Thursday, February 08, 2018 6:42:29 AM

UCHC - Shorts are Covering Short Positions

UCHC - Facing a Massive Short Squeeze!

Short Information

http://www.otcmarkets.com/stock/AAPT/short-sales

http://shortsqueeze.com/?symbol=AAPT&submit=Short+Quote%E2%84%A2

http://otcshortreport.com/company/AAPT

https://www.interactivebrokers.com/en/index.php?key=AAPT&cntry=usa&tag=United+States&ib_entity=llc&ln=&asset=&f=4587&conf=am&amref=1

________________________________________________________________

What is a Short Squeeze ?

Quick Easy To Understand - Explanation

http://www.investopedia.com/video/play/short-squeeze/

Short Squeezes - Explained

http://www.investinganswers.com/financial-dictionary/real-estate/short-squeeze-2045

* The "Shorts" will Buy after you Buy,

because they have to Cover their "Short Positions" !

* They lose money as the stock climbs !

* Your Buying, Forces them to Buy,

and their Buying, causes the stock to Climb Higher !

The possibility of a "Short Squeeze"

Short Squeeze - What it is:

A short squeeze

occurs when the stock's price doesn't decline as anticipated.

A short squeeze is a situation in which

a stock's price increase

triggers a rush of buying activity among short sellers.

Short sellers must buy stock

to close out their short positions and cut their losses,

which results in a further increase in stock prices,

which compel still more short sellers to cover their positions.

The possibility of a "short squeeze"

is one reason some analysts

look at a high amount of short interest

as a Bullish Indicator.

Short Interest is the fuel,

performance is the fuse,

says ShortSqueeze.com

- USA Today

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=113157377

A Short Sale reverses the normal

buy first/sell second sequence

as a way to profit from

an anticipated future fall in price.

An investor borrows shares of UCHC from a broker

and sells them at the market price.

The investor hopes to buy back the shares

at a lower price in the future,

thereby "covering" the position

by giving back the broker his shares.

Instead of the traditional "buy low/sell high",

an investor seeks to "sell high/buy low".

A short squeeze occurs

when the stock's price doesn't decline as anticipated.

For example,

let's say you Sell Short UCHC stock at 0.0004

But, instead of the price going down,

it goes up to 0.0012

and appears to be going higher.

Now you're in trouble.

You need to cover your position and limit your losses.

You decide to buy UCHC shares as soon as possible

-- you and everybody else who shorted the stock.

This generates tremendous buying pressure on the stock,

and the short sellers rushing to cover their positions

only escalate the price increase.

Short squeezes

occur more often in small-cap stocks with small floats,

but they can occur with any stock.

http://www.investinganswers.com/financial-dictionary/real-estate/short-squeeze-2045

________________________________________________________________

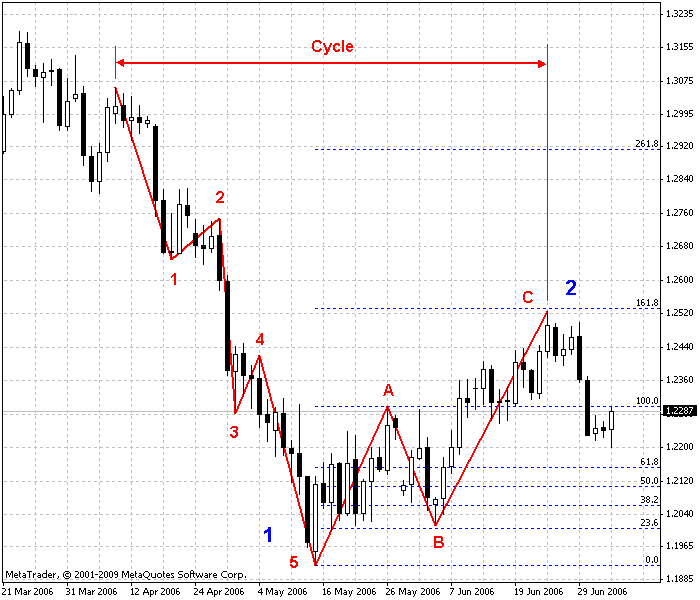

UCHC - Fibonacci Retrace Targets

Fibonacci Numbers

http://www.stockta.com/cgi-bin/school.pl?page=fib

Fibonacci Retracements

* Common Retracements

* Moderate Retracements

* Golden Retracements

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:fibonacci_retracemen

Fibonacci Retracements

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=77145842

________________________________________________________________

Fibonacci Numbers

are commonly used in Technical Analysis

with or without a knowledge of Elliot Wave Analysis

to determine potential support, resistance,

and price objectives.

The most popular Fibonacci Retracements are

61.8% and 38.2%

61.8% retracements

imply a new trend is establishing itself.

38.2% retracements

usually imply that the prior trend will continue

38.2% retracements

are considered natural retracements in a healthy trend.

Fibonacci Retracements

can be applied after a decline

to forecast the length of a counter-trend bounce.

________________________________________________________________

The 50% retracement is not based on a Fibonacci number.

Instead, this number stems from Dow Theory's assertion

that the Averages often retrace half their prior move.

50% retracement

implies indecision.

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=137833062

_________________________________________________________________

UCHC - Targets 0.0012 / 0.0030

UCHC - Facing a Massive Short Squeeze!

Short Information

http://www.otcmarkets.com/stock/AAPT/short-sales

http://shortsqueeze.com/?symbol=AAPT&submit=Short+Quote%E2%84%A2

http://otcshortreport.com/company/AAPT

https://www.interactivebrokers.com/en/index.php?key=AAPT&cntry=usa&tag=United+States&ib_entity=llc&ln=&asset=&f=4587&conf=am&amref=1

________________________________________________________________

What is a Short Squeeze ?

Quick Easy To Understand - Explanation

http://www.investopedia.com/video/play/short-squeeze/

Short Squeezes - Explained

http://www.investinganswers.com/financial-dictionary/real-estate/short-squeeze-2045

* The "Shorts" will Buy after you Buy,

because they have to Cover their "Short Positions" !

* They lose money as the stock climbs !

* Your Buying, Forces them to Buy,

and their Buying, causes the stock to Climb Higher !

The possibility of a "Short Squeeze"

Short Squeeze - What it is:

A short squeeze

occurs when the stock's price doesn't decline as anticipated.

A short squeeze is a situation in which

a stock's price increase

triggers a rush of buying activity among short sellers.

Short sellers must buy stock

to close out their short positions and cut their losses,

which results in a further increase in stock prices,

which compel still more short sellers to cover their positions.

The possibility of a "short squeeze"

is one reason some analysts

look at a high amount of short interest

as a Bullish Indicator.

Short Interest is the fuel,

performance is the fuse,

says ShortSqueeze.com

- USA Today

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=113157377

A Short Sale reverses the normal

buy first/sell second sequence

as a way to profit from

an anticipated future fall in price.

An investor borrows shares of UCHC from a broker

and sells them at the market price.

The investor hopes to buy back the shares

at a lower price in the future,

thereby "covering" the position

by giving back the broker his shares.

Instead of the traditional "buy low/sell high",

an investor seeks to "sell high/buy low".

A short squeeze occurs

when the stock's price doesn't decline as anticipated.

For example,

let's say you Sell Short UCHC stock at 0.0004

But, instead of the price going down,

it goes up to 0.0012

and appears to be going higher.

Now you're in trouble.

You need to cover your position and limit your losses.

You decide to buy UCHC shares as soon as possible

-- you and everybody else who shorted the stock.

This generates tremendous buying pressure on the stock,

and the short sellers rushing to cover their positions

only escalate the price increase.

Short squeezes

occur more often in small-cap stocks with small floats,

but they can occur with any stock.

http://www.investinganswers.com/financial-dictionary/real-estate/short-squeeze-2045

________________________________________________________________

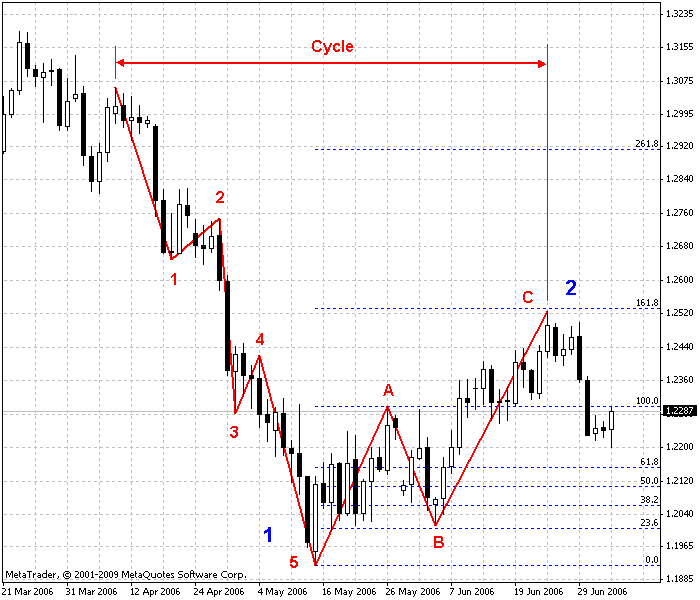

UCHC - Fibonacci Retrace Targets

Fibonacci Numbers

http://www.stockta.com/cgi-bin/school.pl?page=fib

Fibonacci Retracements

* Common Retracements

* Moderate Retracements

* Golden Retracements

http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:fibonacci_retracemen

Fibonacci Retracements

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=77145842

________________________________________________________________

Fibonacci Numbers

are commonly used in Technical Analysis

with or without a knowledge of Elliot Wave Analysis

to determine potential support, resistance,

and price objectives.

The most popular Fibonacci Retracements are

61.8% and 38.2%

61.8% retracements

imply a new trend is establishing itself.

38.2% retracements

usually imply that the prior trend will continue

38.2% retracements

are considered natural retracements in a healthy trend.

Fibonacci Retracements

can be applied after a decline

to forecast the length of a counter-trend bounce.

________________________________________________________________

The 50% retracement is not based on a Fibonacci number.

Instead, this number stems from Dow Theory's assertion

that the Averages often retrace half their prior move.

50% retracement

implies indecision.

________________________________________________________________

Buy after an Elliott Wave 5-Wave Decline

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=137833062

_________________________________________________________________

UCHC - Targets 0.0012 / 0.0030

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.