| Followers | 679 |

| Posts | 140700 |

| Boards Moderated | 37 |

| Alias Born | 03/10/2004 |

Sunday, October 29, 2017 5:13:56 PM

By: Clive Maund | October 29, 2017

Like gold, silver now appears to be completing an intermediate Head-and-Shoulders top that we can see on its latest chart below, within a much larger and very bullish Head-and-Shoulders bottom pattern. Both these Head-and-Shoulders tops are related to the Head-and-Shoulders bottom that just completed in the dollar index, that we look at in the parallel Gold Market update. With the dollar index having just made a convincing breakout from its Head-and-Shoulders bottom, and looking set to rally to the 97 area, silver looks set to react back, probably to the $15.50 - $16.00 area, before reversing to the upside as the dollar turns lower again.

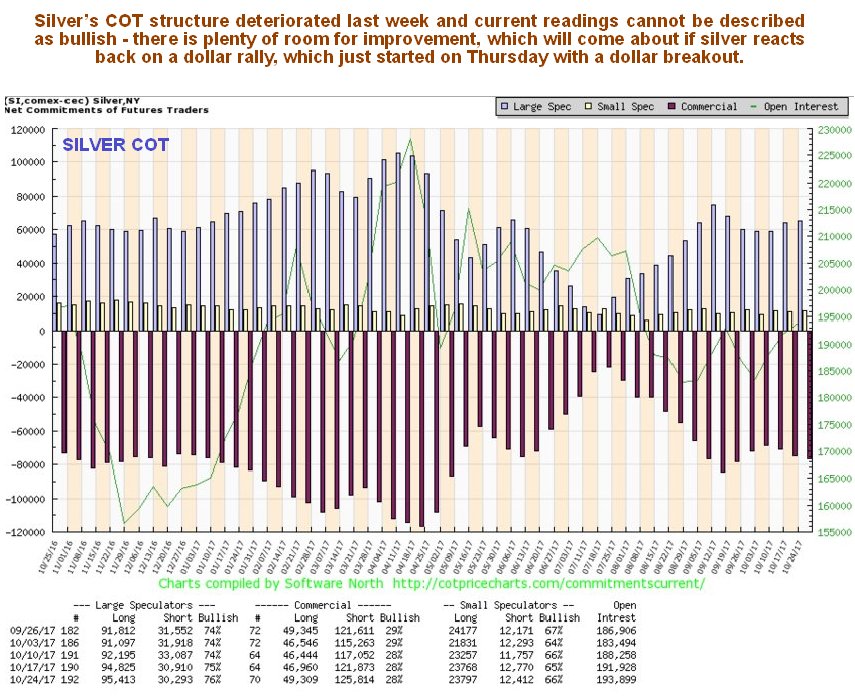

Unlike gold, silver’s COT structure showed further deterioration last week, and readings are now at levels that are construed as bearish. There is plenty of room for improvement, which will come about if the silver reacts back as expected on a continuation of the dollar rally.

Like gold, silver is marking out a giant Head-and-Shoulders bottom pattern, but in silver’s case it is downsloping as we can see on its 8-year chart below, which reflects the fact that silver tends to underperform gold at the end of sector bearmarkets and during the early stages of sector bullmarkets. Prolonged underperformance by silver is therefore a sign of a bottom. This chart really does show how unloved silver is right now, but although the price has drifted slightly lower over the past several years, volume indicators have improved, especially this year, a positive sign. A break above the neckline of the pattern, the black line, will be a positive development, and more so a break above the band of resistance approaching the 2016 highs. Once it gets above this it will have to contend with a quite strong zone of resistance roughly between $26 and $28. Over the short to medium-term, however, as discussed above, silver is likely to first react back to the $15 - $15.50 area on a dollar rally.

https://www.clivemaund.com/free.php?id=67

• DiscoverGold

Click on "In reply to", for Authors past commentaries

****************************************

*** For Market Direction and Trends visit our board:

https://investorshub.advfn.com/Market-Direction-and-Trends-26249/

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

Coinllectibles' Subsidiary, Grand Town Development Limited, Acquires Rare Song Dynasty Ceramics Worth Over USD28million • COSG • Apr 18, 2024 8:03 AM

ILUS Provides Form 10-K Filing Update • ILUS • Apr 17, 2024 9:54 AM

Glucotrack Announces Expansion of Its Continuous Glucose Monitoring Technology to Epidural Glucose Monitoring • GCTK • Apr 17, 2024 8:00 AM

Maybacks Global Entertainment To Fire Up 24 New Stations in Louisiana • AHRO • Apr 16, 2024 1:30 PM

Cannabix Technologies Begins Certification of Contactless Alcohol Breathalyzer, Re-Brands product series to Breath Logix • BLOZF • Apr 16, 2024 8:52 AM

Kona Gold Beverages, Inc. Acquires Surge Distribution LLC from Loud Beverage Group, Inc. (LBEV) • KGKG • Apr 16, 2024 8:30 AM