Wednesday, May 15, 2019 12:04:15 AM

Data Kiss

Good Morning Good Evening

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

On the show tonight: Great Data & News by Harvey Organ,A Look At Yesterdays Monster Bank Exposure To Derivatives and What Their Up Too,GATA Daily Dispatches and a Tribute To My Grand Pa Joseph and All The Families Who Have Lost Loved Ones In Mining

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a fine evening

EnJoy the show

OK...As Meghan Trainor & Charlie Puth say in our second video 'Lets Marvin Gaye and Get It On'......

MMGYS

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MAY 14/HUGE INCREASE IN GOLD OPEN INTEREST USED TO QUELL ITS RISE YESTERDAY: GOLD DOWN $5.45 TO $1295.55//SILVER UP 2 CENTS TO $14.79//CONTINUED QUEUE JUMPING AT BOTH GOLD AND SILVER COMEX INDICATING SCARCITY OF PHYSICAL METAL//ITALY THROWS THE GAUNTLET DEMANDING A REWRITING OF ITS BUDGET MUCH TO THE ANGER TO BRUSSELS/SEEMS THAT TURKEY IS PREPARING FOR WAR AGAINST CYPRUS WHICH WILL NO DOUBT BRING IN THE ISRAELIS: WILL RUSSIA COME TO THE AID OF TURKEY IN THIS FIASCO//BARR SELECTS A VERY STRONG ATTORNEY TO GO OVER THE DEMOCRATS: DURHAM//MORE SWAMP STORIES FOR YOU TONIGHT///

May 14, 2019 · by harveyorgan · in Uncat

GOLD: $1295.55 DOWN $5.45 (COMEX TO COMEX CLOSING)

Silver: $14.79 UP 2 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold : 1297.00

silver: $14.80

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING 42/43

EXCHANGE: COMEX

CONTRACT: MAY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,300.100000000 USD

INTENT DATE: 05/13/2019 DELIVERY DATE: 05/15/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

657 C MORGAN STANLEY 3

661 C JP MORGAN 42 28

737 C ADVANTAGE 1 12

____________________________________________________________________________________________

TOTAL: 43 43

MONTH TO DATE: 232

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 43 NOTICE(S) FOR 4300 OZ (0.1337 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 232 NOTICES FOR 23200 OZ (.7216 TONNES)

SILVER

FOR MAY

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

13 NOTICE(S) FILED TODAY FOR 65,000 OZ/

total number of notices filed so far this month: 3373 for 16,865,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: OPENING MORNING TRADE :$8060 UP $258.00

Bitcoin: FINAL EVENING TRADE: $7642 DOWN $31

end

XXXX

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI ROSE BY A CONSIDERABLE SIZED 1934 CONTRACTS FROM 201,956 UP TO 203,890 DESPITE YESTERDAY’S 2 CENT LOSS IN SILVER PRICING AT THE COMEX. ,LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW IN FULL FORCE FOR GOLD. TODAY WE ARRIVED CLOSER TO AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A GOOD SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 1163 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 1163 CONTRACTS. WITH THE TRANSFER OF 1163 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 1163 EFP CONTRACTS TRANSLATES INTO 5.82 MILLION OZ ACCOMPANYING:

1.THE 2 CENT FALL IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 18.335 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

12,868 CONTRACTS (FOR 10 TRADING DAYS TOTAL 12,868 CONTRACTS) OR 64,34 MILLION OZ: (AVERAGE PER DAY: 1260 CONTRACTS OR 6.30 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 64,34 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 9.19% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 805.44 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD A CONSIDERABLE SIZED INCREASE IN COMEX OI SILVER COMEX CONTRACTS OF 1934 WITH THE TINY 2 CENT FALL IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A GOOD SIZED EFP ISSUANCE OF 1164 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE GAINED A STRONG SIZED: 3097 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 1163 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH INCREASE OF 1934 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 2 CENT FALL IN PRICE OF SILVER AND A CLOSING PRICE OF $14.77 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.020 BILLION OZ TO BE EXACT or 145% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 13 NOTICE(S) FOR 65,000 OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 18.335 MILLION OZ ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST ROSE BY A CRIMINALLY SIZED 31,765 CONTRACTS, TO 520,485 WITH THE STRONG RISE IN THE COMEX GOLD PRICE/(AN INCREASE IN PRICE OF $15,25//YESTERDAY’S TRADING).

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A HUGE SIZED 9488 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 9488 CONTRACTS DECEMBER: 0 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 520,485. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE AN ATMOSPHERIC AND CRIMINALLY SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 41,253 CONTRACTS: 31,765 OI CONTRACTS INCREASED AT THE COMEX AND 9488 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 41,253 CONTRACTS OR 4,125,300 OZ OR 128,31 TONNES. YESTERDAY WE HAD A GAIN IN THE PRICE OF GOLD TO THE TUNE OF $15,25….AND WITH THAT STRONG RISE, WE HAD AN UNBELIEVABLE GAIN OF 128.31 TONNES!!!!!!.??????

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES:

“AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NO INTO THE NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 59,969 CONTRACTS OR 5,996,900 OR 186.52 TONNES (10 TRADING DAYS AND THUS AVERAGING: 5997 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 10 TRADING DAYS IN TONNES: 186.52 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 186.52/3550 x 100% TONNES =5,25% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 2002.08 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: AN ATMOSPHERIC SIZED INCREASE IN OI AT THE COMEX OF 31,765 WITH THE STRONG RISE IN PRICING ($15.25) THAT GOLD UNDERTOOK YESTERDAY) //.WE ALSO HAD A STRONG SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 9488 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 9488 EFP CONTRACTS ISSUED, WE HAD AN ATMOSPHERIC AND CRIMINALLY SIZED GAIN OF 41,253 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

9488 CONTRACTS MOVE TO LONDON AND 31,765 CONTRACTS INCREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 128,31 TONNES). ..AND THIS HUGE DEMAND OCCURRED WITH A STRONG RISE IN PRICE OF $15.25 IN YESTERDAY’S TRADING AT THE COMEX. NO DOUBT THAT A STRONG PERCENTAGE OF OI GAIN WAS DUE TO THE CONTINUING OF THE SPREADING OPERATION AS I HAVE OUTLINED ABOVE.

we had: 43 notice(s) filed upon for 4300 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD DOWN $5.45 TODAY

THE FOLLOWING MAKES A LOT OF SENSE:

A MASSIVE DEPOSIT OF 3.23 TONNES OF GOLD

INVENTORY RESTS AT 733.23 TONNES

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORy

SLV/

WITH SILVER UP 2 CENTS TODAY:

NO CHANGE IN SILVER INVENTORY AT THE SLV//

/INVENTORY RESTS AT 316.582 MILLION OZ.

end

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER ROSE BY A CONSIDERABLE SIZED 1934 CONTRACTS from 201,956 UPTO 203,890 AND CLOSER TO THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 1163 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 1163 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI GAIN AT THE COMEX OF 1934 CONTRACTS TO THE 1163 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A STRONG GAIN OF 3097 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE GAIN ON THE TWO EXCHANGES: 15.455 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 18.335 MILLION OZ FOR MAY

RESULT: A CONSIDERABLE SIZED INCREASE IN SILVER OI AT THE COMEX DESPITE THE TINY 2 CENT LOSS IN PRICING THAT SILVER UNDERTOOK IN PRICING// YESTERDAY. WE ALSO HAD A GOOD SIZED 1163 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

)TUESDAY MORNING/ MONDAY NIGHT:

SHANGHAI CLOSED DOWN 20.10 POINTS OR 0.69% //Hang Sang CLOSED DOWN 428.22 POINTS OR 1.50% /The Nikkei closed DOWN 124.55 POINTS OR 0.59%//Australia’s all ordinaires CLOSED DOWN .85%

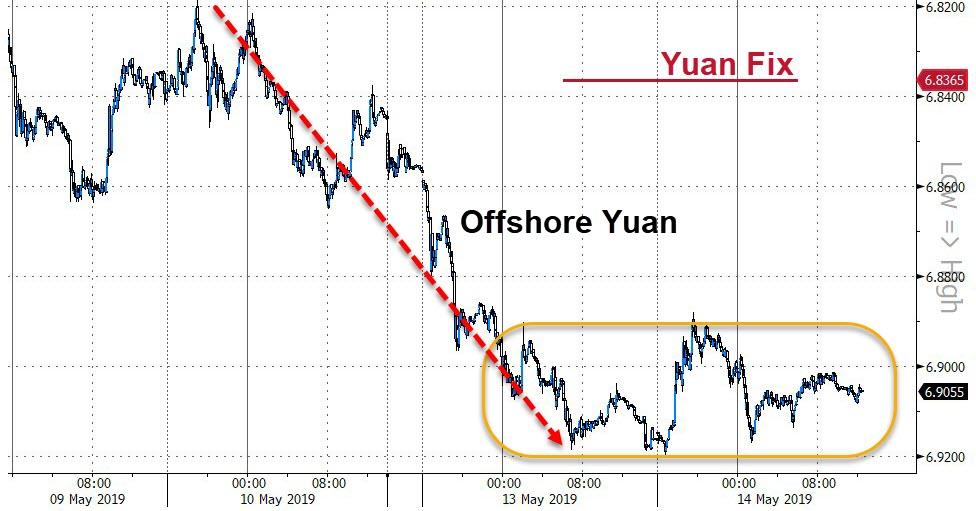

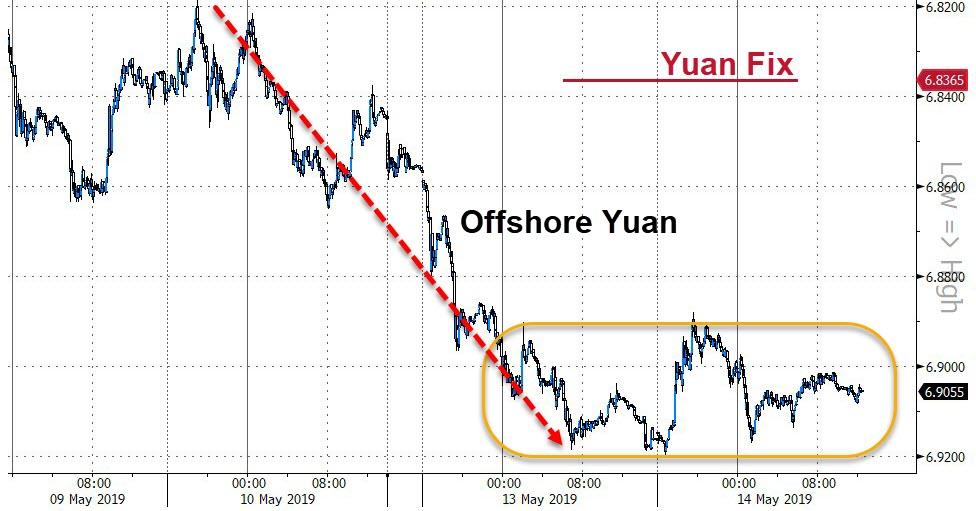

/Chinese yuan (ONSHORE) closed DOWN at 6.8816 /Oil UP to 61.64 dollars per barrel for WTI and 71.08 for Brent. Stocks in Europe OPENED GREEN// ONSHORE YUAN CLOSED DOWN // LAST AT 6.9068 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.8816 TRADE TALKS STILL ON//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP THREATENS TO RAISE RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

i)NORTH KOREA

b) REPORT ON JAPAN

3 China/Chinese affairs

i)China/USA/

Jeffrey Snider outlines the warning signs that we must be cognizant of: the low price of copper, the higher yen values, and lower CNY exchange and the scarcity of dollars floating around the globe: all indicators of a massive global slowdown. He states that we should not pay any attempt to the Chinese threatening to dump dollars

( Jeffrey Snider/Alhambra Investment Partners)

ii)Although both Trump and Chinese leaders toned down the rhetoric today which caused the European and USA markets to rise, the Chinese media seem very upset with the USA. They are calling for a people’s war against the USA and vowing to fight for a “New World”

( zerohedge)

4/EUROPEAN AFFAIRS

i)ITALY

Again, Salvini aggravates Brussels: this time Italy declares wars on boats rescuing immigrants

( zero hedge)

ii)The war between Salvini and Brussels intensifies as our Italian’s defacto leader is now willing to break EU budget rules.

( zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

Turkey

A little background to this story: Israel made this very big discovery of natural gas and some oil off its coast several years ago. They knew that the discovery was heading onto Cyprus and told sovereign Cyprus on the nature of that discovery. You will recall that Cyprus had a civil war in 1974 between Greece and Turkey whereby an armistice was established in that Northern Cyprus would be governed by Turkish Cypriots and the rest of the country by Greek Cypriots. The capital Nicosia would be under control of Greek Cypriots. Turkey never recognized the Greek overthrow of Cyprus and now that a massive amount of gas has been discovered and badly needed by Turkey, you can now see why Turkey is ready to go to war over this.

( zerohedge)

6. GLOBAL ISSUES

Cuba

Crisis begins in Cuba as there is widespread rationing of food: so much for socialism

( zerohedge)

7. OIL ISSUES

8 EMERGING MARKET ISSUES

VENEZUELA

9. PHYSICAL MARKETS

I)Slowly and surely many nations are moving away from the dollar. Today we find that Asian leaders are adding Chinese yuan and Japanese yen to the reserve buffers

( South China Morning post/GATA)

ii)Mike Kosares posts his views on gold/silver in this May report which is now in the open

( USA Gold/Mike Kosares)

iii)This is deadly as James Turk claims that counter party risk (credit default swaps) are rising fast and that should be good for gold.

(James Turk/GATA)

iv)A slow down in gold demand from China last month coming in at 151.89 tonnes. It will improve next month.

( Lawrie Williams)

v)Lawrie Williams tackles the USA China trade war with respect to gold With respect to who will win the war between the USA and China it is up in the air. Williams thinks that China will win.( Lawrie Williams)

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//

ii)Market data

this is not what the Fed wants to see: USA import, export prices disappoint as China’s deflationary impulse hits a 12 year low

In a nutshell, China is sending deflation throughout the globe due to its excess capacity

( zerohedge)

ii)USA ECONOMIC/GENERAL STORIES

USA/China

a)USA posts details on the 300 billion dollars of remaining goods to be tariffed.

( zerohedge)

b)A USA trade official states that a trade deal is not even close: It could be in for a long trade war with China.

( zerohedge)

c)Another indicator that the trade deal is a long way off: Trump: “we will make a deal with China when the time is right”

( zerohedge)

d)This is one of the big casualties of the trade war: soybean prices crash to decade lows.

( zerohedge)

e)It looks like Boeing will need to shell out over one billion dollars for those doomed 737 Max passengers(courtesy zerohedge)

SWAMP STORIES

a)Barr selects apolitical Attorney John Durham, a non nonsense fellow to head the investigation into FBI/DOJ spying. He has also investigated the FBI before

( zero hedge)

b)Rosenstein slams Comey. Grab your popcorn on this;

( zerohedge)

c)Clapper is nervous; he now claims: “we don’t need another investigation of the investigators”. I wonder why he thinks that

( zerohedge)

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST ROSE BY A HUMONGOUS AND CRIMINALLY SIZED 31,765 CONTRACTS.TO A LEVEL OF 520,485 WITH THE STRONG GAIN IN THE PRICE OF GOLD ($15.25) IN YESTERDAY’S // COMEX TRADING)

WE ARE NOW IN THE NON ACTIVE DELIVERY MONTH OF MAY.. THE CME REPORTS THAT THE BANKERS ISSUED A HUGE SIZED TRANSFER THROUGH THE EFP ROUTE AS THESE LONGS RECEIVED A DELIVERABLE LONDON FORWARD TOGETHER WITH A FIAT BONUS., THAT IS 9488 EFP CONTRACTS WERE ISSUED:

0 FOR JUNE ’19: 9488 CONTRACTS , DEC; 0 CONTRACTS: 0 AND ZERO FOR ALL OTHER MONTHS:

TOTAL EFP ISSUANCE: 9488 CONTRACTS.

THE OBLIGATION STILL RESTS WITH THE BANKERS ON THESE TRANSFERS. ALSO REMEMBER THAT THERE IS NO DOUBT A HUGE DELAY IN THE ISSUANCE OF EFP’S AND IT PROBABLY TAKES AT LEAST 48 HRS AFTER LONGS GIVE UP THEIR COMEX CONTRACTS FOR THEM TO RECEIVE THEIR EFP’S AS THEY ARE NEGOTIATING THIS CONTRACT WITH THE BANKS FOR A FIAT BONUS PLUS THEIR TRANSFER TO A LONDON BASED FORWARD.

ON A NET BASIS IN OPEN INTEREST WE GAINED THE FOLLOWING TODAY ON OUR TWO EXCHANGES: 41,253 TOTAL CONTRACTS IN THAT 9488 LONGS WERE TRANSFERRED AS FORWARDS TO LONDON AND WE GAINED A HUMONGOUS SIZED 31,765 COMEX CONTRACTS.

NET GAIN ON THE TWO EXCHANGES : 41,253 contracts OR 4,125,300 OZ OR 128,31 TONNES.

We are now in the NON active contract month of MAY and here the open interest stands at 159 contracts, having GAINED 40 contracts. We had 2 notices served yesterday so we gained 42 contracts or an additional 4200 oz will stand as they guys refused to morph into a London based forward as well as negating a fiat bonus

The next contract month after May is June and here the open interest ROSE by 7372 contracts UP to 290,212. July GAINED 0 contracts to stand at 86. After July the next active month is August and here the OI rose by 19,523 contracts up to 149,299 contracts.

TODAY’S NOTICES FILED:

WE HAD 43 NOTICES FILED TODAY AT THE COMEX FOR 4300 OZ. (0.0062 TONNES)

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

And now for the wild silver comex results.

Total COMEX silver OI ROSE BY A CONSIDERABLE SIZED 1934 CONTRACTS FROM 201,956 UP TO 203,890 (AND CLOSER TO THE NEW RECORD OI FOR SILVER SET ON AUGUST 22.2018. THE PREVIOUS RECORD WAS SET APRIL 9.2018/ 243,411 CONTRACTS) AND TODAY’S STRONG OI COMEX GAIN OCCURRED DESPITE A 2 CENT LOSS IN PRICING.//YESTERDAY.

WE ARE NOW INTO THE ACTIVE DELIVERY MONTH OF MAY. HERE WE HAVE 307 OPEN INTEREST STAND SO FAR FOR A LOSS OF ONLY 16 CONTRACTS. WE HAD 19 NOTICES SERVED UPON YESTERDAY SO IN ESSENCE WE GAINED ANOTHER 3 CONTRACTS OR AN ADDITIONAL 15,000 OZ WILL STAND FOR DELIVERY AS THESE GUYS REFUSED TO MORPH INTO LONDON BASED FORWARDS AND AS WELL THEY NEGATING A FIAT BONUS. SILVER MUST BE SCARCE AT THE COMEX. QUEUE JUMPING RETURNS WITH A VENGEANCE. WE HAVE NOW SURPASSED THE INITIAL AMOUNT STANDING WHICH OCCURRED ON APRIL 30.2019

THE NEXT MONTH AFTER MAY IS THE NON ACTIVE MONTH OF JUNE. HERE THIS MONTH GAINED 2 CONTRACTS UP TO 741. AFTER JUNE IS THE ACTIVE MONTH OF JULY, (THE SECOND LARGEST DELIVERY MONTH OF THE YEAR FOR SILVER) AND HERE THIS MONTH GAINED 1459 CONTRACTS UP TO 155,379 CONTRACTS. THE NEXT ACTIVE MONTH AFTER JULY FOR SILVER IS SEPTEMBER AND HERE THE OI ROSE BY 446 UP TO 18,991 CONTRACTS.

TODAY’S NUMBER OF NOTICES FILED:

We, today, had 13 notice(s) filed for 65,000 OZ for the MARCH, 2019 COMEX contract for silver

Trading Volumes on the COMEX TODAY: 231,465 CONTRACTS

CONFIRMED COMEX VOL. FOR YESTERDAY: 442,835 contracts

Gold Tops $1,300/oz As Trade Wars Escalate and Increased Risk of U.S. War With Iran

14, May

* Gold sees safe haven demand push it to highest in one month as it breaches key $1,300/oz and £1,000/oz levels

* U.S. China trade wars escalates as China retaliates and imposes tariffs on $60 billion of U.S. goods

* Increased risk of war in Middle East after U.S. alleges Iran bombed Saudi oil vessels destined for the U.S.

Gold in USD – 1 Year

Gold prices held steady near one-month highs today as an escalation in Sino-U.S. trade war saw increased risk aversion and sharp selling of stocks which sent investors into safe haven gold.

Increasing tensions in the Middle East are likely also leading to safe haven demand, particularly in the region. The U.S. appears to be inching towards war with Iran and unnamed US military officials have accused Iran of using explosives to blow holes in US-bound Saudi oil tankers in alleged sabotage attacks by Iran.

Asian shares extended losses today, following sharply lower U.S. stocks on Wall Street overnight after China announced retaliatory tariff-hike to counter Trump’s aggressive tariffs.

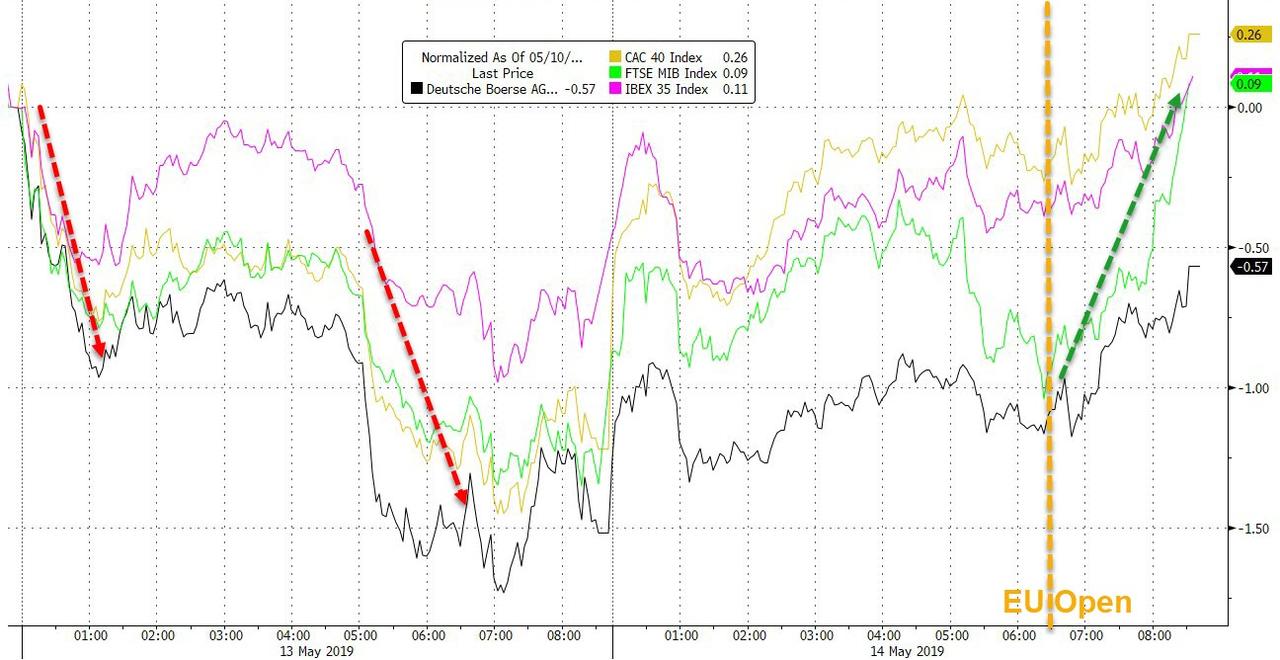

European shares have eked out small gains this morning despite the heightened trade, economic and geopolitical risks.

We believe that given the deteriorating trade, economic and geopolitical outlook, we may be in for a period of market volatility and risk aversion. Gold will again act as an excellent hedge for investors and is likely to eke out further gains in the coming months.

WATCH INTERVIEW HERE

News and Commentary

Gold tops $1,300 for highest finish in a month, as U.S. stock market drops on trade tensions

Gold eyes best day in 3-months as China hits back over U.S. tariffs

Trump says he will meet with Xi and Putin at G20

Wall Street dives as U.S.-China trade war escalates

Metro Bank tells UK customers their deposits are safe

Federal Spending Sets Record Through April: $2,573,708,000,00

Is US-China trade war eroding U.S. dollar dominance?

Top Iranian Official Taunts: US “Not Ready For A War, Specially When Israel Is Within Our Range”

Saudi Arabia Says Two Oil Tankers Attacked Amid Rising Iran Tensions

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

USAGold’s ‘News & Views’ letter for May

Submitted by cpowell on Mon, 2019-05-13 16:33. Section: Daily Dispatches

12:33p ET Monday, May 13, 2019

Dear Friend of GATA and Gold:

USAGold’s ‘News & Views’ letter for May, edited by Mike Kosares, covers many topics of interest to gold investors, including:

— The economist John Exter’s pyramidic chart of global liquidity, in which gold is superior.

— JPMorganChase’s surprising finding that gold has been the second best-performing asset class of the last 20 years.

— Increasing gold purchases by central banks.

— And a collection of brief recent comments by market analysts.

The letter is posted in the clear at USAGold here:

www.usagold.com/cpmforum/nv1005-may19/

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

END

This is deadly as James Turk claims that counter party risk (credit default swaps) are rising fast and that should be good for gold.

(James Turk/GATA)

Counterparty risk soaring and will propel gold, Turk tells KWN

Submitted by cpowell on Mon, 2019-05-13 22:31. Section: Daily Dispatches

6:30p ET Monday, May 13, 2019

Dear Friend of GATA and Gold:

Counterparty risk in the financial markets is rising fast, GoldMoney founder James Turk tells King World News today, and likely will cause a breakout in the monetary metals.

“Money is exiting the financial system so investors can preserve their wealth from bank and bond defaults,” Turk says. “But the best antidote to counteract the poison of counterparty risk is physical gold and silver.”

Turk’s comments are excerpted at KWN here:

https://kingworldnews.com/james-turk-major-gold-breakout-today-as-counte…

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

END

Market Snapshot

S&P 500 futures up 0.4% to 2,817.50

STOXX Europe 600 up 0.4% to 373.88

MXAP down 0.9% to 154.35

MXAPJ down 0.9% to 507.15

Nikkei down 0.6% to 21,067.23

Topix down 0.4% to 1,534.98

Hang Seng Index down 1.5% to 28,122.02

Shanghai Composite down 0.7% to 2,883.61

Sensex up 0.7% to 37,354.89

Australia S&P/ASX 200 down 0.9% to 6,239.91

Kospi up 0.1% to 2,081.84

German 10Y yield rose 1.0 bps to -0.06%

Euro up 0.2% to $1.1239

Italian 10Y yield rose 1.6 bps to 2.326%

Spanish 10Y yield rose 0.7 bps to 0.998%

Brent futures down 0.2% to $70.12/bbl

Gold spot down 0.2% to $1,297.73

U.S. Dollar Index little changed at 97.33

Top Overnight News

The U.S. is prepared to hit China with new tariffs even as President Trump says he’ll meet his Chinese counterpart at next month’s G-20 summit, an encounter that could prove pivotal in a deepening clash over trade. China may release more retaliatory trade measures: Global Times

Prime Minister Theresa May will meet with her cabinet Tuesday as she comes under increasing pressure to pull out of Brexit talks with the opposition Labour Party and set a date for her departure. The latest in a series of cross- party meetings aimed at ending the parliamentary deadlock over leaving the European Union broke up without substantive progress Monday evening, according to a person familiar with the discussions

A gauge of Australian employment slumped to the lowest level in more than three years, according to a closely watched survey of businesses sentiment, in a possible harbinger of interest-rate cuts ahead. National Australia Bank Ltd.’s April employment index dropped to -1 in April from 6 in March, the weakest reading since January 2016

U.S. Secretary of State Michael Pompeo made scant progress persuading European Union counterparts to take a harder line toward Iran during a quick visit to Brussels, with the EU standing behind the nuclear accord abandoned by Washington — and warning of a potential military conflict

In principle Japan will work toward making it easier to raise the sales tax, rather than delaying it, Finance Minister Taro Aso says. Right now Japan isn’t thinking about additional fiscal spending Aso tells reporters

Oil held a loss as an escalating U.S.-China trade war jeopardized the demand outlook, while the rising risk that geopolitical tension in the Middle East will disrupt crude flows prevented further declines

Data in the U.K. showed strong wage growth in the first quarter while the jobless rate hit a 44-year low

Japanese funds have piled $29 billion into French bonds in the space of a month, almost as much as they spent on the debt for the rest of the year.

Asian equity markets were mostly lower as global risk sentiment remained pressured by the escalating US-China trade tensions, which resulted to substantial losses on Wall St. and the worst performance of the S&P 500 in more than 4 months. This followed the tit-for-tat between the world’s 2 largest economies in which China announced its retaliatory tariffs affecting over 5000 US products at a rate of between 5%-25% despite US President Trump’s warnings, while the USTR office later posted details of potential duties on the approximate remaining USD 300bln of Chinese goods. ASX 200 (-0.9%) and Nikkei 225 (-0.6%) were both negative with the declines in Australia led by continued underperformance in its largest weighted financials sector and amid losses in energy names after a retreat in oil prices, while Japanese exporters felt the brunt of the recent flows into JPY. Hang Seng (-1.5%) and Shanghai Comp. (-0.7%) were weaker with Hong Kong playing catch up on return from the extended weekend, although the mainland bourse briefly recovered as participants found some encouragement from a CNY 200bln MLF announcement, as well as comments by US President Trump who suggested we will know the result of trade talks in 3-4 weeks and that he feels talks will be very successful. Finally, 10yr JGBs were uneventful amid a similar lacklustre tone in T-note futures and as the improved results in in the 30yr JGB auction also failed to spur prices.

Top Asian News

Hong Kong Stocks Catch Up With Global Rout as Trump Softens Blow

Biggest U.A.E. Bank Slumps as MSCI Verdict Deals Blow to Stock

A Spat Over FamilyMart China Is Brewing After Its Success

Nissan Is Said to Mull Buying Stake in Chinese Electric Carmaker

European stocks have nursed some losses from yesterday’s sell-off [Eurostoxx 50 +0.6%] in what seems to be (for now) a turn-around from the down-beat Asia-Pac session. Sectors are mostly in the green with defensive sectors underperforming, in-fitting with the “less risk off” tone in the markets. DAX (+0.3%) marginally underperforms its peers as heavyweight Bayer (-2.7%) stumbled after the Co. lost a third trial related to claims its Roundup weed killer causes cancer and the jury awarded USD 2bln in punitive damages. Elsewhere, Renault (-2.5%) shares took a hit after its alliance partner Nissan cut operating profit forecasts whilst also slashing dividend. Sticking with autos, Volkswagen (-1.4%) shares were buoyed amid reports that the company decided to IPO Traton before the Summer break this year. Finally, as the European Q1 earnings season approaches its end, HSBC notes that from the 85% of EU companies that have reported, 55% topped estimates and the results are off the lows seen in Q4 2018 (49% beat). “Though the re-emergence of US-China trade tension remains a concern, we see limited downside to European earnings from here” says HSBC, whilst citing continuing improvement in earning revisions. Furthermore, The bank’s top-down model points to 2019 EPS growth of around 5.3%, marginally above expectations. Despite this, HSBC is underweight on Europe as US companies have outpaced its European counterparts and the “expected 2019 EPS growth forecast for Europe (c.5%) is lower than our [HSBC’s] EPS growth estimates for the US (7%) and global equities (8%)”, the bank concludes.

Top European News

Strong U.K. Wage Growth Continues Amid Tight Labor Market

Krona Becomes Hard to Fathom for Strategists as Trade Woes Mount

VW, Thyssenkrupp, AB InBev Look Past Market Turmoil to Plan IPOs

ECB’s Villeroy Says Recent Data Don’t Refute Economic Forecasts

ECB High-Flier Coeure Risks Third Time Unlucky in Presidency Bid

In FX, It’s too early to talk in terms of a turnaround Tuesday, but the risk pendulum has changed direction to the benefit of high beta currencies that were hit hard yesterday and to the detriment of safe-havens. The catalyst appears to be some respite in US-China trade anxiety as President Trump holds off on additional tariffs and remains optimistic that the 2 sides will reach an agreement down the line. The part reversal in sentiment has also helped the DXY recover some poise, albeit indirectly as a firm rebound in Usd/Jpy and Cable retreat combine to nudge the index back up from near 97.000 lows into a 97.270-390 range.

NZD/EUR/CAD – The Kiwi is leading the comeback from Monday’s depths and is hovering just under 0.6600 vs its US peer, as NZ Finance Minister Robertson pledged to reallocate Nzd1 bn budget expenditure given that Brexit and the US-China tariff spat are both compounding risks faced by the nation’s exporters. Meanwhile, the single currency is holding above 1.1200 and outperforming Sterling near 0.8700 on renewed Brexit angst, with resistance not far above the big figure at 0.8722, and the Loonie has rebounded ahead of 1.3500 into a 1.3487-57 range. Back to Eur/Usd, a decent 1.2 bn option expiries at 1.1240 may influence direction into the NY cut as the pair meanders between 1.1244-20.

JPY/CHF/GBP/AUD – As noted above, the Yen and Franc have lost their safe-haven allure, or at least some appeal, with shorts caught in Usd/Jpy as 109.00 support held and the headline pair squeezed back up to 109.77. Note, 109.50 was a double bottom and 109.23 a key Fib that was breached, but not on a closing basis and this exacerbated the snap back, along with similar tech and stop-fuelled retracements in Yen crosses, like Eur/Jpy and Aud/Jpy according to market contacts. Meanwhile, Cable finally relinquished 1.3000+ status, 100 and 200 DMAs (at 1.3011 and 1.2959 respectively) on the way down to a fresh mtd base (sub-1.2930) before paring some losses and largely shrugging off mixed UK jobs and earnings data. Similarly, the Aussie is lagging either side of 0.6950 following a downbeat NAB business sentiment survey overnight.

SEK/TRY – Some respite for the Swedish Krona and Turkish Lira on top of the less risk averse environment in general as Swedish inflation eclipsed consensus to underscore the Riksbank’s view that it is broadly in line with target, while Turkish IP fell less than expected and latest reports suggest that its planned S-400 purchase from Russia may be shelved until 2020. Eur/Sek now closer to 10.7700 vs 10.8200+ at one stage and Usd/Try nearer 6.0500 than 6.1120 at the earlier high.

In commodities, WTI (+0.4%) and Brent (+0.7%) futures trended lower for much of the session, but have subsequently reverted into positive territory following reports that two Saudi Aramco oil pumping stations have been attacked; for reference, This pipeline replaces the passage of oil through the Hormuz Strait, and as such a failure of this pipeline may increase Iran’s influence of oil flow in the region, as according to Energy Economist Anas Alhajji. Up until this Saudi update, news-flow had been light for the sector, although the OPEC Monthly report is due later today ahead of the API crude stocks report, with the headline expected to build by 2.8mln barrels. Elsewhere, Gold is relatively uneventful and holding onto most its gains just under the USD 1300/oz level, whilst copper prices are just off lows after the red metal tested USD 2.70/lb to the downside amid the heightened US-Sino trade tensions.

US Event Calendar

8:30am: Import Price Index MoM, est. 0.7%, prior 0.6%; YoY, est. 0.3%, prior 0.0%

8:30am: Export Price Index MoM, est. 0.6%, prior 0.7%; YoY, prior 0.6%

DB’s Jim Reid concludes the overnight wrap

Morning (or actually evening from the previous night) from the US West Coast where I’ll be speaking to CFOs/CEOs of major tech companies at a DB conference over the next couple of days. It also gives me a chance to escape from any heart thumping middle of the night encounters at home with the rat colony that our building work seems to have stirred. We’re still a bit shell shocked from that experience although I wish I’d have videoed me with a golf club in hand and my wife shouting to a rat that we were calling the police when we heard loud noises in the next room as we investigated the noise at 2.30am last week. Like with our nerves it’s been a bruising few days for the tech sector given last week’s trade war developments so no doubt that will dominate discussions.

Indeed, since around the middle of last week it’s become clear that it would be hard to quickly de-escalate this latest US/China trade spat as the war of words and actions on both sides became incrementally more entrenched. As such risk assets were clearly vulnerable. As we discussed yesterday the weekend news continued on this theme and markets yesterday caught up to the reality of an extended battle that will likely continue to pressure risk assets. The only good news is that the two sides continue to talk with meetings planned and that Mr Trump and President Xi Jinping’s relationship hasn’t been obviously scarred yet – at least not in public.

The awaited China retaliation was the focus yesterday as they announced the raising of tariffs on a number of US goods from June 1st. To be fair it was hard to really say that the retaliation was much of a surprise however the rubber stamping perhaps confirmed that any hopes for de-escalation were out of the window for now. In addition to that and compounding the pain for markets were the comments from the editor of China’s Global Times Hu Xijin (who has quickly become a must follow on Twitter for his perceived connections) which grabbed equal if not more attention.Not long after the tariff news hit, Xijin tweeted “China may stop purchasing US agricultural products and energy, reduce Boeing orders and restrict US service trade with China. Many Chinese scholars are discussing the possibility of dumping US Treasuries and how to do it specifically”. Hardly the sort of message that implies China is willing to let this pass by then or attempt to compromise. The Treasury comment in particular started to raise alarm bells even if risk-off moves ensured 10yr rallied -6.6bps yesterday. DB’s Alan Ruskin did suggest yesterday that a much more likely approach is a slow structural bleed in China’s US bond holdings, as opposed to a dumping. So should China gets to the point of making real steps to reduce US financial holdings, it’s more likely to come in baby steps to test the waters, rather than any quick rash decisions, not least because China will try to calibrate any global impact, and its rebounding impact on themselves. The possible beneficiaries of such a move, including the yen, the euro, and gold, all rallied sharply after the story broke, outperforming the US dollar.

Not to be outdone, President Trump had already tweeted yesterday that there “is no reason for the US consumer to pay the tariffs” and that “China has taken advantage of the US for so many years that they are well ahead. Therefore, China should not retaliate – will only get worse”. Another tweet by the President said “I say openly to President Xi and all of my many friends in China that China will be hurt very badly if you don’t make a deal because companies will be forced to leave China for other countries”. Risk assets did stage a small attempt at a comeback in the afternoon after Trump said that he plans to meet with President Xi at the G20 next month and that he had not yet decided about when or if to implement the next tranche of tariffs on around $300bn more of Chinese imports. That followed comments from Secretary Mnuchin, who stated that negotiations with China are currently ongoing. Ultimately though, the market seems to be getting a bit more nervous of the more positive comments and rallying much less off the lows than it did last week.

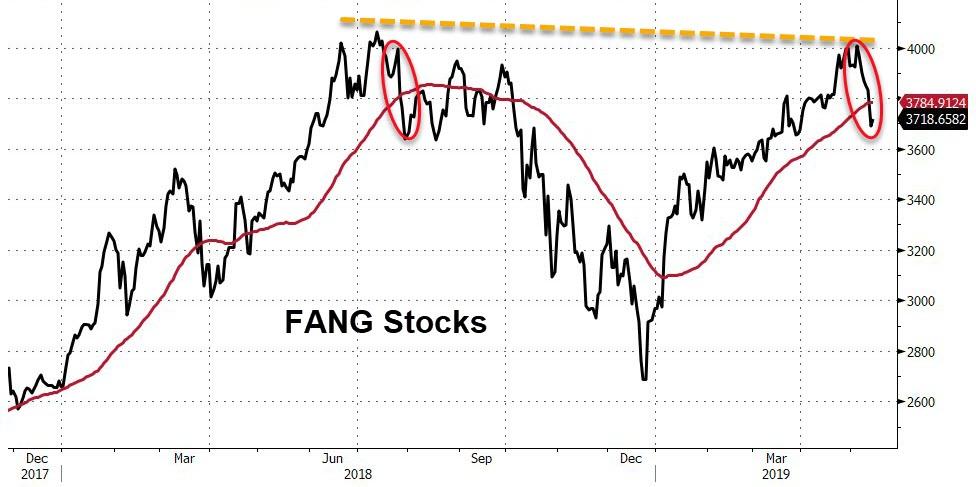

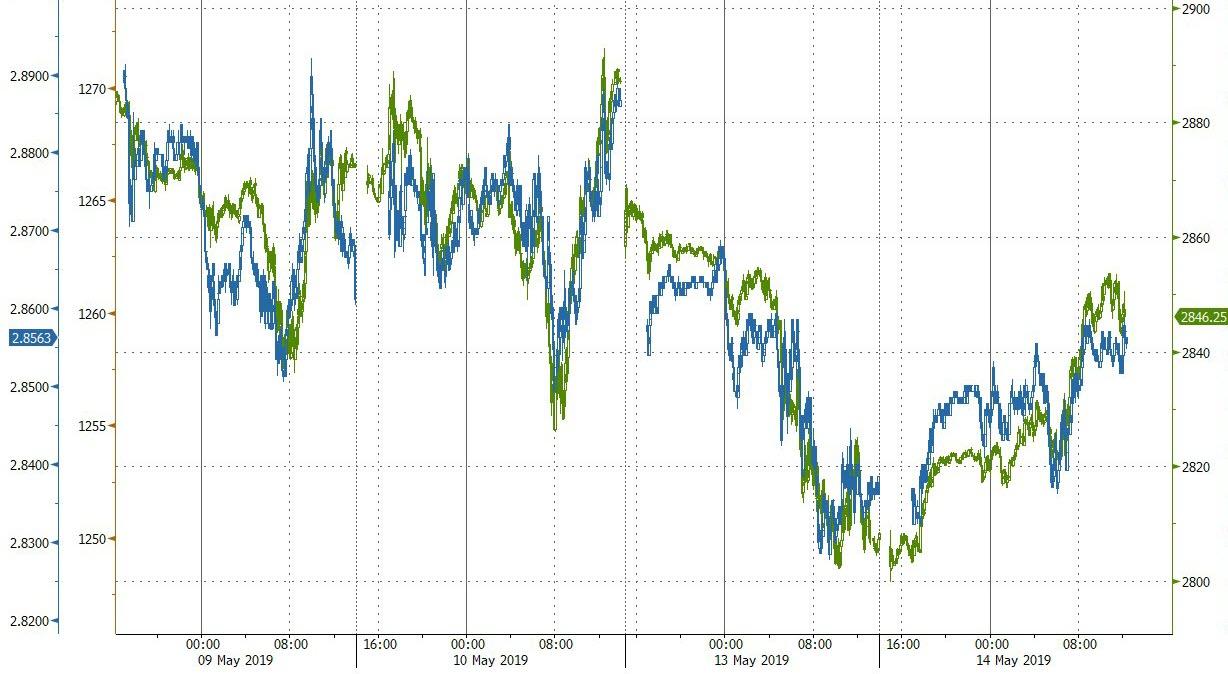

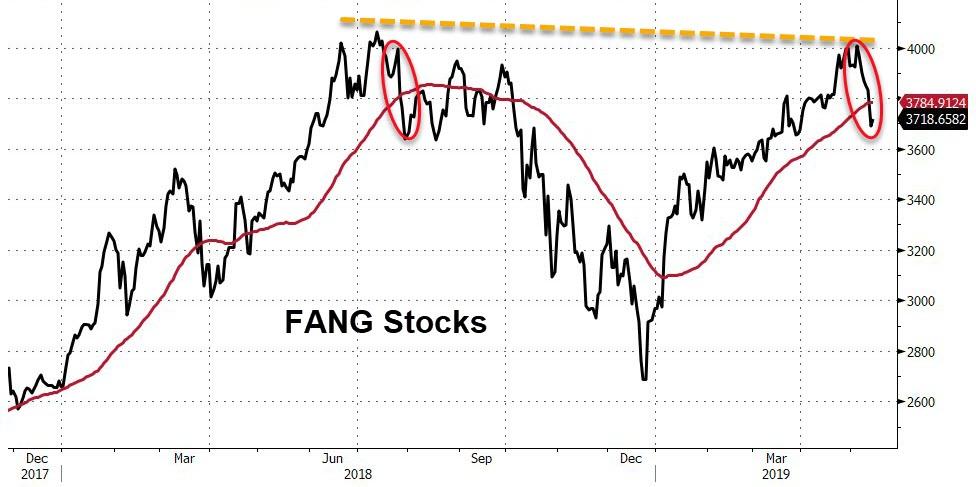

The end result for markets yesterday was the second worst day of the year (behind the January 3rd plunge) for the S&P 500 and DOW, falling -2.41% and -2.38%, respectively. Only utilities (+1.11%) survived at a sector level with tech (-3.71%), consumer discretionary (-2.95%) and financials (-2.87%) seeing the biggest falls. At a stock level, 457 of the 505 stocks in the S&P closed lower. The NASDAQ however tumbled -3.41% for the biggest decline since December 4th last year. Even worse was the performance by the NYSE FANG index, which tumbled -4.40% for its worst day since October 24th, as Apple (-5.81%) shed $52.7bn in value alone yesterday and therefore putting it down -12.29% in just the last 10 days.Apple is acutely exposed to further trade escalation, both because it has a large exposure to China and because it has largely been spared any direct tariff pain so far in this trade war. The same applies, to a lesser extent, to the broader semiconductor industry, with the Philly semiconductor index down -4.73% yesterday and -10.30% over the last ten sessions. To put a cap on a rough day for tech, Uber stock traded down another -10.39% yesterday, meaning it has now shed -17.56% since its IPO on Friday.

After US markets closed yesterday, the USTR announced the timeline for the next tranche of tariffs, should the US decide to implement them. They will take written comments for the next month before holding a public hearing on June 17.The list of products to be tariffed includes a range of consumer technology products, including cell phones and televisions, justifying the earlier market moves in the tech sector. Industry groups are likely to increase their pressure on the US administration for fear of further disruptions, while the stakes are also raised for China. Trump told reporters at the White House early this morning that “we’ll let you know in about three to four weeks whether or not it (talks) was successful…but I have a feeling it’s (talks) going to be very successful”.

It appears that Trump’s comments have done enough to help markets stage a mini rebound overnight in Asia. The Nikkei for example is back to -0.65% after trading down as much as -2.07%, while there are also much more muted declines for the Shanghai Comp (-0.36%) and CSI 300 (-0.18%). The Kospi (+0.11%) has just turned positive also. The Hang Seng (-1.58%) has seen a heavier fall albeit partly playing catch up after being closed on Monday. In FX the CNH has also strengthened this morning by +0.26%, putting it at 6.894 having touched as high as 6.919, while EM FX more broadly is flat. Temporary respite then however it wouldn’t be a great surprise to see risk assets struggle once Europe walks in again.

Back to yesterday, where, in fairness, Europe looked almost calm in comparison.The STOXX 600 slumped a more palatable -1.21% although it is now back to the lowest level since March 8th. The DAX was down -1.52% while in EM land the MSCI EM index was hit to the tune of -3.33% and is now back to the lowest level since January 14th. In fact, the year-to-date gain for EM equities is now just +3.89%. Unsurprisingly vol climbed with the VIX finishing up +4.5pts and closing above 20 for the first time since January 8th. The V2X rose a more modest +0.9pts to 19.5.

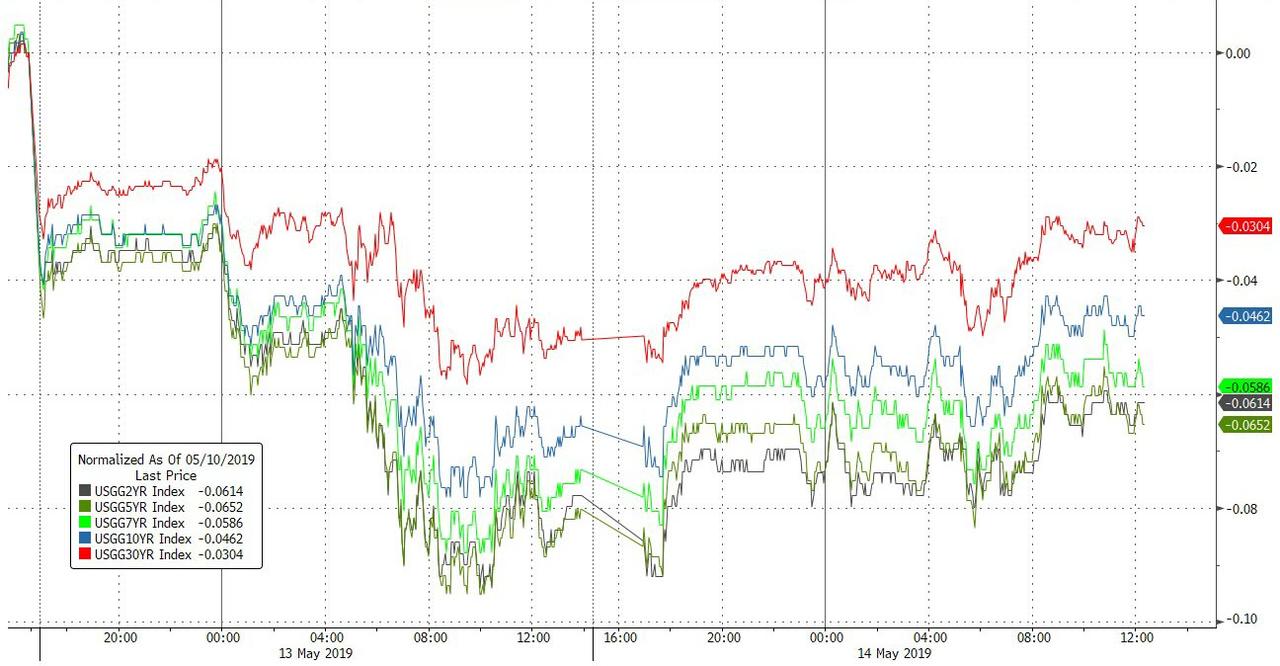

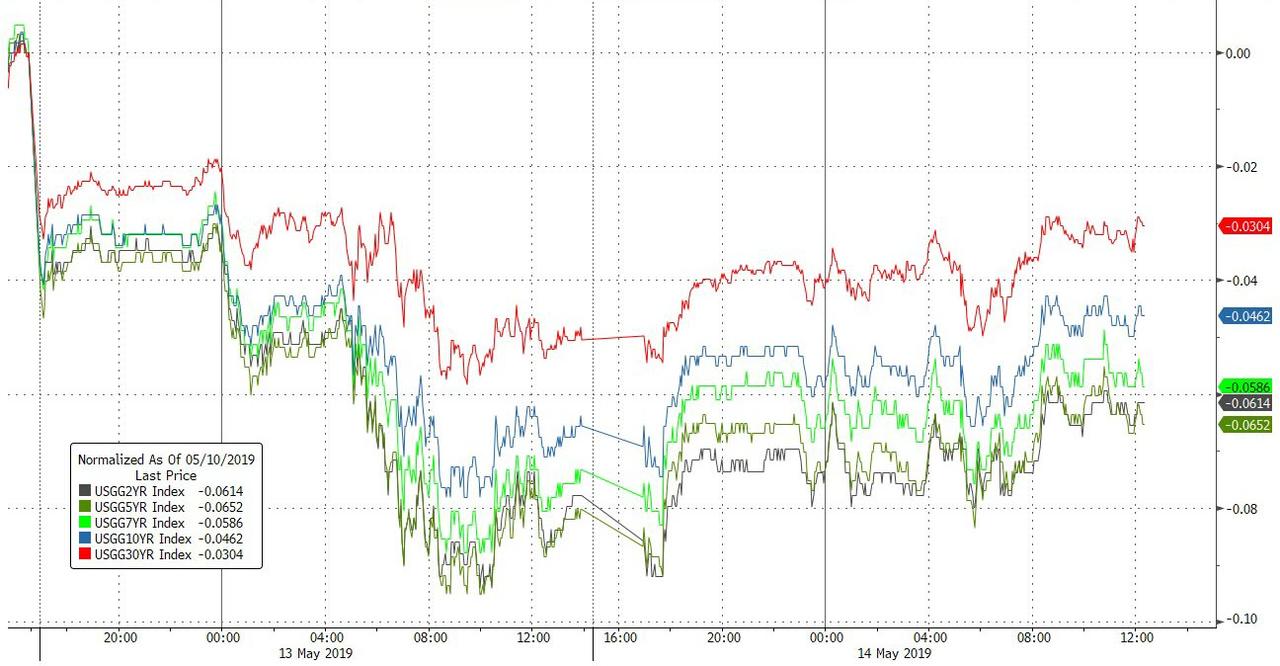

It wasn’t much better for EM FX which is back into negative territory for the year following a -0.65% decline yesterday.The South African Rand (-1.20%), Turkish Lira (-1.25%), and Chilean Peso (-1.01%) saw the biggest moves over the last 24 hours. In contrast the Yen (+0.59%) and Swiss Franc (+0.54%) have earned their status as safe-haven currencies. The same is true for Treasuries (-6.6bps) as discussed earlier with 10yrs hitting 2.387% yesterday before closing at 2.402%, the lowest since March 28th. The front end really took off however with 2y yields rallying -8.2ps, making the curve +1.6bps steeper at 21.3bps. That being said, the 3m10y slope is now inverted again (only the sixth inversion at the close in nearly 11 years – the other five days being in March) while the 18m3m forward minus spot 3m – a favourite of the Fed – is back down at -34bps and approaching the March lows. A Fed cut by year-end is also now 76% priced in.Bunds (-2.5bps) also dropped to -0.072% – still a couple of basis points off the March lows – while the periphery struggled as a result of the wider risk off move, with BTPs spreads up +4.2bps to their widest level since February at 277bps. As for credit, US HY spreads were +19bps wider yesterday to 436bps, which puts the month to date move at +38bps. For some context, at the wides in early January spreads hit 537bps. In commodities Gold (+1.08%) was the obvious beneficiary while soybeans (-1.32%) and more notably cotton (-3.61%) got hit.

Yesterday our China economists put a 60% indicative probability that the two sides cannot reach a deal in May and tariffs will be imposed on the remaining Chinese exports, including mostly consumer goods.The team do expect the two sides to reach a deal eventually (possibly at the G20 in late June), however note that this could take a few months, meaning further weakening in the CNY is likely. See their report here .

Another negative geopolitical risk getting some renewed airtime yesterday was Brexit, with the situation continuing to deteriorate.Last week’s European Parliament poll showed a further drop in support for the Conservative party, who now poll in sixth place. That’s likely to make Tory MPs less willing to stomach a general election but also raises the pressure on PM May to resign. Separately, Labour party leaders said that they are unlikely to accept a compromise deal which does not include a second referendum. That crosses a red line for the Conservatives, so a cross-party deal is looking less and less likely. Elsewhere, BBC’s Laura Kuenssberg tweeted late last night that “Brexit talks are not in good health, but not dead yet, Olly Robbins is heading to Brussels tomorrow to talk about how, and how long it might take to change the political declaration IF there were to be an agreement”. We’re approaching crunch time here, so unless a deal can get finalized this week, the pressure on May will likely rise over the near term.

Economic data understandably took a backseat to the trade developments and sharp market moves, and to be fair there wasn’t a lot of important data regardless. The Bank of France’s business industry sentiment survey fell 1 point to 99, indicating below-average levels of optimism, which was actually the lowest since October 2016. Other than that, Bloomberg released the results of their latest European economic surveys. The only major change was to Italian growth, which consensus now forecasts to be 0.1% this year, which would be the lowest pace of growth since 2014.

To the day ahead now, which this morning kicks off in Germany with the final April CPI revisions (no change from the +1.0% mom flash reading expected). Shortly after that we’re due to get March and April employment data in the UK where the consensus is for no change in the unemployment rate of 3.9% and a small decline in weekly earnings to +3.3%. Also due out this morning is the March industrial production print for the Euro Area and the May ZEW survey in Germany. In the US today we’re due to get the April NFIB small business optimism reading and April import price index print. Away from the data the Fed’s Williams is due to speak at 8.15am BST this morning followed by George (5.45pm BST) and Daly (11pm BST) this evening. The ECB’s Villeroy is also scheduled to speak this morning.

3. ASIAN AFFAIRS

i)TUESDAY MORNING/ MONDAY NIGHT:

SHANGHAI CLOSED DOWN 20.10 POINTS OR 0.69% //Hang Sang CLOSED DOWN 428.22 POINTS OR 1.50% /The Nikkei closed DOWN 124.55 POINTS OR 0.59%//Australia’s all ordinaires CLOSED DOWN .85%

/Chinese yuan (ONSHORE) closed DOWN at 6.8816 /Oil UP to 61.64 dollars per barrel for WTI and 71.08 for Brent. Stocks in Europe OPENED GREEN// ONSHORE YUAN CLOSED DOWN // LAST AT 6.9068 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.8816 TRADE TALKS STILL ON//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP THREATENS TO RAISE RATES TO 25%

3 a NORTH KOREA/SOUTH KOREA

NORTH KOREA

end

3 b JAPAN AFFAIRS

end

3 C CHINA/CHINESE AFFAIRS

i)China/USA/

Jeffrey Snider outlines the warning signs that we must be cognizant of: the low price of copper, the higher yen values, and lower CNY exchange and the scarcity of dollars floating around the globe: all indicators of a massive global slowdown. He states that we should not pay any attempt to the Chinese threatening to dump dollars

(courtesy Jeffrey Snider/Alhambra Investment Partners)

Alhambra: On China’s Empty Treasury ‘Nuke’ Threats

Authored by Jeffrey Snider via Alhambra Investment Partners,

CNY, Its Doom Sisters, & Chinese Threats

xxxxxxxxxxxxxxxxxxxxxxxxxxx

MMGYS

xxxxxxxxxxxxxxxxxxxxxxxxxxx

Dead. Cat. Bounce?

Stocks are up so everything must be awesome again, right?

Despite an early session bid, China stocks ended lower once again..

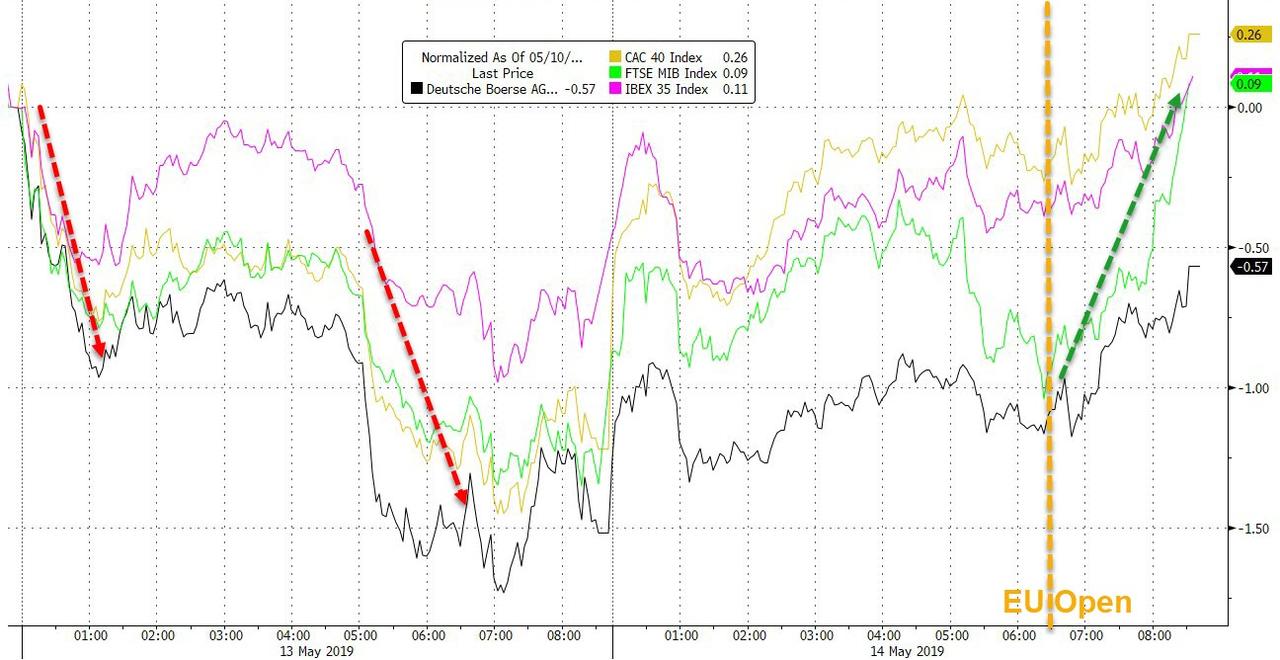

European markets were much more excited with Italy soaring along with France on the day erasing Monday’s losses…

China has caught back down to US and Europe’s YTD performance…

US Equity markets rallied back above the “constructive” rally point from Friday today as a lack of negative things from China and US as well no inflationary fears from import/export data sent markets higher…

Trannies were the best performers in cash markets with Dow and S&P laggards…

Another dead cat bounce?

“Most Shorted” stocks surged today, recovering around half of yesterday’s losses…

All the major US indices moved back above key technical support once again.

FANG Stocks rebounded extremely modestly on the day…

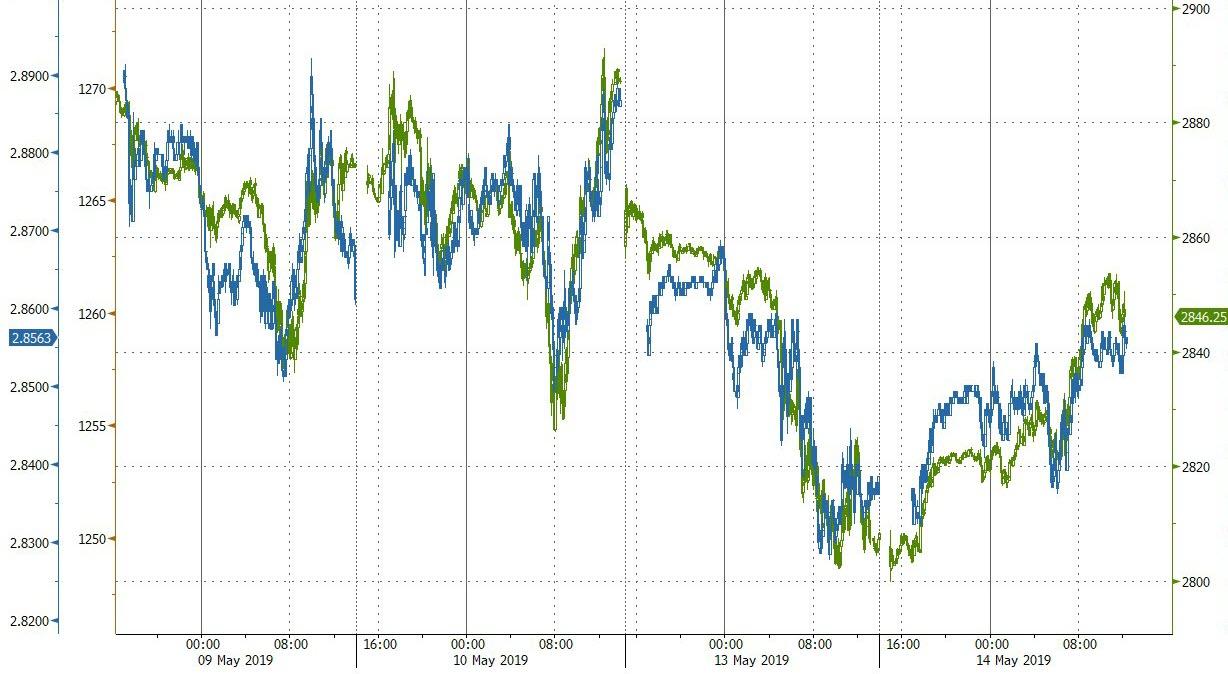

Bonds and stocks have traded almost perfectly in sync through this recent chaos…

Treasury yields inched higher on the day…

The dollar extended its gains from yesterday…

Offshore Yuan went nowhere today, well below the Yuan Fix…

Ripple soared today as most of the major cryptos held on to gains…

Bitcoin flash-crashed around the Asia open overnight, but scrambled back above $8000

Oil prices rebounded today as mideast tension rose (ahead of tonight’s inventory data), Copper and silver were flat and gold was weaker…

Gold slipped back below $1300…

Read more Harvey here......

https://harveyorganblog.com/2019/05/14/may-14-huge-increase-in-gold-open-interest-used-to-quell-its-rise-yesterday-gold-down-5-45-to-1295-55-silver-up-2-cents-to-14-79-continued-queue-jumping-at-both-gold-and-silver-comex-indicating/

.jpg)

Good Morning Good Evening

Welcome to ~*~Mining & Metals Du Jour~*~Graveyard Shift~*~

On the show tonight: Great Data & News by Harvey Organ,A Look At Yesterdays Monster Bank Exposure To Derivatives and What Their Up Too,GATA Daily Dispatches and a Tribute To My Grand Pa Joseph and All The Families Who Have Lost Loved Ones In Mining

Hello everybody I'm J:D your host tonight Thanks for being with us.

Hope Your Having a fine evening

EnJoy the show

OK...As Meghan Trainor & Charlie Puth say in our second video 'Lets Marvin Gaye and Get It On'......

MMGYS

Thank you

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

MAY 14/HUGE INCREASE IN GOLD OPEN INTEREST USED TO QUELL ITS RISE YESTERDAY: GOLD DOWN $5.45 TO $1295.55//SILVER UP 2 CENTS TO $14.79//CONTINUED QUEUE JUMPING AT BOTH GOLD AND SILVER COMEX INDICATING SCARCITY OF PHYSICAL METAL//ITALY THROWS THE GAUNTLET DEMANDING A REWRITING OF ITS BUDGET MUCH TO THE ANGER TO BRUSSELS/SEEMS THAT TURKEY IS PREPARING FOR WAR AGAINST CYPRUS WHICH WILL NO DOUBT BRING IN THE ISRAELIS: WILL RUSSIA COME TO THE AID OF TURKEY IN THIS FIASCO//BARR SELECTS A VERY STRONG ATTORNEY TO GO OVER THE DEMOCRATS: DURHAM//MORE SWAMP STORIES FOR YOU TONIGHT///

May 14, 2019 · by harveyorgan · in Uncat

GOLD: $1295.55 DOWN $5.45 (COMEX TO COMEX CLOSING)

Silver: $14.79 UP 2 CENTS (COMEX TO COMEX CLOSING)

Closing access prices:

Gold : 1297.00

silver: $14.80

JPMorgan has been receiving gold with reckless abandon and sometimes supplying (stopping)

today RECEIVING 42/43

EXCHANGE: COMEX

CONTRACT: MAY 2019 COMEX 100 GOLD FUTURES

SETTLEMENT: 1,300.100000000 USD

INTENT DATE: 05/13/2019 DELIVERY DATE: 05/15/2019

FIRM ORG FIRM NAME ISSUED STOPPED

____________________________________________________________________________________________

657 C MORGAN STANLEY 3

661 C JP MORGAN 42 28

737 C ADVANTAGE 1 12

____________________________________________________________________________________________

TOTAL: 43 43

MONTH TO DATE: 232

NUMBER OF NOTICES FILED TODAY FOR MAY CONTRACT: 43 NOTICE(S) FOR 4300 OZ (0.1337 tonnes)

TOTAL NUMBER OF NOTICES FILED SO FAR: 232 NOTICES FOR 23200 OZ (.7216 TONNES)

SILVER

FOR MAY

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

13 NOTICE(S) FILED TODAY FOR 65,000 OZ/

total number of notices filed so far this month: 3373 for 16,865,000 oz

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Bitcoin: OPENING MORNING TRADE :$8060 UP $258.00

Bitcoin: FINAL EVENING TRADE: $7642 DOWN $31

end

XXXX

Let us have a look at the data for today

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

IN SILVER THE COMEX OI ROSE BY A CONSIDERABLE SIZED 1934 CONTRACTS FROM 201,956 UP TO 203,890 DESPITE YESTERDAY’S 2 CENT LOSS IN SILVER PRICING AT THE COMEX. ,LIQUIDATION OF THE SPREADERS HAVE STOPPED FOR SILVER BUT IT NOW IN FULL FORCE FOR GOLD. TODAY WE ARRIVED CLOSER TO AUGUST’S 2018 RECORD SETTING OPEN INTEREST OF 244,196 CONTRACTS.

WE HAVE ALSO WITNESSED A LARGE AMOUNT OF PHYSICAL METAL STAND FOR COMEX DELIVERY AS WELL WE ARE WITNESSING CONSIDERABLE LONGS PACKING THEIR BAGS AND MIGRATING OVER TO LONDON IN GREATER NUMBERS IN THE FORM OF EFP’S. WE WERE NOTIFIED THAT WE HAD A GOOD SIZED NUMBER OF COMEX LONGS TRANSFERRING THEIR CONTRACTS TO LONDON THROUGH THE EFP:

0 FOR MAY, 0 FOR JUNE, 1163 FOR JULY AND ZERO FOR ALL OTHER MONTHS AND THEREFORE TOTAL ISSUANCE 1163 CONTRACTS. WITH THE TRANSFER OF 1163 CONTRACTS, WHAT THE CME IS STATING IS THAT THERE IS NO SILVER (OR GOLD) TO BE DELIVERED UPON AT THE COMEX AS THEY MUST EXPORT THEIR OBLIGATION TO LONDON. ALSO KEEP IN MIND THAT THERE CAN BE A DELAY OF 24-48 HRS IN THE ISSUING OF EFP’S. THE 1163 EFP CONTRACTS TRANSLATES INTO 5.82 MILLION OZ ACCOMPANYING:

1.THE 2 CENT FALL IN SILVER PRICE AT THE COMEX AND

2. THE STRONG AMOUNT OF SILVER OUNCES WHICH STOOD FOR DELIVERY IN THE LAST NINE MONTHS:

JUNE/2018. (5.420 MILLION OZ);

FOR JULY: 30.370 MILLION OZ

FOR AUG., 6.065 MILLION OZ

FOR SEPT. 39.505 MILLION OZ S

FOR OCT.2.525 MILLION OZ.

FOR NOV: A HUGE 7.440 MILLION OZ STANDING AND

21.925 MILLION OZ FINALLY STAND FOR DECEMBER.

5.845 MILLION OZ STAND IN JANUARY.

2.955 MILLION OZ STANDING FOR FEBRUARY.:

27.120 MILLION OZ STANDING IN MARCH.

3.875 MILLION OZ STANDING FOR SILVER IN APRIL.

AND NOW 18.335 MILLION OZ STANDING FOR SILVER IN MAY.

ACCUMULATION FOR EFP’S/SILVER/J.P.MORGAN’S HOUSE OF BRIBES, / STARTING FROM FIRST DAY NOTICE/FOR MONTH OF MAY:

12,868 CONTRACTS (FOR 10 TRADING DAYS TOTAL 12,868 CONTRACTS) OR 64,34 MILLION OZ: (AVERAGE PER DAY: 1260 CONTRACTS OR 6.30 MILLION OZ/DAY)

TO GIVE YOU AN IDEA AS TO THE HUGE SUPPLY THIS MONTH IN SILVER: SO FAR THIS MONTH OF MAY: 64,34 MILLION PAPER OZ HAVE MORPHED OVER TO LONDON. THIS REPRESENTS AROUND 9.19% OF ANNUAL GLOBAL PRODUCTION (EX CHINA EX RUSSIA)* JUNE’S 345.43 MILLION OZ IS THE SECOND HIGHEST RECORDED ISSUANCE OF EFP’S AND IT FOLLOWED THE RECORD SET IN APRIL 2018 OF 385.75 MILLION OZ.

ACCUMULATION IN YEAR 2019 TO DATE SILVER EFP’S: 805.44 MILLION OZ.

JANUARY 2019 EFP TOTALS: 217.455. MILLION OZ

FEB 2019 TOTALS: 147.4 MILLION OZ/

MARCH 2019 TOTAL EFP ISSUANCE: 207.835 MILLION OZ

APRIL 2019 TOTAL EFP ISSUANCE: 182.87 MILLION OZ.

RESULT: WE HAD A CONSIDERABLE SIZED INCREASE IN COMEX OI SILVER COMEX CONTRACTS OF 1934 WITH THE TINY 2 CENT FALL IN SILVER PRICING AT THE COMEX /YESTERDAY... THE CME NOTIFIED US THAT WE HAD A GOOD SIZED EFP ISSUANCE OF 1164 CONTRACTS WHICH EXITED OUT OF THE SILVER COMEX AND TRANSFERRED THEIR OI TO LONDON AS FORWARDS. SPECULATORS CONTINUED THEIR INTEREST IN ATTACKING THE SILVER COMEX FOR PHYSICAL SILVER (SEE COMEX DATA) . OUR BANKERS RESUMED THEIR LIQUIDATION OF THE SPREAD TRADES TODAY.

TODAY WE GAINED A STRONG SIZED: 3097 TOTAL OI CONTRACTS ON THE TWO EXCHANGES:

i.e 1163 OPEN INTEREST CONTRACTS HEADED FOR LONDON (EFP’s) TOGETHER WITH INCREASE OF 1934 OI COMEX CONTRACTS. AND ALL OF THIS DEMAND HAPPENED WITH A 2 CENT FALL IN PRICE OF SILVER AND A CLOSING PRICE OF $14.77 WITH RESPECT TO YESTERDAY’S TRADING. YET WE STILL HAVE A STRONG AMOUNT OF SILVER STANDING AT THE COMEX FOR DELIVERY!!

In ounces AT THE COMEX, the OI is still represented by JUST OVER 1 BILLION oz i.e. 1.020 BILLION OZ TO BE EXACT or 145% of annual global silver production (ex Russia & ex China).

FOR THE NEW FRONT MARCH MONTH/ THEY FILED AT THE COMEX: 13 NOTICE(S) FOR 65,000 OZ OF SILVER

IN SILVER,PRIOR TO TODAY, WE SET THE NEW COMEX RECORD OF OPEN INTEREST AT 243,411 CONTRACTS ON APRIL 9.2018. AND AGAIN THIS HAS BEEN SET WITH A LOW PRICE OF $16.51.

AND NOW WE RECORD FOR POSTERITY ANOTHER ALL TIME RECORD OPEN INTEREST AT THE COMEX OF 244,196 CONTRACTS ON AUGUST 22/2018 AND AGAIN WHEN THIS RECORD WAS SET, THE PRICE OF SILVER WAS $14.78 AND LOWER IN PRICE THAN PREVIOUS RECORDS.

ON THE DEMAND SIDE WE HAVE THE FOLLOWING:

HUGE AMOUNTS OF SILVER STANDING FOR DELIVERY (MARCH/2018: 27 MILLION OZ , APRIL/2018 : 2.485 MILLION OZ MAY: 36.285 MILLION OZ ; JUNE/2018 (5.420 MILLION OZ) , JULY 2018 FINAL AMOUNT STANDING: 30.370 MILLION OZ ) FOR AUGUST 6.065 MILLION OZ. , SEPT: A HUGE 39.505 MILLION OZ./ OCTOBER: 2,520,000 oz NOV AT 7.440 MILLION OZ./ DEC. AT 21.925 MILLION OZ JANUARY AT 5.825 MILLION OZ.AND FEB 2019: 2.955 MILLION OZ/ MARCH: 27.120 MILLION OZ/ APRIL AT 3.875 MILLION OZ/ AND NOW MAY: 18.335 MILLION OZ ..

HUGE RECORD OPEN INTEREST IN SILVER 243,411 CONTRACTS (OR 1.217 BILLION OZ/ SET APRIL 9/2018) AND NOW AUGUST 22/2018: 244,196 CONTRACTS, WITH A SILVER PRICE OF $14.78.

HUGE ANNUAL EFP’S ISSUANCE EQUAL TO 2.9 BILLION OZ OR 400% OF SILVER ANNUAL PRODUCTION/2017

RECORD SETTING EFP ISSUANCE FOR ANY MONTH IN SILVER; APRIL/2018/ 385.75 MILLION OZ/ AND THE SECOND HIGHEST RECORDED EFP ISSUANCE JUNE 2018 345.43 MILLION OZ

AND YET, WITH THE EXTREMELY HIGH EFP ISSUANCE, WE HAVE A CONTINUAL LOW PRICE OF SILVER DESPITE THE ABOVE HUGE DEMAND. TO ME THE ONLY ANSWER IS THAT WE HAVE SOVEREIGN (CHINA) WHO IS ENDEAVOURING TO GOBBLE UP ALL AVAILABLE PHYSICAL SILVER NO MATTER WHERE, EXACTLY WHAT J.P.MORGAN IS DOING. AND IT IS MY BELIEF THAT J.P.MORGAN IS HOLDING ITS SILVER FOR ITS BENEFICIAL OWNER..THE USA GOVERNMENT WHO IN TURN IS HOLDING THAT SILVER FOR CHINA.(FOR A SILVER LOAN REPAYMENT).

IN GOLD, THE OPEN INTEREST ROSE BY A CRIMINALLY SIZED 31,765 CONTRACTS, TO 520,485 WITH THE STRONG RISE IN THE COMEX GOLD PRICE/(AN INCREASE IN PRICE OF $15,25//YESTERDAY’S TRADING).

THE CME RELEASED THE DATA FOR EFP ISSUANCE AND IT TOTALED A HUGE SIZED 9488 CONTRACTS:

APRIL 0 CONTRACTS,JUNE: 9488 CONTRACTS DECEMBER: 0 CONTRACTS, JUNE 2020 0 CONTRACTS AND ALL OTHER MONTHS ZERO. The NEW COMEX OI for the gold complex rests at 520,485. ALSO REMEMBER THAT THERE WILL BE A DELAY IN THE ISSUANCE OF EFP’S. THE BANKERS REMOVE LONG POSITIONS OF COMEX GOLD IMMEDIATELY. THEN THEY ORCHESTRATE THEIR PRIVATE EFP DEAL WITH THE LONGS AND THAT COULD TAKE AN ADDITIONAL, 48 HRS SO WE GENERALLY DO NOT GET A MATCH WITH RESPECT TO DEPARTING COMEX LONGS AND NEW EFP LONG TRANSFERS. . EVEN THOUGH THE BANKERS ISSUED THESE MONSTROUS EFPS, THE OBLIGATION STILL RESTS WITH THE BANKERS TO SUPPLY METAL BUT IT TRANSFERS THE RISK TO A LONDON BANKER OBLIGATION AND NOT A NEW YORK COMEX OBLIGATION. LONGS RECEIVE A FIAT BONUS TOGETHER WITH A LONG LONDON FORWARD. THUS, BY THESE ACTIONS, THE BANKERS AT THE COMEX HAVE JUST STATED THAT THEY HAVE NO APPRECIABLE METAL!! THIS IS A MASSIVE FRAUD: THEY CANNOT SUPPLY ANY METAL TO OUR COMEX LONGS BUT THEY ARE QUITE WILLING TO SUPPLY MASSIVE NON BACKED GOLD (AND SILVER) PAPER KNOWING THAT THEY HAVE NO METAL TO SATISFY OUR LONGS. LONDON IS NOW SEVERELY BACKWARD IN BOTH GOLD AND SILVER AND WE ARE WITNESSING DELAYS IN ACTUAL DELIVERIES.

IN ESSENCE WE HAVE AN ATMOSPHERIC AND CRIMINALLY SIZED GAIN IN TOTAL CONTRACTS ON THE TWO EXCHANGES OF 41,253 CONTRACTS: 31,765 OI CONTRACTS INCREASED AT THE COMEX AND 9488 EFP OI CONTRACTS WHICH NAVIGATED OVER TO LONDON. THUS TOTAL OI GAIN OF 41,253 CONTRACTS OR 4,125,300 OZ OR 128,31 TONNES. YESTERDAY WE HAD A GAIN IN THE PRICE OF GOLD TO THE TUNE OF $15,25….AND WITH THAT STRONG RISE, WE HAD AN UNBELIEVABLE GAIN OF 128.31 TONNES!!!!!!.??????

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES:

“AS YOU WILL SEE, THE CROOKS HAVE NOW SWITCHED TO GOLD AS THEY INCREASE THE OPEN INTEREST FOR THE SPREADERS. THE TOTAL COMEX GOLD OPEN INTEREST WILL RISE FROM NOW ON UNTIL ONE WEEK PRIOR TO FIRST DAY NOTICE AND THAT IS WHEN THEY START THEIR CRIMINAL LIQUIDATION.

HERE IS HOW THE CROOKS USED SPREADING AS WE ARE NO INTO THE NON ACTIVE DELIVERY MONTH OF MAY HEADING TOWARDS THE VERY ACTIVE DELIVERY MONTH OF JUNE.

AS I HAVE MENTIONED IN PREVIOUS COMMENTARIES, HERE IS THE BANKERS MODUS OPERANDI:

YOU WILL ALSO NOTICE THAT THE COMEX OPEN INTEREST IS STARTING TO RISE IN THIS NON ACTIVE MONTH OF MAY BUT SO IS THE OPEN INTEREST OF SPREADERS. THE OPEN INTEREST IN GOLD WILL CONTINUE TO RISE UNTIL ONE WEEK BEFORE FIRST DAY NOTICE OF AN UPCOMING ACTIVE DELIVERY MONTH (JUNE), AND THAT IS WHEN THE CROOKS SELL THEIR SPREAD POSITIONS BUT NOT AT THE SAME TIME OF THE DAY. THEY WILL USE THE SELL SIDE OF THE EQUATION TO CREATE THE CASCADE (ALONG WITH THEIR COLLUSIVE FRIENDS) AND THEN COVER ON THE BUY SIDE OF THE SPREAD SITUATION AT THE END OF THE DAY. THEY DO THIS TO AVOID POSITION LIMIT DETECTION. THE LIQUIDATION OF THE SPREADING FORMATION CONTINUES FOR EXACTLY ONE WEEK AND ENDS ON FIRST DAY NOTICE.”

ACCUMULATION OF EFP’S GOLD AT J.P. MORGAN’S HOUSE OF BRIBES: (EXCHANGE FOR PHYSICAL) FOR THE MONTH OF MAY : 59,969 CONTRACTS OR 5,996,900 OR 186.52 TONNES (10 TRADING DAYS AND THUS AVERAGING: 5997 EFP CONTRACTS PER TRADING DAY

TO GIVE YOU AN IDEA AS TO THE STRONG SIZE OF THESE EFP TRANSFERS : THIS MONTH IN 10 TRADING DAYS IN TONNES: 186.52 TONNES

TOTAL ANNUAL GOLD PRODUCTION, 2018, THROUGHOUT THE WORLD EX CHINA EX RUSSIA: 3555 TONNES

THUS EFP TRANSFERS REPRESENTS 186.52/3550 x 100% TONNES =5,25% OF GLOBAL ANNUAL PRODUCTION SO FAR IN DECEMBER ALONE.***

ACCUMULATION OF GOLD EFP’S YEAR 2019 TO DATE: 2002.08 TONNES

JANUARY 2019 TOTAL EFP ISSUANCE; 531.20 TONNES

FEB 2019 TOTAL EFP ISSUANCE: 344.36 TONNES

MARCH 2019 TOTAL EFP ISSUANCE: 497.16 TONNES

APRIL 2019 TOTAL ISSUANCE: 456.10 TONNES

WHAT IS ALARMING TO ME, ACCORDING TO OUR LONDON EXPERT ANDREW MAGUIRE IS THAT THESE EFP’S ARE BEING TRANSFERRED TO WHAT ARE CALLEDRIAL FORWARD CONTRACT OBLIGATIONS AND THESE CONTRACTS ARE LESS THAN 14 DAYS. ANYTHING GREATER THAN 14 DAYS, THESE MUST BE RECORDED AND SENT TO THE COMPTROLLER, GREAT BRITAIN TO MONITOR RISK TO THE BANKING SYSTEM. IF THIS IS INDEED TRUE, THEN THIS IS A MASSIVE CONSPIRACY TO DEFRAUD AS WE NOW WITNESS A MONSTROUS TOTAL EFP’S ISSUANCE AS IT HEADS INTO THE STRATOSPHERE.

Result: AN ATMOSPHERIC SIZED INCREASE IN OI AT THE COMEX OF 31,765 WITH THE STRONG RISE IN PRICING ($15.25) THAT GOLD UNDERTOOK YESTERDAY) //.WE ALSO HAD A STRONG SIZED NUMBER OF COMEX LONG TRANSFERRING TO LONDON THROUGH THE EFP ROUTE: 9488 CONTRACTS AS THESE HAVE ALREADY BEEN NEGOTIATED AND CONFIRMED. THERE OBVIOUSLY DOES NOT SEEM TO BE MUCH PHYSICAL GOLD AT THE COMEX. I GUESS IT EXPLAINS THE HUGE ISSUANCE OF EFP’S…THERE IS HARDLY ANY GOLD PRESENT AT THE GOLD COMEX FOR DELIVERY PURPOSES. IF YOU TAKE INTO ACCOUNT THE 9488 EFP CONTRACTS ISSUED, WE HAD AN ATMOSPHERIC AND CRIMINALLY SIZED GAIN OF 41,253 CONTRACTS IN TOTAL OPEN INTEREST ON THE TWO EXCHANGES:

9488 CONTRACTS MOVE TO LONDON AND 31,765 CONTRACTS INCREASED AT THE COMEX. (IN TONNES, THE GAIN IN TOTAL OI EQUATES TO 128,31 TONNES). ..AND THIS HUGE DEMAND OCCURRED WITH A STRONG RISE IN PRICE OF $15.25 IN YESTERDAY’S TRADING AT THE COMEX. NO DOUBT THAT A STRONG PERCENTAGE OF OI GAIN WAS DUE TO THE CONTINUING OF THE SPREADING OPERATION AS I HAVE OUTLINED ABOVE.

we had: 43 notice(s) filed upon for 4300 oz of gold at the comex.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx

With respect to our two criminal funds, the GLD and the SLV:

GLD...

WITH GOLD DOWN $5.45 TODAY

THE FOLLOWING MAKES A LOT OF SENSE:

A MASSIVE DEPOSIT OF 3.23 TONNES OF GOLD

INVENTORY RESTS AT 733.23 TONNES

TO ALL INVESTORS THINKING OF BUYING GOLD THROUGH THE GLD ROUTE: YOU ARE MAKING A TERRIBLE MISTAKE AS THE CROOKS ARE USING WHATEVER GOLD COMES IN TO ATTACK BY SELLING THAT GOLD. IT SURE SEEMS TO ME THAT THE GOLD OBLIGATIONS AT THE GLD EXCEED THEIR INVENTORy

SLV/

WITH SILVER UP 2 CENTS TODAY:

NO CHANGE IN SILVER INVENTORY AT THE SLV//

/INVENTORY RESTS AT 316.582 MILLION OZ.

end

First, here is an outline of what will be discussed tonight:

1. Today, we had the open interest in SILVER ROSE BY A CONSIDERABLE SIZED 1934 CONTRACTS from 201,956 UPTO 203,890 AND CLOSER TO THE NEW COMEX RECORD SET LAST IN AUG.2018 AT 244,196 WITH A SILVER PRICE OF $14.78/(AUGUST 22/2018)..THE PREVIOUS RECORD WAS SET ON APRIL 9/2018 AT 243,411 OPEN INTEREST CONTRACTS WITH THE SILVER PRICE AT THAT DAY: $16.53). AND PREVIOUS TO THAT, THE RECORD WAS ESTABLISHED AT: 234,787 CONTRACTS, SET ON APRIL 21.2017 OVER 1 1/3 YEARS AGO. THE PRICE OF SILVER ON THAT DAY: $17.89. AS YOU CAN SEE, WE HAVE RECORD HIGH OPEN INTERESTS IN SILVER ACCOMPANIED BY A CONTINUAL LOWER PRICE WHEN THAT RECORD WAS SET…..THE SPREADERS HAVE STOPPED THEIR LIQUIDATION IN SILVER BUT HAVE NOW MORPHED INTO GOLD..

EFP ISSUANCE:

OUR CUSTOMARY MIGRATION OF COMEX LONGS CONTINUE TO MORPH INTO LONDON FORWARDS AS OUR BANKERS USED THEIR EMERGENCY PROCEDURE TO ISSUE:

0 CONTRACTS FOR APRIL., 0 FOR MAY, FOR JUNE 0 CONTRACTS AND JULY: 1163 CONTRACTS AND ALL OTHER MONTHS: ZERO. TOTAL EFP ISSUANCE: 1163 CONTRACTS. EFP’S GIVE OUR COMEX LONGS A FIAT BONUS PLUS A DELIVERABLE PRODUCT OVER IN LONDON. IF WE TAKE THE OI GAIN AT THE COMEX OF 1934 CONTRACTS TO THE 1163 OI TRANSFERRED TO LONDON THROUGH EFP’S, WE OBTAIN A STRONG GAIN OF 3097 OPEN INTEREST CONTRACTS. THUS IN OUNCES, THE GAIN ON THE TWO EXCHANGES: 15.455 MILLION OZ!!! AND YET WE ALSO HAVE A STRONG DEMAND FOR PHYSICAL AS WE WITNESSED A FINAL STANDING OF GREATER THAN 30 MILLION OZ FOR JULY, A STRONG 7.475 MILLION OZ FOR AUGUST.. A HUGE 39.505 MILLION OZ STANDING FOR SILVER IN SEPTEMBER… OVER 2 million OZ STANDING FOR THE NON ACTIVE MONTH OF OCTOBER., 7.440 MILLION OZ FINALLY STANDING IN NOVEMBER. 21.925 MILLION OZ STANDING IN DECEMBER , 5.845 MILLION OZ STANDING IN JANUARY. 2.955 MILLION OZ STANDING IN FEBRUARY, 27.120 MILLION OZ FOR MARCH., 3.875 MILLION OZ FOR APRIL AND NOW 18.335 MILLION OZ FOR MAY

RESULT: A CONSIDERABLE SIZED INCREASE IN SILVER OI AT THE COMEX DESPITE THE TINY 2 CENT LOSS IN PRICING THAT SILVER UNDERTOOK IN PRICING// YESTERDAY. WE ALSO HAD A GOOD SIZED 1163 EFP’S ISSUED TRANSFERRING COMEX LONGS OVER TO LONDON. TOGETHER WITH THE STRONG SIZED AMOUNT OF SILVER OUNCES STANDING FOR THIS MONTH, DEMAND FOR PHYSICAL SILVER CONTINUES TO INTENSIFY AS WE WITNESS SEVERE BACKWARDATION IN SILVER IN LONDON.

BOTH THE SILVER COMEX AND THE GOLD COMEX ARE IN STRESS AS THE BANKERS SCOUR THE BOWELS OF THE EXCHANGE FOR METAL

(report Harvey)

.

2.a) The Shanghai and London gold fix report

(Harvey)

2 b) Gold/silver trading overnight Europe, Goldcore

(Mark O’Byrne/zerohedge

and in NY: Bloomberg

3. ASIAN AFFAIRS

)TUESDAY MORNING/ MONDAY NIGHT:

SHANGHAI CLOSED DOWN 20.10 POINTS OR 0.69% //Hang Sang CLOSED DOWN 428.22 POINTS OR 1.50% /The Nikkei closed DOWN 124.55 POINTS OR 0.59%//Australia’s all ordinaires CLOSED DOWN .85%

/Chinese yuan (ONSHORE) closed DOWN at 6.8816 /Oil UP to 61.64 dollars per barrel for WTI and 71.08 for Brent. Stocks in Europe OPENED GREEN// ONSHORE YUAN CLOSED DOWN // LAST AT 6.9068 AGAINST THE DOLLAR. OFFSHORE YUAN CLOSED DOWN ON THE DOLLAR AT 6.8816 TRADE TALKS STILL ON//TRUMP INITIATES A NEW 25% TARIFFS FRIDAY/MAY 10/MAJOR PROBLEMS AT HUAWEI /CFO ARRESTED : /ONSHORE YUAN TRADING ABOVE LEVEL OF OFFSHORE YUAN/ONSHORE YUAN TRADING WEAKER AGAINST USA DOLLAR/OFFSHORE YUAN TRADING WEAKER AGAINST THE DOLLAR /TRADE DEAL NOW DEAD..TRUMP THREATENS TO RAISE RATES TO 25%

3A//NORTH KOREA/ SOUTH KOREA

i)NORTH KOREA

b) REPORT ON JAPAN

3 China/Chinese affairs

i)China/USA/

Jeffrey Snider outlines the warning signs that we must be cognizant of: the low price of copper, the higher yen values, and lower CNY exchange and the scarcity of dollars floating around the globe: all indicators of a massive global slowdown. He states that we should not pay any attempt to the Chinese threatening to dump dollars

( Jeffrey Snider/Alhambra Investment Partners)

ii)Although both Trump and Chinese leaders toned down the rhetoric today which caused the European and USA markets to rise, the Chinese media seem very upset with the USA. They are calling for a people’s war against the USA and vowing to fight for a “New World”

( zerohedge)

4/EUROPEAN AFFAIRS

i)ITALY

Again, Salvini aggravates Brussels: this time Italy declares wars on boats rescuing immigrants

( zero hedge)

ii)The war between Salvini and Brussels intensifies as our Italian’s defacto leader is now willing to break EU budget rules.

( zerohedge)

5. RUSSIAN AND MIDDLE EASTERN AFFAIRS

Turkey

A little background to this story: Israel made this very big discovery of natural gas and some oil off its coast several years ago. They knew that the discovery was heading onto Cyprus and told sovereign Cyprus on the nature of that discovery. You will recall that Cyprus had a civil war in 1974 between Greece and Turkey whereby an armistice was established in that Northern Cyprus would be governed by Turkish Cypriots and the rest of the country by Greek Cypriots. The capital Nicosia would be under control of Greek Cypriots. Turkey never recognized the Greek overthrow of Cyprus and now that a massive amount of gas has been discovered and badly needed by Turkey, you can now see why Turkey is ready to go to war over this.

( zerohedge)

6. GLOBAL ISSUES

Cuba

Crisis begins in Cuba as there is widespread rationing of food: so much for socialism

( zerohedge)

7. OIL ISSUES

8 EMERGING MARKET ISSUES

VENEZUELA

9. PHYSICAL MARKETS

I)Slowly and surely many nations are moving away from the dollar. Today we find that Asian leaders are adding Chinese yuan and Japanese yen to the reserve buffers

( South China Morning post/GATA)

ii)Mike Kosares posts his views on gold/silver in this May report which is now in the open

( USA Gold/Mike Kosares)

iii)This is deadly as James Turk claims that counter party risk (credit default swaps) are rising fast and that should be good for gold.

(James Turk/GATA)

iv)A slow down in gold demand from China last month coming in at 151.89 tonnes. It will improve next month.

( Lawrie Williams)

v)Lawrie Williams tackles the USA China trade war with respect to gold With respect to who will win the war between the USA and China it is up in the air. Williams thinks that China will win.( Lawrie Williams)

10. USA stories which will influence the price of gold/silver)

MARKET TRADING//

ii)Market data

this is not what the Fed wants to see: USA import, export prices disappoint as China’s deflationary impulse hits a 12 year low

In a nutshell, China is sending deflation throughout the globe due to its excess capacity

( zerohedge)

ii)USA ECONOMIC/GENERAL STORIES

USA/China

a)USA posts details on the 300 billion dollars of remaining goods to be tariffed.

( zerohedge)

b)A USA trade official states that a trade deal is not even close: It could be in for a long trade war with China.

( zerohedge)

c)Another indicator that the trade deal is a long way off: Trump: “we will make a deal with China when the time is right”

( zerohedge)

d)This is one of the big casualties of the trade war: soybean prices crash to decade lows.

( zerohedge)

e)It looks like Boeing will need to shell out over one billion dollars for those doomed 737 Max passengers(courtesy zerohedge)

SWAMP STORIES

a)Barr selects apolitical Attorney John Durham, a non nonsense fellow to head the investigation into FBI/DOJ spying. He has also investigated the FBI before

( zero hedge)

b)Rosenstein slams Comey. Grab your popcorn on this;

( zerohedge)

c)Clapper is nervous; he now claims: “we don’t need another investigation of the investigators”. I wonder why he thinks that

( zerohedge)

E)SWAMP STORIES/MAJOR STORIES//THE KING REPORT

Let us head over to the comex:

THE TOTAL COMEX GOLD OPEN INTEREST ROSE BY A HUMONGOUS AND CRIMINALLY SIZED 31,765 CONTRACTS.TO A LEVEL OF 520,485 WITH THE STRONG GAIN IN THE PRICE OF GOLD ($15.25) IN YESTERDAY’S // COMEX TRADING)