Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Why didn’t the shares liquidate yet?

No clue what you're asking here, but to be blunt:

MSLP is dead. Put a fork in it. Your stock has zero value, and will never recover. Per the BK settlement, all previously outstanding shares have been cancelled. Hopefully, you were able to dump some/most/all of your holdings before they filed. Enjoy the writeoff.

The only point in following this thing further is to have a forum to laugh at Drex as he descends through the seven levels of legal hell that (justifiably) await him.

So you’re saying there’s a chance?!?

Insurance policies exclude coverage for fraud. Ryan has already experienced this clause and sued an insurance company and the case was dismissed.

Oh let’s add perjury charges onto this list too. I think he watched Wolf of Wallstreet too many times. Saying “I do not recall” like it was a broken record while you are under oath doesn’t fly with the feds.

There will be an insurance policy that’ll cover the estate. Maybe $4-$5mil. The creditors will take all of it.

But Drexler if he thinks he’s done with all this, far from it. We still have the SEC case pending but soon to come (not if, but when) will be the criminal indictment for fraud. Drexler directly defrauded his banks, lenders, vendors, and shareholders. He believes that because he was constantly berating his employees into doing his dirty work, ask Trump how that worked for him - maybe he’ll beat 91 charges!

The PPP fraud is only the icing on the cake. Drexler screwed so many people over and now karma is coming for him and he’s got no where to hide.

Poor Halbert raised a moron. SEC already has its hook set on Ryan. Now the creditors are coming.

Pursuant to the Plan Support Agreement, the Debtor’s largest secured creditor, Empery, as agent for MP

Collateral, agreed to cap its prepetition secured claim for the Empery Loans at $18 million and carveout any recovery

above $12 million for the benefit of general unsecured creditors, which proceeds will be used in part to establish a

litigation trust to pursue the estate’s claims against the Debtor’s current and former directors and officers, including

Ryan Drexler.

Should be. There is still enough time in Q4 to finalize the securities component and allow you to take your loss.

When will my portfolio remove the holdings and show the loss? Before YE?

Drexler should be focusing on getting his affairs in order before the criminal charges hit and he is looking at facing some real prison time. The SEC can only bring civil charges against him, which they did, but it’s the DOJ that will be bringing the criminal charges. The list of victims due to Drexler’s purposeful fraud is enormous and they are all going to be taking the stand at his trial.

This isn’t going to be a fight he can jiujitsu his way out of. Justice is coming.

Well - there is now a new owner at Musclepharm.

For those few still following the carcass of Musclepharm, here are the highlights:

A. The various creditors, secured and unsecured, the vulture fund Empery, and Drexler spent the summer burning through cash sorting out litigation in Judge Cox's bankruptcy and other civil courts. At least counsel made money out of this debacle.

B. Ultimately the investment bank Hilco was retained to seek a buyer. Empery used their credit bid of $18M as a stalking horse. Naturally, nobody else wanted to bid anywhere near that price.

C. Attached is a link to the results of the sale proceeds - : it's gloomy

So this is the result - Musclepharm's Ch. 11 bankruptcy became a liquidation as expected, and as a result a short micro-cap hedge fund from NYC owns it (for now).

Based on the prepared liquidation analysis, none of the funds went to Drexler, or to Prestige Capital. As for those steep historic NOL, looks like they go to White Winston.

Beast Nutrition is still for sale, at a much more realistic valuation and without the litigation headache. So for any readers out there looking to carry the sports nutrition torch, there's an alternative to start looking elsewhere.

Good night, and good luck.

Madcowelixir, you raise a good point regarding the uneven reporting of expenses as the DIP financing may highlight a situation where the regular GAAP of revenue recognition may not be consistently applied.

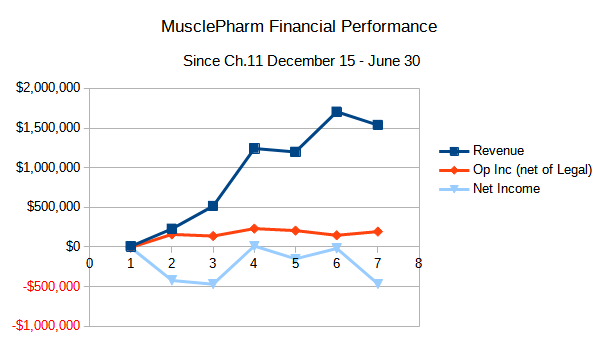

I also note that I was unaware of the South Korean e-commerce channel forming such a significant percentage of revenue - you have been following this company much longer than I have (including under the Goldberg Stein alias). Attached is a summary chart of MSLP's reported financials submitted to the court docket via monthly operating reports, showing topline, income excluding legal and their net income. I think it's fair when counsel for the corporation states that excluding the restructuring costs the company is profitable.

Perhaps you've noticed that Judge Cox struck down the order to enforced the Intercreditor and Subordination Agreement, and Drexler's counsel submitting multiple case law examples citing instances where dispute over a creditor's lien can often nullify the creditor's ability to use its lien as a credit bid. There are multiple Empery entities, but I'm sure you've seen enough 13-F filings to get a general sense of the AUM that Empery controls. If the credit bid is deemed null due to the litigation dispute, I'll tip my hat to Drexler's counsel, if this succeeds and the secondary request for more time is also provided the results of Hilco running an auction might not produce the expected result. My prior comments about this company being a black hole that sucks in everybody's money is yet to be disproved. Retail investors' holdings remain destroyed, either way, which I believe is the biggest tragedy in Musclepharm's history.

Lastly, for your entertainment, here is the list of questions that Drexler will be put to the challenge of answering under his own deposition. I'm sure questions 13 and 14, posted below, will result in some eye-rolling on your part:

INTERROGATORY NO. 13:

Describe the factual circumstance Concerning the turnover of principal accounting officers

of MusclePharm in the third quarter of 2017.

INTERROGATORY NO. 14:

Describe MusclePharm’s process for recognizing revenue on inventory which has been

temporarily stored off-site in trailers rather than being shipped to MusclePharm’s customers prior

to year-end.

Good morning MakeItRain88,

In regards to your question about trade volume, some brokers will allow retail traders to bid/ask for de-listed tickers to trade OTC - but MSLP stock has been illiquid for a very long time. Remember there are really only three institutional shareholders that control over 70% of the total shares outstanding - Consac LLC (which is Ryan Drexler), White Winston/Amerop, and Wynnefield. I've seen bid/asks over the past couple years, particularly during the half-hearted S-1 filing announcing an uplisting to the NASDAQ - which the company would not qualify for - which look like chumming the water for a retail investor to try to take the bait.

Also note that on March 2nd, a trading order was granted that capped share ownership at ~1.6M shares - roughly $4,800. You can read the attachment on the restrictions, but ultimately I repeat the question I asked of the user Codie - you work hard to earn your money, why would you invest it in this dumpster fire of a bankrupt, multiple-times SEC sanctioned firm boiling in litigation, when there are other investments elsewhere to make?

If you have an investment in the firm, you can always treat it as a loss to offset capital gains in better years ahead.

PeonyVMW...."profitable" is questionable at best and not likely in my opinion. Revenues are not being reported corollated to expenses. For example, one the largest revenue streams reporting is Coupang (the S Korean Amazon) but encompass several months of revenues (perhaps quarterly, maybe semi-annual, but I'm guessing) but are reported as revenue in just a single month occasionally and not every month, yet the expenses reported are not corollated and are month to month upon orders via the DIP financing. We don't know if "profitable" is accurate if you attribute perhaps 3 months of revenue to only 1 month of expenses on your largest revenue stream.

Question: Is there any threshold of retail investor loss on this stock or length of time (or specific dates) of their holdings in which they might have any option at all for recouping anything at all?

Follow up: Any miracle scenarios here? Even if it might be a 0.01% chance, what do those of you whom have researched this so well and provided such detailed information (thank you!) see as a ‘Hail Mary’ chance? (If it exists)

Could I asked, as I am unfamiliar, what is the trade volume we are seeing with MSLPQ’s ticker? Is that artificial?

Codie, typically the DOJ's Fraud division is not required to publicly announce a criminal investigation. So there may be something lurking in the reeds that we do not know about.

To consider, when the DOJ does announce an investigation it often produces the intended result of causing skid marks on the undergarments of the announced target. For example, currently investigated short-seller Andrew Left of the infamous Citron Research, made national headlines this month when he publicly announced his cracking under pressure.

"Short Seller Andrew Left Is Living in Fear of the Feds"

Also, Codie, I strongly encourage you to go back and read through madcowelixir's posts, particularly the period from 2019-2021. He understands the plumbing of short-selling stocks, FTDs, using warrants as a locate to cover or close well before a broader population of people have become familiar with it since the 2021-ongoing saga kicked off by Gamestop. I suspect, like me, the work of Michael Lewis and his eye-opening book "Flash Boys" may be what kicked the doors open on understanding the intricacies of markets, including alternative trading systems. Or maybe he's from an institutional trading desk and now flies solo. Point is, go through those posts and see where Empery was likely coming from with the structuring of their notes, both the original Securities Purchase Agreement from Oct '21 and the amendments.

Make no mistake, Empery is a long-short opportunistic fund, and were likely using the warrants they asked for and received in the financing as locates as a way to assist in shorting the stock further. Don't forget, if a short-seller's target goes to zero, the short-seller never has to repay the borrowed stock because it's now worthless. They don't have to close, they don't have to even cover (what's to cover? The ticker is delisted and bankrupt!). Hey, they can even reap the gains without exposure of capital gains taxation, because they never disposed of the asset. That is the cruel fate when short-selling bets pay off. Except in this case, the target company was run by management that repeatedly ran afoul and received sanctions and fines from the SEC, and became more of a litigation company moonlighting as a supplement company.

Have you found the good guys yet? So far I see only villains and hapless shareholder casualties.

Here, to help connect the dots further: A link to some of the parties named in the DOJ short-selling probe.

Now look at the names of the holders of the Empery note: Anson Funds, Hudson Bay Capital, Intracostal Capital

Here's an example of the type of digging others are performing on, say, Anson Funds, one of the participants with Empery in the Securities Purchase Agreement (the "Notes" that ultimately sewered MSLP into bankruptcy.) This site's article on exploiting lax Euro regulations for direct market access, aka "the pipes" is showing an increasingly sophisticated understanding by retail on how some institutional players short-sell stocks.

After you read through all the links, it's worth asking yourself these questions:

--Was there ever a plan from the Note holders to support the business success of MSLP?

--Would a friendly investor charge interest that makes credit card rates look like cheap capital?

--Or perhaps they met their match in Drexler, and that this is a tale in which there are no good guys, just multiple parties looking to short the company into oblivion, but it backfired so now the biggest parties are litigating and grab what they can from this carcass of a company?

Also, if you are interested you can order transcripts and read the rulings and conferences set by Hon. Natalie Cox, the Nevada bankruptcy judge presiding over this case. She shot down Empery's pleading to enforce the Intercreditor and Subordination Agreement, and the deadlines for the second attempt at an auction keep getting pushed back, and parties that were interested in December are pulling out of any second auction. As I referenced in my prior post - against all odds, really - when you strip out the restructuring costs, somehow, this company is profitable, albeit dependent on debtor-in-possession funding for liquidity. But there is so much animosity, destruction of goodwill in that monsoon of litigation, lack of liquidity, narrowing of channels to sell into, that it's hard for me to put a value for this company above zero.

You work hard for your money, why not invest it in supporting a company that deserves your capital?

Agreed, SLC. Perhaps one of the most frustrating aspects of this proposed restructuring is that the legal costs are wiping out the profitable efforts of the new management team. Included is a link to the June operating performance (including financial statements)

MSLP is blazing past $1.5M in legal fees cumulatively since the Ch. 11 filing. Can you see a situation where a company dealing with wholesale whey protein costs nearly doubling since 2019 can survive the stress test of COGS doubling and legal expenses devouring gross profit?

Reading through the court docket on Stretto, it looks like Drexler is relentlessly throwing everything he can as a legal impediment to a) invalidate the Intercreditor and Subordination agreement that he signed to receive funding from Empery and b) tie up the parties attempting to use Hilco Corporate Finance LLC as the investment banker to run a timely auction. Like being caught in a whirlpool and your partner is trying to hold your head under water so you can't climb out.

Court filings by Empery call out that one prospective bidder has already communicated their withdrawal from the auction based on the uncertainty surrounding the asset sale. And to be clear - not all assets are up for sale. White Winston has carved out D&O litigation claims prior to 2018 (based on last month's SEC settled complaint, looks like a rewarding move for WW), there is a pool of litigation for creditors, etc. So when (if?) the auction arrives late this summer, how much are the copyrights, trademarks and trade dress of MP really worth? Particularly if any goodwill has been potentially poisoned by Drexler's behaviour towards all those stiffed vendors

It may still be listed as a Chapter 11, but I agree SLC - it's going to look like a liquidation. Empery can be a stalking horse, but they may find themselves as the only serious bidder. And as for your final point, that the corporate entity may get shopped around as a vehicle for something else to reverse merge to, would be quite poetic. This is precisely how the stock ticker MSLP came to be:

"Rather than go through the onerous IPO process, MusclePharm paid $25,000 for a dormant public company, “isometric training technique” marketer Tone in Twenty, and changed its ticker symbol to MSLP. Once public, MusclePharm began making deals with outfits that buy stock from companies at a huge discount then flip it to individuals. “Brad needed to raise a sensational amount of money,” says William Bossung, who was part of the investor group that helped MusclePharm get listed. One financier paid off $375,000 of the World Extreme Cagefighting debt in exchange for 7.8 million shares. Another, who’d turned to penny stocks after being barred from the hedge fund business, acquired about 200 million shares for as little as three-tenths of a penny each." Source: here

That price fetched for a penny stock listing isn't going to make a dent in the total amounts owing.

The operating performance based on prior, SEC-sanctioned management of this company is a black hole for retail investors, with MP in the middle.

This is an interesting case, as it's a Ch. 11 filing (reorganization), but seems to be progressing more like a Ch. 7 (liquidation). There was never much doubt that Empery had zero interest in allowing the company to survive if doing so would impede its attempt to recover as much $$$ as possible through an auction of assets.

Assuming that the corporate entity does survive the asset sale, it is highly likely that it will cancel all outstanding shares as it emerges from BK, and get shopped around as a vehicle for something else to reverse merge into.

Amazing this is not being handled criminally in any way.

And for those who wish to read the SEC's formal complaint filing against Drexler:

Securities and Exchange Commission vs. Ryan C. Drexler, Case No. 2:23-cv-05102

"Drexler, during his tenure as Chairman, President, and Chief Executive Officer (“CEO”) of MusclePharm, a publicly-traded nutritional supplement company, engaged in a scheme to defraud MusclePharm’s investors about the strength of the company’s controls over financial reporting and disclosures and the devastating impact of MusclePharm’s debt default in the third quarter of 2022. His conduct also ran afoul of critical rules regarding the processes, controls, and procedures that public companies, like MusclePharm, must have in place to provide assurance that their accounting and public reports are accurate."

Followed by:

"Drexler’s fraudulent and deceptive conduct manifested itself in two specific ways. First, Drexler failed to ensure that, and made false statements about whether, MusclePharm had basic processes, controls, and procedures in place to ensure that its accounting for revenue, profit, and other important financial metrics –all of which was reported to and relied on by investors – was correct."

It continues, and it's just as grim. I'll leave the reader to follow the link above if they wish to learn more.

Good morning MakeItRain88,

It's not surprising it has come to this - an SEC investigation was pending, and now that they have disclosed litigation you can close the coffin on this investment.

You can follow along here: Court docket: MusclePharm Chapter 11 bankruptcy

To summarize: there is a hailstorm of litigation, the senior secured noteholders Empery and its affiliates will be liquidating the IP in a second attempt at an auction this summer, I don't expect the firm to recoup their investment. There is also a committee of unsecured creditors that rank junior to Empery, and last of all - there are the common stockholders. I'm sorry MakeItRain, but it's almost guaranteed - and you can read the proposed plan in the filings - but all common stockholders will be wiped out.

Keep track of your loss and you can use it as a tax-loss carry forward for hopefully better years ahead.

Would you be able to explain how this might affect the retail investors? All the individual investors owning shares?

Thanks for any clarification you can provide.

SEC Charges Former MusclePharm Executives with Accounting and Disclosure Fraud!

Washington D.C., June 27, 2023 —

The Securities and Exchange Commission today filed a settled complaint charging Las Vegas-based nutritional supplement company MusclePharm Corp.’s former Executive Vice President of Sales and Operations, Brian H. Casutto, former Vice President of Sales, Matthew J. Zucco, and former contract Chief Financial Officer, Kevin R. Harris, for engaging in improper revenue recognition practices to achieve revenue growth demanded by its former Chief Executive Officer, Ryan C. Drexler. The SEC also separately charged Drexler with fraud in a litigated complaint for disclosure violations and control failures.

The SEC’s settled complaint alleges that Casutto, with the assistance of Zucco, engaged in a fraudulent scheme to prematurely recognize revenue for orders that remained in MusclePharm’s control. The complaint further alleges that Harris should have known that MusclePharm prematurely recognized certain revenue and that MusclePharm overstated other revenue by misclassifying customer credits as advertising expenses rather than as reductions to revenue. The defendants’ misconduct allegedly inflated the company’s publicly reported quarterly revenues by as much as 25 percent and gross profits by as much as 49 percent.

The SEC’s complaint against Drexler alleges that, while CEO, he misled investors about the catastrophic impact of the company’s default with institutional noteholders and that he falsely certified that he evaluated the company’s internal controls.

“Honest and transparent financial disclosures are the bedrock of our markets, but as alleged in our complaint, MusclePharm’s executives disregarded these fundamental rules by continuously inflating reported revenue,” said Jason J. Burt, Regional Director of the SEC’s Denver Office. “These actions highlight that the SEC will not hesitate to bring enforcement actions against individuals who threaten the integrity of our markets.”

Without admitting or denying the SEC’s allegations, Casutto, Zucco, and Harris have each consented to the entry of judgments, subject to court approval, permanently enjoining them from violating the antifraud provisions and other provisions of the federal securities laws; requiring Casutto and Zucco to pay disgorgement with prejudgment interest of $79,760.01 and $15,033.06, respectively; requiring Casutto and Harris to pay a civil penalty of $207,183 and $50,000, respectively, and reserving the issue of Zucco’s civil penalty for further determination by the court; and barring Casutto from serving as an officer or director of a public company for five years.

The SEC charged Drexler with violating and/or aiding and abetting violations of the antifraud provisions and other provisions of the federal securities laws and seeks injunctive relief, civil penalties, reimbursement to MusclePharm under SOX 304(a), and an officer and director bar.

Both complaints were filed in the U.S. District Court for the Central District of California.

The SEC’s investigation was conducted by Jennifer Turner and Michael D’Angelo and supervised by Mary Brady, Nicholas Heinke, and Jason Burt. The litigation is being led by Zachary Carlyle and Sharan Lieberman and supervised by Mr. Burt, Mr. Heinke, and Gregory Kasper.

###

We filed a settled complaint charging former MusclePharm Corp. executives for engaging in improper revenue recognition practices and former CEO Ryan C. Drexler for disclosure violations and control failures.

https://www.sec.gov/news/press-release/2023-120

Gone is the $20m Beverly Hills mansion. Poof goes the Malibu beach pad. Now someone has moved to Reno, NV. https://www.zillow.com/homedetails/724-Marewood-Trl-Reno-NV-89511/251962686_zpid/

To get on the good side of local law enforcement, why not bribe them with leftover product you stole from the suppliers. I'm sure law enforcement isn't investigating this.

Big Thanks to Ryan Drexler from MusclePharm for dropping by some Combat Energy Drinks for our officers as well as their generous contributions to RPD’s upcoming fitness facility and support of our Officers wellness! #WeLiveThis #EnergizeRPD #OfficerWellness pic.twitter.com/BEoBD0GzZE

— Reno Police (@RenoPolice) March 2, 2022

“In mid-October 2017, Amerop provided its proposal to the Special Committee, offering to purchase $18 million of MusclePharm stock on condition that MusclePharm replace senior management, including Drexler. ” Musclepharm Corp. v. White Winston Select Asset Fund Series Fund MP-18, LLC, SUCV20190663BLS2, (Mass. Super. Sep. 20, 2019)

I stand corrected - thank you SLC-JD. Almost six years since then of grief, litigation, animosity - turning down this proposal was clearly not the best for MSLP shareholders. These are the kinds of business decisions that can haunt you.

For those following the court docket - Drexler has been opposing the revised auction, claiming it's rushed when no urgency is required. Also explicitly stated is Drexler's desire to insert the coveted Ch.11 Trustee.The viewpoint is likely that by including a Trustee, Drexler will hold some sort of seat at the table as a party that needs to be negotiated with.

Meanwhile, Empery is leaning on their executed Subordination/Intercreditor agreement to object to any insertion of a Trustee, and to reaffirm the status of the agreement with a Motion to Enforce. In short, Empery's stance remains unchanged - when they made the loans to MSLP that Drexler signed for, he also signed this agreement which handcuffs his ability to act without authorization from the lendor (aka Empery and related-parties).

As quoted in the filing linked directly above; "The Subordination/Intercreditor Agreement was a bargained for agreement for which Empery gave, and Drexler received, valuable consideration. Empery expressly bargained to not be in the situation where Drexler placed Debtor in Chapter 11 and then directly and indirectly acted to block or disrupt an Empery supported Sale and Plan, thereby threating Empery’s ability to collect its debt, so Drexler could enhance his personal bargaining position. Drexler knowingly compromised his rights and cannot now seek to undo that compromise, and deprive Empery of its economic and practical rights under the Subordination/Intercreditor Agreement."

To Drexler's credit, he does point out a potential conflict-of-interest when director Nicholas Rubin was inserted onto MSLP's Board. His past dealings and connections with Garman from the namesake GTG law firm should have been disclosed. Making investments and providing services for each other's companies or interests (as they did with Force-10 and LAWCLERK) - to this layperson - should be disclosed as potential conflicts for consideration. Better to disclose and have the possibility of conflict evaluated than to hope nobody notices. Drexler noticed and he's raising objections. But then stepping back - is this about maximizing the value of the estate for the benefit of MSLP shareholders, or is it about Drexler attempting to maximize his own personal benefit?

What happened to fiduciary duties to maximize shareholder value? I revert to the question raised in my last post - millions of dollars from retail and household investors have evaporated due to the decisions made by senior management at this Company. Retail investors held the bag and at best can have insight into the carcass of the MSLP entity and watch it be picked over, and have a loss carry-forward for their taxes.

Or they could make a bid at the auction in July. Ya never know..

I'm stepping into the wayback machine. This was outlined in some of the company's filings, but the attachments to the forms 14-D/A aren't available in OTC's disclosure service, and MSLP's investor relations pages are long gone. Google found a related opinion here: musclepharm-corp-v-white-winston, tho it only offers a summary of the case without the full detail of the complaint.

In short, one of WW's many actions against MSLP/Drex was a derivative action stating that in 2017 the BOD breached its fiduciary duty by refusing to consider an offer that WW made to purchase $18MM of MSLP stock (enough to buy Drex's position out) on the condition that the management team get the boot.

There were questions of fact as to how valid that offer was, etc., but the gist is that WW could have bought Drex out, but Drex wouldn't allow the BOD to consider it.

While I don't doubt SLC-JD your statement that Drexler likely missed an opportunity to avoid exacerbating MSLP's relationship (and his own dealings) with White Winston, I haven't found evidence of WW offering to buy out the investment and loans. Are you perhaps referring to the proposed settlement agreement, filed by WW as a 13D on December 5th, 2022?

Recall the executed settlement between Drexler and WW was to see Drexler pay $4M cash to WW plus offer a convertible note of $4.6M, plus >16M in warrants in exchange for a release on the library of litigation between the two entities. Empery filed a TRO shortly thereafter, and the settlement fizzled into the background as the Chapter 11 filing came into effect. You can connect the dots and see that WW is now in the same unanimous camp as the committee of unsecured creditors, Empery et. al. It is reasonable to speculate that whatever goodwill was existing between the parties leading up to the proposed settlement agreement has likely since evaporated.

Also, of note April's financial performance was released by the current MSLP management team.

Still not quite making money, but the legal expenses are the line item responsible for flipping this from profitable to unprofitable. A $151K net loss for the month of April, where legal fees comprise $260K of expenses. You can imagine the frustration of stakeholders trying to make a viable go of this company, when your monthly legal bills are north of a quarter million dollars and serving as an anchor that keeps this company unprofitable.

It shall be interested to see what happens between now and the July auction for MSLP assets. Empery is allowed to make a credit bid - they are likely deciding internally that even if they do exercise their credit bid, do they really want to end up owning this company?

Drex could have let WW buy out his position and walked away with WW buying out his original investment and subsequent (converted) loans, not to mention his interest and salary all tucked neatly in his pocket. All he had to do was admit that someone else needed to run the show.

Instead, his ego wouldn't let him give way and he'll lose pretty much everything but the cash he actively pocketed. He'll also continue to face a pissed off WW:

"“White Winston D&O Claims” means the estate’s causes of action (and

associated rights to director and officer insurance) against directors and

officers for breaches of their fiduciary duties of loyalty, care, and good faith

that arose on or before December 31, 2018."

Court filings show it's getting personal:

Filed on May 15th this past week, an adversary complaint from the secured noteholders (Empery and its affiliates) referencing the intercreditor/insubordination agreement signed when the notes were placed.

Paragraph six quoted here, if true, is disturbing:

Since his departure, in violation of the Intercreditor/Insubordination Agreement, Drexler has menaced and taken various actions to undermine and interfere with the recovery by Senior Creditor, as collateral agent for the Noteholders. For example, Drexler brought an action in Nevada state court against Senior Creditor; Drexler sued Tim Silver, a portfolio manager of Empery Asset Management, LP (“EAM”), Senior Creditor’s investment advisor, in yet another Nevada State Court, over communications Silver had with other creditors made “during the scope” of the Chapter 11 Case; and it is believed that Drexler launched a clandestine campaign to intimidate EAM’s principal, Ryan Lane, through anonymous communications to his spouse, his children’s school board, his neighbors and to members of the town in which he resides through posts on social media groups. Senior Creditor has and continues to successfully defend against these wrongful actions of Drexler outside of the Bankruptcy Court.

That's messed up.

All parties except Drexler are trying to speed up the hearing on enforcement of the Intercreditor/Insubordination agreement - this will pave the way for the second attempt at an asset sale via auction. You can read the filing showing the votes.

For reference, almost all parties are in agreement on the proposed Plan Term Sheet, the path forward for liquidating the remaining assets and value of MSLP. Empery's filed a response highlighting the $650,000 increase in expected expenses, blamed on Drexler's claimed excessive legal burdens. At its core, everyone else is agreeing the Intercreditor/Insubordination agreement that Drexler signed to receive the Notes handcuffs Drexler's ability to file legal challenges, and now that he is out of the company his own agenda is at odds with the fiduciary duties of the remaining Musclepharm officers.

On page 450 you can read this Intercreditor/Insubordination document and decide for yourself

Wrapping up, Drexler wants to appoint a trustee so he can insert a party that will negotiate his interests. Right now, Empery, White Winston Select, the unsecured creditors committee, other secured creditors like JW Nutritional are all in agreement with the Plan Term Sheet. Drexler is alone. What does that tell you about the motivations of the parties? Who is actually working towards a reorganization of the company, and who is trying to strip out any last cash they can? And let's not forget, these discussions in bankruptcy court are taking place between debtholders and the institutional shareholders. There are millions of dollars lost by individual retail investors during Drexler's reign as MSLP CEO and largest stockholder that have no say in the matter and can only watch from the sideline.

Based on the financing and proposed path forward, the Noteholders (aka Empery) are due to be paid first. Drexler isn't supposed to be paid until the noteholders are. The question being pondered - after the carcass of MSLP assets are liquidated on July 6th how much money will be generated to pay off the noteholders, and will anything else be left? Maybe the most likely answer to that question explains the actions here.

Getting towards the end of the line here, Drexler's legal counsel has filed paperwork to resign based on...you guessed it - Drexler not paying his bills.

NOTICE OF HEARING ON MOTION OF CARLYON CICA CHTD. TO WITHDRAW AS COUNSEL OF RECORD FOR RYAN DREXLER

You can read the specific details in this filing on Stretto:

The Firm seeks to withdraw from its representation as counsel for Drexler because continued representation will result in an unreasonable financial burden on the Firm. Drexler has not complied with his obligation for timely payment of amounts due to the Firm. In addition, the Firm and Drexler have fundamental disagreements rendering it difficult or impossible for the Firm to continue in its role as attorneys for Drexler

Anybody reach out to Brad Pyatt and get his take on what's left of this smouldering ruin?

Many retail investors were burned on $MSLP, it's disappointing to see this result. Hopefully a company of some value emerges from Ch. 11, as the interim reports filed actually show Musclepharm generating a (small) profit, despite the significant reorganization costs, not to mention the opportunity cost of distraction.

March 2023 numbers:

Sales: $1,241,893

Gross Profit: $568,346

Re-org Costs: $326,269

Net Income: $11,367

Still dealing with significant cash flow problems, reliant on DIP financing, factoring of invoices, etc.

Good luck to the parties involved trying to make a go of this:

https://ibb.co/VWJ2D89

Madcow, the IR website Musclepharmcorp.com's Apache server is still up and publicly available, just hidden from the direct URL.

Most information remains.

I did not.

I stand corrected...

SLC, notice /s ?

you will most commonly see /s to denote some online comment as sarcasm.

Don't disagree with anything in your post, aside from:

This is Ryan and Heller together (/s) at Studio 54 back in the 70s.

Peony, I am not a premium member so do not have access to PM. My allegations regarding Ryan Drexler committing PPP fraud is based on the following facts:

From the Treasury Department:

The funds will be used to retain workers and maintain payroll or to make mortgage, lease, and utility payments.

Payroll costs are capped at $100,000 on an annualized basis for each employee.

.jpg)

Creditors' Motion for Relief from Automatic Stay

Thermolife, a long-suffering creditor that was awarded $1.6M in litigation in an Arizona action via bench trial, filed for motion for relief from the automatic stay during Ch. 11 today. The hearing is scheduled for May 2nd, but at its core, Thermolife's counsel is asserting the awarding of damages in the Arizona court system was finalized prior to the MP bankruptcy filing, and that the remaining $600K in surety bonds that should be excluded from the assets of the bankruptcy estate. Note, Drexler via a mixture of his own payment and personal guarantee pledged the $600K in surety bonds to two entities: Atlantic Specialty Insurance Company and Suretec Insurance Company. The surety bonds, as described in a recent 10-K filing, have the purpose to:

"In the interim, the Company filed an appeal and posted bonds in the total amount of $0.6 million in order to stay execution on the judgment pending appeal. Of the $0.6 million, $0.25 million (including fees) was paid by Mr. Drexler on behalf of the Company"

So there likely emerges another front for court battling - should the May hearing rule in favour of Thermolife's relief motion, the bonds from the insurance companies will be paid out, and the remaining amount (~$1.2M) will remain as outstanding due to creditor.

This provokes a short analysis of Musclepharm's balance sheet, as it's long demonstrated the negative equity (>$50M deficit), of which $48M (!) was last characterized as current liabilities, and much of the amount owing is tied up in litigation, specifically - settlements that have been agreed to but not adhered to.

Below is a short synopsis of litigation, and how it could be interpreted this motion for relief affects creditors:

Thermolife Should they collect on their surety bond for $600K, then their remaining amount owed is $1.2M from the estate.

White Winston The 11th hour attempt to reach a broad settlement across all the ongoing litigation actions makes analysis hazy - clearly White Winston/Amerop believe there is still something there in the business, and are attempting to best position themselves when/if MP can emerge from Chapter 11.

Empery Claims and cross-claims aside, their security agreement makes it very clear they own the collateral, which at this point is mostly the intellectual property and branding, and whatever AR from the Costco account that hasn't already been tied up in factoring. Do you think a New York hedge fund is interested in running this business? The push for an Article 9 auction sale likely answers that question. For those interested, here is an excellent case study of a similar situation to MP, in which an overleveraged food services company relinquished its assets via Article 9 sale. Big difference here is the late Ch.11 filing.

IRS and Estalella Regarding withholding taxes remittance on restricted stock units, last I checked this action was ongoing between the company and the former officers.

Manchester City Football Group MP has owed Manchester City over $3M for years, they've only paid $0.3M so far, and I have yet to see any commitment towards paying additional amounts.

Nutrablend MP had minimum monthly purchase orders of at least $700K to help offset the awarded amount owed to Nutrablend. These payments surely aren't being fully made, as the Company isn't even selling that much in product each month.

4Excelsior Yet another stiffed vendor, along with SK Labs. Both entities were recently named to the committee of unsecured creditors.

For those who have read it this far - how do you see this playing out in the next six months?

One last item to keep in mind - assuming Empery prevails as the senior secured creditor, that Chapter 11 doesn't result in a sustainable reorganization plan, and returns to the Article 9 auction of its collateral (i.e. MSLP branding and IP assets):

Assuming the auction is completed, the buyer must be willing to proceed outside of an insolvency proceeding. In this case, an Article 9 sale could be challenged by creditors as a constructive fraudulent transfer - intent to defraud creditors isn't required to be proven. This type of litigation can be brought as long as four to six years after the sale.

Taken from above:

"To prevail, the party challenging the transaction must establish, first, that the borrower was insolvent on a balance sheet basis or similarly financially challenged on a cash flow or capitalization basis, and second, that the sale was for less than “fair consideration” or “reasonably equivalent value,” depending on whether state law or the U.S. Bankruptcy Code governs the claim. Where the borrower was in default under its credit facility (a requirement of Article 9) and creditors were left unpaid, the insolvency prong would likely not be difficult to prove. But if the sale was an arm’s-length sale to a non-insider of the borrower after a fulsome marketing effort, it may be quite difficult to prove that insufficient value was paid in the sale. The value issue, together with the expense of bringing a fraudulent transfer claim, can be a significant deterrent to an attack by unsecured creditors, but the risk needs to be evaluated on a case-by-case basis. While the risk of such a challenge can be significantly minimized if not nullified by a sale through bankruptcy or other insolvency proceeding, an insolvency proceeding, as noted above, may entail significantly more expense, delay and execution risk. Additionally, from the buyer’s perspective, there is risk that it may lose the deal to a competing bidder. Moreover, an insolvency proceeding is a public proceeding, whereas an Article 9 sale can be conducted outside the public view.

In addition to the risk of potential attack from unsecured creditors who will not be paid all, or an agreed portion, of their claims in connection with the sale, junior lienholders (if any) who are not paid from the sale proceeds can challenge the sale under provisions of Article 9 if it is not a “commercially reasonable” sale. Again, in the context of a private Article 9 sale as a going concern, a professional marketing and sale process will significantly mitigate the risk of a successful challenge on commercial reasonableness grounds. In the particular case described herein, the subordinated lenders and our senior lender client were party to a customary intercreditor agreement under which, after the borrower’s default, the sub debt holders were substantially precluded from contesting any sale or other disposition of collateral that the senior lender supported."

In short, an Auction 9 sale could proceed - but reading through financial statements of MP, would it really fetch a price high enough that unsecured creditors would not be left as bagholders? Now it makes sense why Thermolife so quickly filed their motion to stay and collect on the surety bond.

Filing of draft final budget for the next 13 weeks submitted, for those following the bankruptcy court in Nevada.

Couple observations below the supplied cash flow forecast:

1. This model assumes 16.7% gross profit margin, without including the logistics and shipping costs. The most recent MSLP 10-Q (from March 31, 2022), shows a gross margin of only 11.5%. Logistics' spot on the old 10-Q net income statement isn't explicitly stated. What's caused the favorable significant swing in margin? Most raw materials and inflation are only increasing in prices, hammering CPG margins. Also of note is one of the major suppliers for their protein powders, JW Nutritional has also been appointed to the court-supervised committee of unsecured creditors. Most of the committee contains current or former suppliers involved in litigation with the company. With the debtor-in-possession funding, it stands to reason any supplier would not soften their own pricing to the benefit of the corporation, particularly if there has been litigation in the past.

2. Board member compensation is more than twice the marketing and e-commerce expenses combined. Details aren't available, if the compensation is stock-based (although hard to price equity or options on a delisted ticker), or cash-based. I don't envy having to manage these tough times, but Musclepharm as a brand is coasting on its diminishing legacy reputation. Even acknowledging the stated "catch-up" nature of the compensation for December to February, this still seems out of sync with marketing spend. Sites like Muscle and Strength have long since dropped Combat Protein, and other MP products in their top 50 sellers. But the current bestsellers list is not that impressive - dominated by Chinese-owned MuscleTech, competing with NOW Foods, USN and old standbys like C4 Cellucor. and Allmax. At its core, whey protein is a commodity product and marketing correctly to the target channels will elevate the brand. Is $50K a quarter in marketing really sufficient to drive top-line results?

3. Restructuring costs are about 30% higher than all SG&A costs forecasted for this quarter. That's tough for any balance sheet to absorb, but of note the DIP financing of $2.25M is earning only ~8% in annual interest. With current inflation, it's at par value. Something to think about, which leads to:

4. Assuming the company can emerge from Chapter 11, settle litigation, and actually run as a functional business, and with stripping out all restructuring costs going forward, at current margins including shipping and logistics, this company needs to jump from its forecasted $4.1M revenue per quarter up to about $10.8M. Is this realistic? Not really. That's also making the assumption their non-logistics SG&A costs don't scale and remain fixed. With the customer concentration risk held before with Costco, they might need that account back just to help them meet the sales target.

Very difficult times ahead. I hope the new team can accomplish this feat.

If you want to read what happened behind the scenes the past several months and some of the funniest text message responses to the "good faith" liar Ryan Drexler, click this link.

https://cases.stretto.com/public/x219/12044/PLEADINGS/1204403212380000000044.pdf

Interesting read in how the wolves are now devouring the carcass of the failed trust fund baby of Halbert Drexler.

https://cases.stretto.com/public/x219/12044/PLEADINGS/1204402272380000000144.pdf

Ryan has also downsized from his former Beverly Hills and Malibu estates (where he was delinquent on his property taxes) to a postage stamp lot and tract home in Reno.

Back to very telling IMDB credit: https://www.imdb.com/name/nm3573940/bio

To report fraud on the PPP program, specifically Ryan Drexler who illegally personally pocketed 100% of the PPP funds allocated to Musclepharm:

https://www.sba.gov/partners/contracting-officials/contract-administration/report-fraud-waste-abuse

there are whistleblower awards available.

I, RYAN DREXLER, hereby declare under the penalty of perjury as follows:

1. The following facts are personally known to me and if called to testify thereto, I

could and would competently do so under oath.

2. I am the former CEO of Musclepharm Corporation (“Debtor”) and the former

Chairman of the Board of Directors for Debtor. I tendered my resignation as CEO in early December

2022, but because of litigation brought against the Debtor and I in New York, and the

commencement of this bankruptcy proceeding in Nevada, my resignation did not become effective

until January 8, 2023.

When will we see the PPP program loan of $900k that Ryan illegally diverted 100% to his own salary hit the fraud indictment wire?

|

Followers

|

359

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

80866

|

|

Created

|

02/02/10

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |