Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$SBFM VWAP today $1.02

https://stocktwits.com/KeepItRealistic/message/571019035

$SBFM solid day, solid AH close .9899

Started the day under .80

Went green and stayed green all day including AH

Gap & Go Monday

Fliptards will need to chase …

Good luck here bud. Wish you all the best. You’re gonna need it with SBFM.

Dilution tracker.

Is that a website or an app?

Don’t matter if the float is earning $1.57 cash per share !

Dilution tracker

And that was the lowest vwap on day 5 post RS

How did you know they priced at 1.57? Where can u find that information out? Thanks

My understanding it was shorted down to mark the strikes on the warrants lower. Crazy to think the market cap of this company is a million bucks and they will be profitable later this year if things hold.

Why can't SBFM get back above $1 and then stay above $1? Is there some coordinated effort to sink the price or is the company and management just that bad?

Either way it looks like SBFM is headed back to OTC land!

I can’t believe there used to be not even a million shares in the float and the float has already turned over 6-7 times today

Yes the warrants got repriced at $1.57 and they need higher for a profit and we know how greedy these hedge funds can be

So I figured at least a double and there so happens to be a gap at $3.40 😆

Oh thats a good strategy

Sorry, still have core. Just swung some of it. So they need $1.57 minimum to buy the warrants?

Too risky for me to flip for peanuts 😆

Holding for dollars not pennies !

You never know when this thing 🚀’s leaving all fliptards behind …

This is likely being moved by the warrant holder who has $1.57 warrants and needs to get this over $3 for a two bagger

I sold at 1.18 back in at 1.05

i doubled my position

So my new avg $1.05

Still better than me !

Whats your avg ?

A couple questions:

1. If SBFM is so good, why did the price sink so low and require a 1:100 RS to get back above $1?

2. What makes you think they will get more time to correct the deficiency from the Nasdaq? Have you heard the outcome of the hearing yesterday?

Thanks.

My average is a buckaro

Market cap is tiny hope this bounces more

My avg is $1.11

So was just averaging down on dip opportunity

Heh whoever sold me .77 at open

Much appreciated 😝

$SBFM back over $1 ❤️

Goodbye shorts 😝

Price estimate you think is a good selling point? $5?

No 🧠’er buy and hold for correction

Vitamin reseller pretending to be a drug company

$SBFM warrants repriced at $1.57 per dilution tracker

I guess the first day post RS was included in the 5 days post RS repricing

So people are missing the big picture here

Since our OS was only 1m whatever the amount of warrants get exercised at $1.57 will simply add cash to companies already strong cash position of $26m and just put them in a very strong position to get to profitability without having to do any more offerings and their cash position alone will price them well above the warrant price.

So I see this as a no 🧠’er hold for Market Correction especially with Q1 just around the corner May 15th !

As for delisting, its just fear mongering by shorts who stand to lose big on a potential squeeze here.

Company will be allowed more time to correct deficiency

Thank You for the cheap shares in advance 😝

Old disgruntled shareholder who bought too early in the development of the company and now feels they need to ignore the facts that the company is heading fast towards profitability with a ton of cash 😝

Will SBFM be on the Nasdaq delisting list soon? They aren't on the list as of April 25th (see link) but looks like the have failed miserably to meet the listing requirements, and burned a lot of investors by this failure.

https://listingcenter.nasdaq.com/IssuersPendingSuspensionDelisting.aspx

Did SBFM have the delisting hearing today....if so, do you know the outcome?

Lmfao. I’m sorry bud - but you got no idea what you are in for with this one. 10k you say? Ha. Good luck. Nothing make sense here. 10k doesn’t mean shit. Company’s gonna fuck you just like they did everyone else. When did you start researching this bad boy? Chances are not as long as some of us have been.

Trust me - you will lose here. I’m not even shorting or whatever you wanna make up in your mind that I’m doing. My motive is to bash this bitch because it was a scam when I sat through it for 3 years. You don’t know what you’re talking about bud. Im sorry.

But my god you did give me a laugh.

And if you want just go check my history. I was a bigger supporter of this stock than you are now. Good luck sonny.

I don’t reply to such ignorant posts

Start by doing some DD on the company by reading their last 10K

You should however sell your ☠️ OTC bags and grab these shares under $1 while they last and get some popcorn while your watching !

No popcorn watching paint dry on your OTC’s 😝

Why? Enlighten us please.

I will be watching just to rub it in your face

Total nonsense 😝

I’d only risk more money here if it goes under a penny

Today was bottom

Tomorrow ⬆️ me thinks

Let’s see

|

Followers

|

764

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

113567

|

|

Created

|

10/27/08

|

Type

|

Free

|

| Moderators | |||

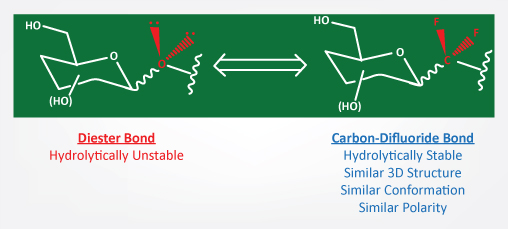

SUNSHINE BIOPHARMA INC

ANTI CANCER DRUGS

ANTI CORONA VIRUS RESEARCH

SBFM Transfer Agent

Corporate Stock Transfer

3200 Cherry Creek Dr. South

Suite 430

Denver, CO 80209

(303) 282 - 4800 p

(303) 282 - 5800 f

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |