and cash equivalents amount to $63 million,

including full receipt of the remaining $26.25 million

from the sale of Murchison plus Approx 2 million ounces of gold Dores,

net of eliminating the gold payback liability.

If anyone can find me another gold producer with no debt and

trading nearly $20 million below cash and cash equivalents ,

inbox me.

by nozzpack @ sth

Just look at our press releases and presentations compared to

Kentor or others .

https://investorshub.advfn.com/Monument-Mining-Ltd-MMTMF-20464/

Monument to Implement Value Creation Strategy

February 16, 2021

View PDF

Vancouver, B.C., February 16, 2021,

https://www.monumentmining.com/news-media/news/2021/monument-to-implement-value-creation-strategy/

$Monument Mining Limited (TSX-V: MMY and FSE: D7Q1) (“Monument” or the

“Company”) is pleased to announce its corporate strategy following

consultation with the Company’s board, management and advisors.

Newly appointed chairman of the Company, Graham Dickson, stated:

“I am honored to be the successor to Robert Baldock as chairman of the

board.

Mr. Baldock has created a strong legacy for Monument and its

shareholders and the board has always been aligned with his philosophy

that shareholders’ value be realized through growth in the Company’s

asset value.

I will diligently progress this culture, stand by our stakeholders, and

continue to strengthen the Company’s gold resource base, which is the

best way to increase shareholders’ return.”

Strategy Highlights

$To establish the Murchison Gold Project as a cornerstone gold

development project;

To place the Selinsing Sulphide Project into production by implementing

a two stage approach;

To build the production profile of the Company through additional

targeted acquisitions in the gold sector.

The board has reviewed and accepted the corporate development

strategies proposed by management.

In the past two years, the Company has increased its resources and

reserves, updated the economic valuation of each of it’s wholly- owned

projects, and streamlined the gold portfolio by spinning out the

Mengapur base metal project.

Given the current market appetite for gold and gold assets, especially

in stable jurisdictions, upon closing the Mengapur transaction,

proceeds will be used to advance our gold portfolio in Western

Australia and Malaysia, and to support further corporate development.

CEO and President Cathy Zhai commented:

“Our overall strategy is to build incremental gold resources and

reserves through exploration, expansion and disciplined acquisitions,

and to locate resources as well as build up market awareness in order

for the market to reflect the Company’s value thus transforming the

Company’s upside potential to benefit our shareholders.”

With cash and cash equivalents on hand and additional upon closing of

the Mengapur transaction, the Company is ready to implement and fund

its preferred development strategy.

Alternative sources of capital remain an option and are progressing,

especially for the development of the Selinsing sulphide project.

DISCUSSION OF STRATEGIES

$Murchison Gold Project

$The Company will seek to develop the Murchison gold project into a

cornerstone asset through an aggressive two-year exploration program to

delineate additional ounces, alongside concluding a preliminary

economic assessment of the restart of the existing plant to build out

an early-stage production story.

The Murchison project represents a significant opportunity for the

Company to generate near term cash flows from the restart of gold

production using the existing well maintained 260k tpa mill.

Further extension drilling and step out exploration programs have the

potential to delineate additional resources, which could justify

expanding the current mill capacity up to 750k tpa for production of

25,000oz to 50,000oz per annum depending on exploration success in

areas which have historically been underexplored.

The Company’s strategy is to focus on an aggressive exploration plan to

increase the existing 380koz NI 43-101 compliant Measured, Indicated

and Inferred Resources over the next two years on a combined quality,

and quantity basis as feed to the already permitted plant and

infrastructure at Burnakura. The potential for treating third party ore

is also being considered.

$Selinsing Gold Mine

The Company plans to develop the Selinsing Sulphide Project into

production through a two stage de-risking process, in order to reduce

the initial upfront investment required.

Step 1 proposes the construction of a flotation plant producing gold

concentrates for sale to a third party, with cash generated from these

sales to be used as construction funding for the planned stage 2 BIOX

plant.

Selinsing has been the flagship project for Monument over the last

decade, with low operating costs, a dedicated operations team and

resources to underpin an additional six-year life of mine.

The completion of the plant upgrade and startup of production for the

new life of mine will provide significant future cash flows which can

be used to fund the second stage of development as well as further

exploration to increase the current resource base and support growth

in other areas of the business.

Selinsing is invaluable to de-risked cash resources to support

Monument’s corporate development and operations.

Cash would be generated at Selinsing from

(1) Gold production cash flow

from Selinsing Gold Mine,

(2) Development of a niche market through bio-leaching process with

third party sulphide concentrates, and

(3) Potential underground mining.

The Company will examine the justification of the above stated

opportunity to open a niche market to procure third parties’ sulphide

gold concentrates as a rationale for financing the Biox® plant that

will provide sustainable cash resources to the Company.

Further Acquisitions

The Company will seek to augment current and future production via a

suitable acquisition strategy that can either supplement future

production from the Murchison project and its possible expansion, or

enhance overall gold production via a large-scale standalone project.

Our mission statement from the very beginning has been to become a mid-

tier gold producer.

By achieving better quality and larger reserves and resources, a

potential acquisition would fundamentally change the Company’s

production profile and its position in the mining industry.

Any acquisition would need to show significant potential to add value

to the current resource base and future cash flows.

IMPLEMENTATION AND MILESTONES

Management will devote its best effort to upgrade and establish a first

class asset base to increase the Company’s value.

Further the Company will allocate resources to build up market

awareness and transparency so that the Company’s long term share value

fully reflects the underlying real value of the portfolio and improve

overall shareholders’ long-term interests, through sustainable long-

term production.

Milestones and Timelines

Selinsing Flotation Production:

two stage construction with flotation

completed within 15 months for an estimated $20M, utilizing debt

financing and/or funding partners where appropriate to preserve cash

position for second stage Biox® plant.

This includes completion of flotation plant optimization and

engineering, procurement, construction and securing off-take

agreements.

Murchison Exploration:

Murchison two-year exploration program estimated to cost A$10M to

delineate new resources to increase the current ounces, increase the

mine life and improve the cash flows of the project.

The program is expected to start subject to closing the Mengapur

Transaction in April 2021.

Murchison Production:

Usage of the current plant to generate cash flow through processing

existing gold mineralized materials or third party ores subject to

(1) completion of SRK review and their recommended follow up works,

and

(2) obtaining road access licenses.

Acquisition target generation:

Continuing internal and external appraisal of potential acquisitions

already underway.

Monument will regularly keep the market updated on its progress.

$About Monument

$Monument Mining Limited (TSX-V: MMY, FSE:D7Q1) is an established

Canadian gold producer that owns and operates;

$The Selinsing Gold Mine in Malaysia.

Its experienced management team is committed to growth and is advancing

several exploration and development projects including

$The Mengapur Copper and Iron Project, in Pahang State of Malaysia,

and

$The Murchison Gold Mines Projects comprising;

$Burnakura Gold Mine project,

$Gabanintha Gold Mine project and

$Tuckanarra Gold Mine project in the Murchison area of Western

Australia.

The Company employs approximately 205 people in both regions and is

committed to the highest standards of environmental management, social

responsibility, and health and safety for its employees and neighboring

communities.

Cathy Zhai, President and CEO

Monument Mining Limited

Suite 1580 -1100 Melville Street

Vancouver, BC V6E 4A6

FOR FURTHER INFORMATION visit the company web site at

http://www.monumentmining.com

or contact:

Richard Cushing, MMY Vancouver T: +1-604-638-1661 x102 rcushing@monumentmining.com

“Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.”

Forward-Looking Statement

https://www.monumentmining.com/news-media/news/2021/monument-to-implement-value-creation-strategy/

$MMY Heap Leach Production Potential of Murchison;

$Kentor has done a decent analysis of the heap leaching potential

of the lower grade ores at Murchison.

As far as I know, we have the necessary heap leach equipment on hand

at $Burnakura for 2 million tons per year.

I used to own GGD which heap leaches very low grade tailings .....less

than 1 gm per ton

Agglomeration was necessary, as recoveries were greater once the head

grade ore was agglomerated with concrete.

However, agglomeration seems to be not needed very much for Burnakura

ore.

The other parameter is leach cycle time......the time required for the

gold to be leached out of the ore once placed on the heap pad.

I used 2 cycles per year.....ie about 150 days to maximize recovery

of gold.

However, Kentor shows about 24 days which I think must mean something

else , as that cycle is quite rapid.

So I use 2 cycles per year Of 500,000 tons of auriferous ore which means

1 million tons per year.

I will use an average of 0.9 gms per ton as head grade of the ore

placed on the heap leach pads.

So, that means 900,000 grams of contained gold on the heap leach pads

per year.

Recovery rates is about 90% for this grade of ore, so we end up

recovering about 800,000 grams of gold per year, which divided

by 31 gms per ounce means an annual production of about

25,000 ounces per year .

This is quite close to the 30,000 ounces recovered/ year by

Indee gold which used this same leach equipment which was

acquired by Kentor.

So, combining 40,000 ounces of high grade production from underground

ore through the Burnakura mill @ 300,000 tons per year.....see my

previous post..and 25,000 ounces of the lower grades from heap leach,

we have about 65,000 ounces of production per year .

Heap leach is cheaper than milling for obvious reasons .

So an AISC of $1000 per ounce for the two combined production methods

seems quite reasonable .

@$1800 POG, we are excess cash flowing about $50 million per year .

Our neighbour KRR ( which I own ) free cash flows $80 million per year

on 95,000 ounces .

This is good agreement .

KRR trades at 5.5 times its free cash flow.

This would imply..but degraded 4,5 times , for lower production ..a

fair value of about $225 million for our Murchison production,

employing fully our current milling and heap leach facilities .

But, we have in addition , that rich gold copper resource at the

Yagahong deposit of Gabathinia along with its other 6 pits none of

which have been fully explored or the possibility of

finding supergene ore.

So, our Murchison assets have superb value at current POG.

It's my analytical opinion, that the Greatest value of our Murchison

assets would accrue to us shareholders by spinning it out to us as

a new public listing, including the Tuckanara seed capital and JV ,

allocated perhaps 80% to shareholders and 20 % to our parent company.

Its a win win situation

By nozzpack

$MMY- $70 mil in assets and only a $42 mil market cap? NO DEBT!

Way undervalued and oversold -

5 bagger + + + + ? or more -

https://www.monumentmining.com/

https://www.monumentmining.com/news-media/photo-gallery/

Imo! TIA

https://investorshub.advfn.com/Monument-Mining-TSXV-MMY-13403/

$Monument Mining (TSXV:MMY) Photo Gallery - well they growing with new

great discovery of plenty more gold ore to increase

the ore reserve with good drilling results to be mined many future

years the weather is good no curtain needed -

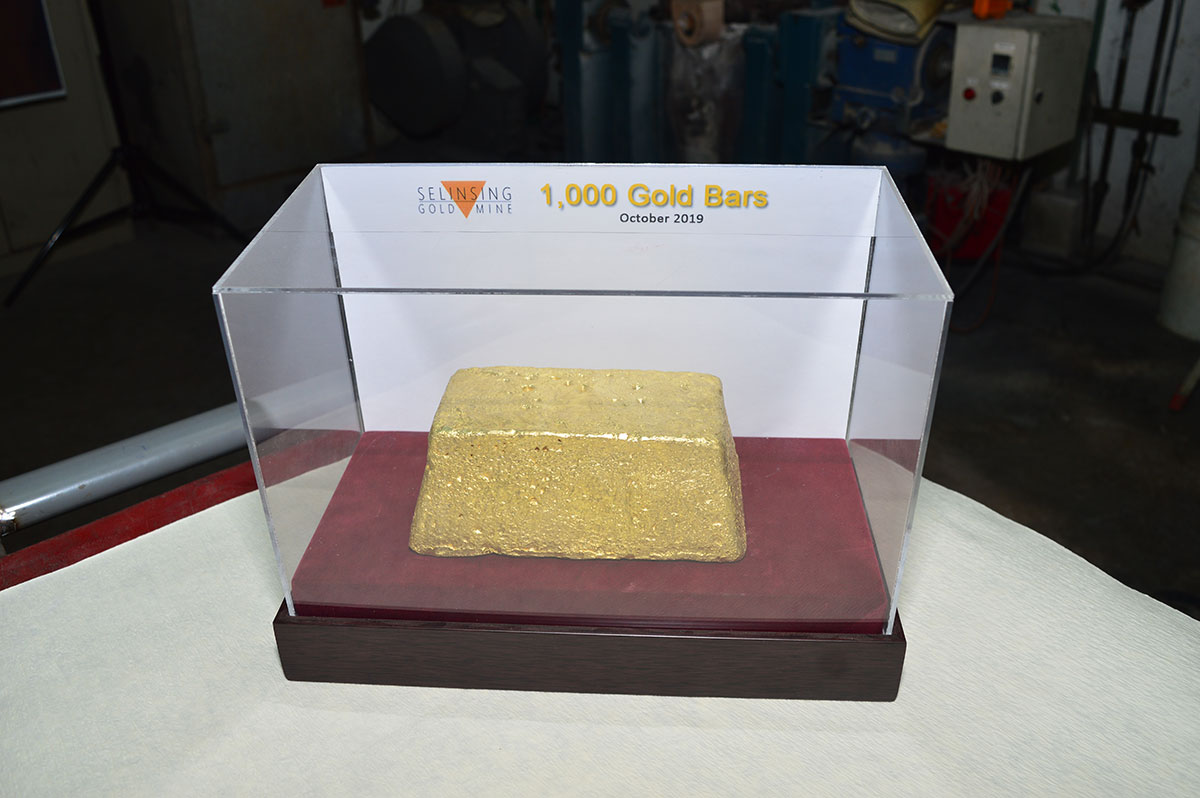

$1,000th Gold Bar Pour Produced by MMY; Photo Gallery

https://www.monumentmining.com/news-media/photo-gallery/

$Market Cap $46 mil. - No Debt - someone has to be kidding

is it the fact ???

What a Great Gold Mines bargain

MMY It's very undervalued, oversold like > hidden giant Au gold mines

soon to be discovered

Imo!

$Selinsing Gold Mine

The Selinsing gold mine is an operating high-grade gold mine at Bukit

Selinsing in Pahang State, Malaysia.

https://www.mining-technology.com/projects/selinsing-gold-mine/

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

VIEW PDF

https://www.monumentmining.com/news-media/news/

https://www.monumentmining.com

News Releases

Monument Reports First Quarter Fiscal 2021 (“Q1 2021”) Results

November 16, 2020

View PDF

Gross Revenue of $5.92 Million and Cash Cost of US$923/Oz

Vancouver, B.C., November 16, 2020,

Monument Mining Limited (TSX-V: MMY and FSE: D7Q1)

“Monument” or the “Company” today announced its first quarter

production and financial results for the three months ended

September 30, 2020.

All amounts are expressed in United States dollars (“US$”) unless

otherwise indicated (refer to www.sedar.com for full financial

results).

President and CEO Cathy Zhai commented:

“Fiscal 2021 started with new challenging as a global COVID-19

pandemic carried forward from fiscal 2020.

The Company has fully resumed its production in the first quarter

from eight-week’s mining ban at Selinsing in the first quarter,

the Selinsing Sulphide gold plant upgrade

is however still pending for financing.

“On the other hand, gold price surged to record high and

the gold mining sector was very active in Western Australia,

gold mining producers enjoyed high production margins, and

investment is flowing into that region for gold explorations.

The Company continues try hard to access to financing, and

it is very closely monitoring the market and looking for

divesting of base metal portfolio to

focus on primary gold assets, as well as

new corporate development opportunities

to lift up market value for the best

interest of its shareholders.”

First Quarter Highlights:

3,504 ounces (“oz”) of gold produced (Q1 2020:

4,852oz) with 3,100oz of gold sold for gross revenue of

$5.92 million (Q1 2020: 4,323oz of gold sold for

revenue of $6.34 million);

Gross margin of $3.06 million (Q1 2020: $2.65 million);

Average realized price per ounce, excluding prepaid gold sales, of

$1,909/oz (Q1 2020: $1,475/oz);

Cash cost per ounce of $923/oz (Q1 2020: $855/oz);

All-in sustaining costs per ounce (“AISC”) of $1,055/oz (Q1 2020:

$1,158/oz);

Peranggih grade control drilling after positive trial mining results

identified 58,662 tonnes at 0.93g/t Au materials;

Production resumed at Selinsing after lifting eight weeks mining ban in

last quarter during COVID-19 pandemic

Entering into a Tuckanarra JV arrangement with Odyssey subsequent to

the quarter opens corporate development opportunities in WA region.

First Quarter Production and Financial Highlights

https://www.monumentmining.com/news-media/news/2020/monument-reports-first-quarter-fiscal-2021-q1-2021-results/

Monument Mining (TSXV:MMY) Note...

RE:Substantial Increase in Gold ...Stage 1 open pit Peranghi

nozzpack @ sth. wrote:

Based on the 2017 GC drilling program which identified a high grade zone

measuring 150 m by 80 m in P North ( see Fig 1 in link below )

management estimated this this GC zone contained 20,000 to 30,000

ounces....see link to 2017 NR below.

The recently completed 5002 m GC drilling of this Zone elicited this

statement from management..

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted than

the initial assay results from 2017 GC drilling program

at the same area.

So in just this small zone, we now have

at least 31,000 to 47,000 ounces of

even higher grade gold within a lesser volume of ore.

I had earlier missed this implication .

They are now telling us that we have a significant new gold deposit

at Peranghi whose size will eventually describe

a substantially new oxide resource once P North and

the other 3 high grade zones are fully explored.

My earlier analyses of these 4 zones showed in

excess of 120,000 ounces.

This discovery completely alters the future perspective

for mining at Selinsing.....no rush

to fund Biox as we have new and

substantial sources of high grade oxides

for years to come

xxxxxxxxxxxxxxx

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be

extracted than the initial assay results

from 2017 GC drilling program at the same area.

A further GC drill program was planned;

The Peranggih phase 1 GC drill program was completed

during Q1 2021 with additional 1,466 meters drilled

bringing total drilling to 5,002 meters.

The drill program identified a;

total of 58,662 tonnes at 0.93g/t Au,

which increased the mining inventory.

The GC delineated indicates;

54.2% higher contained ounces,

63% higher gold grade, and

5.2% less tonnage gold materials to be extracted

than the initial assay results from

2017 GC drilling program at the same area.

A further GC drill program was planned,

see fig 1 at this link

https://www.monumentmining.com/news-media/news/2020/monument-announces-trial-mining-results-at-peranggih-gold-prospect-in-malaysia/

https://www.monumentmining.com/news-media/news/2017/monument-announces-encouraging-results-from-recent-drilling-at-new-gold-field-peranggih-project/

The recent 2017 close spaced RAB drilling program

was carried out at an historic mining site to

test 150m strike length x 80m width of the mineralization.

This allowed the accurate identification of

several high grade gold (HG) zones surrounded

by a main low grade (LG) halo.

The significant drill intersections;

(Au >2.0 g/t & >5m length) within a more

consistent high grade gold area are presented in

Table 1.

The full set of drill results for the holes intercepting

this HG gold mineralization occurrence are listed in

Appendix A and Appendix B.

Previous activities plus more recent exploration works,

totaling 1,700m for 21 trenches, 2,900m of Diamond Drilling (DD) and

Reverse Circulation (RC) drilling for

35 drill holes, and 2,800m of close spaced RAB drilling

for approximately 300 drill holes (completed in 2017)

have been used to outline an exploration

target of 20,000 to 30,000 oz Au contained

within 1 to 2 Mt @ 0.3 to 2.0 g/t Au.

The potential tonnages and grades are con

Gold & Silver bulls starting to break out > ^ > ^ > ^

In GOD We Trust - Real Money -

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

FEATURED Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • Apr 25, 2024 8:52 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM