Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Blowout quarter about to be reported imho legacy asset wasnt reported on last report to my understanding : ) selling for under 1mill market cap now lol think someone had to liqiudate for some reason a month ago. Thyre loss my gain muuhahaha buying again Glta!

MNTR poised for big run.. profits up.. stock hilariously undervalued and should be at $.30 based on revenues alone. Should be at $1.50 by EOY and $5 by EOY 2024.

Will MNTR post a net profit for Q4-2022?

MNTR stats like Price to book value and price to sales making me feel like this is a good value. Looking to add more glta

Had a nice quarter this year. i bought some

when they legalize marijuana for the banking system on the federal level

When will MNTR shares get to $5.00?

Will Chester find someone to run the company and create value for the long-suffering shareholders?

(Shareholders other than him, of course.)

He and his latest wife both draw salaries?

Insurance?

MNTR rents a small space in his house?

For how much per month?

Selling shares?

How does any of this help shareholders get a return on their investment and increase the stock price?

Billingsley Business Brilliance

Do due diligence

No shares traded today (Aug 17, 2022).

Billingsley Business Brilliance

Does Chester do anything besides sign the quarterly report, sell more of his shares and cash his paychecks (earned for all of his "work")?

Is MNTR's renting a room is his very nice Texas house paying for his mortgage?

the stock will move on speculation if the bill in Congress ever gets passed to legalize marijuana otherwise it's dead

Will Chester allow stockholders tohave an annual meeting?

This year?

How long has it been since Chester has allowed mere stockholders to have a say in how $MNTR is governed?

Are $MNTR stockholders paying for Chester's mortgage for his new house in Texas?

Billingsley Business Brilliance

Do due diligence

SEC to make Chester justify his high salary?

Please read the article linked at the bottom of the post.

Would Chester have to use positive performance to justify his high salary?

Does MNTR consistently losing money justify his high salary?

Does sending $600,000 to someone somewhere for "loan insurance" justify his high salary?

(Maybe Chester will use the money from his continuing sale of MNTR stock to repay MNTR for this "interesting" business decision.)

Does taking MNTR stock from over $8.00 a share to around 5 or 6 cents a share justify his high salary?

Billingsley Business Brilliance

Do due dilgence

https://www.newsmax.com/finance/streettalk/ceo-compensation-executive-compensation-sec/2022/01/27/id/1054316/?ns_mail_uid=7e1604b3-bc48-4d61-9421-32969ddd0896&ns_mail_job=DM297537_01302022&s=acs&dkt_nbr=010502shwk9v

So...who would enjoy being a mod and updating the intro?...I'm no good with this stuff...(Boomer)...

I remember that car. There were some serious drug trials going on over at those apartments :)

Thinking we may see a run here soon ![]()

$MNTR

Still watching here.

$MNTR

How Chester plays with his MNTR generated wealth?

How are you spending the money you have made from investing in MNTR?

https://www.excellence-mag.com/issues/285/articles/the-perfectionist

Anyone able to provide a little more DD here may be adding a few tomorrow morning. Seems like the bottom is just about in.

$MNTR

On watch.

$MNTR

When will the annual meeting be held?

Good to see Chester is buying MNTR stock.

He marked "A" for "Acquired" in box 4 in Table I in the 05-21-2021 Form 4 filing.

Hopefully this is not a mistake and he has to refile the Form.

Billingsley Business Brilliance

Do due diligence.

Mentor Capital Revenues Up 15% for the 1st Quarter 2021

https://www.otcmarkets.com/stock/MNTR/news/Mentor-Capital-Revenues-Up-15-for-the-1st-Quarter-2021?id=303668

$MNTR FORM 10K OUT: https://www.otcmarkets.com/filing/html?id=14871524&guid=eTFpUH1fVoZtoth

2020 Revenue up $610k over 2019 (15% increase in COVID year)

2020 Loss down to $1M from $1.7M loss in 2019

2020 Net Income -$786k vs -$3.4M in 2019

Stock is wildly undervalued.. will be $.50 by June 2021

Mentor Capital Rotates from COVID into Bitcoin Space

Mentor participates in Coinbase IPO for its shareholders

$MNTR headed to 1+ ... Other cannabis BDCs PPS are at 4x-8x revenues. Expect ER by mid-to-late month with revenues in the $1.4M range for the quarter and $4-$5M for 2020 with path to $6M in 2021. PPS should be at $1-$2.50

https://www.nytimes.com/2021/03/31/nyregion/cuomo-ny-legal-weed.html

NY makes it official and mostly immediate! 3oz of weed can be possessed by adults for personal use and 24grams of concentrates. Weed can be smoked anywhere smoking is allowed. Pot convictions will be expunged.

HUGE move for MJ industry... MNTR

EOY 2020 results by mid April. Expect ~$4.7M in revenue YOY, and an increase in rev for Qs 3 and 4. NY state just cleared legalization.. MJ stocks are hot!

Vaccine Affirming Lapel Pins Free to Mentor Capital Shareholders

1:52 PM ET 3/23/21 | BusinessWire

Peace of mind in casual settings during transition to maskless normalcy

PLANO, Texas--(BUSINESS WIRE)--March 23, 2021--

Mentor Capital, Inc. (OTCQB: MNTR) announced that any shareholder may receive a metal lapel pin at no cost from Mentor Capital, that is intended to self-indicate for casual situations that the wearer has been vaccinated with the Pfizer, Inc., Moderna, Inc. or AstraZeneca, PLC vaccines. The one inch pin reads "Covid-19 Antibodies" and is intended to give greater peace of mind in supermarkets, restaurants and other casual settings. This allows the wearer to unofficially but easily represent that they are vaccinated. Like an "I Voted" sticker, the pin may also help promote increased vaccine participation in areas where the government and businesses are already transitioning from a masked to a maskless environment.

Mentor shareholders may obtain the lapel pin free of charge by sending a self-addressed stamped return envelope to the company address: Mentor Capital, Inc., 5964 Campus Court, Plano, Texas 75093. The pins are sourced through "Antibody Badge" a non-profit that Mentor has sponsored to help support the anti-Covid-19 effort. Any person may request a free AntiBody Badge pin by asking for one in writing, sent to the company address, and including a self-addressed, stamped, return envelope. The offer is open as long as supplies last.

About Mentor Capital: The Company seeks to come alongside and assist private companies and their founders in meeting their liquidity and financial objectives, to add protection for investors, and to help incubate private companies. Additional important information for investors is presented at: www.MentorCapital.com

This press release is neither an offer to sell nor a solicitation of offers to purchase securities.

The Company undertakes no obligation to update or revise these statements to reflect new information, events, or circumstances occurring after this press release date.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210323005939/en/

CONTACT: Mentor Capital, Inc.

Chet Billingsley, CEO

(760) 788-4700

info@mentorcapital.com

SOURCE: Mentor Capital, Inc.

Copyright Business Wire 2021

EOY results in roughly 2 weeks.. NY cleared the legislative hurdles blocking MJ approval. Formal approval within 2 weeks. Load up, the train is about to leave the station.

Next stop $1..

$mntr EOM ER coming.. expect $1.5M in revenue.. 20% increase YOY sales. Expect $.50 after ER and $1.25 by EOM April

$mntr $0.193 v -0.0125 (-6.08%)

Volume: 20,220 @03/19/21 3:08:04 PM EDT

Final vote on NY legalization of MJ happening possibly by EOW. Full legalization is expected. $MNTR (pot stocks)

Quick DD on MNTR... YOY Rev = appox $4.2mm. Float = 19mm shares.. pps = $.24 (yesterday closing), which makes a market cap of ~$4.5mm.

Other cannabis investment stocks are trading at 4-8x (even 100x!) multiples on revenues. If this stock simply got some respect for its growth and a sector-wide multiple, we'd be at $1 tomorrow.

ER expected by EOM or early April for EOY 2020. NY MJ vote coming soon.. cannabis is hot!

Next leg up starting.. don't miss the boat!

$MNTR huge move yesterday... still undervalued tremendously. Should be trading at $.50+. Look for next leg up after fins come out soon...

$MNTR still undervalued by a factor of 4x. Earnings coming within 2 weeks and should push this to $.50+.

cash is king.....along with some ball$$$$$$$MEN-TOR THE ONLY GREEN IN MY PORT-FOLIO

weekly permalink above $.5 w/o news PRIMED: https://schrts.co/IiKTYSYP jmo:)

Mentor Ip, Llc has 2 trademark applications. The latest application filed is for "(MEN)TOR"

https://uspto.report/company/Mentor-Ip-L-L-C

On September 22, 2020, Mentor IP, LLC, the Company’s 100% owned subsidiary, received a Canadian patent covering certain CBD, THC, and nicotine concentrations in vape systems. Mentor IP, LLC’s interests in the Canadian patent and the parent May 5, 2020 United States patent are governed by a “Larson - Mentor Capital, Inc. Patent and License Fee Facility with Agreement Provisions for an -- 80% / 20% Domestic Economic Interest -- 50% / 50% Foreign Economic Interest” with R.L. Larson and Larson Capital, LLC.

$MNTR weekly https://schrts.co/GYUzstUE

$MNTR Share Structure

Market Cap Market Cap 3,977,889

03/03/2021

Authorized Shares 75,000,000

02/05/2021

Outstanding Shares 22,730,793

02/05/2021

Restricted 2,172,243

02/05/2021

Unrestricted 20,558,550

02/05/2021

Float 19,883,188

11/04/2020

Revenue for the nine months ended September 30, 2020 was $3,539,860 compared to $3,177,083 for the nine months ended September 30, 2019 (“the prior year nine-month period”), an increase of $362,777 or 11.4%.

$mntr $0.25 ^ 0.005 (2.04%)

Volume: 75,597 @02/19/21 3:40:41 PM EST

$MNTR $.35 coming.. on the way back to $.50+. Financials coming.. deregulation with cannabis coming.. solid investments panning out.

|

Followers

|

130

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

3662

|

|

Created

|

02/15/10

|

Type

|

Free

|

| Moderators | |||

MNTR

MNTR

| Authorized Shares 75,000,000 02/05/2021 Outstanding Shares 22,730,793 02/05/2021 Float 19,883,188 11/04/2020 |

| | | |

VIDEOSCannabis: Harvesting the 600% Growth, Without Taking a Hit

|

| Management Today Magazine:  Click to Read Full Article Portfolio & Investments |

Metro Capital, Inc. (MNTR) is a public company that invests in medical and social use cannabis companies. Mentor takes a 10% to 60% position in the family of participating companies, but leaves operating control firmly in the hands of the cannabis company founders. Because adult social use and medical marijuana opportunities often overlap, Mentor Capital also participates in the legal recreational marijuana market. However, Mentor’s preferred focus is medical, and the company seeks to facilitate the application of cannabis to cancer wasting, calming seizures and Parkinson disease, reducing ocular pressures from glaucoma, and blunting chronic pain.

Mentor’s approach and capital structure allows its shareholders to buy an additional $140 million of Mentor shares at approximately a 12.5% discount. As money is sent in to buy into the growing cannabis portfolio, the proceeds are split pro rata amongst the cannabis companies that are participating in the indirect sale in order to receive funding. As more private cannabis companies join in the consortium, the higher the MNTR share price is pushed, other things being equal. The increasing share price increases the exercise of stock options and warrants by both Mentor Capital’s 1,500 mostly accredited shareholders and the public market in general. Using this approach, Mentor can deliver a higher price to founders for a smaller slice of their business. Retaining control and receiving more cash are the two key advantages to cannabis founders working with Mentor Capital, Inc.

Only 3% of the illegal marijuana market has, at the beginning of 2014, been shifted into the legal sector. This implies a 30x potential increase in the size of the cannabis market upon the eventual realization of a federal lifting of the prohibition on cannabis, if lifted for both medical and adult social use. The 30x implied illegal to legal potential market shift may be one factor in why the market capitalization sof some public cannabis companies are in the 30x revenue (i.e. sales) range. The $1.4 Billion legal cannabis market is forecast to grow by 63% during 2014. It is important to note that this 63% annual increase in sales or even the entire 30x potential increase requires no true growth in the overall cannabis market or other growth in cannabis usage. The modeled growth is satisfied, in our understanding, by the shifting of cannabis buyers to legal sellers rather than them risking buying through any remaining illegal channels. The $50 Billion market already exists and does not need to be developed, just shifted over. Antidotal evidence in Denver indicates that illegal channels are already expressing resentment toward the decline in street sales because of the shift to legal, controlled cannabis sale.

To lead and capture a major portion of the potential 30 times increase in the legal cannabis market Mentor Capital's investing strategy is:

1) Be first with significant public money

2) Quickly roll up the best cannabis participants in a public vehicle

3) Bring a high level of character and business professionalism to the marijuana investing sector

Mentor is authorized (almost like a group IPO) to raise $140 million from the public market and is committing those funds to the cannabis companies that join in the cooperative portfolio, trading a slice (10% to 60%) of their business in exchange for public market funding. To Mentor's knowledge, Mentor Capital is the first public company to commit this level of a cash raise to the cannabis market.

In any very rapidly growing situation, companies need large amounts of capital to keep pace with the growth opportunity. It is hoped that the cannabis firms Mentor funds will have a significant advantage in absorbing a large share of the expected business expansion.

In order to apply the $140 million fully and quickly, Mentor Capital has been very aggressive in recruiting cannabis companies to secure their share of a funding portfolio. A very high price in future proceeds is offered, against the backstop of starting within a $1.4 Billion legal market and looking to expand to encompass the $50 billion already existing illegal market, all implying a 30x market growth.

The current public market multipliers are in the 30x to 80x revenues range. This, quite possibly because there is a projected near term market growth of 30 times. Almost any reasonably solid, well-financed company will do well in this sort of environment. Mentor is quite experienced in picking solid companies and even very high offers will still be much less than 30x revenues. This all gives encouragement to green light a roll up of the best available cannabis companies in each sector and region. This investment and acquisition approach may have an expectedly high return but surprisingly low business risk, in our examination.

A final plank in the Mentor Capital investment strategy is qualitative and is pushing to bring a high degree of business professionalism and transactional integrity to the marijuana public market. As a first, the CEO voluntarily placed all of his MNTR shares in escrow with a law firm. This, to address the widespread concerns that pump and dump schemes are prevalent in the medical marijuana market. Additionally, the CEO is taking the role of the non-user, designated driver in this cannabis industry involvement. Finally, following from the West Point, Harvard, General Electric formal approach to the world, all interactions are structured to be 100% business and win-win-win. In an open way all business transactions should be a win for Mentor, for cannabis founders, and the investing public.

This formal, win-win-win, all business approach is a natural one for Mentor Capital. Management hopes in this way to attract the cannabis founders of the best cannabis brands. These founders are brought together with conservative investors who are still looking for a solid business approach within this extraordinary opportunity.

Chester Billingsley is a native of Minnesota, born in 1952. He received a congressional appointment and did his undergraduate work at West Point. Later he went to graduate school at Harvard University where he received a Master’s Degree in Applied Physics with concurrent study at Harvard Business School and at MIT studying proton radiology as applied to difficult to treat cancers, in conjunction with Mass General Hospital.

Mr. Billingsley spent the major portion of his early career at General Electric in technical sectors in project, turn-around and international management positions. In 1985 he formed Tech Start, the predecessor to Mentor Capital in the heart of Silicon Valley. He has held the general manager or president position since that time.

In 1995 he took the firm public and has had lead responsibility in the Tech III Partners, Cambridge Equity Partners, and Mentor Investors I, LP financial partnerships. He has directed the successful acquisition or investment in thirty-six operating business or entities.

Mr. Billingsley is a conservative, 61 years old, non-using businessman. In August 2013, he led the surprising but science-based decision to take Mentor Capital into the medical marijuana space. The goal was to pursue an alternative approach to fighting cancer while seeing significant shareholder returns.

As a public company pioneer in the legal cannabis space, Mr. Billingsley became a founding director and officer of the board of directors of the Nevada Cannabis Industry Association in November 2013.

| Market Value1 | $12,196,693 | Jan 17, 2014 |

| Shares Outstanding | 6,419,312 | Sep 30, 2013 |

| Float | 1,545,670 | Sep 30, 2011 |

| Authorized Shares | 400,000,000 | Sep 30, 2013 |

| Shareholders of Record | 1,561 | a/o Sep 30, 2011 |

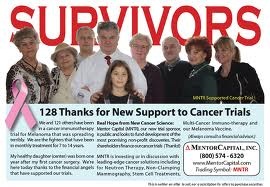

Mentor Capital (MNTR) Invests in Leading-Edge Cancer Therapy & Drug Development Companies

Filings

http://www.otcmarkets.com/stock/MNTR/filings

Summary Data. Management Team. Professional Support. Philosophy.

Ethics. Corporate Governance.

http://www.mentorcapital.com/About-Mentor-Capital.html

Portfolio Companies

Advaxis, Inc. (ADXS)

Advaxis is a biotechnology company that uses a harmless bioengineered bacterium, Listeria monocytogenes to activate the immune system to treat cancer. A vaccine of incapacitated bacteria infiltrate cancer cells. The body attacks the cells containing or marked by the bacteria, killing the cancer cells.

Antigenics (AGEN)

Biotechnology company developing cancer vaccines and other treatments for cancer and infectious diseases.

BioVest International, Inc. (BVTI)

Biovest International develops personalized immunotherapies for life threatening cancers of the blood system.

Celldex Therapeutics, Inc. (CLDX)

Celldex Therapeutics is an integrated biopharmaceutical company that applies its comprehensive Precision Targeted Immunotherapy Platform to generate a pipeline of candidates to treat cancer and other difficult-to-treat diseases.

CEL-SCI (CVM)

CEL-SCI is dedicated to improving the treatment of cancer and other diseases by unleashing the power of the immune system; the body's natural and most potent defense system.

Dendreon (DNDN)

To target cancer and transform lives through the discovery, development and commercialization of novel therapeutics that harness the immune system to fight cancer.

Generex Biotechnology Corporation (GNBT)

Generex is engaged in the research, development, and commercialization of drug delivery systems and technologies. Generex has developed a proprietary platform technology for the delivery of drugs into the human body through the oral cavity (with no deposit in the lungs).

Hadron Systems, Inc. (Private)

Widely recognized by cancer immunologists is the communicative role of tumor stromal cells that shield tumors from the immune system, and the potential of vaccines with inhibiting properties. Hadron Systems, Inc. - a privately held company - represents the targeting and ablation of tumor stroma via targeting/nucleus internalization in combination with particle therapy (the product). The product is classified as a medical device, and a clinical trial to include late-stage cancer patients is planned for September 2012.

ImmunoCellular Therapeutics, Ltd. (IMUC)

ImmunoCellular Therapeutics, Ltd. (OTC:IMUC.OB) We are a clinical-stage company that is focused on developing new therapeutics to fight cancer using the immune system. Our product pipeline includes peptide based vaccine to target cancer stem cells, cellular immunotherapies to target cancer associated antigens, and monoclonal antibodies to diagnose and treat several different cancers. Our main disease focus using our immunotherapy technologies is to treat glioblastoma, but these therapies may also be applicable to multiple other cancers such as pancreatic, colon and breast cancers due to presence of similar epitopes on these malignant cells. Our antibodies are designed to treat small cell lung cancer, pancreatic cancer, multiple myeloma and ovarian cancer.

Northwest Biotherapeutics, Inc. (NWBO)

Northwest Biotherapeutics, Inc. is a development stage biotechnology company focused on discovering, developing and commercializing immunotherapy products that generate and enhance immune system responses to treat cancer.

Oncothyreon (ONTY)

Oncothyreon is a biotechnology company dedicated to the development of oncology products that can improve the lives and outcomes of cancer patients.

Provectus Pharmaceuticals, Inc. (PVCT)

Provectus Pharmaceuticals, Inc., with its home office in Knoxville, Tennessee, is developing advanced prescription drugs in the fields of oncology and dermatology. Clinical trials of our cancer drug PV-10 for the treatment of melanoma, breast cancer, and liver cancer are currently being conducted. PH-10, our topical formulation of Rose Bengal, is also in clinical trials for psoriasis, atopic dermatitis, and eczema.

MNTR's objective is to help defeat cancer by funding $125 Million into the best new cancer fighting companies. MNTR equity is targeted to the critical gap between non-profit discovery and Big-Pharma sales.

To inject funds into the cancer companies (rather than trade in the market) MNTR seeks to directly acquire and escrow $125 Million in shares from fifteen Cancer Index or other leading firms. Any resulting net exercise in MNTR's $125 Million in freely tradable warrants are paid out pro rata to the cancer fighters under MNTR's standard Long-Term Equity Funding Contract.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |