| Followers | 679 |

| Posts | 140823 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Monday, May 10, 2021 3:09:16 PM

By: Schaeffer's Investment Research | May 10, 2021

• Square stock is coming off an impressive earnings beat

• BMO hiked its price target on the online payments stock today

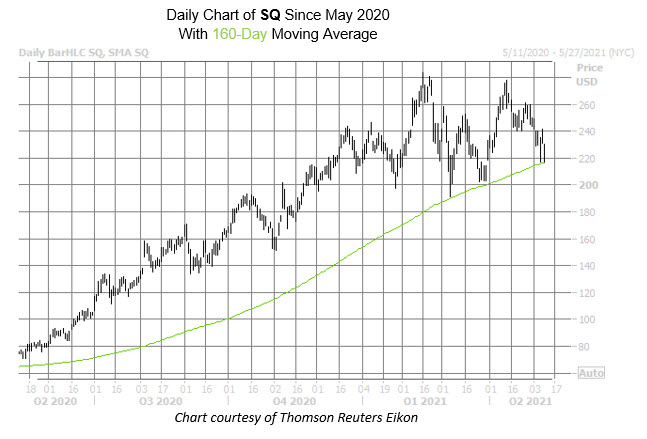

While the shares of Square Inc (NSE:SQ) are down 6.5% to trade at $218.22, taking a breather from last week's post-earnings pop, the security's dip looks to have found some footing at its 160-day moving average -- a trendline that's held as a floor for over a year. Today's drop can be attributed in part to the tech sector selloff, but analysts are keeping the faith with bull notes. This morning, BMO hiked its price target to $269 from $237 which put the 12-month consensus price target at $276.58, a 26.8% premium to current levels.

This general optimism has pervaded the options pits too. SQ once again landed on Schaeffer's Senior Quantitative Analyst Rocky White's list of stocks that have attracted the highest weekly options volume within the past two weeks, with names new to the list highlighted in yellow. White's table shows 382,006 calls and 196,675 puts exchanged during this time period. The most popular contract during this time frame was the weekly 4/30 260-strike call, followed by the 250- and 255-strike calls in the same series.

Today's trading remains bullishly skewed, despite the pullback. So far, 67,000 calls and 56,000 puts have exchanged hands. The two most popular positions are the May 195 put and the weekly 5/14 220-strike call, with positions being opened at both.

Analyst sentiment toward SQ also leans bullish, after several years of being unloved by the brokerage bunch. Of the 35 covering the online payments stock, 21 consider it a "buy" or better, 11 say "hold," and three consider it a "sell" or worse.

Options are an affordable way to speculate on SQ's next move. The security's Schaeffer's Volatility Index (SVI) of 48% stands higher than just 11% of readings from the part year, meaning these traders are pricing in relatively low volatility expectations at the moment. On top of this, Square's Schaeffer's Volatility Scorecard (SVS) ranks at 95 out of 100, meaning the stock has mostly exceeded these expectations during the past year -- a good thing for option buyers.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent SQ News

- Block Innovates Bitcoin Mining, DOJ Proposes 3-Year Prison for Changpeng Zhao, and More Crypto News • IH Market News • 04/24/2024 05:50:55 PM

- Apple Terminates 614 Employees, Disney Unveils June Crackdown on Password Sharing, and More Updates • IH Market News • 04/05/2024 11:38:57 AM

- Block to Announce First Quarter 2024 Results • Business Wire • 04/04/2024 09:23:00 PM

- Exxon Mobil Forecasts Earnings Decline, Twilio Seeks Board Tenure Changes, and More News • IH Market News • 04/04/2024 11:30:20 AM

- Bitkey commence à expédier les premières unités de son dispositif matériel et ajoute des fonctions de sécurité et de récupération • Business Wire • 03/13/2024 10:10:00 PM

- Afterpay Expands to More In-Demand Categories with New Spring Merchants • Business Wire • 03/13/2024 01:00:00 PM

- Bitkey Starts Shipping First Units of Its Hardware Device, Adds Security and Recovery Features • Business Wire • 03/13/2024 12:27:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/06/2024 11:04:30 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/04/2024 10:31:45 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/23/2024 10:11:42 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/23/2024 10:08:05 PM

- Uniswap Skyrockets 55% with Incentive Proposal, Avalanche Confronts 4-Hour Shutdown, and More • IH Market News • 02/23/2024 06:26:18 PM

- Goldman Sachs Reconsiders Fed Cuts, LUNR Surges Over 40% in Pre-Market, and More • IH Market News • 02/23/2024 01:03:59 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/23/2024 12:06:53 AM

- Form S-8 - Securities to be offered to employees in employee benefit plans • Edgar (US Regulatory) • 02/22/2024 09:51:43 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 02/22/2024 09:42:06 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/22/2024 09:11:06 PM

- Block Announces Fourth Quarter and Full Year 2023 Results • Business Wire • 02/22/2024 09:05:00 PM

- U.S. Futures Surge on Nvidia’s Stellar Performance, Global Markets Respond Positively • IH Market News • 02/22/2024 11:05:39 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 02/21/2024 10:40:10 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 02/21/2024 10:39:40 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 02/21/2024 10:39:04 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 02/21/2024 10:38:14 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 02/20/2024 10:29:28 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/09/2024 09:05:56 PM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM