"C Munger: "It's dangerous to short stocks."

W. Buffett: "Charlie and I have agreed on around 100 stocks over the years that we thought were shorts or promotions. Had we acted on them, we might have lost all of our money, every though we were right just about every time. A bubble plays on human nature. Nobody knows when it's going to pop, or how high it will go before it pops.

A.W. Jones, which had a long-short model, developed the best-known hedge fund in the late 1950s and early 1960s. They were market neutral, but didn't stick with it. Something went wrong with A.W. Jones. A very high percentage of its spin-off funds bit the dust. There were suicides and people lost their fortunes and had to drive cabs.

Ben Graham didn't find shorting particularly successful. Quite a high percentage of his paired investments worked, but he lost a lot on the few he lost on.

I had a harrowing experience shorting a stock in 1954. I wouldn't have been wrong over 10 years, but I was very wrong after 10 weeks, which was the relevant period. My net worth was evaporating.

Shorting is just tough. You must bet small. You can't short the whole company. It takes just one to kill you. As it rises, it consumes more and more money."

Source: BRK Annual Meeting 2002 Tilson Notes

URL:

Time: April 2002

______________________________________________________________

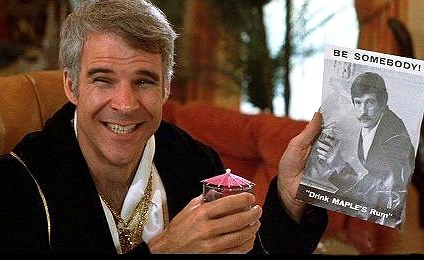

Because the Good Life is Just a Pump or Two Away