Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

personally I do not like TOS. I am staying on strategy desk.

If you do not have access call TDAmeritrade, they will give you access.

Please post screen for Moving average crossover, if you can

Hey citizens checkout this screener, tell me what u think.

Been using it for 2 weeks now. Not as fast as I could hope for but its a start.

(Bar[Close,D] > .0008) AND

(Bar[Close,D] < .99) AND

(Bar[Volume,D] > 500000) AND Bar[Volume,D] >= 2 * MovingAverage[MA,Volume,20,0,D]

Is that smelly french woman still here?

I just went thru the 'infamous' thread here. I am sooo OK. Someone felt threatened.

How much longer before we can trade futures on TD Ameritrade? I can Paper trade it on TOS ............. I am loving oil :)

You can scan for all kinds of things with TOS.

Scan can be done with a MACD Histogram crossover if that is what you are looking for.

trade

tony thanks for the explain, ill look through my other saved stuff, see if i can find that. ive searched the net and am sure i found it.

That's Matties TAAV

That tells you how the cumulative volume so far today compares to a prorated average of the last 20 day's volume. For example, a TAAV of 2.0 means that so far today, the volume is pacing 200% of the average of the last 20 days.

VWAP is a volume weighted average price for the day. Basically it's a volume weighted moving average, but the number of periods is always changing. There are 390 1-minute bars during the trading day. By 10:00 am, the average should look at the last 30 bars. By 11:30 am the average should look at the last 120 bars, etc etc.

is this the vwap formula:

Volume / ((MovingAverage[MA,Volume,20,0,D] / 390) * (((Hour * 60) + Minute) - 570))

can you scan for moving average crossovers with TOS? is TOS merely for trading and charts, can you scan intraday with TOS? thanks.

I had been thinking of changing over to TOS for several months. The final decision was made a week ago when I went to a class Ameritrade offered locally. There is tons of stuff in the platform and it will take me awhile to get it all, but the free online video education sure helps. Still occasionally getting lost and flipping back to SD, but sure it won't be for long.

Can't beat the Support/Chat button for help right on the platform. They can see exactly what my screen looks like and explain what I am doing wrong. Course is makes me feel like a dope sometimes, but that is what they are there for. LOL

Have a great afternoon.

trade

Yep, I think I'm right behind ya.

I really like the charting in TOS, but the Level I scans aren't as good, and the backtesting of strategies is very limited. So I've been using SD at night for scans and backtesting, coming up with my watch list for the next day, then trading with TOS intraday.

I finally gave up on SD and moved to TD's Think or Swim platform. The differences were overwhelming at first, but it has much more to offer and TD gives free education to help me use it.

trade

Needing help

there are 3 things I have been trying to get in SD for some time now, and haven't figured out how to do it.

1. # Days Held - I want a column to add to my Positions window that will tell me the # of days since I opened the position. Any ideas here? the "Position Date" and "EntryDate" fields do not work, either by themselves or part of a formula. I'm stumped...

2. Daily VWAP indicator - would love to add this to all intraday charts if anyone has come up with code for it. QuoteTracker and ThinkorSwim both have this, but not Strategy Desk.

3. Any type of market breadth indicator to chart? $ADVN and $DECN work fine on the TD Ameritrade website, and in ThinkorSwim, but they come up as "Symbol not found" not in SD.

Tech Support at TDA told me that all 3 of these are not possible with the program. But yet I've managed to make a bunch of things in SD that they told me weren't possible. If anyone has figured out the workaround for these 3 things, please help!

Thanks

Tony

Demark Daily Setup

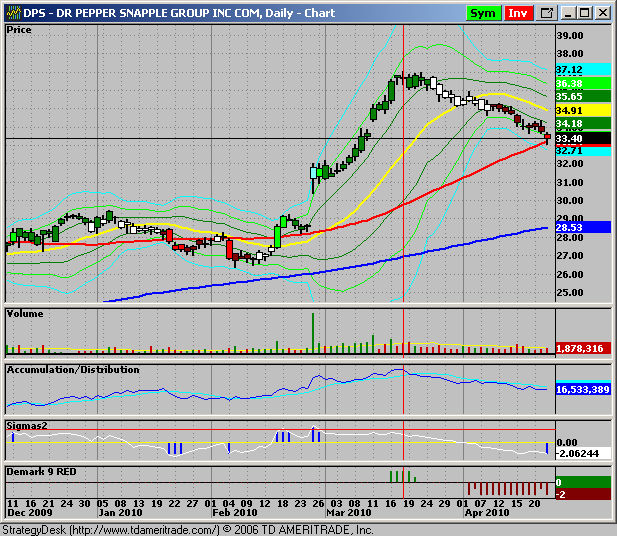

Scanning the S&P500 for Oversold stocks (yes there are some in this market) I found mostly metals and healthcare. For now I'd avoid both sectors. But there is one oversold stock that looks attractive:

Who likes Doctor Pepper?

Demark count -22 (wow)

on rising 50 day SMA support

closed below lower Bollinger Band for first time since February

I have an alert set to go long on strength, with a stop below today's low 33.06. Earnings report May 6.

To scan for stocks that are overbought or oversold according to the Demark 9 count method, use this screener:

(

Bar[Close,D,0] < Bar[Close,D,4] AND

Bar[Close,D,1] < Bar[Close,D,5] AND

Bar[Close,D,2] < Bar[Close,D,6] AND

Bar[Close,D,3] < Bar[Close,D,7] AND

Bar[Close,D,4] < Bar[Close,D,8] AND

Bar[Close,D,5] < Bar[Close,D,9] AND

Bar[Close,D,6] < Bar[Close,D,10] AND

Bar[Close,D,7] < Bar[Close,D,11] AND

Bar[Close,D,8] < Bar[Close,D,12]

)

OR

(

Bar[Close,D,0] > Bar[Close,D,4] AND

Bar[Close,D,1] > Bar[Close,D,5] AND

Bar[Close,D,2] > Bar[Close,D,6] AND

Bar[Close,D,3] > Bar[Close,D,7] AND

Bar[Close,D,4] > Bar[Close,D,8] AND

Bar[Close,D,5] > Bar[Close,D,9] AND

Bar[Close,D,6] > Bar[Close,D,10] AND

Bar[Close,D,7] > Bar[Close,D,11] AND

Bar[Close,D,8] > Bar[Close,D,12]

)

If you use Strategy desk on Ameritrade try the TOS (think or swim) platform. They also offer it free. TOS is much faster at scans because it is web based. TD also offers educational videos for free on how to use the think or swim platform.

I have used SD for several years, but am currently changing over to the TOS platform.

GLTY,

trade

Oh, and I know there are some cheaper brokers out there but TD has never done me wrong. The customer service and free education is top notch. I pay $8 for trades no matter how many shares. Have free L2(not pinks, which I don't trade anyway) and lots of other perks.

IM TRYING THIS TODAY STOCKS THAT GAINED OVER 200% VOLUME YESTERDAY.SEE HOW THEY MOVE ON A 5 MINUTE CHART.ALU,CPBY CA HTZ NBG ZANE XHB GNBT CIGX

SSN UBS GSS OVTI FCH OCN ALGN PCBC SAY RZ FUN XRA TCB CVBF WATG CPF NPBC NR BEAT EWBC EXXI CNLG

i guess youre trying to find stocks that move, high gainers is one way, im looking for an other, the trick is to figure out which way they will move when you buy one!

im also sure SD only allows a scan for 2500 stocks, of course you could open multiple times.i think. again SD is slow but cheap.

you should switch to IB if you trade much, cheaper and faster fills, half the price of TD. if you use IB they have screens for what you want!

you could limit your scan by volume or price! i use stockfetcher, 9$ per month for filters like you need.

show stocks where Average Volume(90) is above 250000

and close is between 1 and 20

yes SD is slow but its free, 65$ per month for trade ideas or madscan(very little documentation)

so lets suppose I want to see percentage gainers of Nasdaq , I Load Nasdaq stocks from load symbols and look for percent change ? Does it work real time Pre-market ? Is there a way to only just load percentage gainers on all exchanges?

Thanks in advance.

Edit:I tried to load all Nasdaq symbols just takes too much time to get all the data , do you get the same problem

click on L1, next, top of screen , click on COLUMNS, next click on Price/Volume, next click on % Change

where is that ?

I have it!! But its not FREE. He's on his 4th formula. It works really good. REALLY GOOD:)

The Think or Swim platform is very nice. You can chart $ADVN and $DECN in there but not in Strategy Desk. You can also get a daily VWAP indicator.

Tony: what do you use to monitor market etc? what software that is?

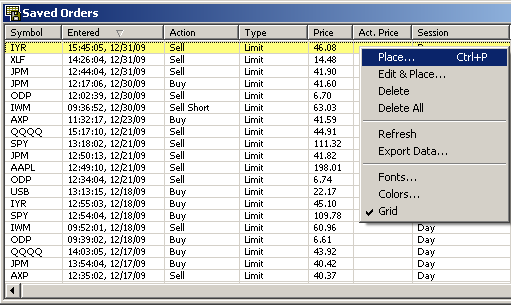

One of the best ways to start using your strategy when you are away from the computer is to use the Saved Orders feature.

Edit -> Preferences

- Alerts Tab: uncheck the first box to enable automatic trading.

- Trading Tab: Enable Integrated Trading, and under settings select NO order confirmation and under program trading select Add to Saved Orders.

You must have your symbols and alerts loaded in, and when the trigger occurs it will add an order to your saved list. For liquid stocks you can buy limit at the ask and sell limit at the bid. Then, let it run and see how your ideas are working. You will end up with a saved order list that may look something like this

once you get the alert, just right click on the saved order and click Place, or Edit and Place. If you are really confident you can set the trading tab to just automatically enter the order and skip the saved step. I have done this and it works like it is supposed to.

For penny stocks and scanning the herd of thousands of stocks, Strategy Desk may not be the right program to use. It is much better used for executing your Buy and Sell triggers on a short-list of stocks and formulas. It's not meant to be a heat-seeker or overall market monitor. Heck they can't even monitor advance/decline, so use it for what it's worth. Hope this helps.

also , i think the limit for scans is 2000 stocks, but i hear people open SD multiple times to scan more!

you can write Strategy desk support, try explaining two conditions to them, perhaps when that occurs all of your conditions will be met, tell them you would like a scan, when they reply, read your manuals, two conditions are fairly simple,

Hello and Happy New year Everyone.

First off I will give you some background about myself.I am a 30 something blue collar worker .....Millwright (or greasy collared worker LOL) I have been trading for about 2 years now I made some money and lost some money . I am pretty much Even.

I have been following some guys here on Ihub and they are doing real well . I also just pick a stock I might get a lead on . Any way They send out alerts via Email and what not and I have it set up so I get a text when they send out their email's.the Trouble is a lot of time I am in the middle of something on the Job and cant stop what I am doing and hold up 10 other guys just to read a text then try to sign in to TD Ameritrade and make that trade. be it a by or a sell.

Now I have(hopefully ) a job coming up in the spring(draw back there is no Cell service) where I work (4) 10's and Have Friday off. I am looking forward to this so I can Live trade at home.

I do not want to have to rely on waiting for other people. I want to learn how to do this myself. I want to be able to set up alerts for my self on SD . I want to Use MACD,Stochastic, Stochastic RSI Aroon and Barpoint(I think LOL)so when they all cross the upper line at the same time I get an alert But I do not know how to set it up or what formula to use I trade mainly Penny's.

Here is a pic of SRCH I was interested in when it was @$1.55 on Dec 29 2009 dipped to $1.46 the next day and was as high as $1.62 Today.

I did not buy the next day but should of at 3:25 (15:25) see that vertical red line near the middle? that's when I want to get an alert. now if any one has a better idea of an indicator I should use and how to set it up I am all ears.

I would also like to be able to set up sell alerts for my positions in the same manner Probably opposite than the buy alerts I assume.

So I would Like to get this set up and play with it a bit and get used to it before the spring time so I can live trade on Fridays. How many Symbols can I scan/screen in this manor?

Hello,

No i do not have it.

I wonder if it is a scam.

Let me know about it please if anyone have this indicator.

Thank you very much.

I am looking for the KILLERSDFORMULA code also. Let me know if you found it and I will do he same for you.

What is the closest way to approximate a trailing stop within a formula. I know i can use a conditional order and specify a trailing stop but that precludes any other sell formula criteria that I may want to use... My formula references 30 min. bars so I know I can do this for example

(Bar[Close,30] < EntryPrice * .980) OR (Bar[Close,30] < Bar[High,30] * .980)

I don't want to maintain positions over night, so I'm really only dealing with the high of each 30 min. bar from entry until 1600.

i have many variations of oscillators, however, they are most useful in 'sideways' or churning/channeling stocks. There are great indicators appropriate for 'trends' and strength.

Strategy Desk Users! I have been working with SD since inception, as Apex Client. I have unique Indicators and Sytems working within SD.(price/Volume driven) that produce 85% Win/Loss ratio and Power Factors upwards to 1000%. (Directional; Buy only, or Sell Only)Combined produce higher returns.

Available for Swing and INtraday 15 to 30 mins. Several Proven Strategies for all markets. No need to be a Chart Expert

Use Color bars or price charts.

Workspace Layout with auto screening in place. Auto Buy/Sell Alerts OR Trading. Great Visuals on Charts for Clear Reasons for Entry and Exit. No Correlated Indicators, so no 'fake-outs'.

Auto-pick Stocks that follow your strategy with highest returns; on Workspace. Continous backtesting proves Results.

Interested please reply "davestocknews@gmail.com"

Well SD is not an EVERYBODY thing. There is a group of people that I have no idea how big. But at there is a board for questions that might arise. I myself would not except something here everyday.

Hey guys. I guess you've all noticed the lack of care and feeding of the board here. I've just had some bumps in the road lately and haven't been able to devote the time needed to keep it maintained. There is a small group of people at favstocks.com discussing Strategy Desk. I hope the information that we shared here at least helped some of you. I know it helped me!

Thanks all,

Happy Trading

have been using it with 60min. charts for 2x etf's, and daily charts for SPY and QQQQ.

Yes it is. And that's definitely something that could be done in SD. Have you used the oscillator before?

.....great name, right ? ;-]

just give it a google and you will find plenty of detailed descriptions.

I'm also interested in the timeline of when various indicators came into use through the years. This appears to be a newer one. Thanks

Probably... LOL... what's the awesome oscillator? If you can describe it I can probably build it.

has anyone ever been able to create a formula for the "awesome oscilator" in SD ?

This is an ongoing problem that I have had with support. Any of my assumptions are based on tedious e-mails and conversations with SD support.

It appears that we are not receiving consistent answers.

Let's keep asking questions until our analysis verifies their answers

Your # 4 assumption I think is not true. I have not gone auto trade yet, however, I can get close results using the trade alert history. I have been told by SD that there is at least a 3 second delay in execution using auto trade. This could be large on an entry or exit.

I've noticed that problem as well! I think it has to do with screen resolution. My smaller screen doesn't show the bottom custom fields for selection but my bigger screen does.

It's very lonely here!

--------------------------------------------------------------------------------

Using SD...there should be a blog with FYI about SD. It could be questions asked and answered by support or different ways to use SD

for example;

It is my understanding when using SD that:

1) when using Action button and selecting Buy = Open and Sell = Open SD will alert when strategy conditions are met and trigger an execution on Open of next bar

2) when backtesting and checking 1-minute bar inside the interval bar this will "closely" reflect actual results

3) or using "lookback" 1- bar will "closely" reflect actual results

4) when using Saved function will accurately reflect the actual execution prices if program was set on auto

5) backtesting results will accurately portray the drawdown amounts as if utilyzing auto

6) you cannot use Num Triggered or Last when backtesting

7) there is a maximum number of entries one can add to the custom wizard

Comments welcome

|

Followers

|

14

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

795

|

|

Created

|

04/14/09

|

Type

|

Free

|

| Moderators | |||

Who - StrategyDesk users... from beginner to expert.

What - Discussion of StrategyDesk functions......usage, successful strategies, scans, backtesting, logic, issues, enhancements, how-to questions, etc.

Why - So all participants can maximize the power of the platform

WEEKLY TIPS

Support/Resistance http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37153654

Position Size Calc http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37317085

Time Adjusted Average Volume http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37507121

Candle Challenged? http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37710834

Watching multiple positions: http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37910013

Alerts from Chart Annotations http://investorshub.advfn.com/boards/read_msg.aspx?message_id=38108677

WARNING

WARNING

WARNING

There is quite a bit of discussion on this board about the implementation of live trading stratgies. DO NOT attempt to use live trading until you completely understand how this function works and you have thorougly tested your OWN strategies and code.

LINKS AND INFO

1-800-228-8056

http://www.tdameritrade.com/StrategyDesk/help.html?p=fbw

If you are new to iHub, you can join for free here.....

http://investorshub.advfn.com/?mdc=113016

Disclaimer blah blah... board participants are not licensed to give buy, sell, or hold recommendations. All posts are the opinion of the poster. You are responsible for the outcome of your own trades. Refer to the iHub Terms Of Use for more details. (http://investorshub.advfn.com/boards/terms.asp)

***** this section under development ******

BOARD CONTENT INDEX

To navigate through message threads:

BACKWARD…. click the msg # after "In reply to:"

FORWARD… click Replies ( )

| CATEGORY | TOPIC | FIND IT HERE: |

| Chart Annotations | Support and resistance | http://investorshub.advfn.com/boards/read_msg.aspx?message_id=37153654 |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |