Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$WTIC $Oil - 'Hammer' on the Red Ledge. Will it reverse? Hopefully. We'll see...

By: Sahara | March 14, 2025

• $WTIC $Oil - 'Hammer' on the Red Ledge.

Will it reverse? Hopefully. We'll see...

Read Full Story »»»

DiscoverGold

DiscoverGold

The Energy Report. Give Peace A Chance

By: Phil Flynn | March 14, 2025

Democratic war mongers continue to be dismayed at President Trump’s ceasefire initiatives between Russia and Ukraine. I guess they believe that the only good Russian is a dead one. The far left compares Vladimir Putin to Hitler but they also compare Trump to Hitler. So, for them it’s like Predator versus Alien. So the only answer they have is more funding for death and destruction and an endless quagmire because as you know it was Putin that invaded Ukraine.

While Mr, Putin is not a nice guy and I am sure he has a vision of Russia regaining its former Soviet territory and building a new Russia. The reality is that the West and Ukraine was not always on the up and up with Putin either. I guess we should all long for the simple days like when Hillary Clintion gave the Russian’s a big reset button because the mean Republicans did not think he was our friend. Or like when President Barack Obama told failed Republican Presidential Candidate Mitt Romney that the 1980’s called and want their foreign policy back.

Yet despite all the noise from the left, energy markets are starting to bet that President Trump gets his ceasefire. The big players are confident that President Trump will get his ceasefire and are already looking at cutting deals. Bloomberg reported Russian and European officials say the US is exploring ways to work with energy giant Gazprom PJSC on global projects, a step toward forging closer ties with the Kremlin while trying to broker a peace deal on Ukraine. European assessments suggest there have been preliminary contacts between US and Russian representatives on the issue, but it’s not clear who’s leading the conversations or whether the Trump administration is directly involved, according to people familiar with the matter. The White House declined to comment. Discussions between the US and Russia about possible collaboration with Gazprom are at an early stage, according to the people who asked not to be identified discussing private deliberations according to Bloomberg.

The biggest beneficiary of a potential ceasefire would be Europe. As a group they desperately need Russian energy and had they listened to President Trump years ago, it probably wouldn’t have been as acute of a situation but instead Europe decided to laugh. Europe’s not laughing anymore. Not only have they been called out by President Trump for their trade abuses, they’re now in a trade war and really are going to need Russian energy. Until they can transition to more US energy, one of the ways that Europe could help their situation when it comes to the trade war is to drop their tariffs and increase their purchases of American liquefied natural gas as well as some of that beautiful light sweet shale oil.

The trade war caused significant disruption in energy markets yesterday leading to a sell-off. However, with market stabilization and oil showing positive movement, there is optimism. With summer approaching, refiners will need to ramp up production to replenish gasoline supplies quickly.

Despite the concerns of tariffs on China, we are seeing a lot of US energy continued to go to Asia. The Energy Information Administration reported that U.S. propane exports averaged a record 1.8 million barrels per day (b/d) in 2024, the most since we began collecting this data in 1973. U.S. propane exports increased for each of the last 17 years, with growth driven by higher demand in East Asia, mainly China, and a widening propane price differential between U.S. and global benchmarks. Propane is consumed globally in the residential and commercial sectors for uses such as space heating. It’s also used as a petrochemical feedstock to produce propylene and ethylene, key feedstocks in plastic production.”

Record U.S. propane production has supported the rise in propane exports. Propane production, which is a byproduct of natural gas processing and crude oil refining, has increased rapidly over the past 10 years as U.S. natural gas output has grown. Higher propane production has led to lower U.S. propane prices relative to Asia, underpinning the record export levels.

Infrastructure investments have also played a crucial role in accommodating growing shipments. Expansion projects at U.S. propane export terminals that started up in 2019 and in 2023 have allowed U.S. exports to increase by more than 700,000 b/d. U.S. propane exports surpassed 2 million b/d in November 2024 for the first time, as petrochemical and space heating demand in Asia increased.

Natural gas supply has been affected by weather. Make sure you download the Fox Weather app. Yesterday, we tested $400 and bounced, making $400 the support line. Looking ahead, supply may create a potential long-term bottom across the curve. The EIA reported that working gas in storage was 1,698 Bcf as of March 7, 2025, decreasing by 62 Bcf from the previous week. Stocks were 628 Bcf less than last year and 230 Bcf below the five-year average of 1,928 Bcf. At 1,698 Bcf, total working gas is within the five-year historical range.

The FOX Forecast Center said that multiple days of potent thunderstorms could bring destructive winds, large hail, and significant long-tracked tornado activity (EF-3 or higher). The main action on Friday will come in the form of a powerful squall line of storms which is expected to develop during the afternoon across Missouri and Iowa and charge east through the Mississippi Valley, the FOX Forecast Center said.

Read Full Story »»»

DiscoverGold

DiscoverGold

Crude Oil Struggles at Key Support, Reversal Pattern Emerges

By: Bruce Powers | March 13, 2025

• Crude oil remains under pressure, consolidating near $65.50 support. A potential double bottom hints at a bullish breakout, but resistance near $69.26 may challenge upward momentum.

Downward pressure on the price of crude oil remained on Thursday. It is set to end lower for the day following an attempt earlier in the trading session to break out above Wednesday’s high. The low for the current decline was $65.50, which was $15.36 or 19% below the most recent swing high at $80.76. Since finding support crude has been consolidating above $65.50 for the past six days. The consolidation pattern has taken the form of a potentially bullish double bottom reversal pattern.

An upside breakout of the pattern will be signaled on a rise above the neckline of the pattern at $68.37. At the time of this writing crude continues to trade near the lows of the day, which was $66.45. And it could go lower before the end of the day. The high for the day was $68.03.

Long-Term Support Being Tested

Recent support around $65.50 has some significance as it is near support from September of last year at $65.65, prior to the current decline, was the low price for crude oil since May of 2023. Following the 2023 low traded price, crude oil rallied to a peak of $95.50 before progressing lower and establishing a slow downtrend of lower swing highs and lower swing lows. Therefore, the drop to $65.50 recently established a slightly new low for the bear trend.

There are reasons to believe that support may be retained at that low and lead to at least a bounce before being challenged again. For one, the bearish correction from the $80.76 mid-January high was the deepest bearish correction of the prior four larger corrections, but not by much. There was an 18.3% decline from an August swing high, which was the largest decline of the four.

Rally Above 20-Day MA Would Show Strength

Although a bullish signal will be generated on a breakout of the double bottom, a potentially significant resistance zone is slightly higher from around $68.74 to $68.82. However, the 20-Day MA trend indicator, currently at $69.26, marks a more significant price area, along with a downtrend line. Since it is falling the 20-Day line may be within the price zone by the time it is approached. Subsequently, a lower swing high is at $70.81.

Read Full Story »»»

DiscoverGold

DiscoverGold

Natural Gas Declines Below Trendline, Eyes Deeper Correction

By: Bruce Powers | March 13, 2025

• Natural gas struggles after breaking trend support, facing resistance at $4.13. Further declines may target the 50-Day MA at $3.83.

Natural gas continued to pull back from recent highs on Thursday, triggering a drop below a rising trendline. That followed a decline below trend support around the 20-Day MA (purple) on Wednesday. The breakdown was confirmed by a daily close below the 20-Day line. Nonetheless, support was seen today at $3.97, thereby completing a 50% retracement.

An intraday rally followed that low to establish a high for the day at $4.20. If natural gas closes the day below the 20-Day line, now at $4.13, it will represent a test of resistance around the 20-Day line, which was support previously. Therefore, the bearish correction may continue unless there is a rally above today’s high of $4.20 and a subsequent daily close above the 20-Day line.

Short Term Bull Trend at Risk

Support around the 50-Day MA was successfully tested as support during the prior bearish decline following the January swing high. Therefore, if the trend breakdown continues lower then natural gas looks to be targeting the 50-Day MA (orange), now at $3.83. A sustained decline below the 20-Day MA enhances the potential for a test of support of the next higher moving average. There is also potential support around the recent swing low at $3.74.

It is joined by the 61.8% retracement at $3.72. A decline below that low will trigger a bearish reversal of the short bull trend that began from the late-January swing low at $2.99. Notice that the 20-Day MA has stayed above the 50-Day line since the 20-Day crossed above the 50-Day in September of last year, other than for a brief period recently. The bullish crossover followed a swing low at $1.88 in late August, which began a new upswing of a larger developing bull trend.

Trend Slope Adjustment

Also, since the immediate trendline may have been broken, the next lower trendline becomes a potential target. Notice that the lower rising trendlines show an acceleration in bullish momentum as the uptrend from the February 2024 bottom progressed. The most recent trendline shows an unsustainable rate of price appreciation. Since there has been a clearly bearish reaction following another test of resistance around the top of a rising parallel trend channel, there is the possibility that the next lower trendline may be tested before the current decline is complete.

Read Full Story »»»

DiscoverGold

DiscoverGold

Commodities Daily Market Movers (% Price Change)

By: Marty Armstrong | March 13, 2025

• Top Movers

LME Cobalt Cash Composite 15.03 %

Palm Kernel Oil 4.86 %

Cheese 2.99 %

Tokyo Rubber Futures 2.45 %

NY Crude Oil Futures 2.16 %

• Bottom Movers

NY Natural Gas Futures 8.29 %

Canola Futures 2.98 %

ICE Newcastle Coal Continuous 2.93 %

Corn (CBOT) Futures 2.04 %

Coffee (NYCSCE) Futures 1.78 %

*Close from the last completed Daily

DiscoverGold

DiscoverGold

Natural Gas Challenges Trend Support at 20-Day MA

By: Bruce Powers | March 12, 2025

• Following a failed breakout, natural gas is facing pressure near $4.07, with potential for a deeper retracement toward $3.95 or lower if support breaks.

Natural gas continued its bearish pullback on Wednesday, reaching a low of $4.07 and finding support for the day at the 20-Day MA (purple). The low of the day was a six-day low and the 20-Day line is now at $4.11. A test of support at the 20-Day MA followed a bearish reversal of a one-day shooting star candlestick pattern from Monday. Trading continues to be dominated by the sellers as the price of natural gas remains near the lows of the day at the time of this writing. Therefore, a lower price may be seen before the end of Wednesday’s trading session.

Second Test of Support at 20-Day Line

Following a swing low of $2.99 from late-January, natural gas reclaimed its 20-Day MA on February 13. Shortly thereafter, the advance accelerated and subsequently encountered resistance around the top trendline of a large rising parallel trend channel. That led to a decline and an eventual higher swing low at $3.74. Support around the 20-Day MA and the 50-Day MA (orange) were successfully tested around the swing low as it was followed by a bullish key reversal day. The current decline is testing support around the 20-Day line for the first time it was tested in mid-February.

Two Lines Show Dynamic Trend Support

Initial dynamic trend support for the current bearish pullback is around the 20-Day MA and internal uptrend line. If support is maintained around those lines, then the structure of the uptrend from $2.99 remains intact. But a decisive drop below both lines will indicate the potential for a deeper retracement. But further signs of weakening would be needed to further confirm the breakdown.

There is always the possibility of a false breakdown that quickly reclaims the trend support lines. The 38.2% Fibonacci retracement level at $4.17 failed to show support on the way down today. This opens the possibility of an eventual test of support around the 50% retracement level at $3.95. Of course, the 20-Day line and trendline would be broken before then.

Strong Resistance at Top Channel Line

Resistance has been encountered around the top line of a rising channel multiple times since the December interim swing high. On Monday, a bullish breakout of the channel led to a new trend high of $4.90 and then a failure of the breakout given the quick bearish reversal and subsequent downside continuation. Therefore, it is possible that a bearish correction could test lower support levels, below the trendline, before it is done.

Read Full Story »»»

DiscoverGold

DiscoverGold

Crude Inventories Rise By 1.4 Million Barrels; WTI Oil Tests Session Highs

By: Vladimir Zernov | March 12, 2025

Key Points:

• Strategic Petroleum Reserve increased from 395.3 million barrels to 395.6 million barrels.

• Domestic oil production grew from 13.508 million bpd to 13.575 million bpd.

• Oil markets gained ground as traders reacted to the EIA report.

On March 12, 2025, EIA released its Weekly Petroleum Status Report. The report indicated that crude inventories increased by +1.4 million barrels from the previous week, compared to analyst consensus of +2 million barrels.

More information in our economic calendar.

Gasoline inventories decreased by -5.7 million barrels, while analysts expected that they would drop by -2 million barrels. Distillate fuel inventories decreased by -1.6 million barrels from the previous week.

U.S. crude oil imports declined by 343,000 bpd, averaging 5.5 million bpd. Over the past four weeks, U.S. crude oil imports averaged 5.8 million bpd.

Strategic Petroleum Reserve increased from 395.3 million barrels to 395.6 million barrels as the U.S. resumed oil purchases for strategic reserves.

Domestic oil production increased from 13.508 million bpd to 13.575 million bpd. The key question is whether rising domestic production highlights the start of the new trend, which may push domestic oil production towards the 14.0 million bpd level. In this scenario, oil markets may find themselves under more pressure.

WTI oil moved higher as traders reacted to the EIA report. Traders focused on falling gasoline inventories and ignored rising domestic oil production. Currently, WTI oil is trying to settle above the $67.50 level.

Brent oil moved above the $70.50 level after the release of the EIA report.

Read Full Story »»»

DiscoverGold

DiscoverGold

Ceasefire Hopes Trump All. The Energy Report

By: Phil Flynn | March 12, 2025

While the market freaks out about the Trump Trade wars, hope for a Trump ceasefire and a pause in the killing in the Russia Ukraine quagmire raises hopes for peace and lower oil prices. After a wildly volatile session in stocks, reports that Ukraine agreed to a ceasefire overshadowed the trade war fears. Reuters reported that Ukraine said it is ready to accept a U.S. proposal for a 30-day ceasefire in its conflict with Russia, following hours of talks with U.S. officials in Saudi Arabia. Reports say that the U.S. will now take the offer to Russia.

President Trump said he hoped for a swift ceasefire and thought he would talk to Putin this week. “I hope it’ll be over the next few days.” “The ball is today clearly in the Russian camp,” said French President Emmanuel Macron. Russia’s foreign ministry said it did not rule out contacts with U.S. representatives over the next few days. How Moscow would respond was far from certain. Russian President Vladimir Putin has said he is open to discussing a peace deal. But he has ruled out territorial concessions and said Ukraine must withdraw fully from four Ukrainian regions claimed and partly controlled by Russia. The U.S. also agreed to resume military aid and intelligence sharing with Ukraine.

While Ukraine realizes it’s to their advantage to go along with President Trump’s desire for a ceasefire, Iran is still being obstinate. Reuters reported that, “Iran’s President Masoud Pezeshkian said Iran would not negotiate with the U.S. while being threatened, telling President Donald Trump to “do whatever the hell you want”, Iranian state media reported on Tuesday. “It is unacceptable for us that they (the U.S.) give orders and make threats. I won’t even negotiate with you. Do whatever the hell you want”, state media quoted Pezeshkian as saying.

Iran’s Supreme Leader Ayatollah Ali Khamenei said on Saturday that Tehran would not be bullied into negotiations, a day after Trump said he had sent a letter urging Iran to engage in talks on a new nuclear deal.

That will increase the odds that the US and Israel are headed towards a potential conflict and the possibility that oil tankers with Russian oil will be stopped and seized by the United States. It also means the Houthi rebels have new life and now they are saying that they’re going to resume causing havoc in international shipping lanes. Al Jazeera reported that Yemen’s Houthis have announced that they will resume attacks on Israeli ships after their deadline for Israel to allow the resumption of aid deliveries into Gaza passed. The armed group said late on Tuesday that it was “resuming the ban on the passage of all Israeli ships” in the Red Sea because Israel failed to honor the deadline the Houthis announced on Friday. Yemen’s Houthis said they will block ships passing through the Red Sea, the Arabian Sea, and the Bab al-Mandab Strait.

The Iranian regime is the biggest supporter of the Houthi rebels so they may have a bit harder time getting cash and equipment.

Against this backdrop we got the Short-Term Energy Outlook from the EIA that showed that global oil demand was higher than previously predicted and exceeded global supply. A weekly report from the American Petroleum Institute reported a big seasonal drop in gasoline supply that is showing they are getting rid of the winer blends ahead of ramping up for those beautiful and expensive summer blends.

Let’s start with the EIA. The EIA admitted that they missed on their projection of supply and demand and reported that it underestimated demand and overestimated supply. The IEA said the global oil demand came in at 105.17 million barrels a day while global supply came in at 103.92 million barrels a day in February. The EIA said that, “Global oil markets will remain relatively tight through the middle of 2025 before gradually shifting to oil inventory builds later this year. We expect global oil inventories will fall in the second quarter of 2025 (2Q25) in part due to decreasing crude oil production in Iran and Venezuela. As a result, the Brent crude oil spot price in our forecast rises from about $70 per barrel (b) to $75/b by 3Q25. However, we expect oil inventories will build and place downward pressure on crude oil prices in late-2025 and through 2026 when we expect OPEC+ unwinds production cuts and non-OPEC oil production grows. As a result, we forecast the Brent crude oil price will fall to an average of $68/b in 2026.

The API reported a 4.247 increase in crude oil supplies as refiners are running at low rates. They are in maintenance to switch over to the summertime blends of gasoline so out with the old and in with the new. The out with the old means that we got a 4.56 million barrel drop in gasoline inventories. We should get some support from the fact that Cushing, OK oil inventories fell by 1.196 million barrels and distillate inventories were slightly higher up 421,000 but are still well below the average range for this year because of a much colder than expected winter.

What this report also suggests is that the bottom in oil should be close and that soon refiners will have to ramp up their production of gasoline. And generally that happens towards the end of March into April and that’s when we should see prices start to increase.

A lot of focus will be on China demand as they ramp up commodity purchases. JODI reported today that China’s crude oil imports fell by 542 kb/d in December while total product imports were up by 96 kb/d m/m.

Obviously, the concerns about tariffs are keeping the reporting agencies on edge. We know that the Trump administration wants to continue to pressure oil prices lower. Some members of the oil industry are hesitant about President Trump’s advocacy for increased drilling, partly due to the impacts of Strategic Petroleum Reserve releases that broke the market. Scott Sheffield from Pioneer Resources mentioned that much of the prime shale acreage has already been drilled. MSN Reported that Scott Sheffield, the former CEO of Pioneer Natural Resources, the shale company thought to have (had) the deepest inventory depth: “one of the main reasons that Pioneer sold was…we were running out of Tier 1 inventory. Everybody is running out of Tier 1 inventory. People don’t talk about the fact that we are running out of inventory.” The twilight of US shale is upon us.

The EIA also had an interesting take on natural gas as a cold winter changes the nature of the market. The EIA reported on natural gas consumption and inventories. Cold weather during January and February led to more consumption of natural gas and large withdrawals of natural gas from inventories. We now expect natural gas inventories to fall below 1.7 trillion cubic feet at the end of March, which is 10% below the previous five-year average and 6% less natural gas in storage than we had expected last month. We also increased our forecast for overall electricity generation over the next two years. As a result, we now expect the electric power sector will use more than 36 billion cubic feet per day of natural gas on average in 2025 and 2026, 2% and 1% more, respectively, than last month. Overall, we expect natural gas in storage to be 4% lower in 2025 and 3% lower in 2026 compared with what we had forecasted last month.

Natural gas prices. Because we now expect more consumption of natural gas in 2025 and 2026 and less natural gas in storge, we have raised our forecast Henry Hub spot price. We expect the Henry Hub price will average around $4.20 per million British thermal units (MMBtu) in 2025, 11% more than last month’s forecast. We expect the annual average price in 2026 will be near $4.50/MMBtu, up 8% from last month.

It also shows you that in the natural gas market, despite what you think you might know about the fundamentals, weather has the final say and that’s why you have to download the Fox Weather app. The FOX Forecast Center is continuing to monitor the potential for a multiday severe weather outbreak that could blast cities across the central and eastern U.S. with thunderstorms capable of producing large hail, damaging winds and even some tornadoes. Forecasters have been keeping their eyes on computer forecast models and now say the threat of severe weather will continue through the weekend, placing tens of millions of people living along the East Coast on alerts for powerful thunderstorms by Sunday. The FOX Forecast Center said it is most concerned about what could potentially take place starting Friday, but severe weather is also possible on Wednesday and Thursday.

Read Full Story »»»

DiscoverGold

DiscoverGold

Crude Oil Struggles Near Lows, Bearish Momentum Persists

By: Bruce Powers | March 11, 2025

• Downward pressure persists as crude oil struggles near multi-year lows, with support at $65.40 critical for determining the next move.

Downward pressure in the price of crude oil remained on Tuesday as last week’s low of $65.40 was again tested as support. That was also the low for a downswing that completed a $15.36 or 19% decline from the January peak of $80.76. The price of crude hit a low of $65.41 on Tuesday and established a lower daily low and lower daily high. At the time of this writing, it looks likely that it will close neutral but leaning towards bearish, near the middle of the day’s trading range.

Lowest Price Since May 2023

Last week’s low was the lowest traded price for crude oil since a spike in volatility was seen during the first week in May 2023. It indicated the potential for a continuation of the downtrend that began from the September 2023 highs. Also, it marks a potentially significant support zone, particularly since crude has already fallen significantly in the current bearish correction.

What is the chance that new lows will see enough selling pressure to keep the price of crude falling? Certainly, it is less than it might be if crude was falling through long-term support from a closer beginning point, such as a bearish continuation pattern for example. Nonetheless, a decisive decline below $65.40 could see a drop to test support around the May 2023 lows.

Strength Indicated Above $67.27

On the upside, there are no signs of a potential bullish reversal until Tuesday’s high of $67.27 is exceeded. If that price level triggers, crude could test an interim swing high of $68.38. That swing high is part of the downtrend price structure. If it is reclaimed, then crude will show signs of improving demand and it will trigger a bullish reversal as a prior swing low will have been exceeded.

Depending on when it happens, a double bottom breakout may also trigger. The convergence of several lines around $70.23 will then define the next higher potential resistance zone. That zone includes a downtrend line, a rising trendline across support starting from September of last year, and a horizontal level from an interim swing low from late-December.

Key Resistance at 20-Day MA

However, the 20-Day MA, at $69.80 currently, defines the more significant potential resistance area. Keep in mind that since the 20-Day line is falling. Therefore, it may reach the price zone mentioned above prior to or when natural gas reaches the zone.

Read Full Story »»»

DiscoverGold

DiscoverGold

Natural Gas Faces Bearish Pullback After False Breakout

By: Bruce Powers | March 11, 2025

• A shooting star candlestick signals potential weakness in natural gas, but key support levels could define whether a deeper pullback or recovery follows.

Following a false bull breakout on Monday, natural gas triggered a breakdown from a potentially bearish one-day shooting star candlestick pattern on Tuesday, but momentum subsequently died. At the time of this writing, it is set to complete a relatively narrow range day from $4.38 to $4.59.

A drop below Monday’s low of $4.45 triggered the shooting star pattern, yet the decline found support relatively close by at $4.38. Where the day ends should provide clues. A daily close below $4.45 would confirm a breakdown from the bearish candle, while a closing price above that level shows less selling pressure than might be expected.

Signs of Bearish Continuation

Tuesday’s price action established a lower daily high and lower daily low. It is important to notice the day’s high as it shows a successful test of resistance at the nearby trend line. In other words, natural gas found resistance at the trendline, which was support during Monday’s sharp rally above the line. This can more easily be seen in an intraday chart (not shown).

It indicates that the market has recognized the price area around the line as it has done more than a few times since late December. This is short-term bearish behavior that points to a likely deeper decline. The trendline is the top parallel trend channel line for a large channel where the bottom trendline connects to an August 2024 swing low.

Potential for a Test of Trend Support at $4.08

A drop below today’s low of $4.38 will signal a continuation of the bearish pullback. The current advance, beginning from the $2.99 swing low from January 31, shows potential trend support around the 20-Day MA at $4.08 and an internal uptrend line. More significant potential support is around the 50-Day MA, now at $3.81. Moreover, the recent interim swing low at $3.74 is significant in that it partly defines the price structure of the uptrend.

Short-term Bullish Above $4.59

Nonetheless, natural gas remains in a developing uptrend formation in the near term and should recover once it has completed a deeper pullback, if that is what is to come. If the price exceeds Tuesday’s high of $4.59, it is advisable to consider the upper trendline as a resistance level. Otherwise, a daily close above the line could lead to prices rising instead of a pullback.

Read Full Story »»»

DiscoverGold

DiscoverGold

In crude oil, the commercials have been net short to varying degrees since 2009...

By: Tom McClellan | March 10, 2025

• In the COT Report, "commercial" traders are ones who produce or use the subject commodity in their trade or business. In crude oil, the commercials have been net short to varying degrees since 2009. Right now they are at a very small net short position, a bottoming sign.

Read Full Story »»»

DiscoverGold

DiscoverGold

Oil Stood Strong. The Energy Report

By: Phil Flynn | March 11, 2025

While the stock market sold off on fear over reality, oil stood strong with only modest risk-off selling. Perhaps it was the fact that the bulls have abandoned the long side, with a bullish position near a 14-year low! Perhaps they are running out of people to sell, Mortimer. Or maybe it was their realization that despite the expected increase in oil production from OPEC, it’s not going to be enough barrels to significantly move the needle on global inventories. In fact, the market is starting to look so tight as you look out further than even the International Energy Agency, who I’ve criticized for decades because they became the green energy agency, is calling for increasing the production of fossil fuels.

Reuters reported that, “Fatih Birol, the director of the Paris-based International Energy Agency, said on Monday there is a need for investment in oil and gas fields to support global energy security. The comment puts the energy watchdog for industrialized nations more in line with President Donald Trump’s pro-drilling agenda, after it came under pressure from fossil fuel advocates years ago for proposing an end to new oil and gas projects.” Either that or the IEA got hit with a dose of reality after their disastrous calls to end all investment in fossil fuels.

As the stock market freaked out on recession fears, the oil market was suggesting that a recession is not in the cards. In fact, the fears were so evident that they saw an accumulation of a record amount of put option positions and that suggests that when you see something like that, the crowd is almost always wrong. Tariff concerns may be alleviated because US Energy Secretary Chris Wright and suggesting that oil and gas may be exempted from tariffs. Bloomberg is suggesting that concern about President Donald Trump’s threats to impose tariffs on US imports of Canadian oil is waning as the duties’ start date keeps getting pushed back, strengthening local crude prices.

Secretary Wright also suggested that he would cancel all mandated oil sales from the Strategic Petroleum Reserve which means that they are serious about refilling the reserve and should be a put for the price of oil and make it unlikely that we will fall below $60.00 in the short term.

And because of Biden’s manipulation of the market with releases from the strategic petroleum reserve, they disrupted the market in such a way that oil and gas producers according to Reuters are unlikely to increase spending this year and output increases will primarily come from improved efficiencies rather than new drilling citing Baker Hughes Chief Executive Lorenzo Simonelli.

On top of that the way the market held up as we started heading into the end of shoulder season should suggest that we should see some strong markets over the next few weeks. Just remember as we head into the Easter holiday we traditionally get a rally and the market looks primed. If the shorts decide to throw in the towel, we could see a pretty big spike and maybe back to the mid-70s.

Traders will also get a look at the Energy Information Administration “Short Term Energy Outlook” today. It’s going to be interesting to see if they call for more investment in fossil fuels. It’ll also be interesting to see if they have any take on the potential tariffs that could ensue the surrounding energy.

Fears of a government shutdown have also eased. Reuters reported, the Republican-controlled U.S. House of Representatives set up a Tuesday vote on legislation that would keep the government funded and avert a partial shutdown, as Washington is rocked by President Donald Trump’s rapid moves to slash federal agencies. The House Rules Committee advanced the bill on Monday evening to the full chamber, clearing the way for what will likely be a close vote on Tuesday to extend government funding past midnight Friday, when it is due to expire.

Natural gas has calmed down but to make no mistake about it the charts are still pointing out higher natural gas prices. This shift from the perpetual bear market seems to have turned as the outlook for demand for natural gas looks so much stronger down the curve. Increased liquefied natural gas exports as well as increased domestic demand should mean for producers that their long, bearish nightmare is over.

Obviously, weather is going to be key for natural gas as we get into summer predictions of the hot summer after a cold winter is keeping the bears at Bay. In fact Fox Weather is keeping a close eye on these developments. The FOX Forecast Center is continuing to monitor the potential for a multiday severe weather outbreak that could blast cities across the central and eastern U.S. with thunderstorms capable of producing large hail, damaging winds and even some tornadoes. Forecasters have been keeping their eyes on computer forecast models and now say the threat of severe weather will continue through the weekend, placing tens of millions of people living along the East Coast on alert for powerful thunderstorms by Sunday. The FOX Forecast Center said it is most concerned about what could potentially take place starting Friday, but severe weather is also possible on Wednesday and Thursday.

Read Full Story »»»

DiscoverGold

DiscoverGold

Natural Gas Breaks Out, but Bearish Reversal Threatens Rally

By: Bruce Powers | March 10, 2025

• Natural gas spiked to $4.90 but reversed sharply, threatening a failed breakout as price action weakens and a bearish candlestick pattern signals potential downside risk.

Natural gas spiked a new trend high of $4.90 on Monday before encountering resistance that led to a sharp intraday sell-off. The advance led to a bullish breakout above the top trendline of a rising parallel channel set after the August 2024 low. However, subsequent intraday weakness warns of a possible failed breakout.

At the time of this writing, natural gas is trading back below the top trendline and in the lower quarter of the day’s trading range, which was $4.45 to $4.90. If it ends the day in a similar position, a bearish shooting star candlestick will be formed.

Bearish Candlestick Pattern Triggers Below $4.45

Although the candlestick pattern shows sellers in charge near the end of the trading session, the pattern doesn’t trigger until there is a drop below today’s low. Nonetheless, today’s price action is short-term bearish since it follows the breakout of a long-term pattern. Rather than seeing interest increase following the breakout, the candle pattern shows demand dissipating. In other words, the bullish signal was not confirmed, and it is therefore the breakout is subject to failure.

Initial Strength Turns Bearish

The breakout showed strength initially as the 38.2% Fibonacci retracement at $4.77 of the full downtrend that began from the 2022 peak was exceeded without hesitation. Subsequently, resistance was seen just below the next higher potential resistance zone defined by a November 2018 peak at $4.93 and a 78.6% target from a rising ABCD pattern (purple) at $4.97.

The ABCD pattern looks for price symmetry or a harmonic relationship between the second leg up (CD) and the first upswing (AB). Typically, a 100% relationship identifies a potentially key pivot level. That is where the price gains between the two swings are similar. Also, Fibonacci relationships are used to provide other potential pivots. The 78.6% level deserves attention today given the bearish reaction following the day’s high.

Key Support at 20-Day MA

It looks like the spike high occurred due to an order imbalance shortly after the opening of Monday’s session, as it largely occurred within one-minute. A bearish pullback began immediately after the high was reached. This might mean that the failed breakout has less of a lagging effect than it might otherwise if demand was stronger initially. Nonetheless, key support remains the 20-Day MA, which is now at $4.04.

Read Full Story »»»

DiscoverGold

DiscoverGold

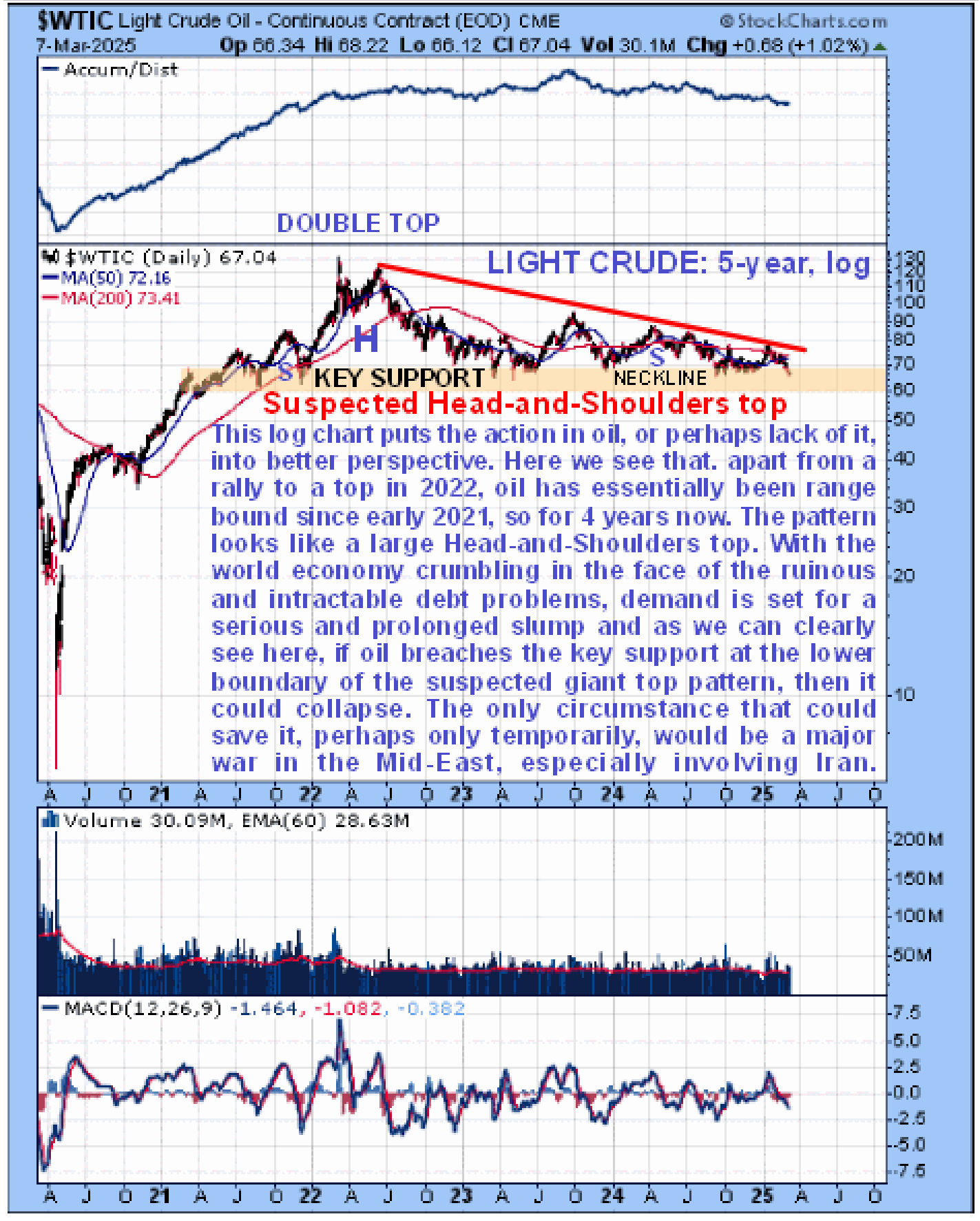

Oil Market Update - multi-year standoff looking set to end soon in a dramatic manner...

By: Clive Maund | March 10, 2025

This is the first Oil Market update for a very long time, a big reason for which is that, apart from a significant runup in 2022 that was followed by a drop of equal magnitude, oil has done little and is virtually unchanged from its price early in 2021. The reason for this update now is that it looks like the long stalemate is going to end soon with a big move that, barring a major war in the Mid-East, is expected to be to the downside.

As many of you are surely aware the world is tipping into the most serious economic depression in history which is caused by the exponentially expanding debt that has now arrived at the point of total saturation and all the continued issuance of debt will do is guarantee a hyperinflationary depression. While Trump is trying to rein it in, even with the best will in the world you can’t fix a problem that was decades in the making in the space of a month or 6 months or even several years. A hyperinflationary depression, or an economic implosion if debt issuance is choked off, means that the economy is contracting and people are getting poorer, which in turn means that there will be less demand for oil – much less. So, unless the powers that be decide they are going to attack Iran to please Israel and see what happens, the oil price looks set to break lower and crater and the charts show that this could happen soon. This was all predicted many years ago by Elliott Wave theorist Robert Prechter in his youth as the end of an epochal “Grand Supercycle”.

The Fed of course has done a stirling job of propping up the stock market up to now despite the rotten economy by creating money out of thin air in gargantuan quantities to throw at propping up the debt market but it’s gotten so extreme that they are “pushing on a piece of string” and as we have seen, the stock market has started to roll over and taking on a more definitely bearish appearance. Their largesse has not, however, extended to propping up the international oil market and oil has been in retreat since mid-January to the point that it is threatening to crash a key support level as we will now proceed to see on the charts.

Whilst we cannot understand what is going on looking solely at a 6-month chart, it’s a good point to start as it does show recent action in detail and how the price has been dropping quite steeply since the middle of January to arrive in a zone of important support towards and at the 6-month lows. It is short-term oversold at this support and so could bounce near-term although the decidedly bearish alignment of its moving averages suggests a high probability that it will then turn lower again – if it bounces at all.

Zooming out via the 4-year log chart gives us a much broader perspective. On this chart we see that, apart from a sharp runup to the $128 area early in 2022, which gains were all lost by the end of that year, oil has been range bound for 4 years now from early 2021. So what is this pattern that has formed from early 2021? – to figure that out we will now proceed to look at the 5-year chart that shows us what preceded this pattern.

On the 5-year chart we see that the pattern that has formed in recent years was preceded by a strong uptrend from the ridiculously low level in the Spring of 2020 associated with the Covid psyop and orchestrated mass psychosis involving lockdowns and masks when many deluded people were led to believe that the world was going to come to an end and for some of them who were taken in by it, it has of course. On this chart the pattern that has been forming since early 2021 looks like a giant irregular Head-and-Shoulders top with its protracted Right Shoulder being a bearish Falling Triangle.

Switching to a 5-year log chart throws the potential top pattern of recent years into sharper relief. This chart shows that the oil price has basically gone nowhere for 4 years and also makes even more clear the importance of the support level towards and at the $60 level – if this support level is breached it will be a huge psychological blow that can be expected to lead to a severe downtrend and oil could crater, especially in percentage terms.

On the very long-term chart going back to the start of the millenium, i.e. to the start of the year 2000, we can see that, should oil breach nearby support and drop, its first stop on the way down will be the support level in the $30 - $40 zone which would likely arrest the decline, although after consolidating in this area it could break to still lower levels.

Is there anything that could stop oil breaking down and instead get it moving higher? - well, there is one thing and that would be a major war in the Mid-East involving Iran. Whilst there are powerful vested interests wanting to keep the oil price elevated, it seems a bit outlandish for them to go as far as orchestrating a war with Iran partly for this purpose, although it is perhaps not as far-fetched as many might think. After all, we have many corrupt politicians in Europe wanting to put the continent on a war footing in part for the massive kickbacks that they would surely receive from the defense industry, although these could turn out to be small comfort if Europe ends up being nuked. Barring this scenario, however, oil looks like it is shaping up to drop and drop hard and perhaps soon.

Read Full Story »»»

DiscoverGold

DiscoverGold

Credit Where Credit Is Due. The Energy Report

By: Phil Flynn | March 10, 2025

Treasury Secretary Scott Bessent said no one gave him credit or the administration credit for falling oil prices or lower interest rates. What that means is that Scott Bessent has not been reading my daily Energy Report. The Phil Flynn Energy Report has indeed pointed out that the Trump Policies will lead to lower prices even as we see challenges in natural gas. Many remain in denial, ignoring that smart energy policies can benefit both the economy and American consumers and energy companies. For years there has been debate about whether presidential policies impact energy prices. The answer is clear, it is yes. Maybe not for every penny up or down in gasoline or crude but policies matter from a production standpoint, from a regulatory standpoint and from an economic growth standpoint.

Biden’s regulatory policies, including the cancellation of the Keystone Pipeline and numerous executive orders aimed at curtailing U.S. oil and gas production, influenced investment in the industry. Additionally, Biden’s use of the Strategic Petroleum Reserve had effects on U.S. energy producers and future investments needed to meet demand. The administration’s policies show that presidential actions can affect energy prices.

Now under the Trump Administration, we are seeing signs that his policies are reducing oil prices and interest rates for consumers. Despite expectations that tariff threats would lead to a surge in oil prices, they have remained subdued. Trump reduction of geopolitical risk by trying to create peace in Ukraine as well as Iran.

President Trump told Maria Bartiromo on Sunday Morning Futures that he sent a letter to Iran’s Supreme Leader Ayatollah Ali Khamenei last week asking that the two leaders “negotiate” over the Islamic republic’s nuclear program. On Saturday, the Iranian leader mentioned the effort by an unnamed “bullying governments” to make a deal over the program. Trump told Maria that, “There are two ways Iran can be handled, militarily or you make a deal,” Trump said. “I would prefer to make a deal, because I’m not looking to hurt Iran. They’re great people. I know so many Iranians from this country.”

Concurrently, natural gas prices are rising as Canada threatens to cut off supply and construct a new pipeline. This could result in a natural gas surplus due to the potential loss of their primary customer.

Regulatory changes are expected to lower long-term energy prices, saving consumers billions. Industry professionals are optimistic as the reduced regulatory burden allows them to operate safely and more effectively. They support fair and effective regulations that enables the industry to contribute to the economy.

But natural gas prices were the story last night as they gapped open higher hitting the limit up circuit breaker before cooling off. In fact natural gas prices actually hit the highest level since December 2022 in part because inventories have fallen well below average at a time where the projections of this summer’s temperatures are going to be much warmer than normal and at a time where Canada is continuing to make threats to cut off supplies.

Natural gas prices increased yesterday when former Prime Minister Jean Chrétien endorsed a natural gas pipeline from Alberta to Quebec. He stated that, “If necessary, the governments can consider going further,” by affecting the American economy “by imposing an export tax on oil, gas, potash, aluminum, and electricity.” Canada could then use the funds from the export tax to build infrastructure needed in Canada, for instance, to construct a natural gas pipeline from Alberta to Quebec. This move may require Canada to find new customers for its natural gas products. Chrétien referred to the U.S. as the most powerful country in the world built upon a rules-based order that has brought peace and prosperity.

Chrétien’s threat was inspiring. Some were disappointed there was no mention of extending the pipeline through Quebec. They need to lift another tariff between provinces. He even mentioned that Ben Franklin went to Montreal to try to get Canada to join the American Revolution. And while he seemed proud about that, in retrospect it was probably a bad move for Canada.

Additionally, Ontario’s threatened 25% surcharge on electricity exports to the U.S. could increase prices for 1.5 million homes in Minnesota, Michigan, and New York. Trump may be able to offset that somewhat. In the short term US buyers will try to find cheaper sources but we are going to have some issues with supply constraints and grids and such but this type of price spike from Canada could do long term damage because the US will find other ways to provide that energy to these areas. So Canada has to be very careful and they’re going to lose their best customer and if they lose their best customer they’re going to have to build more than one pipeline if they want to sell their gas.

A recent cold snap resulted in the fourth-largest withdrawal from U.S. natural gas storage, with January withdrawals nearly reaching 1 trillion cubic feet. Inventories are 4% below the previous five-year average after being 6% above at the start of the heating season.

The U.S. is considering a plan to disrupt Iran’s oil transportation by halting vessels at sea.

The Premier of Ontario, Canada’s most populous province, threatened to cut off energy supplies to the U.S. if President-elect Donald Trump implements proposed tariffs on Canadian goods. This highlights potential trade conflicts between the two nations. “We will go to the full extent depending on how far this goes. We will consider cutting off their energy supplies to Michigan, New York State, and Wisconsin,” Ontario Premier Doug Ford said following a virtual meeting with Canadian Prime Minister Justin Trudeau and other provincial premiers to discuss Trump’s tariff threat. “I don’t want this to happen, but my priority is to protect Ontario, Ontarians, and Canadians as a whole since we are the largest province.”

In November, Trump threatened to impose a blanket 25% tariff on all products from Canada and Mexico unless the countries address the flow of drugs and unauthorized migrants to the U.S..

Bloomberg reported that Ukraine claimed a strike on an oil refinery owned by Rosneft PJSC in Russia’s Samara region, continuing attacks on a key industry on almost on a daily basis. Drones hit the Novokuibyshevsk refinery overnight, a Ukrainian security official said, asking not to be identified because of the sensitivity of the matter. The facility is of “a strategic importance” for the Russian army as it ensures “a stable supply of fuel for military operations,” Andriy Kovalenko, head of the Ukrainian Center for Countering Propaganda, said in a post on Telegram. Rosneft didn’t immediately respond to a request for a comment and it wasn’t possible to independently verify Ukraine’s claims. Samara regional governor Vyacheslav Fedorischev said in a post on social network VK that three Ukrainian drones were shot down overnight in the town of Novokuibyshevsk, with no fire or damage registered.

Oil prices are still locked in the range but building the base for a catapult higher when the seasonality’s kick in later in the month. Natural gas is in an explosive upward move but maybe a bit ahead of itself. As we have talked about for some time, natural gas prices are being influenced not only by the fact that we use more natural gas this year than we have in the years past but also by the fact that we have seen projections for a much warmer summer than normal. that means it will be more difficult to get supplies built up ahead of next winter.

Fox Weather reports that millions in the Midwest and Southeast may face another severe weather outbreak this week. March typically marks the beginning of the active spring severe weather season, and this renewed risk comes after a deadly severe weather outbreak swept across the nation last week. This week, forecasters will monitor the potential for strong to severe thunderstorms as we approach the middle of the week and again as we get ready to welcome the weekend.

Read Full Story »»»

DiscoverGold

DiscoverGold

WTI Crude Oil CoT: Peek Into Future Through Futures, How Hedge Funds Are Positioned

By: Hedgopia | March 8, 2025

• Following futures positions of non-commercials are as of March 4, 2025.

WTI crude oil: Currently net long 153.7k, up 12.5k.

Last September, West Texas Intermediate crude ticked $65.27 and bottomed; it had come under pressure after tagging $84.52 in July. Horizontal support at $65-$66 goes back years. After defense of this support in September, the crude then rallied to $78.46 in October and $79.39 in January. Since that weekly shooting star high, it has dropped for seven weeks in a row.

This week, the crude gave back 3.9 percent to $67.04/barrel, with Wednesday’s intraday low of $65.22. Once again, oil bulls stepped up in defense of $65-$66. A rally is likely. Immediately ahead, there is horizontal resistance at $68. This will be followed by $71-$72, which makes up the lower bound of a months-long range with the upper bound at $81-$82. This range was broken last September.

In the meantime, US crude production in the week to February 28 increased 6,000 barrels per day w/w to 13.508 million b/d; output has come under slight pressure since registering a record 13.631 mb/d in the week to December 6. Crude imports dropped 106,000 b/d to 5.8 mb/d. As did gasoline and distillate inventory which decreased 1.4 million barrels and 1.3 million barrels respectively to 246.8 million barrels and 119.2 million barrels. Crude stocks, however, increased 3.6 million barrels to 433.8 million barrels. Refinery utilization fell six-tenths of a percentage point to 85.9 percent.

Read Full Story »»»

DiscoverGold

DiscoverGold

NY Crude Oil Futures (CL) »» Weekly Summary Analysis

By: Marty Armstrong | March 8, 2025

This market made a new high today after the past 2 trading days. The market opened lower and closed higher. The immediate trading pattern in this market has exceeded the previous session's high intraday reaching 6822. Therefore, this market has rallied over the past 2 trading sessionsNonetheless, the market remains neutral on our system indicators.

This market has not closed above the previous cyclical high of 7314. Obviously, it is pushing against this resistance level.

ECONOMIC CONFIDENCE MODEL CORRELATION

Here in NY Crude Oil Futures, we do find that this particular market has correlated with our Economic Confidence Model in the past. The Last turning point on the ECM cycle low to line up with this market was 2020 and 2009 and 2001 and 1998 and 1994. The Last turning point on the ECM cycle high to line up with this market was 2022 and 2018 and 2011 and 2000.

MARKET OVERVIEW

NEAR-TERM OUTLOOK

The historical broader tone of the NY Crude Oil Futures has been a bearish consolidation following the high established back in 2008. Since then, this market has created 2 reaction highs which have been unable to break this overall protracted bearish consolidating trend. Still, the major low was made in 2023 and the market has bounced back for the last 2 years. The last Yearly Reversal to be elected was a Bullish at the close of 2023.

This market remains in a positive position on the weekly to yearly levels of our indicating models. Pay attention to the Monthly level for any serious change in long-term trend ahead.

The perspective using the indicating ranges on the Daily level in the NY Crude Oil Futures, this market remains moderately bearish position at this time with the overhead resistance beginning at 6856 and support forming below at 6677. The market is trading closer to the support level at this time.

On the weekly level, the last important high was established the week of January 13th at 7939, which was up 8 weeks from the low made back during the week of November 18th. Afterwards, the market bounced for 8 weeks reaching a high during the week of January 13th at 7939. Since that high, we have been generally trading down for the past 7 weeks, which has been a very dramatic move of 17.84% in a stark panic type decline.

When we look deeply into the underlying tone of this immediate market, we see it is currently still in a weak posture. Immediately, this decline from the last high established the week of January 13th has been important, closing sharply lower as well. Before, this recent rally exceeded the previous high of 7288 made back during the week of November 4th. Nonetheless, that high was actually lower than the previous high made the week of October 7th suggesting this market has really been running out of sustainable buying for right now. This decline has been rather important penetrating the previous low formed at 6653 yet the market closed above it just cleaning out the stops. This does not yet imply a shift in trend. We need to close below the previous low just technically to raise that possibility. Right now, the market is below momentum on our weekly models casting a bearish cloud over the price action. Looking at this from a wider perspective, this market has been trading up for the past 2 weeks overall.

INTERMEDIATE-TERM OUTLOOK

YEARLY MOMENTUM MODEL INDICATOR

Our Momentum Models are declining at this time with the previous high made 2021 while the last low formed on 2024. However, this market has declined in price with the last cyclical low formed on 2023 warning that this market remains weak at this time on a correlation perspective declining in both price and Momentum.

Looking at the longer-term monthly level, we did see that the market has made a low following the previous high of January at 6836. The fact that the market for February close below the previous month's low is a sign of near-term weakness with a possible decline into the next turning point on the Array. Currently, March has traded as rallied to exceed the previous month's high reaching 7518.

Some caution is necessary since the last high 7939 was important given we did obtain two sell signals from that event established during January. That high was still lower than the previous high established at 8767 back during April 2024. Nevertheless, at this time, the market is still weak trading beneath last month's low.

DiscoverGold

DiscoverGold

Natural Gas Faces Bearish Pressure After Resistance Test

By: Bruce Powers | March 7, 2025

• Natural gas pulled back after testing resistance, with support at $3.97 in focus. However, a move above $4.43 could signal renewed bullish momentum.

Natural gas fell to a three-day low of $4.13 on Friday, indicating that it might pull back further to test lower support levels. A breakdown of an inside day was triggered today with a drop below $4.25, while further weakness was shown by a decline below Wednesday’s low of $4.23. This is a bearish price action reflecting short-term downward pressure. It follows a new trend high of $4.55 that was reached on Tuesday thereby testing resistance around a top rising trend channel line. Resistance was seen around that line several times before.

Dynamics of Pullback May Provide Clues

Until today, a bullish continuation was possible as resistance around the top channel line continued to be tested over the past couple of days and resistance was retained. The subsequent bearish decline today, however, makes a deeper pullback more likely prior to a new breakout attempt. But that will also depend on what happens next.

Key Trend Support at 20-Day MA

The obvious potential trend support area is represented by the 20-Day MA, now at $3.97. Notice that it aligns with an internal uptrend line. Together, they represent a more significant possible dynamic support area. A pullback prior to another bullish breakout attempt would be normal and healthy for the developing bull trend.

Recent bullish indications that support an eventual move higher, include a sharp bounce off support on Monday defined by the convergence of the 50% retracement, the 20-Day MA, and the 50-Day MA. Moreover, the 20-Day line crossed above the 50-Day line, and natural gas reached a new trend high. This behavior shows strong underlying demand. However, if there is a decline below the 20-Day MA and natural gas stays below it or keeps falling, the near-term outlook and a chance for a new trend high begins to fade.

Weekly Bullish Engulfing Pattern Supports Further Upside

This week will end with a bullish engulfing pattern that is also a key reversal week. Where the price of natural gas ends the week may provide additional insight. A weekly closing price above last week’s high of $4.19 would confirm the weekly breakout, but a close above the three-week high and prior trend high at $4.48, would show greater strength. Despite the potential for a deeper bearish decline, that would begin to change on a sharp rise above today’s high at $4.43. This could be of particular interest if the day ends with a bullish hammer candlestick pattern.

Read Full Story »»»

DiscoverGold

DiscoverGold

$OIL $XLE $BPENER - Unwinding...

By: Sahara | March 7, 2025

• $OIL $XLE $BPENER - Unwinding

There have been Buy & Sell Signals along the way, yet while under the Kosh I find it better to stand aside until I see a reason to enter...

Read Full Story »»»

DiscoverGold

DiscoverGold

$XLE #Energy - Recall I showed a Bear 'Wedge' which had formed last year...

By: Sahara | March 7, 2025

• $XLE #Energy - Recall I showed a Bear 'Wedge' which had formed last year.

Been in-play for a few months with a pot'l B/Test, now testing its Mthly 20/MA again. Which ideally needs to hold, otherwise it will aim for its Targets...

Read Full Story »»»

DiscoverGold

DiscoverGold

$WTIC $Oil -Striving to hold the Red Ledge. Failure will focus on the Lwr Arrowed Targets into the $50's...

By: Sahara | March 7, 2025

• $WTIC $Oil -Striving to hold the Red Ledge.

Failure will focus on the Lwr Arrowed Targets into the $50's...

Read Full Story »»»

DiscoverGold

DiscoverGold

Crude Oil Tests Support After 19% Decline, Reversal Possible

By: Bruce Powers | March 6, 2025

• Oil prices remain under pressure but may see a bounce after finding support near prior lows, while a weekly closing below $66.37 could confirm long-term weakness.

Crude oil consolidated on Thursday following a new retracement low of $65.40 that was reached on Wednesday. It is on track to end today with an inside day. Wednesday’s low completed a $15.36 or 19% decline from the January swing high of $80.76. This makes the current bearish correction the largest of the four prior corrections on a percentage basis.

The four most recent bearish corrections ranged from a decline of 14.8% to 18.3%. On that basis alone crude oil should be close to a potential bottom that could lead to at least a bounce. In addition, support for the decline was seen by a prior trend low support level reached in September at $65.65. Also, notice that the low of this week found support near the lower trendline of a declining channel.

On Track for Lowest Weekly Close in Almost Two Years

Of concern is the weekly closing price for this week. A weekly closing price below $67.22 would be the lowest weekly closing price since March 2023, while a close below $66.37 would be the lowest weekly closing price since August 2021. This would be a bearish sign on a larger time frame and would further confirm recent bearish indications.

At Risk of Bearish Continuation of Long-term Downtrend

Moreover, recent bearish price action along with a test of prior long-term support suggests the possibility of an eventual breakdown to new lows. Given a successful test of support at prior long-term lows and the bottom channel line for the current downswing, it seems likely that a bounce to test resistance within the current decline may come first. That could eventually lead to a larger bullish reversal. But until that time the downtrend can be expected to retain its boundaries and could lead to a bearish continuation.

Bounce Possible Above $67.25

Since today is an inside day, an initial bullish reversal signal will be generated on a rally above the high for the day at $67.25. Previous support around $68.10 becomes the first upside target. That target area is marked by an uptrend line, a prior interim swing low from December, and a prior minor trend low from last week. Higher up is potential resistance around the 20-Day MA trend indicator. It is currently at $70.60 and falling.

Read Full Story »»»

DiscoverGold

DiscoverGold

Natural Gas Consolidates Near Highs, Poised for Breakout Move

By: Bruce Powers | March 6, 2025

• Natural gas holds near trend highs, testing key resistance while consolidation tightens. A breakout move is likely, but direction remains uncertain amid technical signals.

Natural gas continued to consolidate near recent highs on Thursday, and it is set to close lower for the day and as an inside day. At the time of this writing, the high for the day was $4.47 and the low $4.25. Today would be the second consecutive inside day and it reflects a tightening of consolidation. Therefore, there is the potential for a sharp move in the direction of the breakout of the inside days.

Since Thursday will likely end as an inside day, Wednesday’s high of $4.52 and the low of $4.23 provide the outside price range for the past two days. It should provide more reliable price levels for signals versus Thursday’s price range.

New Trend High Stalled Advance

A new trend high of $4.55 was reached on Tuesday and the day ended with natural gas in a relatively weak position in the lower half of the day’s trading range. Moreover, the closing price was the second highest level for the bull trend, but it was not the highest.

That is not a convincing response to a new bull breakout as it shows short-term weakness, rather than improving strength. Then, on Wednesday a new closing daily high was established at $4.52. And Wednesday’s high of $4.52 completed another test of resistance around a top trend channel line that marked a resistance zone for the three most recent rallies.

Top Channel Line Remains Resistance

Previous attempts to break out above the channel line have failed. This would seem to put greater weight on the possibility of a bearish retracement rather than a bullish continuation. Nonetheless, the behavior of natural gas around key near-term price levels mentioned above will provide clues.

Although demand remains relatively strong given the two days of consolidation that further tested resistance around the channel line, a sustained upside breakout and a continuation of the bull trend may have greater success following a pullback first, or a longer rest in consolidation.

Bullish Weekly Price Action

On the weekly time frame natural gas showed strength this week. This week’s rally began following an initial bearish move to test support at a confluence zone that is marked by several indicators. Of significance is the 50-Day MA, now at $3.77. That line was joined by the 20-Day MA and a 50% retracement level. It was the first real test of support at the 50-Day line since it was reclaimed on February 13.

Having both the 20-Day and 50-Day lines converged around the support zone likely contributed to the sharp rally once it was tested as support. Subsequently, a weekly bull breakout triggered on a rise above last week’s high of $4.19. This seems to be supportive of a bullish continuation of the rising trend above $4.55. If so, the $4.70 area is the next upside target.

Read Full Story »»»

DiscoverGold

DiscoverGold

Trump and Dump. The Energy Report

By: Phil Flynn | March 6, 2025

Trumping Oil. Oil got Trumped and dumped. While many people feared that President Trump aggressive trade negotiations would raise the price of oil, so far oil has been Trumped and dumped. Oil prices have defied some analysts fears that Trump would increase prices with his trade threats but so far the opposite seems to be happening. President Trump, with a mix of peace negotiations coupled with relaxing regulations on the oil and gas industry, has caused the price of oil drop even as our trade partners have to raise their tariffs on oil and gas and even cut off their exports.

Now today breaking news may bring oil a bid after a Reuters exclusive reported that the US is mulling a plan to disrupt Iran’s oil by halting vessels at sea. In recent weeks Iran’s oil exports have surged and President Trump, unlike the previous Administration, is looking at ways to clamp down on Iran oil trade. The latest in that effort as reported by Reuters includes considering this more aggressive action. Supply from Iran to China rebounded to 1.4 million bpd in the period February 1-20, after falling close to a two-year low below 800,000 bpd in January, Vortexa data showed. Shandong-bound Iranian volumes surpassed 1.1 million bpd and exceeded the 2024 average, the data showed. Kpler data showed Iranian crude arrivals in China rose to 771,000 bpd in February, up from 692,000 bpd in January.

Reuters reported that, “President Donald Trump’s administration is considering a plan to stop and inspect Iranian oil tankers at sea under an international accord aimed at countering the spread of weapons of mass destruction, sources familiar with the matter told Reuters. Trump has vowed to restore a “maximum pressure” campaign to isolate Iran from the global economy and drive its oil exports to zero, in order to stop the country from obtaining a nuclear weapon.

Trump hit Iran with two waves of fresh sanctions in the first weeks of his second-term, targeting companies and the so-called shadow fleet of ageing oil tankers that sail without Western insurance and transport crude from sanctioned countries. Those moves have largely been in line with the limited measures implemented during Joe Biden’s administration, when Iran succeeded in ramping up oil exports through complex smuggling networks. Trump officials are now looking at ways for allied countries to stop and inspect ships sailing through critical chokepoints such as the Malacca Strait in Asia and other sea lanes, according to six sources who asked not to be named due to the sensitive subject.

President Trump also met with Canadian Prime Minter Trudeau and announced that he would temporarily spare carmakers from a new 25% import tax imposed on Canada and Mexico, just a day after the tariffs came into effect. On Truth Social President Trump said, “For anyone who is interested, I also told Governor Justin Trudeau of Canada that he largely caused the problems we have with them because of his Weak Border Policies, which allowed tremendous amounts of Fentanyl, and Illegal Aliens, to pour into the United States. These Policies are responsible for the death of many people!”

Alberta’s Premier Danielle Smith, said she is halting Alberta’s purchase of U.S. goods, alcohol and gambling machines. That may be a blow to Canadians that want to bet on the hockey playoffs or want a Jack and coke. Yet Trump’s tariffs are leading to more fair trade and has made the Alberta premier see the light. Apparently Alberta is very upset that the United States is putting tariffs on her province, she has come to the realization that Alberta basically puts tariffs on her countrymen and other provinces. She is now lifted her tariffs on British Columbia, Saskatchewan, Manitoba, Ontario, Quebec and even New Brunswick. So, it seems that Trumps policies have expanded free trade in Canada! Free Canada!

This comes as President Trump is sending a message to the Hamas terror group to release the hostages or else. While many other countries seem to be falling all over themselves to support Ukraine, they seem oblivious to supporting Israel that saw a heinous and horrendous attack from Hamas on innocent civilians including the torture of woman and children. President Trump, whom Benjamin Netanyahu called the best friend Israel ever had, has had enough.

On Truth Social President Trump said, ““Shalom Hamas” means Hello and Goodbye – You can choose. Release all of the Hostages now, not later, and immediately return all of the dead bodies of the people you murdered, or it is OVER for you. Only sick and twisted people keep bodies, and you are sick and twisted! I am sending Israel everything it needs to finish the job, not a single Hamas member will be safe if you don’t do as I say. I have just met with your former Hostages whose lives you have destroyed. This is your last warning! For the leadership, now is the time to leave Gaza, while you still have a chance. Also, to the People of Gaza: A beautiful Future awaits, but not if you hold Hostages. If you do, you are DEAD! Make a SMART decision. RELEASE THE HOSTAGES NOW, OR THERE WILL BE HELL TO PAY LATER! DONALD J. TRUMP, PRESIDENT OF THE UNITED STATES OF AMERICA”

Oil inventories were taken as a bit bearish but the drop in runs is seasonal. Demand was impressive. The drop in price should give us a good place to put on the seasonal trades for the Easter run-up.

Reuters reported that, “Mexican state company Pemex is in talks with potential buyers in Asia, including China, and Europe, as it seeks alternative markets for its crude after U.S. President Donald Trump imposed tariffs on imports, a senior Mexican government official said. Trump this week implemented 25% tariffs on goods from Mexico and Canada. While Canadian crude won an exception of a 10% levy, Mexican crude is to be taxed at 25%.

Natural gas exploded on cold weather and natural gas threat from Canada. Alberta Premier Danielle Smith: “Alberta happens to have one of the largest deposits of oil and natural gas on the planet. It is significantly larger and far more accessible than the quickly declining oil and gas reserves located in the United States.” “Whether the US President wishes to admit it or not, the United States not only needs our oil and gas today, they are also going to need it more and more with each passing year once they notice their declining domestic reserves and production are wholly insufficient.”

Maybe today! But not tomorrow. John Kemp Energy reported that, “in contrast to oil, U.S. gas production is likely to increase significantly in 2025, after prices more than doubled in real terms from the multi-decade low in the first quarter of 2024. Dry gas production declined slightly to an average of 103.2 billion cubic feet per day (bcf/d) in 2024 from 103.6 bcf/d in 2023. Front-month futures prices slumped to an average of less than $1.80 per million British thermal units in March 2024, the lowest since futures trading began in 1990, after adjusting for inflation.

Since then, however, prices have more than doubled to an average of $3.74 in February 2025, putting them in the 29th percentile for all months since 1990 in real terms. Falling production, combined with record consumption from gas-fired generators, growth in exports, and the coldest winter for six years, has tightened supplies sharply. Surplus inventories in March 2024 inherited from the very mild winter of 2023/24 had been transformed into a large and widening deficit by February 2025.

Read Full Story »»»

DiscoverGold

DiscoverGold

EIA Natural Gas Storage Draw Of -80 Bcf Misses Estimates

By: Vladimir Zernov | March 6, 2025

Key Points:

• Working gas in storage decreased by -80 Bcf from the previous week.

• At current levels, stocks are -224 Bcf below the five-year average for this time of the year.

• Natural gas tests support at $4.25 - $4.30.

On March 6, 2025, EIA released its Weekly Natural Gas Storage Report. The report indicated that working gas in storage declined by -80 Bcf from the previous week, compared to analyst forecast of -96 Bcf. In the previous week, working gas in storage decreased by -261 Bcf.

More information in our economic calendar

At current levels, stocks are -585 Bcf less than last year and -224 Bcf below the five-year average for this time of the year.

Natural gas prices moved lower after the release of the report. Storage draw missed analyst expectations, which may serve as a bearish catalyst for natural gas markets.

Traders will also continue to monitor the tariff drama. Falling exports from Canada provided material support to natural gas markets in recent trading sessions. In case the U.S. and Canada manage to come up with a deal which reduces or eliminates tariffs, natural gas markets may find themselves under more pressure.

From the technical point of view, natural gas is trying to settle below the support at $4.25 – $4.30. In case this attempt is successful, natural gas will head towards the next support level, which is located in the $4.00 – $4.05 range. RSI is in the moderate territory, and there is plenty of room to gain momentum in the near term.

Read Full Story »»»

DiscoverGold

DiscoverGold

Natural Gas Poised for New Highs or Pullback from Resistance

By: Bruce Powers | March 5, 2025

• Natural gas consolidates near key resistance, with potential for a breakout above $4.55 or a pullback toward support at $4.06 and $3.88.

Natural gas is on track to complete an inside day on Wednesday, following another test of resistance around a top trend channel line earlier in the trading session. The high for the day was $4.52 and the low was $4.23. A breakout through either price level may lead to a continuation in the direction of the breakout.

If an upside breakout triggers, then the trend high from Tuesday at $4.55 may be challenged and a bull trend continuation signal would trigger on a move above that high. In addition to the bullish pattern of a rising trend, natural gas is on track to end the day at its highest daily closing price for the current advance, and the highest price since mid-December 2022.

Above $4.55 Triggers Trend Breakout

If the $4.55 price level is exceeded, then natural gas could reach the next higher target zone around $4.70 to $4.72. Subsequently, the 38.2% Fibonacci retracement of the full decline that began from the 2022 peak of $10.03 is at $4.77. Since that measurement is based on a long-term pattern, it is potentially significant with a good chance that strong resistance might be seen there.

Rising ABCD Pattern Formed