| Followers | 325 |

| Posts | 20140 |

| Boards Moderated | 5 |

| Alias Born | 12/15/2012 |

Wednesday, May 25, 2016 10:14:29 PM

#USAPF: On May 20, 2016 Americas Silver Corp (OTCQX:USAPF) announced a private placement with Eric Sprott and other strategic shareholders. The gross proceeds are estimated at around C$20 million.

http://seekingalpha.com/article/3977415-2-transitional-resource-companies-insider-buying#alt3

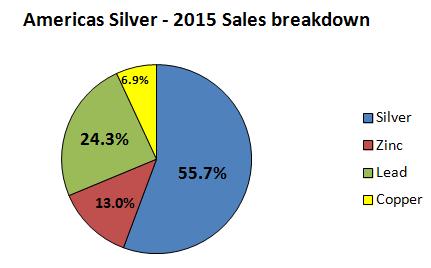

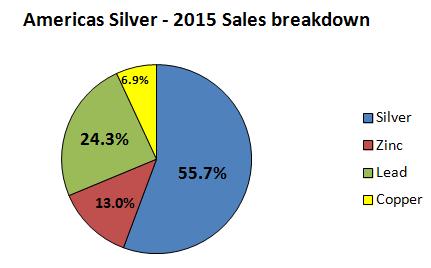

This small silver / base metals miner emerged in late 2014 from a merger between Scorpio Mining and U.S. Silver and Gold Inc. In 2015 the company produced 2.7 million ounces of silver, large amounts of zinc and lead and small amount of copper:

As the chart shows, Americas Silver production (and sales) is split between silver (a precious metal) and base metals.

Well, Americas Silver cannot be called, by any means, a great company. Since its merger in 2013, it has been unprofitable. However, this situation seems to be changing. For the better.

In 1Q 2016 the company was losing "only" $3.11 on each ounce of silver equivalent sold (in 1Q 2015 it was a huge loss of $9.44!). This improvement is attributable to higher prices of silver and lower costs of production. For example, all-in sustaining cost per ounce of silver went down from $19.57 in 1Q 2015 to $14.92 in 1Q 2016 (a decrease of 23.8%). As a result, the Cosala mine, an operation located in Mexico, delivered operating profit of $350 thousand in 1Q 2016. The second mine, Galena (Idaho, USA), was still unprofitable (a loss of $22 thousand).

However, the company is going to perform much better in the not so far future. First of all, Americas Silver has a large mineral base. At the end of 2015 it was holding silver reserves of 31.1 million ounces. Add to that figure the measured and indicated resources of 50.1 million ounces and 37.1 million ounces of inferred resources and the total mineral base amounts to 118.3 million ounces of silver. Well, in my opinion, Americas Silver's mineral base is quite impressive, comparable to such established silver miners as, for example, Endeavour Silver (122.5 million ounces of silver at the end of 2015).

Further, at its Cosala mine the company is transitioning the operations from the Nuestra Senora deposit to San Rafael. This new deposit should deliver much more base metals than previously (silver production should be, more or less, unchanged). For example, San Rafael should be delivering 45.5 million pounds of zinc a year (in 2015 Cosala delivered "only" 11.6 million pounds of zinc).

Generally, the San Rafael project shows a pre-tax internal rate of return of 27%, calculated using the price of silver of $16 per ounce.

Summing up - in the nearest future the following catalysts should have a positive impact on Americas Silver performance:

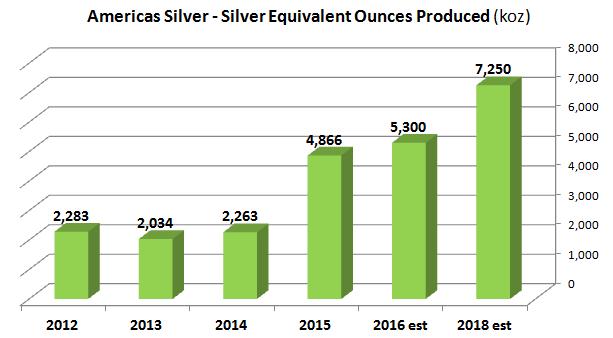

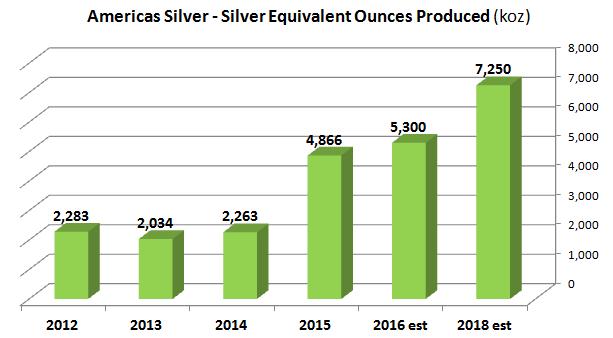

Higher production (chart below) Lower production costs Shifting production at Cosala to the San Rafael deposit (expected in 2017)

A private placement, announced on May 20, should fuel the company with cash of C$20 million. In the case of Americas Silver, it is a huge amount of cash. In my opinion, at the end of 1Q 2016 the company was short of cash (it held only C$2.1 million in cash). To transition its production to San Rafael, Americas Silver needs around C$28 million in initial capital costs - the private placement should cover most of these expenditures. The remaining capital should be delivered from mining operations - in 1Q 2016 the company was able to generate cash flow from operations (without working capital issues) of C$1.2 million. I think that higher silver prices plus lower costs of production should result in higher cash flow from operations, which is going to fill the financing gap at San Rafael.

Summary

Once again both notable resource investors, Ross Beaty and Eric Sprott, made surprising investments. Neither Anfield Gold nor Americas Silver are well known and established companies. However, these two investors surely see some potential in these miners. Of course, the exact reasons standing behind these purchases are known only to Ross Beaty and Eric Sprott but let me summarize these deals:

Both companies operate in established mining jurisdictions: Anfield in Brazil and Americas Silver in Mexico and the USA Both miners are in sort of transition periods: Anfield has just acquired a property in Brazil and Americas Silver is rapidly increasing its production and cutting production costs Both companies are busy with implementing new projects: Coringa at Anfield and San Rafael at Americas Silver At this stage of development both companies are quite risky (although, in my opinion, the investment in Anfield bears much higher risk - this company is not an operating miner).

Last but not least - the timing of these purchases is worth emphasizing. My readers know my point of view on the gold market. In my opinion, it is currently in its first stage of a bull run. However, it is very hard to predict the direction of any market. After its initial rally, the gold market is hesitating now and many investors are trying to guess what is in the cards. Ross Beaty and Eric Sprott are not guessing - they are still buying…

Note: I strongly encourage my readers to visit my blog. It is a continuation of my Seeking Alpha activity where you will find the articles posted on a daily basis.

http://seekingalpha.com/article/3977415-2-transitional-resource-companies-insider-buying#alt3

This small silver / base metals miner emerged in late 2014 from a merger between Scorpio Mining and U.S. Silver and Gold Inc. In 2015 the company produced 2.7 million ounces of silver, large amounts of zinc and lead and small amount of copper:

As the chart shows, Americas Silver production (and sales) is split between silver (a precious metal) and base metals.

Well, Americas Silver cannot be called, by any means, a great company. Since its merger in 2013, it has been unprofitable. However, this situation seems to be changing. For the better.

In 1Q 2016 the company was losing "only" $3.11 on each ounce of silver equivalent sold (in 1Q 2015 it was a huge loss of $9.44!). This improvement is attributable to higher prices of silver and lower costs of production. For example, all-in sustaining cost per ounce of silver went down from $19.57 in 1Q 2015 to $14.92 in 1Q 2016 (a decrease of 23.8%). As a result, the Cosala mine, an operation located in Mexico, delivered operating profit of $350 thousand in 1Q 2016. The second mine, Galena (Idaho, USA), was still unprofitable (a loss of $22 thousand).

However, the company is going to perform much better in the not so far future. First of all, Americas Silver has a large mineral base. At the end of 2015 it was holding silver reserves of 31.1 million ounces. Add to that figure the measured and indicated resources of 50.1 million ounces and 37.1 million ounces of inferred resources and the total mineral base amounts to 118.3 million ounces of silver. Well, in my opinion, Americas Silver's mineral base is quite impressive, comparable to such established silver miners as, for example, Endeavour Silver (122.5 million ounces of silver at the end of 2015).

Further, at its Cosala mine the company is transitioning the operations from the Nuestra Senora deposit to San Rafael. This new deposit should deliver much more base metals than previously (silver production should be, more or less, unchanged). For example, San Rafael should be delivering 45.5 million pounds of zinc a year (in 2015 Cosala delivered "only" 11.6 million pounds of zinc).

Generally, the San Rafael project shows a pre-tax internal rate of return of 27%, calculated using the price of silver of $16 per ounce.

Summing up - in the nearest future the following catalysts should have a positive impact on Americas Silver performance:

Higher production (chart below) Lower production costs Shifting production at Cosala to the San Rafael deposit (expected in 2017)

A private placement, announced on May 20, should fuel the company with cash of C$20 million. In the case of Americas Silver, it is a huge amount of cash. In my opinion, at the end of 1Q 2016 the company was short of cash (it held only C$2.1 million in cash). To transition its production to San Rafael, Americas Silver needs around C$28 million in initial capital costs - the private placement should cover most of these expenditures. The remaining capital should be delivered from mining operations - in 1Q 2016 the company was able to generate cash flow from operations (without working capital issues) of C$1.2 million. I think that higher silver prices plus lower costs of production should result in higher cash flow from operations, which is going to fill the financing gap at San Rafael.

Summary

Once again both notable resource investors, Ross Beaty and Eric Sprott, made surprising investments. Neither Anfield Gold nor Americas Silver are well known and established companies. However, these two investors surely see some potential in these miners. Of course, the exact reasons standing behind these purchases are known only to Ross Beaty and Eric Sprott but let me summarize these deals:

Both companies operate in established mining jurisdictions: Anfield in Brazil and Americas Silver in Mexico and the USA Both miners are in sort of transition periods: Anfield has just acquired a property in Brazil and Americas Silver is rapidly increasing its production and cutting production costs Both companies are busy with implementing new projects: Coringa at Anfield and San Rafael at Americas Silver At this stage of development both companies are quite risky (although, in my opinion, the investment in Anfield bears much higher risk - this company is not an operating miner).

Last but not least - the timing of these purchases is worth emphasizing. My readers know my point of view on the gold market. In my opinion, it is currently in its first stage of a bull run. However, it is very hard to predict the direction of any market. After its initial rally, the gold market is hesitating now and many investors are trying to guess what is in the cards. Ross Beaty and Eric Sprott are not guessing - they are still buying…

Note: I strongly encourage my readers to visit my blog. It is a continuation of my Seeking Alpha activity where you will find the articles posted on a daily basis.

Join the InvestorsHub Community

Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.