Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

“In Florida, we will not be using a federally controlled digital dollar ” - Gov. Ron DeSantis $QQQ

You ain’t make shit compared to this board haha 🤣 u know nada newb

Here we go epic squeeze coming soon…

~sold the odte $444 calls @.24c :)

~sold the odte $443 calls @.31c :)

~sold the 4/4 $449 calls @.24c

We are going to start a correction soon.

Well we are making new high, some may take profit here or at least revamped your stop.

QQQ Closing below 378.40 is sell signal.

Yeap, was a good play months back, not so much now. Good luck

Suckers rally up 40% from

Bottom? Sure ok.

Lets just see, it might be a suckers rally. Haven't had a long bear market in many years, but in this environment it seems possible.

I don't think so, I think this run was purely based on influx from FED in lieu of SVB crashing economy. I think the structural issues still there and more shoes to drop, just like in 2008/9. I think QT will again take this down to lows. I hope to be wrong, because I love when USA wins, but I really think a pullback is inevitable.

All dips shall be bought - AI

~yes so nice

~sold the 6/2 $360 calls for @.27c haha oh yes so nice

Like I said bro. BOOM!!!! LMAO

Still in uptrend but could take a breather.

Lots of indicators of a correction coming so I waiting to pull the trigger on QQQ Dec puts. JMO.

QQQ VERY TOPPY HERE.... GREAT SHORTING OPPORTUNITY!!!!!!!

DON'T BE SO QUICK TO JUDGE.... TECH WILL SELL OFF HARD!!!!!

YOU WILL SEE!!!!!!!

Get a life. You are now on ignore

QQQ $250 COMING..... DON'T LISTEN TO THE MINDLESS PUMPER SHILLS!!!!!!!!

MARGIN CALLS, FORCED LIQUIDATIONS, INSOLVENCIES!!!!!

TRILLIONS IN FAKE PAPER WEALTH IS ABOUT TO BE WIPED OUT!!!!!!!!

THE LONGER YOU HOLD THE MORE YOU WILL LOSE!!!!!!!!!!

MASSIVE CRASH COMING!!!!!!!

BULLTARDS WILL BE SLAUGHTERED!!!!!!!

Closing today above 292.63 worth the risk for initiating a small long position.

QQQ CLOSED $291.75 -5.07 (-1.71%)

QQQ CLOSED $299.70 -1.98 (-0.66%)

Closed on a sell, Stop is 305.59 on closing basis.

We did made some coins, now system testing support. Long above 277.15 on closing basis.

Go Long @ above 264.35 and that is your stop. Do your own Due diligence.

Nothing changed but may change by closing tomorrow.

QQQ is on sell below 285.88. Go long above it on closing basis.

|

Followers

|

127

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

7895

|

|

Created

|

10/13/05

|

Type

|

Free

|

| Moderators | |||

To learn more about NERS please visit,http://investorshub.advfn.com/boards/read_msg.aspx?message_id=14508055 ;

(These are the Basic Rules for NERS (Nocona's Early Retirement System):

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=134066192

When the CCI is above the +100 you are holding long. When it drops below the +100 you are out of the long and short.

When the CCI is below the -100 you are holding short. When it rises above the -100 you cover the short and go long.

The tricky part happens when the CCI will not reach the opposite 100 line. How to handle when (1) the CCI will not break the zero line at all (2) the CCI breaks the zero line but then soon goes back in the other direction (3) the CCI breaks the zero line and holds there for awhile but without breaking the 100 line. These situations have been the subject of discussion between Nocona and I which you can read about in past posts. The one thing Nocona and I agree on is in situation #2 - If the CCI breaks the zero line, but then crosses it again, you close your position and enter the opposite position. (If short, go long; If long, go short.)

If the CCI goes to a HFE (hook from extreme) beyond the 200 line, Nocona will use the break back of the 200 line as an entry, just like the 100 line.

What CCI to use? The idea started with the 60 min chart using a 12 CCI, but Nocona was entering mid bar and not waiting the whole hour for the bar to close. So it then seemed reasonable to move to a shorter time frame chart with a longer (but equivalent) CCI. So:

60 min 12 CCI is equivalent to:

30 min 24 CCI

15 min 48 CCI

10 min 72 CCI

5 min 144 CCI

The 5 min 144 CCI can be very whippy and is not advised to be used alone without consultation of a longer time frame chart.

I think that about covers it.)

Traders resource: http://www.barchart.com/cheatsheet.php?sym=QQQ

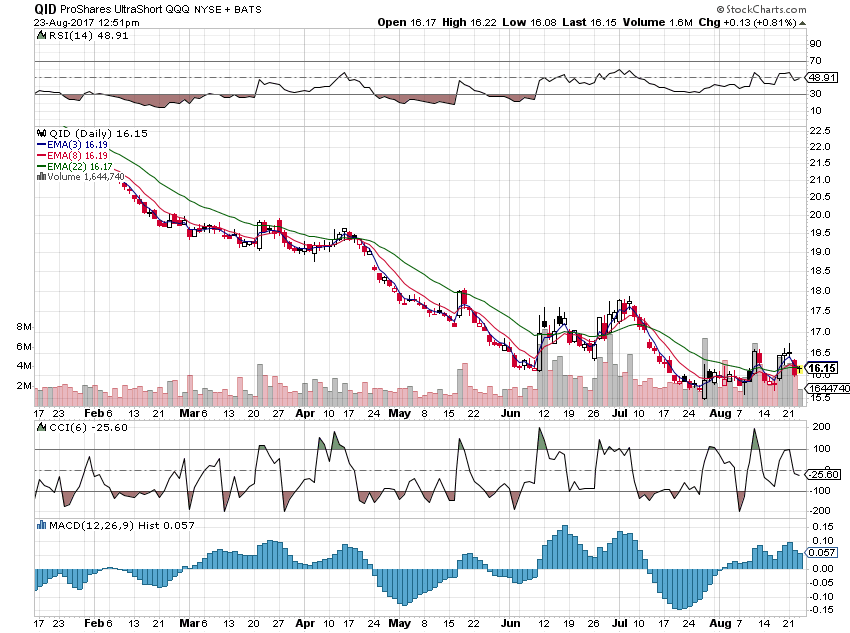

QID daily http://stockcharts.com/h-sc/ui?s=QID&p=D&b=5&g=0&id=p37821192489

http://stockcharts.com/h-sc/ui?s=QLD&p=D&b=5&g=0&id=p86671367294

Daily Chart; http://stockcharts.com/h-sc/ui?s=QQQ&p=D&b=5&g=0&id=p95639970560

Protect your assets use only cash positions to buy stocks, Please do not use margin till trend is in your desired direction. Use stops and protect profits.

Disclaimer: Several trading systems will be presented and discussed on this board over time. While it may appear that the systems are successful, that is no indication that they will be successful for you.

You alone are responsible for doing your own due diligence to prove to yourself that you can be successful with a trading system. No one who presents their views of how to trade can be responsible for your success or failure.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |