| Followers | 679 |

| Posts | 140790 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Thursday, December 24, 2020 10:33:10 AM

By: SentimenTrader | December 24, 2020

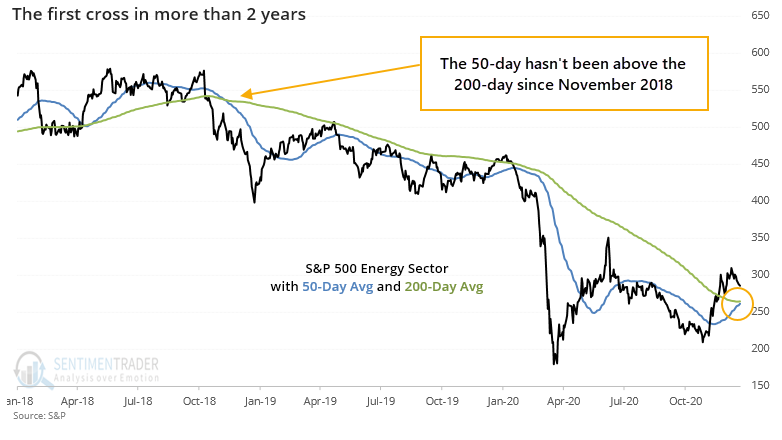

Earlier this fall, we saw that the energy sector had become the most-hated of all time and firms were cutting workers and dividends, before there were finally some signs of an uptick.

Many of these stocks staged a furious rally then spent recent weeks digesting those gains. Even so, it's been enough of a change in trend that the S&P 500 Energy Sector's 50-day moving average is oh-so-close to crossing above the 200-day average. It would be the first time in more than 2 years.

When this finally does cross, it will end the 2nd-longest streak of being in a downtrend since 1926.

When we look at long-term returns after the ends of such long streaks, there were further gains every time during the next 1-2 years, even if it was a volatile path to get there.

What else is happening

• Full details on energy's future returns after ending other prolonged declines

• Taking a look at lesser extremes to see how robust this pattern was

• What happens when the small-cap Russell 2000 hits a new high before year-end

• The index is also up for 8 weeks in row

• Though it did carve out a questionable pattern on Wednesday

• The options market is still going crazy

• An ag market just enjoyed its best run in years

Stat Box

The Russell 2000 closed at a new high with a week left in the year, which it's only done twice before, in 2004 and 2013. Both saw minor gains over the next few days, then losses during the next month.

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

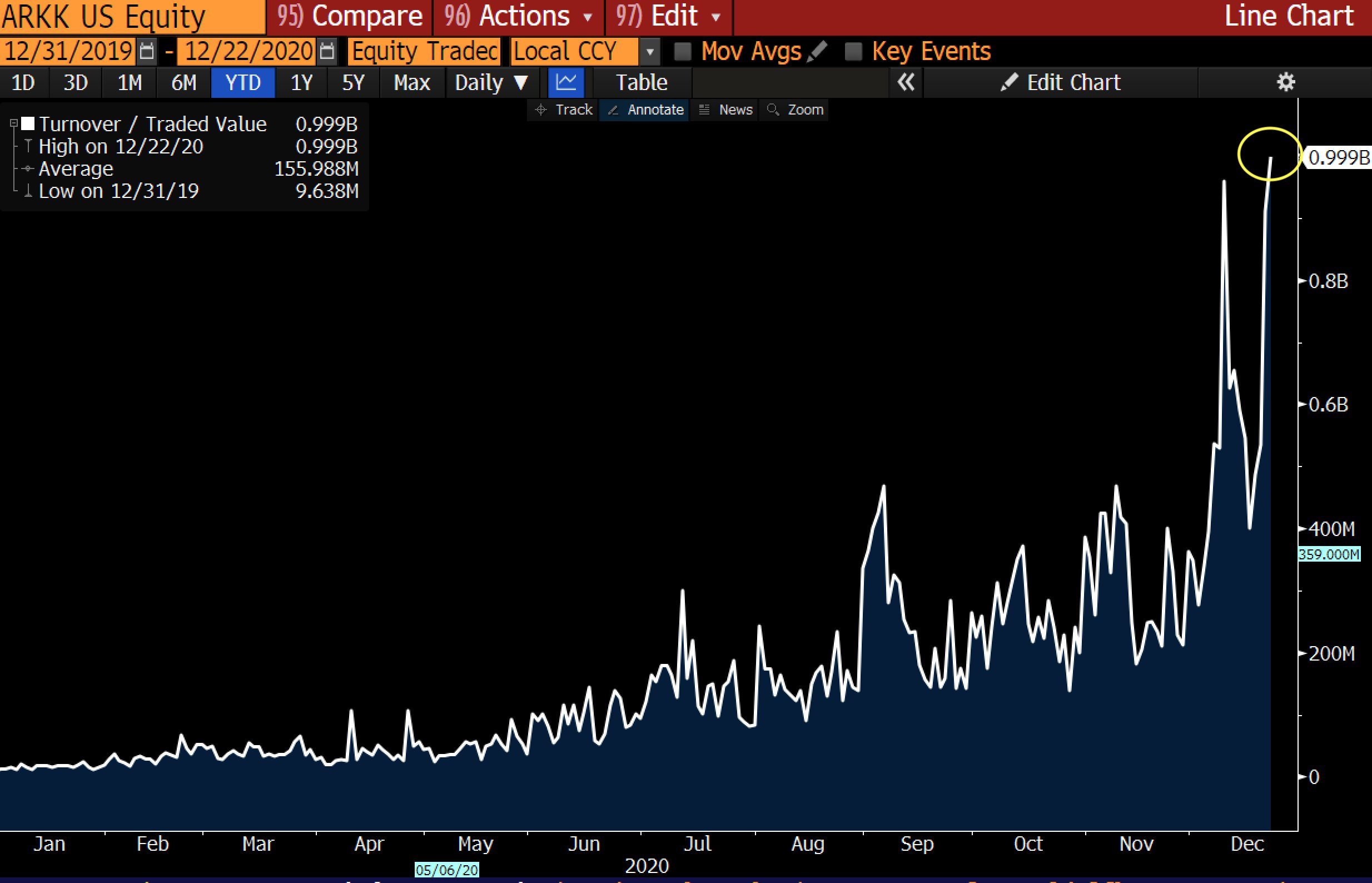

1. At times of minimum risk aversion, investors will buy into stories. Stories like those told by the ARK family of funds, a master at using buzzwords ("ARK believes innovation is key to growth. We aim to capture long-term growth and capital appreciation created by disruptive innovation."). And investors cannot get enough, with trading activity a jaw-dropping levels. [Eric Balchunas]

2. That's driven the ARKK fund's assets to tremendous heights. [Holger Zschaepitz]

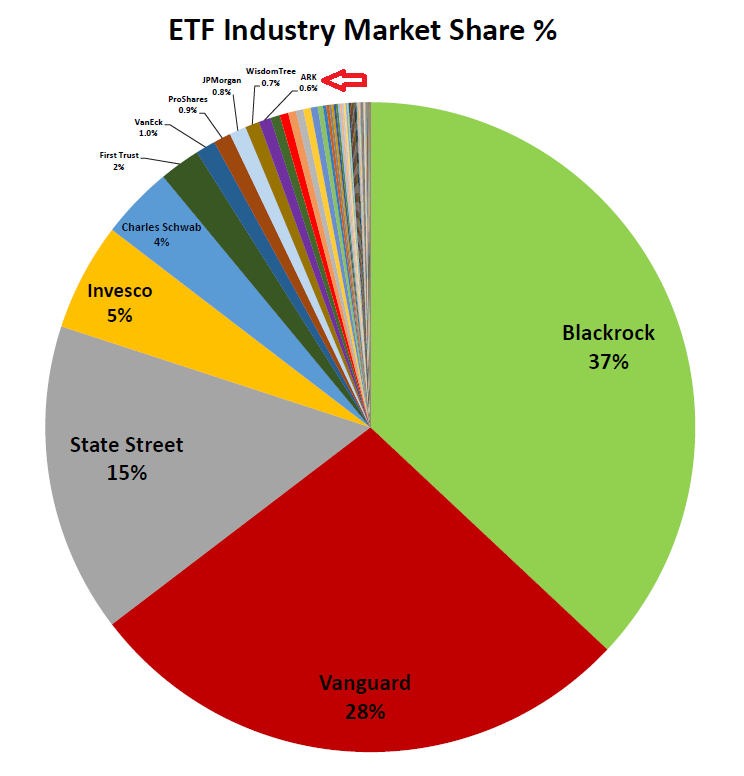

3. The rush into the funds are so mad that the company is now ranking among the largest in the industry. [Nate Geraci]

Read Full Story »»»

DiscoverGold

DiscoverGold

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Caveat emptor!

• DiscoverGold

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM

Kona Gold Beverages, Inc. Prepares for First Production Run Set to Launch May 17, 2024 • KGKG • Apr 22, 2024 8:30 AM