Major Fireworks In The Gold & Silver Markets

May 03, 2021

Today one of the greats in the business told King World News to expect

fireworks in the gold and silver markets as an upside explosion is

close at hand.

Great Day For Gold & Silver

May 3 (King World News) – James Turk: It’s been a great day for the

precious metals, Eric. And I will add that it is long overdue…

As usual, the metals were stuffed last week for the usual reasons –

option expiry, the FOMC meeting and month end marking-to-market.

So it is good to see them come to life today, particularly because

many markets around the world are closed for May Day celebrations.

What’s important from today’s action as I see it, is that some technical

indicators are kicking in.

Also, try as they might, the shorts could not break the precious metals

last week....

$More states pushing to make gold and silver legal tender – former U.S. Mint director (Pt 2/2)

9,420 views•Apr 30, 2021

https://www.youtube.com/watch?v=d5UV5sVj88I

$Monument Mining Limited (MMTMF)(TSXV:MMY) (FSE: D7Q1) Videos Update on Flotation Plant Work at Selinsing Gold Mine -

April 2021

https://www.monumentmining.com/videos/

https://www.monumentmining.com/news-media/photo-gallery/

https://www.monumentmining.com/site/assets/files/4188/mmy_corporate_presentation-2021_04_08.pdf

https://www.monumentmining.com

$NEWS Monument Commences Flotation Plant Work at Selinsing Gold Mine

April 27, 2021

Vancouver, B.C., April 27, 2021,

$Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) (“Monument” or the

“Company”) is pleased to announce commencement of the phase 1

Selinsing Sulphide Gold Project

by adding a flotation plant to the existing processing plant,

which will produce marketable gold concentrates from

the sulphide ore at Selinsing Gold Mine in Pahang State, Malaysia.

CEO and President Cathy Zhai commented: “Monument has completed

the restructuring of its mineral asset portfolio by spinning out the

Mengapur base metals project.

This enables us to focus on development and funding of the gold

portfolio.” She added:

“We plan to spend up to USD$20 million first to build a

flotation plant for saleable gold concentrate, the proceeds from it

can be used to add the planned bioleaching plant to produce gold

bullion should an economic case be demonstrated by then.”

The flotation construction comprises (1) Project economic validation

aimed to optimize flotation design completed in the feasibility study,

to produce saleable gold concentrate;

(2) Detailed flotation design and engineering;

(3) Procurement; (4) Construction and commissioning to deliver

the final plant; and

(5) Mine development.

The flotation construction team has been organized including project

management, engineering, procurement and administrative support,

directly supervised by a newly recruited Project Manager, who has 20

years’ experience in project management, construction and engineering.

$Key milestones and timelines for the project are as follows:

Flotation testwork (February-May 2021)

Flotation pilot plant testing (June 2021 onwards);

Flotation plant procurement starts (June 2021);

Flotation plant construction starts (Late August 2021)

Flotation plant construction completion (April 2022)

Gold concentrate production commences (June 2022)

Please refer to the video “Update on Flotation Plant Work at Selinsing Gold Mine” at the video section of the Monument Mining website:

https://www.monumentmining.com/videos/

in conjunction with the following contents.

PROGRESS OF ECONOMIC VALIDATION

The project economic validation was initiated three months ago at the

on-site laboratory using sulphide samples collected from Buffalo Reef.

It is to confirm the flotation reagent regime, evaluate and maximize

the economics of the gold concentrate product that can be achieved

through the sizing of flotation cells and the number of cleaning

stages.

Orway Mineral Consultants (WA) Pty Ltd. (“Orway”) has been engaged to

design and monitor the test work, and provide a conceptual design

targeting completion in May 2021. Bureau Veritas,an independent

certified laboratory has been chosen to carry out the lab work.

Both companies are located in Perth Western Australia.

Flotation On-site Testwork

$The testwork to date at the Selinsing on-site lab has achieved an

acceptable gold concentrate with recoveries of 83–92%,

containing around 30-45 g/t of gold on composite samples of

Buffalo Reef fresh and transition materials.

$Initial marketing studies using the in-house flotation data have

indicated that concentrate grades of 30 – 35 g/t Au may be preferred.

The test results achieved for samples of Buffalo Reef Central

2 (“BRC2”) and Buffalo Reef Central

3 (“BRC3”) transition and fresh sulphide material are summarized in

Table 1.

Table 1: Selinsing Site Flotation Test Results

1

Note ex....paerl

posted April 29, 2021 02:48 pm by deiwel (94)

again we have a paerl here, only with murchinson as exploration we can

agin 300% , and not forgot we are producer and we have cash flow rate

and reply

https://monumentmining.com/news-media/news/2021/monument-commences-flotation-plant-work-at-selinsing/

$Monument Commences Flotation Plant Work at Selinsing Started New Development to get much more Processed GOLD Produced for great future!

their cash on hand + $10mil of unsold gold (around usd$50 mil total cash equiv)

is still higher than their current market cap of cdn$52mil

at 15.5 cent shares.

crazy that a company is selling for less than its cash.

not needing to raise funding for this project makes MMY extremely

undervalued.

by invest234

Promotional Activities

Today's video by Cathy et al was OK by evidential standards .

It was nice to see that all presenters appeared to be Malaysian, which

is as it should be.

One of my best professional colleagues and a very good friend, since

deceased, was from Malaysia.

He was a nationalist , which basically, we all are.

However, investor markets are never nationalist but diversified

internationalists.

As to Monument, its largest shareholders by shares held are European and

North American.

So, from that perspective , today's Video in English, looked too

scripted and Cathy's zeitgeist lacked reality karma.

Not really her fault but actual reality.

by nozzpack

$Videos; Update on Flotation Plant Work at Selinsing Gold Mine -

April 2021

https://monumentmining.com/videos/

https://monumentmining.com/news-media/photo-gallery/

$Patient Gold & Silver Bulls Are Going To Be Great Rewarded

April 23, 2021

$Monument Mining (TSXV:MMY) This company is worth 7-8 times what it

trading for @ current bargain price

monster upside in 2021!

IMO!

$News Release; Monument Appoints Hugh Bresser to Chief Managing Geologist

April 19, 2021

View PDF

Vancouver, B.C., April 19, 2021,

$Monument Mining Limited (TSX-V: MMY)(MMTMF)(FSE: D7Q1) “Monument” or the

“Company” is pleased to announce the appointment of

Mr. Hugh Bresser to Chief Managing Geologist.

“I am very pleased to have Hugh Bresser join us as Chief Managing

Geologist at this very critical time when we completed the restructure

of our mineral asset portfolio and committed to developing

Murchison Gold Mines towards being a cornerstone project”,

remarks Cathy Zhai, President & CEO of Monument Mining,

“I believe his enthusiasm in gold discovery, extensive experience

in mineral asset development and determination to lead the team

building high performance will make a significant difference in the

progress of our Murchison project.”

Mr. Bresser has built a 30-year career in the minerals industry focused

on exploration, identification, acquisition and development of

economic ore deposits, utilizing conventional and unconventional

targeting and exploration strategies in combination with a commercial

understanding of minerals economics and the resource industry cycle

in Australia, North and South America, Asia and Europe.

His work experience ranging from junior, mid-cap miners and majors

provides a strength and depth of understanding of risk and capital

management, including South 32 Ltd, Pancontinental Mining Ltd.,

P.T. Billiton Indonesia, Billiton Exploration Australia Pty. Ltd., and

various roles at BHP.

He also was the managing director at Overland Resources Limited and

the principal consulting geologist at Milagro Ventures Pty. Ltd.

Mr. Bresser holds professional memberships and affiliations in

MAusIMM, MAIG, MSEG, MGSA, graduated from James Cook University with a

BSc. honors degree in Metalliferous and Economic Geology in North

Queensland and holds an MBA from Mt Eliza Business School in Melbourne,

Australia.

About Monument

$Monument Mining Limited (TSX-V:MMY, FSE:D7Q1) is an established Canadian

gold producer that owns and operates the Selinsing Gold Mine in

Malaysia.

Its experienced management team is committed to growth and is also

advancing the Murchison Gold Projects comprising

Burnakura Gold Mine, own 100%

Gabanintha Gold project (100%) and

Tuckanarra Gold project(20% carried interest) in

the Murchison area of Western Australia.

The Company employs approximately 200 people in both regions and

is committed to the highest standards of environmental management,

social responsibility, and health and safety for its employees and

neighboring communities.

Cathy Zhai, President and CEO

Monument Mining Limited

Suite 1580 -1100 Melville Street

Vancouver, BC V6E 4A6

FOR FURTHER INFORMATION visit the company web site at;

http://www.monumentmining.com

or contact:

Richard Cushing, MMY Vancouver T: +1-604-638-1661 x102

rcushing@monumentmining.com

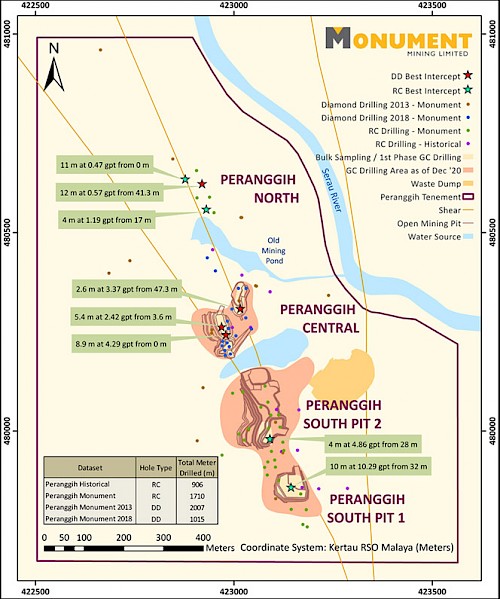

$Monument Mining Ltd. (TSXV:MMY)(MMTMF) Very nice Gold Project

Presentation of Perangih open pit gold mines;

Peranggih exploration is carried out in three separate zones within the main regional structure:

1. Peranggih South open gold mine pit,

2. Peranggih Central gold mine open pit , and

3. Peranggih North open gold mine pit;

Peranggih Area Drill hole Map

$Monument Mining has undertaken a diamond drilling campaigns;

started in March 2014, with 21 holes completed for over 2,007m.

Oxide trenching, pit geological mapping, surface sampling, and

initial geological modeling program were executed

during 2016 and 2017.

A subsequent close space 5m x 5m Percussion Rotary Air Blast

(RAB) drilling program,

2,780m for 298 holes, was carried out

in August 2017 at the Central zone to test

150m strike length x 80m width of the mineralization.

This program initially indicated over 38kt @ 1.00g/t Au

with a broad 15m-20m wide high-grade zone and

multiple isolated high-grade zones, surrounded by more

grade gold mineralization.

It proved the presence of disseminated gold in the breccia matrix.

It is noteworthy that grade control areas for mining bench construction

is much larger than the two starter pits in Peranggih South.

Grade control was conducted within the high grade zones.

This indicates that the final pit size in Peranggih South

will be much larger than currently developed.

The average pit at Selinsing produced 50,000 ounces.

Its not unreasonable that these two starter pits in P South

could reach that level of production + more.

Currently, Peranggih Central has been grade controlled but

the pit has to be ready for production.

This area the management conservative estimated 20,000 to 30,000 ounces

in 2018 which they reported had increased by 44 % by early 2021.

It would seem that this third pit in P Central could also

produce up to 50,000 ounces + more.

Peranggih North has been too sparsely drilled to judge productivity,

but it is also a high grade area -

so another 3rd pit might be developed there.

Mentique adjoins closely with Peranggih.

It has two high grade zones extending at strike by 1.8 km.

The drilling as been done at Peranaggih will make

more gold productivity.

The same setting and lithology and contiguous with

Perangghi, the chances are high that

Mentque could contain two more oxide open pits mines.

$SUMMARY Ex....

Conservative dividing by 2 ( 25,000 ounces per pit ) ,

RE: Peranggih open pit

gold mines;

Peranggih will be a major contributor to increased oxide production -

in the coming years and being decent grade oxides -

will boost recovery levels , thereby reducing cash costs.

$45 million cash in hand approx

That puts MMY at a .135 cent book value, cash only.

Our operational property and Australian lands with mill

have no value in our share price today.

This will have to change or some entity will take this company.

MMY needs to show the market its value.

We are 10 x under valued!

By Tradeup20202025 (15) @ sth

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=163070781

$Monument (MMTMF)(TSXV:MMY) announces sale of its Malyasian subsidiary

Mining

TSXV:MMY $47.70M

Simon Druker

Markets Reporter

simon.druker@themarketherald.ca

08 April 2021 16:00

Monument Mining Limited (MMY) has closed a transaction to sell

its 100 per cent interest in Monument Mengapur, its

Malaysian subsidiary

The company sold Monument Mengapur to Fortress Minerals Limited

Monument Mengapur owns the Mengapur Copper and Iron Project in

its entirety

The Mengapur Project is located in Pahang State, approximately

75 kilometres northwest from Kuantan Monument Mining is

unchanged on the day, with shares trading at C$0.12 at 1:10 pm ET

Monument Mining Limited (MMY) has closed a transaction to sell its

entire 100 per cent interest in Monument Mengapur, its

Malaysian subsidiary.

The company sold Monument Mengapur to Fortress Minerals Limited.

Monument Mengapur owns the Mengapur Copper and Iron Project in its

entirety.

The Mengapur Project is located in Pahang State, approximately 75

kilometres northwest from Kuantan.

The sale of the Mengapur Project is part of Monument’s corporate

restructuring to focus on the development of the company's gold

projects in Malaysia and Western Australia.

Under the terms of the agreement, Monument received US$30 million cash

consideration in full.

The deal also entitles Monument to a royalty of 1.25 per cent of gross

revenue on all products produced at the Mengapur Project.

A finder’s fee of US$600,000 was paid out from the gross proceeds.

Proceeds from the transaction will be used for corporate and future gold

project development.

Founded in 1997 and based in Vancouver, Monument Mining Limited is an

established Canadian gold producer that operates the 100 per cent owned

Selinsing Gold Mine in Malaysia.

Gold Price: Still on Track for $3,000, Another Shot Is

Coming Says John Doody

37,911 views •Mar 24, 2021

https://www.youtube.com/watch?v=VN8AppYd3rQ

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

$Monument Mining Has Seen its Gold Revenue Surge

Swiss Resource Capital AG

19.6K subscribers

https://www.youtube.com/watch?v=a3qrP2Y10M0

SmallCapPower

5.72K subscribers

In this interview at the PDAC 2020 convention, SmallCapPower spoke with

Monument Mining Limited (TSXV:MMY) President and CEO Cathy Zhai.

$Monument Mining has been successfully producing gold in Malaysia for

the past 10 years and now has a promising development project in

Western Australia.

Find out more about Monument Mining’s plans for 2020

by watching our interview.

https://www.youtube.com/watch?v=mRejQP-pbzA

FOR FURTHER INFORMATION visit the company web site at

http://www.monumentmining.com

or contact:

Richard Cushing, MMY Vancouver T: +1-604-638-1661 x102 rcushing@monumentmining.com

“Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.”

Forward-Looking Statement

https://www.monumentmining.com/news-media/news/2021/monument-to-implement-value-creation-strategy/

$MMY Heap Leach Production Potential of Murchison;

$Kentor has done a decent analysis of the heap leaching potential

of the lower grade ores at Murchison.

As far as I know, we have the necessary heap leach equipment on hand

at $Burnakura for 2 million tons per year.

I used to own GGD which heap leaches very low grade tailings .....less

than 1 gm per ton

Agglomeration was necessary, as recoveries were greater once the head

grade ore was agglomerated with concrete.

However, agglomeration seems to be not needed very much for Burnakura

ore.

The other parameter is leach cycle time......the time required for the

gold to be leached out of the ore once placed on the heap pad.

I used 2 cycles per year.....ie about 150 days to maximize recovery

of gold.

However, Kentor shows about 24 days which I think must mean something

else , as that cycle is quite rapid.

So I use 2 cycles per year Of 500,000 tons of auriferous ore which means

1 million tons per year.

I will use an average of 0.9 gms per ton as head grade of the ore

placed on the heap leach pads.

So, that means 900,000 grams of contained gold on the heap leach pads

per year.

Recovery rates is about 90% for this grade of ore, so we end up

recovering about 800,000 grams of gold per year, which divided

by 31 gms per ounce means an annual production of about

25,000 ounces per year .

This is quite close to the 30,000 ounces recovered/ year by

Indee gold which used this same leach equipment which was

acquired by Kentor.

So, combining 40,000 ounces of high grade production from underground

ore through the Burnakura mill @ 300,000 tons per year.....see my

previous post..and 25,000 ounces of the lower grades from heap leach,

we have about 65,000 ounces of production per year .

Heap leach is cheaper than milling for obvious reasons .

So an AISC of $1000 per ounce for the two combined production methods

seems quite reasonable .

@$1800 POG, we are excess cash flowing about $50 million per year .

Our neighbour free cash flows $80 million per year

on 95,000 ounces .

This is good agreement .

KRR trades at 5.5 times its free cash flow.

This would imply..but degraded 4,5 times , for lower production ..a

fair value of about $225 million for our Murchison production,

employing fully our current milling and heap leach facilities .

But, we have in addition , that rich gold copper resource at the

Yagahong deposit of Gabathinia along with its other 6 pits none of

which have been fully explored or the possibility of

finding supergene ore.

So, our Murchison assets have superb value at current POG.

It's my analytical opinion, that the Greatest value of our Murchison

assets would accrue to us shareholders by spinning it out to us as

a new public listing, including the Tuckanara seed capital and JV ,

allocated perhaps 80% to shareholders and 20 % to our parent company.

Its a win win situation

$MMY- $70 mil in assets and only a $42 mil market cap? NO DEBT!

Way undervalued and oversold -

5 bagger + + + + ? or more -

https://www.monumentmining.com/

https://www.monumentmining.com/news-media/photo-gallery/

Imo! TIA

https://investorshub.advfn.com/Monument-Mining-TSXV-MMY-13403/

$Monument Mining (TSXV:MMY) Photo Gallery - well they growing with new

great discovery of plenty more gold ore to increase

the ore reserve with good drilling results to be mined many future

years the weather is good no curtain needed -

$1,000th Gold Bar Pour Produced by MMY; Photo Gallery

https://www.monumentmining.com/news-media/photo-gallery/

$Market Cap $46 mil. - No Debt - someone has to be kidding

is it the fact ???

What a Great Gold Mines bargain

MMY It's very undervalued, oversold like > hidden giant Au gold mines

soon to be discovered

Imo!

$Selinsing Gold Mine

The Selinsing gold mine is an operating high-grade gold mine at Bukit

Selinsing in Pahang State, Malaysia.

https://www.mining-technology.com/projects/selinsing-gold-mine/

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

VIEW PDF

https://www.monumentmining.com/news-media/news/

https://www.monumentmining.com

News Releases

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

View PDF

Gross Revenue of $5.92 Million and Cash Cost of US$923/Oz

Vancouver, B.C., November 16, 2020,

Monument Mining Limited (TSX-V: MMY and FSE: D7Q1)

“Monument” or the “Company” today announced its first quarter

production and financial results for the three months ended

September 30, 2020.

All amounts are expressed in United States dollars (“US$”) unless

otherwise indicated (refer to www.sedar.com for full financial

results).

President and CEO Cathy Zhai commented:

“Fiscal 2021 started with new challenging as a global COVID-19

pandemic carried forward from fiscal 2020.

The Company has fully resumed its production in the first quarter

from eight-week’s mining ban at Selinsing in the first quarter,

the Selinsing Sulphide gold plant upgrade

is however still pending for financing.

“On the other hand, gold price surged to record high and

the gold mining sector was very active in Western Australia,

gold mining producers enjoyed high production margins, and

investment is flowing into that region for gold explorations.

The Company continues try hard to access to financing, and

it is very closely monitoring the market and looking for

divesting of base metal portfolio to

focus on primary gold assets, as well as

new corporate development opportunities

to lift up market value for the best

interest of its shareholders.”

First Quarter Highlights:

3,504 ounces (“oz”) of gold produced (Q1 2020:

4,852oz) with 3,100oz of gold sold for gross revenue of

$5.92 million (Q1 2020: 4,323oz of gold sold for

revenue of $6.34 million);

Gross margin of $3.06 million (Q1 2020: $2.65 million);

Average realized price per ounce, excluding prepaid gold sales, of

$1,909/oz (Q1 2020: $1,475/oz);

Cash cost per ounce of $923/oz (Q1 2020: $855/oz);

All-in sustaining costs per ounce (“AISC”) of $1,055/oz (Q1 2020:

$1,158/oz);

Peranggih grade control drilling after positive trial mining results

identified 58,662 tonnes at 0.93g/t Au materials;

Production resumed at Selinsing after lifting eight weeks mining ban in

last quarter during COVID-19 pandemic

Entering into a Tuckanarra JV arrangement with Odyssey subsequent to

the quarter opens corporate development opportunities in WA region.

First Quarter Production and Financial Highlights

https://www.monumentmining.com/news-media/news/2020/monument-reports-first-quarter-fiscal-2021-q1-2021-results/

Monument Mining (TSXV:MMY) Note...

RE:Substantial Increase in Gold ...Stage 1 open pit Peranghi

nozzpack @ sth. wrote:

Based on the 2017 GC drilling program which identified a high grade zone

measuring 150 m by 80 m in P North ( see Fig 1 in link below )

management estimated this this GC zone contained 20,000 to 30,000

ounces....see link to 2017 NR below.

The recently completed 5002 m GC drilling of this Zone elicited this

statement from management..

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted than

the initial assay results from 2017 GC drilling program

at the same area.

So in just this small zone, we now have

at least 31,000 to 47,000 ounces of

even higher grade gold within a lesser volume of ore.

I had earlier missed this implication .

They are now telling us that we have a significant new gold deposit

at Peranghi whose size will eventually describe

a substantially new oxide resource once P North and

the other 3 high grade zones are fully explored.

My earlier analyses of these 4 zones showed in

excess of 120,000 ounces.

This discovery completely alters the future perspective

for mining at Selinsing.....no rush

to fund Biox as we have new and

substantial sources of high grade oxides

for years to come

xxxxxxxxxxxxxxx

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be

extracted than the initial assay results

from 2017 GC drilling program at the same area.

A further GC drill program was planned;

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a;

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted

than the initial assay results from

2017 GC drilling program at the same area.

A further GC drill program was planned,

see fig 1 at this link

https://www.monumentmining.com/news-media/news/2020/monument-announces-trial-mining-results-at-peranggih-gold-prospect-in-malaysia/

https://www.monumentmining.com/news-media/news/2017/monument-announces-encouraging-results-from-recent-drilling-at-new-gold-field-peranggih-project/

The recent 2017 close spaced RAB drilling program

was carried out at an historic mining site to

test 150m strike length x 80m width of the mineralization.

This allowed the accurate identification of

several high grade gold (HG) zones surrounded

by a main low grade (LG) halo.

The significant drill intersections;

(Au >2.0 g/t & >5m length) within a more

consistent high grade gold area are presented in

Table 1.

The full set of drill results for the holes intercepting

this HG gold mineralization occurrence are listed in

Appendix A and Appendix B.

Previous activities plus more recent exploration works,

totaling 1,700m for 21 trenches, 2,900m of Diamond Drilling (DD) and

Reverse Circulation (RC) drilling for

35 drill holes, and 2,800m of close spaced RAB drilling

for approximately 300 drill holes (completed in 2017)

have been used to outline an exploration

target of 20,000 to 30,000 oz Au contained

within 1 to 2 Mt @ 0.3 to 2.0 g/t Au.

The potential tonnages and grades are con

Gold & Silver bulls starting to break out > ^ > ^ > ^

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA.

FEATURED Cannabix Technologies Begins Certification of Contactless Alcohol Breathalyzer, Re-Brands product series to Breath Logix • Apr 16, 2024 8:52 AM

Kona Gold Beverages, Inc. Acquires Surge Distribution LLC from Loud Beverage Group, Inc. (LBEV) • KGKG • Apr 16, 2024 8:30 AM

Branded Legacy, Inc. Reports Significant Net Income of Over $3.8 Million • BLEG • Apr 16, 2024 8:30 AM

Avant Technologies Begins Development on Next-Generation AI-Driven Resource Allocation Solution • AVAI • Apr 16, 2024 8:00 AM

UC Asset Expected to Report $0.03/share Net Profit for 2023 • UCASU • Apr 11, 2024 10:00 AM

Kona Gold Beverages & Apple Rush Co. Execute Joint Venture & Manufacturing Agreement • APRU • Apr 11, 2024 9:40 AM