Wednesday, July 13, 2011 4:00:32 PM

Compensated Awareness Post View

Disclaimer

$WKLI *dd*~WikiLoan Inc.~"Leading~Peer-to-Peer~lending~platform"~Everyone~can~use~a~Helping~Hand

About WikiLoan Inc.

About WikiLoan Inc.

A leading Peer-to-Peer lending platform in the United States

A leading Peer-to-Peer lending platform in the United States

100% proprietary technology built from the ground up

100% proprietary technology built from the ground up

A fully automated system built for security and efficiency

A fully automated system built for security and efficiency

WikiLoan is a website that provides tools for peer-to-peer borrowing and lending. People can use the tools on the website to borrow and lend money among themselves at rates that make sense to all parties. WikiLoan provides management tools that allow Borrowers and Lenders to manage the process by: providing loan documentation, promissory notes, repayment schedules, email reminders, online account access, and online repayment.

Borrowers go through a simple process to create a loan listing between $500 and $25,000. They set the rate they are willing to pay for the loan, get their WikiScore, and invite friends in their network to view the listing.

Lenders receive an invitation to view a listing and are provided with the borrower's WikiScore, debt-to-income ratio, and the loan repayment schedule.

Once the loan is fulfilled, WikiLoan compiles the promissory note and provides it to all involved parties. WikiLoan handles on-going notifications and provides access to online payment systems to ensure a smooth repayment process.

WikiLoan does not sell, rent or share members' personal information with third party marketers.

Security Details

Security Details

Share Structure

Market Value1 $14,678,777 a/o Jul 09, 2011

Shares Outstanding 497,585,670 a/o Jun 01, 2011

Float 187,269,280 a/o Jun 13, 2011

Authorized Shares 760,000,000 a/o Jun 13, 2011

Par Value 0.001

Standard Registrar and Transfer Co., Inc.

Transfer Agent

12528 South 1840 E.

Draper, UT, 84020

801-571-8844

FORM 10Q reported June 14, 2011 period ending April 30, 2011

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=7992610

Shareholders of Record 1,550 a/o May 11, 2011

Security Notes

Capital Change=shs decreased by 1 for 20 split Pay date=02/26/2008.

Capital Change=shs increased by 10 for 1 split, payable upon surrender.. Pay date=06/01/2011.

Company Notes

Formerly=Swap-A-Debt, Inc. until 6-2009

Formerly=5Fifty5.com, Inc. until 2-2008

Investor Relations

The management team believes the market opportunity for WikiLoan is significant, relative to the ongoing financial crisis, bank consolidations and changing consumer behavior regarding online lending, borrowing and banking, as outlined below:

The management team believes the market opportunity for WikiLoan is significant, relative to the ongoing financial crisis, bank consolidations and changing consumer behavior regarding online lending, borrowing and banking, as outlined below:

The Credit Squeeze

Globally, the recent credit squeeze has led banks to increase interest rates, tighten their lending practices and institute ever tougher borrowing requirements, making it increasingly difficult for would-be borrowers, particularly those with credit challenges seeking small loan sizes of $25,000 and under, to gain access to capital via traditional lending institutions.

The Lending "Gap"

Current market conditions have created an opportunity for private lenders to step-in and fill the small loan lending "gap" increasingly vacated or made more difficult to access by traditional lending institutions. In response, individual lenders and borrowers are connecting directly with one another online, without the use of a financial institution or "middle man", for the purpose of exchanging capital through peer-to-peer lending.

Peer-to-Peer Lending

Peer-to-peer lending is one of the fastest growing sectors of the financial services industry, a trend that is expected to continue for the foreseeable future

Sector: 6153 - Short-term business credit

Products & Services

Products & Services

How Borrowing Works, in Detail

1. Build your Loan Listing Asking a relative or a friend for a personal loan can be awkward. We help you through the process by building a personalized loan proposal you can use when asking for your loan. It only takes a few minutes to create a loan request using our Loan Calculator. +/- Loan Uses

1. Build your Loan Listing Asking a relative or a friend for a personal loan can be awkward. We help you through the process by building a personalized loan proposal you can use when asking for your loan. It only takes a few minutes to create a loan request using our Loan Calculator. +/- Loan Uses

As a borrower, how you'll use your loan is up to you. When building your Loan Listing, selecting the Type of Loan lets your friends & family know the good their helping hand will do in your life. Tell them.

Right now, people just like you are using their loan to:

Consolidate Debt

Consolidate Debt

Education

Education

Events

Events

Home Improvement

Home Improvement

Small Business

Small Business

Automobile

Automobile

Medical

Medical

Other

Other

2. Invite Friends and Family Our Wikinvite tool makes it easy to publish your loan on Facebook, MySpace and Twitter. Now your friends and relatives can participate in a formal loan without pressure.

2. Invite Friends and Family Our Wikinvite tool makes it easy to publish your loan on Facebook, MySpace and Twitter. Now your friends and relatives can participate in a formal loan without pressure.

3. Agree to the terms We give you a simple legally binding document agreed upon by both you and the lender, which allows you to structure the loan in a way that works for you both.

3. Agree to the terms We give you a simple legally binding document agreed upon by both you and the lender, which allows you to structure the loan in a way that works for you both.

4. Repay the Loan, Automatically Once you receive your loan, you can choose to have your loan payment automatically withdrawn from your checking or savings account on the same date each month. You can adjust your preferences to best suit your needs. Opt to pay the minimum payment, or you can select a higher amount in order to chip away at your balance and pay your loan off early.

How Lending Works, in Detail

1. Sign up to open a lender account Fill out a short application, go through identity verification, and set your bank account preferences. It takes about 10 minutes, and you’re ready to lend.

1. Sign up to open a lender account Fill out a short application, go through identity verification, and set your bank account preferences. It takes about 10 minutes, and you’re ready to lend.

2. Browse Loan Listings Lenders have the option of searching for the friend or family member that asked for the loan, or searching through the borrower listings to find other interesting candidates. Be sure to use the filters to help narrow your search by amount, type and credit rating.

2. Browse Loan Listings Lenders have the option of searching for the friend or family member that asked for the loan, or searching through the borrower listings to find other interesting candidates. Be sure to use the filters to help narrow your search by amount, type and credit rating.

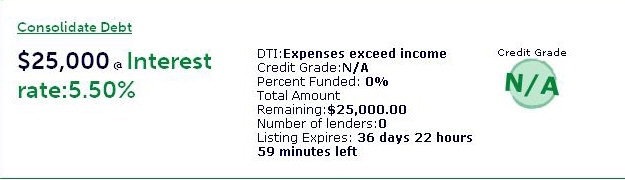

How to Read Loan Listings

The three most important items to look at when reading a loan listing are:

a. The DTI, or the Debt-to-Income ratio. This is a figure that calculates how much of a person’s income is spent paying his or her debts. The higher one’s debt to income ratio is, the more of their monthly income that is solely devoted to paying back debts.

b. The Credit Score. This is a measure of credit risk calculated from credit reports using a standardized formula. Factors that can damage a credit score include late payments, absence of credit references, and unfavorable credit card use.

c. The Interest Rate. This is the rate that is charged or paid for the use of money. Usually, a High Rate = High Risk.

3. Agree to the terms We give you a simple legally binding document agreed upon by both you and the lender, which allows you to structure the loan in a way that works for you both.

3. Agree to the terms We give you a simple legally binding document agreed upon by both you and the lender, which allows you to structure the loan in a way that works for you both.

4. Collect Automatic Payments WikiLoan offers Automatic Payment to Borrowers, which gives Lenders peace-of-mind. If the Borrower does not sign up for auto-pay, WikiLoan sends email reminders when payments are due. The reminders have easy “click here to pay” payment options, so there are never any obstacles.

4. Collect Automatic Payments WikiLoan offers Automatic Payment to Borrowers, which gives Lenders peace-of-mind. If the Borrower does not sign up for auto-pay, WikiLoan sends email reminders when payments are due. The reminders have easy “click here to pay” payment options, so there are never any obstacles.

Browse Loan Listings

http://www.wikiloan.com/listings/

Frequently Asked Questions

http://www.wikiloan.com/main/faqs#lend

Tools & Tips

Four Peer-to-Peer Loan Investor Tips

http://www.bargaineering.com/articles/four-peer-to-peer-loan-investor-tips.html

How to Make Money Micro Lending

http://www.ehow.com/how_5957232_make-money-micro-lending.html

Investing in Peer-to-Peer Loans? Think Like a Bank

http://www.realmofprosperity.com/2010/02/investing-in-peer-to-peer-loans-think-like-a-bank/

Understanding Peer-to-Peer Lending Risks

http://www.moolanomy.com/1190/understanding-peer-to-peer-lending-risks/

How to Cut Credit Card Costs

http://www.inc.com/guides/2010/11/how-to-cut-credit-card-costs.html

Debt Management Tips in a Post Recession World

http://www.americanbankingnews.com/2010/11/09/debt-management-tips-in-a-post-recession-world/

The Next Best Alternative to Banks?

http://www.mybanktracker.com/bank-news/2010/02/02/peer-to-peer-loans-the-next-best-alternative-to-banks/

Peer To Peer Lending Popularity Continues with 'The Simpsons' Appearance

http://steadfastfinances.com/blog/2010/10/04/peer-to-peer-lending-popularity-continues-with-the-simpsons-appearance/

What is Peer to Peer Lending?

http://borrowingadvice.com/what-is-peer-to-peer-lending/

Is Peer To Peer Lending A Good Funding Solution?

http://wisepreneur.com/business-ideas/new-ventures-is-peer-to-peer-lending-a-good-funding-solution

EXAMPLE of Loan Listing

Average Rates

This is a general guideline of interest rates for personal loans for the listed credit grades found on the Internet. Borrowers and lenders may use this for informational purposes, and negotiate rates among themselves.

A+ = 800-850 5.5-7.0%

A = 720-799 7.0-8.0%

B+ = 690-719 8.0-9.5%

B = 660-689 9.5-11%

C+ = 640-659 11-12.5%

C = 620-639 12-14%

D = 600-619 14-15.5%

F = 0-599 15.5%++

State Usury Laws

http://www.wikiloan.com/main/usury

UCC Filings

http://www.wikiloan.com/main/ucc

Peer-to-Peer Lending Glossary

http://www.wikiloan.com/main/glossary

Current News

Current News

WKLI Thursday, June 30, 2011

WKLI WIKILOAN INC. Financials

EDGAR Online Financials (Thu, Jun 30)

WKLI Tuesday, June 14, 2011

WKLI WikiLoan Card Update

PR Newswire (Tue, Jun 14)

WKLI WIKILOAN INC. Files SEC form 10-Q, Quarterly Report

EDGAR Online (Tue, Jun 14)

Management

Management

Marco Garibaldi

Founder, Chief Executive Officer

As the founder and CEO of WikiLoan Inc., Mr. Garibaldi has extensive experience as an entrepreneur and manager overseeing the development and growth of innovative emerging companies. He is also a computer programmer by trade with over 30 years of extensive experience in a variety of sectors including computer programming, the Internet, entertainment and the business advisory industry. He began his career at Burroughs and Sperry, which, in 1986, became Unisys Corp. and later founded a think-tank corporation called InterComm, Inc.

While at InterComm, Inc., Mr. Garibaldi was responsible for introducing a host of essential on-line applications widely used today and familiar to most Internet users. Specifically, his contributions are credited with the development of the online shopping cart, the online bookstore and the auction server, each of which represents a fundamental component of the current Internet commerce environment. Currently, while seeing the underserved need in the micro finance lending industry, Mr. Garibaldi has dedicated his extensive technical skills and creative ingenuity to establishing WikiLoan, an online peer-to-peer lending community designed to bring lenders and borrowers together to pursue new opportunities in this largely untapped market space of micro-lending.

Edward C. DeFeudis

Founder, President, CFO and Chairman of the Board

Mr. DeFeudis is the Founder, President and Chairman of the Board of the Company since August 2005 and he is mainly responsible for start-up activities from business plan through execution. He is the Manager of Spider Investments, LLC, as well as the President of Lion Equity Holding Corp., which has provided investment banking consulting business services for small and emerging growth companies, since 1999. Mr. DeFeudis also served as Financial Advisor for several financial institutions including Merrill Lynch and Oppenheimer Securities from 1996 to 1999. Mr. DeFeudis graduated from University of New Hampshire in 1995 with a BA degree in Political Science.

Contact Info

Contact Info

WikiLoan Inc.

1093 Broxton Avenue

Suite 210

Los Angeles, CA 90024

Phone: 310-443-9246

Website: http://www.wikiloan.com

Penny stocks are very volatile, Always do your own Due Diligence.

Penny stocks are very volatile, Always do your own Due Diligence.

About WikiLoan Inc.

About WikiLoan Inc.

A leading Peer-to-Peer lending platform in the United States

A leading Peer-to-Peer lending platform in the United States  100% proprietary technology built from the ground up

100% proprietary technology built from the ground up  A fully automated system built for security and efficiency

A fully automated system built for security and efficiency WikiLoan is a website that provides tools for peer-to-peer borrowing and lending. People can use the tools on the website to borrow and lend money among themselves at rates that make sense to all parties. WikiLoan provides management tools that allow Borrowers and Lenders to manage the process by: providing loan documentation, promissory notes, repayment schedules, email reminders, online account access, and online repayment.

Borrowers go through a simple process to create a loan listing between $500 and $25,000. They set the rate they are willing to pay for the loan, get their WikiScore, and invite friends in their network to view the listing.

Lenders receive an invitation to view a listing and are provided with the borrower's WikiScore, debt-to-income ratio, and the loan repayment schedule.

Once the loan is fulfilled, WikiLoan compiles the promissory note and provides it to all involved parties. WikiLoan handles on-going notifications and provides access to online payment systems to ensure a smooth repayment process.

WikiLoan does not sell, rent or share members' personal information with third party marketers.

Security Details

Security Details

Share Structure

Market Value1 $14,678,777 a/o Jul 09, 2011

Shares Outstanding 497,585,670 a/o Jun 01, 2011

Float 187,269,280 a/o Jun 13, 2011

Authorized Shares 760,000,000 a/o Jun 13, 2011

Par Value 0.001

Standard Registrar and Transfer Co., Inc.

Transfer Agent

12528 South 1840 E.

Draper, UT, 84020

801-571-8844

FORM 10Q reported June 14, 2011 period ending April 30, 2011

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=7992610

Shareholders of Record 1,550 a/o May 11, 2011

Security Notes

Capital Change=shs decreased by 1 for 20 split Pay date=02/26/2008.

Capital Change=shs increased by 10 for 1 split, payable upon surrender.. Pay date=06/01/2011.

Company Notes

Formerly=Swap-A-Debt, Inc. until 6-2009

Formerly=5Fifty5.com, Inc. until 2-2008

Investor Relations

The management team believes the market opportunity for WikiLoan is significant, relative to the ongoing financial crisis, bank consolidations and changing consumer behavior regarding online lending, borrowing and banking, as outlined below:

The management team believes the market opportunity for WikiLoan is significant, relative to the ongoing financial crisis, bank consolidations and changing consumer behavior regarding online lending, borrowing and banking, as outlined below: The Credit Squeeze

Globally, the recent credit squeeze has led banks to increase interest rates, tighten their lending practices and institute ever tougher borrowing requirements, making it increasingly difficult for would-be borrowers, particularly those with credit challenges seeking small loan sizes of $25,000 and under, to gain access to capital via traditional lending institutions.

The Lending "Gap"

Current market conditions have created an opportunity for private lenders to step-in and fill the small loan lending "gap" increasingly vacated or made more difficult to access by traditional lending institutions. In response, individual lenders and borrowers are connecting directly with one another online, without the use of a financial institution or "middle man", for the purpose of exchanging capital through peer-to-peer lending.

Peer-to-Peer Lending

Peer-to-peer lending is one of the fastest growing sectors of the financial services industry, a trend that is expected to continue for the foreseeable future

Sector: 6153 - Short-term business credit

Products & Services

Products & Services

How Borrowing Works, in Detail

1. Build your Loan Listing Asking a relative or a friend for a personal loan can be awkward. We help you through the process by building a personalized loan proposal you can use when asking for your loan. It only takes a few minutes to create a loan request using our Loan Calculator. +/- Loan Uses

1. Build your Loan Listing Asking a relative or a friend for a personal loan can be awkward. We help you through the process by building a personalized loan proposal you can use when asking for your loan. It only takes a few minutes to create a loan request using our Loan Calculator. +/- Loan Uses As a borrower, how you'll use your loan is up to you. When building your Loan Listing, selecting the Type of Loan lets your friends & family know the good their helping hand will do in your life. Tell them.

Right now, people just like you are using their loan to:

Consolidate Debt

Consolidate Debt  Education

Education  Events

Events  Home Improvement

Home Improvement  Small Business

Small Business  Automobile

Automobile  Medical

Medical  Other

Other  2. Invite Friends and Family Our Wikinvite tool makes it easy to publish your loan on Facebook, MySpace and Twitter. Now your friends and relatives can participate in a formal loan without pressure.

2. Invite Friends and Family Our Wikinvite tool makes it easy to publish your loan on Facebook, MySpace and Twitter. Now your friends and relatives can participate in a formal loan without pressure.  3. Agree to the terms We give you a simple legally binding document agreed upon by both you and the lender, which allows you to structure the loan in a way that works for you both.

3. Agree to the terms We give you a simple legally binding document agreed upon by both you and the lender, which allows you to structure the loan in a way that works for you both. 4. Repay the Loan, Automatically Once you receive your loan, you can choose to have your loan payment automatically withdrawn from your checking or savings account on the same date each month. You can adjust your preferences to best suit your needs. Opt to pay the minimum payment, or you can select a higher amount in order to chip away at your balance and pay your loan off early.

How Lending Works, in Detail

1. Sign up to open a lender account Fill out a short application, go through identity verification, and set your bank account preferences. It takes about 10 minutes, and you’re ready to lend.

1. Sign up to open a lender account Fill out a short application, go through identity verification, and set your bank account preferences. It takes about 10 minutes, and you’re ready to lend.  2. Browse Loan Listings Lenders have the option of searching for the friend or family member that asked for the loan, or searching through the borrower listings to find other interesting candidates. Be sure to use the filters to help narrow your search by amount, type and credit rating.

2. Browse Loan Listings Lenders have the option of searching for the friend or family member that asked for the loan, or searching through the borrower listings to find other interesting candidates. Be sure to use the filters to help narrow your search by amount, type and credit rating. How to Read Loan Listings

The three most important items to look at when reading a loan listing are:

a. The DTI, or the Debt-to-Income ratio. This is a figure that calculates how much of a person’s income is spent paying his or her debts. The higher one’s debt to income ratio is, the more of their monthly income that is solely devoted to paying back debts.

b. The Credit Score. This is a measure of credit risk calculated from credit reports using a standardized formula. Factors that can damage a credit score include late payments, absence of credit references, and unfavorable credit card use.

c. The Interest Rate. This is the rate that is charged or paid for the use of money. Usually, a High Rate = High Risk.

3. Agree to the terms We give you a simple legally binding document agreed upon by both you and the lender, which allows you to structure the loan in a way that works for you both.

3. Agree to the terms We give you a simple legally binding document agreed upon by both you and the lender, which allows you to structure the loan in a way that works for you both.  4. Collect Automatic Payments WikiLoan offers Automatic Payment to Borrowers, which gives Lenders peace-of-mind. If the Borrower does not sign up for auto-pay, WikiLoan sends email reminders when payments are due. The reminders have easy “click here to pay” payment options, so there are never any obstacles.

4. Collect Automatic Payments WikiLoan offers Automatic Payment to Borrowers, which gives Lenders peace-of-mind. If the Borrower does not sign up for auto-pay, WikiLoan sends email reminders when payments are due. The reminders have easy “click here to pay” payment options, so there are never any obstacles.

Browse Loan Listings

http://www.wikiloan.com/listings/

Frequently Asked Questions

http://www.wikiloan.com/main/faqs#lend

Tools & Tips

Four Peer-to-Peer Loan Investor Tips

http://www.bargaineering.com/articles/four-peer-to-peer-loan-investor-tips.html

How to Make Money Micro Lending

http://www.ehow.com/how_5957232_make-money-micro-lending.html

Investing in Peer-to-Peer Loans? Think Like a Bank

http://www.realmofprosperity.com/2010/02/investing-in-peer-to-peer-loans-think-like-a-bank/

Understanding Peer-to-Peer Lending Risks

http://www.moolanomy.com/1190/understanding-peer-to-peer-lending-risks/

How to Cut Credit Card Costs

http://www.inc.com/guides/2010/11/how-to-cut-credit-card-costs.html

Debt Management Tips in a Post Recession World

http://www.americanbankingnews.com/2010/11/09/debt-management-tips-in-a-post-recession-world/

The Next Best Alternative to Banks?

http://www.mybanktracker.com/bank-news/2010/02/02/peer-to-peer-loans-the-next-best-alternative-to-banks/

Peer To Peer Lending Popularity Continues with 'The Simpsons' Appearance

http://steadfastfinances.com/blog/2010/10/04/peer-to-peer-lending-popularity-continues-with-the-simpsons-appearance/

What is Peer to Peer Lending?

http://borrowingadvice.com/what-is-peer-to-peer-lending/

Is Peer To Peer Lending A Good Funding Solution?

http://wisepreneur.com/business-ideas/new-ventures-is-peer-to-peer-lending-a-good-funding-solution

EXAMPLE of Loan Listing

Average Rates

This is a general guideline of interest rates for personal loans for the listed credit grades found on the Internet. Borrowers and lenders may use this for informational purposes, and negotiate rates among themselves.

A+ = 800-850 5.5-7.0%

A = 720-799 7.0-8.0%

B+ = 690-719 8.0-9.5%

B = 660-689 9.5-11%

C+ = 640-659 11-12.5%

C = 620-639 12-14%

D = 600-619 14-15.5%

F = 0-599 15.5%++

State Usury Laws

http://www.wikiloan.com/main/usury

UCC Filings

http://www.wikiloan.com/main/ucc

Peer-to-Peer Lending Glossary

http://www.wikiloan.com/main/glossary

Current News

Current News

WKLI Thursday, June 30, 2011

WKLI WIKILOAN INC. Financials

EDGAR Online Financials (Thu, Jun 30)

WKLI Tuesday, June 14, 2011

WKLI WikiLoan Card Update

PR Newswire (Tue, Jun 14)

WKLI WIKILOAN INC. Files SEC form 10-Q, Quarterly Report

EDGAR Online (Tue, Jun 14)

Management

Management

Marco Garibaldi

Founder, Chief Executive Officer

As the founder and CEO of WikiLoan Inc., Mr. Garibaldi has extensive experience as an entrepreneur and manager overseeing the development and growth of innovative emerging companies. He is also a computer programmer by trade with over 30 years of extensive experience in a variety of sectors including computer programming, the Internet, entertainment and the business advisory industry. He began his career at Burroughs and Sperry, which, in 1986, became Unisys Corp. and later founded a think-tank corporation called InterComm, Inc.

While at InterComm, Inc., Mr. Garibaldi was responsible for introducing a host of essential on-line applications widely used today and familiar to most Internet users. Specifically, his contributions are credited with the development of the online shopping cart, the online bookstore and the auction server, each of which represents a fundamental component of the current Internet commerce environment. Currently, while seeing the underserved need in the micro finance lending industry, Mr. Garibaldi has dedicated his extensive technical skills and creative ingenuity to establishing WikiLoan, an online peer-to-peer lending community designed to bring lenders and borrowers together to pursue new opportunities in this largely untapped market space of micro-lending.

Edward C. DeFeudis

Founder, President, CFO and Chairman of the Board

Mr. DeFeudis is the Founder, President and Chairman of the Board of the Company since August 2005 and he is mainly responsible for start-up activities from business plan through execution. He is the Manager of Spider Investments, LLC, as well as the President of Lion Equity Holding Corp., which has provided investment banking consulting business services for small and emerging growth companies, since 1999. Mr. DeFeudis also served as Financial Advisor for several financial institutions including Merrill Lynch and Oppenheimer Securities from 1996 to 1999. Mr. DeFeudis graduated from University of New Hampshire in 1995 with a BA degree in Political Science.

Contact Info

Contact Info

WikiLoan Inc.

1093 Broxton Avenue

Suite 210

Los Angeles, CA 90024

Phone: 310-443-9246

Website: http://www.wikiloan.com

Penny stocks are very volatile, Always do your own Due Diligence.

Penny stocks are very volatile, Always do your own Due Diligence.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.