Saturday, August 19, 2017 6:25:22 PM

Stop comparing 2nd Q from 2016 vs 2nd Q of 2017

Canada ops is OUT of PICTURE out of BOOKS both as revenue generator and operation loss and liability on books

What 2nd Q shows is:

500,000 in sales +++ 500,000 debt settlement +++ not much SHORT term DEBT is sight :))

I'll take it as very positive as it sits far improved then 1st Q

and a more focused US operations that HAS some EXCITING surprises in STORE soon to be released for PUBLIC enjoyment .. hehee

We are working on some very exciting developments for the Company that we would consider transformative in nature. There are several opportunities to expand our product portfolio that are in front of us. With the debt reductions in place, we are now actively looking for acquisitions to transform our Company for the benefit of our shareholders. We look forward to being able to announce progress in this area when the time is right."

The PPS, as of NOW is FAR adjusted to that operation loss,

.2 pps/2016 with Canada on books @ 1 Mil revs/ 2nd Q

is not same thing as

.0025 pps/2017 on US alone, on a 500k revs/ 2nd Q - 500k debt paid OFF

.2 vs .002 = 10,000% negative pps adjustment

50% less revenues

with 50% less operations liabilities for that market

YOU like it or NOT, this is the new Benchmark as BOTTOM line numbers for future growth reference in the US markets!!

Good to know, there are 150K more to show for the 3rdQ report.. due to circumstances, as JUMP start!!

one day makes the difference is SHOWING or NOT showing on 2nd Q numbers.. :) and it happen right @ EOM, june28th.

http://losangeles.cbslocal.com/2017/06/28/la-port-terminal-still-closed/

PLSB

The Short version of it : SHORT SQUIIZEEE!!!!

The long version: here is WHY, PLSB should short SQUUUIIIZEEE!!

here it is::

So let's have a L@@k why is everyone SCREAMING here??

OS = 633,600,734

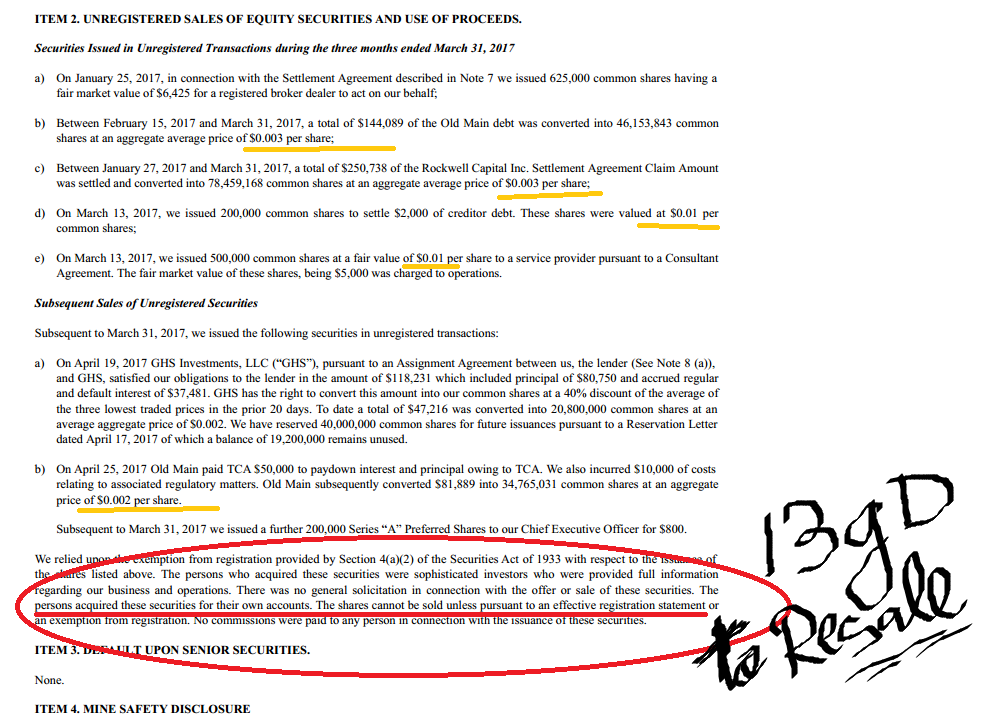

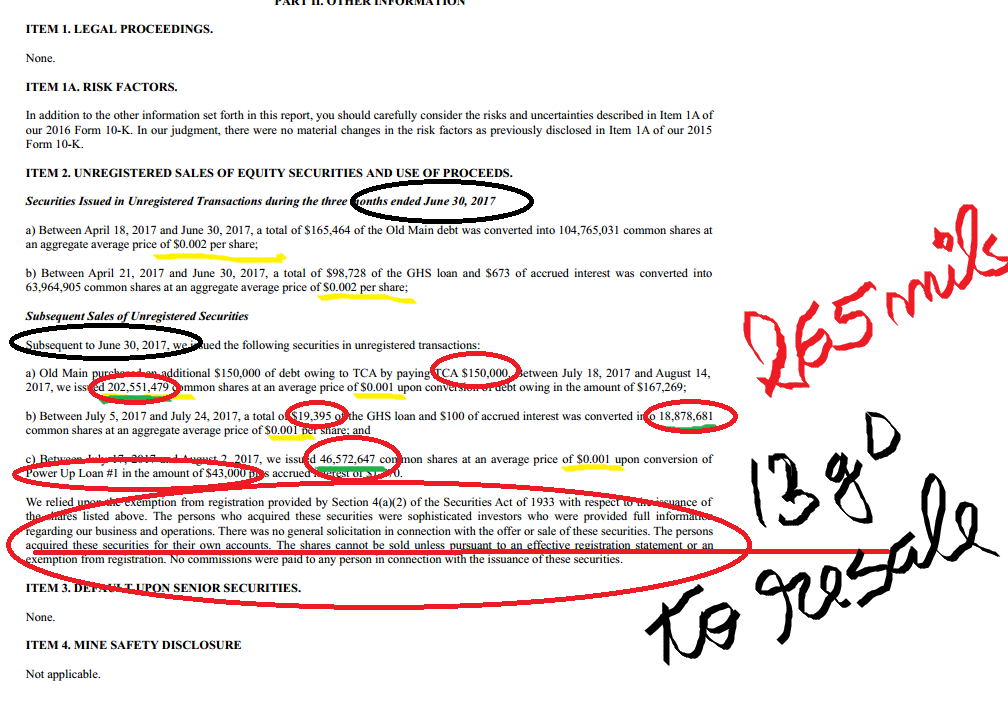

Sales of UNREGISTERED sales of SECURITIES disclosure: :) pictures it.. for easy view::

!!!!! please pay attention to the notes and circumstances.. :)

of regulation 4(a)2 of SEC act of 1933

I don't know who's shorts I bought...

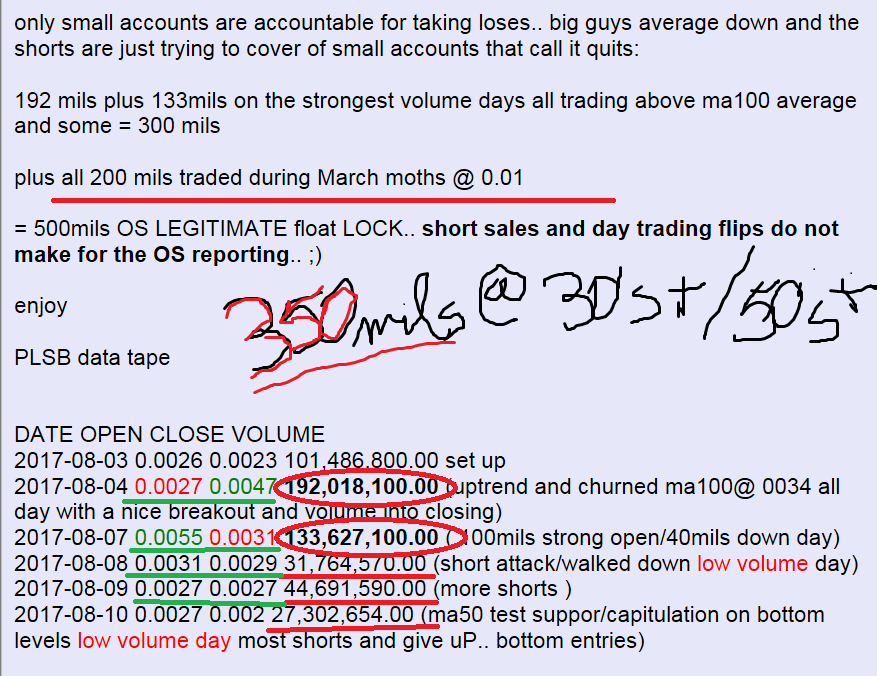

The trading activity, OS and the no of shares converted recently, don't ADD up to that 600mils volume spike we've seen since Aug.

But for sure doesn't look like the converts.. those are to be hold under the private placements regulations and limitations.. so cannot be release for public sale without a proper holding time and without a correct registration statements... as they were exempt from registration on the issuer end (aka the co) but not exempt from registration at the buyer end (lender and converter :))

https://www.sec.gov/fast-answers/answersregis33htm.html

Registration Under the Securities Act of 1933

Often referred to as the "truth in securities" law, the Securities Act of 1933 has two basic objectives:

•To require that investors receive financial and other significant information concerning securities being offered for public sale; and

•To prohibit deceit, misrepresentations, and other fraud in the sale of securities.

JUST a REMINDER.. :)))

http://securities-law-blog.com/2014/10/14/depositing-penny-stocks-with-brokers-creates-obstacles-sec-charges-etrade-with-section-5-violation-1/

The SEC press release on the matter quoted Andrew J. Ceresney, Director of the SEC’s Division of Enforcement, as saying, “Broker-dealers serve an important gatekeeping function that helps prevent microcap fraud by taking measures to ensure that unregistered shares don’t reach the market if the registration rules aren’t being followed. Many billions of unregistered shares passed through gates that E*TRADE should have closed, and we will hold firms accountable when improper trading occurs on their watch.”

so back to 4(a)2..

https://www.sec.gov/info/smallbus/qasbsec.htm

Non-public offering (private placement) exemption

Section 4(a)(2) of the Securities Act exempts from registration "transactions by an issuer not involving any public offering." To qualify for this exemption, which is sometimes referred to as the “private placement” exemption, the purchasers of the securities must:

either have enough knowledge and experience in finance and business matters to be “sophisticated investors” (able to evaluate the risks and merits of the investment), or be able to bear the investment's economic risk;

have access to the type of information normally provided in a prospectus for a registered securities offering; and

agree not to resell or distribute the securities to the public.

In general, public advertising of the offering, and general solicitation of investors, is incompatible with the non-public offering exemption.

The precise limits of the non-public offering exemption are not defined by rule. As the number of purchasers increases and their relationship to the company and its management becomes more remote, it is more difficult to show that the offering qualifies for this exemption. If your company offers securities to even one person who does not meet the necessary conditions, the entire offering may be in violation of the Securities Act.

So in order to RESALE securities purchased under the UNREGISTERED securities EXEMPTION 4(a)2 .. u must comply with: Resales of restricted securities

https://www.sec.gov/info/smallbus/qasbsec.htm#resales

“Restricted securities” are previously-issued securities held by security holders that are not freely tradable because the sale transaction from the issuer to the security holders was a private transaction. After such a private transaction, the security holders can only resell the securities into the market by using an “effective” registration statement under the Securities Act or a valid exemption from the registration requirements of the Securities Act for the resale, such as Rule 144 under the Securities Act.

If holders of restricted securities want to resell using an effective registration statement, the issuing company can provide a registration statement for them to make sales in a public offering by following the process discussed above for registering a public offering of securities.

Alternatively, a holder of restricted securities can resell using an exemption. For example, Securities Act Rule 144 provides an exemption that permits the resale of restricted securities if a number of conditions are met, including holding the securities for six months or one year, depending on whether the issuer has been filing reports under the Exchange Act. Rule 144 may limit the amount of securities that can be sold at one time and may restrict the manner of sale, depending on whether the security holder is an affiliate. An affiliate of a company is a person that, directly, or indirectly through one or more intermediaries controls, or is controlled by, or is under common control with, the company.

What are the new exemptions mandated by the JOBS Act?

see also,

https://www.sec.gov/fast-answers/answerssched13htm.html

Fast Answers

Schedule 13D

Schedule 13D is commonly referred to as a[color=red] “beneficial ownership report.”

http://www.otcmarkets.com/edgar/GetFilingHtml?FilingID=12063562

7. SOLE DISPOSITIVE POWER

25,000,769

http://www.seclaw.com/introduction-private-placements/

Private Placement of Restricted Securities Outside Regulation D

The specific requirements to be satisfied in establishing an exemption under Section 4(2) for a private placement are not stated in that section of the Securities Act of 1933. By studying SEC interpretations and court decisions dealing with Section 4(2), the basic requirements which a private placement must meet can be determined. They are summarized below:

All the offerees and purchasers must have access to the same kind of information concerning the issuer which would appear in an SEC registration statement, and these persons must be able to comprehend and evaluate such information. It must be kept in mind that any offer to an offeree who would not qualify, as well as a sale to a purchaser who would not qualify, may destroy the private placement exemption and result in a violation of Section 5 of the 1933 Act.

The issuer and any parties acting for the issuer, including the broker-dealer, must take all reasonable steps to insure that the information given to the offerees and purchasers is complete and accurate. This is “due diligence.” All information passed on in the course of the private placement, either orally or by memorandum (or offering circular), is subject to the anti-fraud provisions of the federal securities laws. The fact that the offering memorandum is not reviewed by the SEC does not lower the standards for accuracy which would be applicable to any registered offering.

All of the offerees must have access to meaningful current information concerning the issuer. The fact than an offeree has considerable financial resources or is a lawyer, accountant or businessperson, and thus may be considered sophisticated, does not eliminate the need for appropriate information to be made available.

While there is no specific limitation on the number of offerees, the greater the number of offerees, the greater the likelihood that the offering will not qualify for the exemption. In this connection, a private placement cannot be the subject of advertising, general promotional seminars or public meetings in connection with the offering. This limitation does not preclude meeting with offerees to discuss the terms of the offer or to present information concerning the issuer or the offer. After the private placement has been completed, a general announcement (such as a tombstone ad) concerning it may be made if this is desired.

Purchasers in a private placement must acquire the securities for investment and not for the purpose of further distribution. If the purchaser acts in such a manner so as to participate in distribution of the securities to the public, either directly or indirectly as a link between the issuer and the public, he or she will be deemed to be an underwriter and the selling broker-dealer and other participants in the distribution, including the issuer, will be in violation of Section 5 of the 1933 Act.

Each of the purchasers must intend to acquire for investment at the time the securities are purchased. Whether or not investment intent was present will be determined from all the circumstances surrounding the acquisition. Such circumstances would include the financial capability of the purchaser to hold the securities for the long term and whether the purchaser signed a letter of investment intent. The amount of time the securities have been held (the holding period) is one of the factors in a hindsight determination that an investment intent existed at the time of purchase. A two-year holding period is deemed to be the bare minimum.

What is readily apparent from the foregoing is that current and accurate information about the offerees in a private placement transaction is absolutely essential for the making of judgments as to suitability, ability to evaluate an offering, and investment intent.

Very nice educational video cast, for some to learn about some in and outs of securities lows and regulations:

http://lawcast.com/lawcast-segments/

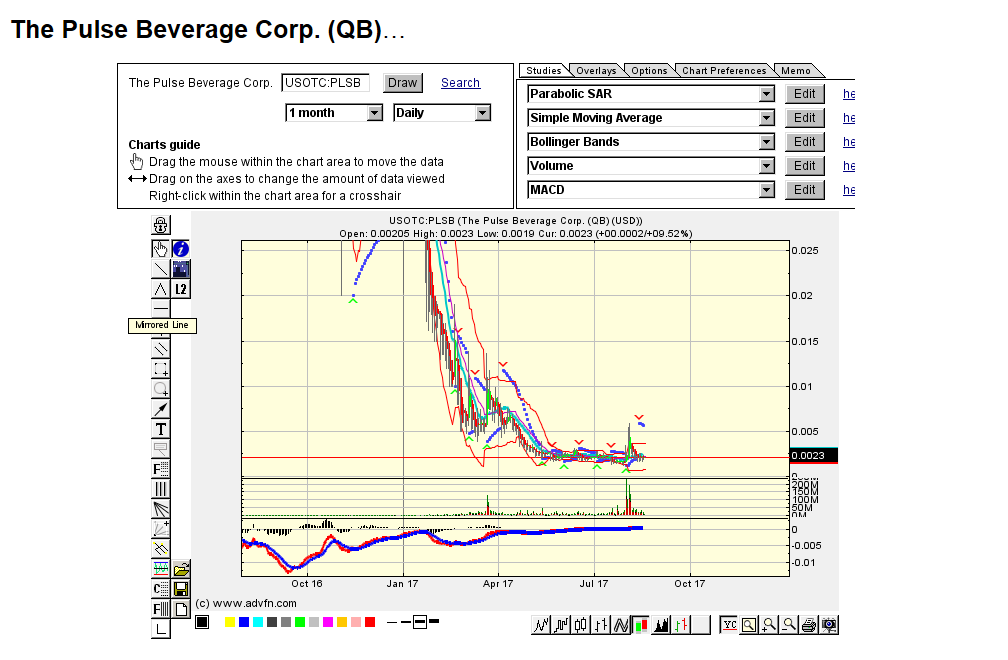

The chart tells the story... and we get to see how many TRUE converts were from the lenders, right there on them filings and how many FAKES shares from shorties

There were MORE then 600 mils shares traded since Aug 2nd to date:

and per the picture posted conversion disclose schedule, the lenders only executed about 265 millions shares that got reported as CONVERTED between jne30th/aug14th prior filing...:)

WITH that beeig said, and looking at the SHORT schedule and NO posted in same category of UNGERGISTERED securities....lol

I won't let out WHAT everyone is LOOKING FOR.. the MORE notes!!!

YEAHIII... ohh well, there are a FEW, in FUTURE tense, aka well into 2018, at MARKET price discount, as Scheduled:: (u can read all fine lines and filings be my guest & done it)

side note:: (market price discount is not = 00000000zz00z0z

look at how much the lenders converted @ already...and they hold 003, 002, and the least 001)

near short term >>> only 30left >>> OUChhhh... not enufff left to drive the PPS down.. no PROBLEM there are a few notes due NEXT year in April.. or July.. or FORGET about it!!!

GApUP?.. lol Big one..

PLSB

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.