Saturday, February 15, 2020 8:04:19 PM

>>> Why the World Worries About Russia’s Natural Gas Pipeline

Bloomberg

By Anna Shiryaevskaya and Dina Khrennikova

June 13, 2019, Updated on December 23, 2019

https://www.bloomberg.com/news/articles/2019-06-13/why-world-worries-about-russia-s-natural-gas-pipeline-quicktake

'Germany Is Making a Tremendous Mistake by Relying on Pipeline,' Says Trump

A new natural gas pipeline into Europe from Russia is shaking up geopolitics. Nord Stream 2, as it’s called, worries leaders in Eastern Europe, has put German Chancellor Angela Merkel on the hot seat and most recently has become the target of U.S. sanctions. The punitive measures approved by U.S. President Donald Trump have stymied construction just as the final sections of pipe were about to be laid.

1. What is Nord Stream 2?

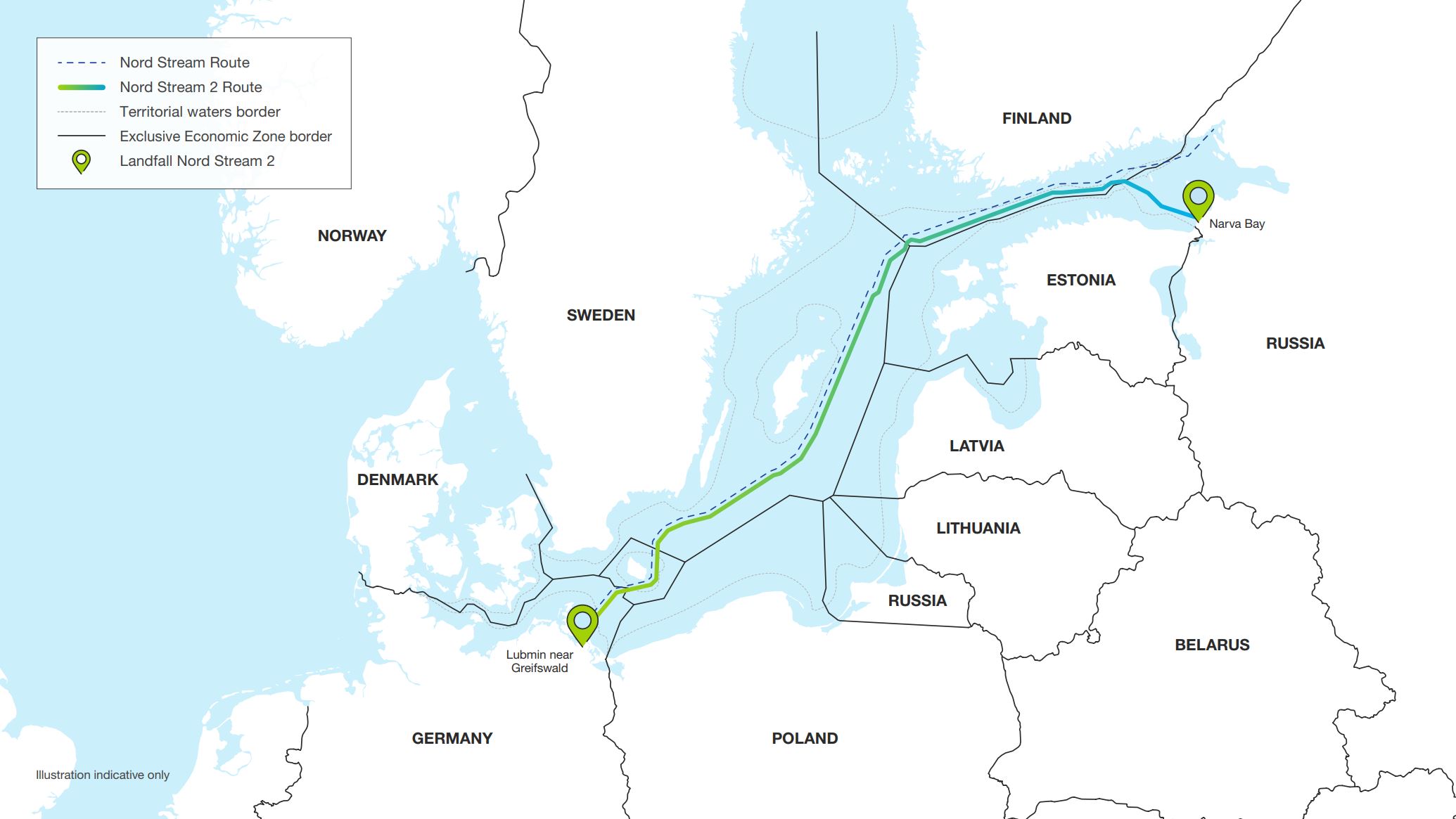

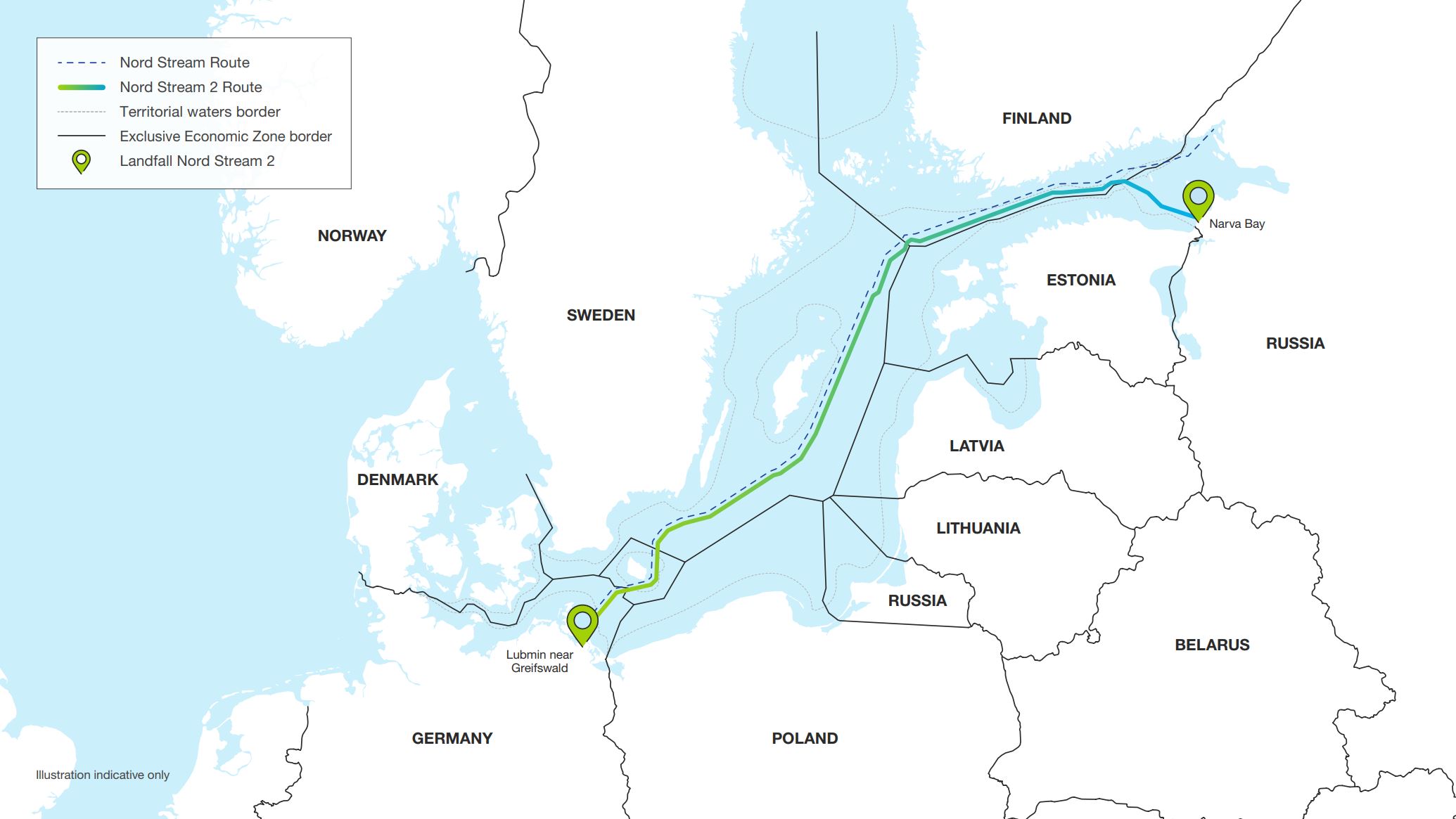

It’s a planned 1,230-kilometer (764-mile) undersea pipeline that will carry natural gas from Russian fields to the European network at Germany’s Baltic coast. It will double the capacity of an existing undersea route -- the original Nord Stream -- that opened in 2011. Russia’s Gazprom PJSC owns the project, with Royal Dutch Shell Plc and four other investors including Germany’s Uniper SE and Wintershall AG providing half of the 9.5 billion-euro ($10.7 billion) cost. Denmark removed one of the project’s last hurdles in October when it approved construction of the link through its waters.

2. Why is it important?

Before the first Nord Stream opened, Russia was sending about two-thirds of its gas exports to Europe through pipelines in Ukraine, a nation with which it has had tense (or worse) relations since the Soviet Union collapsed. That left Gazprom exposed to disruptions. A pricing dispute prompted Russian leaders to halt gas flows through Ukraine for 13 days in 2009. Since then, relations between the two countries have worsened, culminating in the Ukrainian popular revolt that kicked out the country’s pro-Russian president and led to Russia seizing the Crimean Peninsula. The Nord Stream projects are just one part of Gazprom’s decades-long effort to diversify its export options to Europe. Russia expects European gas demand to increase as some nations move away from nuclear and coal power and as their domestic gas production decreases.

Who’s Dependent on Russia’s Gas?

Fourteen countries get more than 50% of their gas from Russia

3. Why is the U.S. involved?

Trump and members of the U.S. Congress worry that Nord Stream 2 will make Europe overly dependent on Russia. Trump has said that Germany in particular will become “a captive to Russia.” And it’s clear that the U.S. is keen to increase its own sales to Europe of what it calls “freedom gas.” Legislation to sanction companies constructing Nord Stream 2 advanced in the U.S. Senate, where Republican Ted Cruz, one of the authors, said it would “deprive Putin the resources to fuel his expansionism and military aggression.” Trump enacted the sanctions as part of an annual defense bill, and contractor Allseas Group SA removed its pipelaying vessels from the route. Germany lashed out against the U.S. move as an “incomprehensible” interference in its internal affairs, and Russia said it would retaliate.

4. What do the sanctions mean for the project?

Even U.S. officials acknowledged that the sanctions are too little, too late, to prevent Nord Stream 2 from being completed. But they will delay the pipeline’s opening until the second half of 2020, or more than six months later than previous estimates. So far, neither the pipeline operator, Nord Stream 2 AG, nor its parent company Gazprom PJSC have announced a backup construction plan. German officials expect the companies to use Russian ships to lay the final kilometers of the link. Pressure testing, cleaning, and filling the link with buffer gas may take six to seven weeks after the link construction is completed, based on the schedule for building the original Nord Stream.

5. Do others oppose Nord Stream 2?

Countries that sit between Russia and Germany collect transit fees on the natural gas that flows through their territories. Those nations include Ukraine, Poland and Slovakia. They have all been worried that they will lose at least part of their revenue after the launch of the link. Those concerns have been partially alleviated after Gazprom reached a deal to continue gas transits via Ukraine through at least 2024.

6. Is Europe really captive to Russian gas?

The European gas market has become more competitive as LNG vies to replace declining local production from the North Sea and the Netherlands. Gazprom estimates that in 2018 its share of the European market grew to just under 37%, from about 34% in 2017. The company’s domestic rival, Novatek PJSC, is also expanding its LNG sales in Europe. But not all countries are equally dependent on Russian imports. Gazprom remains the traditional key supplier for Finland, Latvia, Belarus and the Balkan countries, but western Europe gets gas from a wider range of sources, including Norway, Qatar and North Africa. More nations, from Germany to Croatia, are seeking to build LNG import terminals to accept shipments from around the world.

7. Will the U.S. sell more gas to Europe?

Prospects are clouded. Gas from the U.S. must be chilled into a liquid form and shipped in tankers across the Atlantic at a great cost. Russia is supplying its gas mostly through the world’s largest network of pipelines that have been in place for decades, while adding significant volumes of low-cost LNG produced at its new Arctic plant. Nevertheless, U.S. suppliers have had some success securing deals with Poland, which is eager to loosen Russia’s grip over its energy supply. As U.S. LNG export capacity increases, more cargoes end up in European hubs. But a global glut has lowered prices in Europe so much that U.S. LNG is struggling to compete.

8. Does the U.S. have other options?

U.S. LNG exports are finding a home in Asia, where prices are often higher, or in nearby Latin American markets. Narrowing regional price differences and the ongoing trade war between the U.S. and China may become an obstacle, however. China’s imports of U.S. gas have slumped since Beijing slapped tariffs on the fuel last year in retaliation to the levies imposed by the White House. Still, U.S. LNG is gaining ground in Europe, competing with tanker-borne fuel from Qatar and Russia. This year, quite a few U.S. cargoes landed in Spain, France and the U.K., even as South Korea and Japan accounted for the bulk of the deliveries.

Europe may disappoint Trump if he really expects it to be a “massive buyer” of U.S. LNG.

<<<

Bloomberg

By Anna Shiryaevskaya and Dina Khrennikova

June 13, 2019, Updated on December 23, 2019

https://www.bloomberg.com/news/articles/2019-06-13/why-world-worries-about-russia-s-natural-gas-pipeline-quicktake

'Germany Is Making a Tremendous Mistake by Relying on Pipeline,' Says Trump

A new natural gas pipeline into Europe from Russia is shaking up geopolitics. Nord Stream 2, as it’s called, worries leaders in Eastern Europe, has put German Chancellor Angela Merkel on the hot seat and most recently has become the target of U.S. sanctions. The punitive measures approved by U.S. President Donald Trump have stymied construction just as the final sections of pipe were about to be laid.

1. What is Nord Stream 2?

It’s a planned 1,230-kilometer (764-mile) undersea pipeline that will carry natural gas from Russian fields to the European network at Germany’s Baltic coast. It will double the capacity of an existing undersea route -- the original Nord Stream -- that opened in 2011. Russia’s Gazprom PJSC owns the project, with Royal Dutch Shell Plc and four other investors including Germany’s Uniper SE and Wintershall AG providing half of the 9.5 billion-euro ($10.7 billion) cost. Denmark removed one of the project’s last hurdles in October when it approved construction of the link through its waters.

2. Why is it important?

Before the first Nord Stream opened, Russia was sending about two-thirds of its gas exports to Europe through pipelines in Ukraine, a nation with which it has had tense (or worse) relations since the Soviet Union collapsed. That left Gazprom exposed to disruptions. A pricing dispute prompted Russian leaders to halt gas flows through Ukraine for 13 days in 2009. Since then, relations between the two countries have worsened, culminating in the Ukrainian popular revolt that kicked out the country’s pro-Russian president and led to Russia seizing the Crimean Peninsula. The Nord Stream projects are just one part of Gazprom’s decades-long effort to diversify its export options to Europe. Russia expects European gas demand to increase as some nations move away from nuclear and coal power and as their domestic gas production decreases.

Who’s Dependent on Russia’s Gas?

Fourteen countries get more than 50% of their gas from Russia

3. Why is the U.S. involved?

Trump and members of the U.S. Congress worry that Nord Stream 2 will make Europe overly dependent on Russia. Trump has said that Germany in particular will become “a captive to Russia.” And it’s clear that the U.S. is keen to increase its own sales to Europe of what it calls “freedom gas.” Legislation to sanction companies constructing Nord Stream 2 advanced in the U.S. Senate, where Republican Ted Cruz, one of the authors, said it would “deprive Putin the resources to fuel his expansionism and military aggression.” Trump enacted the sanctions as part of an annual defense bill, and contractor Allseas Group SA removed its pipelaying vessels from the route. Germany lashed out against the U.S. move as an “incomprehensible” interference in its internal affairs, and Russia said it would retaliate.

4. What do the sanctions mean for the project?

Even U.S. officials acknowledged that the sanctions are too little, too late, to prevent Nord Stream 2 from being completed. But they will delay the pipeline’s opening until the second half of 2020, or more than six months later than previous estimates. So far, neither the pipeline operator, Nord Stream 2 AG, nor its parent company Gazprom PJSC have announced a backup construction plan. German officials expect the companies to use Russian ships to lay the final kilometers of the link. Pressure testing, cleaning, and filling the link with buffer gas may take six to seven weeks after the link construction is completed, based on the schedule for building the original Nord Stream.

5. Do others oppose Nord Stream 2?

Countries that sit between Russia and Germany collect transit fees on the natural gas that flows through their territories. Those nations include Ukraine, Poland and Slovakia. They have all been worried that they will lose at least part of their revenue after the launch of the link. Those concerns have been partially alleviated after Gazprom reached a deal to continue gas transits via Ukraine through at least 2024.

6. Is Europe really captive to Russian gas?

The European gas market has become more competitive as LNG vies to replace declining local production from the North Sea and the Netherlands. Gazprom estimates that in 2018 its share of the European market grew to just under 37%, from about 34% in 2017. The company’s domestic rival, Novatek PJSC, is also expanding its LNG sales in Europe. But not all countries are equally dependent on Russian imports. Gazprom remains the traditional key supplier for Finland, Latvia, Belarus and the Balkan countries, but western Europe gets gas from a wider range of sources, including Norway, Qatar and North Africa. More nations, from Germany to Croatia, are seeking to build LNG import terminals to accept shipments from around the world.

7. Will the U.S. sell more gas to Europe?

Prospects are clouded. Gas from the U.S. must be chilled into a liquid form and shipped in tankers across the Atlantic at a great cost. Russia is supplying its gas mostly through the world’s largest network of pipelines that have been in place for decades, while adding significant volumes of low-cost LNG produced at its new Arctic plant. Nevertheless, U.S. suppliers have had some success securing deals with Poland, which is eager to loosen Russia’s grip over its energy supply. As U.S. LNG export capacity increases, more cargoes end up in European hubs. But a global glut has lowered prices in Europe so much that U.S. LNG is struggling to compete.

8. Does the U.S. have other options?

U.S. LNG exports are finding a home in Asia, where prices are often higher, or in nearby Latin American markets. Narrowing regional price differences and the ongoing trade war between the U.S. and China may become an obstacle, however. China’s imports of U.S. gas have slumped since Beijing slapped tariffs on the fuel last year in retaliation to the levies imposed by the White House. Still, U.S. LNG is gaining ground in Europe, competing with tanker-borne fuel from Qatar and Russia. This year, quite a few U.S. cargoes landed in Spain, France and the U.K., even as South Korea and Japan accounted for the bulk of the deliveries.

Europe may disappoint Trump if he really expects it to be a “massive buyer” of U.S. LNG.

<<<

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.