Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

August 16, 2021 CORX registration revoked:

ORDER IMPOSING REMEDIAL SANCTIONS

On the basis of the Commission’s opinion issued this day, it is

ORDERED that the registration of all classes of the registered securities of Core Lithium

Corp., under Section 12(g) of the Securities Exchange Act of 1934 is hereby revoked pursuant to

Exchange Act Section 12(j).

The revocation is effective as of August 16, 2021.

By the Commission.

https://www.sec.gov/litigation/opinions/2021/34-92672.pdf

Thank you Renee, sorry I did not see your post soon enough to make it a sticky.

So I am going to repost and make it the sticky.

GLTA

CORX registration revoked:

https://www.sec.gov/litigation/opinions/2021/34-92672.pdf

Core Lithium investor webinar July 2021

Aug 3, 2021

Core Lithium (CXO) - DFS Allows Funding Talk to Begin in Ernest

Jul 30, 2021

Paydirt's 2021 Battery Minerals Conference Core Lithium Ltd (ASX: CXO)

Jun 17, 2021

May 14, 2021 Core Lithium (CXO) - Tesla Partner - "We Want All You Can Produce"

Core Lithium (CXO) - Binding Agreements & Hoping for Lithium Revival

Investor Insight | Core Lithium and its Finniss Lithium Project

ASX-listed Core Lithium Ltd (ASX: CXO) is well positioned to be Australia’s next lithium producer, developing one of Australia’s most capital efficient and lowest cost spodumene lithium projects located near Darwin Port in the Northern Territory, Australia.

Core’s 2019 Definitive Feasibility Study (DFS) highlights production of 175,000tpa of high-quality lithium concentrate at a C1 Opex of US$300/t and US$50M Capex through simple and efficient DMS (gravity) processing of some of Australia’s highest-grade lithium Mineral Resources.

Core is currently working toward increasing Mineral Resources, Ore Reserves and mine-life ahead of being shovel-ready at the Finniss Project in the second half of 2020, with first lithium production scheduled within 15-months of commencing construction.

The Finniss Lithium Project has arguably the best supporting infrastructure and logistics chain to Asia of any Australian lithium project. The Finniss Lithium Project is within 25km of port, power station, gas, rail and 1 hour by sealed road to workforce accommodated in Darwin and importantly to Darwin Port - Australia’s nearest port to Asia.

Core has already established binding offtake and is in the process of negotiating further agreements within the lithium battery supply chain and electric vehicle industry.

Core Lithium has an experienced and proven team of directors and management with excellent skill sets for driving value growth in the mining industry. They have worked together successfully both as a team and separately in a number of listed mining companies on the ASX.

https://corelithium.com.au/

CORX SEC Suspension for severely delinquent Financials:

https://www.sec.gov/litigation/suspensions/2020/34-89958.pdf

Order:

https://www.sec.gov/litigation/suspensions/2020/34-89958-o.pdf

Admin. Proceeding:

https://www.sec.gov/litigation/admin/2020/34-89957.pdf

http://kirillklip.blogspot.ca/2018/05/lithium-race-to-total-ev-market.html?m=1#.WusCfz6CU4Q.twitter

Lithium Race To The Total EV Market Domination Is ON: Elon Musk Confirms Next Tesla Gigafactory Will Be In China.

Could be the perfect time for CORE if they can make this work. I keep reading about lithium demand everywhere I turn. Now just need some volume here to get in.

http://www.mining.com/lithium-bears-wrong/

Demand “going through the roof”

We've been been crunching the supply and demand numbers for almost a decade – at least since President Obama put aside nearly $2 billion in 2009 to support research on hybrid and electric vehicles and their battery components. What we know is this:

Asia and particularly China are looking to lock up lithium supply, and are years ahead of North America in terms of EV penetration and battery supply chains. Last year China sold about 700,000 electric cars, 200,000 more than 2016. Government subsidies to EVs have been reduced by 20%. The Middle Kingdom sees EVs as the key to unlocking the pollution dilemma that has plagued its car-choked cities. China represents over a quarter of the global EV market, and will own 40% by 2040 according to the International Energy Agency (IEA).

http://www.nemaskalithium.com/en/investors/press-releases/2018/411eb855-075f-4922-a30d-f9bdfed1f3c7/

Good news for Canadian lithium projects. Just goes to show there's lots of interest out there for this!

"Nemaska Lithium and Northvolt Announce Signature of Agreement in Principle for Supply of Lithium Hydroxide"

Yes, it looks like they've managed to get a project with a great postcode.

Anyone have any contact with management or know what the game plan is?

I've been following this for a while and would like to buy a bit but there's never much for sale. I know it was close to $4 not too long ago but I still have a hard time paying $1 today when there's not much trading going on. Need some news and some volumes here.

Undiscovered Lithium Company

Can’t wait for the word get out!!

Holy cow

Just checked out the new website

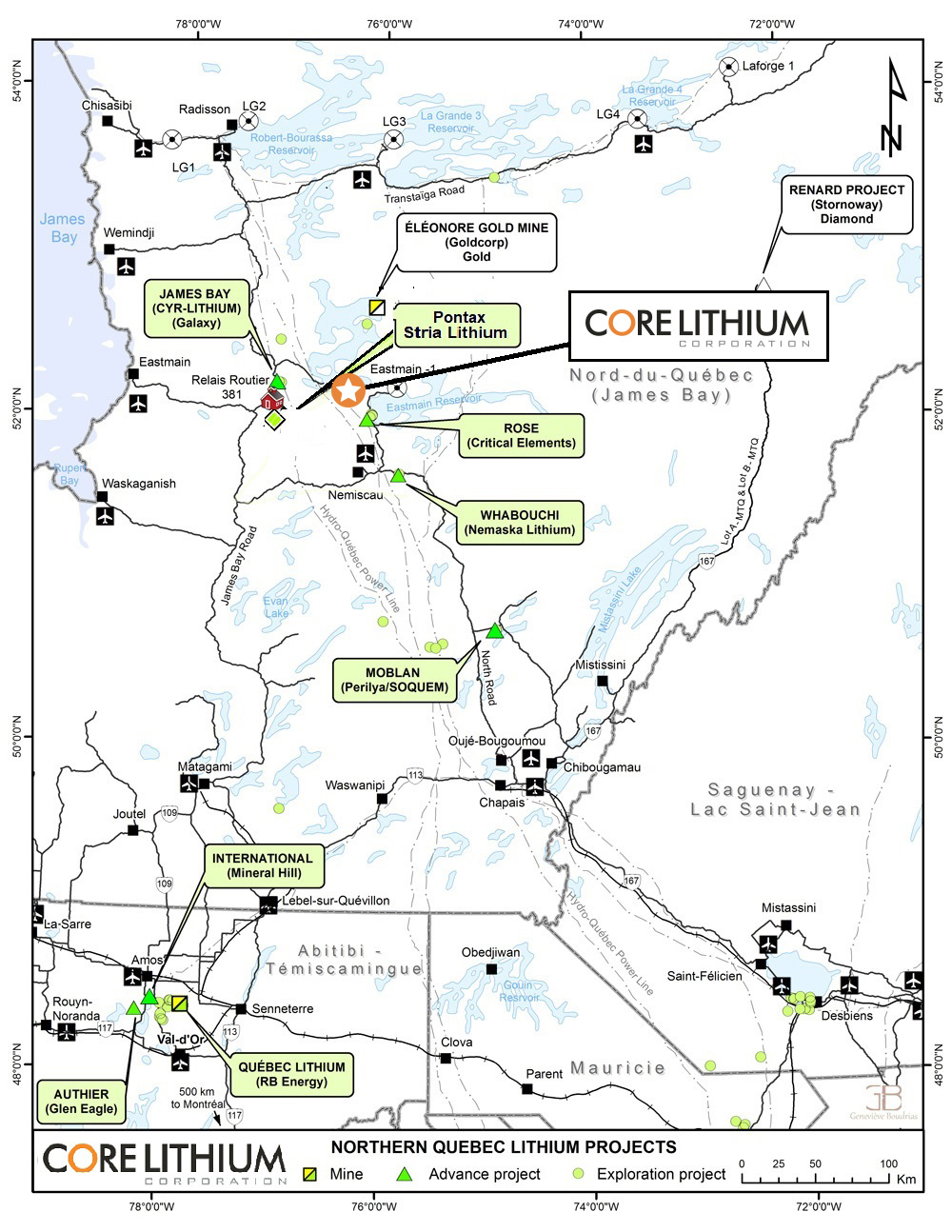

These guys have property next to some BIG names in the Lithium space

Lithium is hot right now

Can’t wait to see what this company is going to do next

New Name and new website

www.corelithium.com

Holy cow. These guys have certainly been busy. See their filings. They've gone a hiring. I guess it's tough to build a company if you don't have people. What's next? Management is you're reading this how about some news telling us what you're going to do!

All American Energy Corp. (AAEH) changed to Core Lithium Corp. (CORX)

http://otce.finra.org/DLSymbolNameChanges

Big news in Quebec lithium space. Maybe we will see AAEH get some big group interest someday. If they ever get moving. Not much going here. When is the time buy?

https://www.reuters.com/article/us-nemaska-lithium-softbank-group/softbank-to-buy-up-to-9-9-percent-stake-in-canadas-nemaska-lithium-idUSKCN1HD0CT

SoftBank to buy up to 9.9 percent stake in Canada's Nemaska Lithium

algorithmic trading? Who knows. It would be nice to get some news flow here to get the bids to creep in and maybe some sellers to come in too.

Yesterday, 2 buys all day for .95 and the pps drops to .30. WTH?????

It's back to trading small lots again. I was hoping to pick some up at the 50 cent area but it seems like we are back to days where it's offered at 95 only.

I wonder when these guys get going here? When does work start?

I'm buying more also, waiting for powder to

Clear, anytime now this is gonna pop, not gonna get caught wanting.

This thing is ready to rip. I'm on the bid now. I'm hoping to get filled before this gets away from me here.

I just keep reading article after article on how lithium is going to the moon. And that the deposits in safe jurisdictions are the ones you want to be in.

Can't get much safer than canada.

https://www.prnewswire.com/news-releases/data-shows-stronger-demand-for-lithium-and-cobalt-675529773.html

I agree. Nice action today and some good volume.

Trading more than normal. Not a lot on offer.

With battery demand exploding I can't help but think that good lithium companies should do well.

Is this the last opportunity to buy before this things moves again? It was $4 back in September.

Damn looks like our huge volume has dried up.

I like the new website. Looks professional and lots of good info and links

https://www.allamericanenergycorp.com/

awooga awooga!

I've been keeping an eye out for new filings or for anything to do with the company. I noticed today that they have a website up now! That's obviously huge. Why bother with the time and cost of a site if you're not doing something? I'm really thinking about buying here right now....

Up to 25 buys now. 26.79-comm. somebody is getting rich here

High volume today, 2 shares bought at .99. To Da Moon

another big trading day.

Who was the lucky guy that picked up 25 shares at 12 cents!

I'm keeping some powder dry to pick some of this up once I start seeing some action. Hopefully that's sooner rather than later.

$137 traded today. A couple market orders. This thing is ready to go on a tear! Lol

But really though, lots of filings, updated profile on otc site, url and site likely coming online, president positions himself with HUGE block of stock. Yeah, something's about to happen.

Whs that I that bought 50 today?

I agree. Tab open on pc to their OTCBB page and check a couple times a day. Thanks for the update on web page, something def going on behind the scenes, looking to add where I can

I've been checking the otcbb page daily to stay on top of filings. Nothing new filings today BUT they now have a webpage url AND email against the AAEH markets page. Before there was no site and the email was a gmail account. The site isn't live yet but i assume it will be soon otherwise why update your otcbb.com info.

Again, just more signs that things are going on behind the scenes here. Have to keep an eye here closely or you might miss the buying opportunity.

When i get into work, I'd hate to turn on my pc at some point and see this has traded 500,000 shares and is back at $4 high.

Website: http://www.allamericanenergycorp.com

Phone: 513-924-4980

Email: info@allamericanenergycorp.com

TDA shows 3399@.99, 100@2.50, 100@5.00. $3365.00 could take this to 2.50.

I only see 1000 on offer at 99 cents now. 100 at 2.50 and 100 shares at 5$.

Just as someone can drop the share price from 99 to 12 by selling 30 shares, if someone did a market order for 1200 shares this would hit $5!

If someone did that, I bet it would wake up other owners of the stock and lead to a lot more volume.

I also have been trying to buy below. The only time this sells off is for some puny little amount that's not worth owning. Even if I did end up getting 150 shares at 12 cents that's $18! Hardly an amount worth following.

There seems to people willing to pay 99 and buy. There's not much on the ask either. I see 1000 on offer at 99 and then not much after.

Maybe I'll have to bit the bullet and pay 99.

I've tried to buy below .99 with no luck

someone trying to keep the price down to get people to sell at a lower price.

$148.50 worth of buys and 21.60 in sales, makes no sense. Someone playing

$3.60, some computer is rich, resistor money for the weekend lol

I saw that too. I bought 6 shares yesterday, that was me lol. Waiting for some real buying, I think 2018 will be a good year with some positive follow thru

|

Followers

|

133

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

12671

|

|

Created

|

01/03/07

|

Type

|

Free

|

| Moderators | |||

Core Lithium Corp.

250 East Fifth Street, 15th Floor PMB#121

Cincinnati, OH 45202 USA

info@corelithium.com

Outstanding Shares: 67,794,661 as of 4/11/18

Shares in Float: 6,107,113 as of 4/11/18

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |