Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Looking for much higher prices for both in the days ahead. Weatherford could be bought out soon. IMHO

Both the warrant price and the stock price surging ahead.

WFTLF : $35.00

WFTLF : $2.19

more people are coming to know of these warrants and can be seen in the volume and price of WFTUF.

WFTUF now 1.80. Looks like this may be more than 10.00 soon. WFTIQ will be bought out at a much higher price and these warrants will be priceless. IMHO

For all those who aren't paying attention and all the panic sellers...WFTIQ split into 2 stocks. WFTLF was issued after the restructure, post bankrupcy. Warrants were issued for a percentage of the previous WFTIQ stocks. Those warrants turned to the new stock ticker WFTUF. That stock went up 175% today. I am now up 14% just for waiting it out. This OTC market is a monster. I will only invest money I would not lose sleep over, but when it works out, that's a fist bump! Good luck all!

WFTUF .98 (8>)

Warrants - Warrants Expiring 12/13/2023

Edit: They are listed on the "Grey market" Kind of thinking they are tracking warrants. But not sure. May be buried in past filings

Are those the warrants?

That sucks, didn't realize.

Just sold my 63 lot at $27....glta

Because they gave you warrants instead of shares just like us

Just sold the lot with 41 shares @ 24.25...almost $200 profit.. Had originally bought 10k @ .08. Just dont know why other lot is still just a cusip with no price

It will be back to 5.00 in a week or two

Assholes got us for over 1100/1, and warrants they issued, even the brokers dont know anything on them

Now my lot with only 41 shares has a symbol WFTL...BID 25 ASK 23.

Hasn't been the 1st to do it.

Not sure how legal it is to treat different buys of common stock unequally

I looked into more and eat h lot had a different split ratio. Lot of 10k I bought in may was 244:1. Lot that had 50k bought in sept 108:1

since my account is showing two lots, they are different cusip #

sine my account is showing two lots, they are different cusip #

Changed again, for the better!

Can't post screen shot from my phone, don't know how. But it's showing $23 again.

If the RS is too high, it will be much harder to make any decent profit from pre RS shares

I few minutes ago, my smaller of 41 show a pps if $23 with a gain of $943. Now then gain is still there but no price. The larger lot has 0000s

Must have changed it. I had 35000 and originally had 400+ now 115, so 1-300+. Not sure how they are getting away with fluctuating RS

I to me higher than that, I had 60k now I have 2 lots with a combined 503 shares.

Looks like mark mcCollum was hard at work today trading all his shares over. More than likely a big split coming after they get this work done from what my broker said today! We will see!

I currently don't own shares, I was looking to buy some today. Looks like I'll have to wait until a new symbol is issued. thanks for the info.

Check your transactions. You should see the mandatory exchange and a number that represents the new shares, until they are assigned a new stock symbol.

There was in essence a 1-70 RS.

Last Friday I was able to see this stock listed OTC on Etrade, today it's not there, did the stock symbol change?

Unlikely

Hmmm, i thought iread it wouldnt affect these shares. I guess we will find out soon enough

Unlikely that these shares will show any upward movement. WFT plans to relist on NYSE with new shares being issued that's what their PR said a few days ago. the current WFTIQ might be getting cancelled.

I believe after the 1st of the year when everyone gets there budgets for the year! Weatherford is gonna get busy, i dont think 50 cents pretty quick is not out of the question. Then i believe we will have some big buyers start buying with new contracts being signed.

They are out of the abyss, and they are getting alot of new business according to the oilfield people i know. Alot of big stuff in the works! Not seen yet. Some companys were waiting on this to go ahead

|

Followers

|

33

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

825

|

|

Created

|

10/06/07

|

Type

|

Free

|

| Moderators | |||

In 1972, the separate company of Energy Ventures, Inc. was founded as an offshore gas and oil exploration and production company.In 1987, Energy Ventures was liquidated and re-established and by 1990, had acquired Grant Oil Country Tubular Company.

In 1991, Weatherford acquired Petroleum Equipment Tools Company (PETCO). Weatherford and HOMCO later merged operations to create Weatherford Services, the largest oil fishing/rental company

in the world. In 1995, Weatherford merged with Enterra, becoming Weatherford Enterra Inc.

In May 1998 Energy Ventures, since renamed EVI, Inc. and Weatherford Enterra, Inc. merged, creating the current company now known as Weatherford. In the next two years,

Weatherford added a number of well-organized brands to its expertise, including Dailey, Orwell, Energy Rentals, Whiting, Williams, BBL and ECD Northwest. Weatherford also created

a stronger completion competence with the addition of well-known brands in the sector such as Petroline, Cardium, Nodeco, McAllister, Johnson Screens, Houston Well Screens, Arrow, and CIDRA.

In 2005, Weatherford acquired Precision Drilling Corporation’s Precision Energy Services and International Contract Drilling divisions.

In 2008, the company announced that it was shifting its place of incorporation from Bermuda to Switzerland. That same year, Weatherford completed its acquisition of V-Tech International,

a pioneer in the development of mechanical power tong systems in the North Sea to improve rig safety.

Company focus

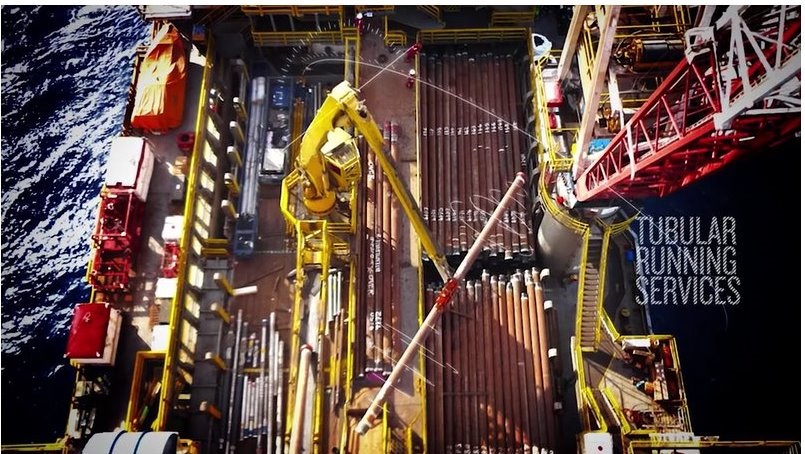

As an oil and natural gas drilling services company, Weatherford produces a variety of products and services for the oil and gas industry. These include drilling services, electronic well

measurement and monitoring, completion, production, and evaluation products and services. In particular, the company has developed directional drilling services that can extend through

miles of bedrock with great precision, and tubular running services that are used on almost half of the world’s deepwater drilling projects. The company has more sand screen systems installed

worldwide than any other company, and production optimization systems in more than 100,000 wells around the world. Additionally, Weatherford is the industry’s only provider of all forms of

artificial lift. Weatherford also offers intervention, completion, and decommissioning services for well owners, in addition to pipeline precommissioning, commissioning operations, and one of

the world's most diverse fleets of inline inspection tools.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |