| Followers | 679 |

| Posts | 140829 |

| Boards Moderated | 36 |

| Alias Born | 03/10/2004 |

Sunday, April 09, 2017 9:23:39 AM

By Carl Swenlin | April 8, 2017

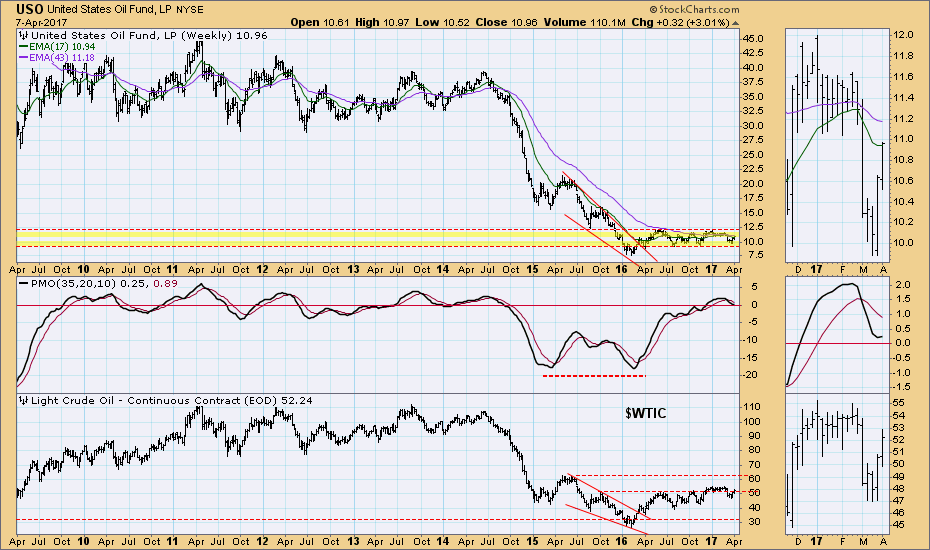

CRUDE OIL (USO): As of 3/8/2017 United States Oil Fund (USO) is on an Intermediate-Term Trend Model Neutral signal. The Long-Term Trend Model, which informs our long-term outlook, is on a SELL signal as of 3/9/2017, so our long-term posture is bearish.

The one-year daily chart shows USO moving sideways, with the potential to advance in the area of 11.80. The PMO bottomed in oversold territory last month, and that is a good base for a rally.

I find it useful to compare weekly charts of USO and $WTIC because USO price incorporates the cost of continuously rolling over futures contracts. Also, we get to keep the proper perspective on the price of crude, which has been edging higher after the initial bounce in early-2016. I can see the potential for about $60/barrel, but the fundamental problem of oversupply would seem to argue against any major rally for crude oil.

http://stockcharts.com/articles/decisionpoint/2017/04/decisionpoint-weekly-wrap-4-7-2017.html

• DiscoverGold

Click on "In reply to", for Authors past commentaries

Information posted to this board is not meant to suggest any specific action, but to point out the technical signs that can help our readers make their own specific decisions. Your Due Dilegence is a must!

• DiscoverGold

FEATURED Cannabix's Breath Logix Alcohol Device Delivers Positive Impact to Private Monitoring Agency in Montana, USA • Apr 25, 2024 8:52 AM

Bantec Reports an Over 50 Percent Increase in Sales and Profits in Q1 2024 from Q1 2023 • BANT • Apr 25, 2024 10:00 AM

Kona Gold Beverages, Inc. Announces Name Change to NuVibe, Inc. and Initiation of Ticker Symbol Application Process • KGKG • Apr 25, 2024 8:30 AM

Axis Technologies Group and Carbonis Forge Ahead with New Digital Carbon Credit Technology • AXTG • Apr 24, 2024 3:00 AM

North Bay Resources Announces Successful Equipment Test at Bishop Gold Mill, Inyo County, California • NBRI • Apr 23, 2024 9:41 AM

Epazz, Inc.: CryObo, Inc. solar Bitcoin operations will issue tokens • EPAZ • Apr 23, 2024 9:20 AM