Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Based on information I gathered about Gary's celebrity jewelry designer daughter, it appears that Gary passed away in March 2021. As a reality TV show (RHOSLC season 2) celebrity, she talked publicly about her father's death.

still have the shares, but yes easily remade what was lost here, always need to be diversified

Likely nothing ever.

I already relinquished all my shares, so technically I'm not a QLTS shareholder anymore. The OTC market was very hot last winter. It was easy making back all the QLTS losses.

so really nothing for QLTS share holders that I see

so really nothing for QLTS share holders that I see

CERTIFICATION OF JUDGMENT issued on May 29, 2019, in favor of Goldstein Family Partnership, LP against Q Lotus, Inc. in the amount of $10,114,753.76. Certification of judgment mailed by the Court. (km)

https://www.pacermonitor.com/public/case/23008708/Goldstein_Family_Partnership,_LP_v_Q_Lotus,_Inc_et_al

JTG Equities, LLC v. Greenberg, No. 18 C 7927 (N.D. Ill. Jul. 3, 2019)

JTG EQUITIES, LLC & JOSHUA GOLDSTEIN, Plaintiffs, v. JOEL GREENBERG & JG URBAN R2, LLC, Defendants.

Plaintiffs JTG Equities ("JTG") and Joshua Goldstein bring this action against defendants Joel Greenberg and JG Urban R2 for breach of contract, fraud, and several related claims based on a loan purchase agreement the parties entered into in 2013. The defendants filed a motion dismiss the claims alleging fraud (Counts III-V). For the following reasons, their motion is denied.

https://casetext.com/case/jtg-equities-llc-v-greenberg

Poor timing, for sure!

Q Lotus used to own this former Bank of America building in Lake Zurich, IL. Too bad for this couple who acquired it and began upgrading the building just days before the lockdown.

https://webcache.googleusercontent.com/search?q=cache:7Z9LIMZNxAsJ:https://www.chicagotribune.com/suburbs/lake-zurich/ct-lzc-main-street-redevelopment-project-tl-0402-20200326-j6qfowxhandijmnhezkoek4upm-story.html+&cd=1&hl=en&ct=clnk&gl=us

We love the village of Lake Zurich. One of the things that’s missing is a more communal space in the downtown area.

They envision potential multiple uses, including a coffee shop, restaurant, community theater, wine and coffee bar, arts center, microbrewery or tasting room, as well as a salon or spa, coding business, or dental-medical office

Thanks for the details.

The silica will stay down there until a volcano erupts.

what will happen to the silica mine now?

This new case (1:18-cv-03995) is terminated?

https://www.pacermonitor.com/public/case/24751149/Goldstein_Family_Partneship_LP_v_Q_Lotus_Inc_et_al

what will happen to the silica mine now?

Goldstein Family Partneship LP v. Q Lotus Inc. et al

Plaintiff: Goldstein Family Partnership LP

Defendant: Q Lotus Inc., Q Lotus Holdings Inc. and Gary A. Rosenberg Trust under the Will of Ben J. Rosenberg dated August 28, 1978

Case Number: 1:2018cv03995

Filed: June 8, 2018

Court: Illinois Northern District Court

Office: Chicago Office

County: Cook

Presiding Judge: Sharon Johnson Coleman

Nature of Suit: Other

Cause of Action: Civil Miscellaneous Case

Jury Demanded By: None

https://dockets.justia.com/docket/illinois/ilndce/1:2018cv03995/353239

Gary the swindler ... Karma is coming for you

DEFAULT JUDGMENT in favor of Goldstein Family Partnership, LP against Gary A. Rosenberg Trust, Q Lotus Holdings, Inc. in the amount of $10,616,561.59. It is hereby ORDERED, ADJUDGED AND DECREED: That for the reasons stated in the Court's Order dated May 3, 2018, and for the reasons stated on the record during the show cause hearing on May 3, 2018, Plaintiff's motion for a default judgment against Defendants Q Lotus Holdings Inc. and the Gary A. Rosenberg Trust is GRANTED; judgment is entered in favor of Plaintiff and against Defendant Q Lotus Holdings Inc. in the principal sum of $10,266,561.59 plus post-judgment interest at the rate of 18% per annum, as provided for in the promissory note executed by Q Lotus, Inc. and guaranteed by Q Lotus Holdings Inc. Judgment is also entered in favor of Plaintiff and against Defendant Gary A. Rosenberg Trust, under the Will of Ben J. Rosenberg dated August 28, 1978, in the principal sum of $350,000; accordingly, the case is closed. (Signed by Clerk of Court Ruby Krajick on 5/4/2018)(km)

https://www.pacermonitor.com/public/case/23008708/Goldstein_Family_Partnership,_LP_v_Q_Lotus,_Inc_et_al

Tuesday, April 10, 2018

35 14 pgs respm Memorandum of Law in Support of Motion Tue 5:06 PM

SUPPLEMENTAL MEMORANDUM OF LAW in Support re:29 MOTION for Default Judgment as to ALL DEFENDANTS . . Document filed by Goldstein Family Partnership, LP. (Holahan, David)

34 respm Affidavit in Support of Motion Tue 5:04 PM

AFFIDAVIT of Joshua Goldstein in Support re:29 MOTION for Default Judgment as to ALL DEFENDANTS .. Document filed by Goldstein Family Partnership, LP. (Holahan, David)

https://www.pacermonitor.com/public/case/23008708/Goldstein_Family_Partnership,_LP_v_Q_Lotus,_Inc_et_al

Roger that...

Tax loss write off, bro.

QLTS #1 OTC stock of 2017. Hope it repeats this year, even without Port of Flatulence!

it's safe to assume that Port of Fierce Panties is a no go

Do you have any new information?

Happy New Year QLTS!!!

QLTS will comeback soon!!!

This is our year QLTS!!!

Well, after one year of being revoked, it's safe to assume that Port of Fierce Panties is a no go. The recent hurricane would have devastated that port anyway.

CEO has said open phone line for communication....call for updates!

Gary A. Rosenberg

Chairman & President

Q Lotus Holdings Inc.

C: (312) 498-0301

P: (773) 857-1415

C: (312) 379-1800

looks like we're right on schedule. qlts

Finally, after one year

nothing happened.

Year to date, the value of QLTS shares has only gone down 0%.

QLTS is a very strong stock. Nobody is willing to sell shares for the past year. I've been bidding at no bid forever. No luck getting any shares from weak hands.

I have good and bad news.

The bad news is: I don't have good news.

The good news is: I don't have bad news.

All claims fully updated for 2017! (8/16/2017)

https://thediggings.com/owners/2333024

Yup Thank You Joshua! Along with keeping the mining claims paid to date..QLTS will now turn back full attention to Lake Zurich! ![]()

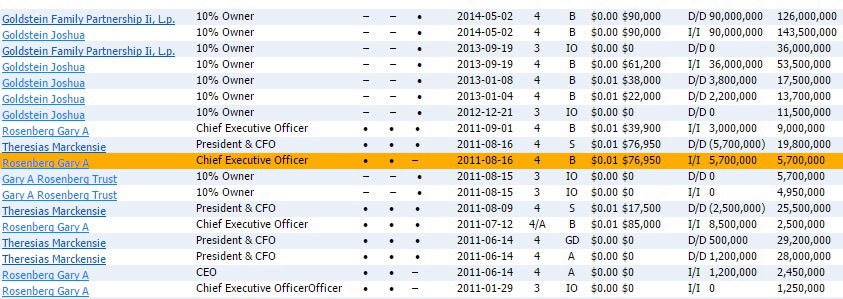

GOLDSTEIN + GOLDSTEIN FAMILY PARTNERSHIP II, L.P.:

SC 13D/A May 05 2014:

ITEM 3. Source and Amount of Funds or Other Consideration

The Reporting Person purchased the shares of Common Stock of the Issuer pursuant to six securities purchase agreements with the Issuer for an aggregate of $325,000. All funds used in such securities purchase agreements were obtained through the personal funds of the Reporting Person.

ITEM 4. Purpose of Transaction

The Reporting Person purchased the shares of Common Stock of the Issuer for investment purposes.

http://www.sec.gov/Archives/edgar/data/1391142/000101905614000627/goldstein_da2.htm

REAL ESTATE PURCHASE

CONTRACT

This REAL ESTATE PURCHASE CONTRACT (the “Contract”), is dated December , 2014 (the “Effective Date”), by and between Q LOTUS, INC., a Nevada corporation (the “Purchaser”) and LAKE ZURICH CENTER, LLC, an Illinois limited liability company (the “Seller”). The “Effective Date” shall be the date upon which this Contract is accepted by Seller.

https://www.lawinsider.com/contracts/2aS5ZVRg1EmgmLL2yqH2u2/q-lotus-holdings-inc/1391142/2015-01-20

Developer has idea for old bank to revitalize downtown Lake Zurich

http://www.dailyherald.com/article/20131014/news/710149938/

Keep a watchful eye out! ![]()

https://thediggings.com/mines/ormc149085

RAMEX #3 is a 20-acre active mining claim in Douglas, Oregon owned by Q Lotus Incorporated. It is a lode claim with a $155 maintenance fee.

Ownership and use of this claim is overseen by the Bureau of Land Management's Roseburg South Riveregon Field Office under the serial number ORMC149085. The last action for this claim occurred on August 17, 2017. Information on the claim was last updated on August 18, 2017.

Events Overview

8/18/2017 File Load Date

8/17/2017 Last Modified

8/17/2017 Last Action

1/1/2017 Last Assessment Maintenance Fee Payment

Actions

Date Action Text Remarks Receipt Number

8/17/2017 Monies Received $3100.00;1 3942272

8/30/2016 Maintenance Fee Payment 2017;$155 3646848

12/21/2015 Refund Authorized $10.00 3382991

9/1/2015 Address Change Filed Q LOTUS INC

8/28/2015 Maintenance Fee Payment 2016;$155 3382991

Breaking News!!!

...is something you find on CNN, not here. Move along.

Guess I'll offer to sell my private shares of Quinoa Lotus Holdings on Craigslist or Backpage. 10 cents per share.

I'm scratching my head figuring out why no broker allows me to buy this "fka" gem. Is there a DQ Grill & Chill on this stock? Maybe the Netflix & Chill will be lifted after 2 weeks?

Looking forward to news on Port of Flesh Pierce redevelopment or the acquisition of Midwest BirdsNest Credit.

Lake Zurich property for lease as of August 15, 2017:

http://www.loopnet.com/Listing/20459255/35-W-Main-St-Lake-Zurich-IL/

Last year, it was on the market for 4 months:

http://www.loopnet.com/Listing/19871253/35-W-Main-St-Lake-Zurich-IL/

I checked all the PINs below on the Lake County Property Tax site. The latest bills for Tax Year 2016 have been paid on September 7, 2017 by:

LAKE ZURICH CENTER, LLC

4 EXECUTIVE BLVD STE 200

SUFFERN, NY 10901-8202

14-20-103-010-0000

14-20-103-011-0000

14-20-104-007-0000

14-20-104-004-0000

14-20-104-003-0000

35 W. Main Street, Lake Zurich, Illinois 60047

I'm not selling my shares until I could sell my shares.

not selling my shares until Nasdaq now

Title AUTHORIZED SIGNER

Jackson, Fredrick

PO Box 640171

Pike Rd, AL 36064

Title AUTHORIZED SIGNER

Bell, Charles

302 North Elm Street

Tuskegee, AL 36083

A quick DD tells me that the gentlemen above are optometrists. Charles Bell is owner of Family Vision & Eye Care.

http://www.smallbusinessdb.com/family-vision-eye-care-tuskegee-al-36083.htm

http://www.wellness.com/dir/1367604/optometrist/al/montgomery/fredrick-jackson-od#referrer

Ted Geiger of West Palm Beach, FL...Independent Investment Banking Professional

https://www.linkedin.com/in/ted-geiger-28b33a8

TIMMERMAN GEIGER HOLDINGS, INC

http://www.fl-corporation-board-members.com/flboard_view.php?editid1=H267816

Is QLTS still working with HarvestBread Worldwide Olive Oil Trust London, LLC? Annual report just came out August 31, 2017 and I see new names added.

http://search.sunbiz.org/Inquiry/CorporationSearch/SearchResultDetail?inquirytype=EntityName&directionType=Initial&searchNameOrder=HARVESTTIMEWORLDWIDEOILTRUSTLO%20L150000270370&aggregateId=flal-l15000027037-89b64f98-c775-45f8-af76-fbd0d5694b91&searchTerm=Harvest%20Times%20Evangelist%20Ministery%20Incorporation&listNameOrder=HARVESTTIMESEVANGELISTMINISTER%20N000000025810

Come on, Gary Raisinbread and Tim Bellpepper....do yo' thang!

Hope we hear about the Port of Fresh Prince project in 2 weeks.

|

Followers

|

119

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

17170

|

|

Created

|

04/25/11

|

Type

|

Free

|

| Moderators | |||

| Global Operations Center 6725 Via Austi Pkwy, Suite 300 Las Vegas, NV 89119 Telephone: 702-361-3033 Toll Free: 800-785-PSTC (7782) Fax: 702-433-1979 Web: "" rel="nofollow" target="_blank">; style="color:purple;" title="blocked::http://www.pacificstocktransfer.com/ http://www.pacificstocktransfer.com/" rel="nofollow">www.pacificstocktransfer.com | Corporate Office 173-3 Keith Street Warrenton, VA 20186 |

In addition to Zemi Beach House, current developments under construction include 382 rental units and 100,000 square feet of commercial Class A office space in Suffern, New York; a 102,000-square-foot building community in Orange Beach, Alabama; and a town center community in Wheeling, Illinois

https://www.hotel-online.com/press_releases/release/trust-hospitality-appoints-management-team-for-zemi-beach-house-to-open-on

Timothy Bellcourt with over 25 years of experience in the asset-backed lending industry, and a track record with a loan loss ratio of less than 1%, has been involved in audit management, loan administration, portfolio management, credit underwriting, marketing, and profit and loss responsibilities. He has worked for organizations such as LaSalle Business Credit, GE Capital Corporation, and US Bank. Tim has also successfully founded two independent asset-backed lending companies.

Timothy Bellcourt with over 25 years of experience in the asset-backed lending industry, and a track record with a loan loss ratio of less than 1%, has been involved in audit management, loan administration, portfolio management, credit underwriting, marketing, and profit and loss responsibilities. He has worked for organizations such as LaSalle Business Credit, GE Capital Corporation, and US Bank. Tim has also successfully founded two independent asset-backed lending companies.The Company has been asked to be the developer of the Port of Fort Pierce in Florida.

https://www.sec.gov/Archives/edgar/data/1391142/000149315215004492/form8-k.htm

Q LOTUS HOLDINGS, INC.

Q LOTUS HOLDINGS, INC.

Q Lotus Holdings, Inc., is a diversified financial services holding company which provides financing and acquires growing companies in which we believe our management participation in operations can create additional value. Our principal investment focus is to provide equity and debt capital to growing and middle-market companies with increasing cash flow and escalating income in the following areas:

FORM 8-K

Jan. 20, 2015

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=10416517

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |