| Followers | 679 |

| Posts | 140829 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Wednesday, May 18, 2022 12:46:25 PM

By: AG Thorson | May 18, 2022

Gold prices have plunged nearly $300 since peaking in March. The chart is building a bullish hup-with-handle pattern supporting a breakout above $2000 later this year.

Metals and miners could drop further over continued weakness in broader markets. Overall, I believe this dip will be viewed as an excellent long-term buying opportunity.

The next big rally in precious metals will come when the Fed pivots. That could happen soon if we see widespread fuel shortages and price controls, as I expect.

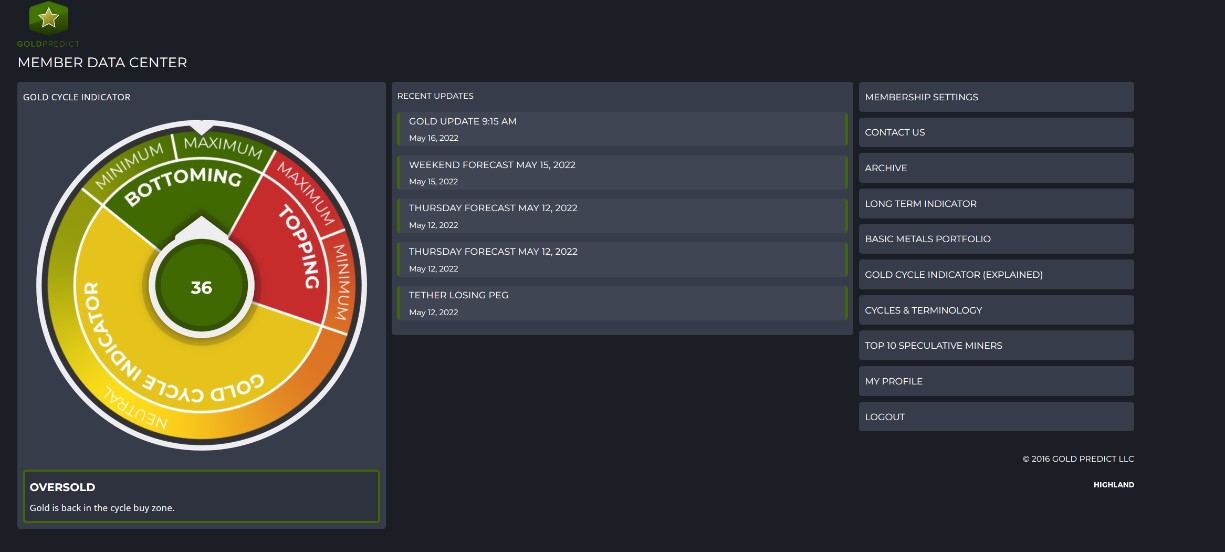

Our Gold Cycle Indicator is at 36 and within maximum cycle bottoming.

Gold Prices

The pattern in gold resembles a cup-with-handle. Prices formed a swing low and closing back above the 200-day MA (currently $1836) would promote a bottom. Our current forecast supports a breakout above $2000 later this year and perhaps as high as $3000 by year-end. A sustained breakdown below $1750 would invalidate the cup-with-handle outlook.

GDX

Miners bounced off long-term support surrounding $30.00. A close above $31.70 would fill last week's gap and support a bottom. Conversely, a daily finish below $30.00 could trigger additional downside.

GDXJ

After dipping below the $36.50 area, junior miners reversed immediately higher, supporting a possible bottom. As long as prices don't close back below $36.50, I see the potential for a cycle low.

DOW

I believe stocks are headed towards the 20% correction level near 29,600. We could get an oversold bounce here or there, but I don't think we see a bottom until retail trader’s panic; I haven't seen that yet.

TSLA

I think we need to see panic and a breakdown in Tesla before markets bottom. As I understand it, Musk has $88-billion in margin debt against his Telsa shares. The Twitter deal may add another $13-billion. That is a lot of debt tied to an extremely volatile and overpriced stock.

If Tesla shares crash like I've been calling for, Musk could see significant financial stress. For his sake, I hope I'm wrong. A price decline below $550 could trigger panic.

Takeaways:

• The general stock market is bouncing, but I won't expect a bottom until retail traders capitulate...watch Tesla.

• A liquidity event is possible, resulting in a flash crash. I'm keeping an eye on cryptocurrencies; they could fail first.

• It's probably a good time to hold cash in anticipation of buying opportunities if prices drop further.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent GDX News

- YieldMax GDXY Name Change • GlobeNewswire Inc. • 01/25/2024 04:22:00 PM

- Surging S&P 500 Breadth • ValueWalk • 07/19/2023 03:16:37 PM

- S&P 500 Corrects In Breadth • ValueWalk • 07/18/2023 03:08:49 PM

- If The USDX Fell So Much, Why Didn’t Gold Truly Soar? • ValueWalk • 07/17/2023 05:16:20 PM

- USD’s Decline That’s… Bearish For Gold?! • ValueWalk • 07/12/2023 02:38:08 PM

- S&P 500 Late Day Reversal Worry • ValueWalk • 07/10/2023 03:17:34 PM

- Massive Gaming Celebrates Global Launch of House of Blackjack with USDC Earning Race • ValueWalk • 07/10/2023 02:44:17 PM

- Breathers In Mining Stocks Are Not Real Rallies • ValueWalk • 07/06/2023 05:20:55 PM

- S&P 500 Character Changes • ValueWalk • 07/06/2023 03:10:06 PM

- S&P 500 – As Bullish As It Gets • ValueWalk • 07/03/2023 04:01:21 PM

- The Great Gold Migration: How Asia Is Dominating The Global Gold Landscape • ValueWalk • 06/30/2023 05:07:35 PM

- S&P 500 Dip Buying And Tame PCE • ValueWalk • 06/30/2023 03:34:13 PM

- The Bullish Reversal In Gold Is Coming • ValueWalk • 06/29/2023 04:00:44 PM

- Insufficient S&P 500 Rotations • ValueWalk • 06/27/2023 02:41:42 PM

- Failing S&P 500 Rotations • ValueWalk • 06/23/2023 03:09:19 PM

- Countdown to S&P 500 Downleg • ValueWalk • 06/19/2023 01:49:20 PM

- Now THAT Was The Game-Changer For The Price Of Gold! • ValueWalk • 06/15/2023 04:40:35 PM

- S&P 500 Manages To Recover Initial Decline • ValueWalk • 06/15/2023 03:30:07 PM

- S&P 500 Manages To Recover From Tech-Driven Decline • ValueWalk • 06/15/2023 03:30:07 PM

- S&P 500 Withstands The Initial Selling – No Hike Tomorrow • ValueWalk • 06/13/2023 03:15:19 PM

- Roadmap For Mining Stocks – Courtesy Of The Stock Market • ValueWalk • 06/06/2023 03:17:49 PM

- Stocks To Still Extend S&P 500 Upswing • ValueWalk • 06/05/2023 03:31:02 PM

- AI, Stocks, And Gold Stocks – Connected After All • ValueWalk • 05/31/2023 03:29:15 PM

- Could Gold Miners Finally Stop Sliding?! • ValueWalk • 05/26/2023 08:42:37 PM

- S&P 500 Fine Selling Initiative • ValueWalk • 05/24/2023 03:06:00 PM

FEATURED Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • Apr 25, 2024 8:52 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM