| Followers | 679 |

| Posts | 140715 |

| Boards Moderated | 37 |

| Alias Born | 03/10/2004 |

Sunday, February 07, 2021 9:55:49 AM

By: Ed Steer | February 7, 2021

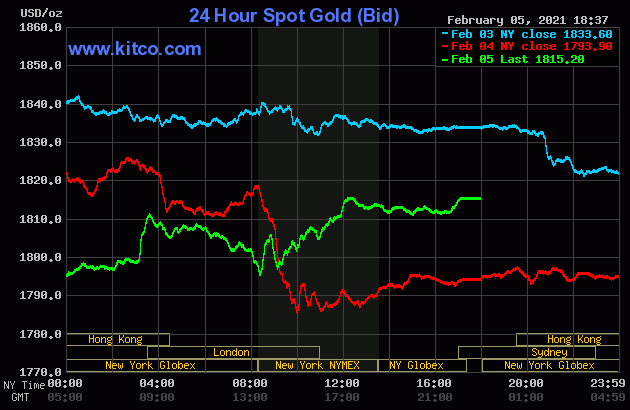

The gold price didn't do much of anything in morning trading in the Far East on their Friday. But starting around 12:45 p.m. China Standard Time it began to edge a bit higher -- and jumped up some more minutes after the London open. That rally wasn't allowed to get far -- and from that juncture it was sold lower going into the 8:30 a.m. jobs report in New York. That sent the gold price higher, but it obviously ran into 'something' around 12:30 p.m. EST -- and it crawled lower until around 4:20 p.m. in after-hours trading. It ticked a few dollars higher going into the 5:00 p.m. EST close.

The low and high tick were reported by the CME Group as $1,792.20 and $1,816.00 in the April contract. The April/June price spread differential in gold at the close yesterday was $2.60...June/August was $2.20 -- and August/October was $1.90.

Gold finished the Friday session on its high of the day...$1,815.20 spot, up $21.30 from Thursday's close. Net volume was on the heavier side, but not overly so, at a bit over 194,500 contracts -- and there was 12,000 contracts worth of roll-over/switch volume on top of that.

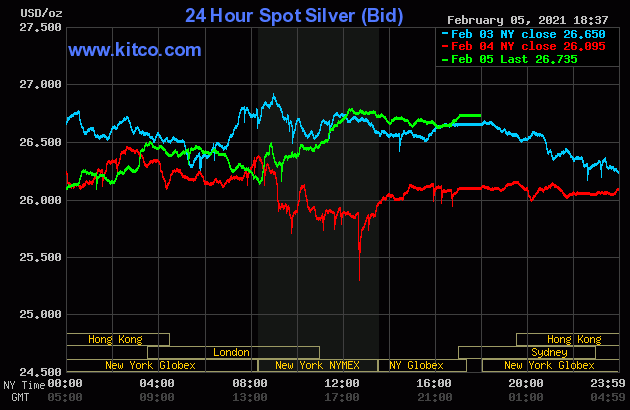

For all intents and purposes, silver's price path was identical to gold's, with the only real difference being that the high price tick in this precious metal was set around 12:15 p.m. in New York...rather than at the 5:00 p.m. EST close.

The low and high ticks in silver were recorded as $26.255 and $27.105 in the March contract. The March/May price spread differential in silver at the close yesterday was 3.9 cents...May/July was 0.9 cents -- and July/September was actually in backwardation by 0.5 cents!!! That's how bloody tight the silver market is -- and gold too...but nothing like silver.

The stresses are obviously enormous. Ted will certainly have something to say about this in his weekly review for his paying subscribers this afternoon.

Silver finished the Friday trading session in New York at $26.735 spot, up 64 cents on the day. Net volume was slightly elevated at a hair under 66,000 contracts, which is certainly good news considering the price action -- and there was a hair under 29,000 contracts worth of roll-over/switch volume out of March and into future months...mostly May.

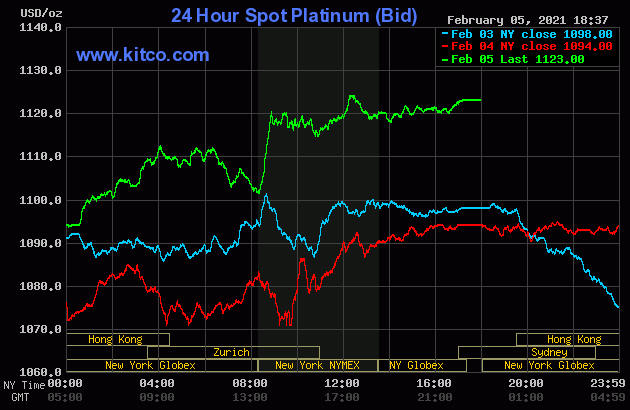

The platinum price traded flat until around 1:40 p.m. China Standard Time on their Friday afternoon -- and then began to head higher. It obviously ran into 'something' a minute or so after 10 a.m. in Zurich -- and after trading sideways for a couple of hours, was sold lower until 8:30 a.m. in New York. Away it went to the upside from there, but obviously ran into another 'something' about fifteen minutes later. Then, under obvious price resistance at 12:30 p.m. like in silver and gold, crept higher until trading ended at 5:30 p.m. EST. Platinum finished the day at $1,123 spot, up 29 bucks from Thursday's close.

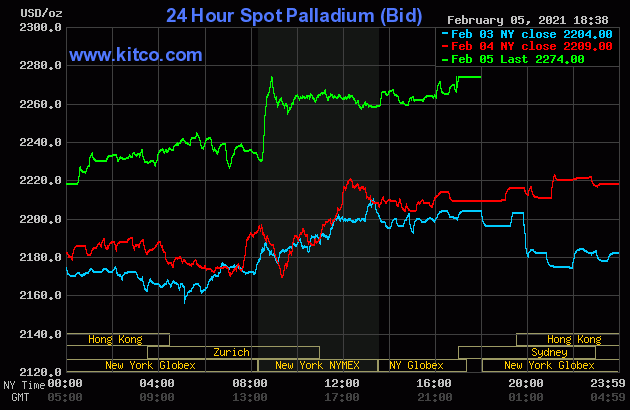

The palladium price stair-stepped its way quietly higher until around 11:40 a.m. in Zurich trading -- and then was sold lower until the 8:30 a.m. EST jobs report hit the wires. Its spike higher at that juncture obviously ran into the same 'something' as platinum -- and it was sold a bit lower before trading flat into the 1:30 p.m. COMEX close. From that point it crept a few dollars higher until trading ended at 5:00 p.m. EST in New York. Palladium finished the Friday session at $2,274 spot, up 65 dollars on the day.

There was a net 1,392 palladium contracts traded in March yesterday, plus there were 667 contracts rolled over into June.

Based on the kitco.com closing spot prices posted above, the gold/silver ratio worked out to 67.9 to 1 on Friday...compared to 68.7 to 1 on Thursday.

Here's Nick's 1-year Gold/Silver Ratio chart, updated with this week's data.

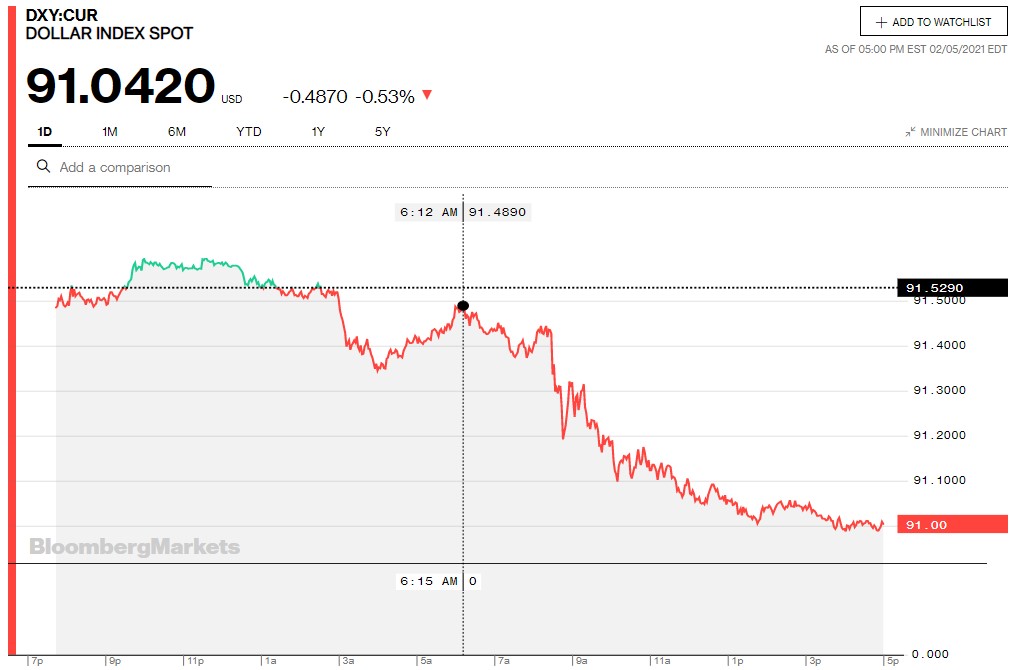

The dollar index closed very late on Thursday afternoon in New York at 91.529 -- and opened down about 4.5 basis points once trading commenced around 7:45 p.m. EST on Thursday evening, which was 8:45 a.m. China Standard Time on their Friday morning. It crawled a bit higher and into positive territory by 11 a.m. CST -- and then began edge very slowly lower until around 11:10 a.m. in London. Then the decline became far more precipitous -- and that decline lasted until about an hour or so before trading ended at 5:30 p.m. in New York.

The dollar index finished the Friday trading session at 91.042...down almost 49 basis points from its close on Thursday, but 4 basis points above its spot close on the DXY chart below.

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

VPR Brands LP Reports Record Annual Financial Performance for Fiscal Year 2023 • VPRB • Apr 19, 2024 11:24 AM

Coinllectibles' Subsidiary, Grand Town Development Limited, Acquires Rare Song Dynasty Ceramics Worth Over USD28million • COSG • Apr 18, 2024 8:03 AM

ILUS Provides Form 10-K Filing Update • ILUS • Apr 17, 2024 9:54 AM

Glucotrack Announces Expansion of Its Continuous Glucose Monitoring Technology to Epidural Glucose Monitoring • GCTK • Apr 17, 2024 8:00 AM

Maybacks Global Entertainment To Fire Up 24 New Stations in Louisiana • AHRO • Apr 16, 2024 1:30 PM

Cannabix Technologies Begins Certification of Contactless Alcohol Breathalyzer, Re-Brands product series to Breath Logix • BLOZF • Apr 16, 2024 8:52 AM