Thursday, April 22, 2021 9:09:17 AM

HWIN + EWST + MDVP = family of stock scams

Besides HWIN, Peter L Coker and his crew are also involved in a couple of other Issuers: EWST and MDVP

https://www.otcmarkets.com/stock/HWIN/profile

https://www.otcmarkets.com/stock/EWST/profile

https://www.otcmarkets.com/stock/MDVP/profile

----------

Homegrown International Inc (HWIN)

Just for a point of reference. Here is how the Coker group took over the HWIN shell.

On December 31, 2019, Peter Coker Jr bought 1,000,000 shares from each of the directors (Paul F. Morina and Christine T. Lindenmuth), representing 38% ownership at the time, for $3,000

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020000412/f8k123119_hometown.htm

On that same day, Peter Coker Jr loaned the company money, receiving a $175,000 Promissory Note

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020000412/f8k123119ex4-1_hometown.htm

On February 17, 2020, Peter Coker Jr, became the Chairman of the Board of HWIN

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020004148/f8k021720_hometown.htm

On March 2, 2020, old HWIN debt was exchange for a new $100,000 debt Note to Peter Coker Sr (Europa Capital Investments LLC) which was immediately converted into 100,000 shares, with the proceeds being used to repurchase a small chunk of stock.

Around that same time, HWIN authorized a bunch of warrants.

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020006988/ea119848-8k_hometown.htm

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020006988/ea119848ex10-3_hometown.htm

Those various classes of warrants, which all have conversion rights into common shares, were sold to a bunch of entities/individuals with links to Hong Kong, including:

Manoj Jain (Maso Capital Partners Limited, Blackwell Partners LLC, STAR V Partners LLC)

Michael R. Tyldesley and Ibrahima Thiam (Global Equity Limited)

Ibrahima Thiam and Lan Moi Lilia (IPC-Trading Company Ltd)

Nathalie Tina Pasyawon (RTO Limited)

Michael Tyldesley (VCH Limited)

Peter L. Coker, Sr. and Peter Reichard (Europa Capital Investments, LLC)

In April, 2020, HWIN sold 2,500,000 shares for $1.00/share in a private placement to 3 investors raising $2,500,000.

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020009459/ea120768-8k_hometown.htm

Based on information in a subsequent S-1 registration those 3 investors (through various offshore entities) were Manoj Jain, Ibrahima Thiam, and Nathalie Tina Pasyawon.

In May 2020, HWIN entered into a consulting agreement with Peter Coker Sr (Tryon Capital)

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020011311/ea121519ex10-1_hometowniter.htm

In May 2020, HWIN entered into a consulting agreement with VCH Limited (Michael R. Tyldesley)

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020011311/ea121519ex10-2_hometowniter.htm

In October 2020, an S-1 freeing up a bunch of stock owned by the HWIN insiders (mainly stock owned by Manoj Jain, Ibrahima Thiam, Nathalie Tina Pasyawon, Lan Moi Lilia, and Peter Coker Sr) was made effective.

As that CNBC articles state, HWIN owns only a single New Jersey deli.

https://www.cnbc.com/2021/04/22/100-million-new-jersey-deli-company-delisted-from-otc-market.html

https://www.cnbc.com/2021/04/16/lawyer-hometown-international-deli-owner-stock-scams.html

https://www.cnbc.com/2021/04/15/hometown-international-nj-deli-owner-worth-millions-in-stock.html

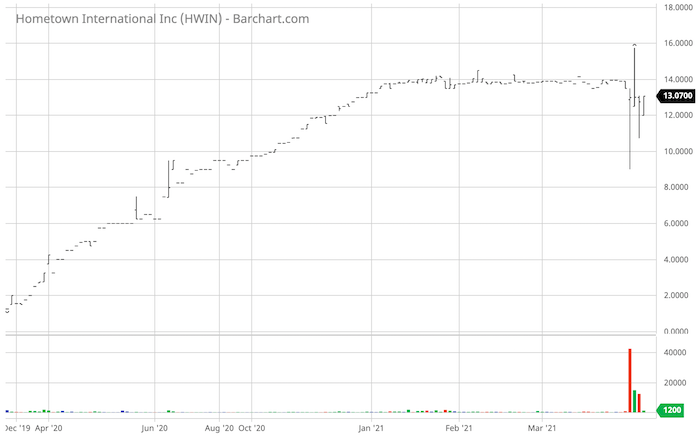

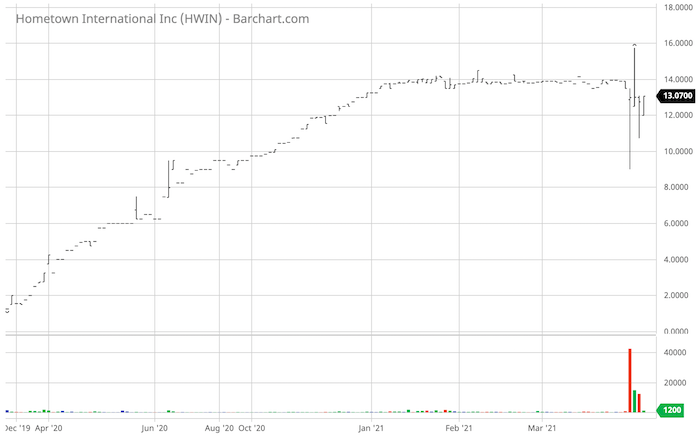

The HWIN chart has been a picture of manipulation since the Coker group showed up in late 2019:

---------

E-Waste Corp

The Coker group acquired control of the EWST shell in September 2020 through a stock sale to Global Equity Limited (Michael R. Tyldesley and Ibrahima Thiam).

https://www.sec.gov/Archives/edgar/data/0001543066/000116169720000420/form_8-k.htm

It came with a $255,000 debt note issued to Peter Coker Sr (Tryon Capital)

https://www.sec.gov/Archives/edgar/data/0001543066/000116169720000420/ex_4-1.htm

Then John Rollo was installed as the puppet CEO and 1,000,000 shares were immediately sold for super cheap at $.05/share in a subscription agreement, raising $50,000.

https://www.sec.gov/Archives/edgar/data/0001543066/000116169720000454/form_8-k.htm

EWST also signed a consulting agreements with Peter Coker Sr (Tryon Capital) and Elliot Mermel (Benzions LLC)

https://www.sec.gov/Archives/edgar/data/1543066/000116169721000045/ex_10-1.htm

https://www.sec.gov/Archives/edgar/data/1543066/000116169721000045/ex_10-2.htm

And EWST signed a $150,000 debt Note with Hometown International Inc (HWIN)

https://www.sec.gov/Archives/edgar/data/1543066/000116169721000045/ex_4-1.htm

EWST just finished another offering selling units (a share and a warrant) at $4.50/unit, raising $2,500,000.

https://www.sec.gov/Archives/edgar/data/0001543066/000116169721000218/form_8-k.htm

EWST uses an address in North Carolina at 610 Jones Ferry Road, Suite 207, Carrboro that is shared with other Peter Coker managed businesses.

Currently, EWST has no business operations, but says it is seeking out opportunities.

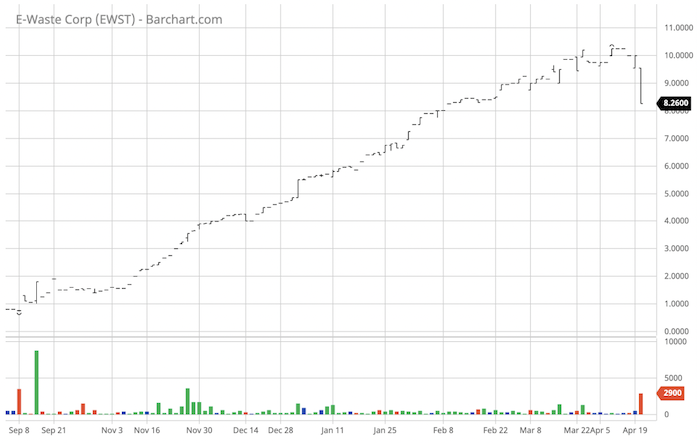

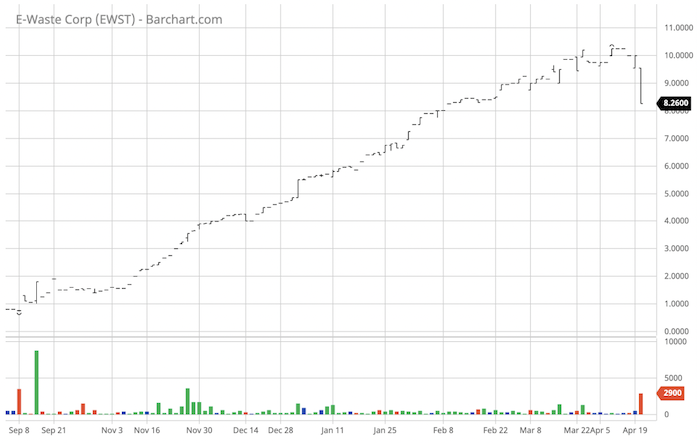

The EWST chart, which started trading around the time of the Coker group takeover, has a similar pattern of manipulation as the HWIN chart.

--------------

Med Spa Vacations Inc (MDVP)

MDVP I did a research report on a couple of years ago because of who was involved in setting up the shell when it went public. It was part of a pretty massive shell factory. The shell has switched hands since then briefly being controlled by some group out of Hong Kong.

Then in February 2021, the shell was sold again to a group linked to Coker.

https://www.otcmarkets.com/filing/html?id=14691880&guid=RTppUp5FeA_sQth

The control stock was split up between 11 purchasers (whose identities were not revealed in the 8K) with the 4 biggest shareholders becoming:

Global Equity Limited (Michael R. Tyldesley and Ibrahima Thiam) - 5,000,000 shares

Hometown Global Services LLC (Peter L Coker Jr) - 1,664,226 shares

Diana Harris Coker - 980,000 shares

David J. Chapman - 950,000 shares

Like with HWIN and EWST, MDVP signed consulting agreement with Peter L Coker Sr (Tryon Capital LLC)

https://www.sec.gov/Archives/edgar/data/0001671077/000164033421000319/medspa_ex101.htm

Like with EWST, MDVP signed a consulting agreement with Elliot Mermel (Benzions LLC)

https://www.sec.gov/Archives/edgar/data/1671077/000164033421000404/mdvp_ex101.htm

Like EWST, the Coker group installed John Rollo as the new puppet CEO.

And like EWST, MDVP signed a $150,000 debt Note with Hometown International, Inc (HWIN)

https://www.sec.gov/Archives/edgar/data/0001671077/000164033421000404/mdvp_ex41.htm

Currently, MDVP has no business operations, but says it is seeking out opportunities.

So far, MDVP hasn't started trading yet, but I suspect when it does, if the SEC doesn't step in before that, it will be manipulated similarly to HWIN and EWST.

Besides HWIN, Peter L Coker and his crew are also involved in a couple of other Issuers: EWST and MDVP

https://www.otcmarkets.com/stock/HWIN/profile

https://www.otcmarkets.com/stock/EWST/profile

https://www.otcmarkets.com/stock/MDVP/profile

----------

Homegrown International Inc (HWIN)

Just for a point of reference. Here is how the Coker group took over the HWIN shell.

On December 31, 2019, Peter Coker Jr bought 1,000,000 shares from each of the directors (Paul F. Morina and Christine T. Lindenmuth), representing 38% ownership at the time, for $3,000

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020000412/f8k123119_hometown.htm

On that same day, Peter Coker Jr loaned the company money, receiving a $175,000 Promissory Note

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020000412/f8k123119ex4-1_hometown.htm

On February 17, 2020, Peter Coker Jr, became the Chairman of the Board of HWIN

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020004148/f8k021720_hometown.htm

On March 2, 2020, old HWIN debt was exchange for a new $100,000 debt Note to Peter Coker Sr (Europa Capital Investments LLC) which was immediately converted into 100,000 shares, with the proceeds being used to repurchase a small chunk of stock.

Around that same time, HWIN authorized a bunch of warrants.

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020006988/ea119848-8k_hometown.htm

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020006988/ea119848ex10-3_hometown.htm

Those various classes of warrants, which all have conversion rights into common shares, were sold to a bunch of entities/individuals with links to Hong Kong, including:

Manoj Jain (Maso Capital Partners Limited, Blackwell Partners LLC, STAR V Partners LLC)

Michael R. Tyldesley and Ibrahima Thiam (Global Equity Limited)

Ibrahima Thiam and Lan Moi Lilia (IPC-Trading Company Ltd)

Nathalie Tina Pasyawon (RTO Limited)

Michael Tyldesley (VCH Limited)

Peter L. Coker, Sr. and Peter Reichard (Europa Capital Investments, LLC)

In April, 2020, HWIN sold 2,500,000 shares for $1.00/share in a private placement to 3 investors raising $2,500,000.

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020009459/ea120768-8k_hometown.htm

Based on information in a subsequent S-1 registration those 3 investors (through various offshore entities) were Manoj Jain, Ibrahima Thiam, and Nathalie Tina Pasyawon.

In May 2020, HWIN entered into a consulting agreement with Peter Coker Sr (Tryon Capital)

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020011311/ea121519ex10-1_hometowniter.htm

In May 2020, HWIN entered into a consulting agreement with VCH Limited (Michael R. Tyldesley)

https://www.sec.gov/Archives/edgar/data/0001632081/000121390020011311/ea121519ex10-2_hometowniter.htm

In October 2020, an S-1 freeing up a bunch of stock owned by the HWIN insiders (mainly stock owned by Manoj Jain, Ibrahima Thiam, Nathalie Tina Pasyawon, Lan Moi Lilia, and Peter Coker Sr) was made effective.

As that CNBC articles state, HWIN owns only a single New Jersey deli.

https://www.cnbc.com/2021/04/22/100-million-new-jersey-deli-company-delisted-from-otc-market.html

https://www.cnbc.com/2021/04/16/lawyer-hometown-international-deli-owner-stock-scams.html

https://www.cnbc.com/2021/04/15/hometown-international-nj-deli-owner-worth-millions-in-stock.html

The HWIN chart has been a picture of manipulation since the Coker group showed up in late 2019:

---------

E-Waste Corp

The Coker group acquired control of the EWST shell in September 2020 through a stock sale to Global Equity Limited (Michael R. Tyldesley and Ibrahima Thiam).

https://www.sec.gov/Archives/edgar/data/0001543066/000116169720000420/form_8-k.htm

It came with a $255,000 debt note issued to Peter Coker Sr (Tryon Capital)

https://www.sec.gov/Archives/edgar/data/0001543066/000116169720000420/ex_4-1.htm

Then John Rollo was installed as the puppet CEO and 1,000,000 shares were immediately sold for super cheap at $.05/share in a subscription agreement, raising $50,000.

https://www.sec.gov/Archives/edgar/data/0001543066/000116169720000454/form_8-k.htm

EWST also signed a consulting agreements with Peter Coker Sr (Tryon Capital) and Elliot Mermel (Benzions LLC)

https://www.sec.gov/Archives/edgar/data/1543066/000116169721000045/ex_10-1.htm

https://www.sec.gov/Archives/edgar/data/1543066/000116169721000045/ex_10-2.htm

And EWST signed a $150,000 debt Note with Hometown International Inc (HWIN)

https://www.sec.gov/Archives/edgar/data/1543066/000116169721000045/ex_4-1.htm

EWST just finished another offering selling units (a share and a warrant) at $4.50/unit, raising $2,500,000.

https://www.sec.gov/Archives/edgar/data/0001543066/000116169721000218/form_8-k.htm

EWST uses an address in North Carolina at 610 Jones Ferry Road, Suite 207, Carrboro that is shared with other Peter Coker managed businesses.

Currently, EWST has no business operations, but says it is seeking out opportunities.

The EWST chart, which started trading around the time of the Coker group takeover, has a similar pattern of manipulation as the HWIN chart.

--------------

Med Spa Vacations Inc (MDVP)

MDVP I did a research report on a couple of years ago because of who was involved in setting up the shell when it went public. It was part of a pretty massive shell factory. The shell has switched hands since then briefly being controlled by some group out of Hong Kong.

Then in February 2021, the shell was sold again to a group linked to Coker.

https://www.otcmarkets.com/filing/html?id=14691880&guid=RTppUp5FeA_sQth

The control stock was split up between 11 purchasers (whose identities were not revealed in the 8K) with the 4 biggest shareholders becoming:

Global Equity Limited (Michael R. Tyldesley and Ibrahima Thiam) - 5,000,000 shares

Hometown Global Services LLC (Peter L Coker Jr) - 1,664,226 shares

Diana Harris Coker - 980,000 shares

David J. Chapman - 950,000 shares

Like with HWIN and EWST, MDVP signed consulting agreement with Peter L Coker Sr (Tryon Capital LLC)

https://www.sec.gov/Archives/edgar/data/0001671077/000164033421000319/medspa_ex101.htm

Like with EWST, MDVP signed a consulting agreement with Elliot Mermel (Benzions LLC)

https://www.sec.gov/Archives/edgar/data/1671077/000164033421000404/mdvp_ex101.htm

Like EWST, the Coker group installed John Rollo as the new puppet CEO.

And like EWST, MDVP signed a $150,000 debt Note with Hometown International, Inc (HWIN)

https://www.sec.gov/Archives/edgar/data/0001671077/000164033421000404/mdvp_ex41.htm

Currently, MDVP has no business operations, but says it is seeking out opportunities.

So far, MDVP hasn't started trading yet, but I suspect when it does, if the SEC doesn't step in before that, it will be manipulated similarly to HWIN and EWST.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.