| Followers | 1447 |

| Posts | 13605 |

| Boards Moderated | 3 |

| Alias Born | 09/16/2015 |

Friday, January 11, 2019 3:59:50 AM

Did you know that...PMPG is SEC Audited and moving toward Compliance?

IMO MUST READ POST..... SEC Audited and compliant - Cannabis Real Estate venture rolling out now

As we fully succumb to 2019, FINDING DD that truly brings VALUE and the POTENTIAL for an exponential return - is actually quite special and we just may have uncovered something here.

Critical over here at $PMPG. The credability and compliant spirit of SEC Audited Financials speaks volumes for the TYPE CANNABIS Real estate ASSET DEALS COMING INTO $PMPG now. Let’s take a few moments together to review why I believe something VERY HUGE is going on now at $PMPG.

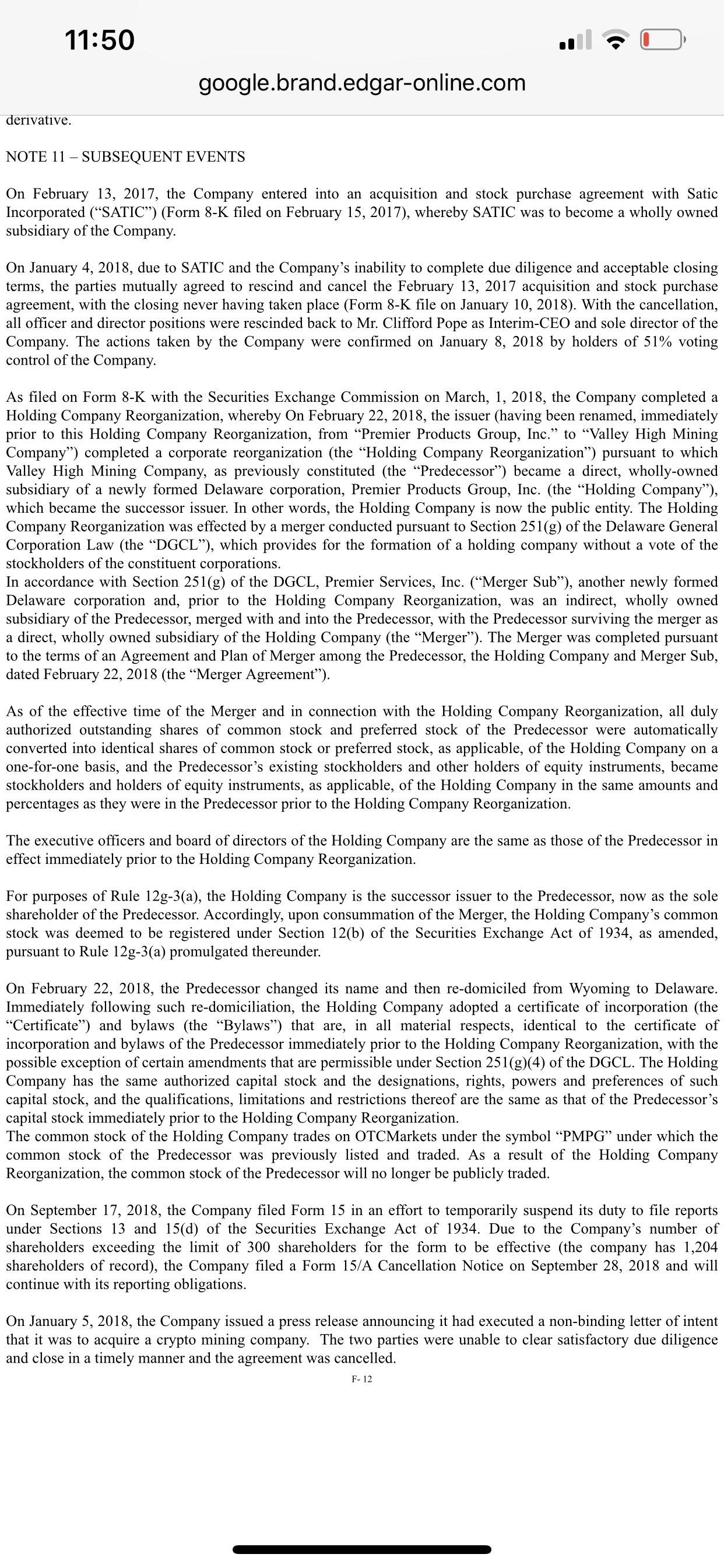

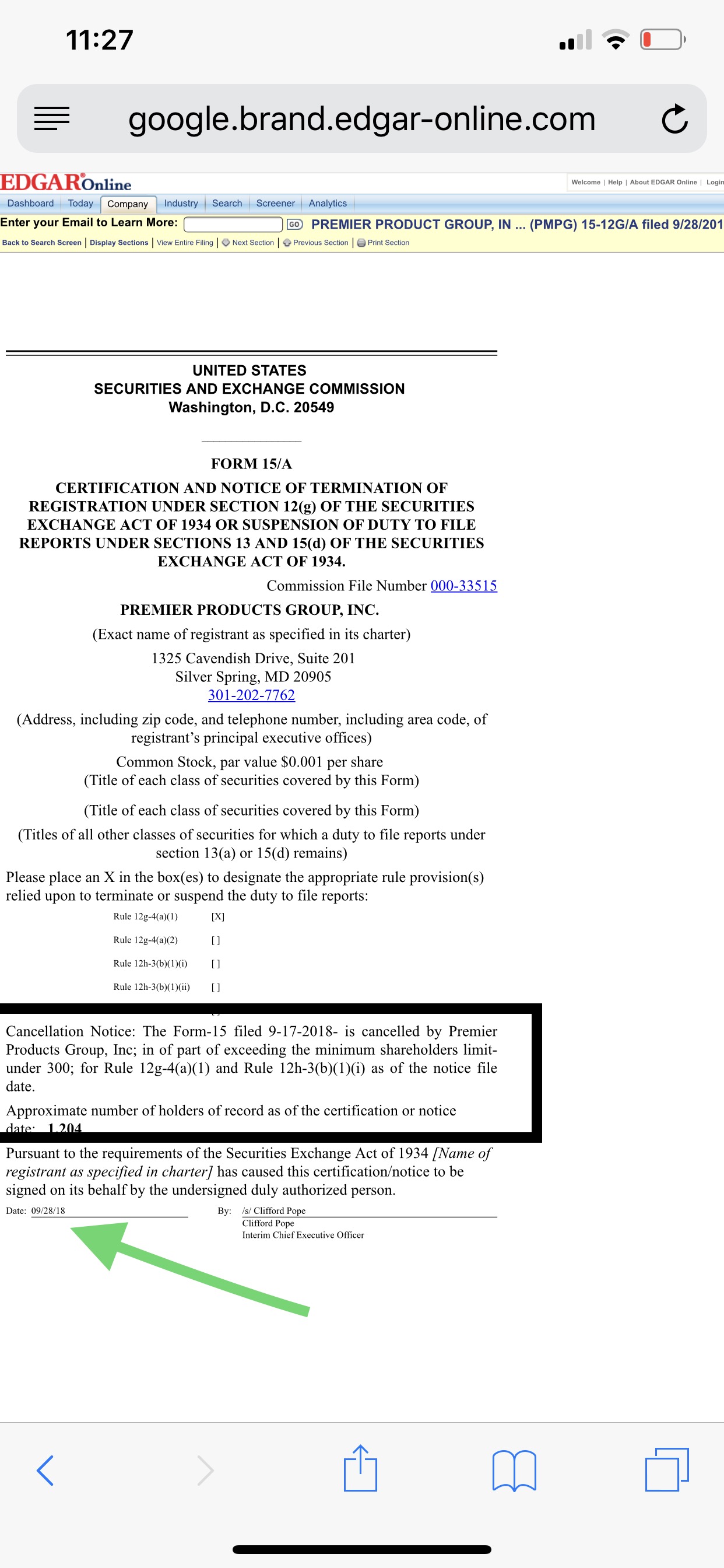

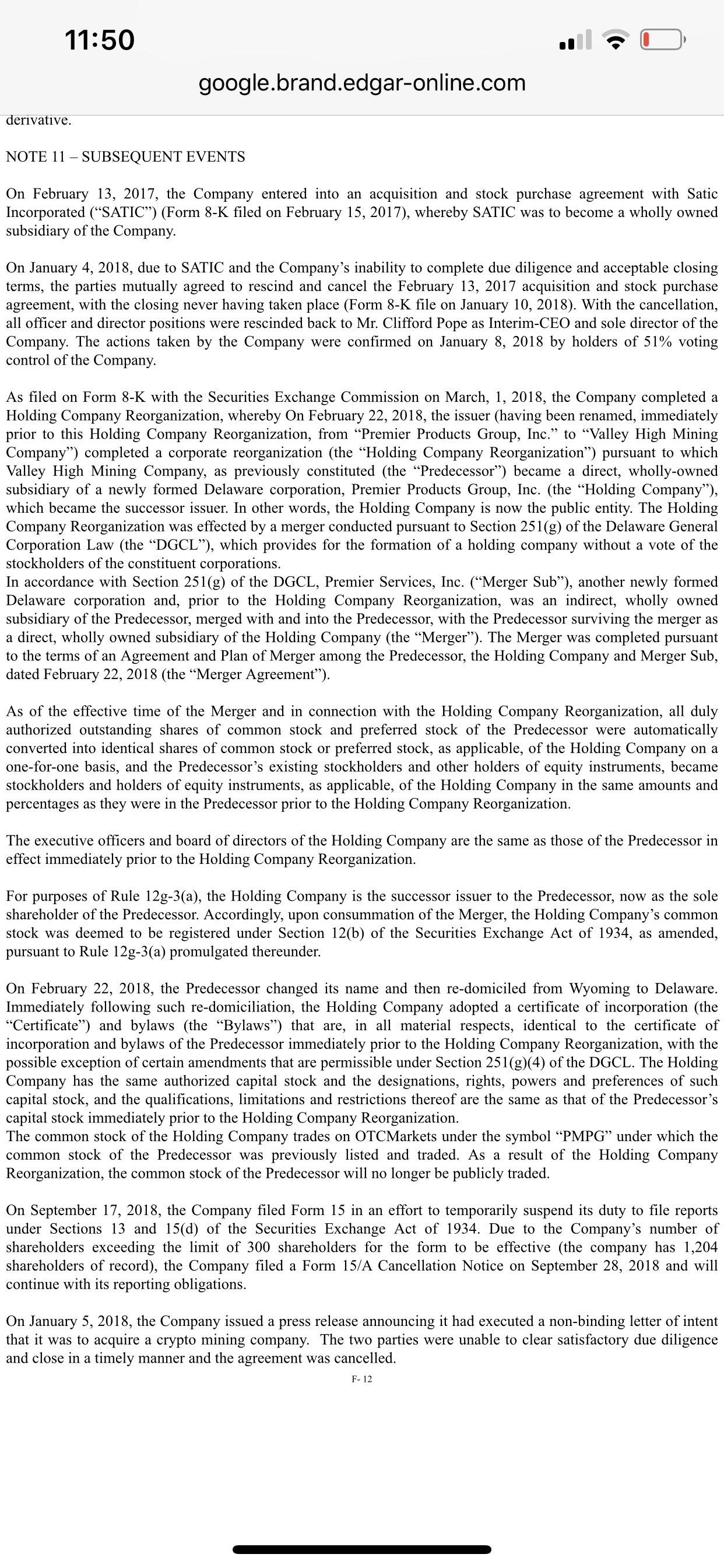

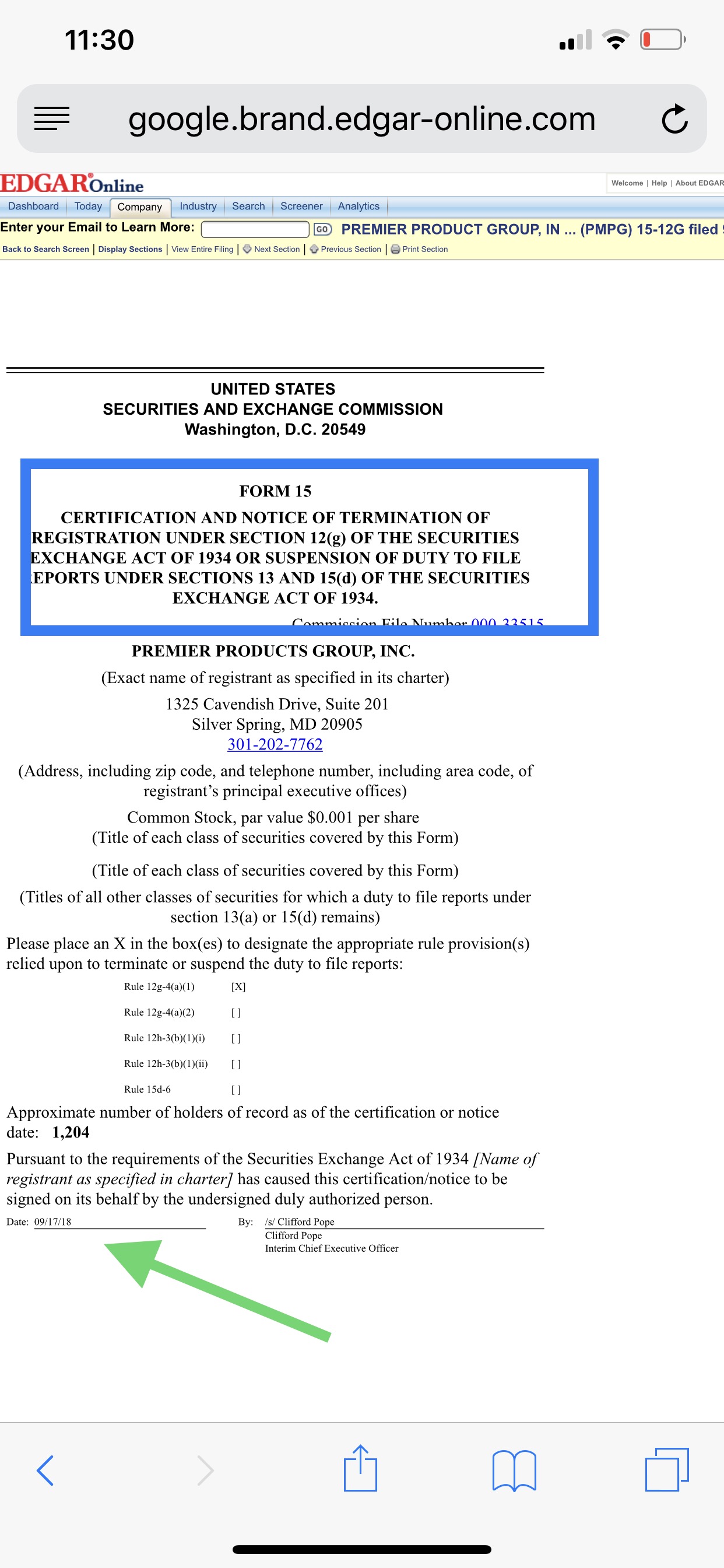

Admittedly, the last I had recalled, $PMPG executed a very business savvy merger through Delaware called a 251G - which occurred back in March 2018. This Delaware document enables a complex three way merger to form usually resulting in a public entity with far less DEBT. Therefore, removing ALL of the DEBT in a stock leaves one with an incredibly value proposition. Then, according to filings - in Oct 2018, I saw that $PMPG issued a FORM 15- deregistering their shares from the SEC and requesting to move toward the cheaper and less transparent OTC alternative reporting. The stock pps took a HIT at that time consequently.

Please see here for more info on what a 251g AND how it affected this stock and mad eyes it for more valuable IMO—

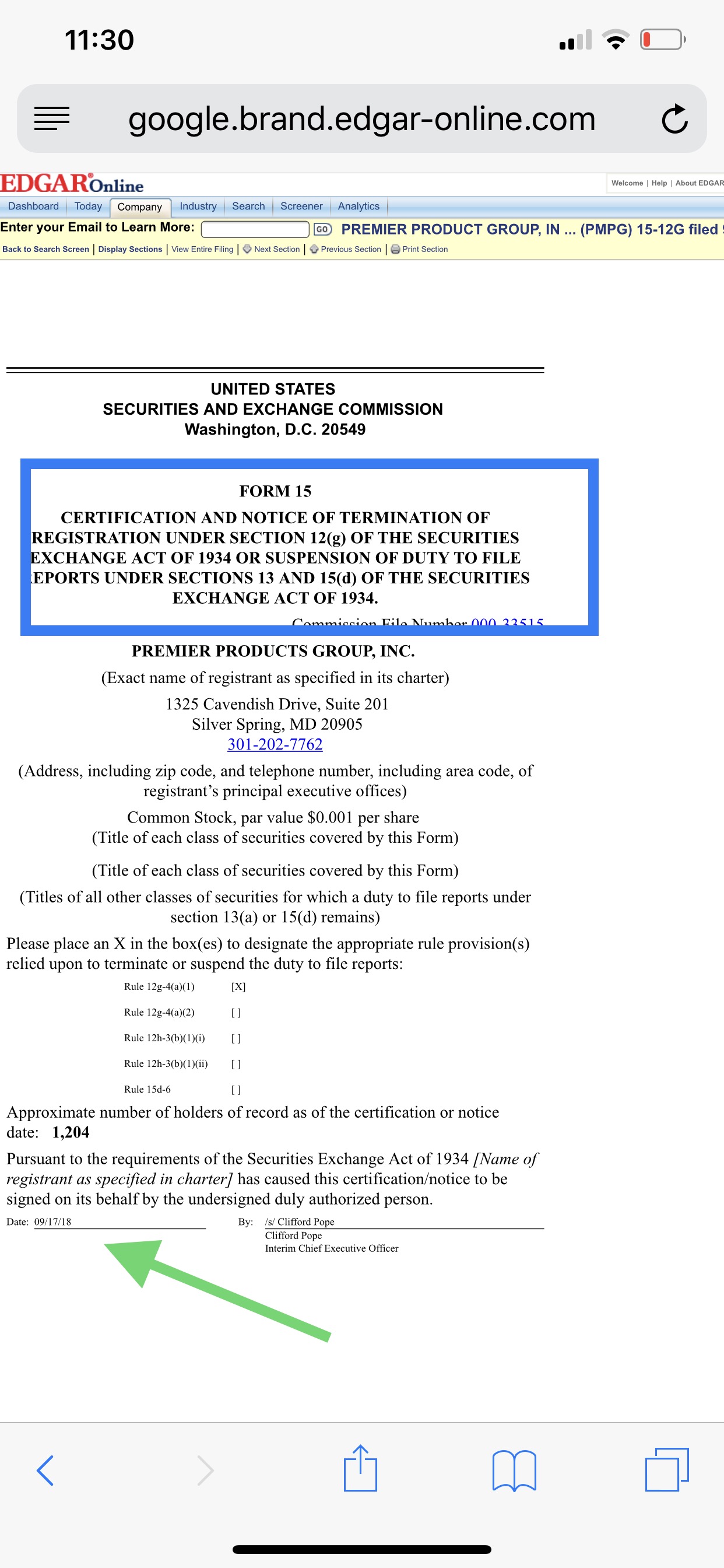

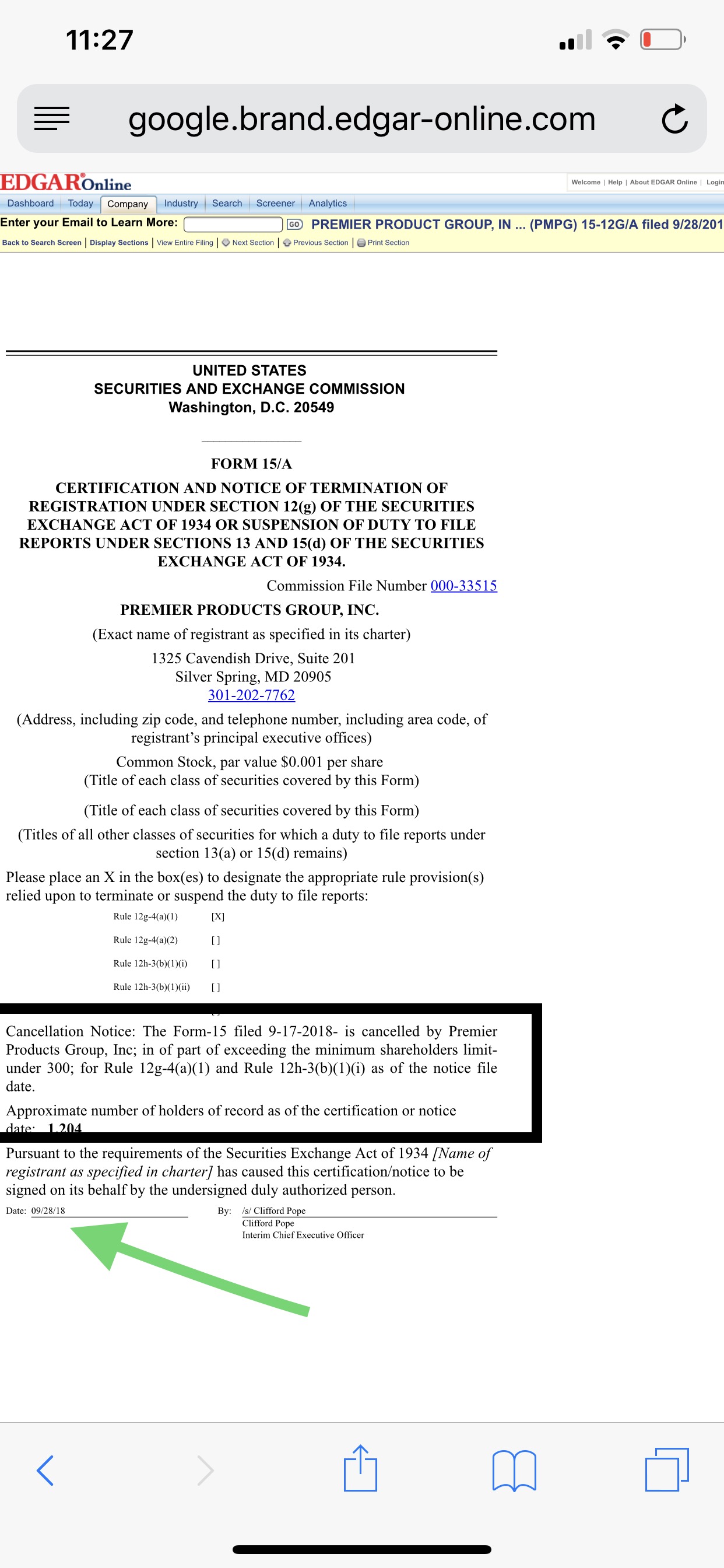

WHILE I remained patient and hopeful that new management would straighten the SHIP, I Never thought that they were actually moving toward TOTAL and ULTIMATE SEC Compliance again -especially after that Form 15 was filed back in October. So it came as a total surprise when I just saw the FILING they did one week after that...literally rescinding their own request To move to dark alternative.

WELL THIS IS WHERE THE DUE DILIGENCE and this STORY gets very interesting ...IMO and it behooves everyone- shareholders and prospective investors alike -to hear out my rationale...

Based on Edgar Online - ONE WEEK after issuing the Form 15 to de-register their shares —(but still also in October 2018), $PMPG management CANCELS the Form 15 - using the proper Form 15-A - and issues an immediate return to SEC Compliance. Now why do such a validating and verifying move? Hmmmm. Even more intriguing - $PMPG then issues out their 2016 10K - (2016 annual report) - which would conceivably put them right back into Compliance pending their 2017 and 2018 audited filings. The Audited 10K in 2016 actually includes up to date material events in 2018 on the very last page - and started spelling out exactly what’s been going on here under the hood IMO.

FURTHER- the FOCUS on the Audited 2016 10K, where management states that they are actively seeking Nutraceutical, pharmaceutical related deals clearly shows just how focused they have been to secure the best revenues/ land asset based deals for shareholders.

Read that here .... buried in the last Audited Financial released a few months ago !! Wow.

Operation

As of the date of this Report, the Company has been positioning itself as an incubator for companies in the pharmaceutical, nutraceutical and medical spaces offering products for all ages from newborns to seniors. The Company’s goal is to identify revolutionary products and create a corporate infrastructure, set up management teams, bring in design professionals both on the development side and marketing side to introduce these offerings to the marketplace. Being part of the new Company team will allow entrepreneurs to flourish without having the constraints of day to day corporate issues, as well provides an easier access to capital and credit lines for growth and expansion of the business. The Company is working to build a strong portfolio of companies to drive revenues and value with an intent that once these companies mature from all aspects inclusive of management, revenues and controls they will have the ability to operate independent of the conglomerate. We are not limiting our search to any specific geographic region. Our plan of operation for the twelve months following the date of this annual report is to continue to review potential acquisitions in the pharmaceutical, nutraceutical and medical sectors. Currently, we are in the process of completing due diligence investigation of various opportunities in the pharmaceutical, nutraceutical and medical sector.

WHAT SHAREHOLDERS SHOULD EXPECT NEXT?

AUDITED FILINGS FILINGS FILINGS .... from Borgers CPA’s

1- we want them to release the 2017 Quarterlies and audited Annual

2- we want to 2018 10K and quarterlies/ disclosures .

.

THEREFORE — $PMPG is actually an SEC Audited Filer and very likely SET to RELEASE their 2017 and then their 2018 Audited Financials starting early next week. Further, they will NOT need an attorney letter to go CURRENT since they are a compliant SEC Filer. With this major confirmation that management intends to REMAIN TRANSPARENT with the SEC , It is my strong opinion that this WILL test significantly higher levels .015- .02 pps next week on the start of FILINGS. INO- they have already confirmed Cannabis and Real Estate and now it’s OBVIOUS why the CPA Lee has stated twice that they are excited to be finishing up the SEC Filings...hmmmmmmmmm

https://www.otcmarkets.com/stock/PMPG/disclosure

IMO MUST READ POST..... SEC Audited and compliant - Cannabis Real Estate venture rolling out now

As we fully succumb to 2019, FINDING DD that truly brings VALUE and the POTENTIAL for an exponential return - is actually quite special and we just may have uncovered something here.

Critical over here at $PMPG. The credability and compliant spirit of SEC Audited Financials speaks volumes for the TYPE CANNABIS Real estate ASSET DEALS COMING INTO $PMPG now. Let’s take a few moments together to review why I believe something VERY HUGE is going on now at $PMPG.

Admittedly, the last I had recalled, $PMPG executed a very business savvy merger through Delaware called a 251G - which occurred back in March 2018. This Delaware document enables a complex three way merger to form usually resulting in a public entity with far less DEBT. Therefore, removing ALL of the DEBT in a stock leaves one with an incredibly value proposition. Then, according to filings - in Oct 2018, I saw that $PMPG issued a FORM 15- deregistering their shares from the SEC and requesting to move toward the cheaper and less transparent OTC alternative reporting. The stock pps took a HIT at that time consequently.

Please see here for more info on what a 251g AND how it affected this stock and mad eyes it for more valuable IMO—

WHILE I remained patient and hopeful that new management would straighten the SHIP, I Never thought that they were actually moving toward TOTAL and ULTIMATE SEC Compliance again -especially after that Form 15 was filed back in October. So it came as a total surprise when I just saw the FILING they did one week after that...literally rescinding their own request To move to dark alternative.

WELL THIS IS WHERE THE DUE DILIGENCE and this STORY gets very interesting ...IMO and it behooves everyone- shareholders and prospective investors alike -to hear out my rationale...

Based on Edgar Online - ONE WEEK after issuing the Form 15 to de-register their shares —(but still also in October 2018), $PMPG management CANCELS the Form 15 - using the proper Form 15-A - and issues an immediate return to SEC Compliance. Now why do such a validating and verifying move? Hmmmm. Even more intriguing - $PMPG then issues out their 2016 10K - (2016 annual report) - which would conceivably put them right back into Compliance pending their 2017 and 2018 audited filings. The Audited 10K in 2016 actually includes up to date material events in 2018 on the very last page - and started spelling out exactly what’s been going on here under the hood IMO.

FURTHER- the FOCUS on the Audited 2016 10K, where management states that they are actively seeking Nutraceutical, pharmaceutical related deals clearly shows just how focused they have been to secure the best revenues/ land asset based deals for shareholders.

Read that here .... buried in the last Audited Financial released a few months ago !! Wow.

Operation

As of the date of this Report, the Company has been positioning itself as an incubator for companies in the pharmaceutical, nutraceutical and medical spaces offering products for all ages from newborns to seniors. The Company’s goal is to identify revolutionary products and create a corporate infrastructure, set up management teams, bring in design professionals both on the development side and marketing side to introduce these offerings to the marketplace. Being part of the new Company team will allow entrepreneurs to flourish without having the constraints of day to day corporate issues, as well provides an easier access to capital and credit lines for growth and expansion of the business. The Company is working to build a strong portfolio of companies to drive revenues and value with an intent that once these companies mature from all aspects inclusive of management, revenues and controls they will have the ability to operate independent of the conglomerate. We are not limiting our search to any specific geographic region. Our plan of operation for the twelve months following the date of this annual report is to continue to review potential acquisitions in the pharmaceutical, nutraceutical and medical sectors. Currently, we are in the process of completing due diligence investigation of various opportunities in the pharmaceutical, nutraceutical and medical sector.

WHAT SHAREHOLDERS SHOULD EXPECT NEXT?

AUDITED FILINGS FILINGS FILINGS .... from Borgers CPA’s

1- we want them to release the 2017 Quarterlies and audited Annual

2- we want to 2018 10K and quarterlies/ disclosures .

.

THEREFORE — $PMPG is actually an SEC Audited Filer and very likely SET to RELEASE their 2017 and then their 2018 Audited Financials starting early next week. Further, they will NOT need an attorney letter to go CURRENT since they are a compliant SEC Filer. With this major confirmation that management intends to REMAIN TRANSPARENT with the SEC , It is my strong opinion that this WILL test significantly higher levels .015- .02 pps next week on the start of FILINGS. INO- they have already confirmed Cannabis and Real Estate and now it’s OBVIOUS why the CPA Lee has stated twice that they are excited to be finishing up the SEC Filings...hmmmmmmmmm

https://www.otcmarkets.com/stock/PMPG/disclosure

https://investorshub.advfn.com/$UPER-$TOCKS-DD-and-RESEARCH-FORUM-31721/

ALL POSTS are just opinion! Never BUY/SELL based on them! MUST consult licensed stock broker!

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.