Sunday, May 09, 2021 8:00:09 PM

>>> I Put Half Of My Net Worth Into These Hard Asset Investments

Seeking Alpha

Nov. 14, 2020

by Jussi Askola

https://seekingalpha.com/article/4388468-i-put-half-of-net-worth-hard-asset-investments

Summary

Most investors put their net worth in financial assets like stocks, bonds and cash.

I prefer to invest mine in hard assets.

You can get exposure to hard assets through publicly-traded vehicles.

Below I explain why I have 60% of my net worth in hard assets, and why you should do the same.

Most investors have the vast majority of their net worth in financial assets. Typically stocks, bonds and cash. These assets are extremely easy to invest in, which explains their popularity. But they come with a lot of downside too. From volatility to returns that barely beat inflation, they come with various disadvantages, depending on which asset class you’re talking about.

Let’s take each of the three most popular financial assets one by one.

Cash. This is like throwing money down the drain. The average savings account has only a 0.06% interest rate according to the FDIC. With inflation running at 2%, you’re losing purchasing power at that rate.

Bonds. They pay nothing or next to nothing after inflation and taxes. They’re better than cash, don’t get me wrong. But all you’re doing with bonds is maintaining your net worth, you’re not growing it. Long-term corporate bond ETFs (VCLT - BLV) yield just around 3%.

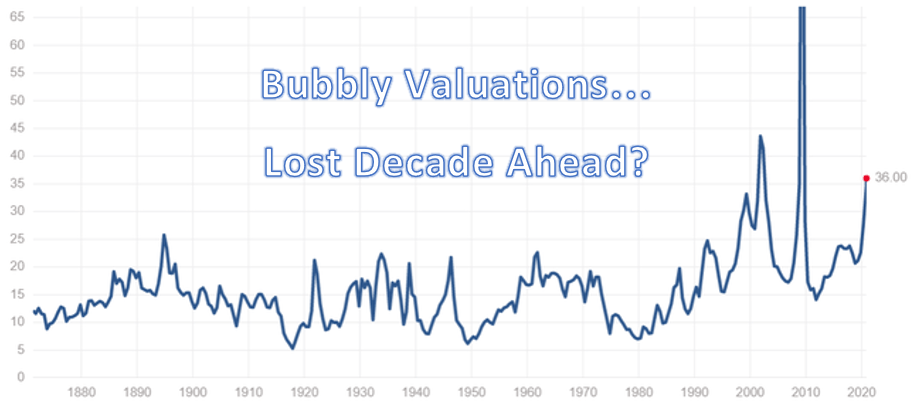

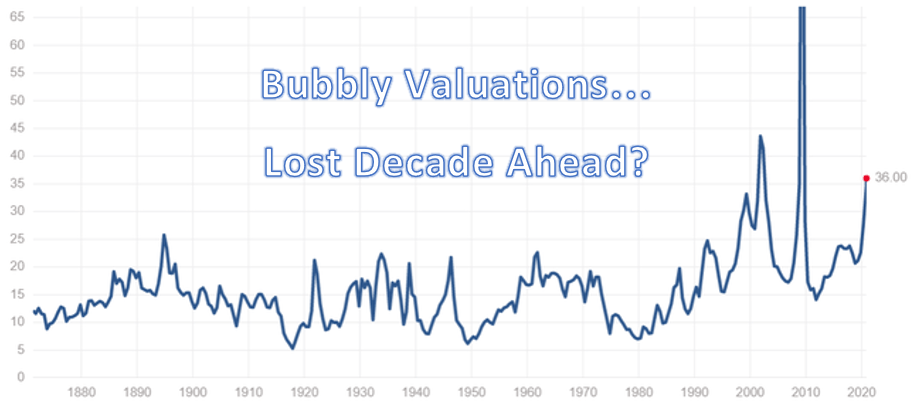

Stocks. Stocks tend to outperform cash and bonds over time. But they’re extraordinarily complex. To truly understand a stock, you need to understand all the moving pieces of a business that may have dozens of subsidiaries, subsidiaries with subsidiaries of their own, foreign operations, and more. And the risk is significant. Putting a large chunk of your net worth in the next Enron is a sure way to evaporate your savings. Finally, today's valuations are astronomically high with the S&P 500 (SPY) trading at 36x earnings, which is over 2x its historical average. Put differently, stocks are now priced at a 2.7% earnings yield even as we go trough a major crisis:

So, if all of the above assets have major problems with them, where do you put your net worth?

Hard Assets.

“Hard assets” is a term for tangible assets that have physical substance. Hard assets physically exist in the world and typically have some practical real-world use. The total list of hard assets would be far too long to reproduce here. But some good examples include:

Real estate.

Pipelines.

Farmland.

Timberland.

Airports.

Toll roads.

Other miscellaneous types of infrastructure.

All of these assets fulfill a real-world need and therefore often have stable, dependable cash flows. Not all hard assets are equal in terms of their income potential. Some are more dependable than others. But as a class, they offer high yield with relatively lower risk.

You might say: “sure, hard assets are good, but I can’t afford a second mortgage… so how do I get my exposure?”

The answer is simple: Through publicly-traded vehicles like REITs. REITs trade on exchanges like stocks but are built on portfolios of hard assets. They typically have mandates specifying that they pass a certain amount of their net income on to investors in the form of dividends. And they’re run by management teams, so you don’t need to worry about physically managing the properties yourself. By buying REITs and other REIT-like entities, you can get quick exposure to a diversified portfolio of hard assets. This is where I have over half of my net worth today, and I don’t plan on changing that any time soon.

Why Favor Hard Assets Over Stocks, Bonds, and Cash?

Reason #1: Yield

The cold hard truth is that there’s just not a lot of yield out there these days. The 10-year Treasury yields a minuscule 0.83%, while the SPDR S&P 500 ETF (SPY) yields 1.6%. The Nasdaq, meanwhile, is lagging both: The Invesco QQQ Trust ETF (QQQ) yields just 0.51%. In this market, the yield is hard to come by.

Unless that is, you look into REITs. REITs as measured by the Vanguard Real Estate ETF (VNQ) yield around 4%. That’s the market as a whole. Individual REITs can yield anywhere from 6% to 8%. If you’re really adventurous, you can find REITs yielding as much as 10%.

Our Core Portfolio is heavily invested in REITs and other hard assets. We target an ~8% yield a ~75% payout ratio. Generally, our actual portfolio yield and payout ratio are close to these targets.

Reason #2: Higher Total Returns

It’s possible to generate very high total returns with hard assets. If you buy real estate with a 6%-7% cap rate and finance half at 3%-4%, you get a 10% yield. That’s a strong return even with no price appreciation in the equation. Throw in a modest 2%-3% annual gain in there, and you’ve got a 15% a year investment.

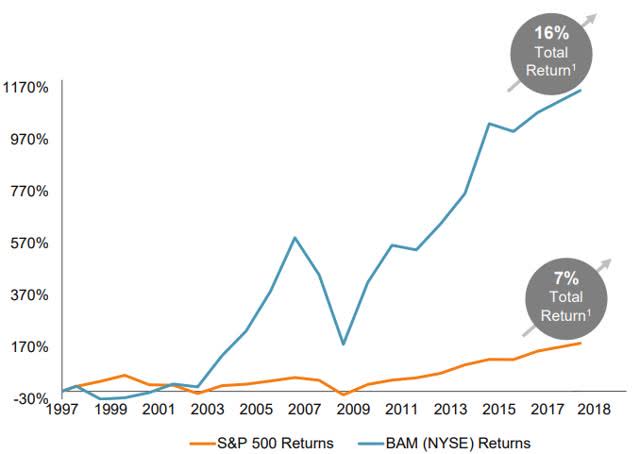

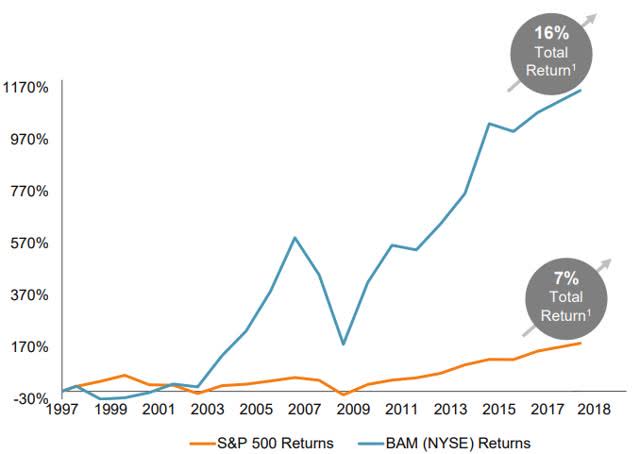

You can do the same by buying hard assets through REITs and other publicly traded hard asset companies. Case in point: Brookfield Asset Management (BAM). Over the past 30 years, it has earned a 16% annualized return, compared to just 7% for the S&P 500.

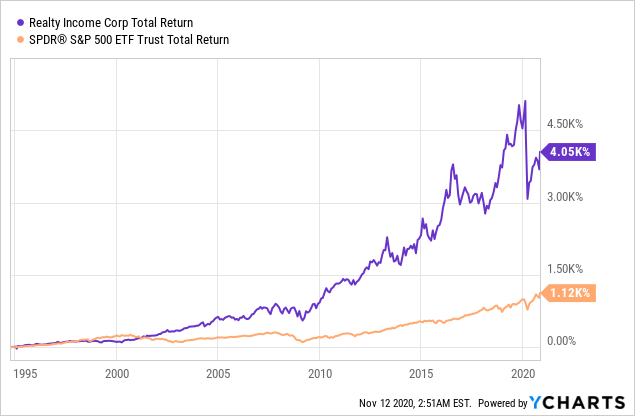

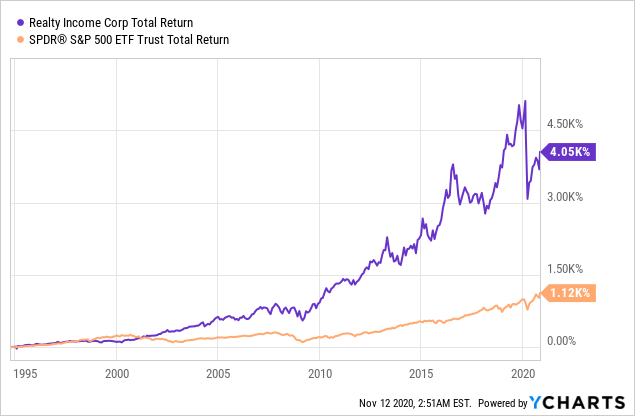

Another example: Realty Income (O) has nearly quadrupled the returns of the S&P500 since its IPO in 1994:

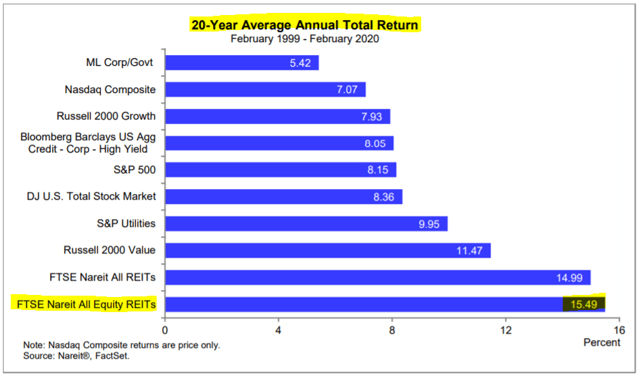

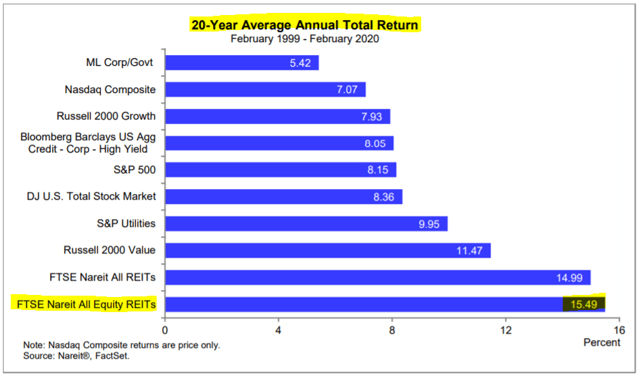

On average, REITs have outperformed nearly every other asset class over the past 20 years leading up the COVID-19 crisis. When you earn high dividends, not much growth is needed to earn double-digit total returns:

Reason #3: Valuation

Finally, we get to valuation. The sad truth about the markets these days is that steep valuations are starting to become the norm. The vast majority of tech stocks trade at more than 10 times book value. Big players like Netflix (NFLX) and Amazon (AMZN) trade at anywhere from 70 to 120 times earnings. These kinds of valuations can’t persist forever. Even with strong earnings growth, it’s hard to justify a 120X multiple. And with tech making up an ever-larger percentage of the S&P 500’s market cap, we’re really talking about “stocks” as a whole here.

Hard assets, by contrast, are cheap relative to cash flow at the moment, particularly if you get your exposure through REITs. In many cases, REITs are down for the year in 2020, and priced at up to 50% discounts to the underlying value of their assets. To be sure, REITs ran into some collections problems that dampened earnings early in the pandemic. But they’re beginning to turn that around even as valuations remain opportunistic.

Smart Money is Rushing into Hard Assets

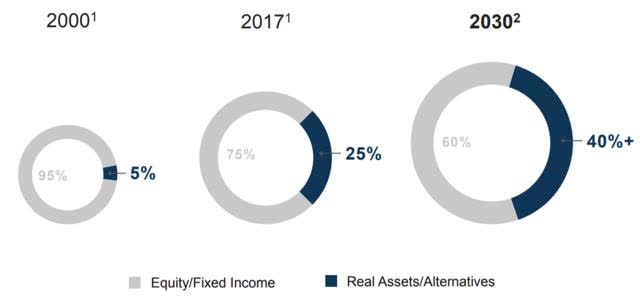

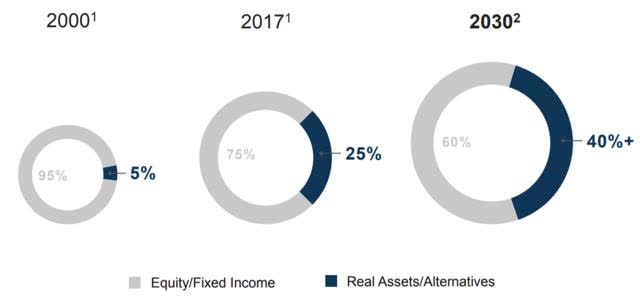

If you want to know where to invest, you need to look at where institutional investors are putting their money. Institutional investors own about 80% of the public equity market, and a growing share of investments in hard assets.

That institutional investors are increasing in clout is obvious. From 2008 to 2018, institutional capital nearly tripled. It’s expected to rise to $100 trillion by 2030.

That a large share of this capital is going into hard assets also is evident. Many pension funds and other big institutions favor yield in their portfolios as income is paramount for institutions with regular cash expenses. As mentioned above, there’s barely any yield these days in stocks and Treasuries. So yield-hungry institutions will likely move into hard assets in the years ahead. That may include direct investments as well as positions in REITs.

How to Profit from Hard Assets

Once you’ve decided you want exposure to hard assets, there are several asset classes you can look into. In no particular order:

Commercial real estate. Investments in apartment communities, e-commerce warehouses, data centers, or even casinos. AvalonBay Communities (AVB) and Digital Realty (NYSE:DLR.PK) would be classic examples.

Airports. Believe it or not, there are publicly-listed airports you can buy today on equity markets. Grupo Aeroportuario del Pacifico (PAC) is an example of one.

Timberland and farmland. You can invest directly in Timberland and Farmland through LPs and REITs like Gladstone Land (LAND) and Catchmark Timber (CTT).

Energy pipelines. Companies that transport oil and gas by pipe systems. Examples include the 10%-yielding Enterprise Product Partners (EPD) and Energy Transfer (ET).

Windmills. You can invest in alternative energy projects through partnerships like Brookfield Renewable Partners (BEP).

All of the hard assets listed above have high-income potential and have delivered steady growth over time. With a diversified portfolio consisting of these types of assets, you could outperform the markets.

That’s not to say there aren’t risks with hard assets. On the contrary, there are several you need to look out for. Retail REITs are vulnerable to industry trends like e-commerce, which has wreaked havoc on lower quality mall REITs CBL (CBL) and Washington Prime Group (WPG). Pipelines are subject to regulatory scrutiny and often find their projects delayed for long periods. Airports see revenue dip during recessions. The value of windmills decreases over time.

Because of these risk factors, you need to be careful about which hard assets you invest in. It’s not a simple matter of buying any hard asset and hoping it will deliver a good return. Nor is it as simple as buying a REIT ETF (VNQ) — with VNQ, you won’t get the 6%-8% yields mentioned earlier. Instead, you need to be selective and build a reasonably diversified portfolio of hard assets with the desired characteristics.

Our Hard Asset Portfolio

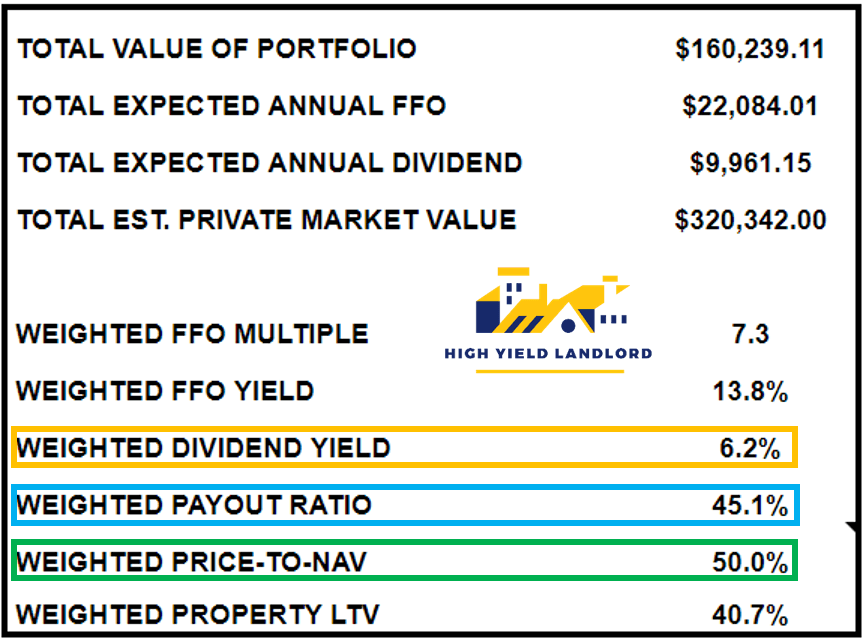

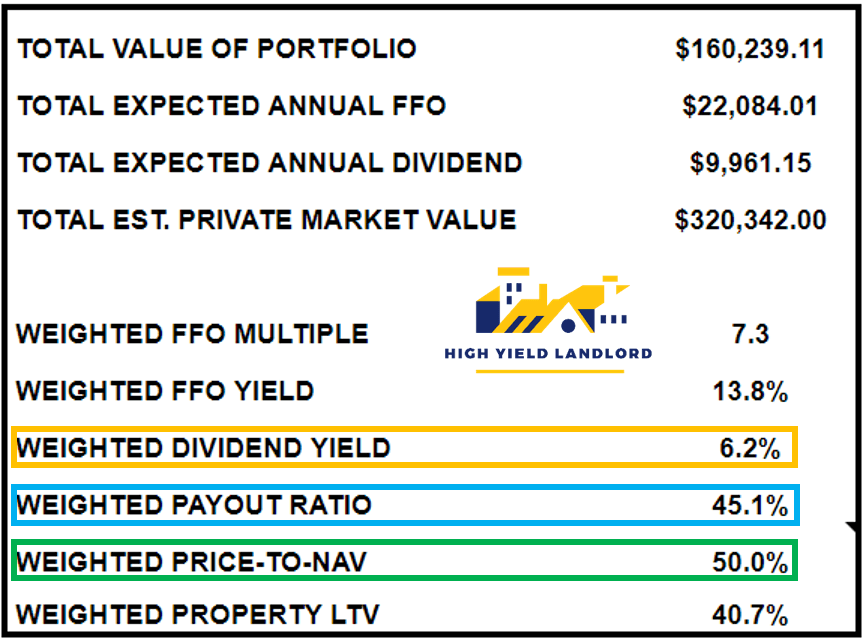

Over the years, we have built a portfolio of REITs and REIT-like entities that delivers on three key metrics:

High Yield

Low Payout Ratio

Substantial Discount to NAV

With this portfolio, we generate approximately $10,000 in annual income on just $160,000. You can see how this breaks down in the table below.

These are the characteristics of our Core Portfolio in November 2020. In today’s market, this is quite achievable. However, you may struggle to build a portfolio with these characteristics if you wait too long. With ultra-low interest rates, capital will flood into hard assets. Valuations will surge and yields will compress. Put simply, the smart money is getting into hard assets today — not waiting for tomorrow.

<<<

Seeking Alpha

Nov. 14, 2020

by Jussi Askola

https://seekingalpha.com/article/4388468-i-put-half-of-net-worth-hard-asset-investments

Summary

Most investors put their net worth in financial assets like stocks, bonds and cash.

I prefer to invest mine in hard assets.

You can get exposure to hard assets through publicly-traded vehicles.

Below I explain why I have 60% of my net worth in hard assets, and why you should do the same.

Most investors have the vast majority of their net worth in financial assets. Typically stocks, bonds and cash. These assets are extremely easy to invest in, which explains their popularity. But they come with a lot of downside too. From volatility to returns that barely beat inflation, they come with various disadvantages, depending on which asset class you’re talking about.

Let’s take each of the three most popular financial assets one by one.

Cash. This is like throwing money down the drain. The average savings account has only a 0.06% interest rate according to the FDIC. With inflation running at 2%, you’re losing purchasing power at that rate.

Bonds. They pay nothing or next to nothing after inflation and taxes. They’re better than cash, don’t get me wrong. But all you’re doing with bonds is maintaining your net worth, you’re not growing it. Long-term corporate bond ETFs (VCLT - BLV) yield just around 3%.

Stocks. Stocks tend to outperform cash and bonds over time. But they’re extraordinarily complex. To truly understand a stock, you need to understand all the moving pieces of a business that may have dozens of subsidiaries, subsidiaries with subsidiaries of their own, foreign operations, and more. And the risk is significant. Putting a large chunk of your net worth in the next Enron is a sure way to evaporate your savings. Finally, today's valuations are astronomically high with the S&P 500 (SPY) trading at 36x earnings, which is over 2x its historical average. Put differently, stocks are now priced at a 2.7% earnings yield even as we go trough a major crisis:

So, if all of the above assets have major problems with them, where do you put your net worth?

Hard Assets.

“Hard assets” is a term for tangible assets that have physical substance. Hard assets physically exist in the world and typically have some practical real-world use. The total list of hard assets would be far too long to reproduce here. But some good examples include:

Real estate.

Pipelines.

Farmland.

Timberland.

Airports.

Toll roads.

Other miscellaneous types of infrastructure.

All of these assets fulfill a real-world need and therefore often have stable, dependable cash flows. Not all hard assets are equal in terms of their income potential. Some are more dependable than others. But as a class, they offer high yield with relatively lower risk.

You might say: “sure, hard assets are good, but I can’t afford a second mortgage… so how do I get my exposure?”

The answer is simple: Through publicly-traded vehicles like REITs. REITs trade on exchanges like stocks but are built on portfolios of hard assets. They typically have mandates specifying that they pass a certain amount of their net income on to investors in the form of dividends. And they’re run by management teams, so you don’t need to worry about physically managing the properties yourself. By buying REITs and other REIT-like entities, you can get quick exposure to a diversified portfolio of hard assets. This is where I have over half of my net worth today, and I don’t plan on changing that any time soon.

Why Favor Hard Assets Over Stocks, Bonds, and Cash?

Reason #1: Yield

The cold hard truth is that there’s just not a lot of yield out there these days. The 10-year Treasury yields a minuscule 0.83%, while the SPDR S&P 500 ETF (SPY) yields 1.6%. The Nasdaq, meanwhile, is lagging both: The Invesco QQQ Trust ETF (QQQ) yields just 0.51%. In this market, the yield is hard to come by.

Unless that is, you look into REITs. REITs as measured by the Vanguard Real Estate ETF (VNQ) yield around 4%. That’s the market as a whole. Individual REITs can yield anywhere from 6% to 8%. If you’re really adventurous, you can find REITs yielding as much as 10%.

Our Core Portfolio is heavily invested in REITs and other hard assets. We target an ~8% yield a ~75% payout ratio. Generally, our actual portfolio yield and payout ratio are close to these targets.

Reason #2: Higher Total Returns

It’s possible to generate very high total returns with hard assets. If you buy real estate with a 6%-7% cap rate and finance half at 3%-4%, you get a 10% yield. That’s a strong return even with no price appreciation in the equation. Throw in a modest 2%-3% annual gain in there, and you’ve got a 15% a year investment.

You can do the same by buying hard assets through REITs and other publicly traded hard asset companies. Case in point: Brookfield Asset Management (BAM). Over the past 30 years, it has earned a 16% annualized return, compared to just 7% for the S&P 500.

Another example: Realty Income (O) has nearly quadrupled the returns of the S&P500 since its IPO in 1994:

On average, REITs have outperformed nearly every other asset class over the past 20 years leading up the COVID-19 crisis. When you earn high dividends, not much growth is needed to earn double-digit total returns:

Reason #3: Valuation

Finally, we get to valuation. The sad truth about the markets these days is that steep valuations are starting to become the norm. The vast majority of tech stocks trade at more than 10 times book value. Big players like Netflix (NFLX) and Amazon (AMZN) trade at anywhere from 70 to 120 times earnings. These kinds of valuations can’t persist forever. Even with strong earnings growth, it’s hard to justify a 120X multiple. And with tech making up an ever-larger percentage of the S&P 500’s market cap, we’re really talking about “stocks” as a whole here.

Hard assets, by contrast, are cheap relative to cash flow at the moment, particularly if you get your exposure through REITs. In many cases, REITs are down for the year in 2020, and priced at up to 50% discounts to the underlying value of their assets. To be sure, REITs ran into some collections problems that dampened earnings early in the pandemic. But they’re beginning to turn that around even as valuations remain opportunistic.

Smart Money is Rushing into Hard Assets

If you want to know where to invest, you need to look at where institutional investors are putting their money. Institutional investors own about 80% of the public equity market, and a growing share of investments in hard assets.

That institutional investors are increasing in clout is obvious. From 2008 to 2018, institutional capital nearly tripled. It’s expected to rise to $100 trillion by 2030.

That a large share of this capital is going into hard assets also is evident. Many pension funds and other big institutions favor yield in their portfolios as income is paramount for institutions with regular cash expenses. As mentioned above, there’s barely any yield these days in stocks and Treasuries. So yield-hungry institutions will likely move into hard assets in the years ahead. That may include direct investments as well as positions in REITs.

How to Profit from Hard Assets

Once you’ve decided you want exposure to hard assets, there are several asset classes you can look into. In no particular order:

Commercial real estate. Investments in apartment communities, e-commerce warehouses, data centers, or even casinos. AvalonBay Communities (AVB) and Digital Realty (NYSE:DLR.PK) would be classic examples.

Airports. Believe it or not, there are publicly-listed airports you can buy today on equity markets. Grupo Aeroportuario del Pacifico (PAC) is an example of one.

Timberland and farmland. You can invest directly in Timberland and Farmland through LPs and REITs like Gladstone Land (LAND) and Catchmark Timber (CTT).

Energy pipelines. Companies that transport oil and gas by pipe systems. Examples include the 10%-yielding Enterprise Product Partners (EPD) and Energy Transfer (ET).

Windmills. You can invest in alternative energy projects through partnerships like Brookfield Renewable Partners (BEP).

All of the hard assets listed above have high-income potential and have delivered steady growth over time. With a diversified portfolio consisting of these types of assets, you could outperform the markets.

That’s not to say there aren’t risks with hard assets. On the contrary, there are several you need to look out for. Retail REITs are vulnerable to industry trends like e-commerce, which has wreaked havoc on lower quality mall REITs CBL (CBL) and Washington Prime Group (WPG). Pipelines are subject to regulatory scrutiny and often find their projects delayed for long periods. Airports see revenue dip during recessions. The value of windmills decreases over time.

Because of these risk factors, you need to be careful about which hard assets you invest in. It’s not a simple matter of buying any hard asset and hoping it will deliver a good return. Nor is it as simple as buying a REIT ETF (VNQ) — with VNQ, you won’t get the 6%-8% yields mentioned earlier. Instead, you need to be selective and build a reasonably diversified portfolio of hard assets with the desired characteristics.

Our Hard Asset Portfolio

Over the years, we have built a portfolio of REITs and REIT-like entities that delivers on three key metrics:

High Yield

Low Payout Ratio

Substantial Discount to NAV

With this portfolio, we generate approximately $10,000 in annual income on just $160,000. You can see how this breaks down in the table below.

These are the characteristics of our Core Portfolio in November 2020. In today’s market, this is quite achievable. However, you may struggle to build a portfolio with these characteristics if you wait too long. With ultra-low interest rates, capital will flood into hard assets. Valuations will surge and yields will compress. Put simply, the smart money is getting into hard assets today — not waiting for tomorrow.

<<<

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.