Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

this should have a very good day tomorrow absent a market meltdown. MS drug par excellence.

I would think we’d be close to the bottom here? Almost at a 52 week low!

GLTA,

Murocman

Cheap at these levels. Should see $20 again before long. Friday should be interesting. If script numbers are good, like last Friday, the share price should get a good boost. Half way through Q3. Dumb drop from $21 to $9.

$TGTX CEO Weiss buys 100k shares at 10.13. Now has 12 million shares

Barely above pre-approval prices. Unbelievable.

Murocman

Anyone catch that Genetech is starting to air commercials since they are losing share?

Great call this morning. Nice run today and just the beginning with Europe coming on soon.

After Hours Time (ET) After Hours Price After Hours Share Volume

17:27:17 $30.5 5,000

$152,500 in one trade. Short covering???

Fun to think about market cap in 2024 and 2025.

Where did you find such news?

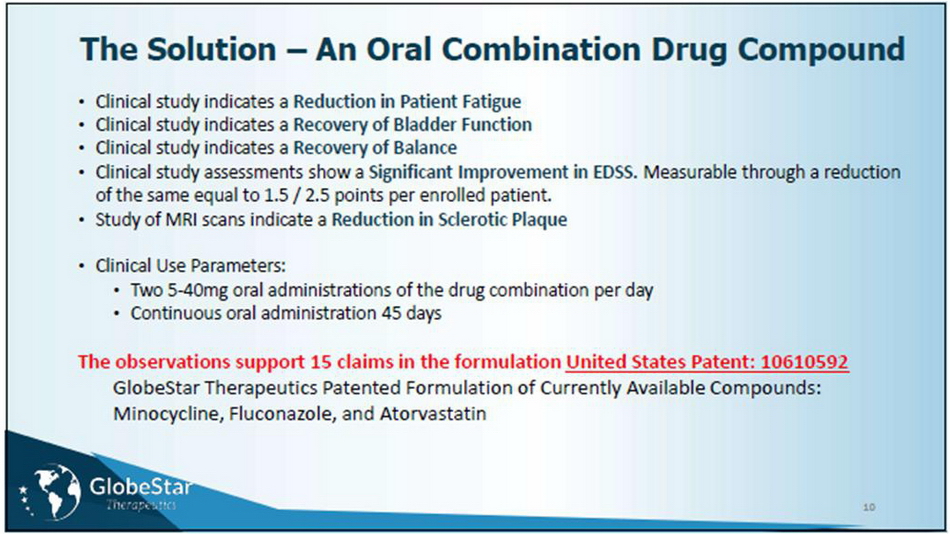

Has anyone checked out $GSTC? Similar biotech company like $TGTX except its much newer and has a patented formulation combinational therapy already FDA approved set and waiting for clinical trial approval in India for Multiple Sclerosis. It is an over-the-counter stock sitting over .01 just waiting for clinical trials approval. The market cap is on $8,000,000. The therapy isn't specific to the type of multiple sclerosis. So, the potential here is huge. The conservative market share that was done by seasoned professionals in the space, that is on their presentation is in the BILLIONs. Read the history here: https://investorshub.advfn.com/boards/read_msg.aspx?message_id=170524593

Looks like tuseday is shorting day .

They have cash and a better MS drug have the price of Roches. Shorts don’t like

$TGTX: Not only that but they must be...............

On the wrong side of the trade.

When you get squeezed on them nards, it never feels good.

No mercy....... TAKE THEM OUT !!!!!!!

GO $TGTX

Analysts keep on giving it bad sell ratings.

That must be a good sign. Analysts for the most part just share selling scam artists

Traded@55.70 Jan 8 ‘21… looks like she’s still got quite a bit togo…

Dosing of first patients in 30 to 45 days from now/going to the market!!

$TGTX No offerings on the horizon per CC

$TGTX No offerings on the horizon per CC lfg

— Cooway Trades 🐊 ⛪️🚀🇺🇸🙏🏽 (@cooway) December 29, 2022

Link to 8;30 webcast/conference call.

https://ir.tgtherapeutics.com/events

Some informative information, pictures of the packaging, disease overview, and more.

https://ml.globenewswire.com/1.0/snippet/1898/eng

TG Therapeutics Announces FDA Approval Of BRIUMVI; Company To Host Conference Call On Thursday, December 29, 2022 At 8:30 Am ET

Given a try; on this one in at 8:47 for a morning was jump !!

See if shorts cover before the weekend ??

Yeah, we may get mm naked! shorts covering tomorrow. Share price may

spike./;)) early GL$$

They have cash and they would let the price go much higher before another offering

$8.73 after hours On a good note company conference 830am and market makers

Probably an offering coming.

Unfortunately lots of illegal naked shorts courtesy of Gary G but see what happens next few days as more shorts cover.

Never a easy game kept a few shares

Damn how low is this going? Not headed in right direction at the moment.

MS drug going to make hundreds of millions..

Dec 28 (Reuters) - TG Therapeutics Inc said on Wednesday that the U.S. health regulator had approved its monoclonal antibody for treating patients with relapsing forms of multiple sclerosis, sending its shares up nearly 9% in afternoon trade.

The approval by the U.S. Food and Drug Administration (FDA) widens the number of such drugs available for treating the disorder to three and may help soften the blow to the company's finances from the withdrawal of its lymphatic cancer drug earlier this year.

TG Therapeutics said it was expecting to launch the drug, branded as Brumvi, in the first quarter of 2023, but did not give details on its pricing.

Jefferies analyst Chris Howerton said ahead of the approval that he was expecting the drug to be priced in the range of $30,000 per patient per year. In comparison, Roche's Ocrevus has a current list price of about $68,000 annually.

Multiple sclerosis is a neurological disease in which the immune system attacks the brain cells causing motor disabilities. It affects about 400,000 people in the United States, according to the National Institutes of Health.

Unlike other MS drugs that target T cells, Brumvi belongs to a class of drugs that tackles B cells' role in driving the inflammation that is central to neurological disease.

The approval, which comes with a warning of infusion reactions from the drug, was based on a late-stage study that showed the drug was effective in reducing the annualized relapse rates in patients. (Reporting by Sriparna Roy, Khushi Mandowara and Raghav Mahobe in Bengaluru; Editing by Anil D'Silva and Shailesh Kuber)

Nice Pump Moon Market

As usual they going to scare folks into

Selling there shares loooks like upper $8s bottom

Still holding about 20% regular short interest and then all the illegal naked Gary G approved ones

$TGTX: Opens at $11...........

Only the beginning now

GO $TGTX

Can be whatever you want if we see $40s..lol

God damn thought you were a woman this whole time

$TGTX: I showered.............

Balls, armpits and buttcrack............. good to go.

Took 2mins

GO $TGTX

220pm stand corrected

alfred

@macronewswire

TG THERAPEUTICS (TGTX)TO RESUME TRADING AT 2:20 P.M.

$TGTX

I'm hearing within the next hour... everyone wins!!

$TGTX: Fantastic !!!!!!!!!!!!!

Works for me

GO $TGTX

Halted I believe until 830am

Press release tomorrow. Don’t take my word but pretty sure

$TGTX: Whats the big deal about PKPH ???

Did they just get an FDA approval like $TGTX ??

GO $TGTX

$TGTX: No comment

I hope it doesn't open till tomorrow............. then yer filthy for the next 23hrs

GO $TGTX

makin..TGTX nice one, Im In !!.Check out pk*ph.., Real cheap

Well they should be. Clean trading is key

$TGTX: Then go do whatever it is you do..........

TGTX doesn't care if you wanna shower.

Stocks arent concerned about your hygiene.

GO $TGTX

$TGTX: Remember when TGTX was $55 last year .................

And we didn't have anything like this FIRE news today.

Time to make up for some lost ground, and then some

We'd be at $1 now if it never got approved

GO $TGTX

I have to take a shower

Want to see it open first

$TGTX: When it wants............

Whats the rush ???

GO $TGTX

|

Followers

|

73

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1435

|

|

Created

|

10/18/08

|

Type

|

Free

|

| Moderators | |||

Great link to a string of PRs on TGTX here:

http://ir.tgtherapeutics.com/releases.cfm

OLD R/S former Biotech info below:

About Manhattan Pharmaceuticals:

Manhattan Pharmaceuticals, Inc. (OTCBB: MHAN) is a specialty healthcare product company focused on developing and commercializing innovative treatments for underserved patient populations primarily in the areas of dermatologic disorders. Manhattan Pharmaceuticals (through a strategic joint venture partnership with Nordic Biotech) is currently developing Hedrin, a novel, non-pesticide treatment for pediculosis (head lice) and a topical GEL for the treatment of psoriasis.

Manhattan Pharmaceuticals is located in New York City and is traded on the OTC Bulletin Board® under the ticker symbol "MHAN".

What's in the pipeline?

Hedrin™ for the Treatment of Head Lice

Hedrin is a novel, non-insecticide combination of silicones (dimethicone and cyclomethicone) that acts as a pediculicidal (lice killing) agent by disrupting the insect’s mechanism for managing fluid and breathing. In contrast with most currently available lice treatments, Hedrin contains no chemical insecticides. Because Hedrin kills lice by preventing the louse from excreting waste fluid, rather than by acting on the central nervous system, the insects cannot build up resistance to the treatment. Recent studies have indicated that resistance to chemical insecticides may be increasing and therefore contributing to insecticide treatment failure. Manhattan Pharmaceuticals believes there is significant market potential for convenient, non-insecticide treatment alternatives. Both silicones in this proprietary formulation of Hedrin are used extensively in cosmetics and toiletries.

To date, Hedrin has been clinically studied in 362 subjects and is currently marketed as a medical device in Western Europe and as a pharmaceutical in the United Kingdom ("U.K.").

To date, Hedrin has been clinically studied in 362 subjects and is currently marketed as a medical device in Western Europe and as a pharmaceutical in the United Kingdom ("U.K.").

In a randomized, controlled, equivalence, clinical study (conducted in Europe), Hedrin was administered to 253 adult and child subjects with head lice infestation. The study results, published in the British Medical Journal in June 2005, demonstrated Hedrin’s equivalence when compared to the insecticide treatment, phenothrin, the most widely used pediculicide in the U.K. In addition, according to the same study, the Hedrin treated subjects experienced significantly less irritation (2%) than those treated with phenothrin (9%).

A clinical study published in the November 2007 issue of PLoS One, an international, peer-reviewed journal published by the Public Library of Science (PLoS), demonstrated Hedrin’s superior efficacy compared to a U.K. formulation of malathion, a widely used insecticide treatment in both Europe and North America. In this randomized, controlled, assessor blinded, parallel group clinical trial, 73 adult and child subjects with head lice infestations were treated with Hedrin or malathion liquid. Using intent-to-treat analysis, Hedrin achieved a statistically significant cure rate of 70% compared to 33% with malathion liquid. Using the per-protocol analysis Hedrin achieved a highly statistically significant cure rate of 77% compared to 35% with malathion. In Europe, it has been widely documented that head lice has become resistant to malathion, and we believe this resistance may have influenced the study results. To date, there have been no reports of malathion resistance in the U.S. Additionally, Hedrin treated subjects experienced no irritant reactions, and Hedrin showed clinical equivalence to malathion in its ability to inhibit egg hatching. Overall, investigators and study subjects rated Hedrin as less odorous, easier to apply, and easier to wash out, and 97% of Hedrin treated subjects stated they were significantly more inclined to use the product again versus 31% of those using malathion.

Two new, unpublished Hedrin studies were completed by T&R in 2008. In the first, Hedrin achieved a 100% kill rate in vitro, including in malathion resistant head lice. In the other, a clinical field study conducted in Manisa province, a rural area of Western Turkey, Hedrin was administered to 36 adult and child subjects with confirmed head lice infestations. Using per protocol analysis, Hedrin achieved a 97% cure rate. Using intent-to-treat analysis, Hedrin achieved a 92% cure rate since 2 subjects were eliminated due to protocol violations. No subjects reported any adverse events.

In the U.S., Manhattan Pharmaceuticals, through the Hedrin JV, is pursuing the development of Hedrin as a medical device. In January 2009, the U.S. Food and Drug Administration ("FDA") Center for Devices and Radiological Health ("CDRH") notified H Pharmaceuticals that Hedrin had been classified as a Class III medical device. A Class III designation means that a Premarket Approval ("PMA") Application will need to be obtained before Hedrin can be marketed in the U.S. The Company expects to be required to complete at least one clinical trial as part of that PMA Application.

According to the American Academy of Pediatrics an estimated 6-12 million Americans are infested with head lice each year, with pre-school and elementary children and their families affected most often.

In February 2008, Manhattan Pharmaceuticals announced that it had entered into a joint venture agreement with Nordic Biotech Advisors ApS ("Nordic") to develop and commercialize Hedrin. The 50/50 joint venture entity, H Pharmaceuticals, now owns, is developing, and is working to secure commercialization partners for Hedrin in North America. Manhattan Pharmaceuticals manages the day-to-day operations of H Pharmaceuticals. H Pharmaceuticals is independently funded and is responsible for all costs associated with the Hedrin project, including any necessary US clinical trials, patent costs, and future milestones owed to the original licensor, Thornton & Ross Ltd.

What's all this talk about a merger?

The Ariston Merger

| · | After the Ariston Merger, Manhattan would own 100% of the outstanding capital stock of Ariston. |

| · | As consideration for the Ariston Merger, Manhattan would pay to the holders of Ariston capital stock, in the aggregate, shares of Manhattan common stock as follows: | |||||

| o | at the closing of the Ariston Merger, 7,062,423 shares of Manhattan common stock (a number which represents 10% of the shares of Manhattan common stock which were issued and outstanding as of September 10, 2009, which was the date of the non-binding letter of intent); and | |||||

| o | the right to receive additional contingent share consideration after the closing as follows: | |||||

| § | 7,062,423 additional shares of Manhattan common stock upon acceptance by the US Food and Drug Administration (“ FDA ”) of Ariston’s filing of the first New Drug Application for Ariston's AST-726 product candidate; and | |||||

| § | 8,828,029 additional shares of Manhattan common stock upon Ariston receiving FDA approval to market Ariston's AST-726 product candidate in the United States; and | |||||

| § | 8,828,029 additional shares of Manhattan common stock if there is demonstration of clinical activity and safety with the AST-914 metabolite in the current National Institutes of Health study in essential tremor patients resulting in a decision by our Board of Directors, within 12 months following the closing, to further develop the product internally or to seek a corporate partnership based on the program | |||||

| · | Ariston would cause the holders of all outstanding Ariston convertible promissory notes to convert their notes into convertible new promissory notes to be issued by Ariston at the closing of the Ariston Merger. The principal amount of the new notes will be equal to the lesser of the principal amount of the currently outstanding notes plus accrued and unpaid interest thereon through the date of the closing of the Ariston Merger or $15.5 million. The new notes would have the following terms: | |||||

| o | interest rate of 5% per annum compounding annually; | |||||

| o | interest and principal are to be repaid from the net cash flow from AST-726 and AST 914 programs, 50% of this net cash flow will be used to repay the interest and principal. (subject to adjustment if the notes include a conversion feature and are converted.) | |||||

| o | the holders of the new notes will have no recourse to Manhattan or any entity other than Ariston with respect to the payment of any amount under the new notes or any indebtedness which had been converted into new notes. | |||||

| o | the new notes may include a conversion feature such that the new notes would be convertible at the option of the holder thereof into Manhattan common stock at a conversion price currently anticipated to be $.40 per share (the “ Conversion Price ”) if a sufficient number of authorized common stock is available. | |||||

Ariston Pharmaceuticals, Inc. is a specialty biopharmaceutical company focused on the acquisition, clinical development and rapid commercialization of human therapeutics in the Neurology area.

The Company is currently developing three clinical-stage compounds for application in four clinical indications. Prototypes of each product have shown evidence of efficacy and safety in previous clinical studies. Ariston intends to develop specialty sales and marketing capabilities to launch some of these products in the US market.

Ariston's Pipeline:

The lead compound, AST-726, is a nasal reformulation of a well-established and very safe vitamin B12 treatment and is expected to enter Phase II clinical trials in Europe for migraine prevention in 2006. A GMP formulation of AST-726 successfully completed Phase I studies in 2005 in the US.

Migraine affects 30 million or more people in the US. Acute migraine medications such as the successful triptans help some patients. However, roughly 40% of attacks are not completely resolved by such acute medications and many patients with cardiovascular problems can not take triptans. Some patients have attacks so frequently that acute treatment is not sufficient. Therefore, up to 11 million patients in the US are candidates for safe preventative medications, such as AST-726, to reduce severity and frequency of attacks.

AST-726 is also expected to enter Phase III trials in 2007 for maintaining healthy vitamin B12 levels. Vitamin B12 deficiency affects 1-3% of the US general population and particularly the elderly. Existing first line therapies for this indication require chronic intramuscular injections, often for life.

AST-117 is an oral drug for the treatment of anxiety states. In vitro, animal and human clinical studies indicate that AST-117 could provide a safer and effective alternative to leading anxiety drugs.

AST-914 is an oral drug for the treatment of a highly prevalent movement disorder. In vitro, animal and human clinical studies indicate that AST-914 could provide a safe and effective treatment for this disorder which currently has very few treatment options.

Stock Information:

Manhattan Pharmaceuticals, Inc.

Stock Symbol: MHAN.OB

From PinkSheets.com:

460 as of Mar 31, 2008

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |