Why A Massive 5-10X Gold Revaluation Is Coming

bAugust 12, 2021

https://kingworldnews.com/look-at-what-indias-central-bank-just-said-about-gold-plus-this-is-why-a-massive-5-10x-gold-revaluation-is-coming/

$Gran Colombia Gold Corp. (TPRFF) Committed to Responsible Mining;

https://www.youtube.com/watch?v=C3uTYwk2qow&t=40s

$IMO buckle up buttercup, gold should explode higher any day now.

first it has to reset to 1820 area, and hold, then its go time.

then again, maybe not, all so complicated.

by trunkmonk thanks

https://www.youtube.com/watch?v=L5hh1HKQP7Y&t=584s

Had missed this, 3 weeks ago Commodity TV interview, it is very good. Talks getting extra $8 million from tailings with new setup.

EDIT: Was half way thru, now 90% He talks valuation a lot.

Says they have $300 million of stock in other public companies and

$200 million EBITDA a year, that their valuation is ridiculous.

He owns 5% of it.

Current mkt cap is $365 million and effective production is set to go

way up with ARIS 6 months from mine build.

That is not counting Denarius, new Gold X acquisition, and there are

two more.

So even though someone could with quick look think they have 3 years

left if you take ARIS at 44% of 6 million oz = 2.64 million oz or

13 years more GCM share,

then Toroparu at 10 million oz 100% = 50 years, so 63 years

in addition to Segovia.

Segovia is 150 years of continuous operations, Serafino has said his

grandchildren will be mining Segovia after he is gone.

Lets just call it REAL mine life at Segovia of 30 years = 103 years

of gold left at current rate.

So is mine life a weakness or a strength for Gran Colombia?

by geodan thanks

Artisanal Small-Scale Mining

https://youtu.be/Jd7wtTQ0dBU

https://youtu.be/qLJVMFh72e4

$Gran Colombia Gold: Upgrading Very Profitable Operation and Developing World Class Asset

983 viewsJul 8, 2021

https://www.youtube.com/watch?v=L5hh1HKQP7Y

Swiss Resource Capital AG

20.8K subscribers

Interview with Executive Chairman Serafino Iacono. Gran Colombia Gold operates Segovia, one of the five highest grade underground mines in the world. The company is conducting a 60,000m drill program there to further increase production. Gran Colombia is also developing the recently acquired Toroparu project in Guyana, which is expected to be brought into production quickly. Thus, total gold production is expected to more than double in the next few years.

TSX:GCM

Frankfurt:6KLD

WKN:A2DQSF

http://www.grancolombiagold.com

$Gran Colombia Announces Second Quarter 2021 Production and Webcast;

Provides Details of Forthcoming Repayment of Its Gold Notes;

Declares Monthly Dividend to be Paid on August 16, 2021

July 15, 2021

https://www.grancolombiagold.com/news-and-investors/press-releases/press-releases-details/2021/Gran-Colombia-Announces-Second-Quarter-2021-Production-and-Webcast-Provides-Details-of-Forthcoming-Repayment-of-Its-Gold-Notes-Declares-Monthly-Dividend-to-be-Paid-on-August-16-2021/default.aspx

TORONTO, July 15, 2021 (GLOBE NEWSWIRE) --

$Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF) announced today

that it produced a total of 16,789 ounces of gold at its

Segovia Operations in June 2021 bringing the total gold production for

the second quarter of 2021 to 52,198 ounces compared with 44,377 ounces

from Segovia in the second quarter of 2020.

The Company also produced 54,573 ounces of silver at Segovia in the

second quarter of 2021, up from 41,342 ounces of silver in the second

quarter last year.

For the first half of 2021, Segovia’s gold and silver production

totalled 101,256 ounces and 111,888 ounces, respectively,

up from 94,723 ounces of gold and 87,260 ounces of silver

in the first half of 2020.

Lombardo Paredes, Chief Executive Officer of Gran Colombia, commenting

on the Company’s latest results, said, “We have continued to gain

momentum in the second quarter of 2021.

With our trailing 12-months total gold production from Segovia at the

end of the second quarter amounting to 202,895 ounces, up 3% over 2020,

we remain on track to meet our production guidance at Segovia for the

full year of 200,000 to 220,000 ounces of gold.

The expansion of Maria Dama to 2,000 tpd is proceeding well and

commissioning of the new polymetallic plant at Segovia will commence in

the third quarter.

Our use of cash is typically higher in the second quarter each year as

we complete the required payments of income tax instalments in

Colombia.

In May 2021, we also used $10.4 million of cash to complete an early

optional redemption of our Gold Notes ahead of schedule.

At the end of June 2021, we had a cash position of approximately

US$57 million and the aggregate principal amounts of our Gold Notes and

Convertible Debentures outstanding were reduced to US$19.75 million and

CA$18 million, respectively.

We are very pleased with our progress through the first half of 2021,

including the successful completion of our acquisition of

the Toroparu Project in Guyana and the recently announced high-grade

drilling results from our ongoing exploration programs at Segovia.”

The Segovia Operations processed an average of 1,581 tonnes per day

(“tpd”) in the second quarter of 2021 with an average head grade of

12.6 g/t compared with 1,211 tpd at

an average head grade of 13.9 g/t in the second quarter last year.

It should be noted that the second quarter 2020 production was affected

in the first half of April 2020 by the early stages of adapting

Segovia’s operations to the pandemic.

For the first half of 2021, the Segovia Operations processed an average

of 1,526 tpd with an average head grade of 12.7 g/t compared with 1,247

tpd at an average head grade of 14.4 g/t in the first half last year.

Second Quarter 2021 Results Webcast

Gran Colombia announced today that it will release its 2021 second

quarter and first half results after market close on Thursday,

August 12, 2021 and will host a conference call and

webcast on Friday, August 13, 2021 at 9:00 a.m. Eastern Time to discuss

the results.

Webcast and call-in details are as follows:

Live Event link: https://edge.media-server.com/mmc/p/8pi4h8ou

Canada Toll / International: 1 (514) 841-2157

North America Toll Free: 1 (866) 215-5508

Colombia Toll Free: 01 800 9 156 924

Conference ID: 50186481

A replay of the webcast will be available at www.grancolombiagold.com from Friday, August 13, 2021 until Friday, September 10, 2021.

Quarterly Amortizing Payment of Gold Notes on August 3, 2021

Gran Colombia announced today the details for the forthcoming quarterly repayment of its 8.25% Senior Secured Gold-Linked Notes due 2024 (the “Gold Notes”) (TSX: GCM.NT.U) as follows:

Payment date: August 3, 2021

Record date: July 26, 2021

Cash payment amount: Approximately US$0.12881677 per US$1.00 principal amount of Gold Notes issued and outstanding on the Record date representing an amortization payment of the principal amount of approximately US$0.08829114 per US$1.00 principal amount of Gold Notes and a gold premium of approximately US$0.04052563 per US$1.00 principal amount of Gold Notes. Based on the London P.M. Fix on July 15, 2021 of US$1,823.75 per ounce, the aggregate amount of the cash payments on the Payment Date will be US$2,544,131, of which US$1,743,750 will be applied to reduce the aggregate principal amount of the Gold Notes issued and outstanding and the balance represents the Gold Premium.

Principal amount issued

and outstanding: As of today’s date, there is a total of US$19,750,000 principal amount of Gold Notes issued and outstanding. After this quarterly repayment, the aggregate principal amount of the Gold Notes as of August 3, 2021 will be reduced to US$18,006,250.

Monthly Dividend Declaration

Gran Colombia also announced today that its Board of Directors has declared the next monthly dividend of CA$0.015 per common share will be paid on August 16, 2021 to shareholders of record as of the close of business on July 30, 2021.

About Gran Colombia Gold Corp.

Gran Colombia is a mid-tier gold producer with a proven track record of mine building and operating in Latin America. In Colombia, the Company is currently the largest underground gold and silver producer with several mines in operation at its high-grade Segovia Operations. In Guyana, the Company is advancing the Toroparu Project, one of the largest undeveloped gold projects in the Americas. Gran Colombia also owns an approximately 44% equity interest in Aris Gold Corporation (TSX: ARIS) (Colombia – Marmato), an approximately 27% equity interest in Denarius Silver Corp. (TSX-V: DSLV) (Spain – Lomero-Poyatos; Colombia – Guia Antigua and Zancudo) and an approximately 26% equity interest in Western Atlas Resources Inc. (TSX-V: WA) (Nunavut – Meadowbank).

Additional information on Gran Colombia can be found on its website at www.grancolombiagold.com and by reviewing its profile on SEDAR at www.sedar.com.

Cautionary Statement on Forward-Looking Information:

This news release contains "forward-looking information",----Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements.

For Further Information, Contact:

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

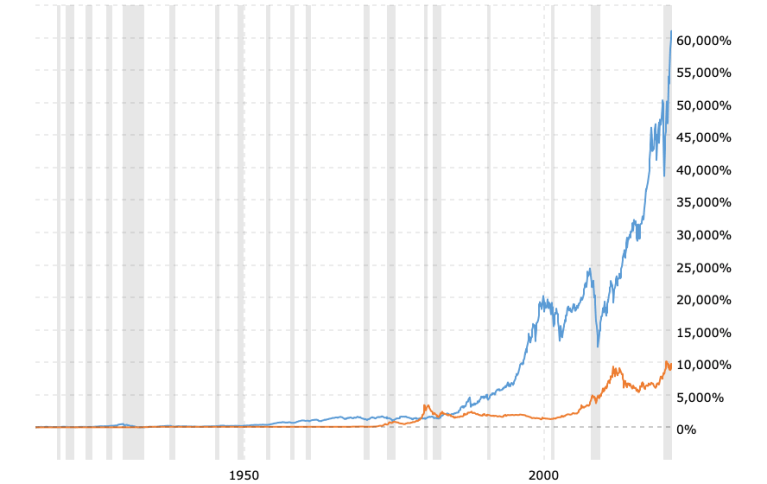

$Gold Price vs Stock Market – 100 Year Chart

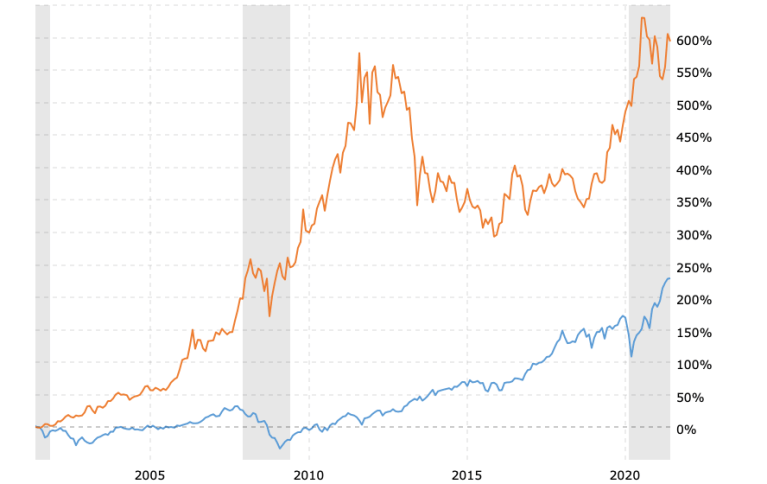

$Gold Price vs Stock Market – 20 Year Chart

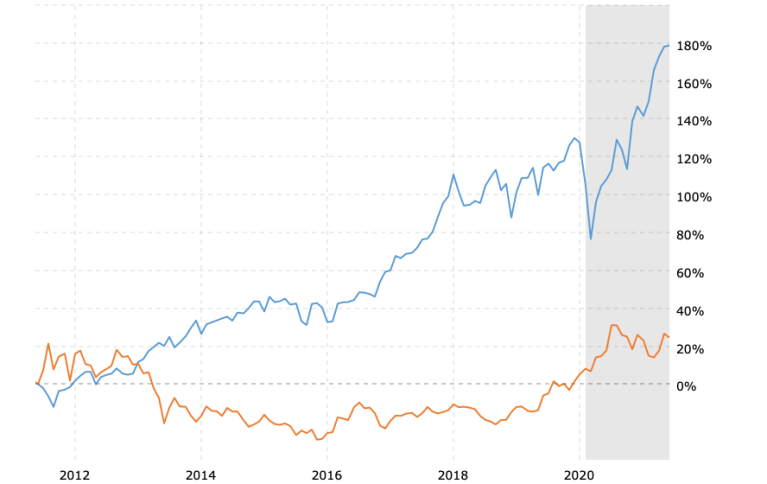

$Gold Price vs Stock Market – 10 Year Chart

$Pierre Lassonde: 1:1 Dow to Gold Ratio - $25,000 Gold Coming

22,126 views•May 31, 2021

https://youtu.be/XyroIjmQi_I

Palisades Gold Radio

70.2K subscribers

Tom welcomes mining legend Pierre Lassonde to the show. Pierre is the Co-

Founder of Franco Nevada and Formerly President of Newmont Mining.

https://www.youtube.com/watch?v=XyroIjmQi_I

$trunkmonk thanks; Aris Gold Announces 10,000 Metre Drill Program At Juby Project, Ontario, Canada

Aris Gold Corp this morning announced that it has begun

planning for a drill program on its Juby Project within

the Abitibi greenstone belt of Ontario.

The program is expected to consist of a total of 10,000 metres of

drilling.

https://thedeepdive.ca/aris-gold-announces-10000-metre-drill-program-at-juby-project/

Aris Gold Corp (TSX: ARIS) this morning announced that it has begun

planning for a drill program on its Juby Project within the Abitibi

greenstone belt of Ontario.

The program is expected to consist of a total of 10,000 metres of

drilling.

The initial drill program is set to begin in the third quarter of 2021,

with the program targeting an extension between the Big Dome and Golden

Lake deposits, while also testing known high grade mineralized zones.

Currently, the project contains a 10 kilometre long strike which

follows the Tyrrell Shear Zone.

Presently, the 14,000 acre Juby property contains a mineral resource

estimate of 773,000 ounces of indicated gold within 21.3 million tonnes

based on an open pit model.

A further 1,488,000 ounces of inferred resource is contain within the

model, within 47.1 million tonnes. The estimate is based on a 0.4 g/t

cut-off, and was established via 105,861 metres of drilling within 379

holes.

Active exploration has not occurred on the property since 2018.

Aris Gold last traded at $2.30 on the TSX.

$Gran Colombia Gold (TPRFF)(GCM:TSE) also owns approximately

44% of Aris Gold Corporation (TSX: ARIS), a Canadian mining company

currently advancing a major expansion and modernization of its

underground mining operations at its

Marmato Project in Colombia.

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

FEATURED Glucotrack Announces Expansion of Its Continuous Glucose Monitoring Technology to Epidural Glucose Monitoring • Apr 17, 2024 8:00 AM

ILUS Provides Form 10-K Filing Update • ILUS • Apr 17, 2024 9:54 AM

Maybacks Global Entertainment To Fire Up 24 New Stations in Louisiana • AHRO • Apr 16, 2024 1:30 PM

Cannabix Technologies Begins Certification of Contactless Alcohol Breathalyzer, Re-Brands product series to Breath Logix • BLOZF • Apr 16, 2024 8:52 AM

Kona Gold Beverages, Inc. Acquires Surge Distribution LLC from Loud Beverage Group, Inc. (LBEV) • KGKG • Apr 16, 2024 8:30 AM

Branded Legacy, Inc. Reports Significant Net Income of Over $3.8 Million • BLEG • Apr 16, 2024 8:30 AM