Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Aris Mining - Q4 Results Conference Call - 2023

Aris Mining Corporation

The Pros are running this company, great results, great guidence.

ARIS MINING REPORTS 2023 RESULTS WITH GUIDANCE ACHIEVED, NET EARNINGS OF $11.4M, ADJUSTED EARNINGS OF $52.2M ($0.38/SHARE),

ADJUSTED EBITDA OF $159M

March 06, 2024

Download(opens in new window)

VANCOUVER, BC, March 6, 2024 /PRNewswire/ -

Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) announces financial and operating results for the three and twelve months

ended December 31, 2023 (Q4 2023 and FY 2023, respectively). All amounts are in US dollars unless otherwise indicated.

https://www.aris-mining.com/news/news-details/2024/ARIS-MINING-REPORTS-2023-RESULTS-WITH-GUIDANCE-ACHIEVED-NET-EARNINGS-OF-11.4M-ADJUSTED-EARNINGS-OF-52.2M-0.38SHARE-ADJUSTED-EBITDA-OF-159M/default.aspx

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=173916527

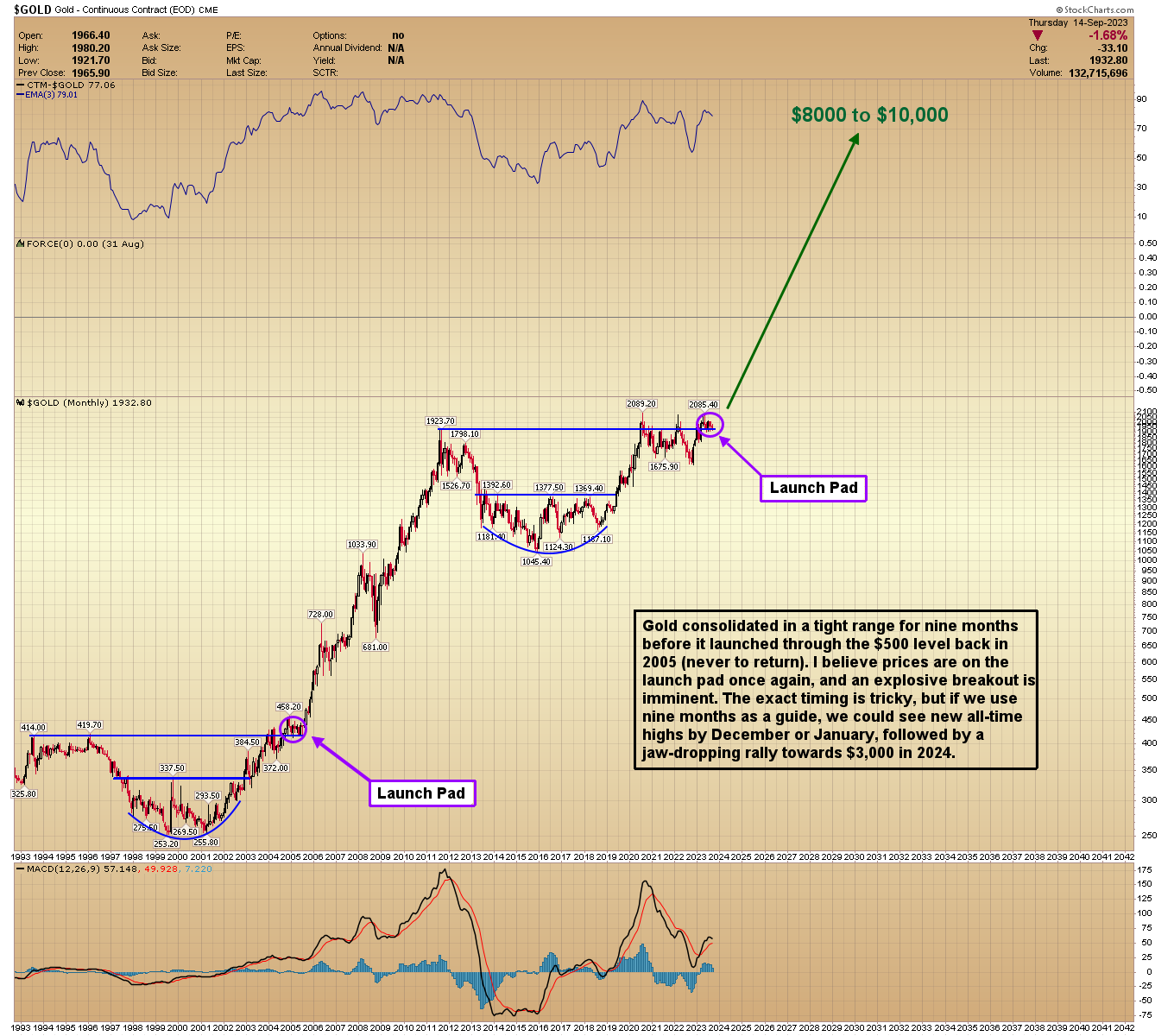

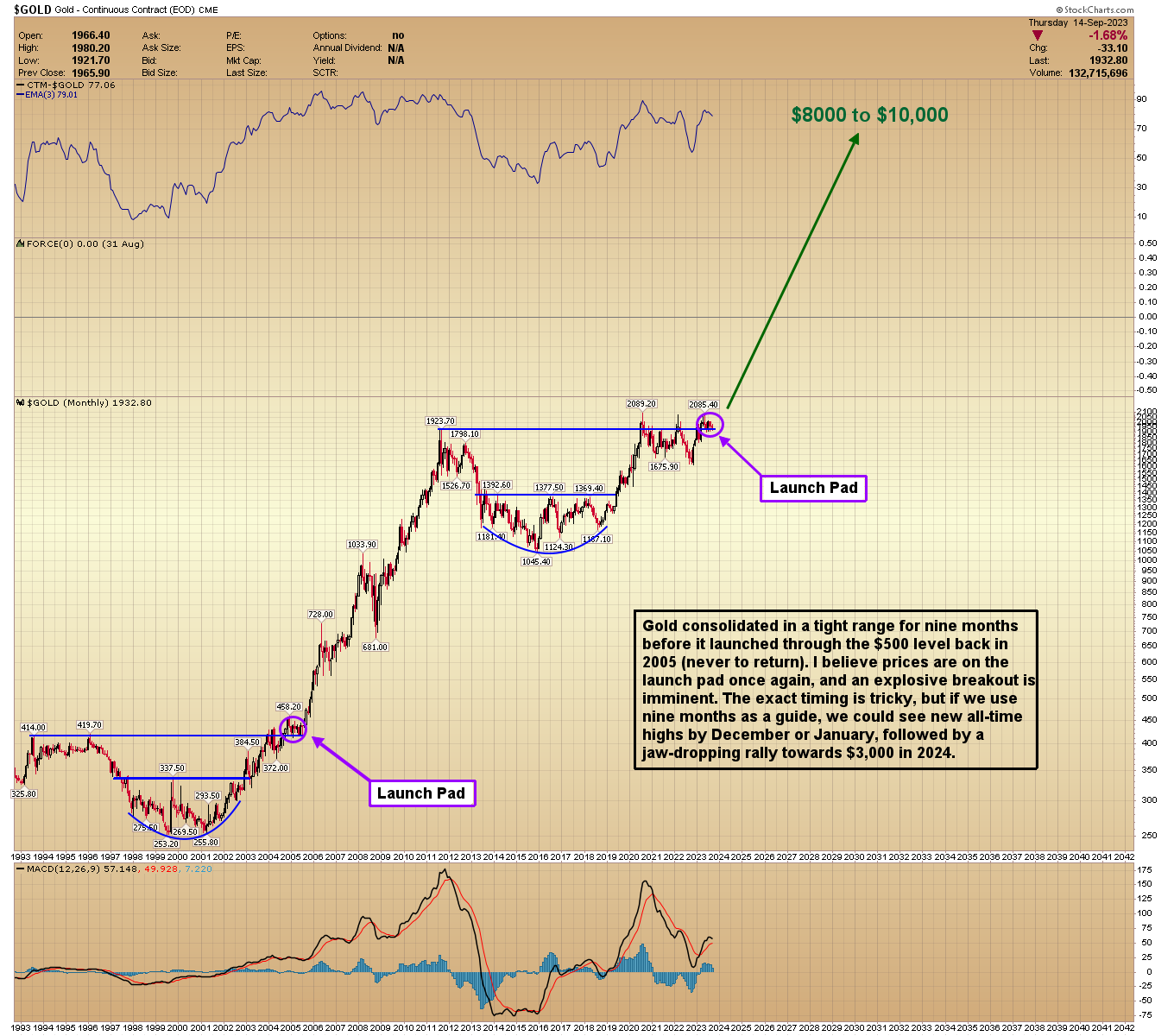

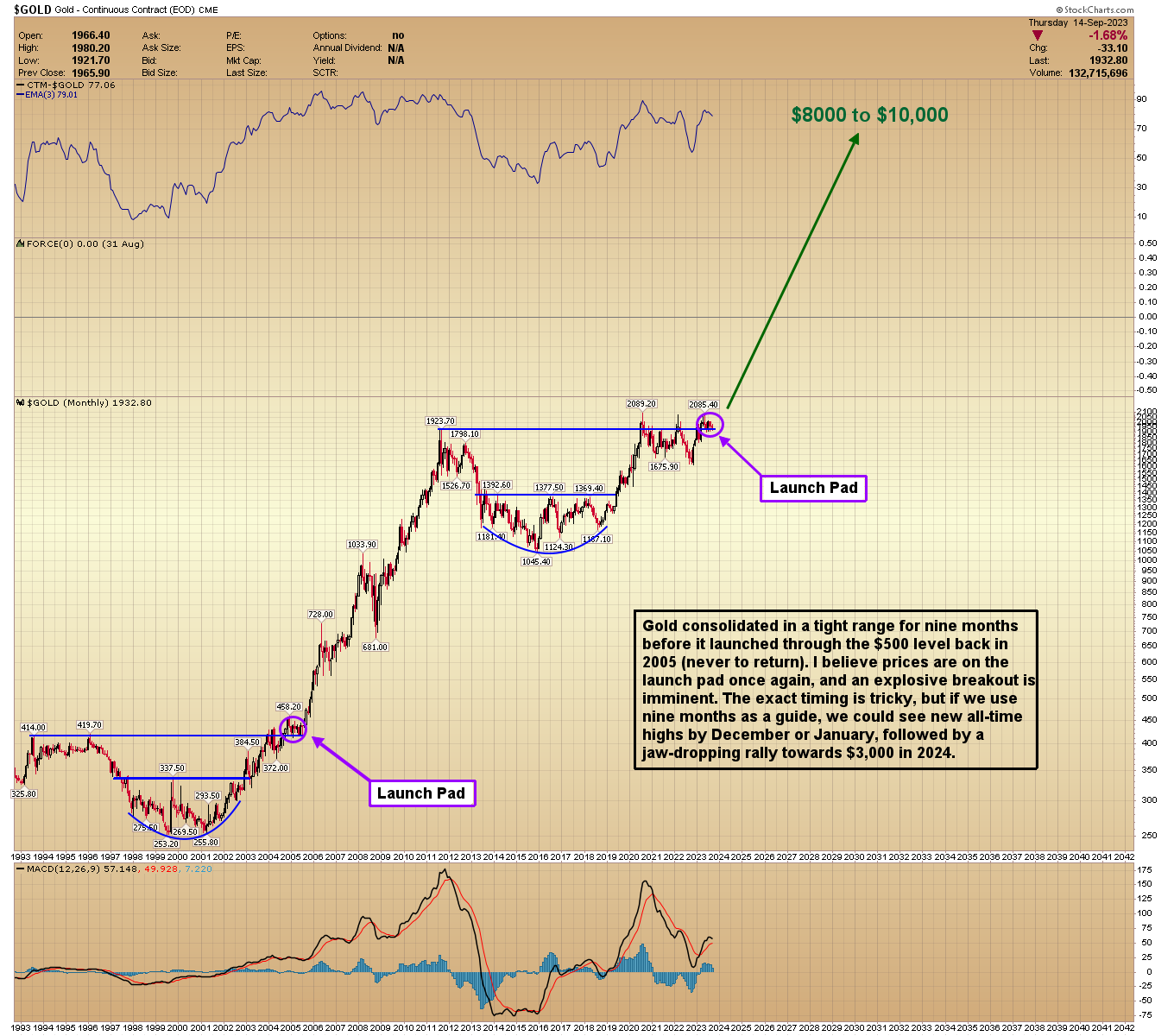

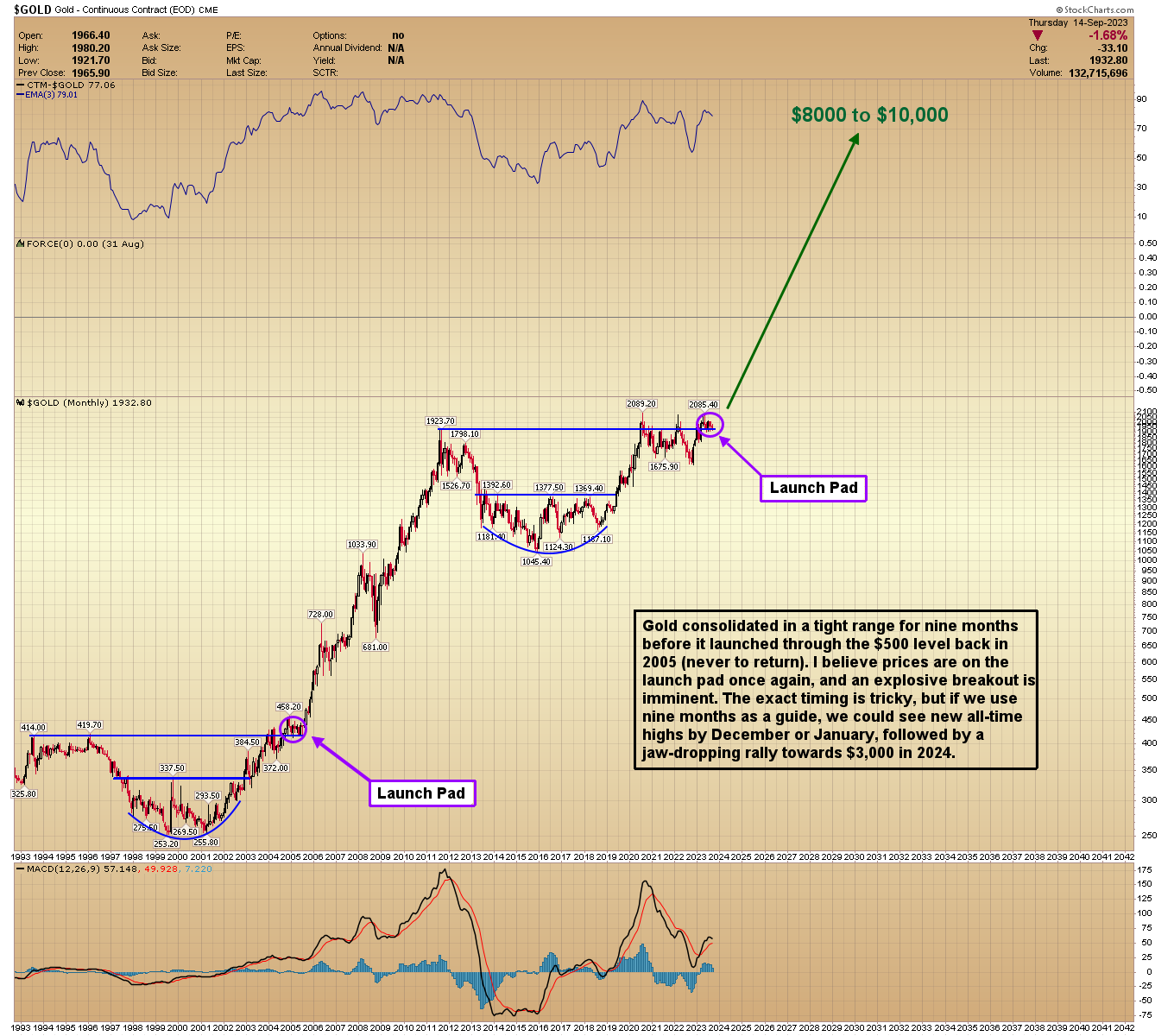

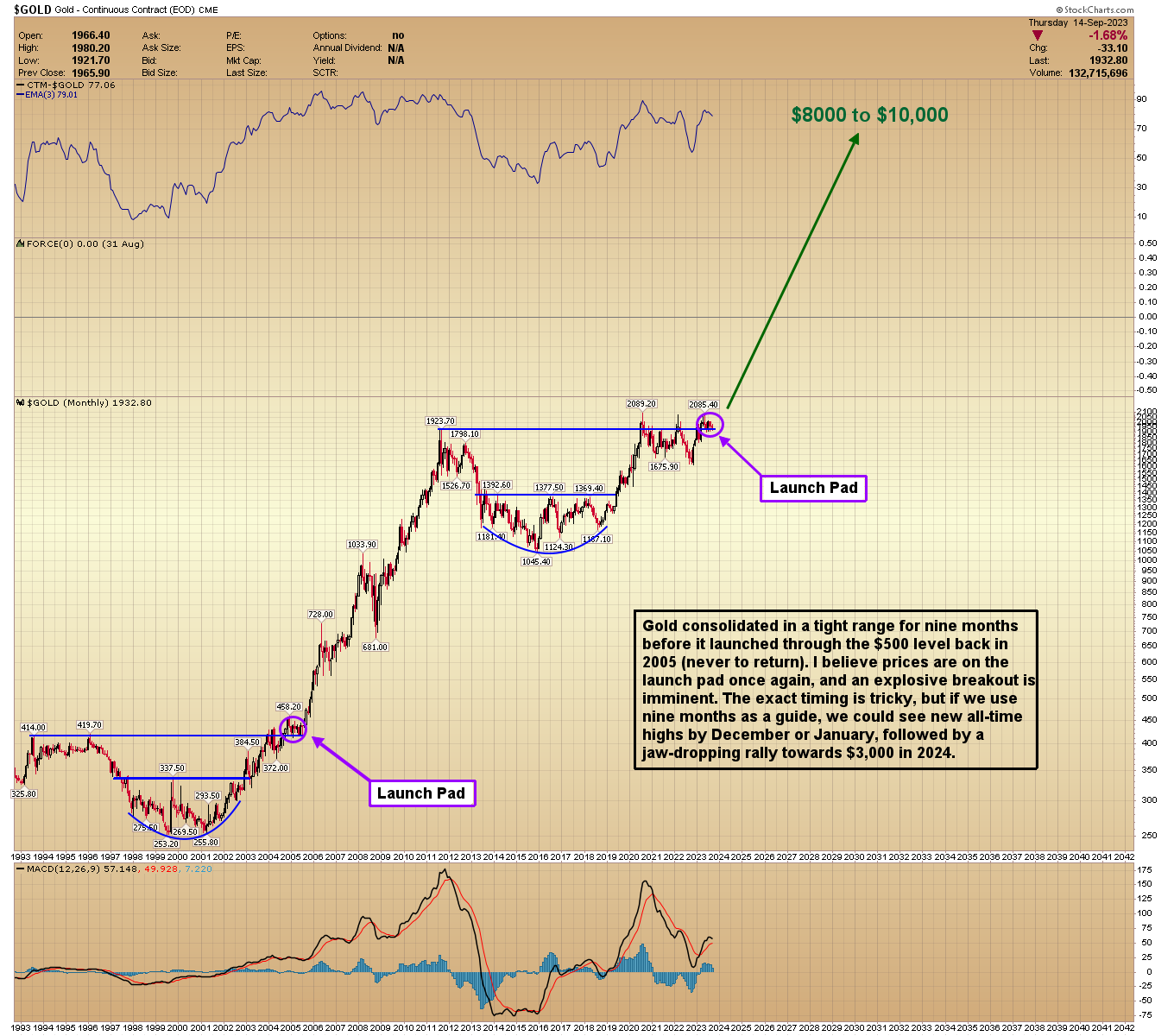

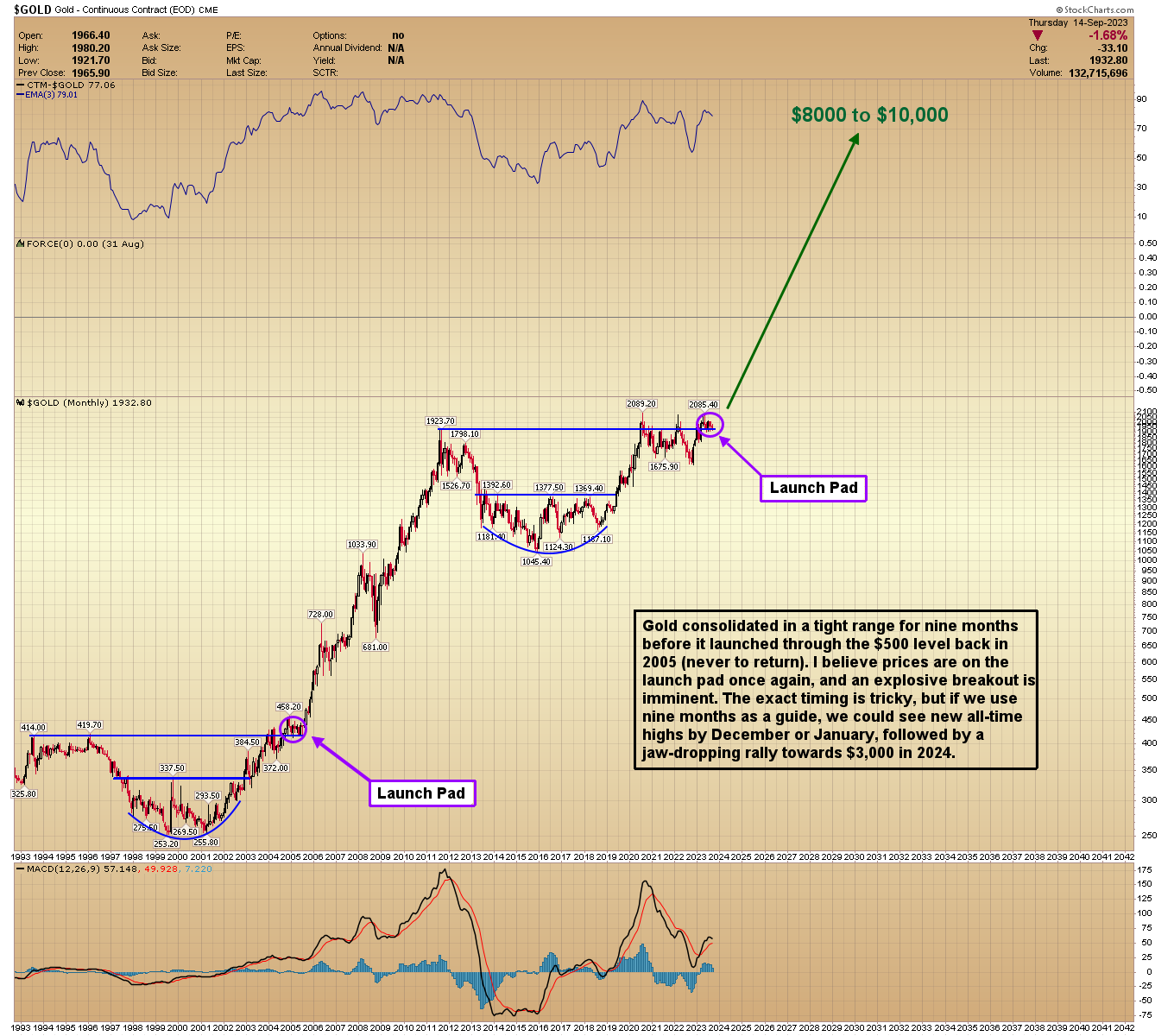

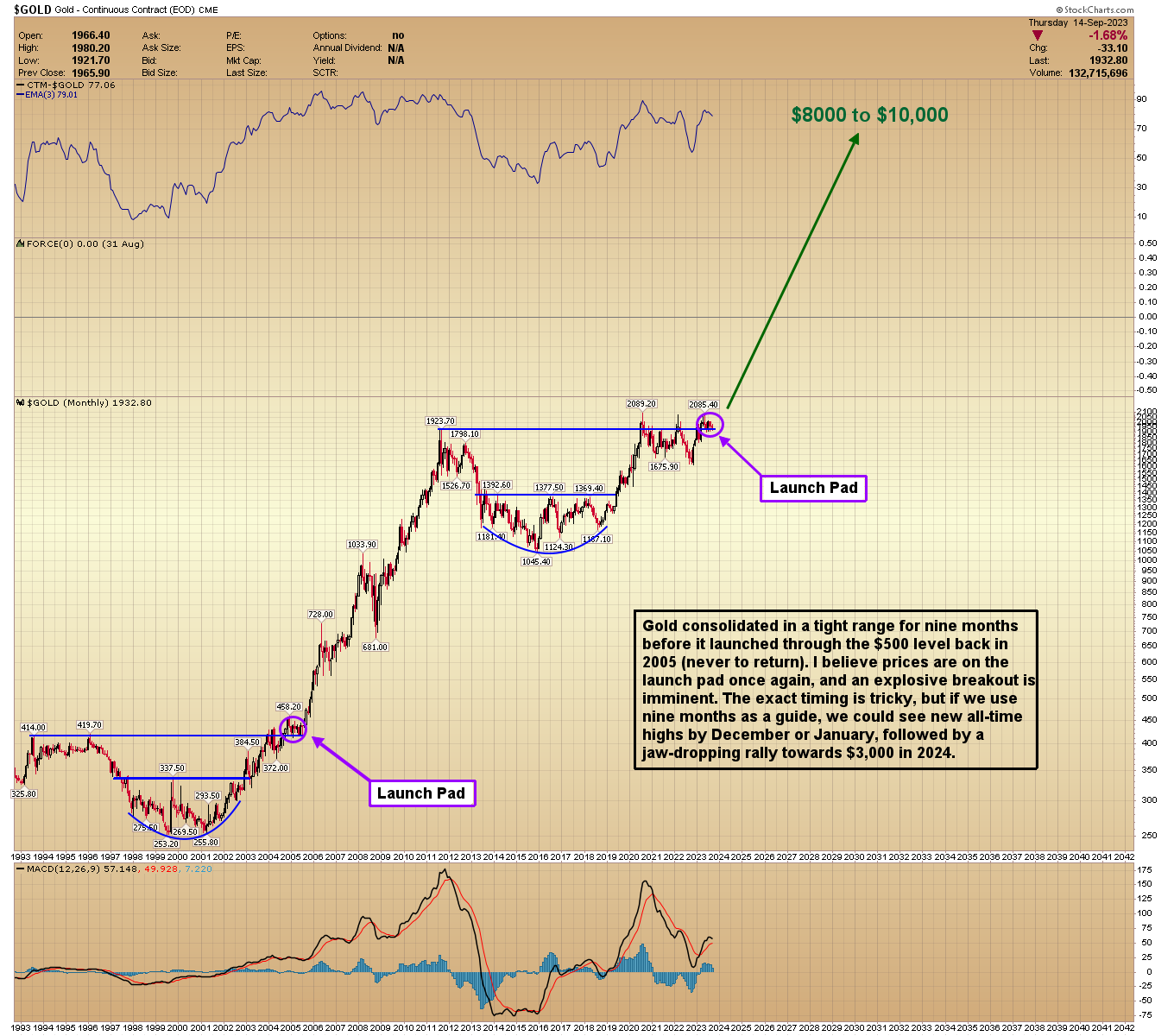

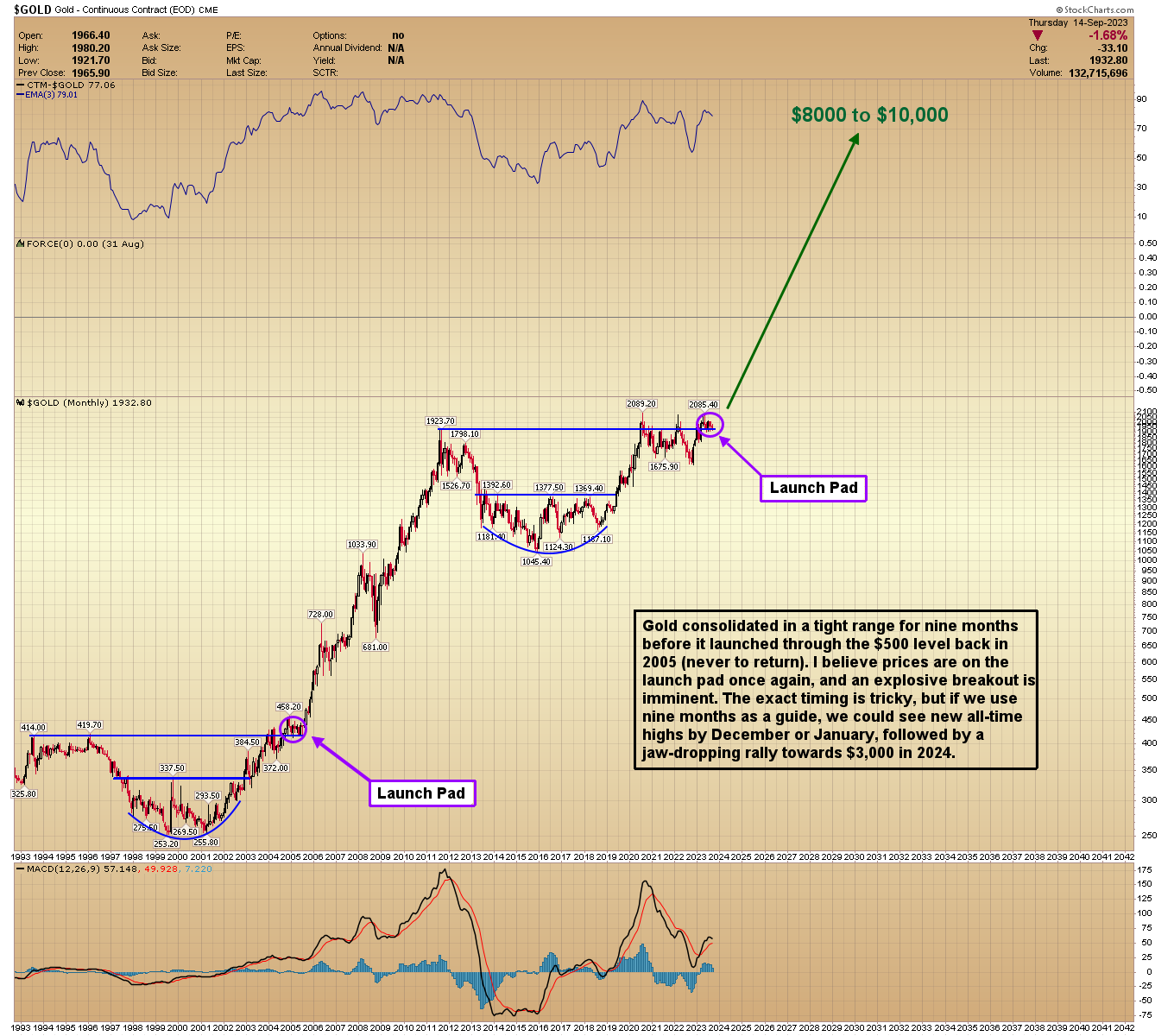

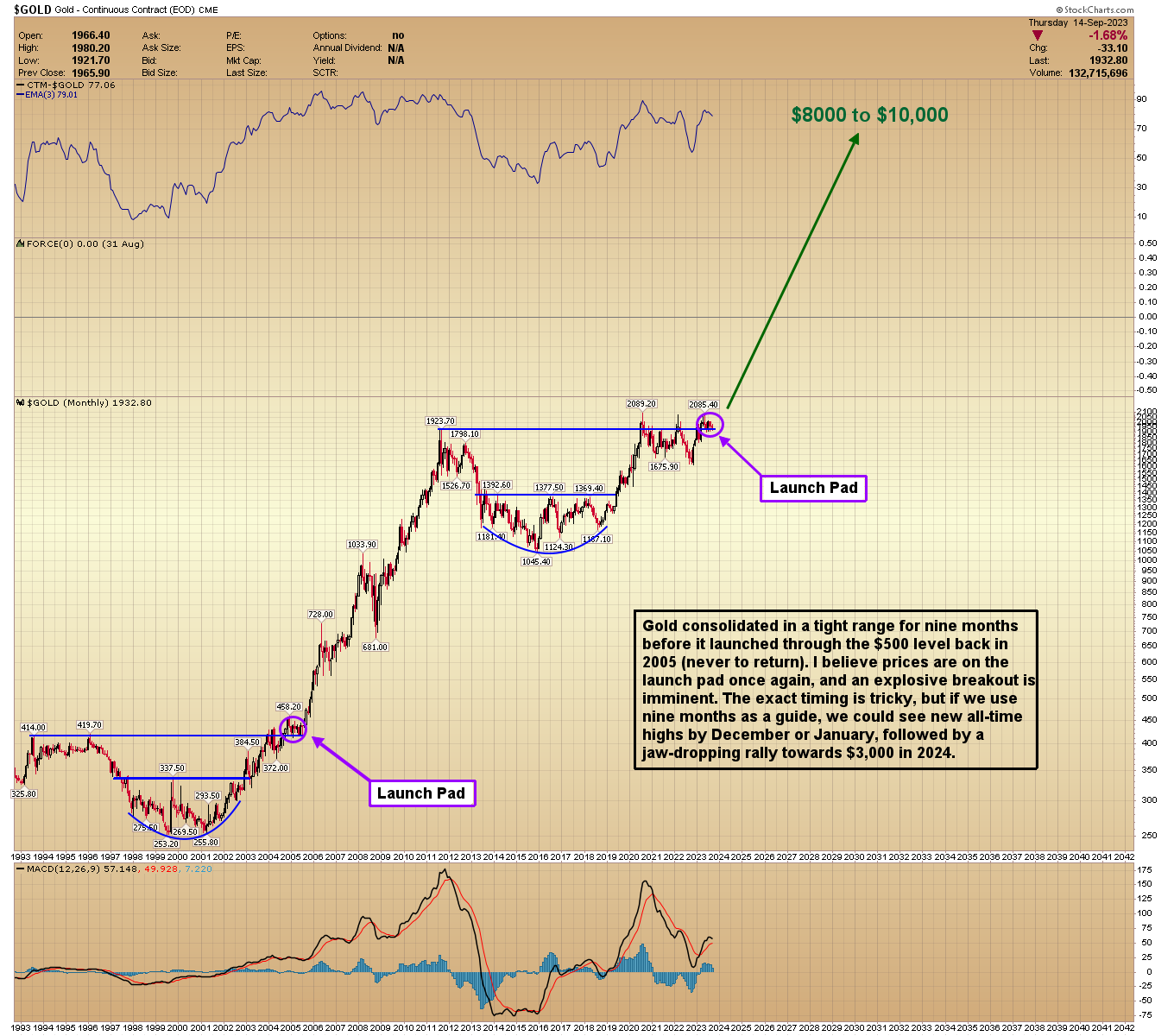

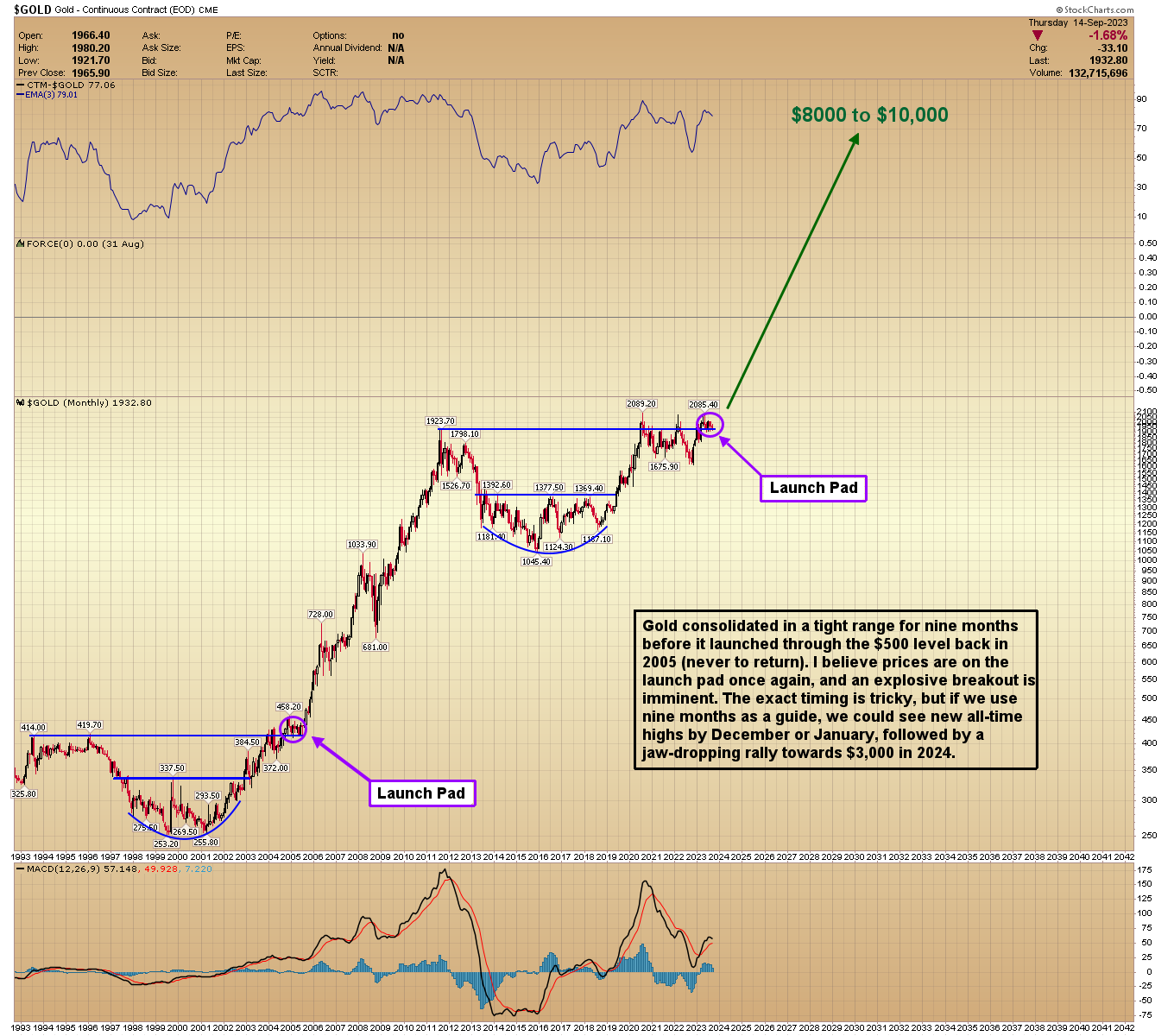

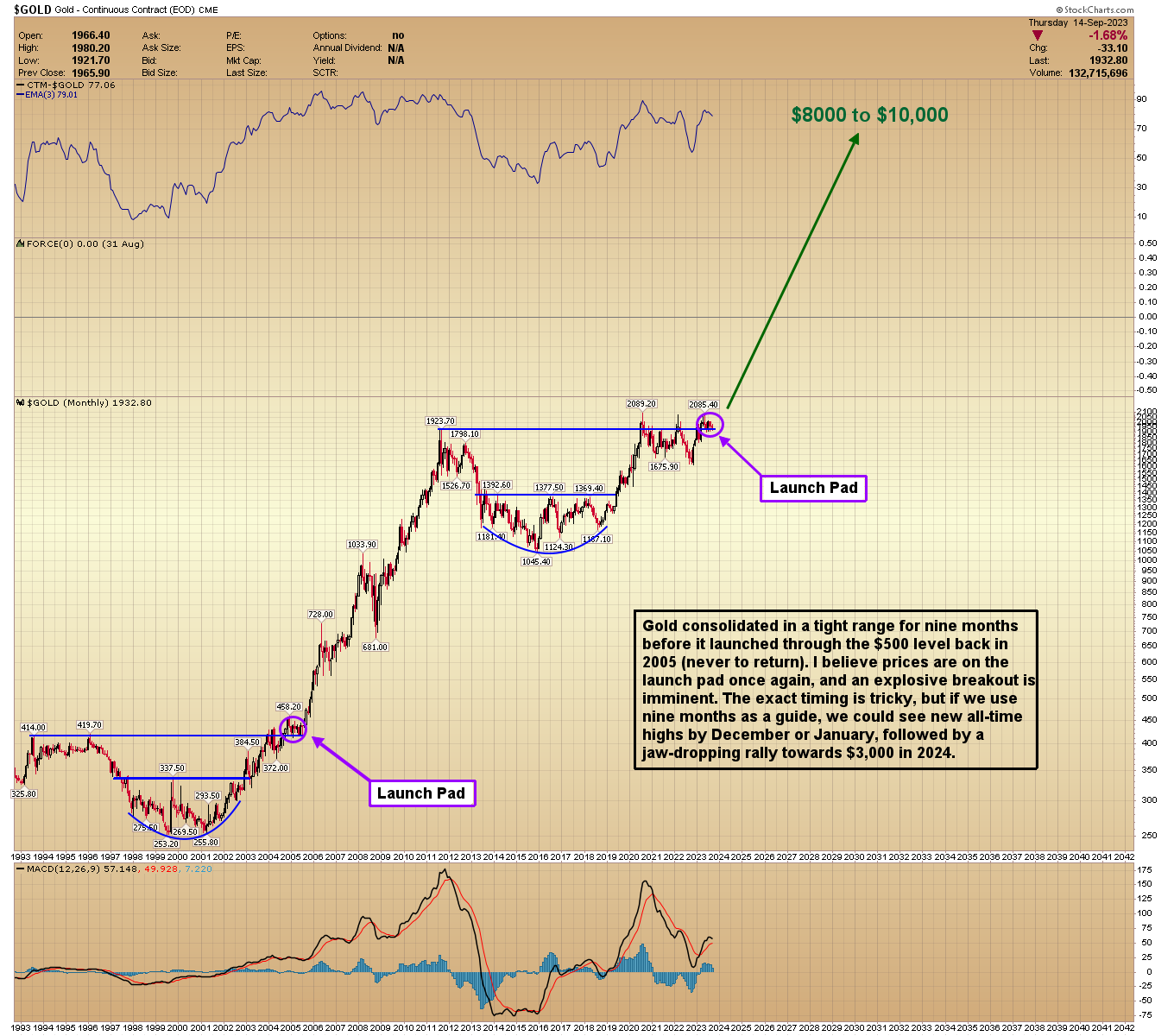

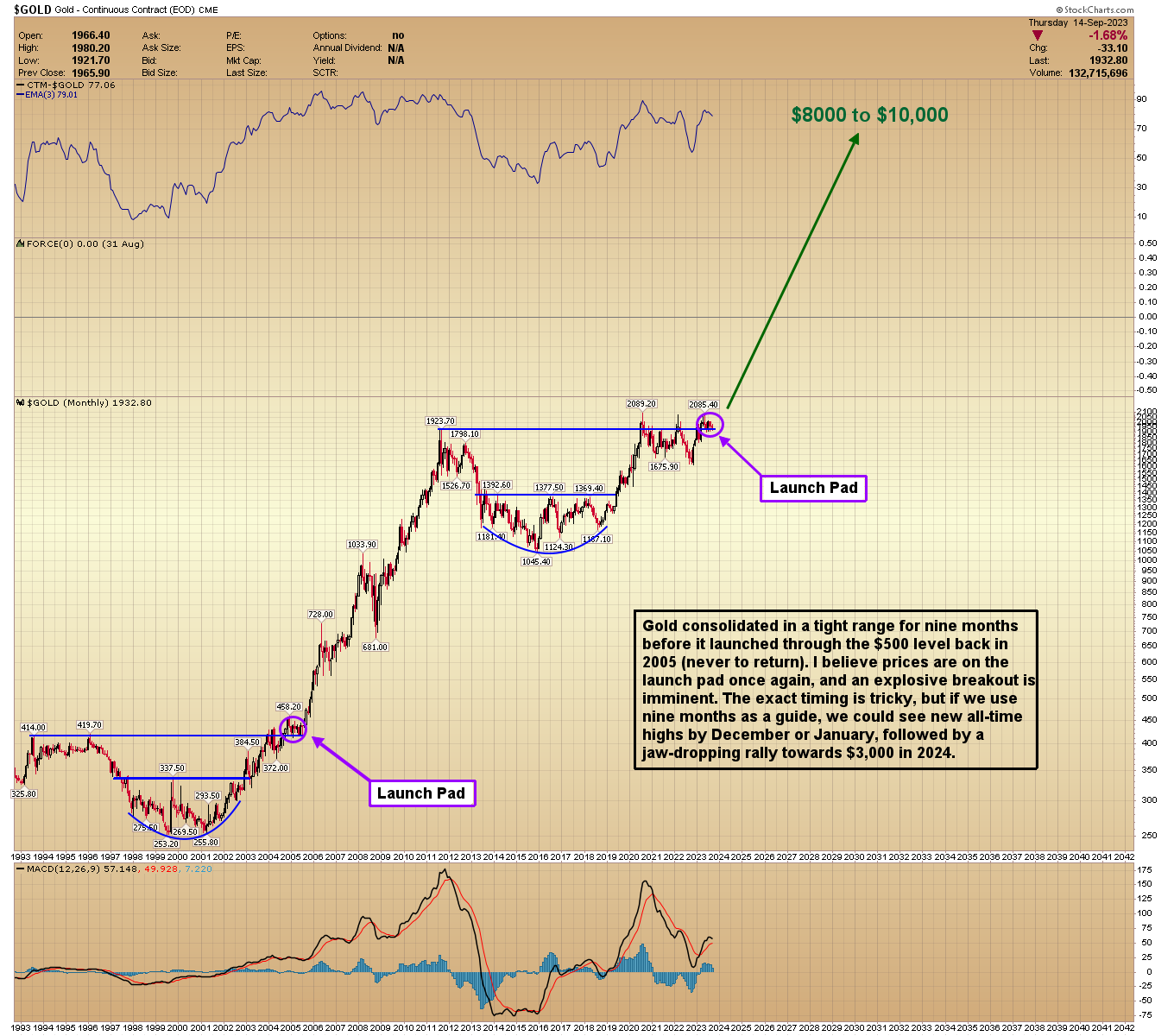

Gold vs M2 Money Supply:

Gold Massively Undervalued vs US Money Supply

$NEWS - Is Gold Setting Up for a Huge, Once in a Generation, Rally?

By Chris Vermeulen

Is there a generational opportunity coming to get into gold?

it may be time to add more.

ARIS MINING TO ANNOUNCE FULL-YEAR 2023 RESULTS ON MARCH 6, 2024

NEWS PROVIDED BY

Aris Mining Corporation

22 Feb, 2024, 07:50 ET

SHARE THIS ARTICLE

https://www.prnewswire.com/news-releases/aris-mining-to-announce-full-year-2023-results-on-march-6-2024-302068224.html

VANCOUVER, BC, Feb. 22, 2024 /PRNewswire/ -

Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE–A: ARMN) will announce its full-year 2023 operations and financial results after market close on March 6, 2024.

Management will host a conference call on Thursday, March 7, 2024, at 11:00 am ET/8:00 am PT to discuss the results. The call will be webcast and can be accessed at Aris Mining's website at

https://www.aris-mining.com, or at https://services.choruscall.ca/links/arismining2023q4.html

To join the conference via telephone dial:

Toll-free North America: 1-866-668-0730

International: +1 604-638-5357

Participants may also choose to pre-register to join the conference call automatically, at LINK. Upon registering, participants will receive a calendar invitation with dial-in details and a unique PIN, which will allow them to bypass the operator queue and connect directly to the conference.

The call will be available for playback for one week by dialing:

Toll-free in the US and Canada: +1 800.319.6413

International: +1 604.638.9010

Replay access code: 0729

A replay of the event will be archived at Aris Mining Corporation - Investors - Events & Presentations (aris-mining.com).

About Aris Mining

Aris Mining is a gold producer in the Americas, currently operating two mines with expansions underway in Colombia. The Segovia Operations and Marmato Upper Mine, known for their high-grade deposits, produced 226,000 ounces of gold in 2023. With ongoing expansion projects, Segovia and Marmato are targeting to produce 500,000 ounces of gold in 2026. Aris Mining also operates the Proyecto Soto Norte joint venture, where environmental licensing is advancing to develop a new underground gold, silver and copper mine. In Guyana, Aris Mining is advancing the Toroparu Project, a gold/copper project. Aris Mining intends to pursue acquisitions and other growth opportunities to unlock value through scale and diversification.

Aris Mining promotes the formalization of artisanal and small-scale mining as this process enables all miners to operate in a legal, safe and responsible manner that protects them and the environment.

Additional information on Aris Mining can be found at www.aris-mining.com, www.sedarplus.ca, and on www.sec.gov.

Forward-Looking Information

This news release contains "forward-looking information" or forward-looking statements" within the meaning of Canadian and U.S. securities legislation. All statements included herein, other than statements of historical fact, including, without limitation, statements relating to the timing of the release of the Company's annual financial results and the Company's target production in 2026, and its plans and strategies are forward-looking. When used herein, forward looking terminology such as "expect", "plan", "anticipate", "estimate", "may", "will", "should", "intend", "believe", and similar expressions, are intended to identify forward-looking statements. Forward-looking statements are based on estimates and assumptions made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors that the Company believes are appropriate in the circumstances. Many factors could cause the Company's actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements, including those described in the "Risk Factors" section of the Company's most recent AIF and in the Management's Discussion and Analysis for the three and nine months ended September 30, 2023, which are available on the Company's profile on SEDAR+ at www.sedarplus.ca and in its filings with the U.S. Securities and Exchange Commission at www.sec.gov. These factors should be considered carefully, and readers should not place undue reliance on the Company's forward-looking statements. The Company has no intention and undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

SOURCE Aris Mining Corporation

Also from this source

ARIS MINING ANNOUNCES APPOINTMENT OF TWO INDEPENDENT DIRECTORS

VANCOUVER, BC, Feb. 14, 2024 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) announces the appointment ...

ARIS MINING ACHIEVES 2023 PRODUCTION GUIDANCE AND PROVIDES 2024 OUTLOOK

VANCOUVER, BC, Jan. 16, 2024 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) reports 2023 gold...

More Releases From This Source

Gold Surges $44 After US & UK Strikes In Yemen

January 12, 2024

Gold Surges $44 After US & UK Strikes In Yemen

The price of gold has surged $44 on the heels of the US & UK strikes in Yemen. Silver is also moving higher once again above $23.50, up nearly $1. Here is what to watch.

https://kingworldnews.com/gold-surges-44-after-us-uk-strikes-in-yemen/

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=173374182

Aris Mining Corp. Chart - Near Bullish Flag Pattern Breakout

Almost broke out this morning but go tamped down by sellers.

The Bull Flag pattern has a price objective of 5.40.

We have resistance at 4.50, 4.70 and 4.92 on the immediate horizon.

The 4.70 level looks to be the toughest nut to crack.

Aris Short Term Chart

https://stockcharts.com/c-sc/sc?s=ARIS.TO&p=D&yr=1&mn=1&dy=0&i=p44734753125&a=1260483926&r=1701896854669

Aris 42 Month Chart

https://stockcharts.com/c-sc/sc?s=ARIS.TO&p=W&yr=3&mn=6&dy=0&i=p56363874243&a=1326772940&r=1701896521189

Frank Giustra on Aris Mining's Proven Winning Strategy | Mines & Money Coverage

CEO.CA

7.17K subscribers

The only reason fer that much buying in China is the Yuan that can't be taken out of the country about to be devalued into a Zimbabwe like steaming pile of Communists!

Frank Giustra on Aris Mining's Proven Winning Strategy | Mines & Money Coverage

CEO.CA

7.17K subscribers

Explosion of POG related to massive buying of Gold..China - Not surprising ...the USD is collapsing..

https://www.zerohedge.com/markets/behind-mysterious-explosion-gold-prices-chinas-massive-accumulation-gold

$Aris Mining Corp - Golden Surprise at Segovia -

Imagine turning $11 million into $80+ million annually for several years starting in just ~15 months.

From a company trading at 1.33X 2026 EBITDA before this Golden Suprise.

Breaking story:

https://www.thebigscore.com/p/golden-surprise-at-aris-mining

Aris Mining’s 2023 PM Zurich Conference Presentation

Below is the link to Aris Mining's 2023 Precious Metals Zurich Conference Presentation lead by CEO, Neil Woodyer.

Nov 17, 2023

Neil Woodyer, CEO of Aris Mining, presents at the 2023 Precious Metals Zurich Conference (November 12, 2023).

Aris Mining Corporation

$Aris Mining Corp - Golden Surprise at Segovia -

Imagine turning $11 million into $80+ million annually for several years starting in just ~15 months.

From a company trading at 1.33X 2026 EBITDA before this Golden Suprise.

Breaking story:

https://www.thebigscore.com/p/golden-surprise-at-aris-mining

Aris Mining’s 2023 PM Zurich Conference Presentation

Below is the link to Aris Mining's 2023 Precious Metals Zurich Conference Presentation lead by CEO, Neil Woodyer.

Nov 17, 2023

Neil Woodyer, CEO of Aris Mining, presents at the 2023 Precious Metals Zurich Conference (November 12, 2023).

Aris Mining Corporation

A Golden day today.

$Aris Mining Ord Shs ARMN TSX:ARIS - Very Heavy Volume - $Aris has now had a parabolic rise moving higher

by almost $1.00 in a week. Right now with more than 2 more hours of trading left, the combined total volume

traded (TSX + NYSE) is over 900,000. Mom and Pop aren't the ones buying right now.

Toronto is about 2.5 times that of New York. The Canadian funds that kept grinding the stock lower for

most of the year are likely not going to be playing the stock to the downside much longer, if at all.

The series of press releases has been outstanding recently and I can think of no time over the last 20 years where

100,000 ounces of achievable production can be realized for so little ($11 million) in such a short period of time (early 2025).

I'm curious in the next month or two, how many more analysts are going to begin covering Aris.

What the stock desperately needed is institutions to climb on board and we might be

in the midst of seeing that happen now in real time.

$Aris Mining Corp - Golden Surprise at Segovia -

Imagine turning $11 million into $80+ million annually for several years starting in just ~15 months.

From a company trading at 1.33X 2026 EBITDA before this Golden Suprise.

Breaking story:

https://www.thebigscore.com/p/golden-surprise-at-aris-mining

Aris Mining’s 2023 PM Zurich Conference Presentation

Below is the link to Aris Mining's 2023 Precious Metals Zurich Conference Presentation lead by CEO, Neil Woodyer.

Nov 17, 2023

Neil Woodyer, CEO of Aris Mining, presents at the 2023 Precious Metals Zurich Conference (November 12, 2023).

Aris Mining Corporation

I can imagine changing 3 dollars to $100!!!

$Aris Mining Corp - Golden Surprise at Segovia -

Imagine turning $11 million into $80+ million annually for several years starting in just ~15 months.

From a company trading at 1.33X 2026 EBITDA before this Golden Suprise.

Breaking story:

https://www.thebigscore.com/p/golden-surprise-at-aris-mining

Aris Mining’s 2023 PM Zurich Conference Presentation

Below is the link to Aris Mining's 2023 Precious Metals Zurich Conference Presentation lead by CEO, Neil Woodyer.

Nov 17, 2023

Neil Woodyer, CEO of Aris Mining, presents at the 2023 Precious Metals Zurich Conference (November 12, 2023).

Aris Mining Corporation

Aris Mining’s 2023 PM Zurich Conference Presentation

Below is the link to Aris Mining's 2023 Precious Metals Zurich Conference Presentation lead by CEO, Neil Woodyer.

Nov 17, 2023

Neil Woodyer, CEO of Aris Mining, presents at the 2023 Precious Metals Zurich Conference (November 12, 2023).

Aris Mining Corporation

.jpg)

Aris Mining’s 2023 PM Zurich Conference Presentation

Below is the link to Aris Mining's 2023 Precious Metals Zurich Conference Presentation lead by CEO, Neil Woodyer.

Nov 17, 2023

Neil Woodyer, CEO of Aris Mining, presents at the 2023 Precious Metals Zurich Conference (November 12, 2023).

Aris Mining Corporation

ARIS = best in class.

ARIS MINING INCREASES SEGOVIA OPERATIONS' MEASURED AND INDICATED MINERAL RESOURCES BY +114% TO 3.6 MOZ AT 14.34 g/t AU

November 02, 2023

VANCOUVER, BC, Nov. 2, 2023 /PRNewswire/ -

Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE: ARMN) announces updated mineral resource estimates for its

Segovia Operations in Colombia effective September 30, 2023 (the "2023 MRE").

Aris Mining will file an updated technical report in support of the 2023 MRE within 45 days of this news release.

https://www.aris-mining.com/news/news-details/2023/ARIS-MINING-INCREASES-SEGOVIA-OPERATIONS-MEASURED-AND-INDICATED-MINERAL-RESOURCES-BY-114-TO-3.6-MOZ-AT-14.34-gt-AU/default.aspx

Neil Woodyer, CEO of Aris Mining, commented "In early 2023, Aris Mining launched a strategic exploration and infill drill program at

the Segovia Operations and a review of the geological interpretation and resource estimation methodology.

After assessing the findings of our reviews as well as our impressive mid-year drilling results (see News Release from August 16, 2023),

we decided to expedite the process of updating our mineral resource and mineral reserve estimates. Segovia has a history of expanding its

gold resources and this current estimate represents a leap forward.

We are now in the process of updating the mineral reserve estimates, which is expected to be completed by the end of November."

Figure 1: Growth of gold mineral resources (in million of ounces or Moz), net of production depletion1

https://www.aris-mining.com/news/news-details/2023/ARIS-MINING-INCREASES-SEGOVIA-OPERATIONS-MEASURED-AND-INDICATED-MINERAL-RESOURCES-BY-114-TO-3.6-MOZ-AT-14.34-gt-AU/default.aspx

Watch Update from one of the world's highest-grade gold mine | In Conversation with Aris Mining

Red Cloud TV

10.9K subscribers

Next 100 dollar stock here.

Watch Update from one of the world's highest-grade gold mine | In Conversation with Aris Mining

Red Cloud TV

10.9K subscribers

Update from one of the world's highest-grade gold mine | In Conversation with Aris Mining

Red Cloud TV

10.9K subscribers

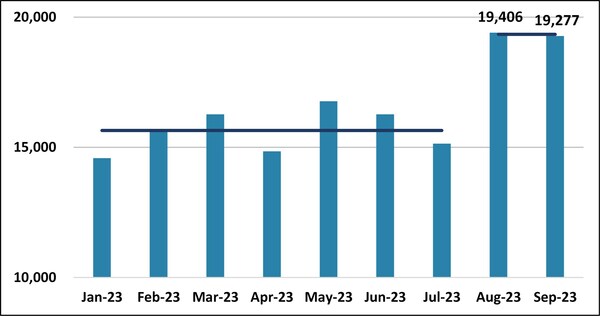

ARIS MINING PRODUCED 60,193 OUNCES OF GOLD IN Q3 2023

Aris Mining logo (CNW Group/Aris Mining Corporation)

NEWS PROVIDED BY

Aris Mining Corporation

10 Oct, 2023, 07:00 ET

SHARE THIS ARTICLE

VANCOUVER, BC, Oct. 10, 2023 /PRNewswire/ -

Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) reports third

quarter 2023 gold production of 60,193 ounces, with 53,826 ounces from the Segovia Operations and

6,367 ounces from the Marmato Upper Mine.

The Segovia Operations maintained strong performance throughout September, building on the

impressive record monthly production achieved in August.

https://www.prnewswire.com/news-releases/aris-mining-produced-60-193-ounces-of-gold-in-q3-2023--301951067.html

In the future, Aris Mining plans to provide quarterly gold production updates preceding the release of its quarterly financial statements.

Chart 1: Monthly Gold Production (in ounces), Segovia Operations (CNW Group/Aris Mining Corporation)

Chart 1: Monthly Gold Production (in ounces), Segovia Operations (CNW Group/Aris Mining Corporation)

Q3 2023 Conference Call Details

Aris Mining plans to announce operational and financial results for Q3 2023 after market close on Wednesday, November 8, 2023. Management will host a conference call and webcast on Thursday, November 9, 2023 at 9:30 am PT / 12:30 pm ET.

Webcast link

https://services.choruscall.ca/DiamondPassRegistration/register?confirmationNumber=10022576&linkSecurityString=1a2bc09050 https://services.choruscall.ca/links/arismining2023q3.html

Replay Dial-in

Canada/USA

+1.800.319.6413

International

+1.604.638.9010

Replay access code

0482

Participants can pre-register to join the call automatically, at:

https://services.choruscall.ca/DiamondPassRegistration/register?confirmationNumber=10022576&linkSecurityString=1a2bc09050

After the conference call, a replay of the event will be available at Aris Mining Corporation - Investors - Events & Presentations (aris-mining.com).

About Aris Mining

Aris Mining is a gold producer in the Americas with a growth-oriented strategy. In Colombia,

Aris Mining operates several high-grade underground mines at its Segovia Operations and the

Marmato Mine, which together produced 235,000 ounces of gold in 2022.

Aris Mining is currently advancing construction of the Marmato Lower Mine Expansion project, which

will provide access to wider porphyry mineralization below the current Upper Mine.

Aris Mining also operates the Soto Norte Project joint venture, where environmental licensing is

advancing to develop a new underground gold, silver and copper mine. In Guyana,

Aris Mining is advancing the Toroparu Project, a gold/copper project.

Aris Mining plans to pursue acquisitions and other growth opportunities to unlock value creation from

scale and diversification.

Aris Mining promotes the formalization of artisanal and small-scale mining as this process enables all

miners to operate in a legal, safe and responsible manner that protects them and the environment.

Additional information on Aris Mining can be found at

https://www.aris-mining.com , www.sedarplus.ca, and on

www.sec.gov.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=172853545

Forward-Looking Information

This news release contains "forward-looking information" or forward-looking statements" within the meaning of Canadian and U.S. securities legislation. All statements included herein, other than statements of historical fact, including, without limitation, statements relating to the Company's plans to provide regular updates on its gold production on a quarterly basis, the timing of the release of the Company's third quarter results and the Company's plans and strategies are forward-looking. When used herein, forward looking terminology such as "expect", "plan", "anticipate", "estimate", "may", "will", "should", "intend", "believe", and similar expressions, are intended to identify forward-looking statements. Forward-looking statements are based on estimates and assumptions made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors that the Company believes are appropriate in the circumstances. Many factors could cause the Company's actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements, including those described in the "Risk Factors" section of the Company's most recent AIF and in the Management's Discussion and Analysis for the three and six months ended June 30, 2023, which are available on the Company's profile on SEDAR+ at www.sedarplus.ca and in its filings with the U.S. Securities and Exchange Commission at www.sec.gov. These factors should be considered carefully, and readers should not place undue reliance on the Company's forward-looking statements. The Company has no intention and undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

SOURCE Aris Mining Corporation

Also from this source

ARIS MINING RELEASES ITS ANNUAL SUSTAINABILITY REPORT

ARIS MINING RELEASES ITS ANNUAL SUSTAINABILITY REPORT

VANCOUVER, BC, Oct. 6, 2023 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) has published its 2022...

ARIS MINING COMMENCES TRADING ON THE NYSE AMERICAN AS "ARMN"

ARIS MINING COMMENCES TRADING ON THE NYSE AMERICAN AS "ARMN"

VANCOUVER, BC, Sept. 14, 2023 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (NYSE-A: ARMN) announces that the...

More Releases From This Source

gold epicenter of wave C about to take off. very good chance it takes out 2200 this year.

Fed dead ahead, or is that dead head Fed ahead….gonna double this year???? Maybe.

28M oz $Gold in Columbia, Guyana, and Canada | $Aris Mining Interview

ceo bbq

This is an interview with Aris Mining's senior vice president, Tyron Breytenbach.

Aris Mining is a gold producer with 2 producing mines in Columbia,

1 development project in Columbia, 1 development project in Guyana, and

1 development project in Canada.

trunkmonk TIA $Gold Forecast: Gold Prices Could Explode Higher, and Soon

AG Thorson

Technical Analysis Expert & Editor @ GoldPredict.com

September 15, 2023

https://www.gold-eagle.com/article/gold-forecast-gold-prices-could-explode-higher-and-soon

CENTRAL BANKS & BILLIONAIRES ARE BUYING GOLD AT THE FASTEST PACE IN HISTORY

WATCH

https://www.bitchute.com/video/28YR3ejWxUuk/

USA OIL For $fiat-Peanuts - WORTH $900 BILLION! China Buys US Super Oil Field For $1.7 Billion

Obama/Biden giving US away

[

TPRFF changed to ARMN. Moved to the NYSE AMEX from the OTC:

https://otce.finra.org/otce/dailyList?viewType=Deletions

I’m tellin ya, this is next hundred dolla holla.

ARIS MINING ANNOUNCES RECORD SEGOVIA OPERATIONS GOLD PRODUCTION

September 11, 2023

https://www.aris-mining.com/news/news-details/2023/ARIS-MINING-ANNOUNCES-RECORD-SEGOVIA-OPERATIONS-GOLD-PRODUCTION/default.aspx

ARIS MINING TO LIST COMMON SHARES ON NYSE AMERICAN, DRIVEN BY OUR GROWTH AND PROJECT ADVANCEMENTS

Aris Mining logo (CNW Group/Aris Mining Corporation)

NEWS PROVIDED BY

Aris Mining Corporation

06 Sep, 2023, 07:00 ET

https://www.prnewswire.com/news-releases/aris-mining-to-list-common-shares-on-nyse-american-driven-by-our-growth-and-project-advancements-301918469.html

VANCOUVER, BC, Sept. 6, 2023 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (OTCQX: TPRFF) announces that it has received approval to list its common shares on the NYSE American LLC (NYSE American). Since the launch of Aris Gold two years ago, Aris Mining has grown to include two operating mines producing over 230,000 ounces of gold per year and generated US$153 million of Adjusted EBITDA1. The Company's growth continues with the in-progress construction of the Marmato Lower Mine, following receipt of permits in July 2023. Aris Mining is also advancing the Soto Norte gold/copper project, which is positioned to become one of Colombia's largest and most advanced underground mines.

Neil Woodyer, CEO of Aris Mining, commented "Listing Aris Mining on the NYSE American will increase our visibility to investors in the United States and internationally. We are optimizing our operations with a focus on cash flow generation, extending mine life, building new mines, and exploring acquisitions. Aris Mining has a strong balance sheet and we believe we are on track to produce 400,000 ounces of gold in Colombia in 2026, based on steady-state production from our Segovia Operations and the expanded Marmato Mine. As we step forward, our strategy is centered around the belief that successful mining in Colombia hinges on our collaboration with and support of local Artisanal and Small-Scale Miners."

Trading of the Company's common shares on the NYSE American is expected to commence on or about Thursday, September 14, 2023 under the symbol "ARMN", with trading on the OTCQX to cease concurrent with the NYSE American listing. The Company will remain listed on the Toronto Stock Exchange under the symbol "ARIS".

About Aris Mining

Aris Mining is a gold producer in the Americas with a growth-oriented strategy. In Colombia, Aris Mining operates several high-grade underground mines at its Segovia Operations and the Marmato Mine, which together produced 235,000 ounces of gold in 2022. Aris Mining is currently advancing the Marmato Lower Mine Expansion project, which will provide access to wider porphyry mineralization below the current Upper Mine. Aris Mining plans to pursue acquisitions and other growth opportunities to unlock value creation from scale and diversification.

Aris Mining promotes the formalization of artisanal and small-scale mining as this process enables all miners to operate in a legal, safe and responsible manner that protects them and the environment.

Additional information on Aris Mining can be found at www.aris-mining.com and www.sedarplus.ca.

Non-IFRS Measures

Adjusted EBITDA is a non-IFRS financial measure included in this news release. This measure does not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers. For full details on this measure, refer to the "Non-IFRS Measures" section of the Company's Management's Discussion and Analysis (MD&As) for the periods ended June 30, 2023, December 31, 2022 and June 30, 2022 for a reconciliation of Adjusted EBITDA for the relevant periods. The MD&As are incorporated by reference into this news release and are available on the Company's profile on SEDAR+ at www.sedarplus.ca.

Forward-Looking Information

This news release contains "forward-looking information" or forward-looking statements" within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, including, without limitation, statements relating to the commencement of trading of the Company's common shares on the NYSE American and the ceasing of trading on the OTCQX and the timing thereof, growth plans pertaining to the Marmato Lower Mine and the Soto Norte Project, and expected benefits thereof including anticipated production in 2026, and the Company's plans and strategies are forward-looking. When used herein, forward looking terminology such as "expect", "plan", "anticipate", "estimate", "may", "will", "should", "intend", "believe", and similar expressions, are intended to identify forward-looking statements. Forward-looking statements are based on estimates and assumptions made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors that the Company believes are appropriate in the circumstances. Many factors could cause the Company's actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements, including those described in the "Risk Factors" section of the Company's most recent AIF and in the Management's Discussion and Analysis for the three and six months ended June 30, 2023, which are available on the Company's profile on SEDAR+ at www.sedarplus.ca. These factors should be considered carefully, and readers should not place undue reliance on the Company's forward-looking statements. The Company has no intention and undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

_______________________________

1 Adjusted EBITDA for the 12 month period ended June 30, 2023 is a non-IFRS financial measure. This measure does not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers. Refer to the Non-IFRS Measures section below for more details.

SOURCE Aris Mining Corporation

https://www.prnewswire.com/news-releases/aris-mining-to-list-common-shares-on-nyse-american-driven-by-our-growth-and-project-advancements-301918469.html

$TPRFF This article looks at what is likely to emerge as a replacement currency system, and

concludes that from practical and legal aspects, bitcoin and

the entire cryptocurrency industry will fail with fiat,

while mankind will return to gold, as it has always done in the past

when state control over currency fails. ...

... For the remainder of the analysis:

https://www.goldmoney.com/research/hedging-the-end-of-fiat?gmrefcode=gata

$ARIS MINING REPORTS Q2 2023 FINANCIAL AND OPERATING RESULTS

August 09, 2023

Download(opens in new window)

VANCOUVER, BC, Aug. 9, 2023 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (OTCQX: TPRFF) announces financial and operating results for the three and six months ended June 30, 2023 (H1 2023). All amounts are in US dollars unless otherwise indicated.

https://www.prnewswire.com/news-releases/aris-mining-reports-q2-2023-financial-and-operating-results-301897363.html

Bullish

BULLISH

ARIS MINING TO LIST COMMON SHARES ON NYSE AMERICAN, DRIVEN BY OUR GROWTH AND PROJECT ADVANCEMENTS

Aris Mining logo (CNW Group/Aris Mining Corporation)

NEWS PROVIDED BY

Aris Mining Corporation

06 Sep, 2023, 07:00 ET

https://www.prnewswire.com/news-releases/aris-mining-to-list-common-shares-on-nyse-american-driven-by-our-growth-and-project-advancements-301918469.html

VANCOUVER, BC, Sept. 6, 2023 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (OTCQX: TPRFF) announces that it has received approval to list its common shares on the NYSE American LLC (NYSE American). Since the launch of Aris Gold two years ago, Aris Mining has grown to include two operating mines producing over 230,000 ounces of gold per year and generated US$153 million of Adjusted EBITDA1. The Company's growth continues with the in-progress construction of the Marmato Lower Mine, following receipt of permits in July 2023. Aris Mining is also advancing the Soto Norte gold/copper project, which is positioned to become one of Colombia's largest and most advanced underground mines.

Neil Woodyer, CEO of Aris Mining, commented "Listing Aris Mining on the NYSE American will increase our visibility to investors in the United States and internationally. We are optimizing our operations with a focus on cash flow generation, extending mine life, building new mines, and exploring acquisitions. Aris Mining has a strong balance sheet and we believe we are on track to produce 400,000 ounces of gold in Colombia in 2026, based on steady-state production from our Segovia Operations and the expanded Marmato Mine. As we step forward, our strategy is centered around the belief that successful mining in Colombia hinges on our collaboration with and support of local Artisanal and Small-Scale Miners."

Trading of the Company's common shares on the NYSE American is expected to commence on or about Thursday, September 14, 2023 under the symbol "ARMN", with trading on the OTCQX to cease concurrent with the NYSE American listing. The Company will remain listed on the Toronto Stock Exchange under the symbol "ARIS".

About Aris Mining

Aris Mining is a gold producer in the Americas with a growth-oriented strategy. In Colombia, Aris Mining operates several high-grade underground mines at its Segovia Operations and the Marmato Mine, which together produced 235,000 ounces of gold in 2022. Aris Mining is currently advancing the Marmato Lower Mine Expansion project, which will provide access to wider porphyry mineralization below the current Upper Mine. Aris Mining plans to pursue acquisitions and other growth opportunities to unlock value creation from scale and diversification.

Aris Mining promotes the formalization of artisanal and small-scale mining as this process enables all miners to operate in a legal, safe and responsible manner that protects them and the environment.

Additional information on Aris Mining can be found at www.aris-mining.com and www.sedarplus.ca.

Non-IFRS Measures

Adjusted EBITDA is a non-IFRS financial measure included in this news release. This measure does not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers. For full details on this measure, refer to the "Non-IFRS Measures" section of the Company's Management's Discussion and Analysis (MD&As) for the periods ended June 30, 2023, December 31, 2022 and June 30, 2022 for a reconciliation of Adjusted EBITDA for the relevant periods. The MD&As are incorporated by reference into this news release and are available on the Company's profile on SEDAR+ at www.sedarplus.ca.

Forward-Looking Information

This news release contains "forward-looking information" or forward-looking statements" within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, including, without limitation, statements relating to the commencement of trading of the Company's common shares on the NYSE American and the ceasing of trading on the OTCQX and the timing thereof, growth plans pertaining to the Marmato Lower Mine and the Soto Norte Project, and expected benefits thereof including anticipated production in 2026, and the Company's plans and strategies are forward-looking. When used herein, forward looking terminology such as "expect", "plan", "anticipate", "estimate", "may", "will", "should", "intend", "believe", and similar expressions, are intended to identify forward-looking statements. Forward-looking statements are based on estimates and assumptions made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors that the Company believes are appropriate in the circumstances. Many factors could cause the Company's actual results, performance or achievements to differ materially from those expressed or implied by the forward-looking statements, including those described in the "Risk Factors" section of the Company's most recent AIF and in the Management's Discussion and Analysis for the three and six months ended June 30, 2023, which are available on the Company's profile on SEDAR+ at www.sedarplus.ca. These factors should be considered carefully, and readers should not place undue reliance on the Company's forward-looking statements. The Company has no intention and undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

_______________________________

1 Adjusted EBITDA for the 12 month period ended June 30, 2023 is a non-IFRS financial measure. This measure does not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers. Refer to the Non-IFRS Measures section below for more details.

SOURCE Aris Mining Corporation

https://www.prnewswire.com/news-releases/aris-mining-to-list-common-shares-on-nyse-american-driven-by-our-growth-and-project-advancements-301918469.html

$TPRFF This article looks at what is likely to emerge as a replacement currency system, and

concludes that from practical and legal aspects, bitcoin and

the entire cryptocurrency industry will fail with fiat,

while mankind will return to gold, as it has always done in the past

when state control over currency fails. ...

... For the remainder of the analysis:

https://www.goldmoney.com/research/hedging-the-end-of-fiat?gmrefcode=gata

$ARIS MINING REPORTS Q2 2023 FINANCIAL AND OPERATING RESULTS

August 09, 2023

Download(opens in new window)

VANCOUVER, BC, Aug. 9, 2023 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (OTCQX: TPRFF) announces financial and operating results for the three and six months ended June 30, 2023 (H1 2023). All amounts are in US dollars unless otherwise indicated.

https://www.prnewswire.com/news-releases/aris-mining-reports-q2-2023-financial-and-operating-results-301897363.html

I read it, kinda extreme view about crypto but spot on for gold. The world not only needs to return to it, it must. But I also believe silver will become much more important in coming world economy, and some cryptos will be used for money transfers between countries.in fact I believe the first crypto to be backed by instant transfer to silver or gold will survive it all, and may be next trillionaires in the process.

$TPRFF This article looks at what is likely to emerge as a replacement currency system, and

concludes that from practical and legal aspects, bitcoin and

the entire cryptocurrency industry will fail with fiat,

while mankind will return to gold, as it has always done in the past

when state control over currency fails. ...

... For the remainder of the analysis:

https://www.goldmoney.com/research/hedging-the-end-of-fiat?gmrefcode=gata

$ARIS MINING REPORTS Q2 2023 FINANCIAL AND OPERATING RESULTS

August 09, 2023

Download(opens in new window)

VANCOUVER, BC, Aug. 9, 2023 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (OTCQX: TPRFF) announces financial and operating results for the three and six months ended June 30, 2023 (H1 2023). All amounts are in US dollars unless otherwise indicated.

https://www.prnewswire.com/news-releases/aris-mining-reports-q2-2023-financial-and-operating-results-301897363.html

$Aris Mining Presentation Wednesday

Join Aris Minimg on Aug 23, for a presentation at the @RedCloudVan Roadshow with

SVP Capital Markets of $ARIS, Tyron Breytenbach & VP IR, Kettina Cordero. We have 2 sessions at 10am PT & 1pm PT in Vancouver.

Learn about Aris Mining's plans for 2023 & more.

RSVP: lmclennan@redcloudfs.com

I like the fact that the company has hired a new VP of IR. On paper she looks very impressive. I have posted her LinkedIn Profile below.

Investor Relations and communications professional with more than 15 years’ experience working strategically with executive management to develop and

execute successful Investor Relations and communications programs.

Energetic and results driven, builds solid relationships within the organization and with the investment community. Has a deep understanding of Latin American

geopolitical and cultural issues as well as excellent written and verbal communications skills in English and Spanish, and conversational German.

CisionView original content to download multimedia:

https://www.prnewswire.com/news-releases/aris-mining-reports-q2-2023-financial-and-operating-results-301897363.html

SOURCE Aris Mining Corporation

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=172038293

$BRICS 2023 Summit Key Takeaways, Day 1 Overview and Future Goals

Lena Petrova, CPA - Finance, Economics & Tax 146K subscribers

ARIS MINING REPORTS Q2 2023 FINANCIAL AND OPERATING RESULTS

August 09, 2023

Download(opens in new window)

VANCOUVER, BC, Aug. 9, 2023 /PRNewswire/ - Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (OTCQX: TPRFF) announces financial and operating results for the three and six months ended June 30, 2023 (H1 2023). All amounts are in US dollars unless otherwise indicated.

Aris Mining logo (CNW Group/Aris Mining Corporation)

https://www.prnewswire.com/news-releases/aris-mining-reports-q2-2023-financial-and-operating-results-301897363.html

Aris Mining CEO Neil Woodyer stated: "Since the merger with GCM Mining in September 2022, Aris Mining has been making continuous progress in the integration and transformation of our Colombian operations. We've been diligently advancing our growth projects by closely collaborating with local stakeholders. With the acquisition of permits and secure funding in place, we are poised to commence construction on the Marmato Lower Mine project in late Q3 2023.

Additionally, our efforts are focused on driving forward the Soto Norte project. Notably, this project has recently received confirmation of its location outside the Páramo de Santurbán, a protected area of the Andes mountains. This affirmation comes after a favorable delimitation process completed in June 2023, involving local communities and government authorities in the four municipalities associated with the project.

During the six-months ending on June 30, we achieved significant milestones. Our gold sales reached 103,386 ounces, resulting in $68 million in income from mining operations. A particular emphasis of our operations review has been on the Segovia Operations business structure. Here, approximately 55% of our production stems from the traditional 'owner-operated' mining approach, while the remaining 45% originates from 'partner-operated' mining. This partner-operated mining category encompasses our contractor workforce as well as the acquisition of mill-feed from artisanal and small-scale miner units.

Our 'for-profit' partnerships with community-based groups introduce two distinct operating cost structures at the Segovia Operations. During H1 2023, the all-in sustaining costs from our owner-operated mining operations were $1,007 per ounce of gold1. In contrast, the AISC from partner-operated mining operations was $1,236 per ounce of gold1. It's notable that our partner-operated cost structure primarily hinges on a percentage of the spot gold price.

Anticipating an upswing in partner-operated mining activities for the latter half of 2023, we have developed projections based on an average gold price of $1,900 per ounce. As a result, we are revising our overall 2023 outlook for the Segovia Operations AISC to a range of between $1,125 and $1,175 per ounce of gold."

Operations Review – H1 2023

Total production of 104,906 ounces of gold from the Segovia Operations (94,395 ounces) and the Marmato Upper Mine (10,511 ounces).

Segovia Operations had attributable gold production from owner-operated mining of 52,732 ounces at an AISC of $1,007 per ounce, and 41,663 ounces from partner-operated mining at an AISC of $1,236 per ounce.

Income from mining operations of $68.0 million.

EBITDA of $51.6 million1 and adjusted EBITDA of $78.2 million1.

Expenditures of $30.9 million on growth capital, including $10.2 million at the Segovia Operations, $11.3 million at the Marmato Upper and Lower Mines, and $9.3 million at the Toroparu Project1.

Net earnings of $2.9 million or $0.02 per share.

Adjusted earnings of $26 million or $0.19 per share1.

Cash and cash-equivalents of $214.3 million as of June 30, 2023, following a $52.9 million annual tax payment in Q2 related to Segovia Operations taxable income from 2022.

Full Year 2023 Outlook

To continue developing and expanding the 'partner-operated' mining model across the Segovia Operations, Marmato Mine and the Soto Norte Project. This commitment is rooted in our firm belief that cultivating 'for-profit' community partnerships is the most effective way to drive the sustained growth of our business within the Colombian landscape; it not only bolsters the well-being of those involved but also contributes to the broader objective of responsible mining practices.

Based on H1 production and H2 outlook (see table below), the Segovia Operations are expected to produce between 195,000 and 210,000 ounces at an AISC of between $1,125 and $1,175 per ounce during 2023.

The Marmato Lower Mine construction plan is expected to allow the existing Upper Mine to continue producing gold in the range of 20,000 to 30,000 ounces during 2023, in line with the 25,216 ounces produced in 2022.

On a consolidated basis, Aris Mining expects to produce between 220,000 and 240,000 ounces during 2023, which compares to the previous guidance range of between 230,000 and 270,000 ounces.

Segovia Operations – Mid-year 2023 Outlook

H1

H2 Outlook

FY 2023 Outlook

Actual

Low

-

High

Low

-

High

Owner-operated mining (ounces)1

52,732

57,000

-

66,000

111,000

-

118,000

Attributable AISC/oz

$ 1,007

$ 950

-

$ 1,050

$1,000

-

$ 1,050

Partner-operated mining (ounces)2

41,663

43,000

-

51,000

84,000

-

92,000

Attributable AISC/oz

$ 1,236

$ 1,200

-

$ 1,300

$1,250

-

$ 1,300

Total Segovia Operations

94,395

100,000

-

115,000

195,000

-

210,000

AISC/oz, total mining operations

$ 1,108

$ 1,145

-

$ 1,245

$ 1,125

-

$ 1,175

Previous 2023 production guidance for Segovia Operations

200,000

-

230,000

Previous 2023 AISC/oz guidance for Segovia Operations3

$950

-

$1,050

1.

Attributable production from Company-operated areas within the mines, utilizing owner-managed labour.

2.

Attributable production from contractor-operated and other artisanal and small-scale mining operations under contract to deliver the mill feed mined to the Company's Maria Dama plant for processing.

3.

Previous 2023 AISC/oz guidance was based on partner-operated mining operations costs assuming a gold price of $1,700/oz

___________________________________________

1 Refer to the Non-IFRS Measures section for a reconciliation of AISC ($ per oz sold) EBITDA, adjusted EBITDA, adjusted earnings and expenditures on growth capital to the most directly comparable financial measure disclosed in the Company's Q2 2023 financial statements.

Additional Q2 2023 and H1 2023 Financial and Operating Highlights

Three months ended

Three months ended

Six months ended

June 30, 2023

March 31, 2023

June 30, 2023

Gold sold (ounces)

54,228

49,158

103,386

Gold produced (ounces)

54,003

50,903

104,906

Average realized gold price ($/ounce sold)

1,959

1,869

1,888

Gold Revenue ($'000)

106,239

91,863

198,102

Cash costs ($/ounce sold)1

1,019

922

973

AISC – all operations ($/ounce sold)1

1,234

1,214

1,225

Income from mining operations ($'000)

34,877

33,152

68,029

EBITDA ($'000)1

30,496

21,105

51,601

Adjusted EBITDA ($'000)1

39,528

38,646

78,174

Net earnings (loss) ($'000)

8,258

(5,401)

2,857

Adjusted earnings ($'000)1

14,837

11,176

26,013

Earnings (loss) per share – basic ($)

0.06

(0.04)

0.02

Adjusted earnings per share – basic ($)1

0.11

0.08

0.19

Balance sheet, as at ($000s)

June 30, 2023

December 31, 2022

Cash and cash equivalents

214,344

299,461

Total assets

1,235,023

1,242,120

Total debt2

Senior Notes

300,000

300,000

Gold Notes

62,312

66,006

Convertible Debentures

13,593

13,300

Shareholders' equity

570,679

501,375

1.

Refer to the Non-IFRS Measures section for full details on cash costs ($ per oz sold), AISC ($ per oz sold), EBITDA, adjusted EBITDA, adjusted earnings and additions to mining interests. Comparative cash cost and AISC values have been adjusted from amounts disclosed prior to Q3 2022 following a change in the methodology used to calculate total cash costs ($ per oz sold) and AISC ($ per oz sold) in Q3 of 2022.

2.

The principal of current and long-term debt as at June 30, 2023 are as disclosed in Note 10 to the Interim Financial Statements.

Aris Mining's Q2 2023 interim financial statements and related MD&A are available on SEDAR+ and in the Financials section of Aris Mining's website here.

About Aris Mining

Aris Mining is a Canadian company led by an executive team with a track record of creating value through building globally relevant mining companies. In Colombia, Aris Mining operates several high-grade underground mines at its Segovia Operations and the Marmato Mine, which together produced 235,000 ounces of gold in 2022. Aris Mining is currently advancing the Marmato Lower Mine Expansion project, which will provide access to wider porphyry mineralization below the current Upper Mine. Following completion and ramp up of the Marmato Lower Mine Expansion project in 2025, the Marmato Mine is expected to deliver average production of 162,000 ounces per year over a nearly 20-year mine life from the existing mineral reserves2. Aris Mining also operates the Soto Norte Project joint venture, where environmental licensing is advancing to develop a new underground gold, silver and copper mine. In Guyana, Aris Mining is advancing the Toroparu Project, a gold/copper project. Aris Mining plans to pursue acquisition and other growth opportunities to unlock value creation from scale and diversification.

Aris Mining promotes the formalization of artisanal and small-scale mining as this process enables all miners to operate in a legal, safe and responsible manner that protects them and the environment.

Additional information on Aris Mining can be found at www.aris-mining.com and www.sedarplus.ca.

Cautionary Language

Non-IFRS Measures

Cash costs ($ per oz sold), AISC ($ per oz sold), EBITDA, adjusted EBITDA, adjusted (loss)/earnings and expenditures on growth capital are non-IFRS financial measures and non-IFRS ratios contained in this document. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers. For full details on these measures and ratios refer to the "Non-IFRS Measures" section of the Company's Management's Discussion and Analysis for the three months and six months ended June 30, 2023 (MD&A). The MD&A is incorporated by reference into this news release and is available on the Company's profile on SEDAR+ at www.sedarplus.ca.

The tables below reconcile the non-IFRS financial measures contained in this news release for the current and comparative periods to the most directly comparable financial measure disclosed in the Company's Q2 2023 financial statements.

_______________________________________

2 See section entitled Qualified Person and Technical Information for the reference to technical information.

Total cash costs

Segovia Operations

Total Operations

Three months ended,

Six months ended,

Three months ended,

Six months ended,

($000s except per ounce amounts)

Jun 30, 2023

Mar 31, 2023

Jun 30, 2023

Jun 30, 2023

Mar 31, 2023

Jun 30, 2023

Total gold sold (ounces)

48,381

44,908

93,289

54,228

49,158

103,386

Cost of sales1

51,030

44,083

95,113

62,947

53,705

116,652

Less: royalties1

(3,488)

(2,660)

(6,148)

(4,615)

(3,410)

(8,025)

Less: by-product revenue1

(2,755)

(4,877)

(7,632)

(3,077)

(5,043)

(8,120)

Less: other adjustments

-

-

-

-

77

77

Total cash costs

44,787

36,546

81,333

55,255

45,329

100,584

Total cash costs ($ per oz gold

sold)

926

814

872

1,019

922

973

1.

As presented in the Interim Financial Statements and notes for the respective periods.

All-in sustaining costs (AISC)

Segovia Operations

Total Operations

Three months ended,

Six months ended,

Three months ended,

Six months ended,

($000s except per ounce amounts)

Jun 30, 2023

Mar 31, 2023

Jun 30, 2023

Jun 30, 2023

Mar 31, 2023

Jun 30, 2023

Total gold sold (ounces)

48,381

44,908

93,289

54,228

49,158

103,386

Total cash costs

44,787

36,546

81,333

55,255

45,329

100,584

Add: royalties 1

3,488

2,660

6,148

4,615

3,410

8,025

Add: social programs 1

2,419

2,404

4,823

2,666

2,404

5,070

Add: sustaining capital

expenditures

2,450

7,332

9,782

3,812

7,867

11,679

Add: lease payments on sustaining

capital

588

656

1,243

588

656

1,243

Total cash costs

53,732

49,598

103,329

66,936

59,666

126,601

Total cash costs ($ per oz gold sold)

1,111

1,104

1,108

1,234

1,214

1,225

1.

The Marmato Mine was purchased as part of the Aris Mining Transaction on September 26, 2022, as such prior year comparatives are not applicable to the Company.

The table below reconciles the cash cost per ounce sold and the AISC per ounce sold for ore sourced from owner-operated mines and other partner-operated mines to the totals for the consolidated Segovia Operations:

Six months ended June 30, 2023

Owner Operated mining1

Partner Operated mining2

Total Segovia

Attributable gold sold (ounces)

52,120

41,169

93,289

Total cash costs ($'000)3

35,805

45,528

81,333

Cash cost per ounce sold ($/ounce)3

$ 687

$ 1,106

$ 872

All-in sustaining costs ($'000)3

52,462

50,867

103,329

AISC cost per ounce sold ($/ounce)3

$ 1,007

$ 1,236

$ 1,108

1.

Includes Company-operated areas within the mines, utilizing owner-managed labour.

2.

Comprises contractor-operated and other small-scale mining operations within the Company's mining title that are operated by miners under contract to deliver the mill feed mined to the Company's Maria Dama plant for processing.

3.

Refer to the Non-IFRS Measures section for full details on cash costs ($ per oz sold) and AISC ($ per oz sold). Comparative cash cost and AISC values have been adjusted from amounts previously disclosed following a change in the methodology used to calculate total cash costs ($ per oz sold) and AISC ($ per oz sold) in Q3 of 2022.

Additions to mineral interests, plant and equipment

Three months ended,

Six months ended,

($'000)

June 30, 2023

March 31, 2023

June 30, 2022

June 30, 2023

June 30, 2022

Sustaining capital

Segovia Operations

2,450

7,332

11,176

9,782

19,698

Marmato Upper Mine1

1,362

535

-

1,897

-

Total

3,812

7,867

11,176

11,679

19,698

Non-sustaining growth capital

Segovia Operations

7,639

2,641

3,169

10,280

8,168

Toroparu Project

4,625

4,690

24,228

9,315

30,964

Marmato Lower Mine1

6,126

3,881

-

10,007

-

Marmato Upper Mine1

645

681

-

1,326

-

Juby Project1

-

33

-

33

-

Total

19,035

11,926

27,397

30,961

39,132

Total Additions 2

22,847

19,793

38,573

42,640

58,830

1.

The Marmato Mine and Juby Project were purchased as part of the Aris Mining Transaction on September 26, 2022, as such prior year comparatives are not applicable to the Company.

2.

As presented in the Interim Financial Statements and notes for the respective periods

Earnings before interest, taxes, depreciation, and amortization (EBITDA) and adjusted EBITDA

Three months ended,

Six months ended,

($000s)

June 30, 2023

March 31, 2023

June 30, 2022

June 30, 2023

June 30, 2022

Earnings (loss) before tax1

17,283

6,751

58,100

24,034

78,890

Add back:

Depreciation and depletion1

8,825

7,646

8,965

16,471

17,201

Finance income1

(2,358)

(2,173)

(1,572)

(4,531)

(2,079)

Interest and accretion1

6,746

8,881

6,539

15,627

12,938

EBITDA

30,496

21,105

72,032

51,601

106,950

Add back:

Share-based compensation1

459

1,147

(1,148)

1,606

60

Revaluation of investments (Denarius) 1

10,023

-

-

10,023

-

Loss from equity accounting in investee1

1,427

3,241

1,095

4,668

2,127

(Gain) loss on financial instruments1

(10,114)

10,810

(25,230)

696

(17,914)

Foreign exchange (gain) loss1

7,237

2,343

(1,094)

9,580

(439)

Adjusted EBITDA

39,528

38,646

45,655

78,174

90,784

1.

As presented in the Financial Statements and notes for the respective periods.

Adjusted net earnings and adjusted net earnings per share

Three months ended,

Six months ended,

($000s except shares amount)

June 30, 2023

March 31, 2023

June 30, 2022

June 30, 2023

June 30, 2022

Basic weighted average shares outstanding

136,229,686

136,188,570

97,913,264

136,616,968

97,850,225

Diluted weighted average shares outstanding

140,289,533

136,188,570

108,125,857

141,236,861

109,022,012

Net earnings (loss) 1

8,258

(5,401)

38,965

2,857

44,203

Add back:

Share-based compensation1

459

1,147

(1,148)

1,606

60

Revaluation of investments (Aris Gold/Denarius) 1

10,023

-

-

10,023

-

(Income) loss from equity accounting in investee1

1,427

3,241

1,095

4,668

2,127

(Gain) loss on financial instruments1

(10,114)

10,810

(25,230)

696

(17,914)

Foreign exchange (gain) loss1

7,237

2,343

(1,094)

9,580

(439)

Income tax effect on adjustments

(2,453)

(964)

(84)

(3,417)

(105)

Adjusted net (loss) / earnings

14,837

11,176

12,504

26,013

27,932

Per share – basic ($/share)

0.11

0.08

0.13

0.19

0.29

1.

As presented in the Interim Financial Statements and notes for the respective periods.

Qualified Person and Technical Information

Pamela De Mark, P.Geo., Senior Vice President, Technical Services of Aris Mining, is a Qualified Person as defined by National Instrument 43-101 (NI 43-101) and has reviewed and approved the technical information contained in this news release.

Scientific and technical information concerning the Marmato Mine is summarized, derived, or extracted from the technical report entitled "Technical Report for the Marmato Gold Mine, Caldas Department, Colombia, Pre-Feasibility Study of the Lower Mine Expansion Project" dated November 23, 2022 with an effective date of June 30, 2022, prepared by Ben Parsons, MAusIMM (CP), Anton Chan, Peng, Brian Prosser, PE, Joanna Poeck, SME-RM, Eric J. Olin, SME-RM, MAusIMM, Fredy Henriquez, SME, ISRM, David Hoekstra, PE, NCEES, SME-RM, Mark Allan Willow, CEM, SME-RM, Vladimir Ugorets, MMSA, Colleen Crystal, PE, GE, Kevin Gunesch, PE, Tommaso Roberto Raponi, P.Eng, David Bird, PG, SME-RM, and Pamela De Mark, P.Geo., each of whom is a "Qualified Person" as such term is defined in NI 43-101, and with the exception of Pamela De Mark of Aris Mining, are independent of the Company within the meaning of NI 43-101, and is available for review on the Company's website at www.aris-mining.com and on the Company's profile on SEDAR+ at www.sedarplus.ca.

Forward-Looking Information

This news release contains "forward-looking information" or forward-looking statements" within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, including, without limitation, statements relating to the construction of the Marmato Lower Mine and the advancement of the Soto Norte project and the details and timing thereof, the anticipated upswing in partner-operated mining operations, gold price assumptions, the updated 2023 production and AISC outlook for the Segovia Operations and the Marmato Upper Mine, statements and information under the headings "Full Year 2023 Outlook" and "Segovia Operations – Mid-year Outlook", and the Company's plans and strategies are forward-looking. Generally, the forward-looking information and forward looking statements can be identified by the use of forward looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", "will continue" or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". The material factors or assumptions used to develop forward looking information or statements are disclosed throughout this presentation.

Forward looking information and forward looking statements, while based on management's best estimates and assumptions, are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Aris Mining to be materially different from those expressed or implied by such forward-looking information or forward looking statements, including but not limited to those factors discussed in the section entitled "Risk Factors" in Aris Mining's annual information form dated March 31, 2023 and available on SEDAR+ at www.sedarplus.ca.

Although Aris Mining has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information and forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information or statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information or statements. The Company has and continues to disclose in its Management's Discussion and Analysis and other publicly filed documents, changes to material factors or assumptions underlying the forward-looking information and forward-looking statements and to the validity of the information, in the period the changes occur. The forward-looking statements and forward-looking information are made as of the date hereof and Aris Mining disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements or forward-looking information contained herein to reflect future results. Accordingly, readers should not place undue reliance on forward-looking statements and information.

This news release contains information that may constitute future-orientated financial information or financial outlook information (collectively, FOFI) about the Company's prospective financial performance, financial position or cash flows, all of which is subject to the same assumptions, risk factors, limitations and qualifications as set forth above. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise or inaccurate and, as such, undue reliance should not be placed on FOFI. The Company's actual results, performance and achievements could differ materially from those expressed in, or implied by, FOFI. The Company has included FOFI in order to provide readers with a more complete perspective on the Company's future operations and management's current expectations relating to the Company's future performance. Readers are cautioned that such information may not be appropriate for other purposes. FOFI contained herein was made as of the date of this news release. Unless required by applicable laws, the Company does not undertake any obligation to publicly update or revise any FOFI statements, whether as a result of new information, future events or otherwise.

CisionView original content to download multimedia:

https://www.prnewswire.com/news-releases/aris-mining-reports-q2-2023-financial-and-operating-results-301897363.html

SOURCE Aris Mining Corporation

VIEW ALL NEWS

NYBob, I still have my big ARIS position. Have you looked at I-80? Multiple super rich gold deposits, I have taken big position yesterday.

Riddle me this, riddle me that. The US debt got downgraded to AA+ from AAA.

The Dow then sold.of to the tune of 400 points.

As always all stocks sell off. The gold miners will reverse before the other industries.

Don't be a weak hand as thats what the big boys are hoping as they load up.

Hold your shares. Blue Sky Breakout coming soon to a theatre near you!!!

President Ronald Reagan - “Money Printing Causing Crippling Inflation” Returning to Gold Standard Priority #1

Gold Silver Index

Can't have unlicensed trannies running around creating havoc now can we!

ARIS MINING ANNOUNCES RECEIPT OF LICENSE TO TRANSFORM MARMATO MINE AND NEW PATH FORWARD FOR GOLD PROJECTS IN COLOMBIA

T.ARIS

VANCOUVER, BC, July 12, 2023 /PRNewswire/ -

Aris Mining Corporation (Aris Mining or the Company) (TSX: ARIS) (OTCQX: TPRFF) announces it

has received approval from the Corporación Autónoma Regional del Caldas (Corpocaldas), a

regional environmental authority in Colombia, of the Environmental Management Plan (PMA) which

now

permits the development of the Marmato Lower Mine.

Aris Mining (CNW Group/Aris Mining Corporation)

Construction of the new underground mine will provide access to the wider porphyry mineralization

below the current Upper Mine, which allows for bulk mining methods in the Lower Mine.

The Upper and Lower Mine has a measured and indicated mineral resource of 6.0 million ounces

(Moz) of gold, which includes a proven and probable mineral reserve of 3.2 Moz.

The Marmato Mine is expected to deliver average production of 162,000 ounces per year over a

nearly 20-year mine life from the mineral reserves.1

Aris Mining CEO Neil Woodyer stated:

"This is a milestone for Aris Mining as it will grow Marmato's gold production five-fold and, following

construction, our Colombian gold production from Segovia and Marmato will be approximately

400,000 oz per year.

View original content to download multimedia:

https://www.prnewswire.com/news-releases/aris-mining-announces-receipt-of-license-to-transform-marmato-mine-and-new-path-forward-for-gold-projects-in-colombia-301876024.html

SOURCE Aris Mining Corporation

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=172276802

Aris Mining Corp - Hey management -

Not to bother you while you are busy, but how about a news release explaining why the stock price is

too high?

I can only surmise you think it is too high since you seem so GD adamant about NOT DOING A

BUYBACK.

Now, I'll admit I'm not a mining genius like you boys, but I did get a finance degree and

spent 20 years as a broker.

And from where I'm sitting you have a boatload of cash earning next to nothing with a stock price at,

what, half, maybe a quarter of real value?

Don't you have warrants that could be exercised and add more cash.

Well, maybe that's the fly in the ointment, you don't want them exercised.

Not sure what you dim bulbs are thinking, but sure would be nice if you released something

explaining why you think the price is too high and why you want the stock below

warrant exercise price.

Little backwards from what they teach in finance classes.

While Serafino did a lot of self serving deals that didn't benefit shareholders, he at least had the

cajones to post here.

He also had a dividend and stock buyback.

Maybe you guys are in with the shorts and are loving what is happening?

But, the shareholders here are looking at a gold price a mere $100 under all time highs and

you sit on your hands afraid to spend a few million to screw the shorts, help shareholders and

make an instant profit for the company.

But, I imagine it's nap time for you underachievers, so I won't bother you anymore today.

T

Post by tsoprano24 on Jul 10, 2023 11:38am

WATCH: Red Cloud Financial Services Webinar Series Presents:

Hear what Aris Mining's SVP of Capital Markets, Tyron Breytenbach, had to say about their team and

gold production.

WATCH: Red Cloud Financial Services Webinar Series Presents:

Hear what Aris Mining's SVP of Capital Markets, Tyron Breytenbach, had to say about their team and

gold production.

Well done sir.

http://www.321gold.com/editorials/hoye/hoye063023.pdf

TM Thanks I agree; It’s gonna be huge, bigger than I ever imagined. Raising debt ceiling is the most

irresponsible thing the

government has done since Nixon took the dollar of gold standard. China will crush us without firing a

shot and they are loving it.

https://www.thedailydoom.com/p/the-treasury-storm-of-the-century

https://kingworldnews.com/billionaire-investor-pierre-lassonde-says-ignore-volatility-gold-is-headed-into-a-mania/

Last chance people.

It’s gonna be huge, bigger than I ever imagined. Raising debt ceiling is the most irresponsible thing the government has done since Nixon took the dollar of gold standard. China will crush us without firing a shot and they are loving it.

https://www.thedailydoom.com/p/the-treasury-storm-of-the-century

https://kingworldnews.com/billionaire-investor-pierre-lassonde-says-ignore-volatility-gold-is-headed-into-a-mania/

Last chance people.

Nothing has changed, this is going to 100.

Aris Mining Corp. | Webinar Replay & 25 Milllion Oz. In ARIS - ![]() )

)

Red Cloud TV

8.89K subscribers

TORONTO, ON --(Marketwired - May 12, 2016) - Gran Colombia Gold Corp. (TSX: GCM) (OTC PINK: TPRFF) announced today the release of its unaudited condensed consolidated financial statements and accompanying management's discussion and analysis (MD&A) for the three months ended March 31, 2016. All financial figures contained herein are expressed in U.S. dollars unless otherwise noted.

First Quarter 2016 Highlights

Lombardo Paredes Arenas, Chief Executive Officer of Gran Colombia, commenting on the Company's results for the first quarter of 2016, said, "We are making steady progress in the execution of our business plan. The improvement in our adjusted EBITDA, made possible through reductions in our costs and production growth, is enabling us to use our operating cash flow in the short-term to improve our balance sheet by reducing our working capital deficit and, ultimately, is essential for building the cash required to repay our senior debt."

Financial and Operating Summary

A summary of the financial and operating results for the first quarters of 2016 and 2015 follows:

| First Quarter | |||||||

| 2016 | 2015 | ||||||

| Operating data: | |||||||

| Gold produced (ounces) | 31,489 | 23,973 | |||||

| Gold sold (ounces) | 29,686 | 25,332 | |||||

| Average realized gold price ($/oz sold) | $ | 1,144 | $ | 1,193 | |||

| Total cash costs ($/oz sold) (1) | 685 | 824 | |||||

| All-in sustaining costs ($/oz sold) (1) | 790 | 938 | |||||

| Financial data ($000's, except per share amounts): | |||||||

| Revenue | $ | 34,470 | $ | 30,658 | |||

| Adjusted EBITDA (1) | 11,586 | 7,143 | |||||

| Net income (loss) attributable to shareholders | 10,826 | (3,315 | ) | ||||

| Basic and diluted income (loss) per share | 0.15 | (0.14 | ) | ||||

| Adjusted net income (loss) attributable to shareholders (1) | 251 | (1,816 | ) | ||||

| Basic and diluted adjusted income (loss) per share (1) | 0.00 | (0.08 | ) | ||||

| March 31, | December 31, | ||||||

| 2016 | 2015 | ||||||

| Balance sheet ($000's): | |||||||

| Cash and cash equivalents | $ | 3,024 | $ | 3,004 | |||

| Senior debt (2) | 78,373 | 100,740 | |||||

| Other debt, including current portion | 2,760 | 3,012 | |||||

| (1) | Refer to "Additional Financial Measures" in the Company's MD&A. | |

| (2) | Represents carrying amounts which are at a discount to principal amounts. Refer to Company's Interim Financial Statements for additional details regarding the 2018 and 2020 Debentures. | |

Segovia Operations

First quarter 2016 gold production at Segovia totalled 25,999 ounces, up 8.9% from the fourth quarter of 2015 and up 40.3% from the first quarter a year ago. An increased volume of higher grade material from the contract mining cooperatives enabled the Company to process an average of 730 tpd with head grades averaging 12.9 g/t in the first quarter of 2016, an improvement from 678 tpd at an average head grade of 12.0 g/t in the fourth quarter of 2015 and 500 tpd at head grades averaging 14.1 g/t in the first quarter a year ago. Gran Colombia is continuing with the mine development and mechanization program according to the optimized mine plan developed in 2015 and expects to produce a total of 96,000 to 110,000 at its Segovia Operations for the full year 2016.

The Company's total cash cost results in the first quarter of 2016 saw a continuation of the trend experienced in 2015 as further devaluation of the Colombian peso against the U.S. dollar, increased production volumes reducing fixed costs on a per ounce basis and costs savings all combined to decrease total cash costs at the Segovia Operations to $659 per ounce, 17% lower than reported for the first quarter last year.

Marmato Operations

At the Marmato Underground mine, the Company processed 820 tpd at an average head grade of 2.6 g/t yielding gold production of 5,490 ounces in the first quarter of 2016, down 11.2% from the fourth quarter of 2015 in which it processed 860 tpd at head grades averaging 2.8 g/t and on par with the first quarter a year ago when it processed 813 tpd at head grades averaging 2.6 g/t. The Company expects to produce a total of 24,000 to 28,000 ounces at its Marmato Operations for the full year 2016.

Further devaluation of the Colombian peso also had a positive impact on Marmato's total cash costs per once in the first quarter of 2016 compared with previous quarters and, despite a decline in head grades resulting in lower gold production that contributed to an increase in its total cash costs to $847 per ounce in the current quarter, Marmato's total cash costs per ounce were still 7% better than the first quarter last year.

Outlook

With a total of 43,542 ounces of gold produced through the first four months of 2016, the Company is well on its way towards its annual gold production guidance for 2016 of approximately 120,000 to 138,000 ounces. The results for total cash costs and AISC per ounce for the first quarter of 2016 were also in line with Gran Colombia's expectations. For the full year 2016, Gran Colombia expects its total cash costs to average between $700 and $750 per ounce, which will be influenced by the exchange rate of the Colombian peso relative to the U.S. dollar and by production volumes during the balance of the year. Gran Colombia also anticipates that its average AISC for the full year will be between $850 and $950 per ounce, reflecting an expected increase in the level of capital investment in its Segovia Operations in the second half of 2016.

Since the debt restructuring closed in January 2016, holders of the 2018 Debentures and the 2020 Debentures have elected to convert $2.3 million and $0.7 million, respectively, into a total of 23.5 million common shares, increasing the issued and outstanding common shares to a total of 137,074,520 and reducing the principal amounts of the 2018 Debentures and 2020 Debentures to $68.8 million and $103.3 million, respectively, at May 12, 2016.

Webcast

As a reminder, the Company will host a conference call and webcast on Friday, May 13, 2016 at 9:30 a.m. Eastern Time to discuss the results.

Webcast and call-in details are as follows:

Live Event link: http://edge.media-server.com/m/p/7hmyqdxe

Toronto & International: 1 (514) 841-2157

North America Toll Free: 1 (866) 215-5508

Colombia Toll Free: 01 800 9 156 924

Conference ID: 42439708

Published: Feb 25, 2016 3:45 p.m. ET

VANCOUVER, Feb. 25, 2016 (Canada NewsWire via COMTEX) -- Frank Giustra and his related entities filed an early warning report pursuant to the early warning requirements of applicable securities laws in Canada with respect to holdings in Gran Colombia Gold Corp. (the "Issuer").

Pursuant to the completion of the Issuer's debt restructuring, Frank Giustra converted Silver Notes into 16,041,913 common shares representing 14.07% of the issued and outstanding shares of the Issuer and Radcliffe Corporation, a company owned and controlled by Frank Giustra, converted Silver Notes into 11,535,940 common shares representing 10.12% of the issued and outstanding common shares of the Issuer and converted Gold Notes into US$260,371 2020 Convertible Debentures representing 1.76% of the Issuer's outstanding 2020 Convertible Debentures.

As a result of the conversions, Frank Giustra directly and indirectly, owns and or controls, in aggregate 25,577,853 common shares of the Issuer, representing 24.18% of the current issued and outstanding shares of the Issuer and would own 29,580,707 common shares, representing 25.49% on a partially diluted basis, assuming the conversion of US$260,371 2020 Convertible Debenture at US$0.13.