Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

It’s still trading on the “expert” market, which means no new filings have been submitted in my opinion.

Still good price action though. Small dollar value trade in reality.

https://www.otcmarkets.com/stock/AFYG/quote#trade-data

Am I dreaming or is this thing alive ?

Shes ALIVE!!!!!..... LOL

Are you still owed your stock certificate for AFYG?

If, for whatever reason, any AFYG investor has yet to receive their stock certificate for any issuance they are still owed, or if you know of anyone else who has not recieved their stock certficates, please respond to me a private reply.

The bright side I suppose you could buy super cheap if you decided to add shares.

That’s why it’s .0000001 now. No bid/ask. They won’t make market until there is current info filed.

https://www.reuters.com/business/finance/us-pink-sheets-shakeup-securities-regulator-looks-stamp-out-fraud-2021-09-23/

There’s nothing unless he gets current- after the GameStop run up they started looking at all the subpenny shit, Wall Street doesn’t like to lose, when they do they change the rules. This won’t ever trade again unless it gets current

I wish someone had something good to offer about this company....

Well almost a month since last message and we even made it thru

APRIL FOOLS

All I hear are crickets ;-(

Otherwize, hope all is well among the AFYG gang waiting for a better tomorrow and ME Lucky Charms LOL

Do we have a pulse?..Come on AFYG

Come on Corey give us an update.... let's get this thing current....LETS Go AFYG!!!!

Time for Cory to step up and provide an update...

Thanks for the reply with more flavor.

Now you made me look, I came into this party in Feb 2010.

Dreams of buying my own private island danced in my head back then.

I had a short stint working for a brokerage firm in Chicago back in the 80's as a mainframe programmer and managed to pick up a few tips here and there, so this one sounded promising.

If the right things happen, then this could still turn out good for all of us. Optimizem 101 for sure

Absolutely, I didn’t take your questions as being negative at all, I was just kinda unloading everything I could remember about it without doing too much re-reading to refresh my memory.

it just comes down to the book keeping, records, and miscellaneous junk being sorted and arranged into 8-K’s and 10-K’s that comply with the sec’s requirements.

I don’t recall exactly what it was, that stalled it. The accounting firm he hired was supposed to be able to pull it off. The only filings there have been in a very long time, was a form 4 from Oct. 2020, which appeared to me to be a positive sign at the time, that Corey had been able to secure some working capital from a local investment company, to hopefully get filings done, or improve the operation.

whatever it was for, it wasn’t chump change- and I can’t imagine an investment banker just tossing money at something unless he saw some intrinsic value. Either with the potential growth, or with hard assets like ownership in mining projects.

I’ve been in since mid 2013-ish. not going anywhere either.

money is long since spent for me, not selling out now (not that I could).

https://sec.report/Ticker/AFYG

With that sort of response, I am guessing that those of us who have been hanging in there for the long haul still have HOPE that things can sort themselves out and we end up with a positive response.

Just looking for one more WARM FUZZY to make my feeble old brain happy.

I do appreciate the previous candid remarks for sure.

ROCK ON AFYG, but only the shiny pretty ones ![]()

Thanks KnownProphet. I understand that this is operational. I am a very very long shareholder and have been around since long before those calls. I am not disputing the fact that this is an operational company and we are all going to benefit with continued patience. I was just simply asking what administrative or what details does AFYG owe to make it compliant in 2022.

most everything is still in the intro box, if you go on the desktop version of the board. The info is there, not much has changed in the iBox since I added most of it back then, none of the audio podcasts still work because I quit axing for the podcast account a long time ago, but the written transcripts I spent hours creating are still there from past conference calls. There was a PR from 2014 that talked about the accounting firm he hired, but the story is so old now it won’t open from that link- you may be able look back at the posts on the board from around the same time period, and I’m sure we were all talking about the bits and pieces of info. You’d be able to fill in the blanks in your mind.

There were real properties, with gold in the ground. I believe(d) in this one. I went heavier here than I typically did in pink sheet stocks.

It’s a long story. Cory hired a firm years ago to go through all the financials and begin the process of filing 10K’s and whatever else the SEC wanted in order to bring everything up to date. Things looked good for a while, I don’t recall what got in the way- there was something that they couldn’t quite overcome in audits or something. It’s going back quite a while. I don’t recall all the particulars. Last I heard there was an operational mine pulling small amounts of gold out of the ground though. If you read back through the old posts here I’m sure you can find the details.

I guess the question is: What is stopping Affinity from becoming current?

I don’t think any “Non-Current” penny stock is going to be allowed to trade anymore, by way of Market Makers no longer making a market for them. Thank the wall street elite that got their clocks cleaned by by reddit and gamestop. They got Pwned so we get punished.

WAKE UP AFYG it's a new year time to get back in action

Anyone have any information? Corey Corey Corey give us something sir

tune1186, love your optimism and my gut tells me you're absolutely right!

I'm STILL in for the longterm.

They will get current and this will trade again...

Thanks for the reply.

I guess I shall do like most of us are doing, and just wait around to see if some of the predictions here come true, or not... ![]()

At least this gives me a web page to go to every so often when I get bored.

WOOOOHOOO LOL

We should all let go of the idea that there is anything left to get here - I have been watching the board for years, partly interested but more amused - I am also a shareholder.

The money has long since been spent, the guys are doing nothing - annual accounts and/or insolvency are being delayed.

Thanks for the link, but I have tried that before with no luck.

They haven't even bothered to update the web page since 2014.

I guess, until the golden egg is found, Mum is the word ![]()

We are a patient bunch.

All it means in my opinion is that it’s more important than ever to get current with OTC, as they will no longer quote prices until AFYG does.

As far as getting information- I’d start here and see what happens

https://www.affinitygold.com/contact

WOW

Thanks for sharing that, as it makes a lot of sense now what triggered this moment of going dark for no apparent reason.

Since a lot of time has passed, I don't recall is there any place else where we can get any info on what Corey is doing these days, or anything related to some of the positive directions we saw before this happened?

I got used to getting the latest info here and didn't save anything else that might still have info on what might be going on.

Thanks SEC for bending us over. GGGRRRRRR

Just my opinion though, I think it’ll like stay tanked until some financials are updated, if that ever takes place. Be sure to thank the SEC for “protecting” you by rendering the investment worthless

I think they just never got current, and the new rule caught up. https://www.reuters.com/business/finance/us-pink-sheets-shakeup-securities-regulator-looks-stamp-out-fraud-2021-09-23/

LZARK, not dead...winter's almost here so she's just hibernating for a while. All those things you describe in your post have been going through my mind as well over the last couple of weeks. We've seen this before with AFYG in the past and she's managed to come back...hopefully, she will again. We're all in the same boat so let's hope she keeps floating for a while longer.

Well

Things look really empty here, but might as well as ask.

Does anyone know for certain, that this puppy is dead?

Never been in a spot like this before.

Can this wake back up if good news surfaces or did we all just set a lot of buckos on FIRE?

Hindsight is a great thing, and when it climbed, had a chance to sell...

Now, depending on the answer, probably a big dummy here....

Any comments or digs or jokes welcome.

DITTO

Same question Never seen darkness like this.

Very odd

All I hear is crickets

Anyone know what's going on ? Are we on hold or something?

Can’t PM. I don’t subscribe anymore. $AFYG

I wish I saw this earlier so I could have gained a little more...but to tell you the truth was happy it had a slight pulse. I hope you are well let's PM to catch up.

The longest long hold ever.

I’ll tell you though, I held millions of shares of a sub-penny stock for years that I assumed was dead forever, and it awoke suddenly and unexpectedly- (right after the GameStop run), and I was able to pull some money out of it that I assumed was lost forever. I sold way too early though, I was just happy to see it move, never imagined it would (or could) get as high as it did.

Was very tempted to add shares a while ago, when it appeared as though something was on the horizon. Glad I didn’t now- as recent prices are a bargain compared to those multi-penny prices.

Tic-Toc…..

Come on Afyg do something

Really? Someone traded 10 shares valued at 6 cents total. Wish I could understand this...but I don't. Well, I've been here this long, I certainly don't plan on going anywhere now.....besides, I want to see what happens next!

These kind of games can get really messy playing with a 999 TURD like AFYG.

WOW

Popped in here as I usually do every so often and saw this.

Someone out there is playing some games. GGGRRRRRR

Clear manipulation going on with prices.. who sells 100 shares at .006.. Time for Corey to say hello and get the ball rolling.

Someone shorted the stock and then the price was driven up by the covering (IMO)

Nice candle yesterday even though price got clear down to a penny

However, I am still very confused by what happened not long ago.

We had a nice to run to .10 and things were looking mighty positive.

Things still look positive as far as I know, but what on earth whacked this back to 2 cents?

Price and volume slowly creeping back up ....go Afyg

|

Followers

|

73

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

9445

|

|

Created

|

03/12/09

|

Type

|

Free

|

| Moderators | |||

AFFINITY GOLD CORP. - ( Ticker: AFYG )

Website: www.affinitygold.com

Investor Information: www.affinitygold.com/investors

Investors Relations Contact: Click Here to contact IR

Audio From May 30th CC:

Click here to listen to the Audio

Click here to view the Written Transcript (will be posted later)

Audio From May 9th CC: (Rescheduled April 25th Call)

Click here to listen to the Audio

Click here to view the Written Transcript

Audio From March 28th CC:

Click here to listen to the Audio

Click Here to view the Written Transcript

Audio From Feb 28th CC:

Click here to listen to the Audio

Click Here to view the Written Transcript

Audio From Dec 23rd CC:

SHARE STRUCTURE:

AUTHORIZED SHARES: 250,000,000 shares of common stock with a par value of $0.001

ISSUED & OUTSTANDING: 137,310,336 as of February 05, 2014

FLOAT: 26,427,000 as of February 16, 2014

RESTRICTED: 100,298,336 as of February 05, 2014

NUMBER OF SHARE HOLDERS ON RECORD: 86 as of September 16, 2013

Hans J. Rasmussen, Technical & Business Development Advisor

Mr. Rasmussen has over 29 years of professional experience in the mining industry as a geophysicist / geologist. He currently serves as the Vice President of Exploration at Coeur Mining, Inc. (NYSE: CDE, TSX: CDM) with a key focus on identifying high-grade precious metal deposits viable for near-term production. He most recently served as President and Chief Executive Officer of Colombia Crest Gold Corporation, a public company with gold exploration in Colombia, Peru and Bolivia.

Mr. Rasmussen has held senior positions with mining exploration companies in North and South America and worked as a consultant with clients that included Teck Cominco Ltd., Quadra Mining Ltd. and Mansfield Minerals Inc. His experience includes conducting and managing all geological and geophysical aspects of exploration, commercial transactions and investor relations. Mr. Rasmussen’s prior employment included four years with Newmont Exploration Ltd., 12 years with the Kennecott Exploration / Rio Tinto group, including three years as Country Manager of Argentina and Bolivia. Most recently, Mr. Rasmussen was Chief Geophysicist with White Knight Resources. Mr. Rasmussen is an active member of the Society of Exploration Geologists, Northwest Mining Association and the Geologic Society of Nevada. He graduated with a Master of Science in Geophysics from the University of Utah, and holds Bachelor of Science degrees in geology and physics from Southern Oregon State College. Mr. Rasmussen is also a Director of Pachamama Resources Ltd., StoneShield Capital Corp., and Golden Phoenix Minerals, Inc.

RECENT NEWS ITEMS:

Affinity Gold Corporation (Ticker: AFYG) is a mineral exploration and development company engaged in the acquisition and development of near-term precious mineral

production assets within Peru.

Affinity Gold is solely focused on the acquisition and development of both primary and secondary type deposit assets that:

Have a history of production evidenced by data and on-site workings,

Offer near-term production within 12-18 months, or less

Require less than $3M to start, and

Have significant upside exploration potential

Through its 99.99% owned subsidiary AMR Project Peru, S.A.C., Affinity Gold Corp is the owner of the mining concession title named "AMR Project" covering 500 hectares and the mining concession certificate as evidenced by Certificate No. 7996-2006-INACC-UADA granted to AMR by the Republic of Peru, National Institute of Concessions and Mining Cadastre on December 11, 2006 (the "Mining Concession Rights"), which Mining Concession Rights are located in the Inambari River Basin on the flat plains region at an altitude greater than 1500' and accessible by land and air, in the District of Ayapata, Province of Carabaya, Department of Puno, Peru.

Affinity Gold Corp. was formed in 2009 to facilitate the going public of its flagship project and become a publicly trading junior mining company listed in the U.S. on the Over-the-Counter Bulletin Board (OTC BB) exchange.

In February 2009, Affinity Gold Corp. entered into a Letter of Intent with AMR Project Peru , S.A.C. ("AMR") to purchase the mining concession rights for 500 hectares of land in southeastern Peru near the Andean Mountains . AMR Project Peru , S.A.C. is a Peruvian holding company founded in 2005 for the purpose of facilitating the exploration, acquisition and development of mining concessions located within Peru .

On March 2, 2009, Affinity Gold Corp. entered into an Asset Purchase Agreement with AMR. The AMR Project covers 500 hectares represented by the physical mining concession Certificate No. 7996-2006-INACC-UADA granted to AMR by the Republic of Peru, National Institute of Concessions and Mining Cadastre on December 11, 2006, and includes all improvements, structures and equipment on and used by AMR on such mining concession rights (collectively, the "Mining Concession Rights"). The Mining Concession Rights are located in the Inambari River Basin of Puno, Peru.

On April 30, 2009, the Company entered into an Amendment Agreement with AMR, whereby the parties decided to amend the arrangement by changing the structure of the arrangement from an asset purchase agreement to a share exchange agreement resulting in AMR becoming our wholly-owned subsidiary upon closing of the share exchange agreement. In addition, under the Amendment Agreement, the parties agreed to terminate the Asset Purchase Agreement so it will no longer have any force and effect.

On May 8, 2009, we entered into a Share Exchange Agreement with AMR and all the shareholders of AMR, whereby we agreed to acquire 99.99% of the issued and outstanding shares in the capital of AMR in exchange for the issuance of 12,000,000 shares of our Common Stock in aggregate to the shareholders of AMR on a pro rata basis in accordance with each AMR shareholders' percentage of ownership in AMR. Once the transaction closes, Affinity Gold Corp. will own and control the concession rights, through its wholly-owned subsidiary AMR Project Peru , S.A.C., for the 500 hectare area of land in southeastern Peru.

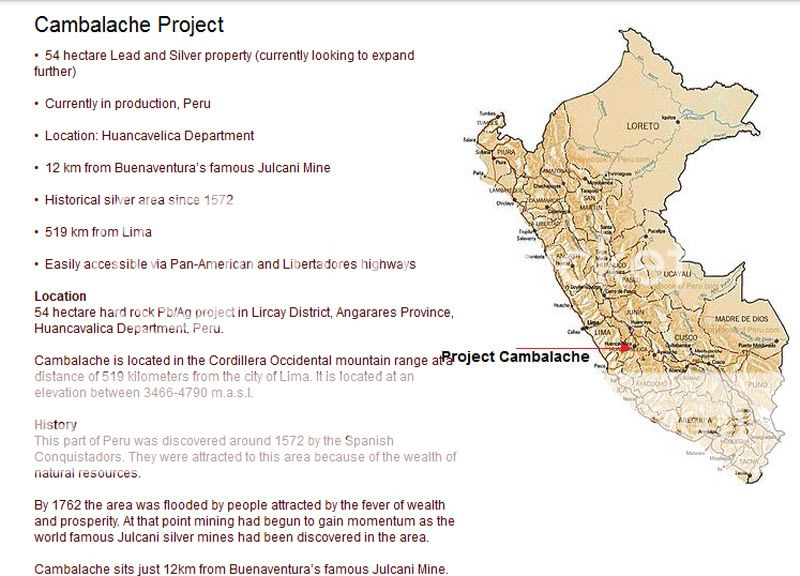

Cambalache is Affinity Gold Corp.’s third project and the Company’s first site to be in production and generating revenue.

Estimated Project Potential

The Machacala Project is a hard rock property located in the District of Carabamba, province of Julcan, La Libertad region to the North of Peru, at an elevation of 3,300 meters above sea level. The property contains 966 hectares comprised of 18 contiguous concessions. It is approximately 110 miles southeast of the city of Trujillo, capital of the region, and 574 Km of Lima, capital of Peru.

The La Libertad is one of the largest Gold and Silver producing regions in Perú and in the World, including mines such as Yanacocha which is producing millions of Gold ounces annually; 42 kilometers east of the coastal city of Trujillo in northern Peru.

Machacala Project Highlights

Project offers near-term production potential from both tailings and underground.

Previously producing property with over 235,000 tons of ore mined with estimated average grades of 6.0g/t Au and 340g/t Ag

Large un-leached tailings pile on site

Volume Est.: 210,000 Metric Tone

Grade Est.: 1. 34 g/T Au 56.36g/T Ag (average grade)

Located in a well-known mining area.

Barrick Gold, Rio Alto Mining, and Southern Peak Mining are operating in region.

Exploration drilling programs from 1996 by Gold Hawk Resources, Meridian Gold, and Buenaventura.

Drilling totaled over 8,500 m in 45 core and RC drill holes (Meridian Gold, Gold Hawk Resources).

Metallurgical studies show 87% Au, 50% Ag recoveries in 24 hrs leaching on un-milled tailings, with re-milling (-400 mesh) shows increased recoveries to 90% Au, 73% Ag in 24 hrs leaching.

NOTE: Mine has multiple low sulphidation, epithermal Au-Ag veins on property of which thirteen have been identified and "only" four have been modestly exploited.

MINERAL RIGHTS:

966 hectares comprised of 18 contiguous mineral concessions

SURFACE RIGHTS:

150 hectares of surface rights. This is where the estimated 210,000 metric tons of tailings are located.

WATER RIGHTS:

Water rights to the nearby Carabamba reservoir. Additional source of water supply exists if necessary.

The Carabaya 500 hectare property is located along the Inambari River basin in the Puno region of Southeastern Peru. Archaeological researchers have claimed that the source of gold adorned by the Incas was from the Eastern slopes of the Andes. The Inambari Madre De Dios River system is relatively close to Cusco, Machu Pichu and other Inca ruins suggesting that this area may have been mined for centuries. In 1860 explorers found gold in the Rio Madre de Dios here, and later in the 20th Century the Corps of Mining Engineers catalogued this river as being rich in gold.

Technical Report

R. W. Laakso, B. Sc.; P. Eng.

Shaft & Tunnel Engineering Services Limited

Holland Landing, Ontario, Canada

Link: Technical Report

Strategy Plan

Link: Carabaya Strategy Plan

Affinity Gold Corporation

13570 Grove Drive, #310

Maple Grove, MN 55311

Corporate Contact

Telephone: 763-515-1462

Facsimile: 763-420-5092

Email: info@affinitygold.com

Website: http://www.affinitygold.com

Nevada Agency & Transfer Co.

50 W. Liberty St., Suite 880

Reno, NV 89501

Telephone: 1-775-322-0626

Facsimile: 1-775-322-5623

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |