Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Americas Gold and Silver and the Ministers of the Mexican Government Announce Agreement to Reopen the Cosalá Operations

July 07 2021 - 07:00AM

Business Wire

Alert

Print

Share On Facebook

Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) (“Americas” or the “Company”), is pleased to report that it has signed an agreement with the Mexican Ministries of Economy, Interior and Labour committing to a reopening at the Cosalá Operations shut for over 17 months by an illegal blockade.

After the long period of denied access, the agreement contemplates immediate right to possession of the property with a joint inspection coordinated by the Ministry of Labor this Thursday, so that the mine can restart operations in a safe and sustainable manner. Following the inspection and Company review, the Company will provide an update on a schedule to a return to normal operations at the mine and mill.

Once production can be initiated, it is anticipated that the current higher silver prices will allow the Company to target the higher-grade silver ores in the Upper Zone of San Rafael and develop the silver-copper EC120 project. Mining these silver-rich areas of the Cosalá Operations is expected to significantly increase silver production to over 2.5 million ounces of silver per annum in the years following the restart. Coupled with the exploration success at the Galena Complex in Idaho, where the Company is targeting to reach peak historical annual production levels of approximately 5 million ounces per year, the Company expects to significantly increase silver production over the next few years.

“I am very pleased that this agreement could be signed,” stated Americas Gold and Silver President & CEO Darren Blasutti. “Through extensive deliberations with senior Mexican ministers, certain union representatives, the will of our workers and the community and the President of Mexico, the agreement is a significant step to ensure the long-term stability of the operations by its signatories. I would like to personally thank all parties involved including our employees and representatives in Mexico, the Mexican and Sinaloa governments, the people of Cosalá, and the organizers of numerous petitions and rallies who have all played important roles in providing a long-term solution for the benefit of the Cosalá Operations. The Company is eager to get the operation ramped-up for all to benefit from the current strong silver, zinc and lead prices.”

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in North America. The Company owns and operates the Relief Canyon mine in Nevada, USA, the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned Galena Complex in Idaho, USA. The Company also owns the San Felipe development project in Sonora, Mexico. For further information, please see SEDAR or www.americas-gold.com.

$PDAC: Americas Gold & Silver's transition toward more gold revenue

Americas Gold and Silver CEO Darren Blasutti gives an update on

the Relief Canyon mine in Nevada and the latest news on

the blockade at their Cosala mine in Mexico.

https://www.bnnbloomberg.ca/investing/video/pdac-americas-gold-silver-s-transition-toward-more-gold-revenue~1914748

https://www.americas-gold.com/investors/presentations/

https://www.americas-gold.com/site/assets/files/5628/fact20210303.pdf

https://www.americas-gold.com/

https://www.americas-gold.com/investors/upcoming-events/

Legend Pierre Lassonde Has Been Aggressively Buying This Mining Stock, His Top Pick For 2021

February 23, 2021

https://kingworldnews.com/pierre-lassonde-has-been-aggressively-buying-this-mining-stock-his-top-pick-for-2021/

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Legend Pierre Lassonde Has Been Aggressively Buying This Mining Stock, His Top Pick For 2021

February 23, 2021

https://kingworldnews.com/pierre-lassonde-has-been-aggressively-buying-this-mining-stock-his-top-pick-for-2021/

Legend Pierre Lassonde Has Been Aggressively Buying This Mining Stock, His Top Pick For 2021

Legend Pierre Lassonde has been aggressively buying this mining stock, his top pick for 2021. Lassonde is arguably the greatest company builder in the history of the mining sector. He is past President of Newmont Mining, former Chairman of the World Gold Council and former Chairman of Franco Nevada. Lassonde is one of the wealthiest, most respected individuals in the gold world, and as always King World News would like to thank him for sharing his wisdom with our global readers during this critical period in these markets.

Great Value In Mining Stocks

Eric King: “Pierre, some of these large cap mining stocks have become value plays. And there is even more value as you start to go down the line, particularly into some of the smaller stocks. We invest alongside each other and we have been buying a company called America’s Gold & Silver. I invested 7 figures into that (stock), Pierre, and I know you own 5% of the company.”

America’s Gold & Silver: All Of The Upside For Free

Pierre Lassonde: “In the mid-cap (mining stock space) there are a number of stocks that I really like. And I like stocks that have a lot of optionally values. Meaning that you are buying the existing asset but then you are getting all of the upside for free.

The Discovery Of A New Silver Zone

And America’s Gold & Silver (symbol USAS in the United States and USA in Canada) is one of those where if you look at the results that they’ve been putting out on their Galena property, the intercepts that they are seeing, and the discovery of the new silver zone in the hundreds of grams per tonne (800-900 grams per tonne silver), I mean it is fascinating, it is really interesting. Plus there is like 2%-5% copper on top of that. And so in terms of equivalent, you are looking at 40+ ounces of gold equivalent per tonne. Well that’s like $1,000+ per tonne material, like something the ‘old timers’ would see. Plus they are finally getting good results at Relief Canyon — their gold project.

Unlocking Value

And it looks like they are finally going to get started back in Mexico. They are getting agreements done with all of the various parties. They are finally getting that sorted out with the help of the federal government. So things are finally coming together and the stock is selling for less than .4 NAV (Net Asset Value). Well, I love buying a thing for 40 cents on the dollar and then being able to sell them at full (plus rising) NAV. And that’s why I’ve been saying to you that it’s a great deal and why I’ve been picking up stock in the market. And yes, I do own about 5% of the company.”

MUST LISTEN: In this audio interview Pierre Lassonde shares with KWN listeners around the world what they should be doing with their money right now in the gold and silver sector as well as discussing where the price of gold is headed and why he is so bullish and you can listen to the interview by CLICKING HERE OR ON THE IMAGE BELOW.

Montanore thanks; Legend Pierre Lassonde Has Been Aggressively Buying This Mining Stock, His Top Pick For 2021

February 23, 2021

https://kingworldnews.com/pierre-lassonde-has-been-aggressively-buying-this-mining-stock-his-top-pick-for-2021/

Legend Pierre Lassonde Has Been Aggressively Buying This Mining Stock, His Top Pick For 2021

Legend Pierre Lassonde has been aggressively buying this mining stock, his top pick for 2021. Lassonde is arguably the greatest company builder in the history of the mining sector. He is past President of Newmont Mining, former Chairman of the World Gold Council and former Chairman of Franco Nevada. Lassonde is one of the wealthiest, most respected individuals in the gold world, and as always King World News would like to thank him for sharing his wisdom with our global readers during this critical period in these markets.

Great Value In Mining Stocks

Eric King: “Pierre, some of these large cap mining stocks have become value plays. And there is even more value as you start to go down the line, particularly into some of the smaller stocks. We invest alongside each other and we have been buying a company called America’s Gold & Silver. I invested 7 figures into that (stock), Pierre, and I know you own 5% of the company.”

America’s Gold & Silver: All Of The Upside For Free

Pierre Lassonde: “In the mid-cap (mining stock space) there are a number of stocks that I really like. And I like stocks that have a lot of optionally values. Meaning that you are buying the existing asset but then you are getting all of the upside for free.

The Discovery Of A New Silver Zone

And America’s Gold & Silver (symbol USAS in the United States and USA in Canada) is one of those where if you look at the results that they’ve been putting out on their Galena property, the intercepts that they are seeing, and the discovery of the new silver zone in the hundreds of grams per tonne (800-900 grams per tonne silver), I mean it is fascinating, it is really interesting. Plus there is like 2%-5% copper on top of that. And so in terms of equivalent, you are looking at 40+ ounces of gold equivalent per tonne. Well that’s like $1,000+ per tonne material, like something the ‘old timers’ would see. Plus they are finally getting good results at Relief Canyon — their gold project.

Unlocking Value

And it looks like they are finally going to get started back in Mexico. They are getting agreements done with all of the various parties. They are finally getting that sorted out with the help of the federal government. So things are finally coming together and the stock is selling for less than .4 NAV (Net Asset Value). Well, I love buying a thing for 40 cents on the dollar and then being able to sell them at full (plus rising) NAV. And that’s why I’ve been saying to you that it’s a great deal and why I’ve been picking up stock in the market. And yes, I do own about 5% of the company.”

MUST LISTEN: In this audio interview Pierre Lassonde shares with KWN listeners around the world what they should be doing with their money right now in the gold and silver sector as well as discussing where the price of gold is headed and why he is so bullish and you can listen to the interview by CLICKING HERE OR ON THE IMAGE BELOW.

Seeking Alpha Article by Don Durrett

Here is a link to an article - How to Ride this PM Bull Market to the Top -

by Don Durrett. America's Gold & Silver is one of the top companies he

recommended to be invested in during this run.

The link to the article can be found below.

How To Ride This Precious Metals Bull Market To The Top

https://seekingalpha.com/article/4376036-how-to-ride-this-precious-metals-bull-market-to-top

Americas Gold And Silver Provides Update On Relief Canyon

Americas Gold and Silver Corporation Logo (PRNewsfoto/Americas Gold and Silver)

NEWS PROVIDED BY

Americas Gold and Silver Corporation

Sep 10, 2020, 07:00 ET

SHARE THIS ARTICLE

https://www.prnewswire.com/news-releases/americas-gold-and-silver-provides-update-on-relief-canyon-301127087.html

TORONTO, Sept. 10, 2020 /PRNewswire/ -- Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) ("Americas" or the "Company"), a growing North American precious metals producer, today provides an update on the ramp-up of the Relief Canyon mine toward commercial production.

Highlights

Since placing first ore on the 6W leach pad on August 4, 2020, leach solution grade coming from the pad has increased significantly and is operating within expected norms.

Continued improvements to operating practices will improve consistency of heap performance and reduce operating costs.

Commercial production remains targeted for Q4-2020.

"The Company is thrilled to report that the new section of the leach pad is operating according to plan" stated Americas President and CEO Darren Blasutti. "Leach solution grade has bumped up nicely which bodes well for continued increases in gold production and a strong finish to the year. We remain committed to declaring commercial production before the new year."

On August 4, 2020, the Company began stacking higher-grade ore from lower levels of the pit and applied revised and improved operating practices. Based on a month of operating data, the Company is pleased to report that the leach solution grade from the pad has significantly increased and modelled leach recovery is trending towards feasibility levels.

As highlighted previously, the operation is currently employing a temporary stacker with a capacity of approximately 8,000 tonnes per day. With the reduced stacking rate, the Company is taking the opportunity to prioritize waste stripping as the operation currently has a large run of mine ore stockpile of over 200,000 tons. With the increased waste stripping, the Company will have added operational flexibility to optimize production moving forward. The return of the radial stacker, with a capacity of 16,000 tonnes per day, is scheduled for mid-Q4-2020.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth, precious metals mining company with multiple assets in North America. The Company's newest asset, the Relief Canyon mine in Nevada, USA, has poured first gold and is expected to ramp up to full production over the course of 2020. The Company also owns and operates the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned Galena Complex in Idaho, USA. The Company has completed the outstanding option acquisition agreement for the San Felipe development project in Sonora, Mexico, subject to closing conditions. For further information, please see SEDAR or www.americas-gold.com.

For more information:

Stefan Axell

Darren Blasutti

VP, Corporate Development & Communications

President and CEO

Americas Gold and Silver Corporation

Americas Gold and Silver Corporation

416-874-1708

416–848–9503

Qualified Persons

Daren Dell, Chief Operating Officer, who is an employee of the Company and a "qualified person" under National Instrument 43-101, has approved the applicable contents of this news release.

Cautionary Statement on Forward-Looking Information:

This news release contains "forward-looking information" within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas Gold and Silver's expectations, intentions, plans, assumptions and beliefs with respect to, among other things, estimated production rates and results for gold, silver and other precious metals, as well as the related costs, expenses and capital expenditures, the Company's construction, production, development plans and performance expectations at the Relief Canyon Mine, its ability to finance, develop and operate Relief Canyon, including the anticipated timing of commercial production at Relief Canyon. Often, but not always, forward-looking information can be identified by forward-looking words such as "anticipate", "believe", "expect", "goal", "plan", "intend", "potential', "estimate", "may", "assume" and "will" or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas Gold and Silver as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas Gold and Silver to be materially different from those expressed or implied by such forward-looking information. With respect to the business of Americas Gold and Silver, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreak including the COVID-19 pandemic; the impact of COVID-19 on our workforce, suppliers and other essential resources and what effect those impacts, if they occur, would have on our business, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of the Company relating to the unknown duration and impact of the COVID-19 pandemic; interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; the ability to develop, complete construction, bring to production and operate the Relief Canyon Project; and risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions and other factors limiting mine access, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities, labor relations or disruptions, social and political developments and other risks of the mining industry. The potential effects of the COVID-19 pandemic on our business and operations are unknown at this time, including the Company's ability to manage challenges and restrictions arising from COVID-19 in the communities in which the Company operates and our ability to continue to safely operate and to safely return our business to normal operations. The impact of COVID-19 on the Company is dependent on a number of factors outside of its control and knowledge, including the effectiveness of the measures taken by public health and governmental authorities to combat the spread of the disease, global economic uncertainties and outlook due to the disease, and the evolving restrictions relating to mining activities and to travel in certain jurisdictions in which it operate. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward–looking information is available in Americas Gold and Silver's filings with the Canadian Securities Administrators on SEDAR and with the SEC. Americas Gold and Silver does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. Americas Gold and Silver does not give any assurance (1) that Americas Gold and Silver will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward–looking information concerning Americas Gold and Silver are expressly qualified in their entirety by the cautionary statements above.

SOURCE Americas Gold and Silver Corporation

Related Links

http://www.americas-gold.com

Also from this source

Americas Gold And Silver Announces Significant Increase To Galena ...

Americas Gold And Silver Corporation Reports Second Quarter 2020...

Explore

More news releases in similar topics

Mining & Metals

Mining

Accounting News & Issues

Contact PR Newswire

888-776-0942

from 8 AM - 9 PM ET

Contact Us

Gold & Silver bulls starting to break out > ^ > ^ > ^

Americas Gold and Silver Announces Closing of C$39.4 Million Bought Deal Financing

CNW GroupSeptember 4, 2020

TORONTO, Sept. 4, 2020 /PRNewswire/ --

Americas Gold and Silver Corporation (the "Company") (TSX: USA;

NYSE American: USAS) is pleased to announce that it has closed its

previously announced and upsized bought deal financing with a syndicate

of underwriters co-led by Desjardins Capital Markets and Cormark

Securities Inc., and including Stifel GMP, Clarus Securities Inc., and

Laurentian Bank Securities Inc., (collectively the "Underwriters").

A total of 10,204,510 common shares of the Company (the "Common

Shares"), including the partial exercise of the over-allotment option

by the Underwriters, were sold at a price of C$3.86 per Common Share,

for aggregate gross proceeds to the Company of C$39,389,409 (the

"Offering").

The net proceeds from the sale of the Common Shares will be used for the exploration, development and/or improvement of the Company's existing mine properties, including those relating to bringing Relief Canyon into commercial production and for working capital and general corporate purposes, as detailed in the Prospectus (as defined below).

The Offering was made pursuant to a short form prospectus (the "Prospectus") dated August 31, 2020 filed in all the provinces of Canada excluding Quebec. A copy of the Prospectus is available under the Company's profile on SEDAR at www.sedar.com.

The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or under any U.S. state securities laws, and may not be offered, sold, directly or indirectly, or delivered within the "United States" or to, or for the account or benefit of, persons in the "United States" or "U.S. persons" (as such terms are defined in Regulation S under the U.S. Securities Act) except in certain transactions exempt from the registration requirements of the U.S. Securities Act and all applicable U.S. state securities laws. This release does not constitute an offer to sell or a solicitation of an offer to buy such securities in the United States, Canada or in any other jurisdiction where such offer, solicitation or sale is unlawful.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in North America. The Company's newest asset, the Relief Canyon mine in Nevada, USA, has poured first gold and is expected to ramp up to full production over the course of 2020. The Company also owns and operates the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned Galena Complex in Idaho, USA. The Company has recently completed the outstanding option acquisition agreement for the San Felipe development project in Sonora, Mexico, subject to closing conditions. For further information, please see SEDAR or www.americas-gold.com.

For more information:

Stefan Axell

Darren Blasutti

VP, Corporate Development & Communications

President and CEO

Americas Gold and Silver Corporation

Americas Gold and Silver Corporation

416-874-1708

416–848–9503

Cautionary Statement on Forward-Looking Information:

This press release contains certain statements that constitute forward-looking information and forward-looking statements within the meaning of applicable securities laws ("forward-looking statements"), which reflects management's expectations regarding the Company's future growth and business prospects and opportunities. Forward-looking statements include, without limitation, including the anticipated use of proceeds of the Offering, and possible events, conditions or results of operations, future economic conditions expectations and anticipated courses of action, including the Company's ability to finance, develop, achieve commercial production at and operate Relief Canyon and the expected timing and completion of the Company's exercise of its option to acquire the San Felipe development project. Although the forward-looking statements contained in this press release reflect management's current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, such forward-looking statements are based upon assumptions, opinions and analysis that management believes to be reasonable and relevant but that may prove to be incorrect. The Company cautions you not to place undue reliance upon any such forward-looking statements.

Americas Gold and Silver Corporation TSE:USA

Alternate Symbol(s): USAS

CORPORATE PRESENTATION JULY 2020

https://www.americas-gold.com/site/assets/files/5498/presentation20200805.pdf

https://www.americas-gold.com/

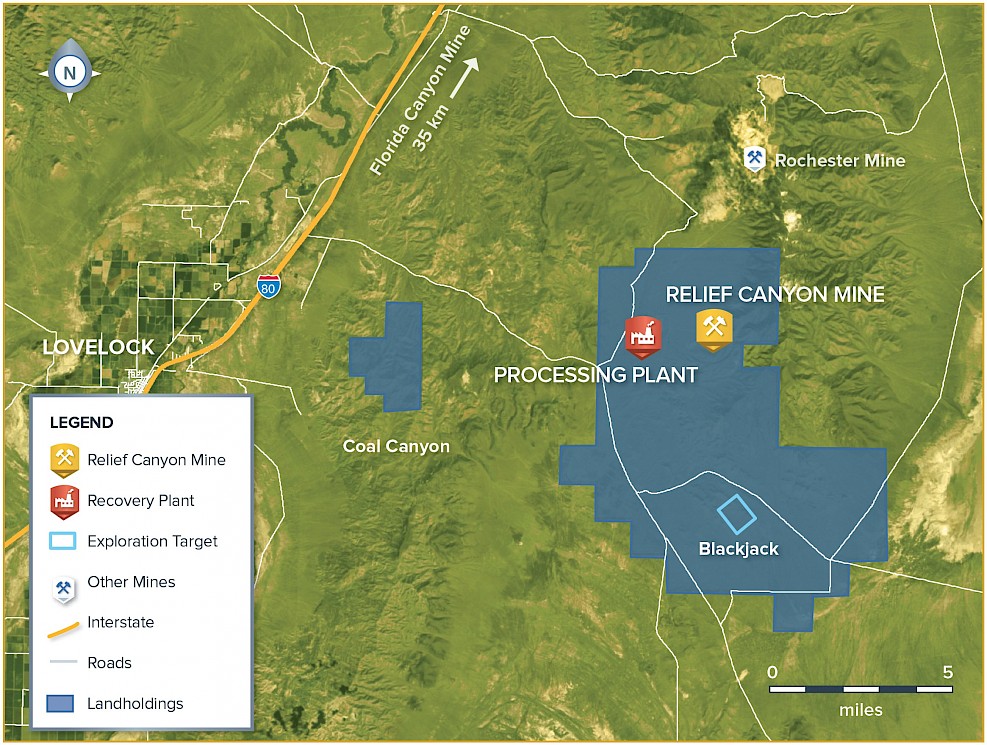

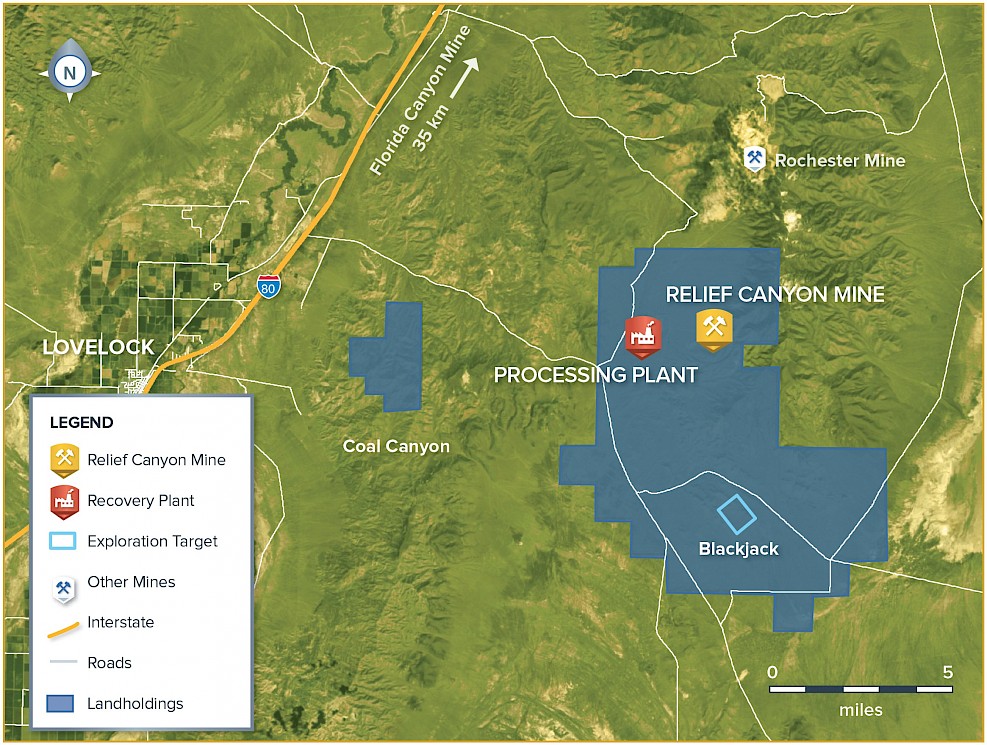

Relief Canyon

Mining in Nevada

Nevada has the second largest gold reserves in the world. It has 23 major gold mines, produces five million ounces of gold annually, and has produced more than 152 million gold ounces since 1835. Nevada has a stable tax regime, robust legal framework, streamlined permitting process, nearby infrastructure and unparalleled access to qualified labor. It is ranked by the Fraser Institute as the fourth most mining friendly jurisdiction in the world.

Relief Canyon Mine and Processing Facility

The Relief Canyon Mine is located in Pershing County, Nevada. The project encompasses an open pit mine and heap leach processing facility. Americas Gold and Silver is currently permitted to begin mining and processing at Relief Canyon under the existing Plan of Operations.

Americas Gold and Silver's landholdings cover approximately 25,000 acres that include the Relief Canyon Mine asset and lands surrounding the mine in all directions. This land package provides Americas Gold and Silver with the opportunity to expand the Relief Canyon deposit and to explore and make new discoveries on nearby lands.

The existing gold recovery plant has the capacity to handle three thousand gallons per minute of gold bearing solution. The leach pad is permitted to hold 21 million tons and can be readily expanded. A crushing and conveying system will be constructed to allow ore placement of over 6 million tons per year. The facility is conveniently situated to process ore from future discoveries of satellite deposits.

Relief Canyon is situated at the southern edge of the Pershing Gold and Silver trend along the Humboldt Range. It is approximately 95 miles northeast of Reno, Nevada. Electricity is available on the property, and water is available from two wells located east of the processing plant. The City of Lovelock is located approximately 19 miles by road west-southwest of Relief Canyon.

Permitting

Currently, Americas Gold and Silver has all state and federal permits necessary to begin mining and heap leach processing operations. Americas Gold and Silver is following a two-phase approach for project permitting. Phase I, which has been approved, is the re-purposing of previously approved disturbance for expanded mining to a pit bottom elevation of 5,080 feet, partial backfilling of the pit to eliminate formation of a pit lake, expanded exploration operations, full build-out of the heap leach pad to accommodate leaching of the Phase I ore, and construction of a new waste rock storage facility. This phase will carry the project through the first 30 months of operation. During this period the Company will pursue approval of the Phase II permits to allow production from the entire reserve. The key aspects of this phase involve further pit expansion and formation of a pit lake upon closure (i.e. no backfilling required). Technical data supporting the Phase II permit was submitted in June 2018 and accepted as complete in February 2019. It is anticipated that the Phase II permitting process will conclude in the second half of 2020.

Processing

The Relief Canyon mine has proven production history to show the ore is amenable to cyanide heap leach processing. More recent metallurgical test work on drill core and bulk samples has confirmed the viability of heap leach processing for additional resources identified within the proposed pit. The metallurgical test work covers all three distinct mineralized zones identified in geological modeling; Main, Lower, and Jasperoid.

The planned processing method is heap leach cyanidation of primary crushed ore (80% passing three inch) that has been agglomerated using cement and conveyor stacked in 20-foot lifts. The primary leach cycle lasts approximately 130 days.

The column-leach and permeability tests indicate that agglomeration is required in order to achieve hydraulic conductivity and a corresponding gold recovery on a consistent basis. There is also evidence that blending of low and high fines content material will aid hydraulic conductivity.

The Best Investment Advice by Warren Buffett & Charlie Munger | BerkshireHathaway 1999

397 views•Aug 16, 2020

Americas Gold and Silver Corporation TSE:USA

Alternate Symbol(s): USAS

CORPORATE PRESENTATION JULY 2020

https://www.americas-gold.com/site/assets/files/5498/presentation20200805.pdf

https://www.americas-gold.com/

Relief Canyon

Mining in Nevada

Nevada has the second largest gold reserves in the world. It has 23 major gold mines, produces five million ounces of gold annually, and has produced more than 152 million gold ounces since 1835. Nevada has a stable tax regime, robust legal framework, streamlined permitting process, nearby infrastructure and unparalleled access to qualified labor. It is ranked by the Fraser Institute as the fourth most mining friendly jurisdiction in the world.

Relief Canyon Mine and Processing Facility

The Relief Canyon Mine is located in Pershing County, Nevada. The project encompasses an open pit mine and heap leach processing facility. Americas Gold and Silver is currently permitted to begin mining and processing at Relief Canyon under the existing Plan of Operations.

Americas Gold and Silver's landholdings cover approximately 25,000 acres that include the Relief Canyon Mine asset and lands surrounding the mine in all directions. This land package provides Americas Gold and Silver with the opportunity to expand the Relief Canyon deposit and to explore and make new discoveries on nearby lands.

The existing gold recovery plant has the capacity to handle three thousand gallons per minute of gold bearing solution. The leach pad is permitted to hold 21 million tons and can be readily expanded. A crushing and conveying system will be constructed to allow ore placement of over 6 million tons per year. The facility is conveniently situated to process ore from future discoveries of satellite deposits.

Relief Canyon is situated at the southern edge of the Pershing Gold and Silver trend along the Humboldt Range. It is approximately 95 miles northeast of Reno, Nevada. Electricity is available on the property, and water is available from two wells located east of the processing plant. The City of Lovelock is located approximately 19 miles by road west-southwest of Relief Canyon.

Permitting

Currently, Americas Gold and Silver has all state and federal permits necessary to begin mining and heap leach processing operations. Americas Gold and Silver is following a two-phase approach for project permitting. Phase I, which has been approved, is the re-purposing of previously approved disturbance for expanded mining to a pit bottom elevation of 5,080 feet, partial backfilling of the pit to eliminate formation of a pit lake, expanded exploration operations, full build-out of the heap leach pad to accommodate leaching of the Phase I ore, and construction of a new waste rock storage facility. This phase will carry the project through the first 30 months of operation. During this period the Company will pursue approval of the Phase II permits to allow production from the entire reserve. The key aspects of this phase involve further pit expansion and formation of a pit lake upon closure (i.e. no backfilling required). Technical data supporting the Phase II permit was submitted in June 2018 and accepted as complete in February 2019. It is anticipated that the Phase II permitting process will conclude in the second half of 2020.

Processing

The Relief Canyon mine has proven production history to show the ore is amenable to cyanide heap leach processing. More recent metallurgical test work on drill core and bulk samples has confirmed the viability of heap leach processing for additional resources identified within the proposed pit. The metallurgical test work covers all three distinct mineralized zones identified in geological modeling; Main, Lower, and Jasperoid.

The planned processing method is heap leach cyanidation of primary crushed ore (80% passing three inch) that has been agglomerated using cement and conveyor stacked in 20-foot lifts. The primary leach cycle lasts approximately 130 days.

The column-leach and permeability tests indicate that agglomeration is required in order to achieve hydraulic conductivity and a corresponding gold recovery on a consistent basis. There is also evidence that blending of low and high fines content material will aid hydraulic conductivity.

The Best Investment Advice by Warren Buffett & Charlie Munger | BerkshireHathaway 1999

397 views•Aug 16, 2020

Americas Gold and Si (USA)

4.13 ? -0.37 (-8.22%)

Volume: 347,198 @08/11/20 12:56:05 PM EDT

Bid Ask Day's Range

4.12 4.13 4.09 - 4.31

TSX:USA Detailed Quote

Americas Gold and Si (USA)

3.18 ? -0.19 (-5.64%)

Volume: 442,615 @06/11/20 1:18:27 PM EDT

Bid Ask Day's Range

3.18 3.19 3.14 - 3.38

TSX:USA Detailed Quote

Americas Gold and Silver Announces Closing of C$28.75 Million Bought Deal Financing

https://www.americas-gold.com/news-releases/2020/americas-gold-and-silver-announces-closing-of-c-28.75-million-bought-deal-financing/

TORONTO, ONTARIO - May 13, 2020 -

Americas Gold and Silver Corporation (“the “Company”) (TSX:USA; NYSE American: USAS) is pleased to announce that it has closed its previously announced bought deal financing with a syndicate of underwriters co-led by Cormark Securities Inc. and Desjardins Capital Markets (collectively, the “Underwriters”). A total of 10,269,500 common shares of the Company (the “Common Shares”), including the exercise of the over-allotment option in full by the Underwriters, were sold at a price of C$2.80 per Common Share, for aggregate gross proceeds to the Company of C$28,754,600 (the “Offering”).

The net proceeds from the sale of the Common Shares will be used for working capital and general corporate purposes, primarily the exploration, development and/or improvement of the Company’s existing mine properties, including those relating to bringing Relief Canyon into commercial production.

The Offering was made by way of a prospectus supplement dated May 7, 2020 (the “Prospectus Supplement”) to the Company’s base shelf prospectus dated June 28, 2019 (the “Base Shelf Prospectus”). The Prospectus Supplement was filed in Alberta, British Columbia and Ontario and, together with the related Base Shelf Prospectus, are available on SEDAR at www.sedar.com.

The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or under any U.S. state securities laws, and may not be offered, sold, directly or indirectly, or delivered within the “United States” or to, or for the account or benefit of, persons in the “United States” or “U.S. persons” (as such terms are defined in Regulation S under the U.S. Securities Act) except in certain transactions exempt from the registration requirements of the U.S. Securities Act and all applicable U.S. state securities laws. This release does not constitute an offer to sell or a solicitation of an offer to buy such securities in the United States, Canada or in any other jurisdiction where such offer, solicitation or sale is unlawful.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in North America. The Company’s newest asset, Relief Canyon in Nevada, USA, has poured first gold and is expected to ramp up to full production over the course of 2020. The Company also owns and operates the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned Galena Complex in Idaho, USA. The Company also holds an option on the San Felipe development project in Sonora, Mexico. For further information, please see SEDAR or www.americas-gold.com.

For more information:

Stefan Axell

VP, Corporate Development & Communications

Americas Gold and Silver Corporation

416-874-1708

Darren Blasutti

President and CEO

Americas Gold and Silver Corporation

416-848-9503

Cautionary Statement on Forward-Looking Information:

This press release contains certain statements that constitute forward-looking information within the meaning of applicable securities laws ("forward-looking statements"), which reflects management's expectations regarding the Company's future growth and business prospects and opportunities. Forward-looking statements include, without limitation, the anticipated use of proceeds of the Offering, and possible events, conditions or results of operations, future economic conditions expectations and anticipated courses of action. Although the forward-looking statements contained in this press release reflect management's current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, such forward-looking statements are based upon assumptions, opinions and analysis that management believes to be reasonable and relevant but that may prove to be incorrect. The Company cautions you not to place undue reliance upon any such forward-looking statements.

The risks and uncertainties that may affect forward-looking statements include, among others: the inherent risks involved in exploration and development of mineral properties, including government approvals and permitting, changes in economic conditions, state of the financial markets, changes in the worldwide price of gold and other key inputs, changes in mine plans and other factors, the impact of the novel coronavirus (COVID-19), such as project execution delays, many of which are beyond the control of the Company, as well as other risks and uncertainties which are more fully described in the Company's Annual Information Form dated March 9, 2020 and in other filings of the Company with securities and regulatory authorities which are available on SEDAR at www.sedar.com. The Company does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change. Nothing in this document should be construed as either an offer to sell or a solicitation to buy or sell the Company securities. All references to the Company include its subsidiaries unless the context requires otherwise.

Americas Gold and Silver Corporation Reports First Quarter 2020 Results

TORONTO, ONTARIO - May 15, 2020 - Americas Gold and Silver Corporation (“Americas” or the “Company”) (TSX: USA; NYSE American: USAS), a growing North American precious metals producer, today reported consolidated financial and operational results for the first quarter of 2020.

https://www.americas-gold.com/news-releases/2020/americas-gold-and-silver-corporation-reports-first-quarter-2020-results/

This earnings release should be read in conjunction with the Company’s Management’s Discussion and Analysis, Financial Statements and Notes to Financial Statements for the corresponding period, which have been posted on the Americas Gold and Silver Corporation SEDAR profile at www.sedar.com, on its EDGAR profile at www.sec.gov, and are also available on the Company’s website at www.americas-gold.com. All figures are in U.S. dollars unless otherwise noted.

Operational and First Quarter Financial Highlights

Relief Canyon continues to ramp-up following first gold pour in February and the Company is focused on achieving commercial production by late Q2-2020 or early Q3-2020.

Subsequent to Q1-2020, the Company closed a bought deal public offering for gross proceeds of approximately C$28.75 million which provides the Company with available capital to address working capital needs including bringing Relief Canyon into commercial production, particularly in the COVID-19 environment.

As a result of Relief Canyon being in pre-commercial production, the Cosalá Operations producing for less than a month during the quarter, and the exclusion of operating metrics from the Galena Complex during the Galena recapitalization plan (“Recapitalization Plan”), Q1-2020 revenue was $7.3 million resulting in a net loss of $4.1 million or ($0.03) per share.

Cosalá production for the first 26 days of Q1-2020 yielded 420 gold equivalent ounces[1] or 0.3 million silver equivalent ounces[2] at cost of sales of $7.19/oz equivalent silver, by-product cash cost[3] of negative ($11.32/oz) silver, and all-in sustaining cost3 of negative ($0.83/oz) silver.

The Galena Recapitalization Plan is proceeding better than expected with the Company seeing both increased production and encouraging exploration results.

Outlook for 2021 continues to be 90,000 to 110,000 gold equivalent ounces at expected all-in sustaining costs[4] of $900 to $1,100 per gold equivalent ounce.

At March 31, 2020, the Company had a cash balance of approximately $16.4 million.

The Company has chosen not to host a conference call to discuss the Q1-2020 results given the limited production and the extensive operations update released on May 4, 2020. The Company will resume the quarterly conference calls following its Q2-2020 results.

“The Company is in a great position to benefit from the strong gold price environment moving forward as we addressed common start-up challenges at Relief Canyon and it continues to ramp-up” said Americas President & CEO Darren Blasutti. “All operating aspects at Relief Canyon are trending positively, the Cosalá Operations should be able to resume production early in the second half of 2020 as we have had several encouraging developments in Mexico and the Galena Recapitalization Plan is proceeding better than expected. The recently completed financing provides the Company with sufficient working capital to bring Relief Canyon to commercial production.”

Relief Canyon

The Company issued a press release on May 4, 2020 providing details of the Relief Canyon ramp-up. The Company continues to target commercial production by late Q2-2020 or early Q3-2020 and will be providing more regular updates regarding the operation between now and then.

Since the start of pre-production, approximately 5.2 million tonnes of material have been mined, including 4.2 million tonnes of waste and 1.0 million tonnes of ore. Waste movement is ahead of budget and the operation currently has an ore stockpile of approximately 0.2 million tonnes ahead of the crusher waiting to be placed on the leach pad.

Approximately 0.8 million tonnes of ore have been stacked on the leach pad. Solution flow rates from the pad have continued to increase since the update on May 4, 2020 as the surface area available for leach irrigation has increased.

Cosalá Operations

The Cosalá Operations operated for the first 26 days of the quarter as the operation was negatively impacted by the previously announced illegal blockade since the end of January 2020. As a result, operating results year-over-year were negatively impacted and not generally comparable.

On March 31, 2020, the Government of Mexico issued a national COVID-19 related decree for the temporary suspension of all non-essential businesses in the country, including all mining operations. This week the Government of Mexico issued a number of statements that are expected to allow for the re-opening of mining operations starting in June 2020. The Company believes this will provide a pathway for the Cosalá Operations to resume production early in the second half of 2020, including a legal and legitimate labour representative for its workers, allowing for a resolution to the current illegal blockade. The Company’s priority continues to be the safety of its workers and the community of Cosalá that have been negatively impacted – first by the illegal blockade and now by COVID-19.

Galena Complex

In addition to providing an update regarding the ramp-up of Relief Canyon, the Company also provided an extensive update regarding the Galena Recapitalization Plan in the May 4, 2020 update, including information regarding the rehabilitation development , equipment purchases, and early drill results from the 39,000-meter drill program.

The Company has suspended disclosure of certain operating metrics such as cash costs, and all-in sustaining costs for the Galena Complex until the Recapitalization Plan is substantially completed; the Galena Complex results are not included in the Consolidated Results.

Consolidated Financial and Consolidated Production[5] Results

Consolidated operating results from Q1-2020 are generally not comparable to Q1-2019 due to the illegal blockade temporarily halting mining and processing at the Cosalá Operations, and the exclusion of operating results from the Galena Complex as a result of the Recapitalization Plan. Consolidated operating results include only 26 days of production from the Cosalá Operations.

Gross revenue decreased by $10.5 million during Q1-2020 compared to Q1-2019 primarily due to the illegal blockade. This decrease was offset by a $0.9 million increase in silver and lead revenue at the Galena Complex from increased production in the early stages of the Recapitalization Plan.

Consolidated cost of sales was $7.19/oz equivalent silver representing an increase year-over-year, while by-product cash cost was negative ($11.32/oz) silver, and all-in sustaining cost was negative ($0.83/oz) silver, representing increases year-over-year, respectively.

Further information concerning the consolidated and individual mine operations is included in the Company’s first quarter Condensed Interim Consolidated Financial Statements for the three months ended March 31, 2020 and Management’s Discussion and Analysis for the three months ended March 31, 2020.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in North America. The Company’s newest asset, Relief Canyon in Nevada, USA, has poured first gold and is expected to ramp up to full production over the course of 2020. The Company also owns and operates the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned Galena Complex in Idaho, USA. The Company also holds an option on the San Felipe development project in Sonora, Mexico. For further information, please see SEDAR or www.americas-gold.com.

Qualified Persons

Darren Dell, P.Eng., Chief Operating Officer and Niel de Bruin, Director of Geology, who are each employees of the Company and a “qualified person” under National Instrument 43-101, have approved the applicable contents of this news release.

For more information:

Stefan Axell

VP, Corporate Development & Communications

Americas Gold and Silver Corporation

416-874-1708

Darren Blasutti

President and CEO

Americas Gold and Silver Corporation

416-848-9503

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information includes, but is not limited to, Americas Gold and Silver’s expectations, intentions, plans, assumptions and beliefs with respect to, among other things, estimated production rates and results for gold, silver and other precious metals, as well as the related costs, expenses and capital expenditures, the Company’s construction, production, development plans and performance expectations at the Relief Canyon Mine, , its ability to finance, develop and operate Relief Canyon, including the anticipated timing of commercial production at Relief Canyon, the resolution and removal of the illegal blockade at the Company’s Cosalá Operations and the resumption of mining and processing operations, the resolution, easing or removal of the temporary restrictions on all non-essential businesses in Mexico resulting from the COVID-19 pandemic affecting the Company’s Cosalá Operations, and the expected use of the net proceeds from the Company’s bought deal equity financing. Often, but not always, forward-looking information can be identified by forward-looking words such as “anticipate”, “believe”, “expect”, “goal”, “plan”, “intend”, “potential’, “estimate”, “may”, “assume” and “will” or similar words suggesting future outcomes, or other expectations, beliefs, plans, objectives, assumptions, intentions, or statements about future events or performance. Forward-looking information is based on the opinions and estimates of Americas Gold and Silver as of the date such information is provided and is subject to known and unknown risks, uncertainties, and other factors that may cause the actual results, level of activity, performance, or achievements of Americas Gold and Silver to be materially different from those expressed or implied by such forward-looking information. With respect to the business of Americas Gold and Silver, these risks and uncertainties include risks relating to widespread epidemics or pandemic outbreak including the COVID-19 pandemic; the impact of COVID-19 on our workforce, suppliers and other essential resources and what effect those impacts, if they occur, would have on our business, including our ability to access goods and supplies, the ability to transport our products and impacts on employee productivity, the risks in connection with the operations, cash flow and results of the Company relating to the unknown duration and impact of the COVID-19 pandemic; interpretations or reinterpretations of geologic information; unfavorable exploration results; inability to obtain permits required for future exploration, development or production; general economic conditions and conditions affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral and commodity prices; the ability to obtain necessary future financing on acceptable terms or at all; the ability to develop, complete construction, bring to production and operate the Relief Canyon Project; and risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), ground conditions and other factors limiting mine access, failure of plant, equipment, processes and transportation services to operate as anticipated, environmental risks, government regulation, actual results of current exploration and production activities, possible variations in ore grade or recovery rates, permitting timelines, capital and construction expenditures, reclamation activities, labor relations or disruptions, social and political developments and other risks of the mining industry. The potential effects of the COVID-19 pandemic on our business and operations are unknown at this time, including the Company’s ability to manage challenges and restrictions arising from COVID-19 in the communities in which the Company operates and our ability to continue to safely operate and to safely return our business to normal operations. The impact of COVID-19 on the Company is dependent on a number of factors outside of its control and knowledge, including the effectiveness of the measures taken by public health and governmental authorities to combat the spread of the disease, global economic uncertainties and outlook due to the disease, and the evolving restrictions relating to mining activities and to travel in certain jurisdictions in which it operate. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, or intended. Readers are cautioned not to place undue reliance on such information. Additional information regarding the factors that may cause actual results to differ materially from this forward-looking information is available in Americas filings with the Canadian Securities Administrators on SEDAR and with the SEC. Americas does not undertake any obligation to update publicly or otherwise revise any forward-looking information whether as a result of new information, future events or other such factors which affect this information, except as required by law. Americas does not give any assurance (1) that Americas will achieve its expectations, or (2) concerning the result or timing thereof. All subsequent written and oral forward-looking information concerning Americas are expressly qualified in their entirety by the cautionary statements above.

[1] Gold equivalent production throughout this press release was calculated based on the average gold spot metal prices and average silver realized metal prices during each respective period.

[2] Silver equivalent production throughout this press release was calculated based on all metals production at average gold spot prices, and average silver, zinc, and lead realized prices during each respective period.

[3] Cash cost per ounce and all-in sustaining cost per ounce are non-IFRS performance measures with no standardized definition. For further information and detailed reconciliations, please refer to the Company’s 2019 year-end and quarterly MD&A.

[4] Net of by-product zinc and lead credits assuming $1.05/lbs zinc and $0.90/lbs lead

[5] Throughout this press release, Q1-2020 consolidated production results exclude Q1-2020 from the Galena Complex due to the Recapitalization Plan.

2020

2019

2018

2017

2016

2015

2014

CORPORATE

Americas Gold and Silver Announces C$25 Million Bought Deal Public Offering

T.USA | 7 hours ago

TORONTO, May 5, 2020 /CNW/ - Americas Gold and Silver Corporation ("the "Company") (TSX:USA; NYSE American: USAS)

has today entered into an agreement with a syndicate of underwriters co-led by Cormark Securities Inc. and Desjardins Capital Markets (collectively, the "Underwriters") pursuant to which the Underwriters have agreed to purchase on a bought deal basis 8,930,000 common shares of the Company (the "Common Shares") at a price of C$2.80 per Common Share (the "Offering Price"), for aggregate gross proceeds of approximately C$25,000,000 (the "Offering").

The Company has also granted an option to the Underwriters, exercisable until 11:59 p.m. on the 30th day following the closing date of the Offering to purchase, from the Company such number of additional common shares of the Company as is equal to 15% of the number of common shares of the Company at the Offering Price for market stabilization purposes and to cover over-allotments, if any.

Strategic investors led by Pierre Lassonde and Eric Sprott have indicated that they intend to subscribe for such number of common shares from the offering totalling C$8.75 million.

The proceeds from the sale of the Common Shares will be used for working capital and general corporate purposes, which may include the exploration, development and/or improvement of the Company's existing mine properties, including those relating to bringing Relief Canyon into commercial production.

The Offering will be made by way of a prospectus supplement (the "Prospectus Supplement") to the Company's base shelf prospectus dated June 28, 2019. The Prospectus Supplement will be filed in Alberta, British Columbia and Ontario and, together with the related Base Shelf Prospectus, will be available on SEDAR at www.sedar.com.

Closing of the Offering is expected to take place on or about May 13, 2020 and is subject to the receipt of approvals of the Toronto Stock Exchange and the NYSE American LLC and other necessary regulatory approvals.

The securities to be offered have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or under any U.S. state securities laws, and may not be offered, sold, directly or indirectly, or delivered within the "United States" or to, or for the account or benefit of, persons in the "United States" or "U.S. persons" (as such terms are defined in Regulation S under the U.S. Securities Act) except in certain transactions exempt from the registration requirements of the U.S. Securities Act and all applicable U.S. state securities laws. This release does not constitute an offer to sell or a solicitation of an offer to buy such securities in the United States, Canada or in any other jurisdiction where such offer, solicitation or sale is unlawful.

Forward-Looking Statements

This press release contains certain statements that constitute forward-looking information within the meaning of applicable securities laws ("forward-looking statements"), which reflects management's expectations regarding the Company's future growth and business prospects and opportunities. Forward-looking statements include, without limitation, all disclosure regarding closing of the Offering, the anticipated use of proceeds of the Offering, and possible events, conditions or results of operations, future economic conditions expectations and anticipated courses of action. Although the forward-looking statements contained in this press release reflect management's current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, such forward-looking statements are based upon assumptions, opinions and analysis that management believes to be reasonable and relevant but that may prove to be incorrect. The Company cautions you not to place undue reliance upon any such forward-looking statements.

The risks and uncertainties that may affect forward-looking statements include, among others: the inherent risks involved in exploration and development of mineral properties, including government approvals and permitting, changes in economic conditions, state of the financial markets, changes in the worldwide price of gold and other key inputs, changes in mine plans and other factors, the impact of the novel coronavirus (COVID-19), such as project execution delays, many of which are beyond the control of the Company, as well as other risks and uncertainties which are more fully described in the Company's Annual Information Form dated March 9, 2020 and in other filings of the Company with securities and regulatory authorities which are available on SEDAR at www.sedar.com. The Company does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change. Nothing in this document should be construed as either an offer to sell or a solicitation to buy or sell the Company securities. All references to the Company include its subsidiaries unless the context requires otherwise.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in North America. The Company's newest asset, Relief Canyon in Nevada, USA, has poured first gold and is expected to ramp up to full production over the course of 2020. The Company also owns and operates the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned Galena Complex in Idaho, USA. The Company also holds an option on the San Felipe development project in Sonora, Mexico. For further information, please see SEDAR or www.americas-gold.com.

SOURCE Americas Gold and Silver Corporation

Cision View original content: http://www.newswire.ca/en/releases/archive/May2020/05/c8832.html

Stefan Axell, VP, Corporate Development & Communications, Americas Gold and Silver Corporation, 416-874-1708; Darren Blasutti, President and CEO, Americas Gold and Silver Corporation, 416-848-9503Copyright CNW Group 2020

Canada Newswire

May 5, 2020 - 4:34 AM PDT

Tags:

INDUSTRIAL METALS & MINERALS

Investing News

8.82K subscribers

At this year’s PDAC convention, the Investing News Network caught up with

Darren Blasutti, CEO of Americas Gold and Silver.

#PDAC2020 #Gold #Investing

Americas Gold and Si (USA)

3.05 ? -0.08 (-2.56%)

Volume: 140,611 @04/30/20 10:47:03 AM EDT

Bid Ask Day's Range

3.04 3.05 3.02 - 3.13

TSX:USA Detailed Quote

Americas Gold and Silver: Gold to Rise Strongly, Equities to Follow

Americas Gold and Silver Corporation

TSX Exchange | Mar 19, 2020, 3:26 PM EDT | Real-time price

logo

USA $ 2.19 RT

CHANGE

0.22 (11.168%)

VOLUME

442,345

Day Low: 1.85

Day High: 2.19

52 Week Low: 1.39

52 Week High: 5.20

Americas Gold And Silver Corporation Reports Full-Year 2019 Financial Results

T.USA | 1 day ago

TORONTO, March 9, 2020 /CNW/ --

Americas Gold and Silver Corporation (TSX: USA) (NYSE American: USAS) ("Americas" or the "Company"), a growing North American precious metals producer, today reported consolidated financial and operational results for the year ended December 31, 2019 and provided a general update on the operations.

This earnings release should be read in conjunction with the Company's Management's Discussion and Analysis, Financial Statements and Notes to Financial Statements for the corresponding period, which have been posted on the Americas Gold and Silver Corporation SEDAR profile at www.sedar.com, on its EDGAR profile at www.sec.gov, and are also available on the Company's website at www.americas-gold.com. All figures are in U.S. dollars unless otherwise noted.

Year-End and Operational Highlights

Revenue of $58.4 million and net loss of $34.2 million for the full-year of 2019 or ($0.46) per share, a decrease of $10.0 million in revenue and an increase in net loss of $23.5 million compared to year-end of 2018. Adjusted net income1 was $23.3 million prior to one-time adjustments or ($0.30) per share

Previously reported year-end consolidated production2 of approximately 5.8 million silver equivalent ounces3 and 1.2 million silver ounces, representing decreases of 7% and 18% year-over-year to both silver equivalent ounces and silver ounces, respectively. Galena silver production for the fourth quarter was not included as a result of the start of the Recapitalization Plan accounting for the majority of the production decreases year-over-year.

Previously reported year-end consolidated cash costs4 of $4.61 per silver ounce and all-in sustaining costs4 of $12.71 per silver ounce, both representing increases year-over-year.

Successfully poured first gold in February 2020 at the Company's Relief Canyon mine in Nevada and completed initial construction estimated to be within the guidance of $28 - $30 million.

Mined tonnage at Relief Canyon is tracking ahead of schedule and the ore stacking rate is ramping up. To date, the operation has over 250,000 tonnes of ore placed on the leach pad with commercial production expected before the end of Q2-2020.

With the addition of Relief Canyon, precious metals production is expected to increase by over 300% in 2020 to 60,000 – 70,000 Gold Equivalent Ounces5 ("GEO") and by over 500% in 2021 to 90,000 – 110,000 GEOs compared to approximately 14,000 GEOs produced in 2019.

The Company has tremendous support from employees and contractors at the Cosalá Operations following the illegal blockade of the operations. The Company continues to actively engage with all levels of Government regarding the illegal blockade and hopes to resolve the dispute by the end of Q1-2020.

The Galena Complex Recapitalization Plan began in mid Q4-2019 and continues into 2021. The joint venture has purchased new equipment, refurbished existing equipment and completed extensive re-development in the 4300 and 5500 Levels. Over 10,000 feet of new drilling has been completed with several promising targets being evaluated. The operation has already begun to experience an increase in production rates over 2019.

The Company had a cash balance of approximately $20.0 million as at December 31, 2019.

"The Company delivered Relief Canyon to first gold pour within nine months from the commencement of construction; an impressive accomplishment for our team in a short period of time," said Americas President & CEO Darren Blasutti. "Relief Canyon is expected to significantly increase precious metal exposure by 500% by fiscal 2021 and increase the overall profitability of the Company as we deliver full production into a rising gold price environment after successfully acquiring the gold asset when gold was trading at less than $1,200 per ounce in early 2019. The Cosalá Operations successfully executed its production plans for the year increasing mill tonnage to over 1,750 per operating day, and increasing production of precious and by-product metals. The Galena Recapitalization Plan is being executed as planned with the purchase and delivery of essential equipment and drilling commencement. The Company is well positioned for the continued transition to a profitable, high-growth, precious metals producer as Relief Canyon ramps up."

Consolidated Financial and Operational Results

Consolidated Financial, Production and Cost Detail

20192

2018

Revenues ($M)

$58.4

$68.4

Net Loss ($M)

$(34.2)

$(10.7)

Comprehensive Loss ($M)

$(35.1)

$(9.9)

Total ore processed (tonnes milled)

701,884

685,152

Silver produced (ounces)

1,163,618

1,417,537

Zinc produced (pounds)

43,314,002

34,219,472

Lead produced (pounds)

26,193,098

30,466,799

Silver equivalent produced2 (ounces)

5,836,446

6,286,531

Silver recovery (percent)

73.2

76.6

Silver grade (grams per tonne)

70

84

Zinc grade (percent)

3.96

3.65

Lead grade (percent)

2.12

2.46

Silver sold (ounces)

1,159,432

1,424,745

Zinc sold (pounds)

41,733,934

33,714,154

Lead sold (pounds)

26,129,771

30,620,153

Realized Silver Price ($ per ounce)

$15.99

$15.65

Realized Zinc Price ($ per pound)

$1.19

$1.32

Realized Lead Price ($ per pound)

$0.91

$1.02

Cost of sales ($ per equivalent silver ounce)

$8.43

$8.29

Silver cash cost3 ($ per silver ounce)

$4.61

$(0.63)

All-in sustaining cost3 ($ per silver ounce)

$12.71

$9.80

The Company's San Rafael mine in Mexico had continued success during fiscal 2019 as mill tonnage increased by 13% and sustained an average milling rate of approximately 1,750 tonnes per operating day during the year. Silver grade and recovery both increased by approximately 6% and 8%, respectively, with base metal grades and recoveries also increasing. These improvements resulted in increases of 28%, 27% and 27% in silver, zinc and lead production when compared to 2018. Despite the Cosalá Operation's strong performance, consolidated silver equivalent production decreased 7% to approximately 5.8 million ounces compared to production of 6.3 million ounces during 2018. Consolidated silver production for 2019 was approximately 1.2 million silver ounces, a decrease of 18% compared to 2018. The decrease in metal production was due to lower tonnage, and silver and lead grades at the Galena Complex prior to commencement of the Recapitalization Plan in Q4-2019, partially offset by strong results at the Cosalá Operations.

Gross revenue decreased by $1.4 million compared to 2018 primarily due to a decrease in silver equivalent production despite increases in realized silver prices during the year. The silver spot price increased to an average of $16.21 per ounce in 2019 from an average of $15.71 per ounce in 2018 as uncertainty in global markets increased during the year with further increases in precious metal prices generally continuing into fiscal 2020. Net revenues were further negatively impacted by an increase in concentrate treatment and refining charges of $8.5 million or 32% over 2018 for a net total decrease in revenue of $9.9 million.

The Company's profitability was negatively impacted in fiscal 2019 by: the lower tonnage and grades at the Galena Complex without a corresponding decrease in costs; lower by-product metal prices; higher zinc treatment charges at the Cosalá Operations lowering net revenues; higher cost of sales primarily at the Cosalá Operations due to higher tonnage mined and milled; higher depletion and amortization due to higher production; and higher non-cash items such as share-based payments and loss on derivative instruments. Consolidated cash costs increased during the year primarily due to higher industry-wide zinc concentrate treatment charges, as well as lower production and lower grades at the Galena Complex.

Further information concerning the consolidated and individual mine operations is included in the Company's year-end Consolidated Financial Statements for the year ended December 31, 2019 and Management's Discussion and Analysis for the year ended December 31, 2019.

Consolidated 2-Year Production Outlook

Table 1*

Consolidated 2-Year Outlook (Excluding the Galena Complex)

2020 Guidance

2021 Outlook

Gold Production (ounces)

50 – 60 koz

80 – 90 koz

Silver Production (ounces)

0.8 – 0.9 Moz

1.0 – 1.5 Moz

Gold Equivalent Production (ounces)

60 – 70 koz

90 – 110 koz

All-in Sustaining Cost ($ per equivalent gold ounce)

$900 – 1,100/oz

$850 – 1,050/oz

Cost of Sales ($ per equivalent gold ounce)

$1,100 – 1,250/oz

$1,000 – 1,200/oz

Sustaining Capital Expenditures ($)

$8 – 10 M

$8 – 10 M

* Forecasts for 2020 and 2021 include only Relief Canyon and the Cosalá Operations. 2020 Guidance assumes 11 months of production from the Cosalá Operations. Continuation of the blockade may impact guidance further.

The Company reiterates the forecasted production for the next two years and expects to significantly increase precious metals production with the gold contribution from Relief Canyon. This represents a significant transition from a silver/base metal producer to a predominantly precious metals producer. Precious metal production is expected to increase by over 300% in 2020 and by over 500% in 2021 when compared with production in 2019. For additional detail regarding our production outlook, please refer to the Company's press release on February 18, 2020.

Relief Canyon

Relief Canyon poured first gold in February and has over 250,000 tonnes of ore placed on the leach pad. Ore crushing and stacking is steadily improving with the addition of the night shift and is now operating on a 24-hour basis. Heap leach permeability and leaching characteristics of the ore are meeting expectations. The operation has a significant ore stockpile of over 200,000 tonnes ahead of the crusher and waste stripping is ahead of schedule. Commercial production continues to be expected before the end of Q2-2020.

Cosalá Operations

The Company continues to have discussions with government authorities at both the state and federals levels. The operation also continues to have tremendous support from its workers, local community, ejidos and small businesses in the Cosalá area which have all been negatively impacted by the illegal blockade. The Company appreciates this support.

The Company will not negotiate with representatives of this illegal blockade and is exploring all legal channels to resolve this dispute in a peaceful and timely fashion.

Galena Complex

The Galena Complex is benefiting from the Recapitalization Plan that commenced in October 2019. Equipment has arrived on site and additional equipment will continue to mobilize over the next couple of months. Productivity has improved to start the year as well as worker morale. Most importantly, there has been a steady improvement in worker safety. There has been extensive repair to the 5500 level and 4300 level drifts which will allow the operation to establish diamond drill stations to test for deep mineralization below the current workings. Finally, shaft repair at the 5500 level is also progressing which will allow the operation to re-establish the lowest loading pocket. This will reduce the need to haul ore and waste by ramp to higher levels of the mine. The Company is confident that the Recapitalization Plan will provide the Galena Complex with the intended benefits of lower costs, higher production and a longer mine life.

Year-End 2019 Conference Call

President & CEO Darren Blasutti will be hosting a year-end 2019 conference call on Monday, March 9th, 2020 at 4:30pm EST. A copy of the presentation will be made available on the company's website at www.americas-gold.com.

Step 1: Dial-In

Canada and USA Toll-Free: 1-800-750-5861

International Toll Number: 1 416-981-9007

Step 2: Online Login

https://cc.callinfo.com/r/1o51voa85hx01&eom

Callers are advised to dial-in 10-15 minutes prior to the call. As there is no audio on the participant URL, please dial-in to follow along with the presentation.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious metals mining company with multiple assets in North America. The Company's newest asset, Relief Canyon in Nevada, USA, has poured first gold and is expected to ramp up to full production over the course of 2020. The Company also owns and operates the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned Galena Complex in Idaho, USA. The Company also holds an option on the San Felipe development project in Sonora, Mexico. For further information, please see SEDAR or www.americas-gold.com

For more information:

Stefan Axell

Darren Blasutti

VP, Corporate Development & Communications

President and CEO

Americas Gold and Silver Corporation

Americas Gold and Silver Corporation

416-874-1708

416-848-9503

Cautionary Statement on Forward-Looking Information: