| Followers | 363 |

| Posts | 10551 |

| Boards Moderated | 1 |

| Alias Born | 08/14/2014 |

Saturday, February 27, 2021 10:02:57 PM

SING DD

SING NEWS OTCMARKETS

https://www.otcmarkets.com/stock/sing/news

SING INVESTOR PAGE

https://www.singlepoint.com/investing/

SING INVESTOR YOUTUBE PAGE - 869 SUBSCRIBERS

https://m.youtube.com/channel/UCe5rHo1dGXOZVn1oaTBBR5Q

SING SEC FILINGS

https://sec.report/CIK/0001443611

..........................................................................

**SING IS A SHORT TERM PLAY WITH LONG TERM INTENTIONS**

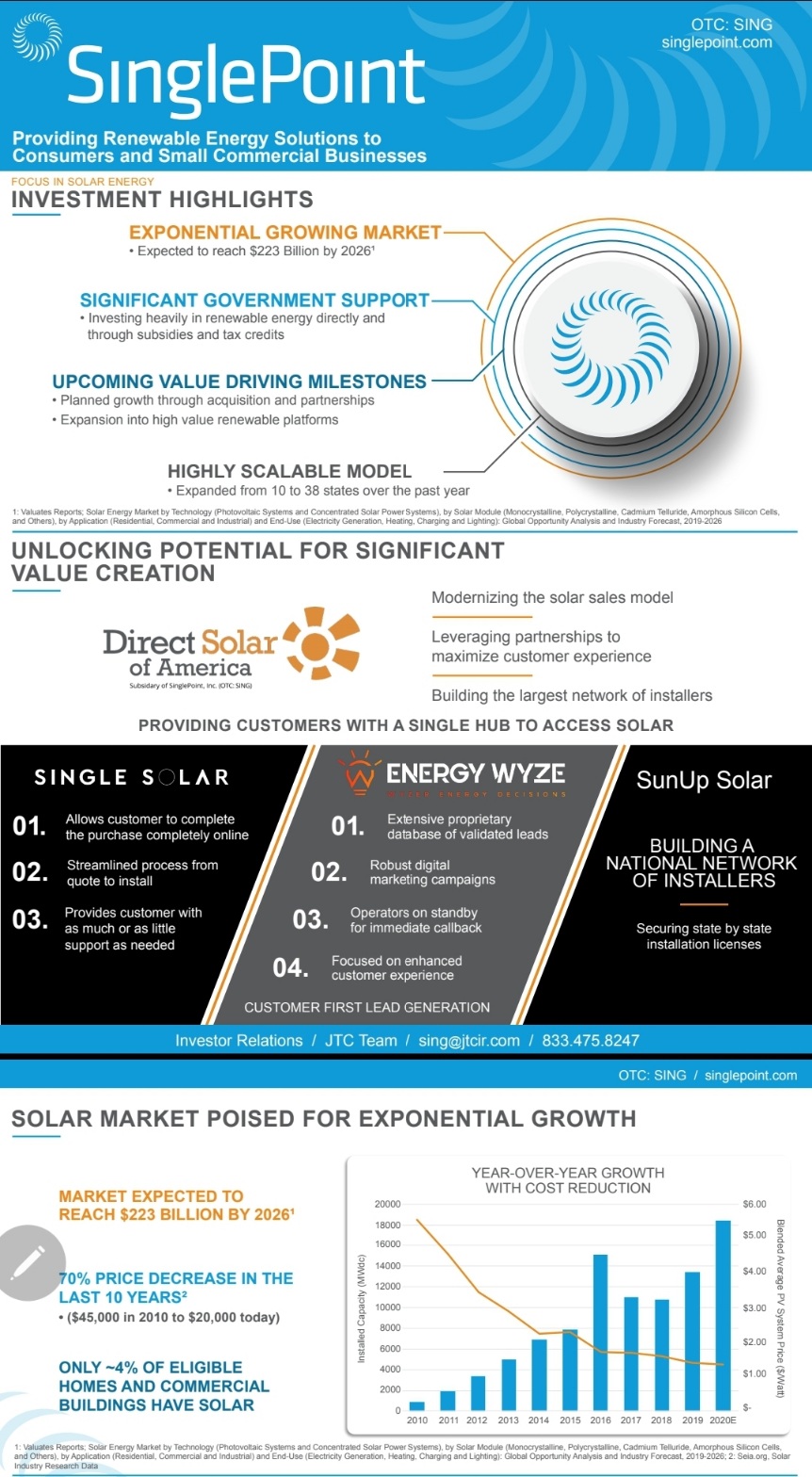

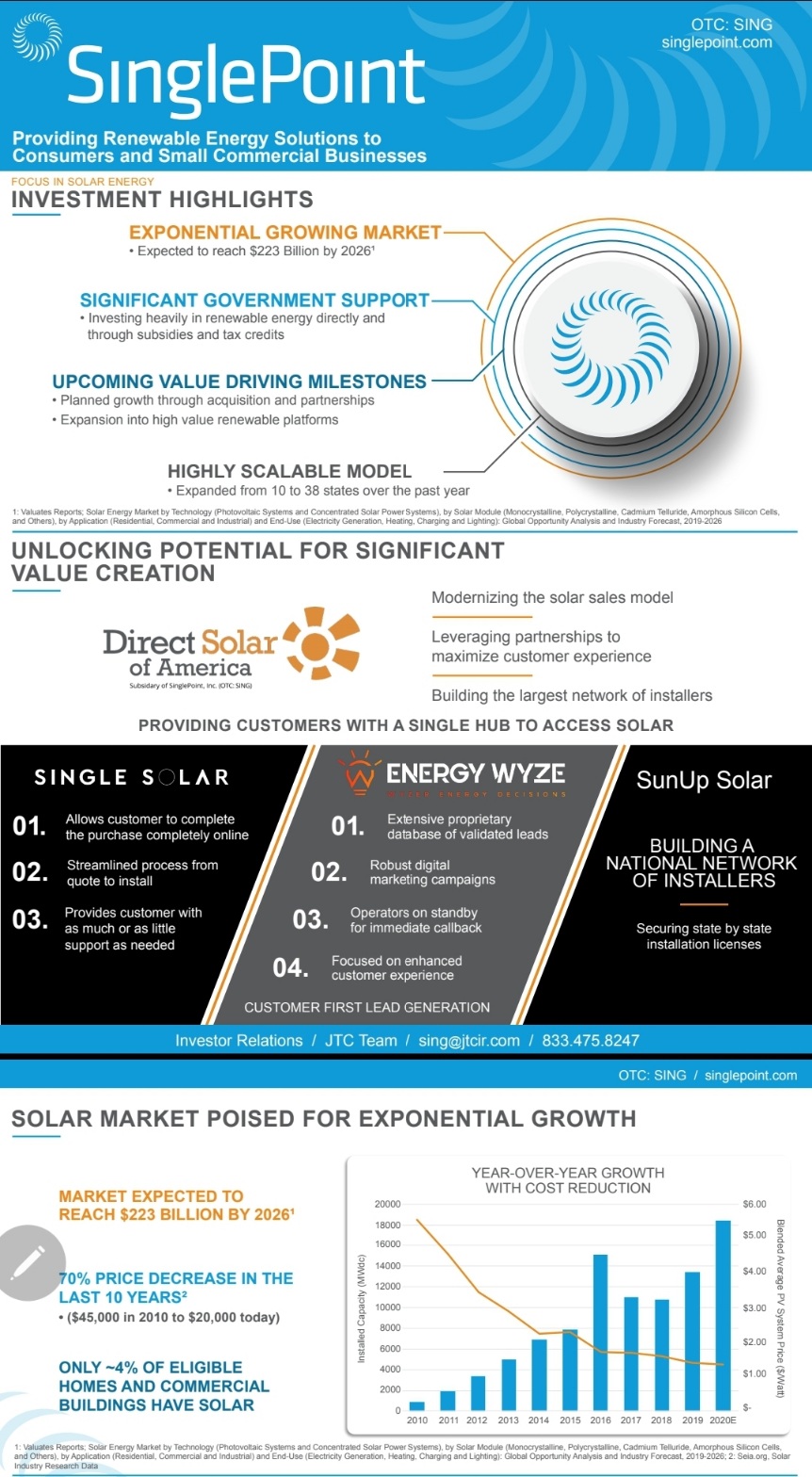

SING is a - SEC REPORTING - SOLAR FOCUSED - HOLDING COMPANY

SING Got into SOLAR with the acquisition of DIRECT SOLAR MAY 2019

https://www.otcmarkets.com/stock/SING/news/SinglePoint-Completes-Asset-Purchase-Acquisition-with-Direct-Solar-in-SinglePoints-Largest-Deal-to-Date?id=228211

What I like about DIRECT SOLAR is its ability to handle the ENTIRE PROCESS - soup to nuts

• Offers installs to clients as low as NO $ DOWN

• No UPFRONT COSTS

• location review - design - permitting - install - inspection

• grid connection - WHOLE PROCESS

• All a client needs to do is WANT SOLAR to HAVE SOLAR

I also like how SING handles much of this for the CONTRACTORS - MAKING THEIR JOBS MUCH EASIER and by extension will get more business from THEM

SING completes aquisition of ENERGY WYZE LLC - A SOLAR LEAD GENERATION COMPANY FOCUSED SOLELY ON SOLAR INDUSTRY

DIRECT LEADS

https://www.singlepoint.com/news-events/press-release/singlepoint-completes-acquisition-of-premier-solar-lead-generation-engine-energywyze-llc/

This deal will create an extensive database of VALIDATED SOLAR LEADS - WHICH WHEN CONSIDERING THE NEXT POINT BELOW WILL BE LIKE SELLING ICE WATER IN THE DESERT THIS YEAR:

|

V

INSIDE BIDENS MULTI TRILLION STIMULUS PLAN is $ BILLIONS going to companies just like THIS to turn AMERICA into a RENEWABLES HAVEN.

THIS IS HOW THESE SERVICES ARE BEING OFFERED WITH NO UPFRONT COSTS TO CLIENTS - SIMILAR TO TESLA AS FAR AS GOVT PARTICIPATION ON DISCOUNTS ETC

SING IS SPINNING OFF ITS NON - RENEWABLE ASSET 1606 Corp to shareholders 1:1. Meaning they will list those shares separately and we will receive those shares as a separate investment. IMO like getting free riding shares cuz the real prize is SING shares till we know more on 1606 status post spin off

https://www.otcmarkets.com/stock/sing/news/SinglePoint-Announces-Capital-Re-Structuring-and-Spin-Off-of-Non-Core-Asset-1606-Corp-to-All-Shareholders?id=285524

...........................................................................

SING has had solid consistant volume from its lows to today

SING has tried to run a company like RJDG in the past - (a holding company in several different industries) and the growing pains led them to RENEWABLES

SING now runs a holding company more like RXMD - (a holding company in one general industry) RXMD had different kinds of growing pains - but theirs led them to other parts of the same industry - not a completely different one

SING and RXMD couldnt be more different - from management styles to investor relations - to industry - to share structure - REVS etc. But the story of the SP has been STRANGELY riding the SAME TRAJECTORY for YEARS!

Almost as though the same WALL STREET FOLKS (investment bankers etc.) who are working behind the scenes with RXMD are strategizing with SING as well

SING is coming off HIGHS late 2017 early 2018 as RXMD had done

SING effectively nosedived immediately after and put its bottom in almost 3 years later - December 2020

RXMD bottom was also put in almost 3 years later - December 2020

BOTH are in the uplist process currently - but SING is ALREADY SEC REPORTING

BOTH HAVE JUST GONE PARABOLIC on UPLIST NEWS

https://www.otcmarkets.com/stock/SING/news/story?e&id=1790350]

BOTH HAVE FINS COMING OUT LATE NEXT MONTH THAT WILL BE USED TO PROPELL TOWARDS A NATIONAL EXCHANGE

*TO UPLIST SING WILL NEED AN RS JUST LIKE RXMD - THEY SEEM TO HAVE A BETTER HANDLE ON SP THAN RXMD SO THEY SET A FIXED 75:1 SPLIT*

AS RXMD INVESTORS WE KNOW *WHY ITS 75:1 - THATS THE # THEY BELIEVE THEY NEED TO GET TO $5/SHARE WHICH LEAVE ROOM POST SPLIT FOR VOLATILITY

THAT MEANS SING EXPECTS TO BE >.06 BY SPLIT TIME

MY EXPERIENCE IS COMPANIES WHO FULLY EXPOSE THEMSELVES TO AUDIT AND HIGHER EXCHANGE REQUIREMENTS USUALLY HAVE ALOT GOING FOR THEM AS FAR AS GROWTH AND POTENTIAL AND HAVE BEEN TOLD BY POWERS THAT BE THAT THEY WILL HAVE SUPPORT BEHIND THEM TO PULL IT OFF

.........................................................................

SING MADE A DEAL WITH ITS LENDERS LATE 2020 TO REMOVE ALL CONVERTIBLE DEBT AND RELATED DERIVATIVES FROM ITS BALANCE SHEET IN RETURN FOR 130M SHARES THAT WILL BE DILUTED (LOL) I think SELLING BEGAN 1/29/21

https://www.otcmarkets.com/stock/sing/news/SinglePoint-Inc-Strengthens-Balance-Sheet-with-Elimination-of-Convertible-Secured-Note-Agreement?id=287903

NORMALLY DILUTION IS *B A D BUT I KEEP BRINGING UP RXMD BECAUSE OF THE SIMILARITIES - WE WERE ABLE TO TRACK THE END OF 2017 RXMD DILUTION TO BEST KNOW WHEN THE SP WOULD BEGIN TO TURN AROUND. IF YOU REMEMBER WE GOT IT CLOSE ~ 1 WEEK AND MANY ENTERED IN THE .01 RANGE AS A RESULT. THAT TURNS THE DEBT REMOVAL INTO A CATALYST BECAUSE

A) IT REMOVES THE CONVERTIBLE DEBT / DERIVATIVE

B) ITS NEEDED FIRST TO CLEAN BOOKS TO UPLIST

SING LENDERS HAVE 130M SHARES TO SELL. ITS EASY TO FIND OUT AN APPROXIMATE DATE OF COMPLETION USING THE 5% FIGURE FROM THE DEAL AND THE DATE SHARES BEGAN TO SELL..

2,600,000,000 TOTAL VOLUME NEEDED TO SELL 130M SHARES (5%)

2,325,000,000 TOTAL VOLUME SINCE JANUARY 29 2021

LEAVES US ~275M IN VOLUME NEEDED TO FINISH

***NOTICE SHSREHOLDERS RAN THE STOCK ON HEAVY VOLUME FAST *AFTER THE DEBT ANNOUNCEMENT*

THOSE SAME FOLKS WILL RUN US HARD TO INTO THE RS + UPLIST***

WE HAVE HAD > 250M VOLUME/WEEK OR CLOSE TO ALL 2021- SO DILUTION ENDING BY THIS FRIDAY IS A REAL POSSIBILITY

IMO SING WILL NOT DROP BELOW .022 AGAIN, AND IT MAY POTENTIALLY FLIRT WITH .025 AGAIN THIS WEEK BUT THATS THE LAST TIME

WE SIT ~40% BELOW WHERE WE EXPECT TO BE COME RS TIME, AND IF RXMD BEHAVIOR IS ANY INDICATOR - WE WILL RISE INTO IT AS WELL

*THERE REALLY IS A TON MORE TO COVER - BUT THIS IS THE BASICS OF SING*

I BELIEVE SING WILL GIVE US 1 MORE WEEK TO LOAD UP

THEN DILUTION WILL BE OVER - AND THOSE RUNNING THIS WILL DRIVE US TO .10 GOING INTO MARCH REVS ANNOUNCEMENT AND UPLIST**

**I SAID THIS IS A SHORT TERM PLAY WITH LONG TERM INTENTIONS**

THIS MEANS LETS SEE HOW IT PLAYS OUT - ITS A PARABOLIC PLAY - SO 2.75B OS IS NOT FACTORING INTO THIS FOR ME AT ALL RIGHT NOW

REVS GROWTH YEAR TO YEAR

2017 259,000

2018 1,154,000

2019 3,343,000

2020 Q3: 2,500,000 Covid-19 effected Q2

INVEST WISELY

SING NEWS OTCMARKETS

https://www.otcmarkets.com/stock/sing/news

SING INVESTOR PAGE

https://www.singlepoint.com/investing/

SING INVESTOR YOUTUBE PAGE - 869 SUBSCRIBERS

https://m.youtube.com/channel/UCe5rHo1dGXOZVn1oaTBBR5Q

SING SEC FILINGS

https://sec.report/CIK/0001443611

..........................................................................

**SING IS A SHORT TERM PLAY WITH LONG TERM INTENTIONS**

SING is a - SEC REPORTING - SOLAR FOCUSED - HOLDING COMPANY

SING Got into SOLAR with the acquisition of DIRECT SOLAR MAY 2019

https://www.otcmarkets.com/stock/SING/news/SinglePoint-Completes-Asset-Purchase-Acquisition-with-Direct-Solar-in-SinglePoints-Largest-Deal-to-Date?id=228211

What I like about DIRECT SOLAR is its ability to handle the ENTIRE PROCESS - soup to nuts

• Offers installs to clients as low as NO $ DOWN

• No UPFRONT COSTS

• location review - design - permitting - install - inspection

• grid connection - WHOLE PROCESS

• All a client needs to do is WANT SOLAR to HAVE SOLAR

I also like how SING handles much of this for the CONTRACTORS - MAKING THEIR JOBS MUCH EASIER and by extension will get more business from THEM

SING completes aquisition of ENERGY WYZE LLC - A SOLAR LEAD GENERATION COMPANY FOCUSED SOLELY ON SOLAR INDUSTRY

DIRECT LEADS

https://www.singlepoint.com/news-events/press-release/singlepoint-completes-acquisition-of-premier-solar-lead-generation-engine-energywyze-llc/

This deal will create an extensive database of VALIDATED SOLAR LEADS - WHICH WHEN CONSIDERING THE NEXT POINT BELOW WILL BE LIKE SELLING ICE WATER IN THE DESERT THIS YEAR:

|

V

INSIDE BIDENS MULTI TRILLION STIMULUS PLAN is $ BILLIONS going to companies just like THIS to turn AMERICA into a RENEWABLES HAVEN.

THIS IS HOW THESE SERVICES ARE BEING OFFERED WITH NO UPFRONT COSTS TO CLIENTS - SIMILAR TO TESLA AS FAR AS GOVT PARTICIPATION ON DISCOUNTS ETC

SING IS SPINNING OFF ITS NON - RENEWABLE ASSET 1606 Corp to shareholders 1:1. Meaning they will list those shares separately and we will receive those shares as a separate investment. IMO like getting free riding shares cuz the real prize is SING shares till we know more on 1606 status post spin off

https://www.otcmarkets.com/stock/sing/news/SinglePoint-Announces-Capital-Re-Structuring-and-Spin-Off-of-Non-Core-Asset-1606-Corp-to-All-Shareholders?id=285524

...........................................................................

SING has had solid consistant volume from its lows to today

SING has tried to run a company like RJDG in the past - (a holding company in several different industries) and the growing pains led them to RENEWABLES

SING now runs a holding company more like RXMD - (a holding company in one general industry) RXMD had different kinds of growing pains - but theirs led them to other parts of the same industry - not a completely different one

SING and RXMD couldnt be more different - from management styles to investor relations - to industry - to share structure - REVS etc. But the story of the SP has been STRANGELY riding the SAME TRAJECTORY for YEARS!

Almost as though the same WALL STREET FOLKS (investment bankers etc.) who are working behind the scenes with RXMD are strategizing with SING as well

SING is coming off HIGHS late 2017 early 2018 as RXMD had done

SING effectively nosedived immediately after and put its bottom in almost 3 years later - December 2020

RXMD bottom was also put in almost 3 years later - December 2020

BOTH are in the uplist process currently - but SING is ALREADY SEC REPORTING

BOTH HAVE JUST GONE PARABOLIC on UPLIST NEWS

https://www.otcmarkets.com/stock/SING/news/story?e&id=1790350]

BOTH HAVE FINS COMING OUT LATE NEXT MONTH THAT WILL BE USED TO PROPELL TOWARDS A NATIONAL EXCHANGE

*TO UPLIST SING WILL NEED AN RS JUST LIKE RXMD - THEY SEEM TO HAVE A BETTER HANDLE ON SP THAN RXMD SO THEY SET A FIXED 75:1 SPLIT*

AS RXMD INVESTORS WE KNOW *WHY ITS 75:1 - THATS THE # THEY BELIEVE THEY NEED TO GET TO $5/SHARE WHICH LEAVE ROOM POST SPLIT FOR VOLATILITY

THAT MEANS SING EXPECTS TO BE >.06 BY SPLIT TIME

MY EXPERIENCE IS COMPANIES WHO FULLY EXPOSE THEMSELVES TO AUDIT AND HIGHER EXCHANGE REQUIREMENTS USUALLY HAVE ALOT GOING FOR THEM AS FAR AS GROWTH AND POTENTIAL AND HAVE BEEN TOLD BY POWERS THAT BE THAT THEY WILL HAVE SUPPORT BEHIND THEM TO PULL IT OFF

.........................................................................

SING MADE A DEAL WITH ITS LENDERS LATE 2020 TO REMOVE ALL CONVERTIBLE DEBT AND RELATED DERIVATIVES FROM ITS BALANCE SHEET IN RETURN FOR 130M SHARES THAT WILL BE DILUTED (LOL) I think SELLING BEGAN 1/29/21

https://www.otcmarkets.com/stock/sing/news/SinglePoint-Inc-Strengthens-Balance-Sheet-with-Elimination-of-Convertible-Secured-Note-Agreement?id=287903

NORMALLY DILUTION IS *B A D BUT I KEEP BRINGING UP RXMD BECAUSE OF THE SIMILARITIES - WE WERE ABLE TO TRACK THE END OF 2017 RXMD DILUTION TO BEST KNOW WHEN THE SP WOULD BEGIN TO TURN AROUND. IF YOU REMEMBER WE GOT IT CLOSE ~ 1 WEEK AND MANY ENTERED IN THE .01 RANGE AS A RESULT. THAT TURNS THE DEBT REMOVAL INTO A CATALYST BECAUSE

A) IT REMOVES THE CONVERTIBLE DEBT / DERIVATIVE

B) ITS NEEDED FIRST TO CLEAN BOOKS TO UPLIST

SING LENDERS HAVE 130M SHARES TO SELL. ITS EASY TO FIND OUT AN APPROXIMATE DATE OF COMPLETION USING THE 5% FIGURE FROM THE DEAL AND THE DATE SHARES BEGAN TO SELL..

2,600,000,000 TOTAL VOLUME NEEDED TO SELL 130M SHARES (5%)

2,325,000,000 TOTAL VOLUME SINCE JANUARY 29 2021

LEAVES US ~275M IN VOLUME NEEDED TO FINISH

***NOTICE SHSREHOLDERS RAN THE STOCK ON HEAVY VOLUME FAST *AFTER THE DEBT ANNOUNCEMENT*

THOSE SAME FOLKS WILL RUN US HARD TO INTO THE RS + UPLIST***

WE HAVE HAD > 250M VOLUME/WEEK OR CLOSE TO ALL 2021- SO DILUTION ENDING BY THIS FRIDAY IS A REAL POSSIBILITY

IMO SING WILL NOT DROP BELOW .022 AGAIN, AND IT MAY POTENTIALLY FLIRT WITH .025 AGAIN THIS WEEK BUT THATS THE LAST TIME

WE SIT ~40% BELOW WHERE WE EXPECT TO BE COME RS TIME, AND IF RXMD BEHAVIOR IS ANY INDICATOR - WE WILL RISE INTO IT AS WELL

*THERE REALLY IS A TON MORE TO COVER - BUT THIS IS THE BASICS OF SING*

I BELIEVE SING WILL GIVE US 1 MORE WEEK TO LOAD UP

THEN DILUTION WILL BE OVER - AND THOSE RUNNING THIS WILL DRIVE US TO .10 GOING INTO MARCH REVS ANNOUNCEMENT AND UPLIST**

**I SAID THIS IS A SHORT TERM PLAY WITH LONG TERM INTENTIONS**

THIS MEANS LETS SEE HOW IT PLAYS OUT - ITS A PARABOLIC PLAY - SO 2.75B OS IS NOT FACTORING INTO THIS FOR ME AT ALL RIGHT NOW

REVS GROWTH YEAR TO YEAR

2017 259,000

2018 1,154,000

2019 3,343,000

2020 Q3: 2,500,000 Covid-19 effected Q2

INVEST WISELY

INSTATRADERS LONG TERM WINNERS

https://investorshub.advfn.com/INSTATRADERS-LONG-TERM-OTC-WINNERS!!!!-32023/

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.