Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

This development as well as expansion into other Canadian markets with open up revenue opportunities that don't exist at the moment.

$CBHG

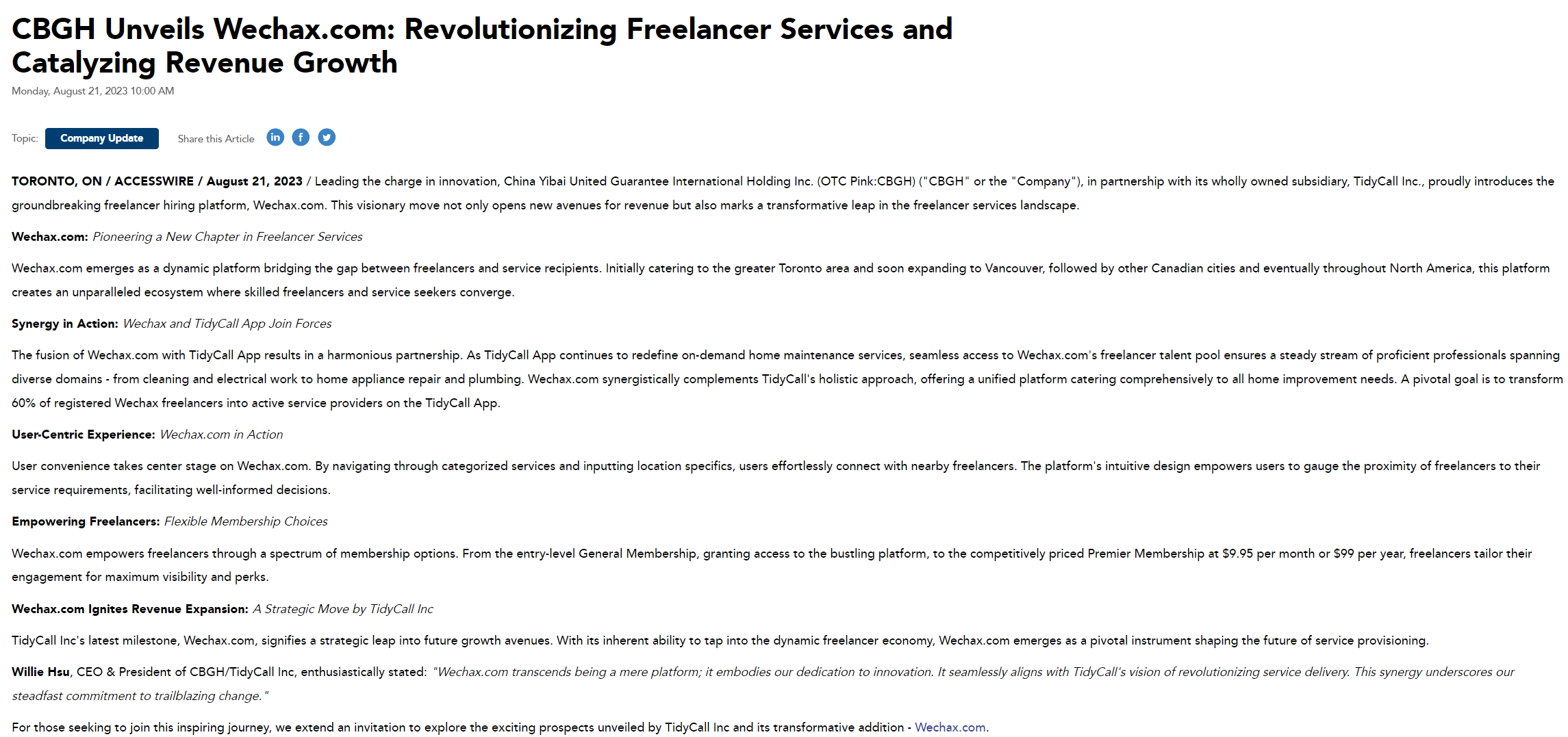

$CBGH Wechax.com Ignites Revenue Expansion: A Strategic Move by TidyCall Inc

TidyCall Inc's latest milestone, Wechax.com, signifies a strategic leap into future growth avenues. With its inherent ability to tap into the dynamic freelancer economy, Wechax.com emerges as a pivotal instrument shaping the future of service provisioning.

HUGE volume today at or near the high of the day...

$CBGH

$CBGH +57.35% big breakout!

$CBGH Chart view more room to go imo https://www.stockscores.com/charts/charts/?ticker=CBGH&ChartStyle=i

Establishing an office in Vancouver and thereby expanding TidyCall's footprint in Western Canada would open up a large population of Canada to grow the company's services.

$CBGH

$CBGH Great article covering all the advantages and market growth potential of this company which provides new and better ways to get a range of very necessary home maintenance services:

This Company can become a Major Player in the Billion-Dollar Global Cleaning & Freelancer Services Industries: Wechax.com & TidyCall (Stock Symbol: CBGH)

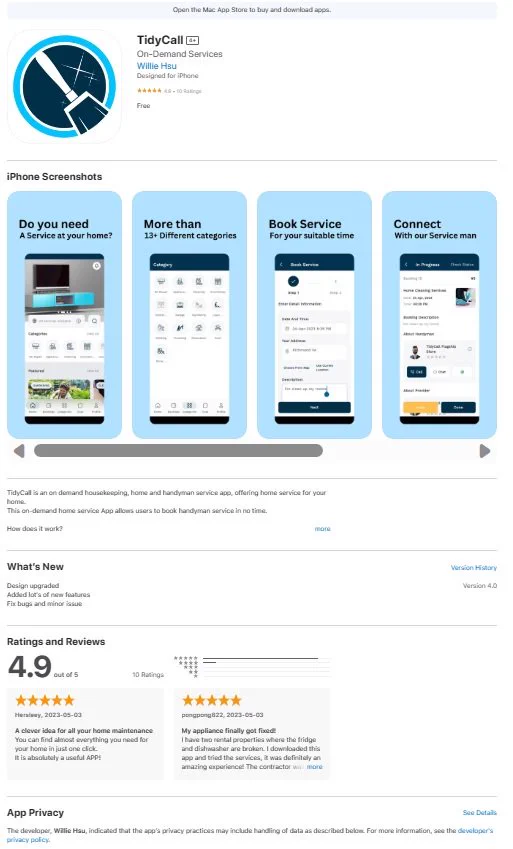

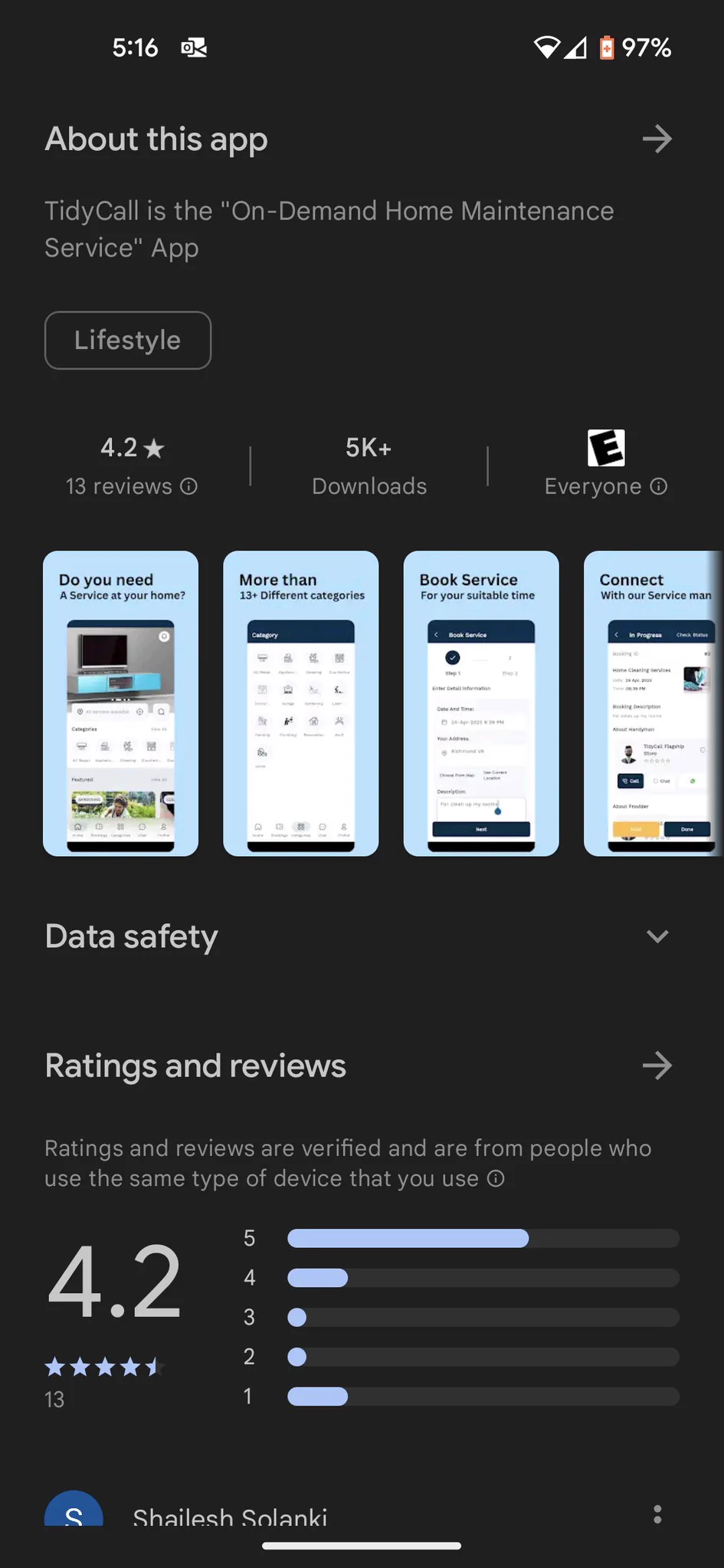

On-Demand Home Maintenance Services via Innovative TidyCall™ Mobile App.

Goal to Become a Major Player in the Hundred-Billion-Dollar Global Cleaning Service Industry.

Launched Wechax.com Revolutionizing Freelancer Services and Catalyzing Revenue Growth.

Wechax.com Platform Creates an Unparalleled Ecosystem Where Skilled Freelancers and Service Seekers Converge.

Two Industry Seasoned Executives Appointed to Propel Company Growth.

https://einpresswire.com/article/651463807/company-enters-billion-dollar-global-cleaning-freelancer-service-industries-wechax-com-tidycall-stock-symbol-cbgh

In a pivotal announcement towards the conclusion of the press conference, Willie Hsu, CEO & President of CBGH/TidyCall, disclosed an ambitious strategic plan to establish an office in Vancouver, thereby expanding TidyCall's footprint in Western Canada. He also articulated the company's intent to enhance its leadership team by recruiting a Chief Operating Officer and Chief Financial Officer, underscoring his confidence in TidyCall's strategic vision.

$CBGH

"We warmly welcome Andy Kuo and Jeffrey Pai to the TidyCall family and are thrilled to appoint candidates of their caliber to our executive team," said Willie Hsu, CEO of $CBGH/TidyCall. "As TidyCall continues its growth, we eagerly anticipate harnessing Andy Kuo and Jeffrey Pai's vast experience and network to capture demand and expand our market presence."

With the addition of these seasoned executives, TidyCall is poised to strengthen its position in the home maintenance industry and deliver enhanced services to its valued customers.

$CBGH Wechax.com emerges as a dynamic platform bridging the gap between freelancers and service recipients. Initially catering to the greater Toronto area and soon expanding to Vancouver, followed by other Canadian cities and eventually throughout North America, this platform creates an unparalleled ecosystem where skilled freelancers and service seekers converge.

The company website: https://www.wechax.com/ provides two options for its user base...

*Our Mission & Promise

Finding professionals is easy with Wechax. Search our website to instantly connect with professionals.

*List Your Business - Today!

For professionals, Wechax works as a powerful tool for attracting more clients.

$CBGH

$CBGH High Profile Press Conference Held to Showcase Launch of Groundbreaking Freelancer Hiring Platform for The Global Household Service Industry; Serving the Sharing Economy Similar to @DoorDash and @Uber Stock Symbol: CBGH $CBGH http://WECHAX.COM

https://www.icontact-archive.com/archive?c=1509905&f=9622&s=9871&m=224918&t=af975177fe956d61556fde3aa910d6888d88ee79172042f2c41a64eb9ef97563

$CBGH/TidyCall has a new vision to unleash the revolutionary potential of its TidyCall™ APP3.0 to expand its business scope from Cleaning Service to the full spectrum of Home Services. With the enhanced TidyCall™ App3.0, the company will provide customers with a one-stop solution for all their home-related needs, including home cleaning, roof repair, household appliance repair and installation, plumbing repair, garage door repair, electrician services, and small-scale renovations.

$CBGH Revenue Growth - Two Industry Seasoned Executives Appointed to Propel Company Growth

$CBGH covering all the advantages and market growth potential of this company which provides new and better ways to get a range of very necessary home maintenance services.

https://einpresswire.com/article/651463807/company-enters-billion-dollar-global-cleaning-freelancer-service-industries-wechax-com-tidycall-stock-symbol-cbgh

From the article:

This Company can become a Major Player in the Billion-Dollar Global Cleaning & Freelancer Services Industries: Wechax.com & TidyCall (Stock Symbol: CBGH)

On-Demand Home Maintenance Services via Innovative TidyCall™ Mobile App.

Goal to Become a Major Player in the Hundred-Billion-Dollar Global Cleaning Service Industry.

Launched Wechax.com Revolutionizing Freelancer Services and Catalyzing Revenue Growth.

Wechax.com Platform Creates an Unparalleled Ecosystem Where Skilled Freelancers and Service Seekers Converge.

Two Industry Seasoned Executives Appointed to Propel Company Growth.

https://www.wechax.com/ allows users to browse the directory to find freelancers, view profiles, and compare freelancers you find.

$CBHG

Wechax.com emerges as a dynamic platform bridging the gap between freelancers and service recipients. Initially catering to the greater Toronto area and soon expanding to Vancouver, followed by other Canadian cities and eventually throughout North America, this platform creates an unparalleled ecosystem where skilled freelancers and service seekers converge. $CBGH

Hopefully the company can turn this positive experience during the conference into business opportunities.

During the press conference, Mr. Willie Hsu delivered an exhaustive presentation elucidating the features and advantages of TidyCall App 3.0 and WeChax.com. He methodically walked through the app's usage, ensuring attendees had a clear understanding. Moreover, two representatives from the service provider and client (user) communities shared their enriching experiences and the tangible benefits they derived from utilizing the platform, piquing the interest of potential service providers and clients.

$CBHG

Unreal close yesterday... going to get some funds together here.

$CBGH

$CBGH .03's up now. HOD .036 Low Float Moves quickly.

It's trading 40% over its 10-day average volume as we get closer to lunchtime... Nice accumulation again today.

$CBGH

Your a jackass. $108.00 in buying. Stop pumping.

Nice volume today, someone is accumulating shares quietly.

$CBGH

Looking forward to seeing how this will benefit the company...

The press conference was keenly anticipated within the Chinese community, as it drew participation from over ten influential Chinese-language media outlets. Subsequently, these media sources extensively covered the event, creating a profound impact within the Chinese community in Ontario, Canada.

$CBGH

Looks like we'll see further updates as things progress...

In a pivotal announcement towards the conclusion of the press conference, Willie Hsu, CEO & President of $CBGH/TidyCall, disclosed an ambitious strategic plan to establish an office in Vancouver, thereby expanding TidyCall's footprint in Western Canada. He also articulated the company's intent to enhance its leadership team by recruiting a Chief Operating Officer and Chief Financial Officer, underscoring his confidence in TidyCall's strategic vision.

#BreakingNews: $CBGH 's TidyCall Inc. Successfully Launches Press Conference, Captivating Ontario's Thriving Chinese Community https://finance.yahoo.com/news/cbghs-tidycall-inc-successfully-launches-140000218.html?soc_src=social-sh&soc_trk=tw&tsrc=twtr

News Out! $CBGH's TidyCall Inc. Successfully Launches Press Conference, Captivating Ontario's Thriving Chinese Community https://finance.yahoo.com/news/cbghs-tidycall-inc-successfully-launches-140000218.html?soc_src=social-sh&soc_trk=tw&tsrc=twtr via @YahooFinance

$CBGH thin to .04's!

$CBGH Wechax.com & TidyCall -Global Cleaning https://www.einpresswire.com/article/651463807/company-enters-billion-dollar-global-cleaning-freelancer-service-industries-wechax-com-tidycall-stock-symbol-cbgh

Wechax.com transcends being a mere platform; it embodies our dedication to innovation. It seamlessly aligns with TidyCall's vision of revolutionizing service delivery.”— Willie Hsu, CEO & President of $CBGH

Wechax.com emerges as a dynamic platform bridging the gap between freelancers and service recipients. Initially catering to the greater Toronto area and soon expanding to Vancouver, followed by other Canadian cities and eventually throughout North America, this platform creates an unparalleled ecosystem where skilled freelancers and service seekers converge.

$CBGH

$CBGH +17.61% Today - Revenue Growth as Two Industry Seasoned Executives Appointed to Propel Company Growth

CBGH covering all the advantages and market growth potential of this company which provides new and better ways to get a range of very necessary home maintenance services.

https://einpresswire.com/article/651463807/company-enters-billion-dollar-global-cleaning-freelancer-service-industries-wechax-com-tidycall-stock-symbol-cbgh

It's trading nearly 65% of its 10-day average volume as lunchtime approaches... UP 18% and at the high of the day.

$CBGH

$CBGH big news here: Rising star company CBGH Unveils Wechax.com: Revolutionizing Freelancer Services and Catalyzing Revenue Growth https://finance.yahoo.com/news/cbgh-unveils-wechax-com-revolutionizing-140000601.html?soc_src=social-sh&soc_trk=tw&tsrc=twtr via @YahooFinance

The fusion of Wechax.com with TidyCall App results in a harmonious partnership. As TidyCall App continues to redefine on-demand home maintenance services, seamless access to Wechax.com's freelancer talent pool ensures a steady stream of proficient professionals spanning diverse domains - from cleaning and electrical work to home appliance repair and plumbing. Wechax.com synergistically complements TidyCall's holistic approach, offering a unified platform catering comprehensively to all home improvement needs. A pivotal goal is to transform 60% of registered Wechax freelancers into active service providers on the TidyCall App.

$CBGH

Wechax.com emerges as a dynamic platform bridging the gap between freelancers and service recipients. Initially catering to the greater Toronto area and soon expanding to Vancouver, followed by other Canadian cities and eventually throughout North America, this platform creates an unparalleled ecosystem where skilled freelancers and service seekers converge. $CBGH

It's a HUGE market for Canada... Approximately 20% of the entire Canadian population.

$CBGH

It'll be interesting to see how Wechax.com generates revenue in the short term.

*Launched Wechax.com Revolutionizing Freelancer Services and Catalyzing Revenue Growth.

*Wechax.com Platform Creates an Unparalleled Ecosystem Where Skilled Freelancers and Service Seekers Converge.

$CBGH

$CBGH @TidycallApp TidyCall Inc., a wholly owned subsidiary of CBGH, is a prominent Canadian company headquartered in Markham, situated in the Greater Toronto Area (GTA). https://tidycall.com/#/

$CBGH Launched Wechax.com Revolutionizing Freelancer Services and Catalyzing Revenue Growth. https://www.einpresswire.com/article/651463807/company-enters-billion-dollar-global-cleaning-freelancer-service-industries-wechax-com-tidycall-stock-symbol-cbgh

Better Link: to comprehensive feature on CBGH covering the company's approach to new and better ways to get a range of very necessary home maintenance services. With the rising demands on employer time, this is a very much needed business today:

https://einpresswire.com/article/651463807/company-enters-billion-dollar-global-cleaning-freelancer-service-industries-wechax-com-tidycall-stock-symbol-cbgh

From the article:

This Company can become a Major Player in the Billion-Dollar Global Cleaning & Freelancer Services Industries: Wechax.com & TidyCall (Stock Symbol: CBGH)

On-Demand Home Maintenance Services via Innovative TidyCall™ Mobile App.

Goal to Become a Major Player in the Hundred-Billion-Dollar Global Cleaning Service Industry.

Launched Wechax.com Revolutionizing Freelancer Services and Catalyzing Revenue Growth.

Wechax.com Platform Creates an Unparalleled Ecosystem Where Skilled Freelancers and Service Seekers Converge.

Two Industry Seasoned Executives Appointed to Propel Company Growth.

If we can get some revenue projections it would help investors understand the full potential here.

$CBGH

Thank you for sharing that insight on the chart...

"Wechax.com opens new avenues for revenue but also marks a transformative leap in the freelancer services landscape."

$CBGH

$CBGH Revenue Growth https://finance.yahoo.com/news/cbgh-unveils-wechax-com-revolutionizing-140000601.html?soc_src=social-sh&soc_trk=tw&tsrc=twtr via @YahooFinance

Very good feature on CBGH covering all the advantages and market growth potential of this company which provides new and better ways to get a range of very necessary home maintenance services.

ttps://einpresswire.com/article/651463807/company-enters-billion-dollar-global-cleaning-freelancer-service-industries-wechax-com-tidycall-stock-symbol-cbgh

From the article:

This Company can become a Major Player in the Billion-Dollar Global Cleaning & Freelancer Services Industries: Wechax.com & TidyCall (Stock Symbol: CBGH)

On-Demand Home Maintenance Services via Innovative TidyCall™ Mobile App.

Goal to Become a Major Player in the Hundred-Billion-Dollar Global Cleaning Service Industry.

Launched Wechax.com Revolutionizing Freelancer Services and Catalyzing Revenue Growth.

Wechax.com Platform Creates an Unparalleled Ecosystem Where Skilled Freelancers and Service Seekers Converge.

Two Industry Seasoned Executives Appointed to Propel Company Growth.

It shows a really nice cup and handle pattern and now the handle keeps in 5 weeks. Usually the handle will take 4-6 weeks then coming with the real break out imo!!! Just wait the price goes up over last high 0.0519, could be very soon!

Looking good UP 3% but could use an update on revenue projections for memberships as well as any other monetized options.

Empowering Freelancers: Flexible Membership Choices

Wechax.com empowers freelancers through a spectrum of membership options. From the entry-level General Membership, granting access to the bustling platform, to the competitively priced Premier Membership at $9.95 per month or $99 per year, freelancers tailor their engagement for maximum visibility and perks.

$CBGH

$CBGH /TidyCall has a new vision to unleash the revolutionary potential of its TidyCall™ APP3.0 to expand its business scope from Cleaning Service to the full spectrum of Home Services. https://einpresswire.com/article/651463807/company-enters-billion-dollar-global-cleaning-freelancer-service-industries-wechax-com-tidycall-stock-symbol-cbgh

The fusion of Wechax.com with TidyCall App results in a harmonious partnership. As TidyCall App continues to redefine on-demand home maintenance services, seamless access to Wechax.com's freelancer talent pool ensures a steady stream of proficient professionals spanning diverse domains - from cleaning and electrical work to home appliance repair and plumbing. Wechax.com synergistically complements TidyCall's holistic approach, offering a unified platform catering comprehensively to all home improvement needs. A pivotal goal is to transform 60% of registered Wechax freelancers into active service providers on the TidyCall App.

$CBGH

$CBGH provides mobile-device users on-demand services (residential & commercial) information and access through its proprietary TidyCall™ App. There are two versions of the CBGH/TidyCall™ App available for download: TidyCall User™- for consumers who use commercial Cleaning Services (CSUs), and TidyCall Provider - for approved Cleaning Service Providers (CSPs). Individuals interested in becoming a TidyCall CSP can now apply at https://TidyCall.com.

$CBGH looking good here, thin to .05+!

|

Followers

|

83

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

15667

|

|

Created

|

02/06/09

|

Type

|

Free

|

| Moderators | |||

DISCLAIMER:

Nothing in the contents transmitted on this board should be construed as an investment advisory, nor should it be used to make investment decisions.

There is no express or implied solicitation to buy or sell securities.

The author(s) may have positions in the stocks or financial relationships with the company or companies discussed and may trade in the stocks mentioned.

Readers are advised to conduct their own due diligence prior to considering buying or selling any stock. All information should be considered for information purposes only.

No stock exchange has approved or disapproved of the information here.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |