto lending keeps surging this is not leading to an improvement in the overall condition of the US economy. What this is doing is strapping consumers further down in the debt bucket which reduces their ability to spend money on other items (diminished disposable income). And when considering the $10 trillion mortgage mountain the student loan debacle and sub-prime auto loans are baby biology by comparison. This time around, a renewed household borrowing binge will not happen due to the baby-boom retirement crush, which liquidates household debt, and the “Dodd-Franking” of the banking system which inhibits lending—risky and otherwise. There is therefore a mechanism in place which reduces Federal money from flowing to the consumer. Pretty tricky stuff, when you think about it. As this all comes into focus, the Fed is printing money for the banks.

Complicating Matters Further: Tuition Expense Increases

Let’s take a look at the cost of college tuition fees (per annum) which continue to flow upward through the year 2012 and parabolic from 2012-2014:

With such expensive “degrees” in hand, perhaps college graduates can look forward to getting a position with one of these quality jobs (where the real job expansion in the US is coming from that the occupant of the White House [Barry, whoever he is] boasts so loudly about):

With that being said and seen, take a look at the labor market participation rate in the United States (Civilian):

Does anybody see a recovery taking place when college students are asses in over their elbows in student loan debt and can only get minimum wage jobs with their college degrees? At least they can purchase an automobile, huh? Where has the growth (if any) been? Has it been with automakers dumping their inventory from their pipeline while the next sucker comes in to look for a “free ride”? For those of you that have been reading you can see that the present situation is well documented. Consumers are basically being enticed to increase their education level (which leads to nowhere in many cases) while “buying a new car” on a “minimum wage earning schedule” and eliminating their disposable income by pushing any extra cash they might be able to accumulate towards rent, associated bills and with rental properties along with gasoline for transportation to and from work along with food which is guaranteed to take every last dime that they make. I can just hear the background noise, “Hey dad can I borrow some more money?!” Welcome to the “New World” economy.

“Somebody scoffed: ‘Oh, you’ll never do that;

At least no one ever has done it;’

But he took off his coat and he took off his hat

And the first thing we knew he’d begun it.

With a lift of his chin and a bit of a grin,

Without any doubting or quiddit,

He started to sing as he tackled the thing

That couldn’t be done, and he did it.”

The Demise of the Petro-Dollar ~ The Final Act of Poisoning The US Economy:

Dr. Jim Willie (known as “The Golden Jackass”) CB is a statistical analyst in marketing research and retail forecasting and holds a PhD in Statistics. In the financial world, his career has stretched over 25 years. During a recent interview with Greg Hunter of USA Watchdog, Dr. Willie recently stated, “We’re going to end this year with no resemblance to the beginning.” Dr. Willie agrees with this writer’s perspective in that the whole system broke in 2007 and 2008 with the subprime mortgages. Actually, the system was crumbling prior to 2007 and 2008. During the dot.com era, the system was under a high degree of abuse. It was during that time when the Glass-SteagulI Act was repealed under the guidance of then President William Clinton. This was a major part that played a role in the creation of the now infamous dot.com stock market bubble which handed a great deal of financial power over to the globalists and the ruling elite (the bankers). Meanwhile, those that were fortunate enough to get in on the ride were out drinking Kool-aid and had reached the conclusion the party would go on forever. Well, it didn’t. Those who fell asleep at the wheel went over the cliff. The system was never fixed. Instead, wound covers were put in place along with spit and fears to cover up the catastrophe that was developing and experienced by those who “trusted the system in existence”.

As internal conditions worsened through the year 2007, The Federal Reserve Bank pursued “0 Percent Interest Rates” to keep the dysfunctional system alive. What else happened? Then the Federal Reserve monetized bonds with zero percent interest rates to create liquidity in the financial systems. This was monetary or “fiat money” inflation and the event ran in comparison to what happened during the period of the Weimer Republic (1921-1924) in Germany. Dr. Willie made another statement in Greg Hunter’s interview that, “Now all the QE and bond purchases are causing some major problems, breaking major economic structures. . . It’s all breaking, it’s all breaking, and they are having a tremendous problem holding it together. Now, the whole Eastern World is rebelling against the dollar.”

Global Evidence of Financial Collapse at Precision Points are Revealing Themselves in The Financial Markets of the World

Back in 1971, NASDAQ stood for National Association of Securities Dealers Automated Quotations. It was founded in 1971 by the National Association of Securities Dealers (NASD). This past week, the readers of the “All Star Economics Thread” on Investorshub.com were notified of the following parameters for a “market correction” that had taken place. For those that closely monitored this situation and were previously forewarned

~ they had the benefits of utilizing the free tools that were available to them. At this point, who really cares? Take a look at the trigger signals that sent chills down the spine of “the informed”:

And expectations for the future in the Nasdaq market are:

During this same period of time, the “Quantitative Easing” also known as “QE,” (or printing money out of thin air) that the Federal Reserve has been pumping into the market led to the revelation of the following trend in the Dow Jones Industrial Average charts. From Wikipedia, “The Dow Jones Industrial Average /?da? 'd?o?nz/, also called the Industrial Average, the Dow Jones, the Dow Jones Industrial, the Dow 30, or simply the Dow, is a stock market index, and one of several indices created by Wall Street Journal editor and Dow Jones & Company co-founder Charles Dow.”:

Now take a look at the Nikkei Stock Exchange and understand what this exchange is along with why it is relevant to this article. Here is the definition based in simple terms from Wikipedia: “The Nikkei 225 (?????? Nikkei heikin kabuka?, ??225), more commonly called the Nikkei, the Nikkei index, or the Nikkei Stock Average[1][2] (/'n?ke?/, /'ni?ke?/, or /n?'ke?/), is a stock market index for the Tokyo Stock Exchange (TSE). It has been calculated daily by the Nihon Keizai Shimbun (Nikkei) newspaper since 1950. It is a price-weighted index (the unit is yen), and the components are reviewed once a year. Currently, the Nikkei is the most widely quoted average of Japanese equities, similar to the Dow Jones Industrial Average. In fact, it was known as the "Nikkei Dow Jones Stock Average" from 1975 to 1985.[3]”

Japan’s economy is based on the same delusional belief that Ben Bernanke of the Federal Reserve Bank (privately owned bank) put into full swing. “Printing money” or otherwise, “throwing money from helicopters” is how Ben stated it when he initiated the program for his own purposes in order to divert another “Great Depression”. Obviously, he either didn’t know what he was doing or had another agenda in mind. Guess what, it didn’t work for Japan and it most certainly isn’t working for the United States. We won’t jump the gun just yet. First take a look at where we can expect Ben’s policy to take the Dow and the Nasdaq stock exchanges by seeing how well a similar program has been working for Japan:

So the QE program in Japan has led Japanese stocks down 15% from their highs and they are presently trading at six-month lows which get lower every day while the USDJPY is tumbling further. The following chart is a comparison of the Dow Jones stock market in America and the Nikkei from Japan:

The next chart shows where the money printing from Ben Bernanke started and the effect it has had on the amount of debt created by the privately owned Federal Reserve Bank:

(Image can be seen on the sister thread to this blog as denoted in the Intro)

At the moment, David Stockman who served as Budget Director under President Ronald Reagan ~ has an assessment that looks something like this, “. . .the Fed’s balance sheet was $500 billion then and $4.5 trillion today–a 9X gain. Needless to say, this comparison does not comprehend a brief interval; it encompasses the greatest monetary policy experiment ever undertaken and suggests that there is no link whatsoever between the Fed’s policy of radical balance sheet expansion and job market developments.” See the following chart for further understanding:

Is this time really going to be different? Let us now venture to look at the Russell 2000 index. Here’s another quick definition from Wikipedia so that you can all see how this fits into the present state of the economy: “The Russell 2000 is by far the most common benchmark for mutual funds that identify themselves as "small-cap", while the S&P 500 index is used primarily for large capitalization stocks. It is the most widely quoted measure of the overall performance of the small-cap to mid-cap company shares.” With that being defined, we can see how the companies represented by the Russell 2000 index are performing and how they are expected to perform at present and in the near future:

Legendary Swiss investor and jovial doom-and-gloom forecaster Marc Faber says a market crash “worse than 1987” is coming in 2014. You can see the full content of Faber’s article in the reference section of this market expose’. For now, take a look at the comparison with the S&P 500 index over the years of dismal activity from 1982-1987 and now compare to 2009 – 2014 (totally based on fake money being pumped into the market by the Federal Reserve Bank). The S&P 500 is the cardinal comparison stock exchange for how well the economy is performing. At least, it was at a point prior to the artificial Federal Reserve money printing. So in fact, most experts consider the S&P 500 one of the best benchmarks available to judge overall U.S. market performance. At least during the years of 82’ through 87’ it was a real economy. Now, this economy is a total fake as created by the Federal Reserve. Does anybody smell a fish, here? It appears to be three days old (three QE’s) and it has been sitting in the sun a bit too long:

Before leaving the charts of this wonderful economy, let us not veer from revealing what is going on with the European markets. The exuberance in European stocks is fading fast:

Off The Charts:

Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy under Ronald Reagan and associate editor of the Wall Street Journal. Dr. Paul Craig Roberts has his own ideas and perceptions of how all of this is going to turn out which he expresses in his latest article in the reference section of this text named, “Is the US or the World Coming to an End?” His projections and assumptions are pretty much in alignment with those of this writer. Unless people are totally blind they can see events overseas where instability is taking place in Iran, Iraq, Afghanistan, Libya, Syria, Ukraine, Egypt, the EU, Turkey and in South America as well. All of these events were perpetrated by the West. Do a little history research to discover who that involves. During this period of economic collapse, there is one thing to consider, “Are you prepared?”

Ponder that last thought as well as the following: “What is the secret to life?” The answer comes naturally for those with direction. . . “To live for something, and live in opposition to something else.” Or in the “Warrior’s Code,” be ready to “Fight for that which is right and be willing to die fighting against that which is wrong.” And in general terms. . .”One will either stand for something, or they will fall for anything.” How can you fail on that pretext? Think about it.

“There are thousands to tell you it cannot be done,

There are thousands to prophesy failure,

There are thousands to point out to you one by one,

The dangers that wait to assail you.

But just buckle in with a bit of a grin,

Just take off your coat and go to it;

Just start to sing as you tackle the thing

That ‘cannot be done,’ and you’ll do it.”

PS: Never you fear folks, we can trust our government to take care of us (view the following posts to be assured things will be getting better with the Bozos directing procedures from the Beltway):

1: http://www.shtfplan.com/headline-news/video-militias-are-on-route-is-the-2nd-american-revolution-starting-in-bunkerville-nevada_04102014

2: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100359083

3: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100349767

4: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100262819

5: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100205344

References:

1: John Burch Society, Overview of America ~ (Video): http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100120692

2: The Burning Platform: http://www.theburningplatform.com/

Marketwatch.com ~ Why long-time unemployed can’t get back on track: http://www.marketwatch.com/story/for-long-time-unemployed-full-time-work-is-elusive-2014-04-04?link=MW_story_popular

The Economic Collapse ~ This Is What Employment In America Really Looks Like: http://theeconomiccollapseblog.com/archives/this-is-what-employment-in-america-really-looks-like

USA Watchdog ~ Whole Eastern World Rebelling Against the Dollar-Jim Willie interview with Greg Hunt: http://usawatchdog.com/whole-eastern-world-rebelling-against-the-dollar-jim-willie/

Investopedia ~ What Was The Glass-Steagall Act?: http://www.investopedia.com/articles/03/071603.asp

Zero Hedge; The Day That BTFD Failed: http://www.zerohedge.com/news/2014-04-06/day-btfd-failed

Political Calculations ~ The Ongoing Inflation of the Higher Education Bubble: http://politicalcalculations.blogspot.ca/2014/04/the-ongoing-inflation-of-higher.html#.U0OvsMIo_IX

Investor’s Hub ~ Consumer Credit Expenses: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100188302

Investor’s Hub ~ Another Banker Mysteriously Loses Life: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=100188089

Enenews ~ The Latest on Fukushima: http://enenews.com/canadian-experts-predict-fukushima-radioactivity-in-fish-shellfish-to-exceed-govt-food-limit-to-be-well-above-1000-bqkg-maximum-according-to-scientific-model-a-high-priority-looming

Of Two Minds, Charles Hugh Smith: http://www.oftwominds.com/blog.html

Mark Faber Comment @ http://www.zerohedge.com/news/2014-04-10/marc-faber-warns-market-waking-how-clueless-fed

Contra Corner, David Stockman’s Assessment: http://davidstockmanscontracorner.com/2014/04/10/the-born-again-jobs-scam-part-2-the-feds-labor-market-delusion/

Dr. Paul Craig Roberts; Is the US or the World Coming to an End?”: http://www.paulcraigroberts.org/2014/04/09/us-world-coming-end-paul-craig-roberts/

National Center for Education Statistics. 2012 Digest of Education Statistics. Table 381. Average undergraduate tuition and fees and room and board rates charged for full-time students in degree-granting institutions, by level and control of institution: 1969-1970- through 2011-12. [Excel Spreadsheet]. NCES 2014-015, December 2013.

U.S. Census Bureau. 2013 Current Population Survey. Annual Social and Economic Supplement. Table H-5. Race and Hispanic Origin of Householder--Households by Median and Mean Income: 1967 to 2012. [Excel Spreadsheet]. P60-245, September 2013.

Bureau of Labor Statistics. Consumer Price Index - All Urban Consumers. U.S. City Average, All Items, Not Seasonally Adjusted. Online Application]. Accessed 8 March 2014.

Recommended Sites on the Internet for Attaining Accurate Geopolitical and Financial Information:

1: Zerohedge.com: http://www.zerohedge.com/

2: The Keiser Report: http://www.maxkeiser.com/

3: Breaking The Set with Abby Martin: https://www.youtube.com/channel/UC2Xd902w9u5_2oa7SHFSvZw?sub_confirmation=1

4: The Common Sense Show with Dave Hodges: http://thecommonsenseshow.com/

5: The X22 Report: http://x22report.com/

6: Ben Swann’s “Truth in Media”: http://benswann.com/

7: The Hagmann & Hagmann Report: http://www.homelandsecurityus.com/

8: Paul Craig Roberts Official Homepage: http://www.paulcraigroberts.org/

9: Canada Free Press: http://canadafreepress.com/

10: Caravan to Midnight with John B. Wells: http://caravantomidnight.com/

11: Peter Schiff’s Europacific Capital: http://www.europac.net/

12: Testosterone Pit: http://www.testosteronepit.com/

Real Warriors Follow @Conan644 on Twitter.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.