Tuesday, December 24, 2019 7:35:55 PM

>>> Axsome Therapeutics: A Company With Booming Catalysts And A Remarkable Innovation In Treating Depression

Seeking Alpha

Dec. 24, 2019

by Zhiyuan Sun

https://seekingalpha.com/article/4314036-axsome-therapeutics-company-booming-catalysts-and-remarkable-innovation-in-treating?dr=1&utm_medium=email&utm_source=seeking_alpha

Summary

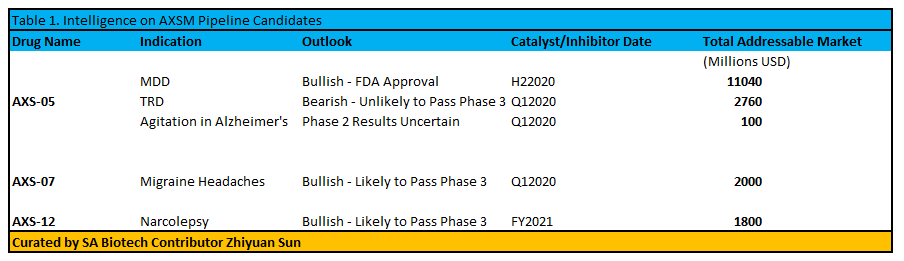

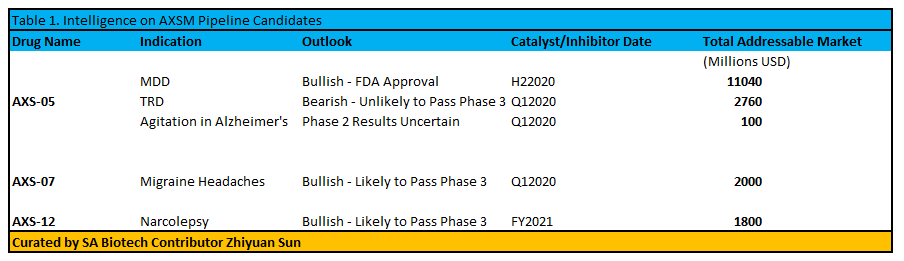

AXS-05's success in treating MDD is alone enough to justify the entire enterprise valuation of AXSM.

AXS-05 may become the first ever antidepressant which can produce lasting relief without psychotomimetic side effects.

Aside from its flagship candidate, the company's upcoming catalysts include strong likelihood of Phase 3 success for AXS-07 in Q1 2020.

Company Thesis

Axsome Therapeutics (AXSM) has developed an antidepressant candidate which has achieved the impossible - alleviating the symptoms of depression without side effects such as psychosis, somnolence, or suicidal tendencies. AXS-05 is a remarkable innovation which would alone justify AXSM's multi-billion dollar valuation, and would likely reach blockbuster status in the event of approval. Despite a 3.5k% run-up this year, AXSM has more catalysts on the table which would further enhance shareholder value. Without further ado, let's take a look as to why the company's buy rating will be reiterated.

Key Research:

AXS-05

In a recent data release, AXSM's flagship candidate AXS-05 surpassed all expectations in its Phase 3 investigation for treatment of depression. For starters, patients taking AXS-05 saw a 16.6 point reduction in depressive symptoms on the MADRS scale, compared to 11.9 points for placebo at 6 weeks of dosage. Remission of depression (MADRS<10) was reported to be 40% in the treatment arm compared to 17% in the placebo arm. Improvements in depressive symptoms for AXS-05 was 20% greater than that of placebo. Statistical significance north or south of p=0.01 was reported for all primary and secondary endpoints for all stages of the investigation.

While these results are excellent, they are far from the spotlight. In context, nearly all antidepressants on the market today possess side effects such as psychosis, suicidal tendencies, or somnolence. In AXS-05's GEMINI trial, however, there were no psychotomimetic side effects reported during its investigation of more than 300 patients. Furthermore, the drop out rate for non-severe adverse events was 6.2% for AXS-05 and 0.6% for placebo, representing a marginal increase. In other words, if approved, AXS-05 would simultaneously rank above Wellbutrin, Buproprion, Prozac, and other commonly prescribed antidepressants in terms of safety profile.

According to med-gadget, the total addressable market for anti-depressant drugs is valued at $13.69B in 2018 and expected to reach $15.88B by 2025 with CAGR of 2.15%. This projection is largely supported by the rising rates of depression in nearly all Western countries. Considering the clinically significant, statistically significant, and highly innovative nature of AXS-05, it is extremely likely the drug will be approved by the end of FY2021. Once commercialized, AXS-05 may capture up to one-thirds ($4.5B) of the total addressable market for depression due to the drug's lack of meaningful risk profile. As an icing on the cake, the drug's patent protection extends well into 2034, giving AXSM nearly 14 years of market exclusivity on this innovation.

AXS-12

AXS-12 (reboxetine) is a highly selective, potent norepinephrine reuptake inhibitor in development for the treatment of narcolepsy. In its recent Phase 2 data release, narcoleptic patients taking AXS-12 saw a 14.6 reduction in the number of cataplexy attacks compared to 2.6 in placebo, representing an improvement of 40.2%. Moreover, 46.2% more patients saw 50% or greater reduction in the weekly number of cataplexy attacks. Secondary endpoints, such as reduction in the number of inadvent naps or improvements in sleep quality, beat placebo by a margin of 30-40%. Statistical significance was observed at all endpoints, with p values ranging from 0.001 to 0.03.

While the trial only involved 21 patients, the mean number of cataplexy attacks reduced are on par when compared to the current standard of care, that of Jazz Pharmaceuticals' (JAZZ) Xyrem. More importantly, the drug's active pharmaceutical ingredient is not a Schedule III controlled substance unlike sodium oxybate. As a result, it is able to replicate the effect of Xyrem at the high end of its therapeutic window (9g) without serious adverse events such as confusion. Investors should be excited about AXS-12's Phase 3 trial likely commencing in FY2020, which will serve one of many catalysts to AXSM's further appreciation.

Upcoming Catalysts/Inhibitors:

AXS-05

Unlike major depressive disorder, AXS-05 treatment resistant depression Phase 3 investigation due for data readout in Q1 2020 may not achieve its primary endpoints. Going back to AXS-05's MDD trial, the drug achieved a 4.7 point reduction against placebo in its 324 patient Phase 3 trial versus a 5.0 point reduction vs. Buproprion in its 80 patient Phase 2 trial (both on the MADRS scale). Hence, the efficacy of AXS-05 appears to be less replicable at greater sample sizes, which serves a barrier to its success in TRD. Continuing on, the comparison arm in Phase 3 TRD consists of Bupropion, not placebo, and it is difficult to see how a drug with modest benefits vs. dummy can outperform itself in a non-inferiority study. Finally, TRD derives its name from the fact 20-33% of MDD patients are unresponsive to at least 2 treatment methods, and presents itself as an extremely difficult barrier for AXS-05 to meet in the context of its data release.

AXS-07

AXS-07 is a synergistic formulation of 20mg meloxicam and 10 mg rizatriptan currently under Phase 3 development for the acute treatment of migraine headaches. Both active pharmaceutical ingredients are FDA approved to treat a variety of pain indications. Rizatriptan is a serotonin (5-HT) 1B/1D receptor agonist (triptan) indicated for the acute treatment of migraine with or without aura in adults and in pediatric patients. Meloxicam is an NSAID that provides potent pain relief with a long duration of action for osteoarthritis and rheumatoid arthritis. Both drugs have serious adverse events, including risk of heart attack, various cardiovascular disorders, and gastrointestinal disorders. Currently, both drugs are only able to demonstrate analgesia 1 to 6 hours after dosage. The company hypothesizes in such synergistic formulation, AXS-07 would possess a shorter onset of action for the delivery of acute pain relief.

Its Phase 1 pharmacokinetics data seems to support this hypothesis. In this data release, healthy volunteers who took AXS-07 had a time to maximum concentration of just 17 to 38 minutes after dosage. Moreover, the half life of AXS-07 was found to be 18 hours, indicating significant analgesia long after dosage completes. The current standard of relief for migraine headache after onset remains that of mild analgesics and caffeine, which have significant delayed onsets of action. Hence, the innovation present in AXS-07 is a welcoming solution to this health problem.

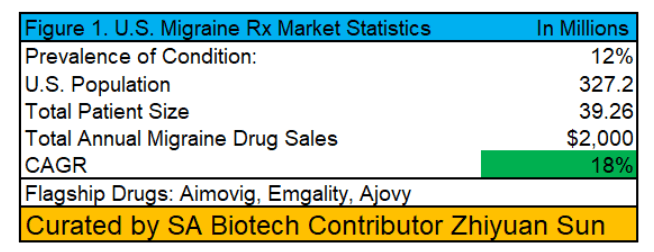

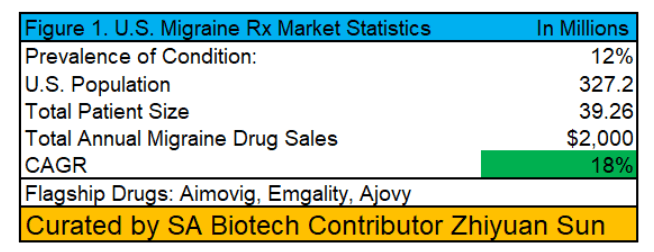

Source: Migraine Foundation, Bloomberg Intelligence, Grand View Research, Author's Curation

Currently, the vast majority of drugs focused on treating migraine headaches, such as Eli Lily's (LLY) Emgality, Novartis' (NVS) Aimovig, and Teva's (TEVA) Ajovi, focus on prevention instead of analgesia. In its clinical trials, however, the 3 drugs have proven to reduce the number of migraine headaches by just 1-2 incidences per month vs. placebo in patients with over 8-9 monthly migraine attacks. These results are at best, modest, and should pave way for AXS-07 to capture a portion of the $2 billion total addressable market that is growing at +18% Y/Y due to its rapid pain relief for the remainder of unpreventable attacks.

Financials

After the success of AXS-05, AXSM announced an equity offering of 2M shares at $87 for total proceeds of $169M to be used for R&D expenses. At an enterprise valuation of $3.5B, the stock offering amounts to a meager 5% dilution for stakeholders, and should instead serve as a bullish sign for investors. All combined, spending for AXS-05, AXS-07 and AXS-12 amounted to a run rate of $33.8M for FY2019. In other words, this means AXSM will not need to dilute its stockholders to fund clinical trial expenses for up to 5 years. By the end of FY2024, Phase 3 data readouts for all of AXSM's investigations will have wrapped up and its key products would have entered the commercialization phase if approved.

Takeaway

In the next 2 years, catalysts for AXSM include potential approval of AXS-05 for MDD, Phase 3 success for AXS-12, and Phase 3 success for AXS-07. On the other hand, the unlikelihood of trial success for AXS-05 in agitation for Alzheimer's and TRD may cause significant volatility for the stock after data is released. Unfortunately, the barrier to trial success for treatment resistant depression is very high, and may pose an impossible standard for a drug with 5 point reduction vs. placebo on the MADRS scale. To make matters worse, the trial evaluating AXS-05 for TRD is benchmarked against Buproprion as opposed to dummy.

Nevertheless, the success of AXS-05 for MDD alone is more than enough to justify the entire $3.5B valuation for AXSM. The psychiatry sector is in dire need of antidepressants which produce lasting effects while simultaneously possessing no psychotomimetic side effects. There have been no drugs approved in the sector in the past 30 years which can meet this clinical goal. In addition, management should be applauded for diluting shareholders by a mere 5% in its new round of equity offering in exchange for cash worth up to 5 years of R&D expenses. In all, AXSM remains an enticing long-term buy even after a remarkable 3.5k% run up this year due to significant catalysts on the horizon.

<<<

Seeking Alpha

Dec. 24, 2019

by Zhiyuan Sun

https://seekingalpha.com/article/4314036-axsome-therapeutics-company-booming-catalysts-and-remarkable-innovation-in-treating?dr=1&utm_medium=email&utm_source=seeking_alpha

Summary

AXS-05's success in treating MDD is alone enough to justify the entire enterprise valuation of AXSM.

AXS-05 may become the first ever antidepressant which can produce lasting relief without psychotomimetic side effects.

Aside from its flagship candidate, the company's upcoming catalysts include strong likelihood of Phase 3 success for AXS-07 in Q1 2020.

Company Thesis

Axsome Therapeutics (AXSM) has developed an antidepressant candidate which has achieved the impossible - alleviating the symptoms of depression without side effects such as psychosis, somnolence, or suicidal tendencies. AXS-05 is a remarkable innovation which would alone justify AXSM's multi-billion dollar valuation, and would likely reach blockbuster status in the event of approval. Despite a 3.5k% run-up this year, AXSM has more catalysts on the table which would further enhance shareholder value. Without further ado, let's take a look as to why the company's buy rating will be reiterated.

Key Research:

AXS-05

In a recent data release, AXSM's flagship candidate AXS-05 surpassed all expectations in its Phase 3 investigation for treatment of depression. For starters, patients taking AXS-05 saw a 16.6 point reduction in depressive symptoms on the MADRS scale, compared to 11.9 points for placebo at 6 weeks of dosage. Remission of depression (MADRS<10) was reported to be 40% in the treatment arm compared to 17% in the placebo arm. Improvements in depressive symptoms for AXS-05 was 20% greater than that of placebo. Statistical significance north or south of p=0.01 was reported for all primary and secondary endpoints for all stages of the investigation.

While these results are excellent, they are far from the spotlight. In context, nearly all antidepressants on the market today possess side effects such as psychosis, suicidal tendencies, or somnolence. In AXS-05's GEMINI trial, however, there were no psychotomimetic side effects reported during its investigation of more than 300 patients. Furthermore, the drop out rate for non-severe adverse events was 6.2% for AXS-05 and 0.6% for placebo, representing a marginal increase. In other words, if approved, AXS-05 would simultaneously rank above Wellbutrin, Buproprion, Prozac, and other commonly prescribed antidepressants in terms of safety profile.

According to med-gadget, the total addressable market for anti-depressant drugs is valued at $13.69B in 2018 and expected to reach $15.88B by 2025 with CAGR of 2.15%. This projection is largely supported by the rising rates of depression in nearly all Western countries. Considering the clinically significant, statistically significant, and highly innovative nature of AXS-05, it is extremely likely the drug will be approved by the end of FY2021. Once commercialized, AXS-05 may capture up to one-thirds ($4.5B) of the total addressable market for depression due to the drug's lack of meaningful risk profile. As an icing on the cake, the drug's patent protection extends well into 2034, giving AXSM nearly 14 years of market exclusivity on this innovation.

AXS-12

AXS-12 (reboxetine) is a highly selective, potent norepinephrine reuptake inhibitor in development for the treatment of narcolepsy. In its recent Phase 2 data release, narcoleptic patients taking AXS-12 saw a 14.6 reduction in the number of cataplexy attacks compared to 2.6 in placebo, representing an improvement of 40.2%. Moreover, 46.2% more patients saw 50% or greater reduction in the weekly number of cataplexy attacks. Secondary endpoints, such as reduction in the number of inadvent naps or improvements in sleep quality, beat placebo by a margin of 30-40%. Statistical significance was observed at all endpoints, with p values ranging from 0.001 to 0.03.

While the trial only involved 21 patients, the mean number of cataplexy attacks reduced are on par when compared to the current standard of care, that of Jazz Pharmaceuticals' (JAZZ) Xyrem. More importantly, the drug's active pharmaceutical ingredient is not a Schedule III controlled substance unlike sodium oxybate. As a result, it is able to replicate the effect of Xyrem at the high end of its therapeutic window (9g) without serious adverse events such as confusion. Investors should be excited about AXS-12's Phase 3 trial likely commencing in FY2020, which will serve one of many catalysts to AXSM's further appreciation.

Upcoming Catalysts/Inhibitors:

AXS-05

Unlike major depressive disorder, AXS-05 treatment resistant depression Phase 3 investigation due for data readout in Q1 2020 may not achieve its primary endpoints. Going back to AXS-05's MDD trial, the drug achieved a 4.7 point reduction against placebo in its 324 patient Phase 3 trial versus a 5.0 point reduction vs. Buproprion in its 80 patient Phase 2 trial (both on the MADRS scale). Hence, the efficacy of AXS-05 appears to be less replicable at greater sample sizes, which serves a barrier to its success in TRD. Continuing on, the comparison arm in Phase 3 TRD consists of Bupropion, not placebo, and it is difficult to see how a drug with modest benefits vs. dummy can outperform itself in a non-inferiority study. Finally, TRD derives its name from the fact 20-33% of MDD patients are unresponsive to at least 2 treatment methods, and presents itself as an extremely difficult barrier for AXS-05 to meet in the context of its data release.

AXS-07

AXS-07 is a synergistic formulation of 20mg meloxicam and 10 mg rizatriptan currently under Phase 3 development for the acute treatment of migraine headaches. Both active pharmaceutical ingredients are FDA approved to treat a variety of pain indications. Rizatriptan is a serotonin (5-HT) 1B/1D receptor agonist (triptan) indicated for the acute treatment of migraine with or without aura in adults and in pediatric patients. Meloxicam is an NSAID that provides potent pain relief with a long duration of action for osteoarthritis and rheumatoid arthritis. Both drugs have serious adverse events, including risk of heart attack, various cardiovascular disorders, and gastrointestinal disorders. Currently, both drugs are only able to demonstrate analgesia 1 to 6 hours after dosage. The company hypothesizes in such synergistic formulation, AXS-07 would possess a shorter onset of action for the delivery of acute pain relief.

Its Phase 1 pharmacokinetics data seems to support this hypothesis. In this data release, healthy volunteers who took AXS-07 had a time to maximum concentration of just 17 to 38 minutes after dosage. Moreover, the half life of AXS-07 was found to be 18 hours, indicating significant analgesia long after dosage completes. The current standard of relief for migraine headache after onset remains that of mild analgesics and caffeine, which have significant delayed onsets of action. Hence, the innovation present in AXS-07 is a welcoming solution to this health problem.

Source: Migraine Foundation, Bloomberg Intelligence, Grand View Research, Author's Curation

Currently, the vast majority of drugs focused on treating migraine headaches, such as Eli Lily's (LLY) Emgality, Novartis' (NVS) Aimovig, and Teva's (TEVA) Ajovi, focus on prevention instead of analgesia. In its clinical trials, however, the 3 drugs have proven to reduce the number of migraine headaches by just 1-2 incidences per month vs. placebo in patients with over 8-9 monthly migraine attacks. These results are at best, modest, and should pave way for AXS-07 to capture a portion of the $2 billion total addressable market that is growing at +18% Y/Y due to its rapid pain relief for the remainder of unpreventable attacks.

Financials

After the success of AXS-05, AXSM announced an equity offering of 2M shares at $87 for total proceeds of $169M to be used for R&D expenses. At an enterprise valuation of $3.5B, the stock offering amounts to a meager 5% dilution for stakeholders, and should instead serve as a bullish sign for investors. All combined, spending for AXS-05, AXS-07 and AXS-12 amounted to a run rate of $33.8M for FY2019. In other words, this means AXSM will not need to dilute its stockholders to fund clinical trial expenses for up to 5 years. By the end of FY2024, Phase 3 data readouts for all of AXSM's investigations will have wrapped up and its key products would have entered the commercialization phase if approved.

Takeaway

In the next 2 years, catalysts for AXSM include potential approval of AXS-05 for MDD, Phase 3 success for AXS-12, and Phase 3 success for AXS-07. On the other hand, the unlikelihood of trial success for AXS-05 in agitation for Alzheimer's and TRD may cause significant volatility for the stock after data is released. Unfortunately, the barrier to trial success for treatment resistant depression is very high, and may pose an impossible standard for a drug with 5 point reduction vs. placebo on the MADRS scale. To make matters worse, the trial evaluating AXS-05 for TRD is benchmarked against Buproprion as opposed to dummy.

Nevertheless, the success of AXS-05 for MDD alone is more than enough to justify the entire $3.5B valuation for AXSM. The psychiatry sector is in dire need of antidepressants which produce lasting effects while simultaneously possessing no psychotomimetic side effects. There have been no drugs approved in the sector in the past 30 years which can meet this clinical goal. In addition, management should be applauded for diluting shareholders by a mere 5% in its new round of equity offering in exchange for cash worth up to 5 years of R&D expenses. In all, AXSM remains an enticing long-term buy even after a remarkable 3.5k% run up this year due to significant catalysts on the horizon.

<<<

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.