Friday, January 19, 2018 3:48:27 PM

...Attendee Reports are after the Slides. I will update & re-post as more come in over the next few days.

1-18-2018: Avid Bioservices’ 2017 Annual Shareholder’s Mtg http://ir.avidbio.com/events.cfm

…10amPT at Avid’s Myford Facility, 14191 Myford Rd, Tustin, CA 72780 MAP: https://tinyurl.com/y9kpqesd

Webcast https://edge.media-server.com/m6/p/ij9i8ypx

PROXY/14A: https://tinyurl.com/y7qprpg9 VotingRecDate=11-27-17

CEO Roger Lias’ ASM Presentation Slides (1-18-18):

ATTENDEE REPORTS (2017 ASM 1-18-18):

By: Hawkfan1 (Michael) 1-18-18 9:41pmET #322974

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=137796412

Here are some of my notes taken at the ASM. They are very brief paraphrases, since I never took shorthand in school.

As usual, Brandon Cox was the first to take the microphone with a long list of questions, that at least this shareholder very much appreciated.

Q. You are burning $3-4mm/qtr, with no cash and no back log. How do you plan to raise capital?

A. Your estimate of our burn rate is in the right ball park. We do have $33mm in backlog, but that is quite conservative. Most companies recognize all of an order when it is placed, but traditionally, PPHM has only recognized backlog as work orders for that order are placed. But clearly, we need more capital. We must eliminate the 'going concern' clause. While it may not be ideal for a small biotech, it is probably something they can live with. But for a manufacturing company, it is a death knell. Customers need to know that you are going to be around for the long term.

Q. How dilutive will it be?

A. We don't know yet. We don't know how much we will need yet.

Q. Is anyone from the old management team working to help sell the R&D technology?

A. Yes, Shelly. And others are working as consultants.

Q. Most CDMO's are private companies. Are there any plans to take the company private?

A. Not currently. (He did mention, kind of jokingly, that it would be nice).

Q. Who are the major institutional investors?

A. Still Ronan, Tappan, and Eastern Capital.

Q. Will they be involved in the capital raise?

A. Hopefully.

Q. What is the cost of being a public company?

A. About $2-3mm/year.

Q. As a strictly mfg. company, do we really need 7 board members?

A. Right now, the experience that they all bring is extremely helpfull. Down the road, maybe not.

Q. How much cash do we currently have?

A. $27.7mm. (Not quite sure I got this right, but I think that $10mm was in customer deposits). [NOTE: the $27.7mm is a/o 10-31-17, the last 10-Q (Deposits were $13.1mm): https://tinyurl.com/ybycb2s6 ]

Q. Will Avid expand beyond the earthquake prone Tustin area?

A. It could be done relatively easily. Down the road, it will be evaluated.

Then Brandon relinquished the mike and North40k gave a long and impassioned commentary about various trials and people (such as Dr. Wolchok) that the company should contact about Bavituximab. He mentioned Wolchok's comment that his next trial "depends on the company".

Dr. Lias stated that Dr. Wolchok has not contacted the company. He mentioned that an associate of Dr. Wolchok had said that it will be 18 mos. before the next trial proceeds. (This was met with incredulity from several shareholders in attendance).

Dr. Lias stated that they have numerous discussions regarding CAR-T, but there was no interest. In some other discussions, they found our technology interesting, but then said "prove it in a trial".

N40k then asked if the recent Halozyme trial failure would affect Avid. It will not.

Brandon Cox then resumed his questioning. He asked a question regarding the IP patent clock, which I previously reported. For continuity, Dr. Lias's answer was that as patents start to expire, and a BP realizes that it will take about $70mm and 3-4 years to bring a product to market, a 5-year patent life is not that exciting to them.

Q. How much Bavi do we have in storage?

A. Enough for a couple of small trials, nothing big.

Q. Client #1 is Halozyme. We don't know the name of client #2, but are they gone for good?

A. No, but I don't expect them to be hugely successful. They will be years down the road.

Q. Question regarding the interest in the Exosome test kit.

A. Not much commercial interest.

Q. Are you trying to sell the IP in bits and pieces or as a package deal?

A. While a package deal would be ideal, not gonna happen.

Then Greg got up and asked about the process of sell the IP. Dr. Lias commented that there was not much interest. The previous board has talked to everyone - it is not a secret - just not much interest.

Then N40k asked the board to contact Precision for Medicine, which concluded the Q&A.

Again, this is very roughly paraphrased from my notes. Other members that were in attendance, please correct anything that I may have inadvertently gotten wrong.

As I decided to take the tour, I was not able to talk to the board members one on one after the meeting.

BY: HAWKFAN1 (MICHAEL)

... 1-18-18 7:54pmET #322954 (INITIAL POST)

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=137794640

Dr. Lias comment about the lack of interest in the IP by BP was in response to a question by Brandon Cox about the declining IP clock. His example was that if BP knows that it will take about $70M and 3-4 years of trials to get a drug to market, then a 5-year patent life is just not that exciting to them. This doesn't address the question of getting a patent extension, however. If this is true, then Dr. Lias needs to be made aware of it.

FU #323010:

Just a few more general impressions from the meeting today. Like the rest of you, I was very disappointed in the approach to marketing the IP. On the one hand, Dr. Lias said that there were on-going discussions that he could not talk about, but he continually down played any expectation that we would receive much value for it. It was almost like they have already given up and have a 'Hey, we tried, but nobody is interested' attitude. They certainly didn't spell out any detailed marketing plan.

On the CDMO front, they generally impressed me as qualified, and will probably do a fine job, but I almost choked when Lias said that Tracy Kinjersky "hit the ground running". Hopefully, she will not emulate Mary Boyd.

The tour of the Myford facility was as impressive as ever. The 2 new 2000L reactors are installed, tested and ready to go, but have not yet been used in production. Someone asked how many employees we have now and we were told about 200, of which 30 something (I don't remember the exact number) are in production. I asked, if only 30 something are in production, what do the others do? I was told quality control, testing, etc., which I would consider as part of production. This brought the number up to about 75. Unfortunately, we were interrupted, and I wasn't able to pursue this breakdown any further.

It seems reasonable to me that we can get to $200mm in sales, but it will be at least 2-3 years down the road. They already have space in the Myford building to build out a duplicate of the existing facility, except that I believe it will use all 2000L reactors. But this space is still raw warehouse space, and will take a minimum of a year to build. And they won't start building it until they have reached significant profits from the exiting facility. So it all hinges on how fast they can attract new clients.

FU#323064:

re: How many in meeting? I didn't actually count, but I was going to guess that there were probably about 20 shareholders, and we were matched, if not outnumbered, by company employees. My impression was that it was a bit smaller attendance by shareholders than in years past.

By: Holotawoopas 1/18/18 4:49pmET #322902

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=137790910

For those who have pinned their hopes on the value of the IP it is time to mourn your loss and move on as there was nothing concrete about any potential monetizing extrapolated at the ASM. N40 gave a valiant effort to plead the case of value of the IP but IMO it fell on deaf ears! The CEO said no BP interest has been received!

FU#322909:

The CEO stated that the biggest down fall to monetizing the IP has nothing to do with leverage but has everything to do with patent expiration!!!

By: Eb0783 1/18/18 1:45pmET #322864

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=137783413

ASM votes: #1 all re-elected, #2 for 36.4mm, #3 for 15.2 v. against 3.6, #4 1 year

FU#322879:

Per Lias, there is no formal process, group, or investment bank in place to sell the IP.

FU#322934:

Lias said he wasn't a patent expert when made those comments about short patent life being an issue. It was obvious he wasn't aware that patents could be extended due to years lost in development. Some of us took that short patent life excuse with a grain of salt.

FU#323063:

re: How many in meeting? I counted about 40 at the start of the meeting. I would guess 50%-60% were shareholders. That is about normal from my experience. I remember counting 40 & 50 in previous ASMs.

FU#323066:

The thing is, if they are really not having a process, group, or IB in place to evaluate/sell our IP, they don't have to spend anything to do it. At the very least, give the task to some IB or 3rd party expert on contingency: you can keep 50% of whatever you can sell it for. (You lawyers often take cases on the same basis and accept 30, 40, 50% quite often). I said that to Lias after the meeting, with Ziebell & Lytle standing there - no comment from them. I find their stance on this incredulous, if true!

By: Djohn 1-19-18 2:18pmET #323067

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=137818937

MY THOUGHTS AFTER THE ASM: I missed the fancy danish, the cream cheese and bagels also missed the fancy hotel backdrop making me think we were on the verge of something astronomical. What did not miss was my thoughts of how many shares had to be sold to pay for me to bite on my bagel, sip on my fine coffee while looking at a beautiful swimming pool at a posh hotel.

It’s amazing what can be done with a couple of cases of bottled water, one pot of coffee and a room with chairs. That alone convinced me our new leadership is serious about how they spend the shareholders money!

For me the ASM went as I expected. It just confirmed to me that we are no longer chasing a dream. We no longer have a questionable cast of characters spending our money diluting our shares. It’s pretty easy, we are a manufacturing company now with basic straight forward business model. We have people in place who are qualified to grow this business and IMO recoup the total amount I invested in PPHM maybe even more.

I have given up the dream! I will awake daily and put on a BaviDermCQ patch. I will develop a 12-step program to wean myself from astronomical thoughts. One of those steps will be to not visit this board as often. Another step will be to fully investigate the members of the BOD in any company I ever invest in again. One other will be to take full responsibility for my investment decisions and accept how they turn out.

I bugged out right after the ASM ended and didn’t stick around for the tour of Avid. I had a flight to catch. Only one flight I could get to make it home that day. Maybe some of you there could gather more insight in talking with BOD or management during the tour. I went on the Avid tour last year and was impressed with the facilities.

FWIW This is what I gathered and is my opinion about the current situation. I saw a group of highly qualified individuals both on the new BOD and new leadership for Avid. These individuals are try to make lemonade out of lemons. Face it folks, after years and years of being told we had a bag of diamonds but we ended up with a bag of lemons! I am not saying that PS/Bavi/IP is worthless. Nobody really knows! Yet! but because the leadership of legacy PPHM did not do the correct things to prove it’s worth, we are left with an IP in shambles. After spending several hundreds of millions they left us with no value for the IP and the only way to prove value of the IP is to spend many more millions. ( A Bag of Lemons) Basically, after Sunrise failure the PPHM leadership decided to spend millions more to search around in the bag of lemons to see if they could just one diamond. We can all speculate on why legacy PPHM leadership continued down their path.

Fact to me is last year PPHM had two things. An R&D division with the IP and faced with spending millions more to prove some worth with low chance of success, even lower based on past successes. A CDMO business that with the right leadership and direction could become a nice profitable business in a few years. The chance of success with CDMO is very high IMO and I think valued much higher than R&D portion.

I think Ronin saw the CDMO business as a good development opportunity and took it. Real business people made real business decisions with maximum potential and maximum returns in mind. C'est la vie PPHM HELLO CDMO

FU#323070:

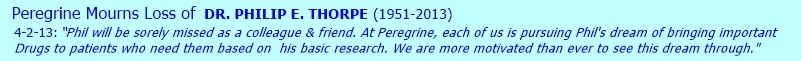

Don't get me wrong. I am not saying IP does not have value! I bought TCLN because I believed it did have value. I could hear the enthusiasm in Dr Thorpe's voice when he presented it. That was powerful! I just think the IP has been squandered all these years and nobody knows how much more money must be spent to realize it's real worth and with failed PIII no one is willing to take a chance on it. Hence, It's not worth much at this point in time. I think best path forward is CDMO to recoup invested money.

By: Aikifredicist 1-18-18 8:16pmET #322961

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=137795041

I got up at the meeting and asked about Exosomes, but Lias just fudged on the answer. He doesn’t know what he has.

= = = = = = = = = = = = = = =RECALL:

1-8-17: EBD's Biotech Showcase 2018 (parallel w/JPM Conf.), SanFran https://ebdgroup.knect365.com/biotech-showcase

...1-2-18 PR: https://tinyurl.com/ydcc9agv

...3:30pmPT: CEO Roger Lias, Corporate Presentation

...1-8-18 Lias BioShowcase’18 Presentation PDF (24 slides): https://tinyurl.com/ya6tgxxa

FULL HISTORY of PPHM-Ronin PR’s, Letters, 13-D’s, Form4’s, Proxy’s, etc: https://tinyurl.com/ycb3fpfm

12-26-17: Roger Lias replaces Steven King as Pres./CEO; in process of changing name to Avid Bio. and new Nasdaq Ticker ("early 2018") https://tinyurl.com/yb34e2t8

12-11-17: Qtly. Conf. Call (Lias/Lytle) Transcript https://tinyurl.com/ybycb2s6

...Dr. Lias, "the company is undergoing a broad-scale transformation, the goals of which are to shift complete focus to the Avid Bioservices CDMO business and the complete divestiture of all of Peregrine's legacy R&D assets, which include bavituximab."

Recent CDMO News

- Avid Bioservices Announces Receipt of Deficiency Notice from Nasdaq Regarding Late Form 10-Q • GlobeNewswire Inc. • 03/20/2024 11:00:10 AM

- Form 8-K - Current report • Edgar (US Regulatory) • 03/07/2024 11:30:11 AM

- Avid Bioservices Announces Pricing of Private Placement of Convertible Notes • GlobeNewswire Inc. • 03/07/2024 04:58:48 AM

- Avid Bioservices Announces Proposed Private Placement of Convertible Notes • GlobeNewswire Inc. • 03/06/2024 09:32:07 PM

- Avid Bioservices Announces Certain Preliminary Financial Results for Third Quarter Ended January 31, 2024 • GlobeNewswire Inc. • 03/06/2024 09:31:28 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 03/06/2024 09:30:18 PM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 01/26/2024 09:57:52 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/13/2024 12:34:35 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:39:18 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:38:30 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:37:38 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:36:27 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/12/2024 12:35:47 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/11/2024 12:56:02 AM

- Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend] • Edgar (US Regulatory) • 01/08/2024 09:32:36 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:56:18 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:55:07 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:53:58 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 01/04/2024 12:51:57 AM

- Form SC 13G - Statement of acquisition of beneficial ownership by individuals • Edgar (US Regulatory) • 12/19/2023 09:05:52 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:34:08 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:33:03 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:32:11 AM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 12/19/2023 12:31:12 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM

Kona Gold Beverages, Inc. Prepares for First Production Run Set to Launch May 17, 2024 • KGKG • Apr 22, 2024 8:30 AM