Friday, September 08, 2017 3:28:57 PM

Below I will explain why the importance of Araloc coming into APHD which could justify a .59+ per share value for the stock. First, it’s important to understand Slide #12 within the ipRisk Control (APHD) slideshow below:

There are a few reasons that Araloc and APHD is making this union transpire. One important reason is that Araloc has over 400 clients as I had indicated within the posts below:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=134410360

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=134166637

Key APHD Variables to Note:

** Recurring monthly revenue from their Software-as-a-Service (SaaS) based Model.

** SaaS model = $5,000 Average Monthly Account Fee.

** $5,000 x 20 Accounts = $100,000 Per Month.

** $100,000 Per Month x 12 Months = $1,200,000 Annual Revenue (Per 20 accounts).

** Average Margins per Slideshow = 75%+ (Presumed Gross Profit Margins).

** Net Income Margin = 50% (Logically Presumed since 75% is Gross Profit Margin).

** Araloc has over 400 clients which would represent 400 accounts.

** APHD las confirmed Outstanding Shares (OS) = 651,767,562 shares:

http://ih.advfn.com/p.php?pid=nmona&article=75593853

** APHD exists within the Computer Services Industry = P/E Ratio of 32.51:

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/pedata.html

Now let’s derive a Fundamental Valuation for APHD given the related variables associated above…

$1,200,000 Annual Revenues = Per 20 accounts

400 Clients ÷ 20 Accounts = 20 Account Increments of $1.2 Million

$1,200,000 x Per 20 Account Increments = $24,000,000 Revenues

$24,000,000 x .50 Net Profit Margin = $12,000,000 Net Income

Net Income ÷ Outstanding Shares (OS) = EPS

$12,000,000 Net Income ÷ 651,767,562 Shares (OS) = .0184 EPS

Now we must multiply the Earnings Per Share (EPS) by a Price to Earnings (P/E) Ratio to get a Fundamental Valuation for APHD. The P/E Ratio is the variable that is multiplied by the EPS to get where a stock should fundamentally trade compared to the other stocks within its Industry or Sector. The links below should help to better understand the P/E Ratio logic as being the growth rate to help assess the fundamental valuation of a stock:

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=57154170

http://www.investopedia.com/terms/p/price-earningsratio.asp

Within the Computer Services Industry, which is the Industry where APHD exists, is indicated to have a P/E Ratio of 32.51 within the link below:

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/pedata.html

Please understand, if one chooses to consider a lower number or a higher number, simply use the Substitution Property to replace such variable or any other variable to what you might choose to believe is a more fair variable to consider.

EPS x P/E Ratio = APHD Share Price Valuation

.0184 = EPS

32.51 = P/E Ratio

.0184 EPS x 32.51 P/E Ratio = .598 APHD Share Price Valuation

This means that once the ”official” confirmation is released from APHD of the completion of the acquisition of Araloc, the stock could be fundamentally worth .598 per share.

This post should now hopefully make more sense:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=134410360

APHD Partners with NASDAQ:SPLK Currently & More…

Within the post below, within Reason #7, I explained it could be strongly hinted that the deal of APHD acquiring Araloc could be done based on what was mentioned within a previous webinar where it was indicated that Splunk is advertised on the Araloc website:

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=134185111

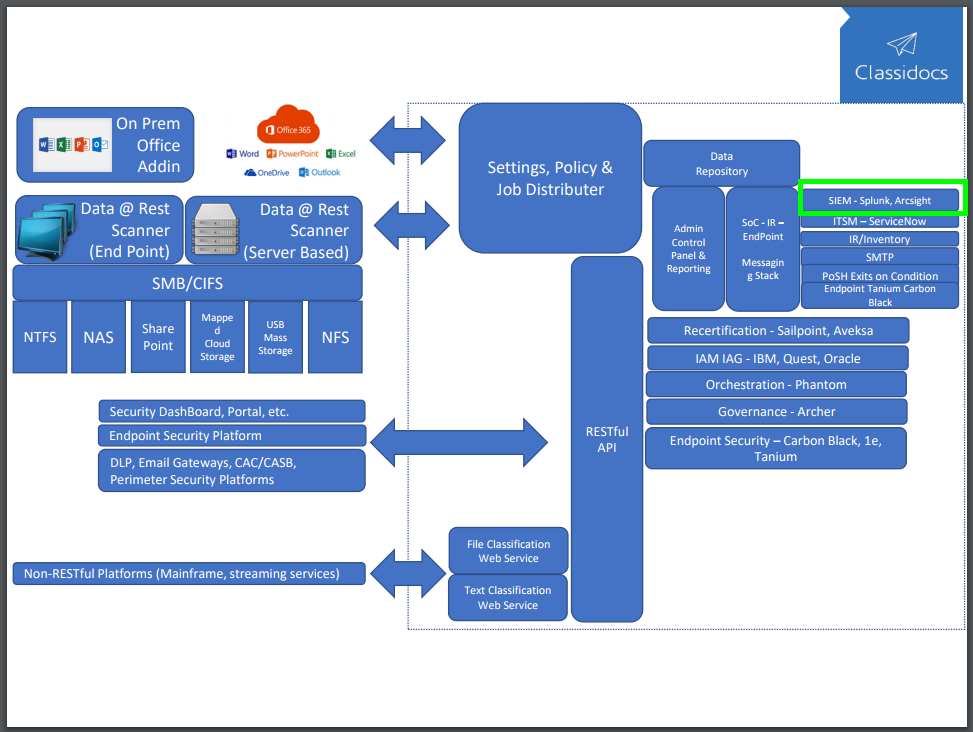

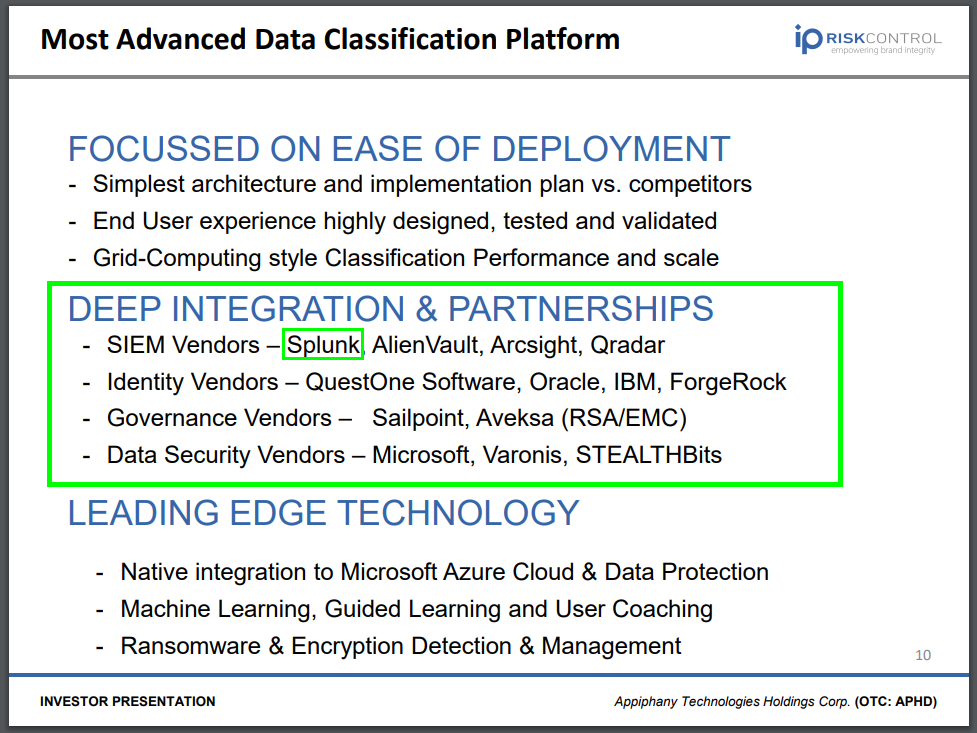

Here's what exists "right now" within APHD as it relates to Splunk and more. Within the APHD Slideshow below, within Slides # 9 and 10, it states that APHD, through its wholly owned subsidiary ClassiDocs, is a partner with Splunk which is $9.08 Billion company that trades on the NASDAQ under the ticker of SPLK at $65.00+ per share:

https://finance.yahoo.com/quote/SPLK/key-statistics?p=SPLK

https://www.splunk.com/

So, to further connect the dots below to reflect confirmation of this:

https://en.wikipedia.org/wiki/Security_information_and_event_management

In the field of computer security, security information and event management (SIEM) software products and services combine security information management (SIM) and security event management (SEM). They provide real-time analysis of security alerts generated by network hardware and applications.

Vendors sell SIEM as software, as appliances or as managed services; these products are also used to log security data and generate reports for compliance purposes.

It is through SIEM that APHD through its wholly owned subsidiary ClassiDocs, provide software products and services in the field of computer security not only Splunk as I had indicated above, but also to AlienVault, Arcsight (a Hewlett Packard company) and Qradar (an IBM company):

https://www.alienvault.com/

ArcSight is a Hewlett Packard Company

http://www.arcsight.com

https://saas.hpe.com/en-us/software/siem-security-information-event-management

QRadar is an IBM Company

https://www.ibm.com/security/campaign/integrated-security-intelligence.html

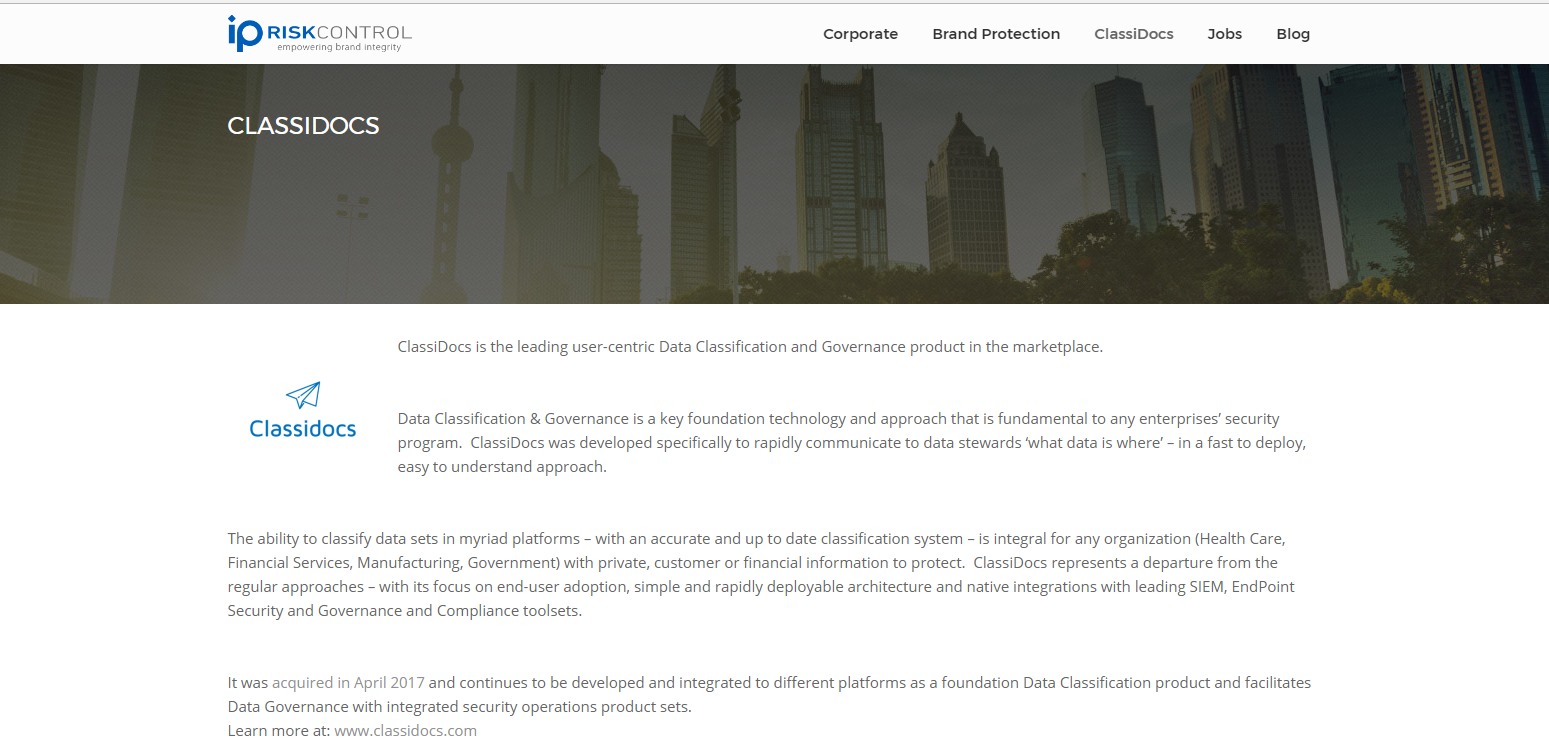

Below is more info to further elaborate and understand the importance and connection of ClassiDocs, the wholly owned subsidiary of APHD:

https://cybersecurity-excellence-awards.com/candidates/classidocs/

http://www.classidocs.com/

https://cybersecurity-excellence-awards.com/candidates/classidocs/

ClassiDocs is the first product on the market to engage your perimeter and internal alerting systems properly – integrating to leading platforms such as Splunk, RSA Archer, Oracle Identity Manager – the data points that accurate data classification give you enable a whole new set of more accurate security response data points.

ClassiDocs, the wholly owned subsidiary of APHD, was indicated above as being the first of its kind technology. ClassiDocs was the first to integrate leading platforms such as Splunk, RSA Archer, Oracle Identity Manager to engage their perimeter and internal alerting systems properly.

https://www.splunk.com/

https://www.rsa.com/en-us

https://www.oracle.com

http://www.oracle.com/technetwork/middleware/id-mgmt/overview/index-098451.html

Again, ClassiDocs was acquired by APHD as can be onfirmed from below:

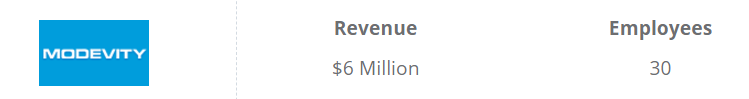

Araloc/Modevity has Annual Income of $6,000,000 with 30 Employees with over 400 active clients with almost a decade of sales and operations behind it which further validates the market acceptance of the product line:

Araloc/Modevity has some big name clientele such as the Cisco, National Geographic, WellStar, McKesson, First Command, and Miami Dolphins:

http://www.modevity.com/

https://araloc.com/

https://www.cisco.com/

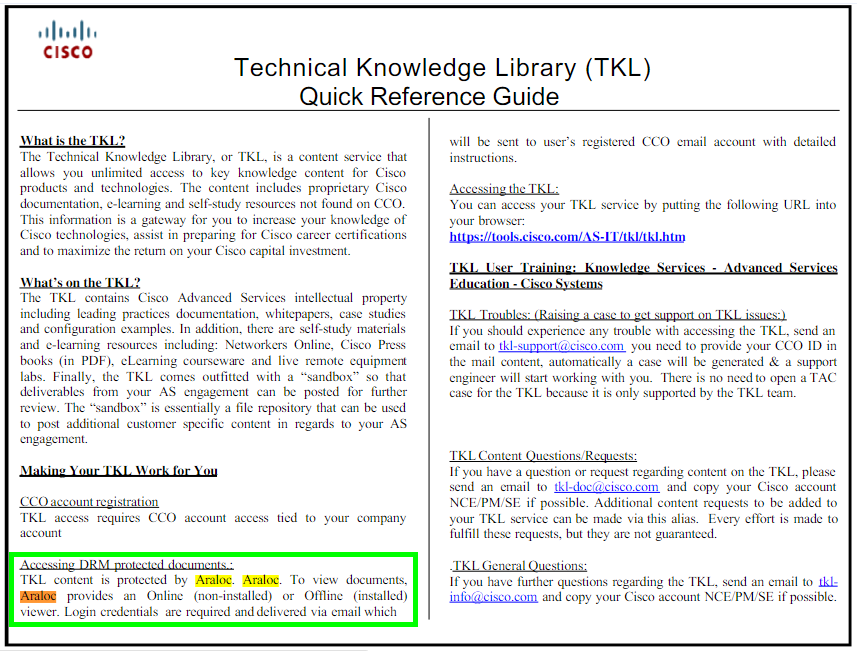

Cisco has its very own Technical Knowledge Library protected by Araloc:

https://www.scribd.com/document/231218388/Cisco-Tkl-at-Glance-Quick-Reference-Guide-v1

http://www.nationalgeographic.com/

https://www.wellstar.org

http://www.mckesson.com/

https://www.firstcommand.com/

ARALOC by Modevity Video - Enterprise Secure Content Distribution

https://www.youtube.com/watch?v=BLvDl5jOsMw

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=134463802

doogdilinger, here's the original APHD/Araloc reason...

Regardless to what was posted within any website about the APHD deal being done for acquiring Araloc, below is the original logic that justified within the eyes of some to believe that such deal was done.

The Fiscal Year Ended is April 30 of every year for APHD. This means that April 30, 2017 was the end of the Fiscal Year for APHD. This means below…

1st Quarter of Fiscal Year 2018 = May 2017, Jun 2017, Jul 2017

2nd Quarter of Fiscal Year 2018 = Aug 2017, Sep 2017, Oct 2017

3rd Quarter of Fiscal Year 2018 = Nov 2017, Dec 2017, Jan 2018

4th Quarter of Fiscal Year 2018 = Feb 2018, Mar 2018, Apr 2018

The Araloc news released by APHD stated that the transaction is to be accretive to earnings beginning Q2 FY 2018 and ongoing:

https://www.otcmarkets.com/stock/APHD/news/IP-Risk-Control-Signs-Letter-of-Intent-to-Acquire-ARALOC-com?id=161716&b=y

The teams are working closely to complete the transition as efficiently as possible, while continuing to grow the customer base and product set. We expect the transaction to be accretive to earnings beginning Q2 FY 2018 and ongoing. The transaction includes the full and completely supported transition of customers, code, sales and marketing and other operational facets of the business. We are very excited to add this solution set to our offerings for our clients, added IP Risk Control president Jason Remillard.

Based on the existence of the beginning of Q2 FY 2018 for APHD being Aug 2017, Sep 2017, and Oct 2017, logically speaking, the deal must be done already for them to capture such earnings as the company has stated.

Before reading any further... understand that Zoominfo is only updated through the company and is username and password based so there is no ability existing for outside tampering of numbers.

Even if one were to consider the $6 Million in Revenues indicated from the Zoominfo link below, it must be understood that Araloc is the operational piece within Modevity that is generating the $6,000,000 in annual Revenues with 30 Employees with over 400 active clients with almost a decade of sales and operations behind it which further validates the market acceptance of the product line. This also confirms that we are still in very good hands here with APHD:

v/r

Sterling

Exit Strategy & Etiquette Thoughts for a Stock

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=128822531

Recent VBHI News

- Form 425 - Prospectuses and communications, business combinations • Edgar (US Regulatory) • 03/05/2024 03:38:56 PM

- Form 425 - Prospectuses and communications, business combinations • Edgar (US Regulatory) • 03/05/2024 01:15:23 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 03/01/2024 09:11:02 PM

- Form S-1/A - General form for registration of securities under the Securities Act of 1933: [Amend] • Edgar (US Regulatory) • 01/05/2024 09:48:32 PM

- Form S-1/A - General form for registration of securities under the Securities Act of 1933: [Amend] • Edgar (US Regulatory) • 12/22/2023 09:17:23 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 12/20/2023 09:09:12 PM

- Form 425 - Prospectuses and communications, business combinations • Edgar (US Regulatory) • 12/15/2023 01:04:27 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 12/15/2023 01:03:07 PM

- Form S-1/A - General form for registration of securities under the Securities Act of 1933: [Amend] • Edgar (US Regulatory) • 12/14/2023 10:08:07 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 12/05/2023 09:58:57 PM

- Form AW - Amendment Withdrawal Request • Edgar (US Regulatory) • 10/17/2023 06:36:47 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 10/13/2023 08:49:43 PM

- Form S-1/A - General form for registration of securities under the Securities Act of 1933: [Amend] • Edgar (US Regulatory) • 10/10/2023 05:15:33 PM

- Form 4 - Statement of changes in beneficial ownership of securities • Edgar (US Regulatory) • 10/04/2023 08:36:16 PM

- Form 10-Q - Quarterly report [Sections 13 or 15(d)] • Edgar (US Regulatory) • 09/19/2023 05:49:23 PM

- Form NT 10-K - Notification of inability to timely file Form 10-K 405, 10-K, 10-KSB 405, 10-KSB, 10-KT, or 10-KT405 • Edgar (US Regulatory) • 07/31/2023 09:28:22 PM

- Form 8-K - Current report • Edgar (US Regulatory) • 06/28/2023 04:01:11 PM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM

Avant Technologies Launches Advanced AI Supercomputing Network and Expansive Data Solutions • AVAI • Apr 23, 2024 8:00 AM

BestGrowthStocks.com Issues Comprehensive Analysis of Triller Merger with AGBA Group Holding Limited • AGBA • Apr 22, 2024 1:00 PM

Cannabix Technologies to Present Marijuana Breathalyzer Technology at International Association for Chemical Testing (IACT) Conference in California • BLO • Apr 22, 2024 8:49 AM