| Followers | 679 |

| Posts | 140644 |

| Boards Moderated | 37 |

| Alias Born | 03/10/2004 |

Monday, April 12, 2021 2:07:39 PM

By: Schaeffer's Investment Research | April 12, 2021

• Square stock could score its fifth-consecutive win

• Premiums are reasonably priced at the moment, too

The shares of business support concern Square Inc (NYSE:SQ) were last seen up 1.3% to trade at $265.10. The equity is on track for a fifth-straight win -- rising on the charts after dropping to $191.36 on March 5 -- its lowest level since mid-November. With long-term support from its 150-day moving average, SQ sports a healthy 342.1% year-over-year lead, and a 20.3% rise in 2021 to boot.

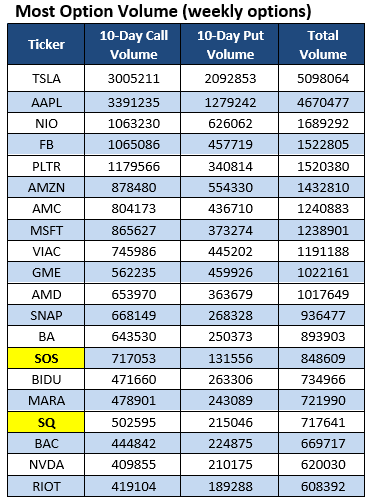

Options traders are paying close attention to Square stock. In fact, SQ has found itself on Schaeffer's Senior Quantitative Analyst Rocky White's list of stocks that have attracted the highest weekly options volume within the past two weeks, with new names to the list highlighted in yellow. According to this data, 502,595 calls and 215,046 puts were exchanged over this two-week period. The most popular contract during this time was the weekly 4/9 255-strike call, followed closely by the 250-strike call from the same series.

Today, SQ is seeing plenty of action from both sides of the tape. So far, 75,000 calls and 39,000 puts have exchanged hands. The April 270 call is the most popular, where new positions are being opened, followed by the 240 put from the same series. This shows plenty of speculation on the direction Square stock will take by the time these options expire at the end of the week.

Now could be a good time to weigh in on the stock's next move with options, too. SQ is seeing attractively priced premiums at the moment, per the security's Schaeffer's Volatility Index (SVI) of 53%, which sits in the relatively low 19th percentile of its annual range. What's more, the security's Schaeffer's Volatility Scorecard (SVS) sits at a high 94 out of 100. This means Square stock has exceeded volatility expectations during the past 12 months -- a boon for options buyers.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

Recent SQ News

- Apple Terminates 614 Employees, Disney Unveils June Crackdown on Password Sharing, and More Updates • IH Market News • 04/05/2024 11:38:57 AM

- Block to Announce First Quarter 2024 Results • Business Wire • 04/04/2024 09:23:00 PM

- Exxon Mobil Forecasts Earnings Decline, Twilio Seeks Board Tenure Changes, and More News • IH Market News • 04/04/2024 11:30:20 AM

- Bitkey commence à expédier les premières unités de son dispositif matériel et ajoute des fonctions de sécurité et de récupération • Business Wire • 03/13/2024 10:10:00 PM

- Afterpay Expands to More In-Demand Categories with New Spring Merchants • Business Wire • 03/13/2024 01:00:00 PM

- Bitkey Starts Shipping First Units of Its Hardware Device, Adds Security and Recovery Features • Business Wire • 03/13/2024 12:27:00 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 03/06/2024 11:04:30 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 03/04/2024 10:31:45 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/23/2024 10:11:42 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/23/2024 10:08:05 PM

- Uniswap Skyrockets 55% with Incentive Proposal, Avalanche Confronts 4-Hour Shutdown, and More • IH Market News • 02/23/2024 06:26:18 PM

- Goldman Sachs Reconsiders Fed Cuts, LUNR Surges Over 40% in Pre-Market, and More • IH Market News • 02/23/2024 01:03:59 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 02/23/2024 12:06:53 AM

- Form S-8 - Securities to be offered to employees in employee benefit plans • Edgar (US Regulatory) • 02/22/2024 09:51:43 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 02/22/2024 09:42:06 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/22/2024 09:11:06 PM

- Block Announces Fourth Quarter and Full Year 2023 Results • Business Wire • 02/22/2024 09:05:00 PM

- U.S. Futures Surge on Nvidia’s Stellar Performance, Global Markets Respond Positively • IH Market News • 02/22/2024 11:05:39 AM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 02/21/2024 10:40:10 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 02/21/2024 10:39:40 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 02/21/2024 10:39:04 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 02/21/2024 10:38:14 PM

- Form 144 - Report of proposed sale of securities • Edgar (US Regulatory) • 02/20/2024 10:29:28 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 02/09/2024 09:05:56 PM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 02/08/2024 09:10:56 PM

FEATURED Cannabix Technologies Begins Certification of Contactless Alcohol Breathalyzer, Re-Brands product series to Breath Logix • Apr 16, 2024 8:52 AM

Maybacks Global Entertainment To Fire Up 24 New Stations in Louisiana • AHRO • Apr 16, 2024 1:30 PM

Kona Gold Beverages, Inc. Acquires Surge Distribution LLC from Loud Beverage Group, Inc. (LBEV) • KGKG • Apr 16, 2024 8:30 AM

Branded Legacy, Inc. Reports Significant Net Income of Over $3.8 Million • BLEG • Apr 16, 2024 8:30 AM

Avant Technologies Begins Development on Next-Generation AI-Driven Resource Allocation Solution • AVAI • Apr 16, 2024 8:00 AM

UC Asset Expected to Report $0.03/share Net Profit for 2023 • UCASU • Apr 11, 2024 10:00 AM