Monday, January 14, 2019 1:30:57 PM

3.30 +0.14 (+4.43%) 13:07 ET [TSX]

BARCHART OPINION for Mon, Jan 14th, 2019 Alerts Watch Help

Overall Average:

96% BUY

Overall Average Signal calculated from all 13 indicators.

Signal Strength is a long-term measurement of the historical

strength of the Signal, while Signal Direction is a

short-term (3-Day) measurement of the movement of the Signal.

https://www.barchart.com/stocks/quotes/GCM.TO/opinion

Gran Colombia Gold Corp. (TPRFF)(TSE:GCM) strong hike back UP -

I like to see old time shareholders to make a fair return on their

investments -

ex.

https://www.barchart.com/stocks/quotes/GCM.TO/technical-chart?plot=BAR&volume=total&data=WO&density=X&pricesOn=1&asPctChange=0&logscale=0&sym=GCM.TO&grid=1&height=500&studyheight=100

GCM making a strong hike back UP and its more earnings, profits, assets

and gold reserve than when GCM traded @ >$50.-/shares so with fairness

GCM will pass the previous high share prices *~<

Gran Colombia Gold Corp. (TSX: GCM): Largest Underground Gold and Silver Producer in Colombia, Improved Balance Sheet, Reduced Debt, and Increased Cash Balance; Interview with Mike Davies, CFO

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/7/2018

http://www.metalsnews.com/t1247359i

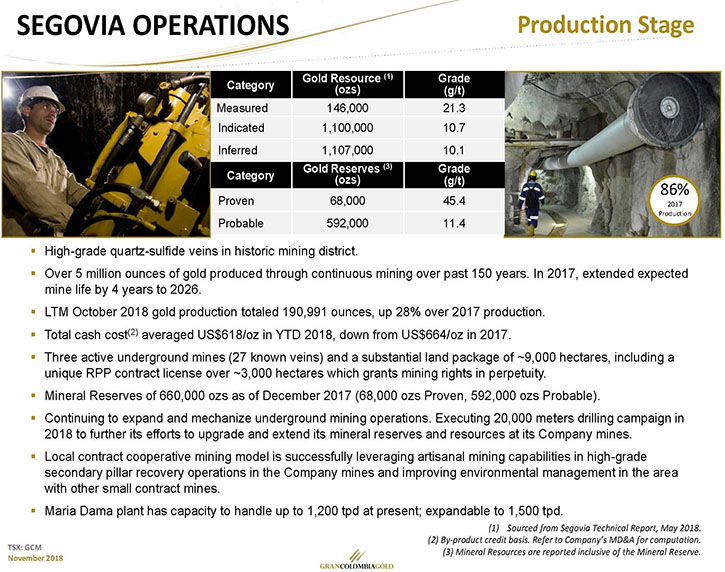

Gran Colombia Gold Corp. (TSX: GCM) is currently the largest underground

gold and silver producer in Colombia,

with several underground mines in operation at its

Segovia and Marmato properties.

The company's 2018 gold production is expected

to surpass 210,000 ounces.

We learned from Mike Davies, the CFO of Gran Colombia,

that the high grade Segovia operations were recognized as

one of the top five highest grade underground mining operations

globally in 2017, and this year they have increased production

over 20 percent compared to the same time in 2017.

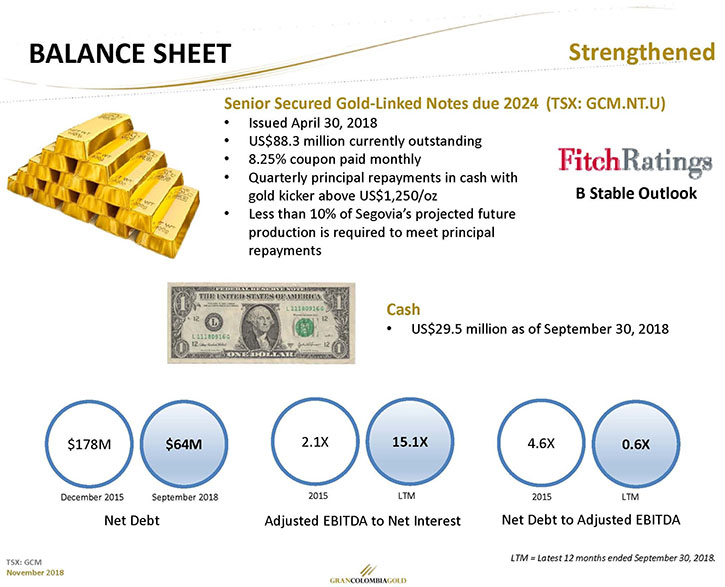

According to Mr. Davies, the Company was able to

improve their balance sheet, reduce debt, and

increase cash balance up to $29.5 million.

With its experienced management team and continued focus on

exploration, expansion and modernization activities,

Gran Colombia Gold is the mid-tier gold miner at a "junior" price.

Gran Colombia Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Davies, CFO of Gran Colombia Gold. You certainly had a great third quarter and a great first nine months in 2018. Could you give our readers/investors an overview of Gran Colombia Gold and highlight your great accomplishments in 2018.

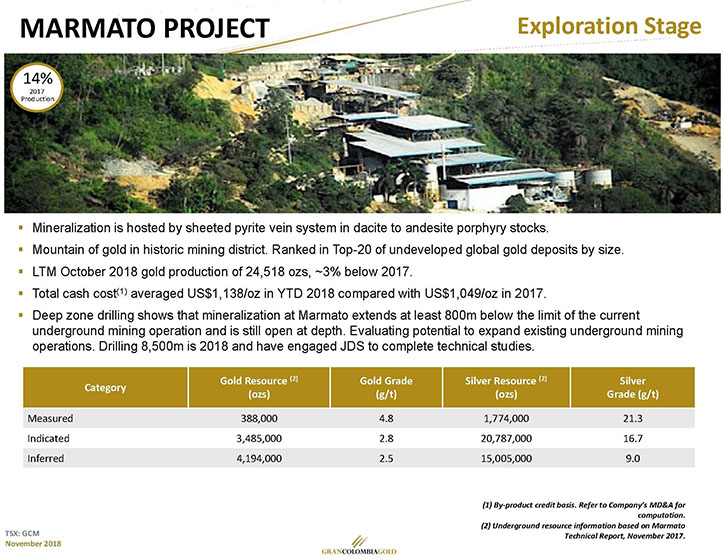

Mike Davies: Sure, thanks Allen. Gran Colombia is the largest producer of gold and silver in Colombia. We are operating from two properties. Our largest, our flagship property is our Segovia operations in the Antioquia Belt north of Medellin. We also have a 100 percent ownership of the Marmato Project, also near Medellin, where we have a small mine that does about 11 percent of our production. We have a third project called Zancudo, which is currently under option to IAMGOLD. They are drilling the project and we released some results in October from their program so far, which looks fairly encouraging.

The third quarter continued to show the continuous improvement in our results that we've been reporting over the last couple of years, as we continue to execute our strategy, which at the moment is largely centered on the high grade Segovia operations. They were recognized earlier this year as one of the top five highest grade underground mining operations globally in 2017 and they've continued to perform much the same way.

Production in the third quarter reached 57,000 ounces for the total company, of which 51,000 ounces came from Segovia. It's the fourth consecutive quarter that we've produced over 50,000 ounces of gold and that brings our trailing 12 months gold production, as of the end of October, to 215,000 ounces this year. So we are up over 20 percent in total production on a rolling 12 month basis compared to where we were in 2017. We're currently calling our production guidance for 2018's annual numbers, between 214,000 and 220,000 ounces.

Our cash cost for the third quarter was $657 an ounce for the company, bringing our nine month number to $674 an ounce and our all-in sustaining cost, for the third quarter and the nine months, was just under $900 an ounce. Our adjusted EBITDA has been one of the biggest beneficiaries of the improved operating results we've seen in the last couple of years. In the third quarter, we did $24.7 million of adjusted EBITDA which brings our nine month total, at the end of September, to $78.7 million.

Our trailing 12 month (TTM) EBITDA at the end of September, has now reached $105 million. That's well over 60 percent higher than where we were in 2017. It's all been predicated on focusing on the high grade veins where we're operating in Segovia and continuing to modernize and mechanize the operations to continue performing this way for the next foreseeable future.

Dr. Allen Alper: Excellent results. That's really great news for your company and your investors.

Mike Davies: Yes. When we look back in history, from where we were in 2014, we're producing more than two times what we did in production back then by focusing on the program at Segovia. More importantly, our capacity to generate cash, has grown significantly from somewhere around the $10 to $11 million annual EBITBA back in 2014 to now over $100 million now. Even with the current gold environment, significant capacity to fund the ongoing exploration, development and capital investment that we're making in our operations, we're spending probably about a third of our EBITDA on those programs and that's teeing us up for continuing to operate in a safe, environmentally friendly and more cost efficient matter, as we move ahead with our model.

Dr. Allen Alper: That's excellent. Could you say a little bit about your balance sheet?

Mike Davies: Certainly, the balance sheet has been the other area of significant improvement in 2018. The key catalyst for the balance sheet improvement was a debt offering that we completed back in April of Gold Linked Notes. They're listed now on the TSX under the symbol GCM.NT.U. We use the net proceeds from that offering to refinance some convertible debt that we had in place since 2016, which was plaguing our shareholder base because of the potential for some pretty significant dilution.

We replaced it with the gold notes as the markets improved this year. The other thing that we did in August, when our junior convertible debts, the ones maturing in 2018 came due, we settled the balance of them 100 percent with shares, as we are allowed to do under the indenture. We increased our share count to 48 million shares. We have another 12 million warrants exercisable at CA$2.21 that are also listed on the TSX, under the symbol GCM.WT.B. So our fully diluted share account, also including stock options, right now is around 63 million shares.

Our debt after the recent repayment of the gold notes at the end of October is now down to $88 dollars. That's less than 50 percent of where it was two years ago. And the biggest thing that we've added to this year is our cash balance. Our cash balance at the end of September had gone up to $29.5 million. We were sitting at $3.3 million at the end of December 2017. We're very pleased with the strengthening of our balance sheet and the simplification of our capital structure, we were able to achieve this year.

Dr. Allen Alper: That's excellent work. That's really a great accomplishment for Gran Colombia Gold. Could you refresh the memory of our readers/investors and say a little bit about your backgrounds and main achievements?

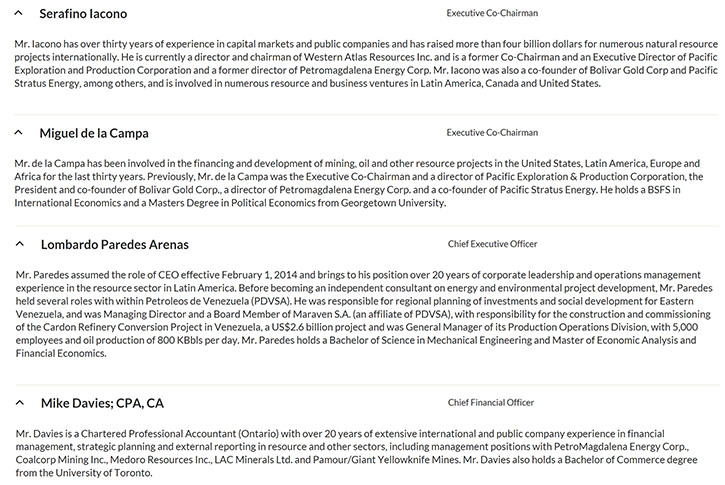

Mike Davies: Our founders, Serafino Iacono and Miguel de la Campa, two entrepreneurial investors who've been involved in a number of businesses in Colombia for more than the past decade, were responsible for bringing Gran Colombia to life in 2010 and continue to be very involved in the business. Serafino Iacono is one of the larger shareholders and debt holders in Gran Colombia. He puts his money into the investments which he runs, so he's fully aligned with our shareholders and debt holders in terms of creating wealth for everybody.

Our CEO is Lombardo Paredes. He's of Venezuelan background. He's been responsible for a number of large scale projects in the resource space and is currently the key driver behind the execution of our operational turn-around the last couple of years. He's led the operating teams through the expansion processes and continues to keep a pretty good handle on our operating costs. I'm a CPA by background and I've worked with Serafino and his partners for the last 11 years as we've opened up businesses in Colombia.

We had a pretty good track run through the last couple of years of bringing the story of Gran Colombia to version 2.0, where we've given it a brand new life and it's performing well.

Dr. Allen Alper: That's a great team. The team has skin in the game and also has given great results to their shareholders. That's excellent. Could you tell me what some of the key objectives are for 2019?

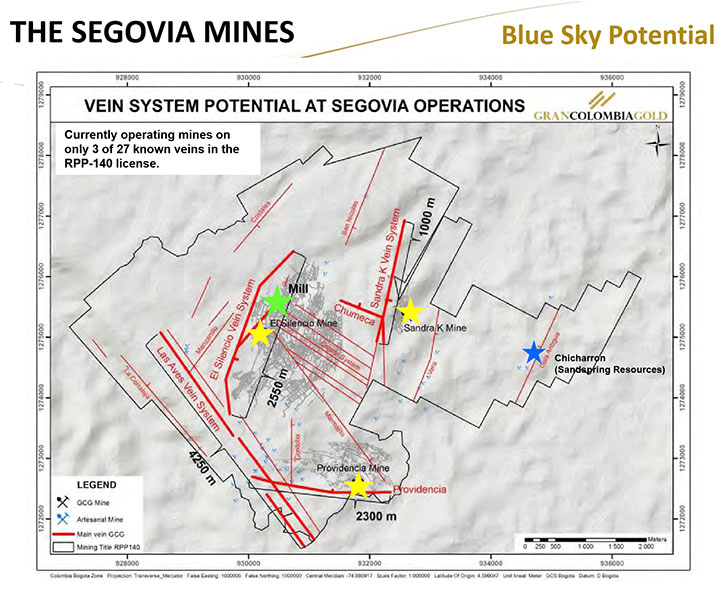

Mike Davies: We're still in the process of fine tuning our guidance for 2019, so haven't provided guidance yet. But I wouldn't expect that you'll see us drop off in production next year. I think it will be another year that looks similar to this one in terms of production. As far as our investment in our projects, in our cash cost and all-in sustaining cost, I also don't see dramatic change from where we've been this year. It's going to be a continuation of the strategy. Continuing to focus on Segovia, first and foremost.

We'll probably see a little bit more of our exploration spending, a bigger proportion devoted to it. We have 24 other veins in the Segovia title that we own that have past production, but which we are not currently mining and on which we have not done a lot of exploration. We're now starting to move from in-fill drilling to step-out drilling, looking for those next mines of the future, that we believe are out there.

We'll continue to work on the underground expansion studies at Marmato next year. We're doing some drilling right now. Based on the results we get by the end of the year, we'll decide about the program. We're hoping to get a PEA done next year on the Marmato underground expansion. And continuing to yield the metrics that got us to where we are this year, including a recent upgrade in our Fitch rating from a B-minus to a B, which was announced in October. Fitch was pleased with our capital structure improvement and the improvement in our balance sheet and the focus on our efforts to generate cash flows from Segovia controlling costs and maintaining operational efficiency. We have continued to be committed to doing the same next year to maintain that rating and see where we go with certain of our other interests.

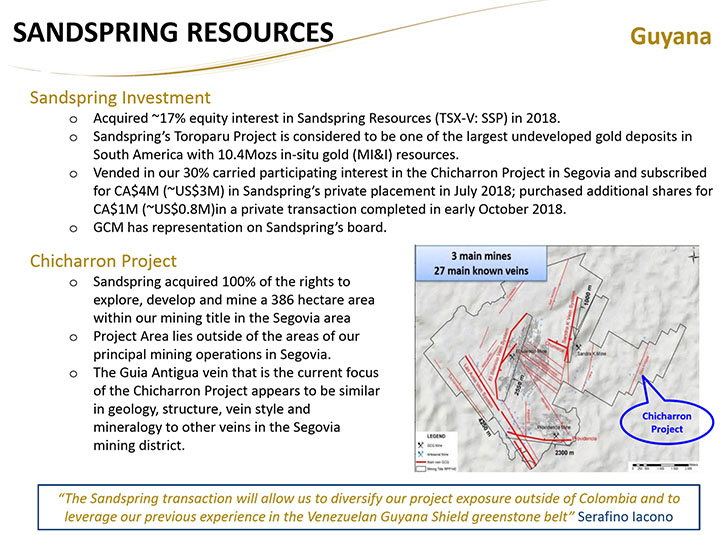

We bought a 17 percent interest in Sandspring this summer. We're currently working with management because they're assessing a feasibility study on their Toroparu project in Guyana. We'll continue to assist them and monitor how that progresses and hopefully see that pan out in time for the development of a new mine there and an opportunity for us to participate as an anchor shareholder in the re-rating potential of Sandspring Resources.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Gran Colombia Gold Corp?

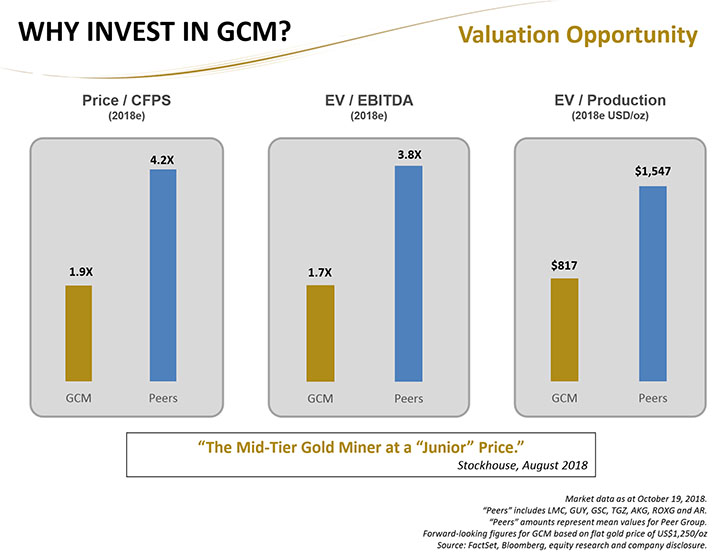

Mike Davies: I think the number one reason for investors to have a look at Gran Colombia Gold is the re-rating potential in the valuation of our shares relative to like peers. If we look at other junior to mid-tier type producers that are doing 150,000 to 200,000 ounces of gold production, comparable to ours, there's a group of them and they're getting two times the multiples on enterprise value to production, or enterprise value to EBITDA, or even as we look at cash flow per share, than Gran Colombia's getting right now. As we continue to execute and people continue to see the steadiness of our operating capability, we should deserve a re-rating of the stock and an improvement in value for shareholders.

Mike Davies: We'll have some further exploration results, Marmato in the near term and then in March next year will be our year end results. Those are the known key updates that'll be coming up. In the meantime, as we continue to produce, we'll continue to update the market on our production, as we have been on a monthly basis going forward. All part of keeping the market informed about our progress.

I was talking with Serafino about this the other day. What a difference it makes when you finally get things going in the right direction. We've gone through some very challenging times in this company and thankfully have had a shareholder and investor base that's been supportive, the key guys having some, as you say, significant skin in the game helps, but the kinds of conversations we have with people these days are very different from a couple of years ago. Getting good results has been part of really turning the financial picture around. It's liberating, and it's a nice challenge now that we spend our time making sure that people aren't getting carried away with the fact that we're generating more money internally. We keep the same discipline that we did to get here, still in line so that we don't become bloated. So, it's a pleasure actually writing the story and telling the story now compared to a few years ago.

Dr. Allen Alper: That's excellent. That's a great position to be in. It's a lot more fun when you're making a lot of money.

Mike Davies: It isn't showing up yet in the share prices yet. But it's very welcoming to be able to have much better results and to be in this kind of positive position, having gone through the very lean challenging times.

Dr. Allen Alper: That's excellent. It's great talking with you again, Mike. I'm very impressed.

Mike Davies: Well, thank you, Dr. Alper. I appreciate the opportunity to have an article on Gran Colombia Gold Corp posted on Metals News. I do follow Metals News, the breaking news, the interviews, the experts’ column and all the photos.

Dr. Allen Alper: I enjoy learning about everything you are doing. We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

http://www.grancolombiagold.com

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

http://www.metalsnews.com/t1247359i

God Bless America

Recent ARMN News

- ARIS MINING Q1 PRODUCTION ON TRACK TO DELIVER FULL YEAR 2024 GUIDANCE WHILE EXPANSION PROJECTS ADVANCE • PR Newswire (US) • 04/15/2024 09:00:00 PM

- ARIS MINING Q1 PRODUCTION ON TRACK TO DELIVER FULL YEAR 2024 GUIDANCE WHILE EXPANSION PROJECTS ADVANCE • PR Newswire (Canada) • 04/15/2024 09:00:00 PM

- ARIS MINING ANNOUNCES APPOINTMENT OF RICHARD ORAZIETTI AS CFO AND OLIVER DACHSEL AS SVP, CAPITAL MARKETS • PR Newswire (Canada) • 04/08/2024 11:00:00 AM

- ARIS MINING ANNOUNCES APPOINTMENT OF RICHARD ORAZIETTI AS CFO AND OLIVER DACHSEL AS SVP, CAPITAL MARKETS • PR Newswire (US) • 04/08/2024 11:00:00 AM

- ARIS MINING REPORTS 2023 RESULTS WITH GUIDANCE ACHIEVED, NET EARNINGS OF $11.4M, ADJUSTED EARNINGS OF $52.2M ($0.38/SHARE), ADJUSTED EBITDA OF $159M • PR Newswire (Canada) • 03/06/2024 11:26:00 PM

- ARIS MINING REPORTS 2023 RESULTS WITH GUIDANCE ACHIEVED, NET EARNINGS OF $11.4M, ADJUSTED EARNINGS OF $52.2M ($0.38/SHARE), ADJUSTED EBITDA OF $159M • PR Newswire (US) • 03/06/2024 11:26:00 PM

- ARIS MINING TO ANNOUNCE FULL-YEAR 2023 RESULTS ON MARCH 6, 2024 • PR Newswire (Canada) • 02/22/2024 12:50:00 PM

- ARIS MINING TO ANNOUNCE FULL-YEAR 2023 RESULTS ON MARCH 6, 2024 • PR Newswire (US) • 02/22/2024 12:50:00 PM

- ARIS MINING ANNOUNCES APPOINTMENT OF TWO INDEPENDENT DIRECTORS • PR Newswire (Canada) • 02/14/2024 10:30:00 PM

- ARIS MINING ANNOUNCES APPOINTMENT OF TWO INDEPENDENT DIRECTORS • PR Newswire (US) • 02/14/2024 10:30:00 PM

- ARIS MINING ACHIEVES 2023 PRODUCTION GUIDANCE AND PROVIDES 2024 OUTLOOK • PR Newswire (US) • 01/16/2024 12:00:00 PM

- ARIS MINING ACHIEVES 2023 PRODUCTION GUIDANCE AND PROVIDES 2024 OUTLOOK • PR Newswire (Canada) • 01/16/2024 12:00:00 PM

- ARIS MINING FILES NI 43-101 TECHNICAL REPORT FOR SEGOVIA OPERATIONS • PR Newswire (Canada) • 12/06/2023 08:44:00 PM

- ARIS MINING FILES NI 43-101 TECHNICAL REPORT FOR SEGOVIA OPERATIONS • PR Newswire (US) • 12/06/2023 08:44:00 PM

- ARIS MINING INCREASES SEGOVIA GOLD MINERAL RESERVES BY +75% TO 1.3 MOZ AND ANNOUNCES PLANT EXPANSION TO INCREASE PRODUCTION RATE • PR Newswire (Canada) • 11/27/2023 12:00:00 PM

- ARIS MINING INCREASES SEGOVIA GOLD MINERAL RESERVES BY +75% TO 1.3 MOZ AND ANNOUNCES PLANT EXPANSION TO INCREASE PRODUCTION RATE • PR Newswire (US) • 11/27/2023 12:00:00 PM

- ARIS MINING INCREASES SEGOVIA OPERATIONS' MEASURED AND INDICATED MINERAL RESOURCES BY +114% TO 3.6 MOZ AT 14.34 g/t AU • PR Newswire (US) • 11/02/2023 10:06:00 PM

- ARIS MINING INCREASES SEGOVIA OPERATIONS' MEASURED AND INDICATED MINERAL RESOURCES BY +114% TO 3.6 MOZ AT 14.34 g/t AU • PR Newswire (Canada) • 11/02/2023 10:06:00 PM

- ARIS MINING RELEASES ITS ANNUAL SUSTAINABILITY REPORT • PR Newswire (Canada) • 10/06/2023 11:00:00 AM

- ARIS MINING RELEASES ITS ANNUAL SUSTAINABILITY REPORT • PR Newswire (US) • 10/06/2023 11:00:00 AM

- Metals & Mining Virtual Investor Conference Agenda Announced for October 3rd- October 5th • GlobeNewswire Inc. • 10/02/2023 12:35:00 PM

VPR Brands LP Reports Record Annual Financial Performance for Fiscal Year 2023 • VPRB • Apr 19, 2024 11:24 AM

Coinllectibles' Subsidiary, Grand Town Development Limited, Acquires Rare Song Dynasty Ceramics Worth Over USD28million • COSG • Apr 18, 2024 8:03 AM

ILUS Provides Form 10-K Filing Update • ILUS • Apr 17, 2024 9:54 AM

Glucotrack Announces Expansion of Its Continuous Glucose Monitoring Technology to Epidural Glucose Monitoring • GCTK • Apr 17, 2024 8:00 AM

Maybacks Global Entertainment To Fire Up 24 New Stations in Louisiana • AHRO • Apr 16, 2024 1:30 PM

Cannabix Technologies Begins Certification of Contactless Alcohol Breathalyzer, Re-Brands product series to Breath Logix • BLOZF • Apr 16, 2024 8:52 AM