Wednesday, February 24, 2021 3:16:31 AM

Targets 0.0020 / 0.0023 / 0.0050 / 0.0080 / $0.010

http://www.allotcbb.com/quote.php?symbol=ICBT

I'll Alert you of stocks to Buy,

before the Run happens !

________________________________________________________________

ICBT Security Details

Share Structure

Market Value1..........$1,699,034 a/o Feb 23, 2021

Authorized Shares..2,200,000,000 a/o Feb 23, 2021

Outstanding Shares.2,123,792,434 a/o Feb 23, 2021

-Restricted................25,261,733 a/o Feb 23, 2021

-Unrestricted...........2,098,530,701 a/o Feb 23, 2021

Held at DTC.............1,106,324,366 a/o Feb 23, 2021

Float..............Not Available

Par Value

https://www.otcmarkets.com/stock/ICBT/security

https://www.otcmarkets.com/stock/ICBT/news

https://www.otcmarkets.com/stock/ICBT/disclosure

________________________________________________________________

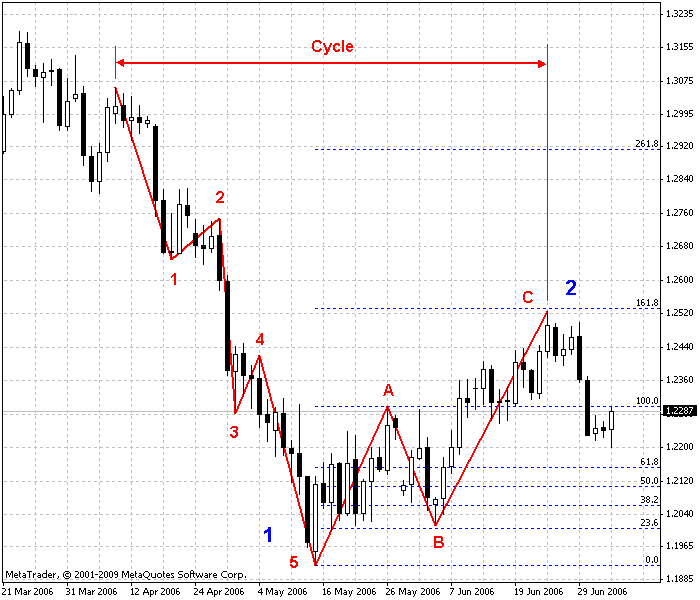

How Targets are Calculated

Fibonacci Numbers and Retrace Targets: Explained

________________________________________________________________

Fibonacci Numbers

http://www.stockta.com/cgi-bin/school.pl?page=fib

Fibonacci Retracements

* Golden 61.8% Retracements

* Moderate 38.2% Retracements

* Common 38.2% Retracements

Fibonacci Retracements

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:fibonacci_retracemen

________________________________________________________________

Fibonacci Numbers

are commonly used in Technical Analysis

with or without a knowledge of Elliot Wave Analysis

to determine potential support, resistance,

and price objectives.

The most popular Fibonacci Retracements are

61.8% and 38.2%

61.8% retracements

imply a new trend is establishing itself.

38.2% retracements

usually imply that the prior trend will continue

38.2% retracements

are considered natural retracements in a healthy trend.

Fibonacci Retracements

can be applied after a decline

to forecast the length of a counter-trend bounce.

________________________________________________________________

The 50% retracement is not based on a Fibonacci number.

Instead, this number stems from Dow Theory's assertion

that the Averages often retrace half their prior move.

50% retracement

implies indecision.

________________________________________________________________

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

_________________________________________________________________

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Chart

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

Live! Charts

________________________________________________________________

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM